InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 7 min

AI is transforming the way insurance companies interact with individuals, making the experience feel more personalized and efficient. Thanks to AI for customized insurance policies, insurers can now offer a truly personalized insurance experience that fits each person’s needs rather than a one-size-fits-all approach.

Instead of relying on outdated methods, AI personalization for insurance utilizes tools like machine learning to recommend solutions that are tailored to your needs. This level of insurance personalization doesn’t just improve how companies work—it makes customers happier, too.

Plus, with AI in customer communications for insurers and AI personalized customer engagement insurance, staying in touch has never been clearer or more relevant. The end result? Smarter services, stronger connections, and better AI-driven customer retention insurance over time.

Leading this shift is Hicron Software, a trusted partner for insurers seeking to prioritize our customers. With deep experience in custom insurance software development,

Personalization in insurance has evolved from a luxury to a fundamental expectation. Modern customers demand seamless, individualized experiences at every touchpoint, and insurance is no exception. By leveraging AI for personalized insurance policies, insurers can now understand and anticipate each individual’s unique needs, preferences, and life circumstances, delivering relevant and meaningful solutions that foster trust and long-term loyalty.

Traditional insurance models struggle to keep pace with these rising expectations. Generic offerings and a lack of transparency often make customers feel like anonymous data points instead of valued clients. Such impersonal approaches not only undermine satisfaction but also create challenges for insurers looking to build lasting relationships and stand out in a crowded market.

AI and insurtech innovations are redefining what’s possible. With smart tools like machine learning, AI personalization for insurance enables companies to analyze vast data sets, predict evolving customer needs, and provide hyper-relevant policy recommendations. Solutions such as custom insurance software, AI in customer communications for insurers, and AI personalized customer engagement insurance are driving a new era of tailored service, from life-stage-based policy advice to proactive support during claims. These advancements ensure clients feel understood, connected, and valued at every step.

The advantages of this shift are clear. Insurers who embrace insurance personalization not only increase customer satisfaction but also enjoy stronger retention and a distinctive competitive edge. Building deeper relationships, offering smarter services, and achieving superior AI-driven customer retention is no longer optional—it is essential for those who aim to lead in the modern insurance landscape.

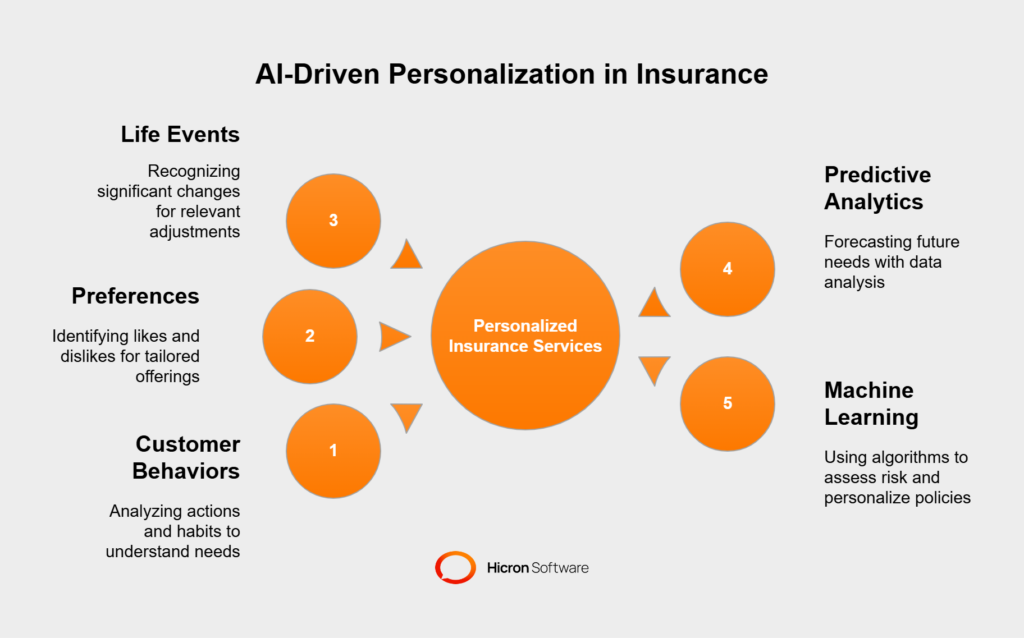

AI is transforming the way insurers understand and interact with their customers. At its core, AI enables the analysis of enormous amounts of data, including customer behaviors, preferences, and life events. This data-driven approach allows insurers to move beyond basic segmentation, offering hyper-personalized services that match individual needs. With AI in insurance, personalization is no longer just a feature; it has become a standard industry practice.

One of the key advantages of AI is its ability to predict customer needs with impressive accuracy. Through advanced techniques such as machine learning, insurers can anticipate what their policyholders may require next.

For example, predictive analytics for insurers allows companies to identify when a customer might benefit from additional coverage or suggest policy adjustments that align with life changes, such as a new job, home, or car.

These tailored recommendations aren’t just convenient; they build trust by showing customers their insurer understands their unique situations.

Machine learning is also reshaping how insurers assess risk. Traditional methods often rely on generalized statistics that don’t capture the full complexity of an individual’s profile. AI changes the game by analyzing deeper behavioral patterns and drawing from more comprehensive datasets.

For instance, a machine learning model can evaluate driving habits for usage-based auto insurance or analyze property photos to create more accurate risk profiles for home insurance.

This precision allows insurers to offer fairer pricing and better-matched policies, improving customer satisfaction and profitability.

These innovations illustrate how AI has become a driving force in insurance tech. By leveraging tools such as predictive analytics and machine learning, insurers can deliver intuitive and relevant services. Customers experience thoughtful, personalized interactions, and insurers gain a sharper competitive edge. It’s a win-win that’s shaping the future of the insurtech industry, one personalized policy at a time.

One of AI’s most impactful contributions to the insurance industry is its ability to craft highly personalized policy recommendations. By harnessing vast amounts of customer data, AI in insurance can identify patterns and preferences previously impossible to uncover. This technology goes beyond surface-level information, analyzing everything from lifestyle habits to demographic details to match customers with policies that perfectly suit their needs.

Predictive analytics is at the heart of this transformation. By examining historical data and real-time insights, AI can anticipate changes in a customer’s lifestyle or circumstances.

For instance, if a young professional is approaching a pivotal life event, such as starting a family or purchasing a property, AI tools can proactively recommend relevant policy updates.

This ensures that customers are always equipped with the right coverage at the right time without having to sift through endless paperwork or generic offers.

The benefits of AI-driven policy personalization go beyond just customer satisfaction. Consider an example from the auto insurance sector: a company implemented AI to analyze driving behaviors and recommend tailored policies based on individual risk profiles.

By offering personalized premiums and policy terms, the insurer improved customer retention and reduced churn rates by 25% within a year. Policyholders felt valued and understood, strengthening brand loyalty and long-term engagement.

This ability to analyze, predict, and deliver hyper-targeted solutions redefines what it means to offer personalized insurance solutions. AI empowers insurers to prioritize the customer experience, fostering trust and demonstrating an unprecedented understanding of individual needs. In an increasingly competitive marketplace, this level of customization isn’t just a differentiator; it’s the key to staying ahead.

Strong communication is the backbone of a positive customer experience, and AI is revolutionizing how insurance companies interact with their policyholders. AI-powered chatbots and virtual assistants now provide instant, round-the-clock support, ensuring customers get answers without long wait times. From responding to policy inquiries to guiding users through claims processes, these tools make support more accessible while significantly improving operational efficiency. For customers, this means higher satisfaction and fewer frustrations.

AI in insurance isn’t just about always being available; it’s also about making communication feel personal and relevant. Advanced algorithms analyze customer data to send tailored messages—renewal reminders timed to an individual’s policy schedule or special offers based on uncovered coverage gaps. By leveraging personalized insurance solutions, insurers can ensure every interaction feels thoughtful and genuinely helpful. This human touch in messaging builds trust and fosters deeper customer relationships.

A major leap forward in insurance tech is the adoption of real-time sentiment analysis tools. These tools interpret how customers feel during every interaction, from chatbot chats to customer calls and emails. By picking up on emotional cues, AI can adjust responses to be more empathetic and professional.

For example, if a customer shows signs of frustration during a claims process, AI can flag the situation and guide the response toward understanding and resolution.

This approach not only diffuses tense situations but also enhances the overall quality of communication.

By integrating next-generation communication tools, insurers are transforming the way they connect with clients. With on-demand support, personalized messaging, and emotion-aware responses, AI is establishing a new standard for customer communication in the insurance industry. The result is happier customers, stronger loyalty, and a seamless experience that proves their insurer truly understands them.

Strong communication is the backbone of a positive customer experience, and Hicron is leading the transformation of insurer-policyholder interactions with advanced technology. Through our expertise in custom insurance software development, Hicron leverages AI-driven personalization solutions to help insurance companies connect more effectively with clients.

Our platforms empower insurers to provide instant, round-the-clock support through AI-powered chatbots and virtual assistants, so customers always get timely answers without lengthy wait times. Whether assisting with policy queries or guiding users through the claims process, these tools significantly enhance accessibility and streamline operations, resulting in higher customer satisfaction and reduced frustration.

Hicron’s AI solutions move beyond basic availability by making every communication personal and relevant. Our advanced algorithms analyze customer data to send tailored messages, such as renewal reminders that align with an individual’s policy schedule or targeted offers that address specific coverage needs.

By delivering thoughtful, personalized experiences, Hicron helps insurers build trust and nurture deeper relationships with customers.

Another standout feature of Hicron’s insurance tech is real-time sentiment analysis. Our intelligent platforms detect customer emotions during interactions, be it in chatbot conversations, support calls, or email correspondence. This allows AI to adapt both tone and response content, ensuring communication is always empathetic and professional.

For example, if a customer expresses frustration during a claims inquiry, Hicron’s solutions can flag the situation and guide responses toward understanding and resolution, defusing tension and improving the overall quality of service.

By integrating Hicron’s advanced communication tools, insurers can transform client engagement. Instant support, personalized messaging, and emotion-aware conversations set a new industry standard, resulting in happier, more loyal policyholders and seamless insurance experiences that demonstrate to customers that their insurers genuinely understand and value them.

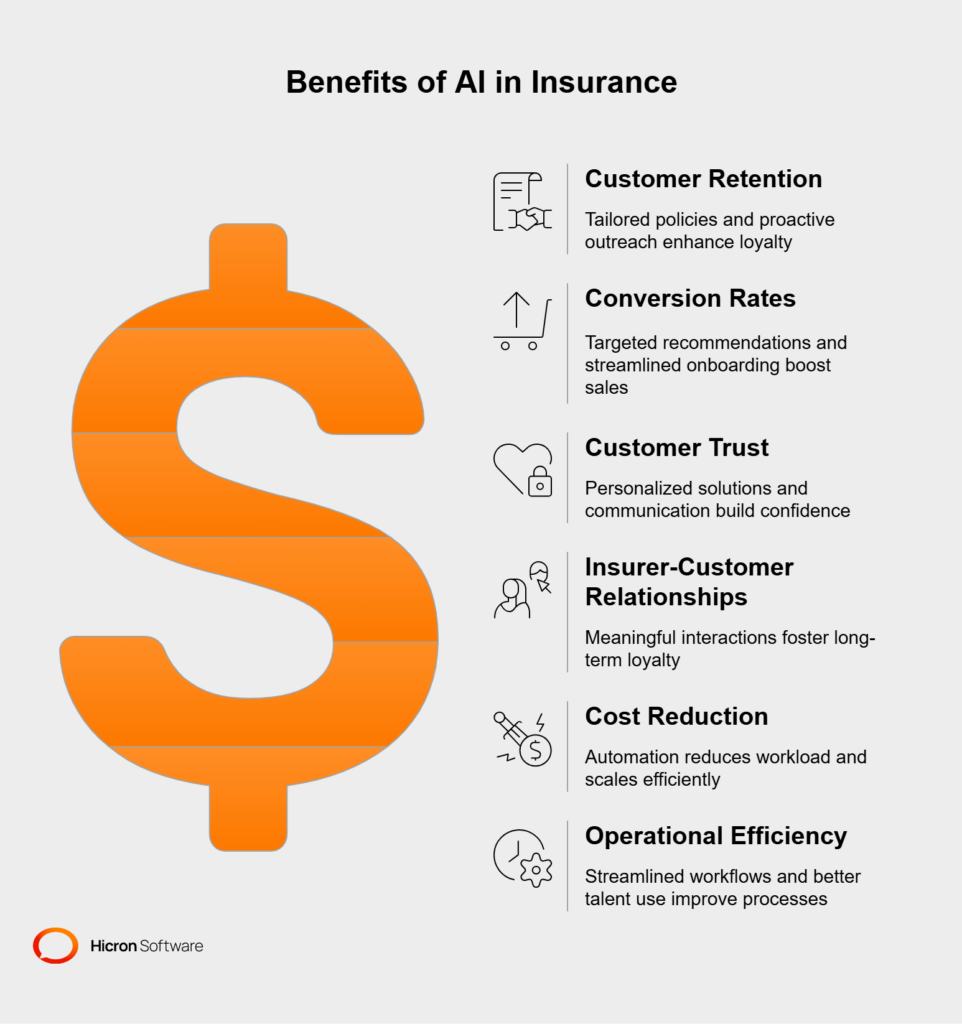

AI-powered personalization is revolutionizing the insurance industry. It moves beyond generic offerings, transforming the customer experience and delivering measurable gains for insurers.

Below is a detailed breakdown of the benefits that AI-powered personalization offers to the insurance industry.

#1 Tailored policies that fit like a glove: In the insurance industry, offering tailored policies is essential for building trust. Imagine an insurer that uses AI-powered personalization to suggest adjusting coverage in response to significant life events, such as buying a home or starting a family. This proactive outreach ensures customers feel understood, and by regularly addressing their evolving needs, insurers create compelling reasons for policyholders to remain loyal year after year.

#2 Keeping engagement alive with proactive outreach: AI-powered personalization tools enable proactive outreach, sending timely and customized reminders about policy renewals, approaching deadlines, or potential gaps in coverage. For example, if a customer lives in an area with increasing flood risk, they may receive a targeted message suggesting the addition of flood insurance. These personalized, proactive interactions help maintain strong customer engagement and make policyholders feel continuously supported.

#1 Targeted product recommendations drive conversions: AI-powered personalization in the insurance industry uses advanced data analytics to match customers with policies that truly meet their needs. By analyzing variables like browsing behavior, inquiry history, and demographic data, insurers can deliver highly relevant product recommendations.

For example, when a small business owner searches for general liability insurance, the AI system can proactively suggest commercial auto coverage specifically tailored to their business type.

These well-timed, precise offers significantly increase the likelihood of moving customers from consideration to purchase.

#2 Streamlining onboarding for higher customer retention: A seamless onboarding experience is essential for converting prospects into loyal policyholders. AI-driven chatbots and virtual assistants can guide new customers through each onboarding step, providing instant answers to frequently asked questions and addressing concerns in real-time. This level of automated yet personalized support reduces friction, enabling more individuals to complete their applications and adopt new policies without frustration or delays.

#1 Proving you understand your customers: Trust grows when customers recognize that their insurer truly understands their needs. AI models analyze individual preferences, lifestyle choices, and financial priorities to craft insurance solutions that feel uniquely tailored to each person.

For instance, a family-focused customer might receive recommendations for a term life insurance policy bundled with child education riders, showing a genuine understanding of their priorities.

#2 Moving beyond the “one-size-fits-all” model: Generic communication can erode trust, but personalized outreach does the opposite. Targeted policy updates or congratulatory messages for milestones, such as paying off a home mortgage, demonstrate to customers that their insurer is attentive to their specific journey. When customers see this level of personalized interaction, they are more likely to trust the company’s intentions and remain loyal.

#1 From transactions to interactions: When insurers use AI-powered personalization to guide policyholders with targeted advice, every interaction feels supportive rather than a sales pitch. This shift from transactions to meaningful engagement fosters loyalty and positions the insurance provider as a partner in the customer’s journey.

#2 Cultivating lasting loyalty: Delivering consistently relevant, personalized interactions confirms the insurer’s dedication to supporting customers’ long-term goals. Policyholders are far more likely to stay with companies that use AI-powered tools to provide tailored policies, build trust, and support them at every step.

#1 Reducing human workload for everyday tasks: AI solutions like chatbots can manage routine queries, such as “What’s my policy number?” or “When is my bill due?” without requiring assistance from human agents.

By automating these everyday interactions, insurance companies free up their staff to focus on higher-value activities, such as resolving complex claims or providing dedicated support during emergencies. This targeted use of AI helps streamline workflows and ensure employees’ expertise is reserved for moments where human insight is most valuable.

#2 Scaling without breaking the budget: Unlike traditional models that rely on expanding teams to meet higher demand, AI tools can scale quickly and cost-effectively. Whether it’s processing hundreds of claims in response to a major disaster or sending personalized renewal reminders to thousands of policyholders, automation enables insurers to handle rapid growth without a corresponding increase in expenses. This flexibility ensures companies can remain agile and competitive, meeting customer needs while keeping costs under control.

#1 Streamlining internal workflows: AI doesn’t just enhance the customer-facing side of insurance—it also optimizes back-end processes.

For example, intelligent automation can triage and prioritize claims based on urgency or complexity, allowing insurers to minimize delays and allocate resources more effectively.

By leveraging AI-powered workflow management, organizations can reduce bottlenecks and maintain higher standards of service.

#2 Better use of human talent: With repetitive and administrative tasks handled by AI, human agents can dedicate their time to providing personalized assistance where it truly matters, such as supporting policyholders after a disaster or helping them navigate complex coverage options. This approach not only increases job satisfaction for employees but also creates more meaningful interactions, ultimately improving the customer experience and driving satisfaction.

The integration of AI for personalized insurance policies is transforming the industry, offering a more tailored and efficient personalized insurance experience. However, this innovation comes with its own set of challenges. From addressing data privacy concerns to modernizing legacy systems and overcoming cultural resistance, insurers must navigate these hurdles to fully leverage AI personalization for insurance.

Ensuring data privacy and compliance is critical for implementing AI insurance personalization effectively. As insurers adopt AI for personalized insurance policies, they must navigate complex regulations, build customer trust, and leverage advanced technologies to strike a balance between personalization and privacy.

#1 Navigating stringent regulations: Data privacy laws, such as the GDPR in Europe and similar regulations worldwide, set strict boundaries around customer data collection, storage, and use. Compliance is essential at every stage of AI personalization for insurance. Non-compliance not only risks hefty fines but also damages the reputation of insurers striving to deliver a personalized insurance experience. Staying updated on evolving regulations and embedding compliance into AI workflows is key.

#2 Building trust through transparency: Transparency is a cornerstone of AI in customer communications for insurers. Insurers should communicate how customer data is used to enhance their experience, from tailored policy recommendations to AI-personalized customer engagement insurance. Simplified privacy policies, opt-in features, and clear explanations of personalization in insurance foster trust while ensuring regulatory compliance. Customers who feel in control of their data are more likely to embrace AI-driven customer retention insurance solutions.

#3 Employing Privacy-Enhancing Technologies (PETs): Advanced AI insurance personalization relies on Privacy-Enhancing Technologies (PETs) such as anonymization, encryption, and federated learning. These tools enable insurers to securely process vast amounts of data, ensuring that sensitive customer information remains protected. By integrating PETs, insurers can strike the perfect balance between delivering a personalized insurance experience and maintaining compliance with data privacy laws.

The integration of AI for personalized insurance policies with legacy systems is a significant challenge for insurers aiming to deliver a personalized insurance experience. Outdated infrastructure and siloed data often hinder the adoption of AI insurance personalization.

#1 Bridging the tech divide: Many traditional insurers rely on legacy systems that were not designed to support AI personalization for insurance. These systems often face issues such as siloed data, limited scalability, and outdated infrastructure, making it challenging to implement AI-driven customer retention and insurance solutions. Addressing these challenges is crucial for enabling personalization in insurance and maintaining competitiveness in a rapidly evolving market.

#2 Adopting a phased approach: Rather than attempting a complete system overhaul, insurers can adopt a phased integration strategy. Gradually implementing AI personalized customer engagement insurance modules alongside existing systems minimizes disruption and improves performance over time. For instance, starting with AI-powered customer service tools, such as chatbots, enables insurers to experience the benefits of AI in customer communications without requiring massive infrastructural changes.

#3 Leveraging middleware and APIs: Middleware solutions and robust APIs are important for bridging the gap between legacy systems and modern AI platforms. These technologies enable seamless data exchange, ensuring that legacy constraints don’t hinder the adoption of AI insurance personalization. By leveraging middleware, insurers can unlock the potential of AI personalization for insurance while maintaining operational continuity.

Adopting AI for personalized insurance policies can face resistance within traditional insurance organizations. Concerns about disruption, job security, and unfamiliarity with technology often hinder the adoption of AI insurance personalization.

#1 Addressing the fear of change: Resistance to AI personalization for insurance often stems from a fear of disrupting established workflows or concerns over job replacement. Employees and stakeholders in traditional insurance organizations may view AI-driven customer retention insurance as a threat rather than an opportunity. Clear communication about the benefits of personalization in insurance is essential to alleviate these fears.

#2 Focusing on collaboration, not competition: Positioning AI in customer communications for insurers as a collaborative tool rather than a replacement for human workers is key. Highlight how AI can handle repetitive tasks, such as claims processing or routine customer inquiries, allowing employees to focus on complex problem-solving and delivering a personalized insurance experience. This approach emphasizes the value of AI personalized customer engagement in insurance as a complement to human expertise.

#3 Providing training and hands-on experience: Investing in training programs is one of the most effective ways to overcome resistance. Demonstrating how AI insurance personalization tools work and how they simplify day-to-day tasks can build confidence among employees and decision-makers. Pilot projects that showcase tangible benefits can further drive adoption and illustrate the potential of AI personalization for the insurance industry.

#4 Engaging leadership to drive change: Change often starts at the top. Engaging leadership in understanding the strategic value of AI for personalized insurance policies ensures their support for digital transformation. Once leadership is on board, they can advocate for the adoption of AI personalized customer engagement insurance, easing concerns and encouraging acceptance across the organization.

While implementing AI for personalization in insurance presents hurdles, each challenge also presents an opportunity to innovate. By prioritizing compliance, modernizing legacy apps or systems, and fostering a culture of collaboration, insurers can turn potential roadblocks into stepping stones.

With the right strategies, traditional organizations can confidently navigate their digital transformation journeys, unlocking the full potential of AI-driven personalization.

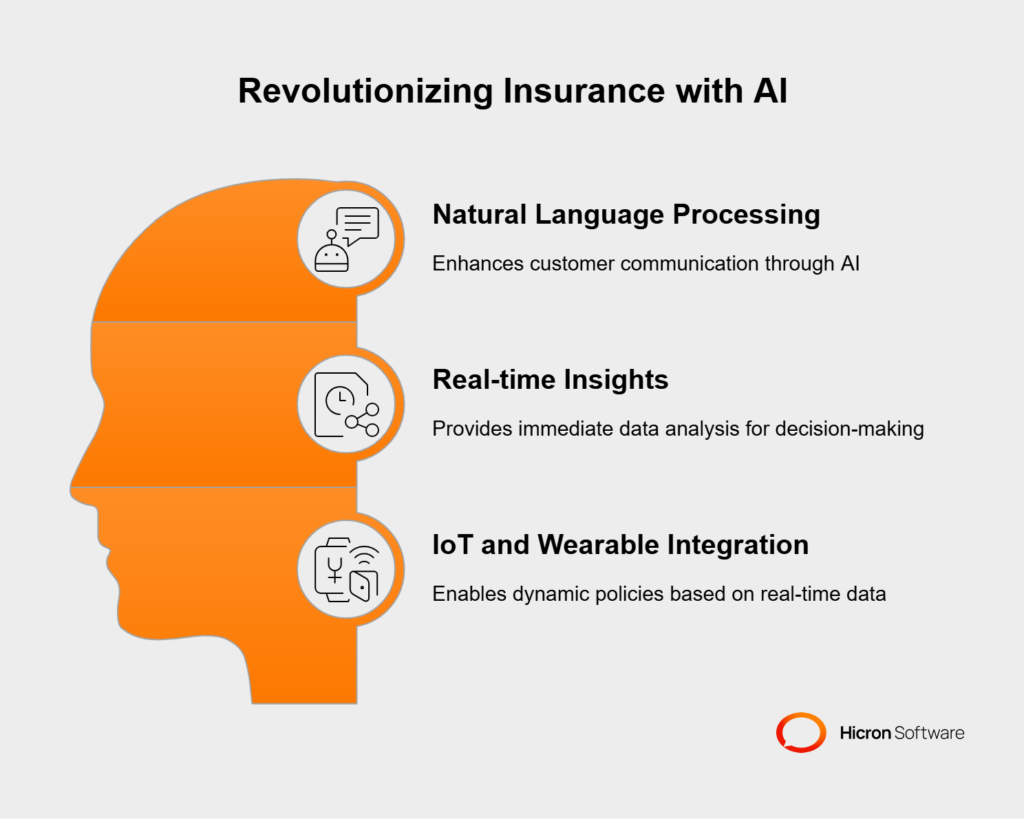

AI-powered personalization is shaping the future of insurance by leveraging cutting-edge technologies to deliver increasingly refined and dynamic customer experiences. From advances in communication to real-time data analysis and the integration of IoT devices, the possibilities are vast.

Below, we explore key trends that are revolutionizing the industry:

Natural language processing (NLP) redefines how insurers interact with their customers. Unlike traditional chatbots that offer generic responses, NLP-powered tools can deeply comprehend the context and nuances of customer inquiries. This allows for tailored, empathetic, and human-like interactions.

For example, an NLP-enabled virtual assistant can guide policyholders through filing a claim, understanding complex policy details, or offering personalized recommendations based on past interactions.

These refined communications don’t just improve customer experience; they also enable insurers to scale high-quality support without increasing operational costs.

The insurance industry is moving toward real-time data analysis as one of its cornerstones. Advanced AI tools now process enormous amounts of data from various sources almost instantaneously, allowing insurers to make data-driven decisions in real-time.

This shift toward real-time insights gives insurers a competitive edge, creating opportunities to improve responsiveness and further personalize offerings.

IoT (Internet of Things) and wearable devices drive innovation in the insurance sector. They enable the creation of dynamic policies that adjust based on real-time data. These policies add a new dimension to personalization by offering customers coverage that evolves alongside their behaviors and lifestyles.

This IoT-driven approach provides policyholders with greater value and enables insurers to focus on prevention rather than just compensation.

The future of AI for personalized insurance policies lies in its ability to push the boundaries of personalization in insurance further. From streamlining communications with NLP to leveraging real-time insights for predictive decision-making, AI insurance personalization is set to transform the industry.

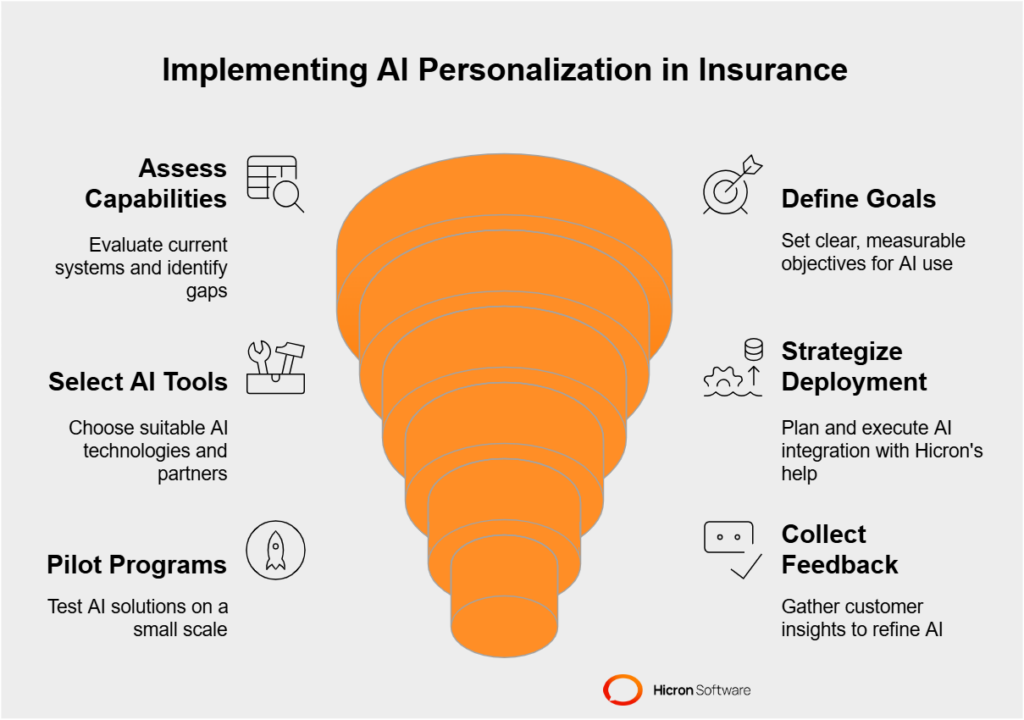

Adopting AI for personalized insurance policies may seem challenging at first, but with a clear roadmap and the right expertise, insurers can transition smoothly into a personalized insurance experience.

Here’s a step-by-step guide to help insurers embrace AI insurance personalization and build a customer-centric, AI-powered future:

Before launching into AI adoption, insurers must evaluate their existing systems, processes, and data infrastructure. This step involves answering key questions like:

A thorough assessment highlights strengths to build on and areas requiring investment, setting the stage for a strategic approach.

Successful AI implementation starts with a clear vision. Insurers should outline specific goals they aim to achieve, such as increasing customer retention, improving conversion rates, or reducing operational costs. These objectives should be measurable (e.g., a 20% increase in policy renewal rates) and aligned with the organization’s priorities.

Choosing AI tools tailored to insurance needs is vital. Look for technologies that offer features such as detailed customer segmentation, real-time analytics, predictive modeling, and natural language processing for enhanced communication. It’s equally important to collaborate with experienced implementation partners who understand the unique challenges of the insurance sector.

Hicron provides insurers with the technical expertise and practical insights they need to succeed. Working with Hicron can streamline the implementation process, from aligning AI capabilities with business goals to integrating the technology with existing systems. Their strategic guidance ensures that AI deployment delivers value across customer experience, operational efficiency, and profitability.

Rather than rolling out large-scale changes immediately, initiate small pilot programs to test the waters. For instance, launch an AI-driven chatbot to handle basic customer queries or set up personalized renewal reminders based on customer data. These early experiments offer invaluable insights, enabling insurers to refine their approach before making a full commitment.

AI works best when it evolves with customer needs. Engage policyholders by asking for feedback on their personalization experience. Were the product recommendations relevant? Did automated communications feel personalized or generic? Insights from this feedback inform further improvements, ensuring the AI becomes more intuitive over time.

AI is a dynamic tool that thrives on iteration. To maintain its effectiveness, regularly update models, algorithms, and workflows based on customer behavior trends, feedback, and industry shifts. A commitment to ongoing improvement helps insurers stay ahead in a competitive market.

Building confidence among internal teams is just as important as deploying AI tools. Provide training to ensure employees understand how to use AI solutions effectively, focusing on collaboration rather than replacement. When staff feel equipped and included, adoption becomes a seamless process.

Following these steps, insurers can develop a robust, customer-centric strategy for AI-powered personalization. With partners like Hicron guiding the process and focusing on continuous customer engagement, the transition to AI doesn’t just enhance the customer experience; it redefines it. Insurers who take this path now position themselves as future-ready leaders in a rapidly evolving industry.

AI-powered personalization is transforming the insurtech industry, revolutionizing how insurers engage with their customers. With tailored solutions, real-time responsiveness, and dynamic policies that adapt to individual needs, modern AI empowers companies to enhance customer satisfaction, foster trust, and build long-term loyalty—key differentiators in today’s competitive insurance landscape.

Leveraging the right expertise is critical for navigating digital transformation successfully. Hicron Software brings deep industry knowledge, supporting insurers as they implement personalized AI solutions and seamlessly integrate modern tools into their existing systems and strategies.

In a rapidly changing market, adopting AI-driven personalization is no longer optional—it’s essential for insurers looking to stay competitive and relevant. Those who proactively adopt these innovations will foster stronger, more meaningful customer relationships and position themselves as future-ready leaders committed to customer-centric excellence.

AI personalization leverages machine learning to offer customized policies and tailored customer experiences in the insurance sector.

AI uses predictive analytics to identify at-risk customers and delivers proactive recommendations to keep them engaged.

Improved customer satisfaction, higher retention rates, and tailored offerings that align with individual needs.

It ensures timely, personalized responses and automates routine inquiries, improving both efficiency and customer service quality.

AI helps insurers tailor policies and services to individual needs by analyzing customer data such as behavior, preferences, and demographics. Techniques like predictive analytics and machine learning enable insurers to recommend personalized policies, adjust pricing based on risk profiles, and provide timely, relevant communications. For example, AI can identify when a customer might need expanded coverage and proactively suggest changes.

AI won’t replace insurance; rather, it will transform how insurers operate. Automation and AI streamline processes like underwriting, claims management, and customer service, making them faster and more efficient. However, human oversight remains essential for complex decision-making, building relationships, and handling unique cases.

A personalization algorithm uses data analysis and machine learning to deliver customized experiences. It evaluates user behaviors, preferences, and historical data to predict individual needs and recommend tailored products or services. In insurance, this could mean offering a policy tailored to someone’s life stage or risk profile.

AI-driven personalization offers several key benefits for insurers:

The 4 Ds of personalization are:

Automated personalization uses AI and machine learning to deliver individualized experiences without manual intervention. It dynamically adjusts content, offers, or messaging in real-time based on user behaviors or conditions. For example, insurers can use automated personalization to send renewal reminders or suggest policy updates based on life events or geographic risk factors.