Key Steps from Legacy Insurance Systems to Insurtech Platforms

- April 29

- 27 min

Legacy system modernization in insurance involves updating outdated technology systems to improve efficiency, scalability, and customer experience. It replaces or enhances old systems with modern solutions like cloud computing, AI, and APIs to streamline operations and integrate with new technologies. This transformation helps insurers reduce costs, mitigate risks, and stay competitive in a rapidly evolving market.

Legacy insurance systems refer to outdated or older technology platforms, software, or IT infrastructure that insurance companies use to manage their operations. These systems were often built decades ago and were designed to handle the needs of the insurance industry at the time. While they may still function, they are typically based on older programming languages, hardware, and architectures, which can make them inefficient and difficult to maintain in today’s fast-paced, technology-driven environment.

You’ll learn how legacy modernization services in insurance drive efficiency, enhance customer satisfaction, and unlock opportunities through the use of AI, cloud computing, and automation. Additionally, explore the modern insurance system’s technology and how leading insurers are adapting to this transformation to future-proof their businesses. By the end, you’ll understand why modernizing legacy systems in insurance is an opportunity to thrive in the digital insurance era.

The insurance industry is undergoing a rapid technological transformation, yet many companies remain anchored to aging legacy systems. While these systems were once essential, they now create challenges that hinder growth, innovation, and competitiveness. Legacy system modernization in insurance is no longer optional; it’s a necessity.

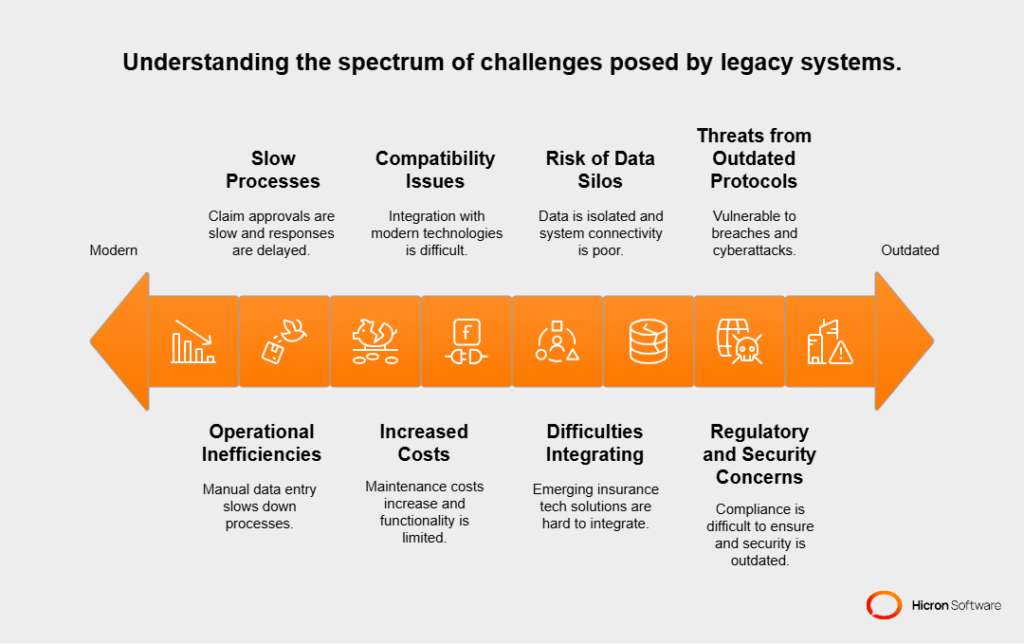

Below, we’ll explore the critical pain points of relying on legacy systems and how solutions like modernization services can help insurers overcome these obstacles.

|

Challenge |

Description |

Example/Impact |

|

Operational inefficiencies caused by outdated systems |

Legacy systems lack speed, flexibility, real-time data processing, and automation, leading to bottlenecks and reduced productivity. |

Manual data entry and outdated workflows slow down underwriting and claims management, making it hard to compete with agile insurtech startups. |

|

Slow processes reducing customer satisfaction |

Legacy systems result in slow claim approvals, delayed responses, and cumbersome policy management, frustrating customers. |

A life insurance applicant might wait weeks for an underwriting decision, leading to dissatisfaction, while insurtech companies deliver decisions in minutes using automation. |

|

High costs of maintaining legacy systems |

Maintenance costs rise as systems age, requiring scarce expertise and draining budgets that could be used for innovation. |

Legacy systems lack functionality for advancements like AI or automation, forcing insurers to invest in outdated infrastructure instead of modern technologies. |

|

Compatibility issues with modern technologies |

Legacy systems are rigid and difficult to integrate with emerging technologies like AI, telematics, or digital claims management. |

Insurers face challenges implementing telematics for usage-based insurance or automated claims systems, putting them at a disadvantage compared to insurtech startups. |

|

Challenges in integrating modern tech solutions |

Legacy systems resist integration with IoT, AI, and predictive analytics, making innovation costly and complex. |

Implementing AI for claims processing or predictive analytics for risk assessment becomes a resource-intensive endeavor. |

|

Risks of data silos and poor connectivity |

Legacy systems create isolated data silos, hindering communication and collaboration across departments. |

A commercial insurance team may struggle to access unified customer data when policies are spread across multiple platforms, leading to inefficiencies and missed opportunities. |

|

Regulatory and security concerns |

Legacy systems lack flexibility to adapt to regulatory changes, leaving insurers vulnerable to compliance issues, fines, and reputational damage. |

Evolving data privacy laws require systems that can quickly adjust to new standards, which legacy systems struggle to meet. |

|

Threats from outdated security protocols |

Legacy systems rely on outdated security protocols, making them vulnerable to cyberattacks and data breaches. |

Hackers can exploit vulnerabilities in aging infrastructure, compromising sensitive customer data. Upgrading to modern systems with advanced security features is essential to protect data and reputation. |

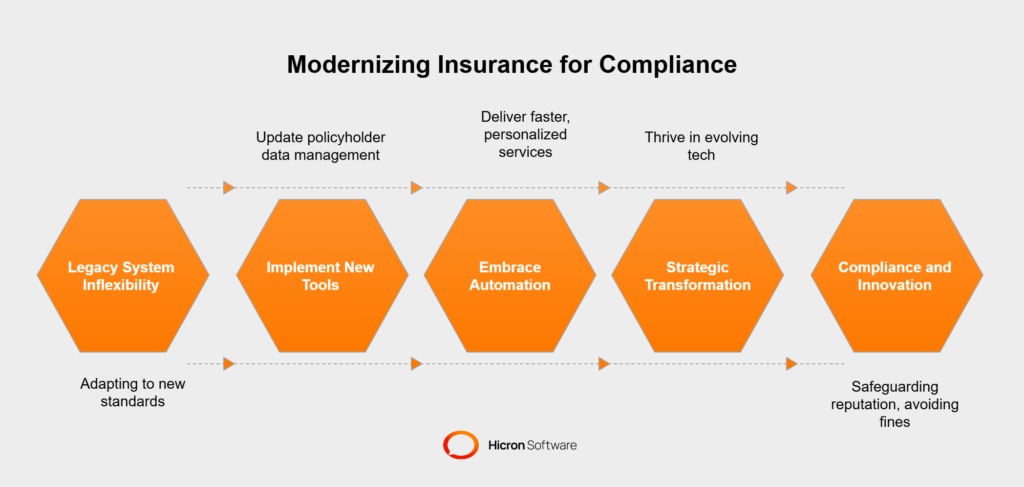

Compliance in the insurance industry is a constantly moving target. New data standards, privacy laws, and industry regulations emerge regularly, requiring insurers to adapt quickly. Unfortunately, insurance legacy systems were designed long before modern compliance frameworks. They often lack the flexibility to meet these evolving demands.

For example, a life insurance company looking to implement advanced policyholder data management tools may find its outdated systems incapable of handling the necessary updates.

This inability to adapt not only risks regulatory penalties but also erodes customer trust. Through legacy system modernization in insurance, insurers can ensure compliance with current and future standards, safeguard their reputation, and avoid costly fines.

Every challenge tied to legacy systems leads to the same conclusion: staying stagnant is an expensive mistake for the insurance industry. Outdated systems create bottlenecks that hinder growth, innovation, and customer satisfaction.

Insurers that fail to modernize risk being outpaced by agile insurtech companies, life insurance tech firms, and custom insurance software providers that prioritize innovation and customer-centric solutions. For example, companies that leverage modern insurance automation and AI-powered tools are delivering faster, more personalized services, leaving traditional insurers struggling to keep pace.

By addressing the constraints of legacy systems, insurers can unlock new efficiencies, improve customer experiences, and explore the full potential of tailored insurance software solutions. Modernization isn’t just a technological upgrade—it’s a strategic transformation that positions insurers to thrive in the rapidly evolving intersection of insurance and technology.

At Hicron Software, we specialize in helping insurers navigate this transformation. From compliance-ready solutions to custom insurance software development, our services are designed to future-proof your business. Learn more about our modernization services here.

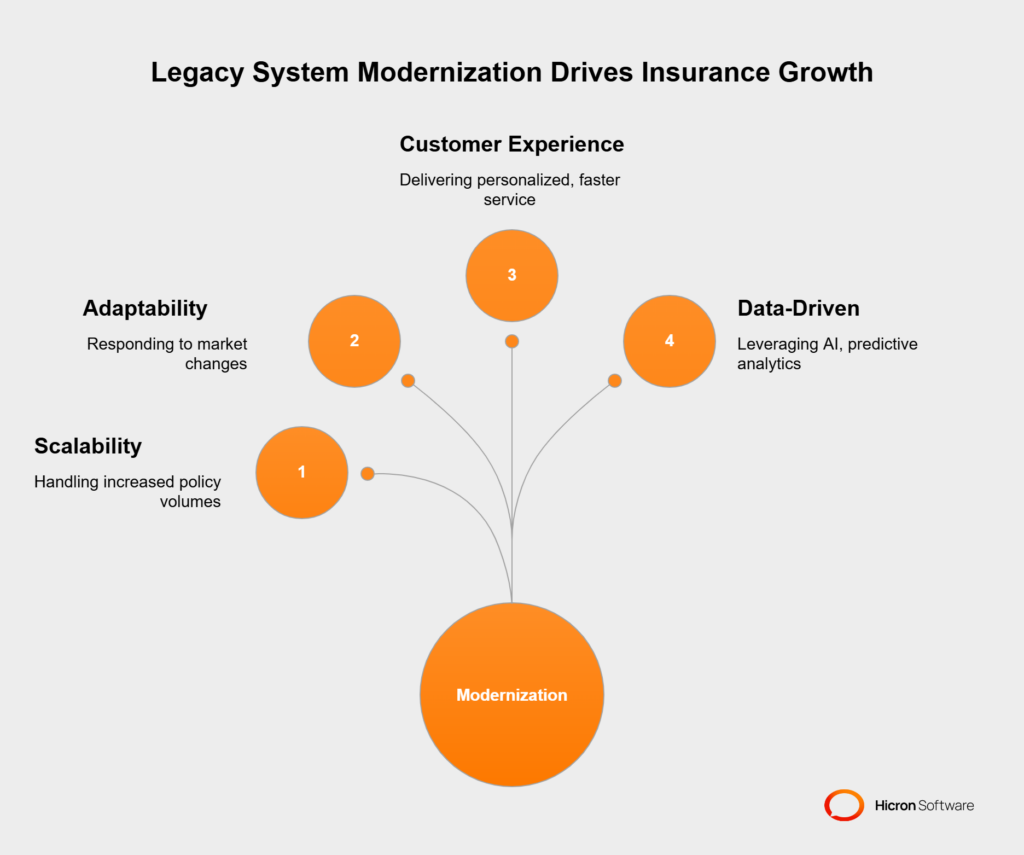

The insurance industry is evolving rapidly, driven by technological advancements, shifting customer expectations, and fierce competition from insurtech startups and insurance tech companies. To thrive in this dynamic environment, insurers must modernize their aging legacy systems.

Here’s why legacy system modernization in insurance is critical for achieving growth, innovation, and long-term success.

The insurance market is growing, with an increasing number of policies being issued and diverse customer needs emerging across sectors such as life insurance, commercial insurance, and healthcare insurance. Modern systems are built for scalability, enabling insurers to handle increased policy volumes without compromising efficiency.

Unlike legacy systems, which often struggle to grow alongside the business, scalable insurance IT systems provide flexible frameworks that adapt to higher demands.

For example, a life insurance company adopting custom insurance software development can expand its services to attract younger, tech-savvy customers while maintaining capacity for traditional clientele.

By modernizing, insurers can confidently pursue new opportunities without being held back by outdated architectures.

Today’s insurers manage more data and transactions than ever before. Legacy systems, however, make adapting to this increased workload a logistical nightmare. Scalability isn’t just about growing capacity—it’s about ensuring systems can handle surges in activity during peak seasons or unexpected events.

For instance, modern insurance software development services often include cloud-based solutions and APIs that can scale in real-time.

This is especially critical in sectors such as medical insurance or real estate insurance, where demand can spike due to natural disasters or emergencies. Automated systems integrated with modern platforms enable insurers to process thousands of claims simultaneously, ensuring smooth operations even during high-pressure situations.

The future of insurance depends on agility and innovation. Legacy systems anchor companies to outdated processes, making it difficult for them to respond to market changes or adopt emerging technologies, such as AI in insurance or IoT for automotive insurance.

Modernized systems, on the other hand, lay the groundwork for future growth and development. Whether it’s integrating usage-based insurance applications or expanding into new markets with custom insurance software solutions, insurers can future-proof their operations with adaptable, forward-thinking platforms. Partnering with insurance software developers ensures businesses address current gaps while positioning themselves for tomorrow’s opportunities.

Customer expectations have never been higher. Today’s insurance customers demand speed, convenience, and personalization at every touchpoint. Legacy systems, with their slow responses and limited functionality, often fail to meet these demands, resulting in poor customer satisfaction and higher churn rates.

Modern solutions, such as AI-driven customer platforms developed by insurance software companies, are transforming the customer experience. By modernizing legacy systems, insurers can deliver faster, more personalized services that keep customers loyal.

Faster policy issuance with modernized systems

Modern technology simplifies bureaucratic processes, reducing the time it takes to issue policies. Automated workflows, supported by insurance automation software, ensure that customers receive coverage faster. This is especially valuable in dynamic sectors like travel insurance, where speed is critical to customer satisfaction.

Real-time interfaces for personalized insurance support

Real-time data interfaces allow insurers to provide tailored services during every customer interaction.

For example, a healthcare insurance platform built with patient-centric software can offer instant query resolution, boosting satisfaction.

These interfaces also enhance policy management by providing real-time updates, reducing waiting times, and delivering personalized recommendations.

Data is the backbone of the insurance industry, and modern systems empower insurers to harness it effectively. Legacy insurance systems, hindered by siloed and inaccessible data, prevent companies from capitalizing on valuable insights.

Through legacy system modernization in insurance, insurers can unlock the full potential of AI and predictive analytics to make smarter, faster decisions.

For example, AI in healthcare insurance can predict patient risks, while telematics in automotive insurance can adjust premiums based on real-time driving behavior.

Leveraging AI and predictive analytics in modern insurance systems

AI technologies have revolutionized the ability to predict risks, detect fraud, and assess policyholder behavior. Predictive analytics, paired with machine learning, enables underwriters to anticipate claim trends and develop proactive coverage solutions.

For instance, in the automotive insurance industry, AI can suggest premium adjustments based on telematics data, helping insurers remain competitive.

Aggregating and analyzing data for smarter insurance decisions

Modern insurance platforms offer tools to aggregate and analyze data, breaking down silos and enabling more intentional decision-making. Whether it’s using disaster claims management tools during a natural disaster or employing predictive analytics for real estate insurance, these systems offer actionable insights that were previously out of reach. Centralized platforms also simplify regulatory compliance, reducing risks from human errors in data processing.

Modernizing insurance legacy systems is a strategic transformation. It enables insurers to scale their businesses, deliver cutting-edge customer experiences, and leverage data to outpace competitors in the insurance technology (insurtech) space.

By investing in technologies such as cloud-based insurance platforms and AI-driven solutions, traditional insurers can regain their competitive edge in a marketplace increasingly dominated by innovation. Partnering with forward-thinking insurance software development companies ensures a transition from insurance legacy limitations to future possibilities.

Modernizing legacy systems in the insurance industry goes beyond fixing outdated technology. It unlocks a range of operational, financial, and strategic benefits that drive growth, innovation, and competitiveness. Here’s why transitioning to modern, scalable systems is a game-changer for insurers.

Legacy systems often create silos, making collaboration and workflow efficiency a challenge. Modern, scalable systems break down these barriers, enabling communication across departments and real-time data sharing.

For example, insurers using integrated systems report a 30% increase in operational efficiency, as teams across underwriting, claims processing, and customer service can access unified data instantly.

A modern insurance software company could implement AI-driven claims automation to process high volumes of claims quickly and accurately, boosting productivity and reducing redundancies.

Manual processes, still common in companies relying on legacy systems, are time-consuming and prone to errors. Modern insurance automation and AI solutions tackle these inefficiencies head-on. Tasks like data entry, policy renewals, and claims approvals can be automated, freeing employees to focus on customer-facing and strategic activities.

For instance, insurers that adopt AI-powered claims automation have reduced processing times by up to 70%, ensuring faster settlements and fewer errors.

This is particularly impactful in high-stakes areas, such as medical insurance, where timely and accurate resolutions are crucial to customer satisfaction.

Modern systems free up both human and financial resources by eliminating inefficient workflows and automating mundane tasks. Employees can shift their focus to strategic initiatives, such as developing tailored insurance software for niche markets or exploring innovative insurtech business solutions.

With these extra resources, insurers can pursue growth opportunities, such as expanding into emerging markets or partnering with insurtech firms. Companies that modernize their systems report a 25% increase in employee productivity, enabling teams to focus on innovation and long-term success.

Maintaining legacy systems is expensive, with rising costs tied to outdated hardware and a shrinking pool of professionals who can service them. Modernizing to scalable systems eliminates these challenges, reducing maintenance costs and freeing up budgets for innovation.

For example, insurers transitioning to cloud-based systems have reported saving 20-30% on IT infrastructure costs annually.

Cloud technology for insurance significantly reduces infrastructure expenses, allowing insurers to reinvest savings into growth-focused projects, such as telematics or AI-driven solutions.

Cloud-based solutions are a game-changer for insurance IT systems. They scale with business needs, allowing insurers to pay only for what they use, which reduces overall IT expenses compared to the fixed costs of legacy systems.

The adoption of cloud technology in the insurance industry is growing rapidly, with forecasts predicting a 23% annual growth rate. This shift not only reduces costs but also improves system performance, enabling insurers to allocate resources to innovation, such as deploying automated claims systems or predictive analytics.

Downtime can disrupt critical processes, such as policy issuance and claims management, damaging productivity and reputation. Legacy systems are prone to failures and slow recovery times, while modern systems are built for reliability and resilience.

Considering that downtime costs insurers an average of $5,600 per minute, minimizing disruptions is essential. Modern systems, equipped with disaster recovery tools and real-time monitoring, ensure insurers remain operational even during crises, protecting both productivity and customer trust.

Security is a top priority in the insurance industry, given the sensitive nature of customer data. Modernized systems offer advanced security features like AI fraud detection and predictive analytics, helping insurers identify and mitigate risks early.

For instance, AI-driven fraud detection can reduce fraudulent claims by up to 40%, saving insurers millions annually.

Additionally, modern encryption standards protect sensitive policyholder information, ensuring compliance with data privacy regulations and reducing the risk of cyberattacks.

Achieving compliance with updated insurance systems

Regulatory changes are constant in the insurance industry, and legacy systems often struggle to keep up. Modern systems, built with compliance tools and consulting, help insurers adapt to new regulations, reducing the risk of fines and penalties.

Insurers using modern compliance tools have reported a 50% reduction in regulatory penalties, thanks to features like automated policyholder data management and smarter workflows.

For example, integrating EDI 834 standards into a modern platform ensures streamlined data exchange and compliance with industry regulations.

Modernizing legacy systems isn’t just an expense—it’s an investment in growth, efficiency, and resilience. Scalable technologies enable insurers to enhance operations, reduce costs, and adapt quickly to market and technological changes.

| Area of Impact | Improvement | Example |

| Operational Efficiency | 30% increase in productivity. | Faster claims processing and reduced redundancies. |

| Cost Savings | 20-30% reduction in IT expenses. | Lower maintenance costs with cloud adoption. |

| Customer Retention | 20% increase in retention rates. | Personalized services and faster resolutions. |

| Fraud Detection | 40% reduction in fraudulent claims. | AI-powered fraud detection tools. |

| Regulatory Compliance | 50% fewer penalties. | Automated compliance tools and workflows. |

Insurers that modernize their systems see an average ROI of 200% within three years, driven by cost savings, improved efficiency, and enhanced customer satisfaction. By adopting future-proof solutions, insurers can thrive in the competitive insurtech industry and meet evolving customer expectations.

We specialize in helping insurers navigate this transformation. From cloud-based solutions to custom insurance software development, our services are designed to future-proof your business. Learn more about our modernization services here.

Modernizing insurance legacy systems has become increasingly imperative for insurance providers seeking to remain competitive in a rapidly evolving industry. Outdated technologies hinder efficiency and limit the ability to adapt to new market demands and customer expectations.

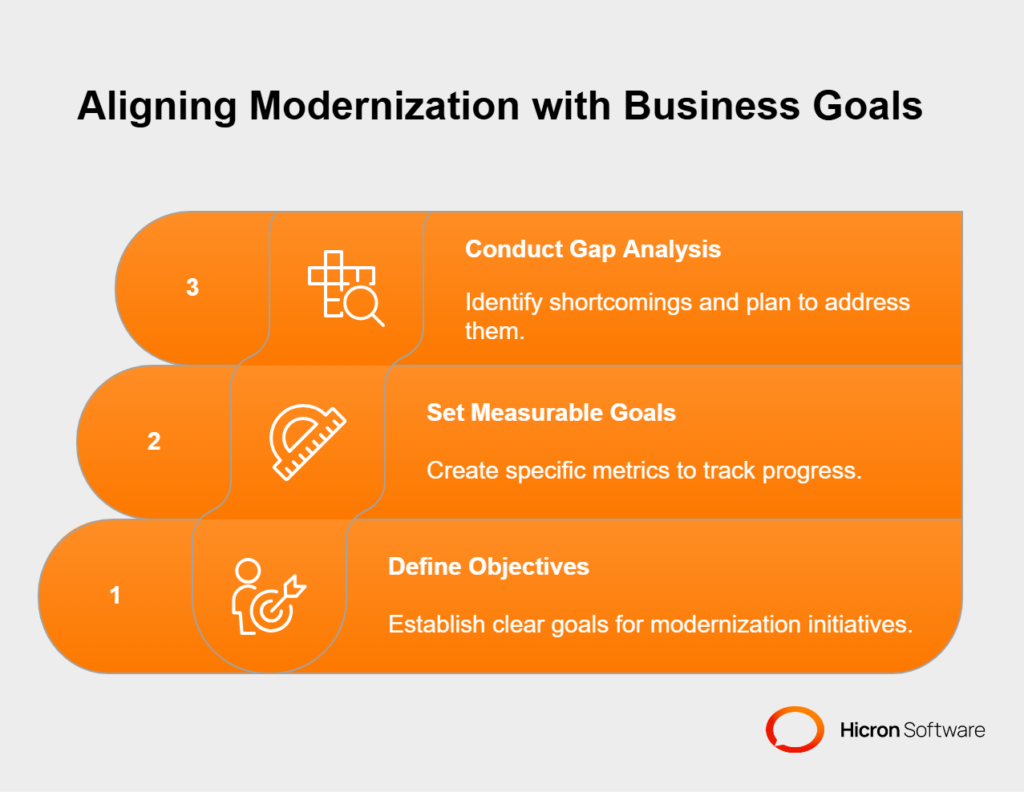

To ensure the success of legacy system modernization in insurance efforts, insurers must consider several critical factors. Below, we break these considerations into detailed, actionable insights.

Legacy insurance system modernization isn’t just a technical upgrade; it must align with your organization’s long-term vision and strategic objectives.

Steps to align modernization with business goals:

1. Define clear objectives and identify what the modernization initiative is expected to achieve:

2. Set measurable goals and create focused metrics, such as:

3. Conduct a gap analysis: Assess where your current systems fall short and map modernization activities to close those gaps.

For example: An insurer aiming to provide more personalized policy offerings can focus on integrating AI-driven customer analytics tools into their system as a priority modernization goal.

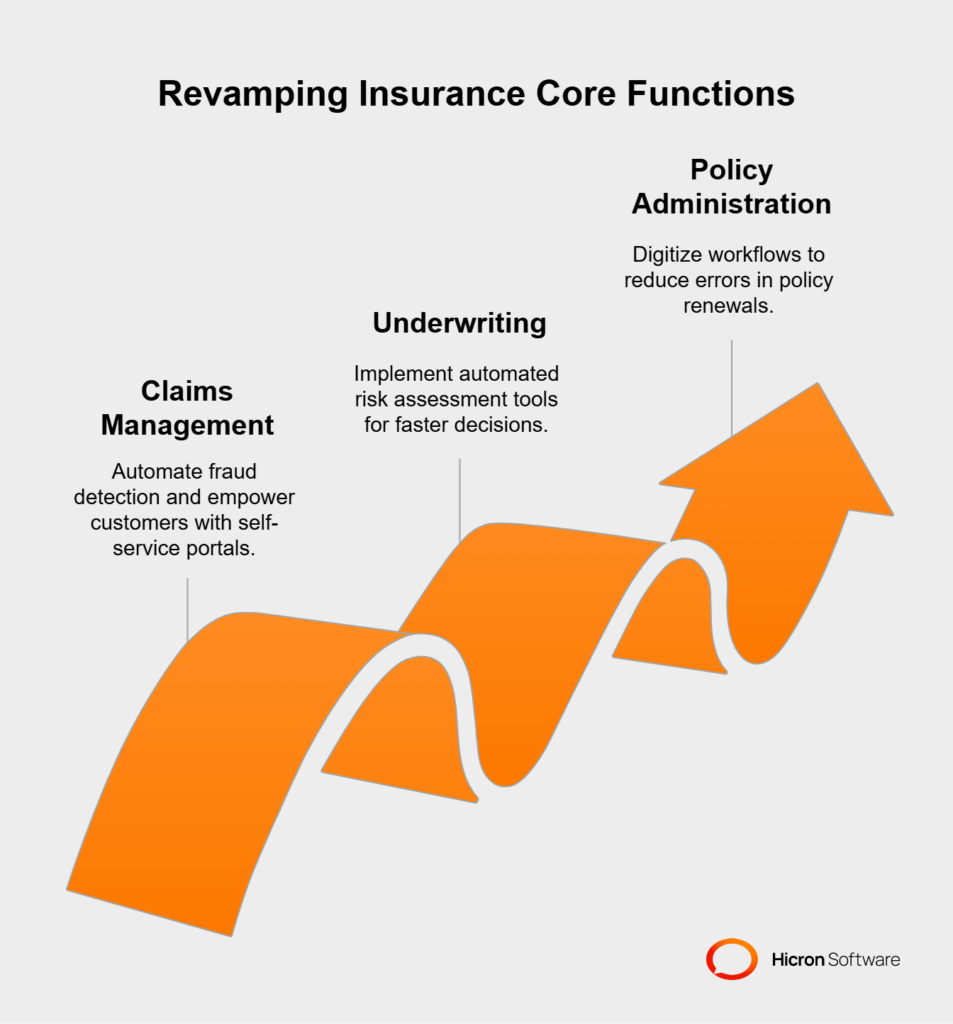

Legacy insurance systems often handle several critical functions. Rather than attempting a complete overhaul at once, insurers should focus on revamping core functionalities that directly impact business performance.

Key functionalities to focus on during insurance upgrades:

1. Claims management:

2. Underwriting: Automated risk assessment tools can process large datasets instantly, enabling faster, data-driven underwriting decisions.

3. Policy administration: By digitizing workflows, Scalable systems reduce policy renewals and adjustments errors.

For example: A health insurance provider revamped its claims management process by adopting predictive analytics, cutting approval times by 40% and significantly improving customer satisfaction.

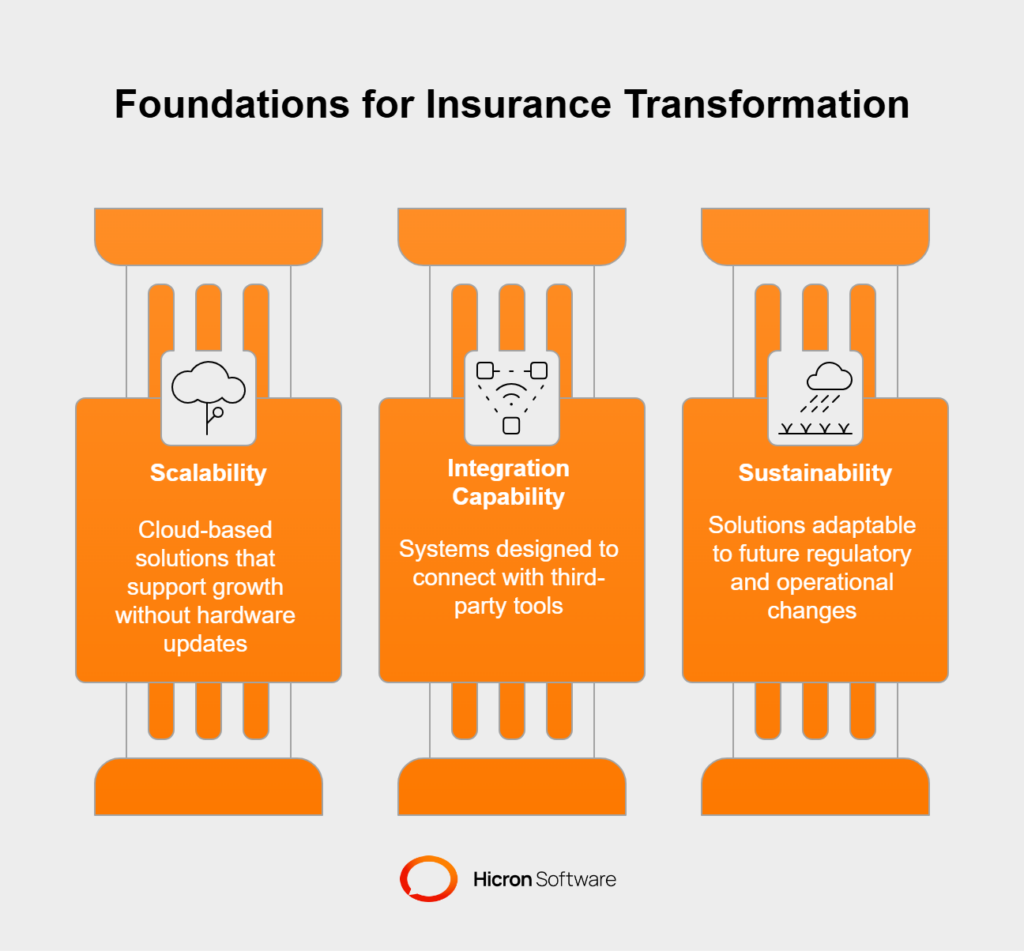

Adopting modern software solutions for insurance without considering their long-term relevance can lead to wasted investments. Carefully selected technologies will ensure insurance scalability, flexibility, and future compatibility.

Key factors for technology selection:

For example: A property insurance company investing in cloud-ready platforms scaled its operations across multiple regions without additional hardware investments, demonstrating the importance of future-proof platforms.

Insurance modernization efforts come with their own set of challenges. Employing preemptive strategies can lessen risks and increase the probability of success.

Protip: Engage employees early by forming cross-departmental groups to test new systems, ensuring usability and buy-in from day one.

Data migration is one of the most sensitive and resource-intensive parts of modernization. Careful planning is critical to avoid data loss or interruptions in business operations.

Proven strategies for smooth data migration:

Case study: A life insurance provider staggered its migration to a cloud platform over six months, starting with historical policy data before implementing real-time customer databases. This approach ensured business continuity with zero downtime.

The key to insurance modernization lies in tailoring solutions to meet business-specific demands while maintaining cost efficiency through standardized processes.

Finding the right balance:

Protip: Combine a standardized backend system with modular, customizable front-end tools for flexibility without compromising reliability.

Insurance modernization often requires specialized expertise, from planning and implementation to post-launch optimization. Collaborating with the right partners can simplify this process.

Roles of experts and providers:

Case study: An insurer working with an insurance IT systems expert successfully transitioned from an outdated claims platform to an AI-powered claims analysis, achieving real-time fraud prevention.

Unlike general IT vendors, insurance-specific providers bring domain expertise, helping address unique industry challenges such as complex compliance requirements or policyholder retention.

Key advantages of specialized providers:

Rushing modernization or failing to include all necessary stakeholders can derail the insurance modernization project. Anticipating potential risks ensures smoother execution.

Tips to avoid common roadblocks:

Modernizing legacy insurance systems is a strategic business decision that unlocks efficiency, reduces costs, and positions insurers for long-term growth. With thoughtful planning, collaboration with industry experts, and a focus on technology that aligns with business goals, insurers can transform challenges into opportunities.

Insurance organizations can build resilient systems tailored to the fast-paced insurtech industry by collaborating with specialized partners and prioritizing strategic functions. It’s a significant investment, but done right, it guarantees returns in the form of agility, customer satisfaction, and market competitiveness.

Insurance companies everywhere face the same challenge: outdated systems that are simply too slow and clunky for today’s fast-paced world. These legacy systems are not just holding insurers back. They’re also creating headaches for employees and frustrating customers.

That’s where modernization comes in. Upgrading to scalable, modern solutions isn’t just a tech decision; it’s a game-changer for efficiency, accuracy, and customer experience. But don’t just take my word for it. Let’s look at real-life examples of how insurers have tackled this and their achievements.

Insurance administrative tasks, such as data entry, compliance reporting, and claims processing, can consume a significant amount of time and resources, especially when managed by outdated systems.

Case study: A mid-sized health insurance provider faced rising operational costs due to inefficiencies in its legacy systems. Manual data entry was consuming hours each week, and the lack of integration between departments created bottlenecks in customer service.

Solution: The organization implemented a modern, cloud-based system focused on workflow automation and centralized data management. Key features included automated policy renewals, real-time claims tracking, and team data-sharing capabilities.

Results:

This example underscores how scalable systems enable insurers to streamline processes and allocate resources more effectively.

Before upgrading, insurers need to understand the pain points limiting their legacy systems. Legacy platforms often create inefficiencies, impact decision-making, and weaken customer trust.

Common pain points:

Example: A property insurance provider operating on a green-screen system found that it could no longer keep pace with the increasing number of claims during natural disasters. The system’s limited processing power delayed claims approvals, frustrating policyholders and straining call center resources.

What can we learn? Identifying these bottlenecks enabled the company to select a digital-first platform that could process high-volume data and reduce approval times.

The transition from legacy systems to modern insurance platforms is a significant project that, when done correctly, generates measurable improvements in productivity and scalability.

Example: A global auto insurance company wanted to modernize its legacy underwriting process to enable faster policy approval times and improve risk assessment accuracy.

Action plan:

Outcomes:

This example illustrates how modern technology streamlines operations and enables insurers to make more informed, data-driven decisions.

Claims processing is one area where legacy systems create significant inefficiencies. Modern systems leverage automation, AI, and cloud technologies to revolutionize this critical function.

Case study: A home insurance provider faced challenges due to lengthy claims processing times, resulting in customer dissatisfaction. Historically, adjusters needed up to two weeks to process claims due to a combination of manual workflows and outdated document management systems.

Solution: The company implemented an AI-powered claims management platform that utilized image recognition and predictive analytics.

Results:

This transformation demonstrates the potential of automation in eliminating process bottlenecks and improving user experiences.

The speed and accuracy with which insurers respond to customer needs significantly influence policyholder loyalty and trust. Transitioning to scalable systems ensures faster service and more reliable results.

Example: A life insurance company using an outdated platform experienced difficulty maintaining accuracy in its customer databases, resulting in incorrect billing statements.

Solution:

Results:

This highlights the importance of modernization in addressing fundamental issues that impact accuracy and customer satisfaction.

Workflow automation is a game-changer for insurance companies transitioning away from legacy systems. By automating repetitive tasks, insurers can reduce costs, increase employee productivity, and improve overall service quality.

Example: An international insurer automated its policy renewal process, which had historically required manual data updates and approval cycles lasting weeks. The new workflow automation tools provided the following solutions:

Results:

Automation enables insurers to focus on innovation and service delivery, while eliminating time-consuming manual tasks.

These case studies highlight the immense potential of modernizing outdated insurance systems. Scalable solutions and advanced technologies enable insurers to reduce costs, streamline workflows, and meet the evolving needs of policyholders. By prioritizing modernization, insurers can unlock measurable results by automating claims processes, reducing turnaround times, or implementing cutting-edge analytics.

By learning from these real-world examples and partnering with industry-specific experts, insurance providers can make legacy system modernization an investment in future growth and success.

The future of insurance technology lies in consistent evolution, with legacy insurance system modernization serving as both the starting point and ongoing necessity. Insurers must stay ready for transformative trends shaping the industry while fully recognizing the opportunities with scalable, cutting-edge systems.

Insurance providers are increasingly moving away from inflexible legacy systems to reduce operational costs, achieve scalability, and meet rising customer expectations for fast, personalized services.

| Trend | Description |

| Modular, API-Driven Systems | Enables integrations without full system overhauls. |

| Incremental Modernization | Focuses on high-impact areas first, like claims processing or policy management. |

| Cloud Adoption | Provides scalable storage and processing power for high-demand periods. |

| AI and Automation | Reduces errors, speeds up processes, and personalizes customer experiences. |

| End-to-End Integration | Unifies critical functions for a cohesive customer and operational experience. |

A key trend is the shift toward modular, API-driven systems that allow integrations rather than requiring complete overhauls. This approach prioritizes agility, enabling insurers to adapt quickly to market demands without the rigidity of one-size-fits-all solutions.

Another emerging strategy is incremental modernization, where insurers focus on high-impact areas, such as policy management or claims processing, first. This phased approach minimizes disruption while ensuring steady progress toward building a more dynamic and responsive technology stack.

Example: A leading insurer modernized its claims processing system using APIs, reducing claim resolution times by 40% while maintaining uninterrupted service during the transition.

Cloud computing, automation, and artificial intelligence (AI) are reshaping the insurance landscape, becoming essential pillars of modernization.

Together, these technologies reduce costs, enhance accuracy, and create better, more customized experiences for policyholders.

Integration is no longer optional—it’s a competitive necessity. Fully integrated, end-to-end platforms unify all critical functions under one digital ecosystem, from marketing and underwriting to claims handling and customer engagement.

| Feature | Legacy Systems | Modern Systems |

| Scalability | Limited, struggles with growth. | Highly scalable, adapts to demand. |

| Integration | Siloed, difficult to connect with tools. | Integration with APIs and platforms. |

| Customer Experience | Slow, outdated processes. | Fast, personalized, and efficient. |

| Cost | High maintenance and operational costs. | Lower costs with cloud and automation. |

| Compliance | Rigid, hard to adapt to new regulations. | Flexible, built-in compliance tools. |

| Security | Vulnerable to breaches and outdated protocols. | Advanced encryption and AI-driven fraud detection. |

This integration eliminates inefficiencies and provides a 360-degree view of customers, enabling faster decision-making and stronger relationships. Additionally, these platforms easily connect with third-party tools, such as telematics for auto insurance or IoT devices for home policies, to anticipate customer needs more effectively.

Example: An insurer using an integrated platform reduced operational redundancies by 25% and improved customer satisfaction scores by offering real-time policy updates and claims tracking.

Scalable systems empower insurers to expand into new markets and offerings without the need for constant reinvestment in technology infrastructure.

For example, insurers can quickly adjust to growing policy volumes or explore microinsurance opportunities in underserved demographics.

Scalable systems also provide the flexibility to handle sudden surges in claims or policy purchases, which are increasingly common during economic shifts or global crises.

Insurers with scalable systems report a 30% faster response time during high-demand periods, ensuring uninterrupted service and customer satisfaction.

The insurance market is constantly evolving, and flexibility is key to staying ahead. Modern systems allow insurers to adapt to fluctuating regulations, emerging risks, and changing customer needs.

For instance, data-driven tools now enable insurers to create dynamic pricing models that adjust premiums in real time based on customer behavior or external factors. Similarly, platforms with built-in flexibility can quickly adapt to broader changes, such as climate risk or gig economy insurance, without requiring months of development.

Example: A global insurer leveraged flexible systems to launch a climate risk insurance product within weeks, capturing a growing market segment and gaining a competitive edge.

Modernizing insurance legacy systems is about gaining a competitive edge. Advanced capabilities, such as real-time data analysis, machine learning-powered fraud detection, and predictive customer behavior modeling, enable insurers to respond faster and smarter.

These systems help businesses identify emerging risks, offer niche policies, and engage customers more meaningfully. Personalized offerings, faster claims resolution, and customer journeys create lasting impressions that boost loyalty and attract new policyholders.

Insurers using predictive analytics have seen a 20% increase in customer retention rates, thanks to personalized recommendations and proactive risk management.

Example: A life insurance company utilized machine learning to identify fraud patterns, resulting in a 40% reduction in fraudulent claims and an annual savings of millions.

The future of insurance depends on modern, agile systems that can adapt to change, drive growth, and deliver unparalleled efficiency and insights. By modernizing insurance legacy systems, insurers can stay ahead of market shifts, exceed customer expectations, and gain a competitive edge through advanced technologies like AI, automation, and cloud computing.

Legacy insurance system modernization is a strategic investment in innovation, resilience, and long-term success. To explore practical steps and tailored strategies for upgrading your systems, connect with industry experts who can guide you through the transformation. Together, we can build a stronger, smarter, and more agile future for the insurance industry.

Legacy system modernization in insurance refers to the process of upgrading or replacing outdated IT systems with modern, scalable, and efficient technologies. This transformation helps insurers improve operational efficiency, reduce costs, enhance customer experiences, and stay competitive in a rapidly evolving industry.

Modernization is essential because legacy systems often lack the flexibility, speed, and integration capabilities required to meet today’s customer expectations and regulatory demands. By modernizing, insurers can:

Some of the main benefits include:

Modernization often involves adopting technologies like:

Cloud computing offers insurers:

Incremental modernization is a phased approach where insurers upgrade high-impact areas (e.g., claims processing or policy management) first, rather than overhauling the entire system at once. This method minimizes disruption, reduces risk, and ensures steady progress toward a fully modernized technology stack.

Modern systems enable insurers to:

These improvements lead to higher customer satisfaction and loyalty.

Insurers that fail to modernize risk:

The timeline for modernization depends on the scope of the project. Incremental modernization (focusing on specific areas first) can take a few months, while a full system overhaul may take 1-2 years. Partnering with experienced insurance software developers can help streamline the process and reduce implementation time.

To ensure success, insurers should: