Insurance Fraud Detection Software in the Era of AI

- March 10

- 30 min

Modern insurance apps & platforms are revolutionizing customer engagement by delivering personalized solutions, real-time insurance updates, and user-friendly experiences that were previously unimaginable.

These platforms leverage advanced technologies, such as AI and machine learning, to address challenges like fraud detection, streamline processes, and boost transparency and trust. By integrating intelligent tools into their systems, insurers not only enhance operational efficiency but also create more meaningful and efficient interactions with policyholders, fostering long-term relationships.

For today’s digital-savvy policyholders, convenience isn’t just a bonus; it’s an expectation. They demand seamless, user-friendly insurance software experiences that fit into their busy lives, whether that means quick claims processing, accessing custom insurance solutions, or receiving real-time insurance updates.

Modern insurance apps & platforms cater directly to these needs, blending intuitive design with cutting-edge capabilities driven by custom insurance app development and ongoing digital transformation for insurance providers.

These apps go beyond simplifying tasks by integrating features such as AI-powered support, automated claims systems, and personalized notifications. They actively enhance Insurtech customer engagement, helping insurers meet and exceed expectations.

The result? Stronger relationships with policyholders, greater benefits of modern insurance apps, and lasting customer retention in an increasingly competitive market.

When it comes to insurance, customer engagement does more than enhance interactions — it builds trust and loyalty, which are the cornerstones of policyholder retention.

Engaged customers are more likely to stick with a brand they feel connected to, even when competitors try to lure them away with lower premiums or flashy offers. For insurers, fostering that connection means creating meaningful, consistent touchpoints, and modern insurance apps & platforms are proving to be the perfect bridge.

Insurance apps powered by innovative insurance app development and insurtech customer engagement solutions help close the gap between insurers and their customers.

They simplify communication, making it easier for policyholders to ask questions, file claims, or manage their policies at any time, while showcasing the benefits of modern insurance apps.

Whether it’s through real-time insurance updates about policy changes, AI-driven chat support, or intuitive claims-tracking tools, these user-friendly insurance software platforms provide a seamless flow of information. This level of accessibility improves the customer experience and reinforces the sense that their insurer is always just a swipe away.

Investing in engaging app experiences also gives insurers a noticeable competitive edge. Consumers now expect the same level of convenience from their insurance providers as they do from other digital services.

By leveraging technologies like custom insurance software and AI integration as part of a broader digital transformation for insurance, companies can stay ahead in the insurtech race.

Engaged customers are more likely to renew their policies and more inclined to recommend that insurer to friends and family, bolstering the brand’s reputation and long-term growth.

Simply put, customer engagement in insurance is no longer an added perk; it has become a strategic necessity. Insurers prioritizing technology-driven engagement are better positioned to retain policyholders, win their loyalty, and thrive in a highly competitive market.

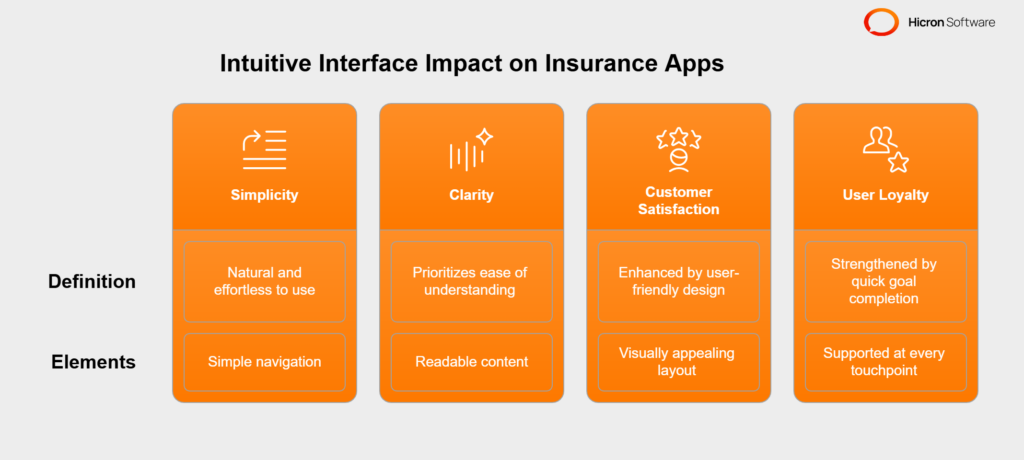

An intuitive interface feels natural and effortless to use, even for someone experiencing it for the first time. It prioritizes simplicity and clarity, allowing users to find what they need without confusion or frustration quickly.

For modern insurance apps & platforms, intuitive design is essential for fostering Insurtech customer engagement. After all, policyholders accessing these platforms often seek solutions to pressing concerns, such as claims, coverage details, or billing issues. An overly complex interface can turn these moments into pain points, while a well-designed one enhances the overall experience.

Key user-friendly design elements in insurance software, such as simple navigation, readable content, and a visually appealing layout, enhance customer satisfaction. Clear pathways within the app ensure users can complete actions, such as filing a claim or checking policy information, without any guesswork.

Readability is equally essential, as concise and well-organized content makes it easy for users to absorb information. Add attractive, modern visuals, and you create an interface that’s both functional and enjoyable. The benefits of modern insurance apps are evident in various examples of successful app redesigns.

For instance, consider cases where insurance companies revamped menus to reduce clutter, implemented straightforward dashboards to highlight key details, or added visual tools like progress bars to guide users through the claims process.

These innovations reflect the ongoing digital transformation in insurance and its commitment to enhancing user experiences through advanced insurance app development. So, changes not only improved usability but also led to greater customer satisfaction. Users who can quickly accomplish their goals are more likely to view their insurer positively, nurturing stronger trust and loyalty.

With insurance software development and digital transformation driving innovation in the insurance industry, creating intuitive interfaces is no longer optional. It’s a vital part of ensuring customers feel supported at every touchpoint. By focusing on simplicity, clarity, and appeal, insurers can craft experiences that keep users coming back—not because they have to, but because they want to.

Modern insurance apps & platforms are no longer static tools for accessing policy information; they’re dynamic platforms designed to elevate customer engagement through scalable features. These functionalities enhance usability and foster a stronger bond between insurers and policyholders, ensuring a seamless experience throughout.

One standout feature is real-time insurance updates, which allow users to stay instantly informed about changes to their coverage, premiums, or renewal dates. Combined with push notifications, this keeps critical information at the forefront, giving customers peace of mind without needing to dig through paperwork or emails. Similarly, chatbots powered by AI in insurance offer 24/7 support, enabling users to quickly and efficiently find answers to common queries or resolve issues.

Self-service capabilities have become another essential aspect of these user-friendly insurance software solutions. Tools like claims tracking and premium payment portals enable policyholders to take control of their accounts without requiring direct assistance. For instance, monitoring the progress of a submitted claim eliminates unnecessary follow-ups and improves transparency. These features save time for customers and insurers, reflecting a commitment to convenience and efficiency driven by insurance app development.

Perhaps most impactful, though, are personalized recommendations and tailored offers powered by AI and advanced analytics. By analyzing policyholder behavior and preferences, apps can suggest add-ons, updates, or specialized coverage that align perfectly with individual needs. This level of personalization not only highlights the benefits of modern insurance apps but also makes customers feel valued, while opening opportunities for insurers to cross-sell or upsell their services in a way that feels natural and beneficial.

These scalable innovations represent the core of customer-centric digital transformation in the insurance industry. By continually leveraging technology to make their apps more intelligent and intuitive, insurers can foster deeper Insurtech customer engagement, greater satisfaction, and long-term loyalty among their policyholders.

Transparency is critical in building strong relationships between insurers and their customers. Real-time insurance updates on claims, renewals, and policy changes play a huge role in keeping policyholders informed at every stage.

When customers can track the status of their claims, receive timely reminders about policy renewals, or instantly view changes to their coverage, it creates an open and honest communication channel. This level of visibility reassures customers that their insurer is proactive and dependable. Real-time insurance updates are compelling in reducing the anxiety often associated with insurance processes.

For example, policyholders might feel stressed or uncertain about the outcome during the claims process. Providing live progress trackers and notifications ensures they know exactly where they stand, eliminating unnecessary guesswork and fostering a sense of control.

Similarly, quick updates for renewals or adjustments give customers ample time to take action, reducing the chances of missed deadlines or lapses in coverage.

From a technological perspective, delivering real-time insurance updates relies on the effective integration of insurance app development and APIs in insurance systems. APIs connect various data sources and applications, enabling seamless communication and the instant delivery of customer information.

For instance, insurance software development can integrate APIs to pull details from claims processing systems, policy management platforms, or underwriting tools, ensuring customers have up-to-the-minute insights.

Additionally, leveraging cloud-based solutions and robust data pipelines as part of a broader digital transformation for insurance ensures that these real-time functions are scalable, secure, and reliable.

Ultimately, these updates do more than just communicate information; they build trust between the insurer and the policyholder. Customers who feel informed are more likely to see their provider as transparent, caring, and professional.

By prioritizing real-time insurance updates through advanced technology and APIs, insurers can meet and exceed customer expectations, setting themselves apart in an industry where trust is everything. These innovations further highlight the benefits of modern insurance apps as a means to facilitate transparency and enhance Insurtech customer engagement within modern insurance apps & platforms.

The advent of digital transformation has prompted insurance companies to modernize their platforms to meet evolving customer expectations and market demands. The HDI Group, an international insurance leader, is an example of how app modernization can drive remarkable results, including a 30% boost in policyholder retention. Collaborating with Hicron Software, HDI overhauled its critical Policy Application, addressing outdated technology and improving overall user experiences.

The Policy Application was a business-critical tool for HDI, managing contracts, drafting policy documents, and issuing invoices. However, its outdated architecture and limited functionality created roadblocks for business and IT teams. Among the primary challenges were:

HDI’s previous modernization attempts with another partner failed to yield the desired outcomes. A new approach, partner, and strategy were urgently needed.

HDI selected Hicron Software for its innovative approach, technical expertise, and ability to align with business goals. A thorough transformation plan was developed and executed with Hicron’s team, focusing on four key areas:

#1 Modern technology adoption

The outdated tech stack replaced modern, scalable technologies, including Vaadin, Java8, and Eclipse RCP. This ensured the system was future-proof and capable of adapting to business expansions and changes.

Check one of our case studies about modernizing insurance application with Vaadin and Java techs.

#2 Interface redesign

The user interface was overhauled for simplicity and usability, resulting in increased satisfaction among internal users and policyholders. Key updates included a more intuitive layout, streamlined navigation, and revised workflows for easier access to critical tools.

#3 Efficiency through automation

Automated testing and streamlined bug-fixing processes drastically reduced update rollout times. Release cycles were shortened from three months to just one week, accelerating time to market for new features.

#4 Enhancing communication and collaboration

Hicron bridged the communication gap between HDI’s IT and business teams. As both a development partner and consultant, Hicron ensured that technical and business requirements were aligned, leading to smoother project execution.

#5 Performance optimization

Hicron optimized application views, reduced code volume, and boosted overall stability. The number of lines of code was trimmed from 450,000 to 250,000, improving both maintainability and system performance.

The modernization of the Policy Application produced transformative results for the HDI Group, impacting both internal operations and customer-facing outcomes:

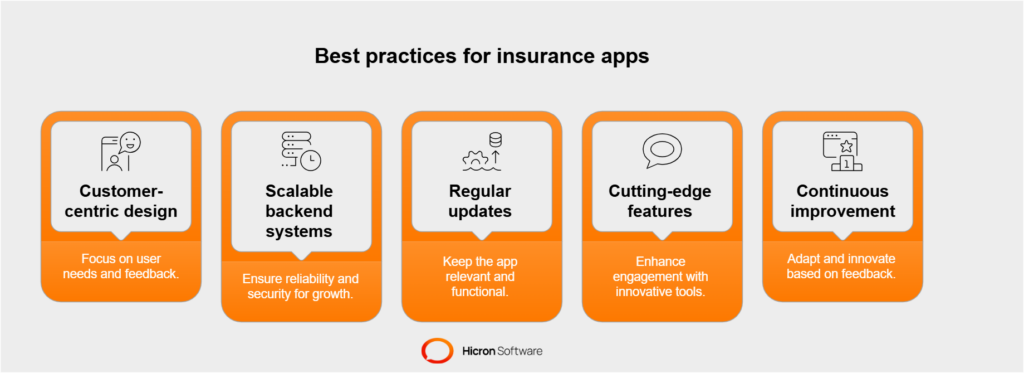

Building a modern insurance app that stands out in today’s landscape requires following best practices that cater to usability, scalability, and innovation. Below are the key principles to help insurers and developers create apps that meet customer expectations and industry demands.

The foundation of successful modern insurance apps & platforms lies in customer-centric design. This means putting the needs and expectations of users at the forefront of the development process. Gathering feedback during every stage of the process is vital.

Conduct focus groups, usability tests, and surveys to identify pain points and areas of improvement. For instance, if users find forms too lengthy or navigation confusing, these insights can lead to meaningful adjustments.

This feedback loop ensures that the final product aligns with the benefits of modern insurance apps by being intuitive and tailored to policyholders’ fundamental requirements.

A robust backend framework is essential for supporting growth and maintaining optimal performance in user-friendly insurance software. Scalable systems allow apps to handle increasing data loads and user activity without lag or downtime. This is particularly crucial as insurers add more features or onboard more customers.

Equally important is ensuring security. Personal details, financial data, and policy information are at the heart of insurance apps. Stringent security protocols, including encryption, multi-factor authentication, and adherence to data protection regulations, safeguard sensitive customer information.

Such practices showcase the potential of insurance app development while fostering trust in the app’s reliability.

Real-time insurance updates and routine improvements help modern insurance apps & platforms keep pace with evolving user needs and technological advancements. Frequent updates address bugs, enhance security, and revise interfaces to remain fresh and user-friendly. These updates ensure smooth functionality and demonstrate insurers’ commitment to digital transformation for insurance initiatives.

Integrating advanced functionalities into modern insurance apps enhances Insurtech customer engagement. Examples include AI-powered insights for personalized recommendations and predictive analytics to help users optimize coverage. Additionally, features such as streamlined claims processing and telematics integrations offer significant value to customers. By staying ahead of industry trends and leveraging technology, insurers exceed user expectations and strengthen engagement.

Consistency in innovation is crucial for success in insurance app development. A thriving app requires continuous improvement based on analytics, feedback, and evolving technologies. This ensures the app remains relevant, supporting both customers and insurers. By continuously leveraging the benefits of modern insurance apps, insurers craft lasting tools that fulfill customer demands and future-proof their digital offerings.

Combining customer-centric approaches, scalable and secure backends, real-time insurance updates, innovative features, and regular updates enables insurers to set a new standard in user-friendly insurance software while leading the way in digital transformation for the insurance industry.

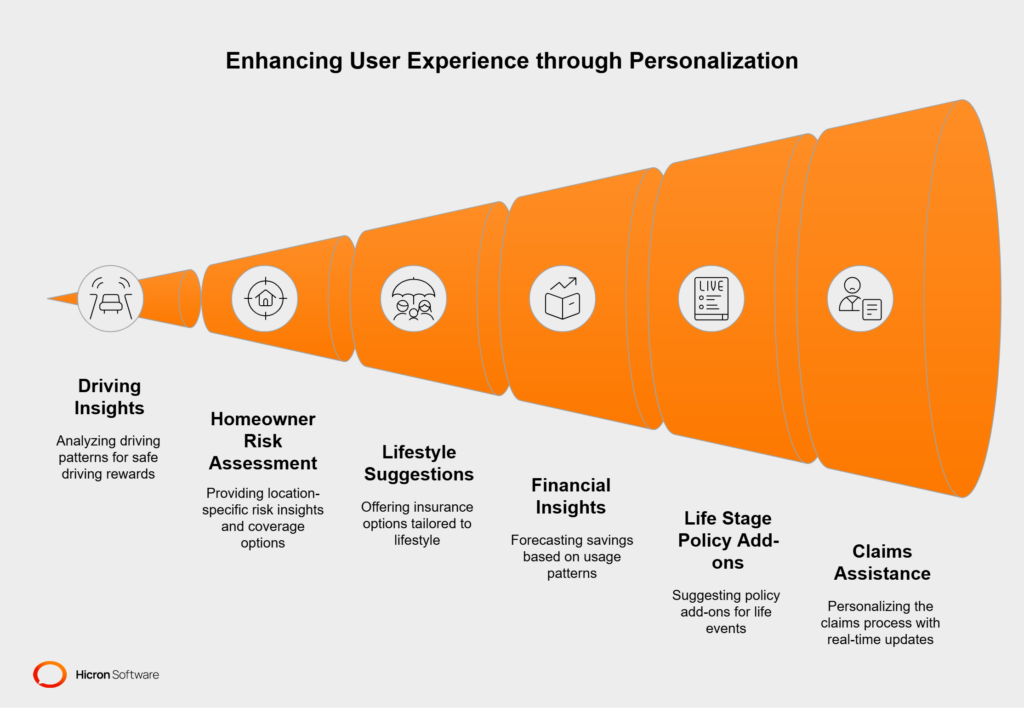

Personalization is quickly becoming a core feature for modern insurance apps & platforms, transforming how customers interact with their providers. By leveraging data, these apps deliver highly customized experiences that meet and exceed users’ expectations.

Tailoring services to individual needs not only highlights the benefits of modern insurance apps but also creates a sense of value and relevance, encouraging more engagement and fostering Insurtech customer engagement.

Through insurance app development, insurers can utilize advanced analytics and AI technology to offer features such as personalized policy recommendations, tailored risk assessments, and even dynamic premium adjustments.

Realizing the potential of personalization within insurance apps aligns perfectly with broader digital transformation strategies for the insurance industry, making platforms more intelligent and customer-centric.

For example, real-time insurance updates keep policyholders informed about claims progress, renewal timelines, or coverage changes, all tailored to their specific needs. These seamless interactions in user-friendly insurance software not only enhance usability but also strengthen long-term customer loyalty by showing an understanding of individual preferences.

By prioritizing personalization as a core element of their digital offerings, insurers can unlock the full potential of modern insurance apps & platforms while setting themselves apart in a highly competitive market.

Modern insurance apps can access a wealth of data from user profiles, behavioral patterns, and external sources, including location and telematics data. By analyzing this information, apps can offer personalized policy recommendations, suggest coverages that align with a user’s lifestyle, or provide reminders tailored to specific milestones, such as payment deadlines or anniversary dates for renewals. Personalized insurance apps enable users to feel understood, ensuring that the services they encounter are tailored precisely to their needs.

Personalized engagement in modern insurance apps & platforms takes many shapes, catering to the diverse needs of individual users. By presenting customized solutions, these apps build trust and create value. Below are several examples, divided into distinct scenarios, that showcase how personalization enhances the user experience.

#1 Driving-based insights in user-friendly insurance software

For young drivers, insurance app development can offer policies that reward safe driving through discounts. By analyzing telematics data, such as braking patterns and average speed, insurers can create more accurate risk profiles and provide real-time insurance updates about customized incentives, including lower premiums or cash back, for responsible driving habits. This encourages safer behavior and ensures users see the benefits of modern insurance apps.

#2 Risk assessment for homeowners powered by digital transformation for insurance

Apps can generate detailed, location-specific insights for homeowners, especially those in high-risk areas.

For instance, someone living in a flood-prone region might receive tailored recommendations for additional flood protection coverage, advice on preventive measures such as installing sump pumps, or alerts about potential weather risks.

These features enhance Insurtech customer engagement, making apps essential for alleviating anxieties and preparing users for potential risks.

#3 Lifestyle-driven suggestions with modern insurance apps

Personalized engagement can also align with a user’s lifestyle. For instance, a frequent traveler might be prompted with tailored travel insurance options, including coverage for lost baggage or medical assistance abroad. Similarly, a pet owner might receive suggestions for pet insurance policies, including detailed comparisons of veterinary coverage or accident protection. These scenarios exemplify the customer-first focus within modern insurance apps & platforms.

#4 Financial insights and savings through user-friendly insurance software

To help users manage their finances, apps can forecast potential savings by analyzing usage patterns.

For example, renters with good credit or those filing fewer claims might receive alerts about premium reductions for consistently low-risk behavior.

These financial insights underscore the benefits of modern insurance apps, positioning them as indispensable financial tools that enhance users’ lives.

#5 Policy add-ons tailored to life stages enabled by digital transformation for insurance

Life events, such as marriage, having children, or purchasing a new home, often give rise to new insurance needs. Apps can leverage insurance app development and AI technology to detect these changes based on user data and suggest policy add-ons, such as life insurance, tuition protection for dependents, or increased liability coverage for home renovations. These personalized suggestions ensure policyholders feel supported during major life milestones.

#6 Claims assistance and tracking through real-time insurance updates

Insurance apps can personalize the claims process for users.

For instance, after a car accident claim is filed, an app could provide updates and insights on the average timeline for similar claims.

Personalized repair shop suggestions based on user location or service preferences improve convenience and reduce the stress of navigating claims. These interactive, user-friendly insurance software features foster trust and enhance usability.

By focusing on personalization through advanced technologies and continual improvements, insurers leverage the core of digital transformation to meet evolving user expectations. Modern insurance apps & platforms stand out for their ability to blend cutting-edge solutions with user-specific value, ensuring higher loyalty and long-term satisfaction.

At the heart of these personalized experiences is the use of AI-driven analytics. Advanced machine learning algorithms can analyze vast datasets to predict customer needs before they arise.

For example, modern insurance apps & platforms powered by AI can anticipate when a user might be planning to upgrade their car and automatically suggest relevant coverage changes.

Simultaneously, these tools can identify cross-sell or up-sell opportunities in ways that align with Insurtech customer engagement strategies, making suggestions feel natural and helpful rather than intrusive.

Additionally, AI enables insurers to deliver hyper-relevant recommendations while eliminating guesswork, creating a smoother and more enjoyable customer experience. These capabilities are essential for user-friendly insurance software, as they provide actionable and specific insights, which improve engagement and make customers feel understood. This combination of technology and empathy highlights the benefits of modern insurance apps.

By embedding personalization into every touchpoint, insurers leverage digital transformation for insurance to turn apps into trusted advisors rather than just transactional tools. Customers are increasingly looking for platforms they can depend on not only for services but also for support and solutions. With features like real-time insurance updates and predictive analytics, these apps foster deeper relationships with users, setting insurers apart in a crowded market.

The integration of data, AI-driven analytics, and thoughtful insurance app development ensures that every interaction feels impactful and meaningful. By striking this balance, insurers can create solutions that resonate with customers, solidifying long-term loyalty and satisfaction.

The insurance industry is undergoing rapid change, with technology at its core. New advancements are shaping apps to be more innovative, more engaging, and more personalized than ever before. Let’s explore some of the most exciting trends that are set to transform how modern insurance apps & platforms connect with and serve their users.

Augmented Reality (AR) and Virtual Reality (VR) are becoming game changers in insurance app development. These technologies have the potential to provide interactive policy simulations, allowing users to visualize coverage scenarios or potential risks in real-time.

On the other hand, gamification enhances Insurtech customer engagement by turning tasks like learning about policies into interactive, rewarding experiences. Features like progress tracking, reward points for completing educational modules, or even simulated risk management games can help users better comprehend insurance products while boosting app usage.

These forward-thinking additions showcase the benefits of modern insurance apps by making policies more relatable and less intimidating, especially for younger audiences.

| Technology | Application in Insurance Apps | Benefits |

| AI & Machine Learning | Personalized recommendations, fraud detection, and claims automation | Enhances Insurtech customer

engagement and operational efficiency |

| IoT Integration | Connected cars, smart homes, and wearables | Enables behavior-based pricing

and proactive risk management |

| 5G Connectivity | Faster app performance and live video consultations | Supports real-time insurance updates and seamless interactions |

| AR/VR | Policy simulations and gamification | Improves user understanding and engagement |

The rollout of 5G technology promises to revolutionize the way modern insurance apps & platforms operate. Ultra-fast connectivity ensures apps run more smoothly, with minimal delays, even when processing complex tasks such as live video consultations for claims or data-heavy, real-time insurance updates. This enhanced speed supports seamless interactions, such as instant chatbot responses or quicker document uploads for claims submissions.

5G also opens doors for innovative features, such as live streaming damage assessments, where users can show accident sites or home damages directly to adjusters through the app. These real-time insurance updates streamline processes, making claims faster and more efficient. Future insurance apps leveraging 5G will deliver instant, ultra-responsive, and connected customer experiences, further driving digital transformation in the insurance industry.

Integration with wearable devices and Internet of Things (IoT) solutions is rapidly gaining momentum in insurance app development. Wearables, such as smartwatches or fitness trackers, enable insurers to design health policies that dynamically adjust based on real-time data, including heart rate, activity levels, and sleep patterns.

For instance, users who maintain active, healthy lifestyles might earn discounts or rewards for their efforts.

IoT-enabled devices, such as connected cars or smart home systems, bring similar value to auto and property insurance policies. A vehicle with IoT sensors can automatically send driving data to the app, enabling behavior-based pricing models. Likewise, smart home devices can alert insurers to risks such as water leaks or unexpected motion detection, providing homeowners with added protection and reducing claims.

These capabilities demonstrate the benefits of modern insurance apps by making insurance more personalized and preventive, helping users avoid unnecessary costs and losses.

Emerging technologies like AR/VR, 5G connectivity, and IoT integration signal a future where modern insurance apps & platforms transcend traditional functionality to deliver interactive, efficient, and highly personalized user experiences. By adopting these innovations, insurers can create user-friendly insurance software that empowers users, streamlines processes, and redefines digital transformation for insurance in a way that resonates with and engages users.

Investing in customer engagement through apps is not just a trend; it’s a strategic move with measurable long-term benefits. For insurance companies, modern apps do more than provide convenience. They help build lasting relationships, enhance brand appeal, and have a significant impact on the bottom line. Here’s how this approach pays off.

A well-designed app fosters stronger Insurtech customer engagement by offering convenience, personalized solutions, and proactive communication. When customers feel valued and supported, they’re less likely to switch providers. This directly contributes to reduced churn, one of the biggest challenges in the insurance industry.

Additionally, engaged users are more likely to explore additional policies or services, increasing their lifetime value. For example, a customer who starts with auto insurance may add home or life insurance thanks to tailored recommendations provided through the app. These personalized suggestions emphasize the benefits of modern insurance apps, boosting revenue while solidifying long-term customer loyalty.

Today’s tech-savvy consumers expect their insurance providers to keep up with advancements in technology. A user-friendly insurance software solution meets these expectations and differentiates your brand in a crowded market. It signals innovation, a focus on customer needs, and a commitment to digital excellence.

Younger generations, especially digital natives, are drawn to brands that offer seamless, app-based experiences. Apps equipped with features like easy claims processing, transparent policy management, and real-time insurance updates provide exactly what these users are looking for.

Adopting a digital transformation strategy for insurance not only attracts new, tech-savvy customers but also drives future growth.

Clear metrics can demonstrate the ROI of an engaging insurance app. Customer retention rates often provide the earliest indicator of success, showing whether users are staying loyal over time. High app engagement metrics, such as daily or weekly active users, feature usage rates, and session durations, reflect ongoing customer satisfaction.

App downloads and onboarding rates reveal how effectively your app reaches new audiences and converts them into active users. Meanwhile, user reviews and ratings on app stores enhance your brand reputation and attract additional customers organically.

By aligning these metrics with ongoing improvements in insurance app development, insurers can quantify financial and reputational benefits, providing undeniable evidence of the benefits of modern insurance apps.

| Metric | What It Measures | Why It Matters |

| Retention Rates | Percentage of customers

staying loyal |

Indicates success in fostering

Insurtech customer engagement |

| App Engagement | Active users, session durations, and feature usage | Reflects customer satisfaction

and app usability |

| App Downloads | Number of new users | Shows effectiveness in reaching

new audiences |

| User Reviews & Ratings | Feedback on app stores | Enhances brand reputation and

attracts new customers |

| Revenue Growth | Increase in cross-sell and up-sell opportunities | Demonstrates the financial impact of modern insurance apps |

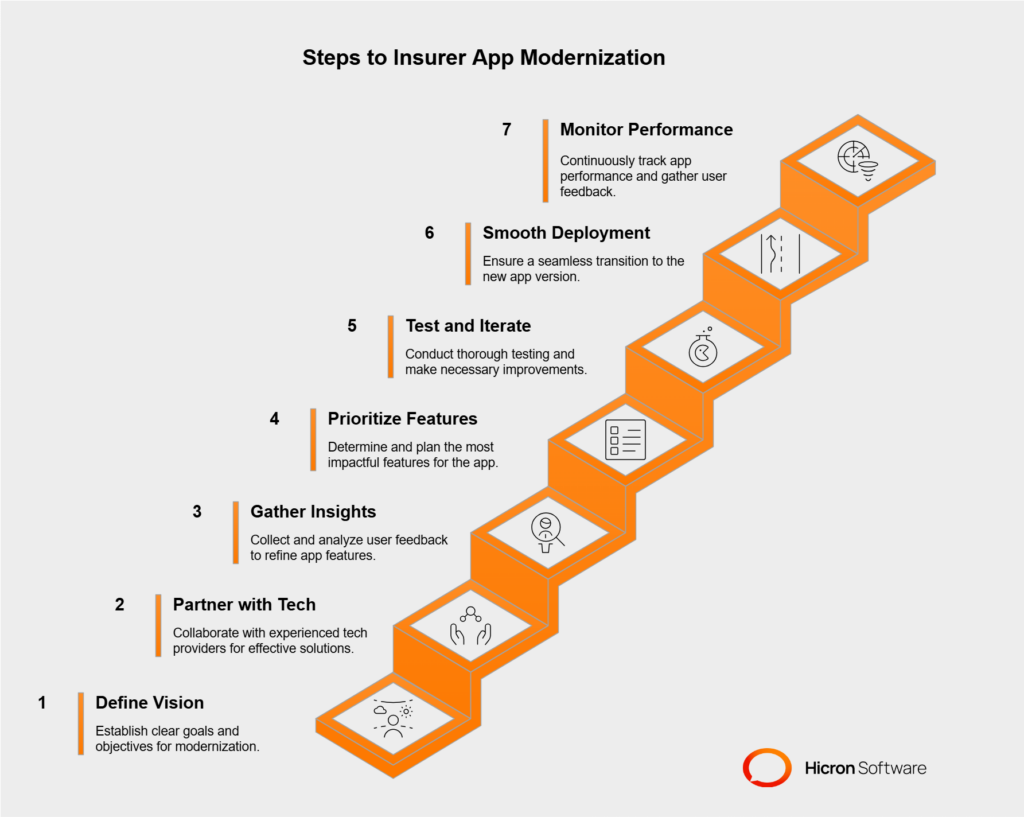

Modernizing an insurance app is no small task, but it’s a crucial step for meeting customer expectations and staying competitive in today’s digital-driven market. Here’s a practical, step-by-step guide to help insurers streamline this process and ensure success.

Start by outlining clear goals for what you want to achieve through modernization. Are you focusing on boosting Insurtech customer engagement, simplifying claims processing, or enhancing app performance?

Defining this vision will guide the insurance app development process and ensure all stakeholders are aligned. From there, identify the features your app will need, such as real-time insurance updates or personalized policy recommendations, to meet these objectives.

Selecting the right technology partner is crucial for a successful app modernization. Look for a provider with expertise in digital transformation for insurance and app development. They’ll not only offer technical skills but also knowledge of regulatory requirements and customer expectations.

A capable partner ensures your app is scalable, secure, and equipped with advanced capabilities that align with the benefits of modern insurance apps.

Your app should revolve around your users’ needs. Conduct surveys, analyze customer feedback, and review behavioral data to pinpoint what’s lacking or could be improved. For example, do users want better claim tracking, easier document uploads, or instant access to policies? These insights will help you design user-friendly insurance software that resonates with your audience and delivers value.

With clear goals and user insights in hand, prioritize the features that will have the most significant impact. Focus on innovations like real-time insurance updates, automated policy recommendations, and streamlined customer support tools. Develop a carefully planned roadmap to implement these features step by step, avoiding rushed rollouts that could compromise the user experience.

Testing is a non-negotiable aspect of modernization. Conduct frequent user testing throughout the development phase to validate the app’s design and functionality. Gather feedback to identify bugs and make iterative improvements. This process ensures the app reflects your goals while delivering the benefits of modern insurance apps in a user-friendly way.

When launching your modern insurance app, focus on seamless deployment. Update training materials for staff, notify customers of new features, and prepare a support team to handle inquiries or technical issues. A well-executed launch builds trust and leaves a strong first impression, emphasizing the value of modern insurance apps & platforms.

The modernization process doesn’t end after deployment. Ongoing performance monitoring is crucial to maintaining the reliability and relevance of your app. Track key metrics such as engagement rates, retention, and feature usage. Regularly gather feedback to identify areas for improvement and release updates to enhance functionality.

This commitment demonstrates dedication to Insurtech customer engagement and solidifies customer trust.

By following these steps, insurers can streamline modernization efforts and create apps that offer the benefits of modern insurance apps. Prioritizing advanced features, real-time insurance updates, and a user-centric design ensures that your app remains competitive and positions your brand as a leader in digital transformation for the insurance industry.

| Step | Key Action | Outcome |

| Define Vision & Scope | Set clear goals and identify

required features |

Aligns stakeholders and ensures focus on objectives |

| Partner with Tech Providers | Choose experts in insurance

app development |

Builds scalable, secure,

and innovative apps |

| Gather User Insights | Analyze feedback and behavioral data | Creates user-friendly insurance software

tailored to customer needs |

| Prioritize Features | Focus on impactful features like real-time insurance updates | Ensures a phased and

effective rollout |

| Test & Iterate | Conduct frequent testing

and gather feedback |

Delivers a polished, bug-free app |

| Smooth Deployment | Plan for seamless transitions and customer communication | Minimizes downtime and ensures

positive user experiences |

| Monitor & Improve | Track metrics and release updates | Maintains relevance and enhances

Insurtech customer engagement |

Modern insurance apps & platforms are revolutionizing how insurers connect with and serve their customers. By enabling seamless interactions, personalized solutions, and real-time insurance updates, these apps elevate Insurtech customer engagement to levels never seen before.

An intuitive design creates user-friendly insurance software that makes navigation effortless, while real-time features ensure customers feel connected and informed. Incorporating innovative updates keeps users engaged and loyal, driving long-term retention.

For insurers, prioritizing insurance app development isn’t just about keeping up with trends; it’s about establishing meaningful relationships with policyholders and differentiating themselves in a competitive market. By integrating the benefits of modern insurance apps into their strategies, companies can enhance customer experiences, foster loyalty, and achieve sustainable growth.

| Feature | Traditional Insurance Apps | Modern Insurance Apps & Platforms |

| User Interface | Basic, outdated design | User-friendly insurance software with intuitive navigation |

| Customer Engagement | Limited | Insurtech customer engagement with personalized solutions |

| Real-Time Features | Rare | Real-time insurance updates for

claims and policy changes |

| Scalability | Limited | Highly scalable for future growth |

| Integration with AI/IoT | Minimal | Advanced digital transformation for

insurance capabilities |

Now is the time to capitalize on digital transformation for insurance, making these advancements the foundation of your strategy to secure your position as a forward-thinking leader in the industry. Contact us to modernize your insurance platform and enhance customer engagement today!

Modern insurance apps & platforms are advanced digital solutions designed to streamline communication, enhance user experiences, and improve customer engagement. Unlike traditional tools, these platforms offer features like real-time updates, personalized recommendations, and AI-driven support, which make managing insurance policies faster and more intuitive.

Real-time updates keep policyholders informed about their claims, policy changes, and renewal deadlines instantly. This transparency reduces stress, ensures users are always in the loop, and fosters trust between the customer and the insurer.

Key features include self-service tools, AI-powered chatbots, claims tracking, and push notifications. These elements allow users to manage their policies independently while ensuring the platform can handle an increasing number of users without compromising performance.

Personalization helps customers feel valued by tailoring recommendations, policy updates, and alerts to their individual needs. For example, apps can suggest specific add-ons or coverage options based on a user’s behavior or preferences, creating a more relevant and engaging experience.

Emerging trends include the integration of IoT devices for dynamic policy management, AR/VR for interactive policy simulations, and 5G technology for improving app performance. These advancements make apps more responsive, interactive, and aligned with user needs.