InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

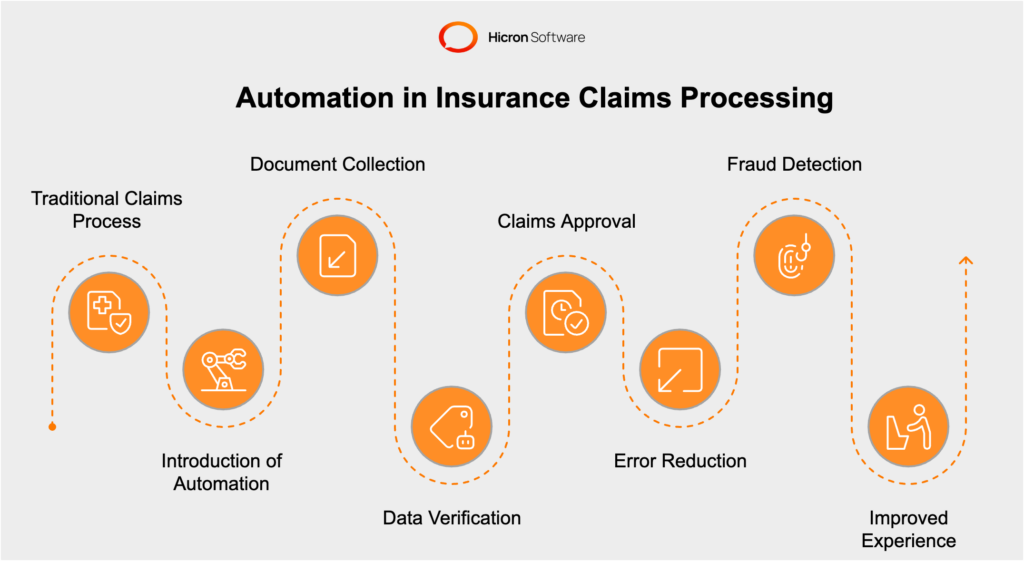

Definition: Insurance claims automation is the process of utilizing advanced technologies, including artificial intelligence and machine learning, to streamline and optimize the insurance claims lifecycle. This includes automating tasks such as data validation, fraud detection, claim assessment, and approvals, reducing manual intervention, minimizing errors, and improving efficiency.

In this article, you’ll discover how claims automation is transforming the insurance industry, the measurable benefits it offers to both insurers and policyholders, and practical insights into its implementation. Learn about real-world examples, cost-saving strategies, and how automation ensures faster, more transparent workflows. Dive in to explore how insurance claims automation is reshaping the future of insurance.

Insurance claims automation is the use of advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA) to streamline and optimize the claims process. It automates tasks such as data extraction, validation, fraud detection, and communication, reducing the need for manual intervention. Claims automation enables faster processing by digitizing and analyzing claim forms, verifying policy details, and flagging inconsistencies or anomalies in real time.

Key benefits:

“Automation doesn’t just streamline workflows; it fundamentally transforms customer experience by providing faster, more accurate results,” says Sarah Lin, Head of Digital Strategy at a leading global insurance firm.

Insurance claims automation is critical for modern insurers because it enhances efficiency, reduces operational costs, and improves accuracy by minimizing human errors. It also accelerates claim settlements, leading to better customer satisfaction and loyalty. Claims automation helps insurers detect and prevent fraudulent claims more effectively, ensuring financial stability. In a competitive market, claims automation allows insurers to scale operations, adapt to customer expectations for speed and transparency, and maintain a competitive edge.

The table provides a detailed, step-by-step breakdown of each stage in insurance claims automation, along with the specific technologies used at each step.

|

Step |

Description |

Key Technologies |

|

Claim Submission |

Customers submit claims through digital channels like mobile apps, websites, or email. AI-powered systems guide users through the submission process, ensuring all required information is provided. |

|

|

Data Collection and Validation |

The system collects and validates submitted data such as policy details, claim forms, and supporting documents (e.g., photos, receipts). AI tools cross-check this data against policy terms and detect inconsistencies or missing information. |

|

|

Fraud Detection |

AI algorithms analyze claims for potential fraud by identifying patterns, anomalies, or red flags. Machine learning models compare claims against historical data to assess their legitimacy. |

|

|

Claim Assessment |

AI systems evaluate the claim’s validity and calculate the estimated payout based on policy terms and conditions, often leveraging computer vision to analyze evidence such as images or videos. |

|

|

Approval or Escalation |

Valid claims are automatically approved and processed for payment. Complex or flagged claims are escalated to human adjusters for further review. |

|

|

Communication and Updates |

Automated systems inform customers about claim statuses through notifications, emails, or chatbots. Customers can track their claims in real-time. |

|

|

Payment Processing |

Once approved, payments are initiated to the customer, typically processed via digital payment methods for quicker transactions. |

|

|

Feedback and Continuous Improvement |

Post-claim feedback is collected to refine the process and enhance customer experience. AI systems continuously learn from completed claims to improve accuracy and efficiency over time. |

|

The insurance industry is undergoing rapid innovation, driven by InsurTech solutions. Recent studies indicate that nearly 50% of insurance operations can be automated using current technology. Companies implementing AI and machine learning report up to 30% cost savings on claims operations and huge reductions in processing times.

The value of insurance claims is compelling, and statistics support the use of automation. Here’s how it reshapes the industry:

|

Insurance Sector |

Automation Adoption Rate (%) |

Average Cost Savings (%) |

|

Auto Insurance |

55% |

25% |

|

Healthcare Insurance |

48% |

30% |

|

Life Insurance |

52% |

20% |

|

Property Insurance |

60% |

35% |

One of the pain points in claims handling is the waiting period. Insurance claims automation solves this by creating streamlined workflows that eliminate bottlenecks.

Steps where insurance claims automation improves speed:

For example, a policyholder submits photos of a damaged vehicle through a mobile app. AI-driven image recognition analyzes the damage, estimates repair costs, and approves the claim within minutes, eliminating days of back-and-forth communication.

The lag time in claims handling can be frustrating for insurers and policyholders. Fortunately, we’re living in a time when technology, rather than paperwork, is becoming the backbone of the insurance sector, and automated workflows are a significant part of this transformation.

Insurance claims automation is like a supercharged assistant for insurers. It eliminates the repetitive, manual tasks that slow things down, creating a smoother and faster claims process. With AI and machine learning tools, modern insurers can now process claims in record time. By using real-time data processing, bottlenecks can be removed and decision-making sped up.

For example, insurance software developers are creating intelligent systems that can flag issues, validate information, and send approvals faster than any human could manage alone.

Imagine a claim for a car accident. Traditionally, paperwork would travel back and forth between adjusters, verification officers, and policyholders. This could take days, even weeks. Now, thanks to insurance claims automation, several steps are streamlined.

The rise of insurance technology and bespoke insurance software development is rewriting the rules of insurance claims processing. Beyond speed, it’s about creating workflows that scale. Whether you’re processing a handful of claims or thousands, insurance claims automation is the key to staying agile, efficient, and competitive.

Fields like healthcare insurance claims automation and automotive insurance digital solutions already benefit from these tools, allowing insurers to focus on delivering better customer care.

At its heart, automated workflows aren’t just about cutting down the hours in claims processing; they’re about giving insurers and their policyholders a better overall experience. Insurers can save time and costs while customers avoid the dreaded waiting game.

It’s a win-win, and as new technology continues to evolve, the process will only improve. Insurance claims automation workflows take the insurance industry from “hold on to your patience” to “we’ve already got it handled.” And honestly? It’s about time.

Accuracy in claims is critical because mistakes can be costly and impact customer trust. Insurance claims automation strongly mitigates the risks associated with human error.

Areas where insurance claims automation enhances accuracy:

When it comes to insurance claims automation, accuracy is everything. An error in their claim can feel like an extra hurdle for policyholders at an already stressful time. For insurers, inaccuracies result in financial losses, wasted time, and eroded customer trust. Insurance claims automation addresses these challenges directly, delivering precision and reliability to a historically error-prone process.

Automation detects missing or inconsistent claim forms by using technologies like Optical Character Recognition (OCR), Machine Learning (ML), and rule-based systems. OCR extracts data from forms, while predefined templates identify key fields. The system checks for missing mandatory fields, validates data formats (e.g., dates, numeric values), and cross-references information with existing databases to ensure accuracy. Logic-based rules flag inconsistencies, such as claim amounts exceeding policy limits, while ML models detect anomalies and duplicates by analyzing patterns in historical claims. Automated alerts and reports highlight errors for manual review, and ML continuously improves detection accuracy over time, streamlining the claims process and reducing manual effort.

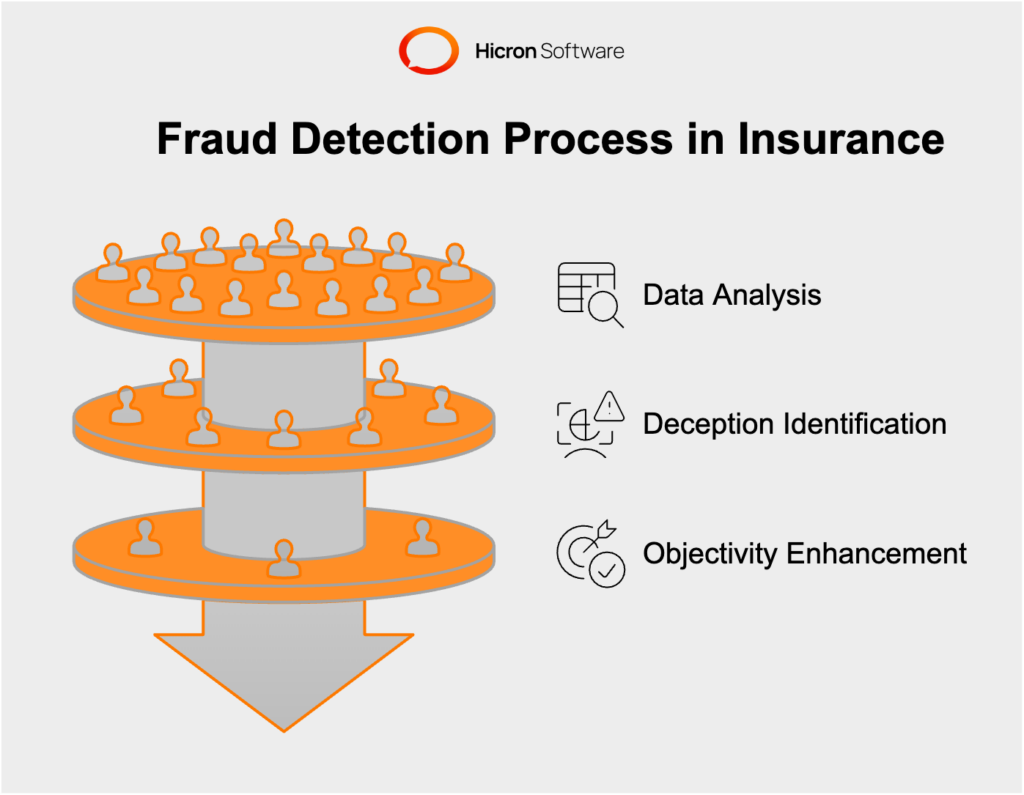

Fraud detection is another area where insurance automation truly shines. Machine learning in insurance is helping pave the way for smarter, more secure claims processing automation.

With fraud detection systems, insurers can analyze an enormous amount of data. From previous claims histories to external databases to identify signs of deception. For instance, a tailored insurance software system might spot that a policyholder exaggerates the value of lost items in a home insurance claim. Trianed automated system brings objectivity to the process, protecting insurers and their honest customers.

Insurance claims automation helps insurers get processes right from the start. Systems can validate information as it’s being entered, cross-checking for accuracy against policy data and industry standards.

This proactive approach reduces risks. AI-driven tools also ensure payout calculations are precise, taking into account all the policy’s fine print without any oversight gaps.

The adoption of insurance tech is making a big difference across sectors, from healthcare insurance claims automation to commercial insurance claims processes. Under the umbrella of innovative InsurTech services, insurers realize that automation is a go-to tool for modernizing claims management.

The result? Faster, cleaner, and more accurate claims handling that keeps customers satisfied and makes insurers more efficient.

By reducing human errors and improving payout accuracy, insurance claims automation is creating a stronger, more trustworthy insurance landscape. It’s not about replacing people but giving them the tools they need to deliver better results. And in an industry built on trust and reliability, that’s a win for everyone involved.

Today, insurance software developers and life insurance tech companies are building innovative, automated solutions to tackle what used to be painfully slow, manual tasks.

Companies investing in custom insurance software development are now

Whether it’s life, auto, or healthcare insurance claims automation, insurers see how technology can transform their operations into something faster, smarter, and more customer-friendly.

It’s not just about tech, for tech’s sake. This shift toward claims automation is helping insurers lower costs, save time, and free up their teams to focus on what truly matters to their customers. And in an industry as crucial and personal as insurance, this is a win for everyone involved. It’s time to address the important question: How does insurance claims automation reduce costs and enhance efficiency?

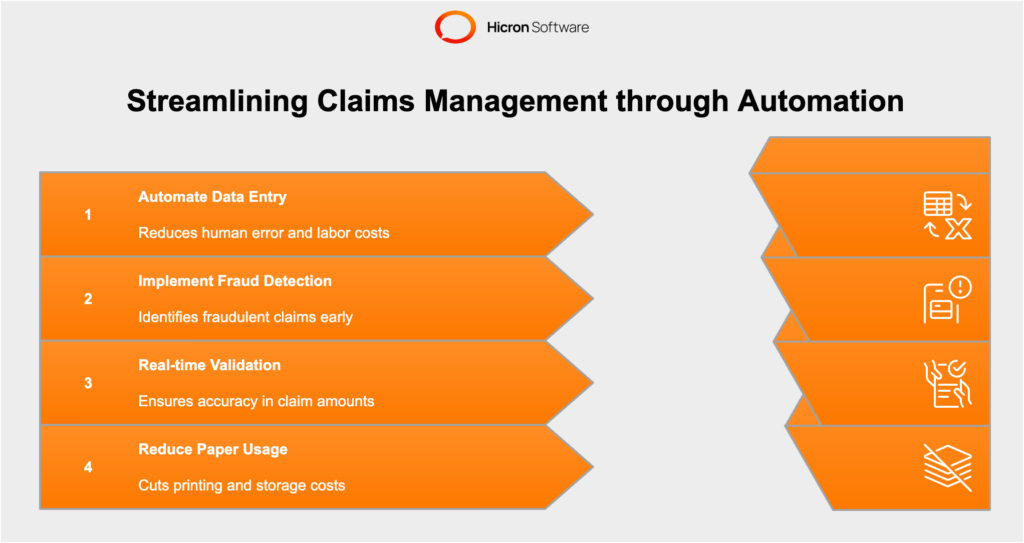

Insurance companies face mounting pressures to cut costs while delivering quality service. Insurance claims automation addresses these challenges head-on.

Key cost-saving areas:

Running an insurance company means keeping a constant eye on the bottom line, and claims management has long been one of the costliest parts of the business. The expenses can quickly add up due to labor-intensive processes and financial losses resulting from inaccuracies, such as overpayments. But that’s where automation steps in—not just to streamline operations but to make them more cost-efficient.

By automating repetitive tasks, insurers can reduce labor costs. With insurance software developers designing systems that handle these workflows, human teams are freed up to focus on higher-value tasks, such as customer service and strategic planning. This doesn’t just reduce costs; it makes the entire process more strategic.

Automating insurance claims management helps insurers eliminate unnecessary payouts stemming from human error.

For example, an error in manual data entry could result in a payout being approved at a significantly higher amount than it should be. However, with AI in claims processing and fraud detection software for insurance, systems can cross-check and validate amounts in real-time.

A policyholder files a healthcare claim with inconsistent details about treatment dates or costs; insurance claims automation tools could immediately flag this, avoiding overpayment and saving money.

It’s also important to mention that insurance claims automation reduces the reliance on paper-based processes, saving money on printing, storage, and mailing expenses. This might seem like a small detail, but these savings can be monumental over time for large insurers handling thousands of claims annually.

Adopting insurtech and fintech solutions has made cutting costs more achievable than ever. With tech solutions and custom insurance software, insurers are investing in efficiency and quality. By reducing human involvement in tedious tasks, companies can focus on providing better service while enhancing their profitability.

Ultimately, insurance claims automation is more than just a cost-cutting tool. It’s a complete shift in how insurers operate, allowing them to work smarter, not harder, while delivering better experiences for their policyholders. And that’s the kind of win-win solution every business loves.

Artificial intelligence (AI) and machine learning technologies provide the backbone for modern insurance claims automation. They increase not only speed but also the accuracy and depth of insights.

|

Technology |

Capability |

Advantage |

|

Natural Language Processing |

Analyzes written or spoken text |

Improves claims documentation review |

|

Predictive Analytics |

Forecasts trends and risks |

Proactive fraud prevention |

|

AI-Image Recognition |

Processes photo evidence |

Speeds up approvals for minor damage |

Using these tools, insurers can go beyond simple automation to achieve smarter, customer-centric operations.

The insurance industry is evolving rapidly, and technology plays a starring role in this transformation. Among these advancements, AI and machine learning (ML) are spearheading a revolution in insurance claims automation.

These aren’t just impressive technologies; they fundamentally reshape how claims are handled, boosting efficiency, accuracy, and customer satisfaction. Here’s how AI and ML are transforming the space, step by step.

Two standout technologies in insurance claims automation are Natural Language Processing (NLP) and predictive analytics.

By combining these tools, insurers can process claims more efficiently and extract deeper, actionable insights, thereby enhancing the overall claims management experience.

AI doesn’t just improve efficiency; it makes decision-making smarter.

For example, a homeowner uploads evidence of water damage after a burst pipe. Within 24 hours, her claim is resolved and approved, and she is connected to an approved contractor to begin repairs immediately.

These tools also shift claims assessment from a reactive to a proactive approach, equipping insurance teams with data-backed risk insights before claims occur.

Natural disasters and peak times have traditionally meant delays and overwhelmed claims teams. AI, however, changes the equation.

During crises such as hurricanes or hailstorms, AI systems can assist in triaging claims. Simple, low-risk claims might be automatically approved, while more complex cases are flagged for human review. This allows insurers to maintain speed while keeping accuracy.

Disaster prediction and preparation: Predictive analytics can also help anticipate where high claim volumes are likely to occur. For instance, if a severe storm is expected in a specific region, insurers can proactively allocate resources and prepare their systems for the expected influx.

One real-world example is an auto insurer using AI tools during a hailstorm. Hundreds of minor claims were processed and approved within hours, ensuring that customers received their payouts quickly. Meanwhile, complex claims received human attention, striking the perfect balance between speed and accuracy.

At its core, AI isn’t just about automating insurance claims. It’s about building trust and delivering better customer experiences. Insurers are strengthening their relationships with their policyholders by leveraging machine learning for fraud detection, predictive tools for proactive decisions, and NLP for smooth communication.

These tools showcase their value during peak periods or disasters by ensuring insurers remain reliable and responsive, even in high-pressure situations.

AI and machine learning are no longer futuristic ideals; they are now a reality. They are here, playing an essential role in modern insurance claims processing. Whether it’s simplifying everyday accident claims, enhancing risk assessments, or handling crises, these technologies are driving progress in the insurance industry.

With increased efficiency, accuracy, and smarter decision-making, insurers are enhancing their processes and transforming the entire claims customer experience. These tools foster trust and agility, and AI undoubtedly drives the future of insurance claims management.

The future of claims automation lies in emerging technologies, such as blockchain for secure data sharing, IoT for real-time monitoring, and advanced predictive analytics for proactive risk management. For instance, blockchain can enable transparent claims processing by creating immutable records, while IoT devices, such as smart home sensors, can alert insurers to potential claims before they occur.

No one enjoys the stress of waiting for a claim to be resolved, especially during an already difficult time. That’s why fast and accurate claims processing is more than just a nice-to-have; it’s now essential for creating happier, more loyal customers. And thanks to insurance claims automation and digitized claims systems, companies are finally delivering on these expectations.

One of the biggest wins of insurance claims automation for customers is faster claim resolutions. Imagine you’ve been in a car accident or your home has faced storm damage. By using automated workflows and AI-driven technologies, insurers resolve claims more quickly and reduce customer stress.

For instance, AI-powered systems can often process and approve low-risk claims in hours. Automated insurance claims assessments and real-time data validation speed up the entire process, meaning customers can get the funds they need to recover faster. The result? A process that feels less like a chore and more like a stable, reliable lifeline.

Faster insurance claims processing times also mean fewer bottlenecks for insurance teams, allowing them to handle more claims in less time. That’s a win-win for everyone.

Another standout feature of digitized insurance claims systems is the ability to offer 24/7 support. Most insurance customers don’t have the luxury of waiting until standard office hours to check on a claim or ask questions. Enter chatbots and automated updates.

Having access to these tools boosts customer satisfaction and helps insurers appear modern, responsive, and trustworthy.

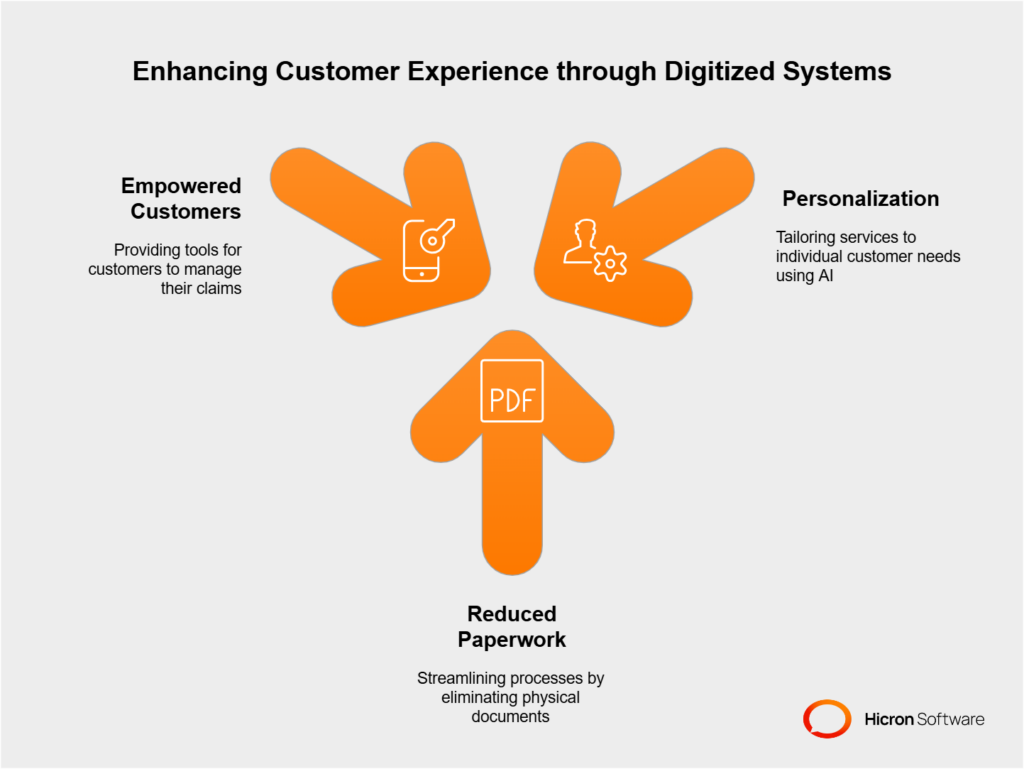

At their core, digitized insurance claims systems are about putting the customer first. Beyond speed and convenience, they provide a smoother and more reliable experience. For example:

Take, for instance, a homeowner who files an insurance claim after a burst pipe. Through a mobile app, they can upload photos of the damage, communicate with insurance claims adjusters, and track approvals from anywhere. With insurance claims automation tools reviewing the details in the background, resolutions may be achieved in days instead of weeks.

Speed and accuracy are redefining claims processing, but how these benefits translate to customer experiences truly matters.

all make customers feel valued and secure. Combine those with the personalized, hassle-free touch of digitization, and you have a recipe for lasting customer loyalty.

From a customer’s perspective, claims automation means less stress and more transparency. Policyholders no longer need to chase updates or worry about errors. Instead, they can track their claims in real-time, receive faster payouts, and enjoy a seamless experience.

For example, a homeowner filing a claim for storm damage can upload photos via a mobile app and receive approval within hours, rather than waiting weeks for an adjuster to visit.

Insurance claims automation for insurance professionals is no longer just a buzzword; it’s making waves across the insurance industry. By eliminating repetitive tasks, leveraging AI, and streamlining operations, insurers see enhanced efficiency, improved customer satisfaction, and substantial cost savings.

Real-world examples highlight the transformative power of claims automation:

Now, let’s explore more scenarios that illustrate the tangible benefits of claims automation, with a focus on industries such as automotive and property insurance.

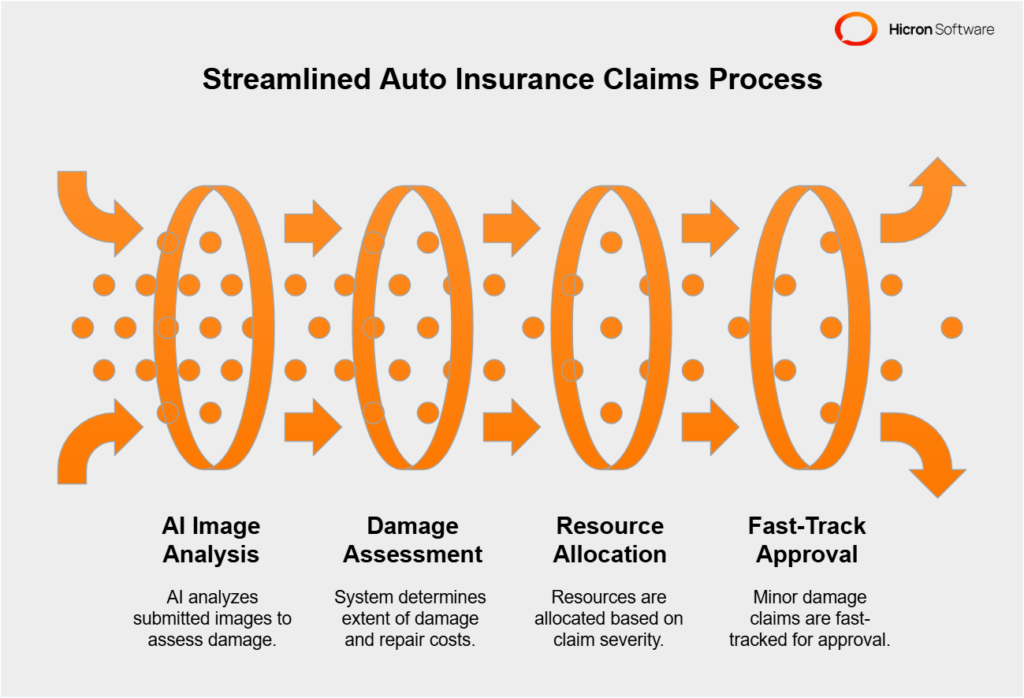

The automotive insurance sector is one area where claims automation has shown incredible results. Here, quick resolutions are critical, as delayed claims processing can impact vehicle repairs, rental car arrangements, and overall customer satisfaction.

The general information: A leading auto insurer reduced its claim inspection time by 70% after implementing an AI-powered image recognition tool. Traditionally, damage assessments required a physical inspection by an adjuster, which could take days. With automation, customers can now upload photos of damaged vehicles via a mobile app. The AI software analyzes these images almost instantly, determining the extent of damage and estimating repair costs.

Results: Claims that once took up to 5 days to process now receive initial assessments in under 24 hours. This improvement slashed operational costs and boosted their customer satisfaction score by 15%.

Scenario: Imagine an auto insurer managing claims after a major hailstorm. Using predictive analytics, they anticipate a spike in claims and allocate additional resources in high-impact areas. Meanwhile, an automated system categorizes claims by severity, fast-tracking minor damages for approval. This ensures faster payouts, reducing customer frustration during a challenging time.

Insurance claims automation in auto insurance transforms a traditionally slow and cumbersome process into a fast and seamless experience, proving especially valuable during emergencies.

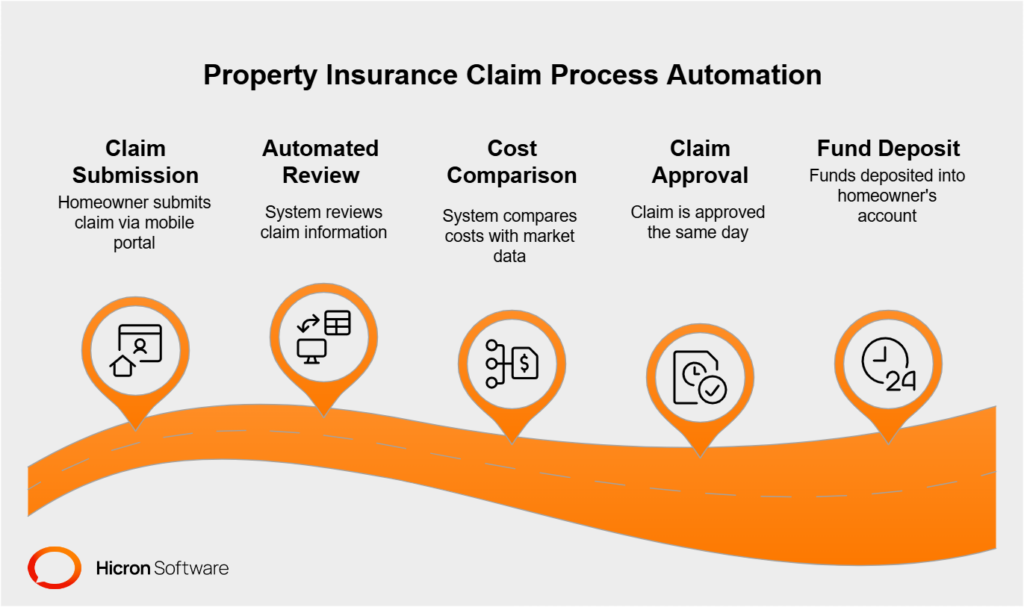

Property insurance claims often involve significant complexity, particularly after large-scale weather disasters, such as hurricanes or floods. With insurance claims automation, insurers are finding ways to simplify the process and reduce bottlenecks.

The general information: A property insurer adopted a digitized claims platform featuring Natural Language Processing (NLP) and AI-driven analytics. When hurricanes hit, claims poured in, but instead of overwhelming their staff, the system helped triage incoming claims. NLP tools analyzed written descriptions submitted by policyholders to identify high-priority cases, while AI detected discrepancies in reported damages to flag potential fraud.

Results: The insurer reported 40% faster processing times and 20% cost savings from improved fraud detection and resource allocation.

Scenario: A homeowner files a claim after a kitchen fire damages their property. Through a mobile portal, they upload videos and receipts for damaged appliances. The insurance claims automation system reviews the information in minutes, comparing market data to determine replacement costs. The claim is approved the same day, and funds are deposited into the homeowner’s account within 48 hours. What could have been weeks of anxiety becomes a stress-free, transparent experience.

Property insurance claims automation enables insurers to handle surges in claims while maintaining accuracy and fostering trust with their customers.

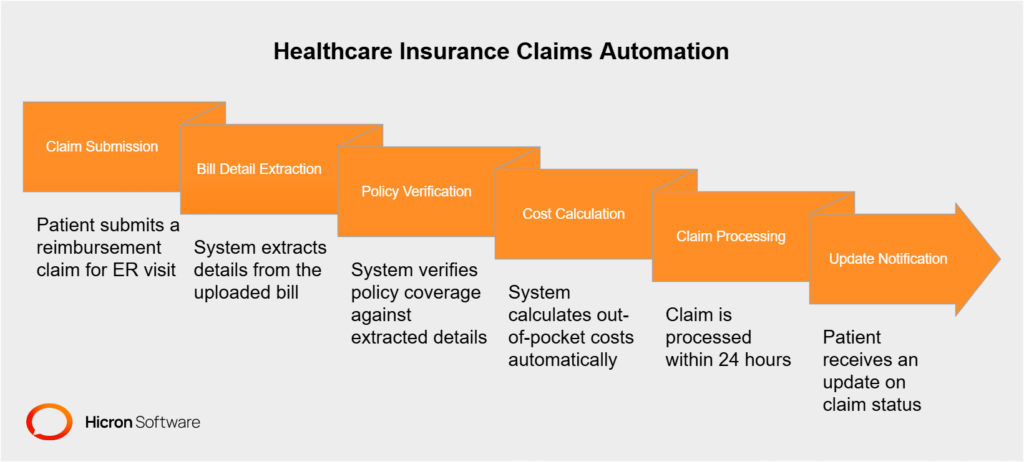

Although it may not be as headline-grabbing, healthcare insurance is another field where automation has proven highly effective in reducing costs and improving the customer experience.

The general information: A healthcare insurer integrated Robotic Process Automation (RPA) to improve how they processed claims involving medical records and billing codes. RPA bots streamlined the matching of medical procedures with policy coverage, a process that previously required hours of manual review.

Results: Claim-processing times dropped by 35%, reducing administrative overhead costs by 25%. Additionally, automation enables customer service representatives to allocate more time to complex cases, rather than routine tasks, resulting in improved customer care.

Scenario: Imagine a patient filing a reimbursement claim for an ER visit. The system extracts details from the uploaded bill, verifies the policy coverage, and calculates out-of-pocket costs automatically. Within 24 hours, the patient receives an update that their claim has been processed, showcasing the value of speed and precision.

The healthcare industry proves that even traditionally paper-heavy sectors can achieve remarkable improvements with insurance claims automation.

Insurance claims automation doesn’t just reduce handling times; it delivers measurable cost savings for insurers. Across industries, automation’s impact is clear:

By leveraging AI and machine learning, insurers can process claims with greater accuracy, reducing errors caused by manual reviews. Insurers use AI for fraud detection, reducing fraudulent claims. This technology enables real-time fraud detection, ensuring that legitimate claims are prioritized while suspicious ones are flagged for further investigation.

For insurers, the benefits go beyond operational efficiency. Automation frees up valuable time for teams to focus on complex cases that require human expertise. Customers, in turn, enjoy faster resolutions and a smoother claims experience.

The financial benefits of claims automation are compelling. Insurers implementing automated claims solutions report operational cost reductions of 30-40% while increasing productivity. By automating repetitive tasks, insurers can reduce operational costs, improve fraud detection, and enhance customer satisfaction.

Claims that once took weeks can now be processed in hours, transforming the experience for both insurers and policyholders. Whether it’s life, healthcare, or auto insurance, automation is setting a new standard for the industry.

These results demonstrate how insurance claims automation enhances operational efficiency and boosts bottom lines, while also increasing customer confidence.

Insurance claims automation isn’t just a technological upgrade; it’s a game-changer. By streamlining processes, reducing costs, and implementing transparent systems, insurers can focus more on customer satisfaction rather than being hindered by administrative inefficiencies.

Industries such as automotive and property insurance, which often face surges in claims due to accidents or disasters, particularly benefit from automation’s ability to scale operations without compromising quality. The result? Happier, more loyal customers and significant cost reduction for insurers.

Insurance claims automation enhances processes and redefines efficient, customer-centric service in today’s insurance industry.

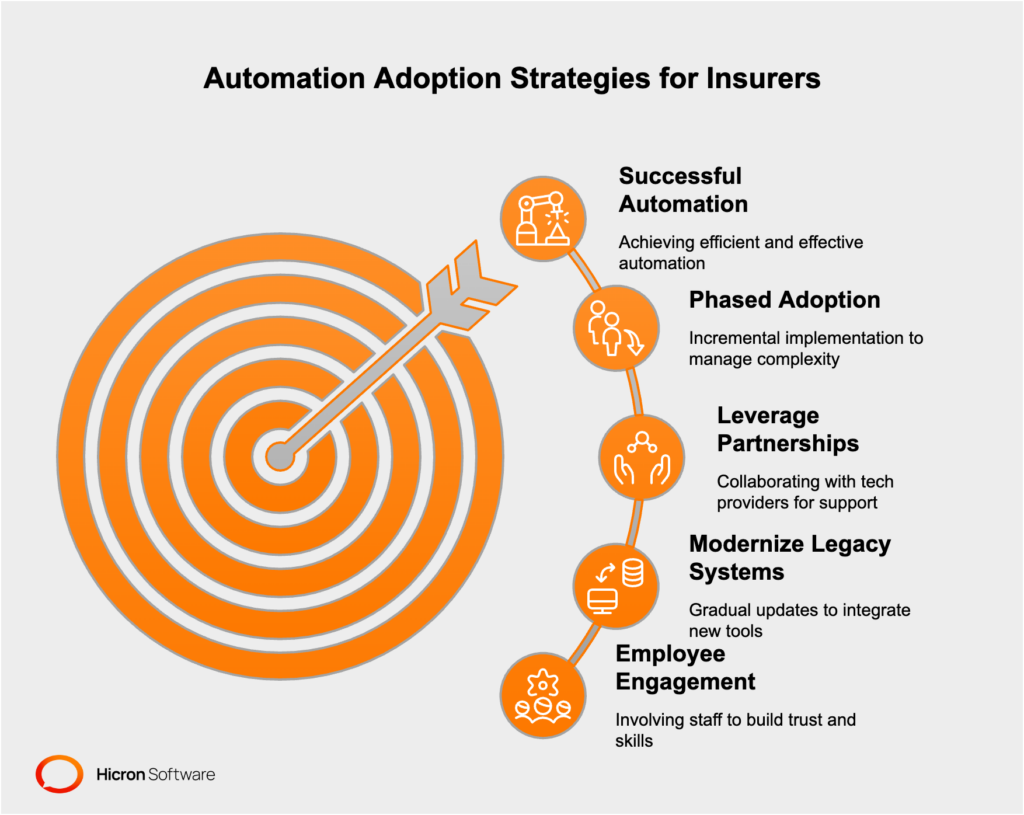

Insurance claims automation is a game-changer for the insurance industry. From speeding up processes to cutting costs, it promises massive benefits. Yet, as with any significant transformation, it doesn’t come without challenges. Whether it’s the daunting cost of implementation or navigating outdated legacy systems, insurers may face roadblocks on their automation journey. But here’s the good news: these barriers can be overcome with thoughtful strategies and the right support. Let’s unpack the challenges and explore how insurers can move past them.

These obstacles can make insurance claims automation feel less of an opportunity and more of a headache. But with the right approach, insurers can overcome these hurdles.

#1 Phased adoption strategies: Adopting insurance claims automation incrementally is one of the most effective ways to manage implementation costs and complexity.

Phased adoption keeps costs manageable and reduces the pressure on teams, making the transition much smoother.

#2 Leverage partnerships: Insurers don’t have to go it alone. Collaborating with technology providers can ease the burden of automation.

#3 Modernize legacy systems piece by piece: Rather than overhauling entire legacy systems, insurers can focus on gradual modernization.

Legacy systems don’t have to be a dealbreaker; they need a thoughtful approach to modernization.

#4 Engage employees early: The people who use these systems daily are critical to the success of automation. Building confidence and trust among employees makes a massive difference.

Employees who see that new technology is designed to benefit them are far more likely to champion the change.

#5 Clean up data: Since good data is the lifeblood of automation, ensuring data is accurate and well-organized should be a top priority.

Strong data foundations create a smoother pathway to insurance claims automation success.

Transitioning to insurance claims automation isn’t without roadblocks, but every obstacle has a solution. Insurers can leap confidently by taking a phased approach, modernizing thoughtfully, and working closely with employees and technology partners. Faster claims processing, lower operational costs, and better customer experiences aren’t just perks; they’re the future of staying competitive in the insurance industry.

Insurance claims automation doesn’t mean leaving behind what works. It means building on what’s already great and making it even better. With the proper steps, insurers will be equipped to keep pace and lead the way.

Insurance claims automation is revolutionizing the process, making it easier, faster, and more accurate. It’s not just about new tech; it’s about creating a better experience for everyone involved.

From cutting-edge AI to connected devices like smart cars and homes, the future of insurance claims automation promises some incredible changes. But what does all this mean for you and the industry? Well, grab a coffee, and let’s break it down.

AI in insurance is about making claims smarter, faster, and fairer. Imagine this. A customer has just been in a car accident. Typically, this would mean phone calls, paperwork, and delays. But with advanced AI, here’s what could happen instead:

Insurance fraud has long been a challenge for the industry, but insurance claims automation offers a transformative solution. Traditionally, fraud detection has been a reactive process, with suspicious claims identified only after delays, leaving investigators to piece together what went wrong. However, with the advent of real-time detection capabilities, this reactive approach is being replaced by proactive, technology-driven solutions that identify and address fraudulent activities as they occur.

Thanks to the Internet of Things (IoT), our homes, cars, and even gadgets are becoming smarter, and this technology is poised to transform how claims are processed.

By leveraging insurance claims automation, insurers remain competitive and deliver services that customers genuinely value.

Take, for example, personalization. Automation lets insurers cater to every individual. Someone who drives their car once a week might get cheaper, usage-based premiums, while a frequent driver gets instant claim approval for minor repairs. These kinds of tailored experiences build loyalty.

Whether the insurer handles claims during a small local storm or a major hurricane, automated claims systems ensure that no one’s claim gets left behind. Fast, consistent service becomes the norm, even in tough situations.

Insurance claims automation offers undeniable benefits for insurers, including reduced costs, increased efficiency, and minimized errors. By streamlining claims processing, automation can create a smoother, more reliable experience for insurers and their customers. It’s an opportunity to make processes smarter, simpler, and more effective.

At Hicron Software, we specialize in crafting insurance claims automation solutions tailored to meet the unique needs of insurers. Our goal is to provide tools that simplify your operations while helping you adapt to the evolving landscape of the insurance industry.

If you’re curious how insurance claims automation could work for your business, now might be a good time to explore the possibilities and contact tech experts. It’s all about taking a step toward processes that are not only more efficient but also future-ready. With thoughtful planning, the path forward can lead to real improvements for your organization and the customers you serve.

Ready to transform your claims process? Explore how automation can reduce costs, improve efficiency, and enhance customer satisfaction. Contact our team of experts today to learn more about implementing claims automation in your organization.

Insurance claims automation refers to the use of advanced technologies, such as artificial intelligence (AI), machine learning, and robotic process automation (RPA), to streamline and expedite the insurance claims process. It reduces manual tasks, enhances accuracy, and improves overall efficiency.

Automation in insurance involves utilizing technology to perform repetitive tasks, such as underwriting, policy management, and claims processing, with minimal human intervention. It ensures faster operations, cost reductions, and improved customer experience.

Yes, many insurance companies are implementing AI for claims management. AI enables faster data processing, real-time fraud detection, and predictive analysis to improve decision-making and efficiency throughout the claims lifecycle.

The four main stages include:

Robotic Process Automation (RPA) in insurance is the deployment of software bots to automate routine tasks such as data entry, policy updates, and claims adjudication. It enhances speed and reduces errors by mimicking human actions in digital systems.

A claims API (Application Programming Interface) allows insurance companies to integrate claims data and workflows with other systems. It facilitates seamless data exchanges, enabling real-time updates and improved communication between stakeholders.

The insurance claims workflow typically includes claim filing, policy verification, loss assessment, documentation review, approval or denial of the claim, and payment processing. Automation simplifies and accelerates each step for better efficiency.

Claims automation leverages AI and machine learning to analyze patterns, flag anomalies, and identify suspicious activities in real-time. This proactive approach helps insurers detect and prevent fraud before payouts occur.

Key technologies driving claims automation include AI, machine learning, RPA, natural language processing (NLP), and predictive analytics. These tools work together to optimize workflows, reduce human error, and improve decision-making.

Claims automation improves customer trust and satisfaction by reducing errors, ensuring faster claims resolution, and providing transparent processes. It enables insurers to deliver consistent and reliable service, building long-term relationships.

Automation can efficiently handle straightforward claims through pre-defined workflows. For complex claims, it provides data insights and decision support for adjusters, enabling faster and more informed resolutions with human oversight when necessary.

The ROI for insurers includes cost savings from reduced manual labor, faster claims processing, fraud prevention, and enhanced customer retention. Long-term gains include operational efficiency and competitive advantages in the market.

Automated systems are designed with robust security protocols, such as encryption, secure access controls, and compliance with regulations like GDPR or HIPAA, to safeguard sensitive data from breaches and unauthorized access.

Insurance claims automation eliminates manual bottlenecks by using AI and RPA to process claims in real-time. Tasks like document verification, fraud detection, and approvals are completed in minutes instead of days.

Common challenges include high implementation costs, integrating automation with legacy systems, and ensuring data quality. However, phased adoption and strong partnerships can help overcome these barriers.

Predictive analytics helps insurers forecast claim trends, identify high-risk policies, and proactively prepare for potential surges, improving efficiency and decision-making.

Automation enables insurers to handle high claim volumes efficiently, especially during natural disasters or seasonal surges, without increasing operational costs or compromising accuracy.

Industries like auto, healthcare, property, and life insurance benefit significantly from automation due to its ability to streamline workflows, reduce costs, and improve customer satisfaction.

Automated systems can use advanced algorithms and machine learning to analyze claim forms for completeness and consistency. They can cross-check required fields, validate data against predefined rules, and flag missing or inconsistent information. Optical Character Recognition (OCR) can also be used to extract and verify data from scanned documents, ensuring accuracy and reducing manual errors.

Automated systems are designed to scale efficiently, allowing them to process large volumes of claims simultaneously. They can prioritize claims based on urgency or predefined criteria, route them to the appropriate departments, and use AI-driven workflows to streamline approvals. Chatbots and self-service portals can assist customers in submitting claims, reducing the burden on human teams and speeding up the overall process.