How Are Smart Insurance Portals Revolutionizing Agent-Client Relationships?

- March 27

- 37 min

This article explores how custom InsurTech solutions are transforming the insurance industry by addressing unique challenges and optimizing operations. You’ll learn why traditional methods and off-the-shelf software fall short in today’s fast-paced, digital-first market. Discover how tailored insurance software solutions empower insurers to streamline claims processing, enhance customer experiences, and leverage technologies like AI, telematics, and predictive analytics. We’ll also discuss the benefits of partnering with experienced insurance software developers to maximize ROI, improve efficiency, and stay competitive. Whether you’re in life, automotive, or commercial insurance, this guide highlights why custom InsurTech is the future of insurance.

The insurance industry is evolving rapidly, driven by technological advancements and shifting customer needs. InsurTech, the fusion of insurance and technology, is now essential for insurers aiming to stay competitive. Traditional methods and generic software solutions fall short in today’s digital-first landscape. Forward-thinking companies recognize the need for tailored solutions to address their unique challenges and meet rising customer expectations.

Custom InsurTech solutions empower insurers to tackle market-specific challenges, offering flexibility and scalability to streamline claims, optimize workflows, and enhance customer experiences. From leveraging telematics in auto insurance to deploying predictive analytics for risk assessment in real estate insurance, tailored insurance software is designed to meet specific business needs. These bespoke technologies go beyond one-size-fits-all systems, delivering solutions that drive efficiency and innovation.

Collaborating with experienced insurance software developers or trusted InsurTech providers ensures insurers can fully harness the power of custom solutions. The result? Greater efficiency, higher accuracy, and improved profitability. As the demand for smarter, faster, and more customer-centric services grows, partnering with experts in insurance technology is not just an advantage – it’s a necessity for staying ahead in an increasingly competitive market.

The push for digital transformation has encouraged many insurance companies to adopt off-the-shelf technology solutions. While these products may offer a quick fix, they often fail to address insurers’ more complex needs. InsurTech solutions lack the adaptability required to cater to the specific demands of diverse sectors within the InsurTech industry, such as life insurance, commercial property, or automotive policies. This one-size-fits-all approach can leave insurers struggling to align technology with their business goals, resulting in inefficiencies and missed opportunities.

This is where custom InsurTech solutions come into play. By partnering with an experienced InsurTech solution provider, insurers can implement custom insurance software solutions that address their unique challenges. Unlike off-the-shelf technology, these InsurTech software solutions are designed to meet the specific needs of insurers, whether it’s integrating telematics for automotive insurance, deploying predictive analytics for life insurance, or streamlining claims processing.

Tailored software InsurTech ensures that insurers can achieve a competitive edge in insurance technology by aligning their tools with their business goals.

Tailored InsurTech software not only meets basic operational needs but also drives innovation. By combining cutting-edge technologies, such as AI in claims processing and telemedicine integration, businesses can unlock operational efficiency in ways that off-the-shelf solutions simply cannot. Custom insurance software allows for the automation of routine processes, faster claims handling, and enhanced fraud detection, all of which contribute to a more agile and competitive business.

Additionally, forward-thinking InsurTech software providers help organizations implement scalable IT systems and cloud technologies that evolve with changing demands, ensuring a future-proof strategy for growth.

Ultimately, investing in custom insurance software solutions, whether for commercial insurance, life insurance, or niche markets, amplifies a company’s ability to innovate, serve customers more effectively, and maintain compliance in a challenging regulatory environment. These InsurTech solutions empower insurers to differentiate themselves in an increasingly crowded and competitive market. With the proper insurance software customization, insurers can achieve a true competitive edge in insurance technology.

InsurTech, the fusion of insurance and technology, is now essential for insurers aiming to stay competitive. Traditional methods and generic software solutions fall short in today’s digital-first landscape. Forward-thinking companies recognize the need for customized solutions to address their specific challenges and meet the increasing expectations of their customers.

| Benefit | Description | Example |

| Efficiency Gains | Streamlines workflows,

reduces redundancies, and automates routine tasks. |

AI-powered claims processing reduces

settlement times by 50% and administrative costs by 30%. |

| Personalization | Delivers tailored policies and services to meet customer needs. | Personalized insurance solutions

increase customer retention by 60% and new sign-ups by 20%. |

| Regulatory Compliance | Automates compliance

workflows to meet region-specific requirements. |

Reduces regulatory penalties by 25% and improves reporting accuracy. |

| Risk Management | Leverages IoT and predictive

analytics to assess and mitigate risks. |

IoT devices reduce claim frequency

by 15% and incentivize safer driving habits. |

| Customer Satisfaction | Enhances customer experiences

with faster service and tailored offerings. |

87% of customers expect personalized

experiences, boosting loyalty and retention. |

The global InsurTech market reflects this shift, with projections showing it will grow at a CAGR of 39.1% from 2023 to 2030, reaching a market size of $152 billion by 2030. This explosive growth underscores the increasing demand for innovative, custom solutions that empower insurers to streamline claims, optimize workflows, and enhance customer experiences.

The insurance industry faces various universal and particular challenges depending on the insurer’s scale, market, and geography. By breaking these challenges down, we can better understand their impact and uncover opportunities for targeted custom InsurTech solutions.

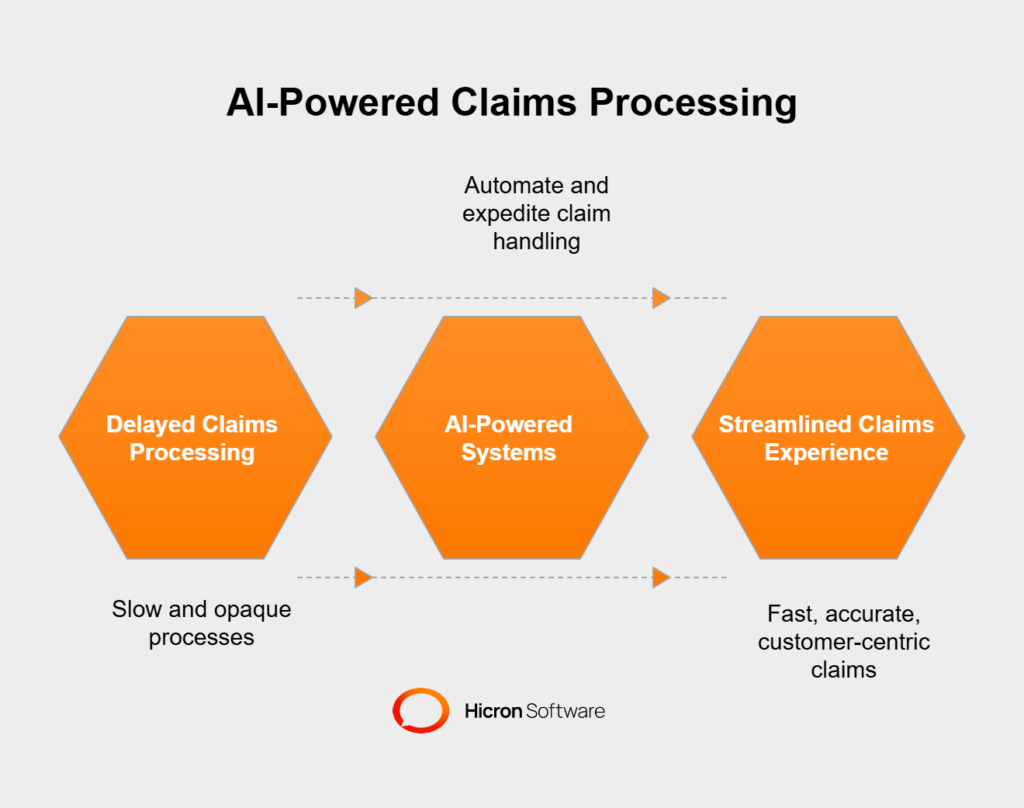

Claims processing delays are a significant pain point for insurers across the board. Customers today expect fast and transparent processes, whether they’re filing a claim for life insurance or automotive damage. Large-scale insurers, which often deal with high-claim volumes, frequently face resource bottlenecks that slow down their operations. On the other hand, smaller or niche providers may lack access to advanced technologies, such as automated claims systems or AI in claims processing, which can make efficiency a challenge.

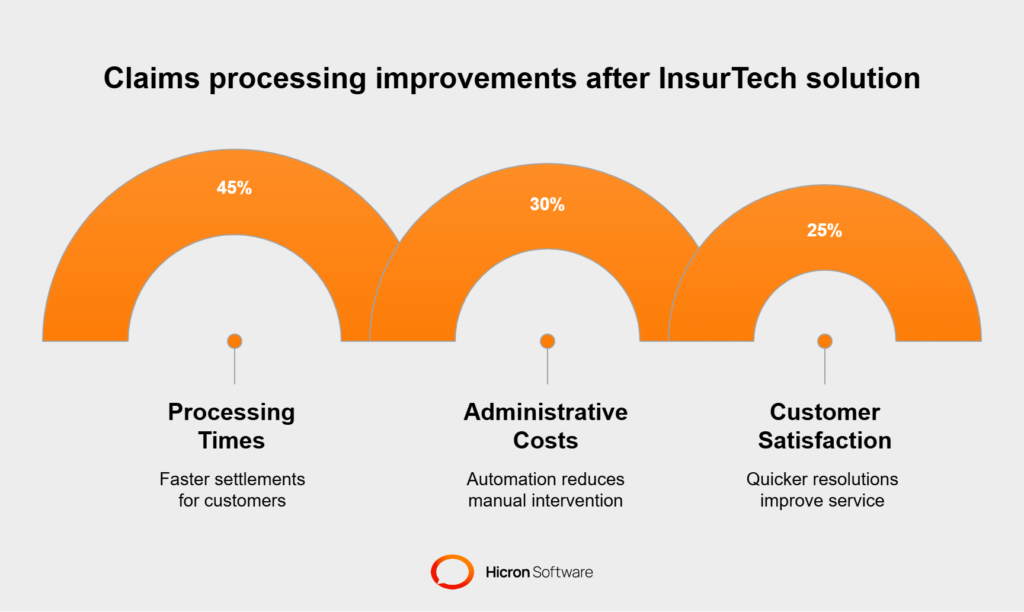

Custom insurance software solutions can transform this process. For example, insurers using AI-powered claims processing have reported a 50% reduction in settlement times and a 30% decrease in administrative costs. These tailored solutions not only expedite settlements but also improve accuracy and reduce manual workloads, ensuring a smoother, faster, and customer-centric claims experience.

Navigating regulatory compliance is a perennial challenge for insurers, especially those operating across multiple regions with varying legal requirements. Without adaptable tools, meeting these mandates can overwhelm insurers and slow down operations. However, automating compliance workflows has proven to be a game-changer, reducing regulatory penalties by 25% and improving reporting accuracy.

Custom insurance technology solutions offer adaptability to address these regulatory hurdles. Insurers can seamlessly integrate compliance into their operations by automating workflows tailored to region-specific requirements. This reduces administrative burdens and strengthens risk governance across diverse markets.

Customer retention is another critical concern, heavily influenced by each market’s unique characteristics. For example, life insurance tech companies focus on long-term engagement strategies that address shifting life stages. In contrast, InsurTech startups in travel insurance might prioritize short-term convenience and fast-purchase experiences. Insurers that fail to adapt to their audiences’ unique expectations risk losing their competitive edge.

Custom strategies, powered by tailored InsurTech solutions, enable insurers to deliver personalized offerings. This ranges from usage-based automotive insurance supported by telematics technology to medical insurance software solutions with telemedicine integration. By leveraging customer-centric tools, insurers can foster loyalty while differentiating themselves in the market.

These challenges highlight the need for insurers to assess their circumstances, whether they involve operational bottlenecks, compliance complexities, or market-specific demands. Companies can collaborate with skilled InsurTech solution providers to create bespoke insurance technology that addresses immediate challenges and long-term growth objectives. This strategic focus enhances operational efficiency and positions insurers as leaders in a highly competitive InsurTech industry.

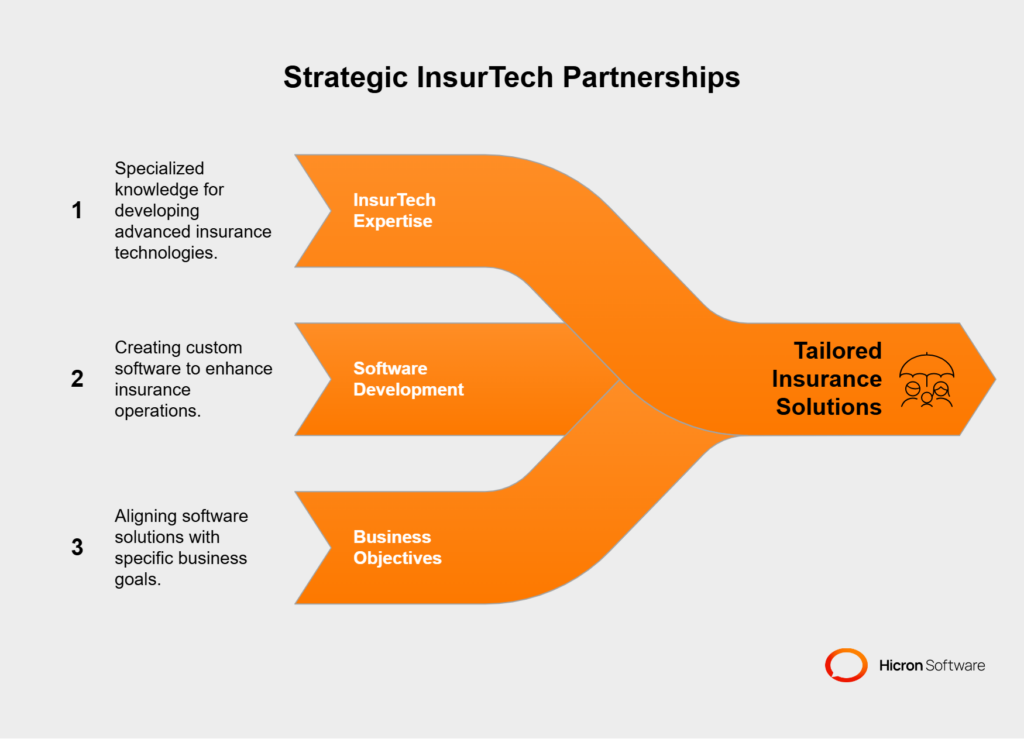

For insurers looking to thrive in a rapidly evolving and competitive market, partnering with experienced InsurTech solution providers is pivotal. These partnerships extend beyond simple transactions; they enable insurers to leverage the specialized expertise required to develop custom insurance software solutions that align with their unique business objectives. Collaborating with skilled insurance software developers ensures operational efficiency and unlocks innovation tailored to meet specific challenges within the InsurTech industry.

Effective collaboration begins with a comprehensive needs assessment. This step involves identifying the unique pain points and opportunities within an insurer’s operations. Whether automating claims processes, integrating telematics for usage-based automotive insurance, or streamlining compliance workflows, a thorough understanding of core requirements sets the foundation for success. Insurers and InsurTech providers work hand-in-hand to ensure the software’s vision aligns with business needs and market demands.

Once the needs assessment is complete, the design and development phase begins. Here, leading InsurTech software companies apply advanced tech stacks and industry-specific knowledge to create custom insurance software that meets predefined goals. This phase often leverages cutting-edge features such as claims automation software, predictive analytics, or AI-powered fraud detection tools, ensuring tailored solutions provide measurable value. Insurance software development companies prioritize scalability and adaptability during this stage, ensuring the product remains future-proof as the business evolves.

The deployment phase is equally critical. Insurers rely on their technology partners to ensure a seamless integration of the new solutions with minimal disruption to day-to-day operations. Regular training and support from software InsurTech providers further empower insurance teams to make the most of their custom InsurTech solutions investments.

A successful partnership requires setting clear objectives and performance metrics from the outset. Both insurers and software providers should define specific goals related to operational efficiency, customer satisfaction, and ROI. For instance, an insurer aiming to improve customer retention might track metrics such as claims resolution time or customer feedback scores post-implementation. Similarly, an insurer dealing with regulatory hurdles can evaluate compliance turnaround times or penalty reductions after deploying tailored insurance software customization solutions.

Such metrics offer transparency in the co-creation process and help both parties stay accountable. This approach ensures that the collaboration remains results-driven, with measurable outcomes demonstrating the value of custom insurance software development.

By partnering with InsurTech solution providers, insurers gain a competitive edge in insurance technology in an increasingly tech-driven landscape. These collaborative efforts combine domain knowledge with technical expertise, yielding solutions that address immediate needs and position insurers for long-term success. Whether transforming legacy apps and systems for digital-first operations or exploring innovative tools like telemedicine integration and IoT-based insurance, partnering with the right insurance software development company ultimately enables insurers to stand out in their respective markets.

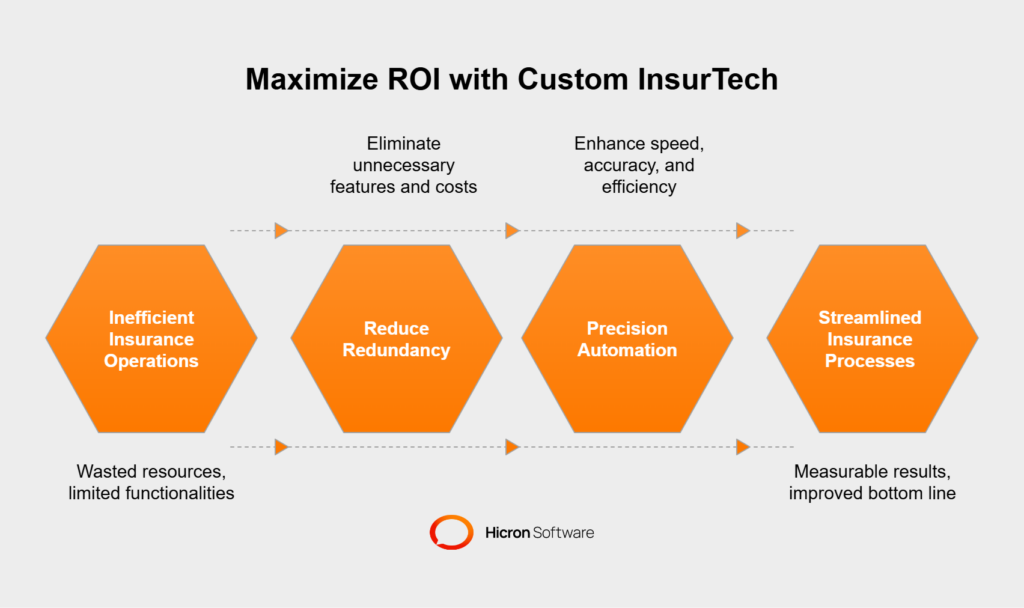

Investing in custom InsurTech solutions is more than a technological upgrade; it’s a strategic move to maximize return on investment (ROI) across all facets of insurance operations. By addressing specific needs and inefficiencies, tailored insurance technology solutions minimize wasted resources, streamline core processes, and deliver measurable results that directly impact the bottom line.

Custom insurance software development eliminates the one-size-fits-all limitations of off-the-shelf technology solutions. Generic systems often come with features insurers don’t need, forcing companies to spend resources on components that add little value to their business. Conversely, tailored InsurTech software focuses exclusively on the functionalities that matter most, whether automating claims workflows, improving underwriting accuracy, or streamlining compliance reporting.

Reducing process redundancy not only cuts costs but also empowers teams to focus on higher-value activities. For instance, claims automation software minimizes manual data entry and repetitive administrative tasks, allowing employees to dedicate more time to strategic decision-making and customer engagement.

Automation is one of the most effective ways to save costs in the insurance industry. Tailored InsurTech solutions utilize advanced tools, such as AI in claims processing and predictive analytics for underwriting, to enhance speed, accuracy, and efficiency. Automated claim systems identify potential fraud quickly, reducing financial losses. Similarly, AI-driven underwriting technology accelerates policy approval processes without compromising accuracy.

For example, a custom digital claims management system can reduce turnaround times from weeks to days, slashing operational expenses by eliminating bottlenecks.

Similarly, automation in policy renewals and customer communications reduces the need for manual intervention, cutting costs while ensuring timely service delivery.

The ROI from custom insurance software solutions is often clear and quantifiable. Insurance tech companies implementing tailored solutions frequently report dramatic improvements in key performance indicators (KPIs). For instance:

One example is life insurance tech companies leveraging custom platforms to provide highly personalized plans, boosting client satisfaction, and generating referrals. Similarly, insurers investing in usage-based automotive insurance solutions have reported reduced claims processing costs and increased customer loyalty, thanks to fairer pricing models.

| Metric | Impact | Technology Used |

| Claims Settlement Time | Reduced by 50%, enabling faster resolutions. | AI-powered claims processing. |

| Administrative Costs | Decreased by 30% through automation. | Workflow automation and AI. |

| Fraudulent Claims | Reduced by 40%, saving millions annually. | AI-driven fraud detection systems. |

| Customer Retention | Increased by 60% with personalized offerings. | Predictive analytics and AI. |

| New Customer Sign-Ups | Increased by 20% due to tailored policies. | Behavioral analytics and IoT. |

Ultimately, custom InsurTech solutions are designed to optimize operations and provide insurers with a sustainable competitive advantage. These strategies redefine operational efficiency and customer satisfaction by minimizing waste, automating critical tasks, and ensuring measurable returns. For insurers eager to future-proof their business, aligning with experienced InsurTech solution providers to develop custom insurance software is an investment that yields robust, long-term growth.

Custom InsurTech solutions provide the competitive edge in insurance technology that insurers need by enabling faster adaptation to market shifts, delivering exceptional customer experiences, and leveraging analytics to uncover new opportunities while managing risks effectively.

The insurance landscape constantly changes, with evolving customer demands, economic conditions, and regulatory requirements reshaping the industry. Off-the-shelf technology solutions often lack the flexibility to keep up with these changes, leaving insurers to grapple with inefficiencies.

Custom InsurTech solutions are designed with adaptability in mind. Whether it’s quickly adjusting pricing models for emerging risks or implementing changes to meet new compliance standards, tailored platforms empower insurers to respond effectively. For instance, automated compliance systems can be programmed to account for region-specific regulations, minimizing downtime and reducing penalties. This level of customization enables insurers to adapt more easily when market conditions change or new regulations emerge.

Customer expectations in the insurance industry have shifted dramatically, with personalization becoming a top priority. Clients now expect seamless, tailored interactions, whether it’s through simplified claims processes or policies designed to fit their individual needs. Insurers that prioritize personalized customer experiences stand out in a crowded market.

Tailored InsurTech solutions enable this by leveraging technologies like artificial intelligence (AI) and machine learning.

For example, insurers can deploy behavioral analytics to offer usage-based automotive insurance policies or customized health plans in medical insurance. A travel insurance provider, for instance, could deliver personalized package recommendations based on a customer’s itinerary and past purchasing behavior.

This approach enhances customer satisfaction and fosters loyalty, providing insurers a significant competitive advantage over those offering generic services.

Personalization boosts customer satisfaction

Customer retention is a critical concern in the insurance industry, heavily influenced by the ability to deliver personalized experiences. Today’s customers expect tailored policies and services that align with their unique needs. In fact, 87% of customers now expect personalized insurance experiences, and 74% are more likely to stay with insurers offering tailored policies.

Custom InsurTech solutions enable insurers to meet these expectations by leveraging technologies like AI, IoT, and predictive analytics. For instance, insurers implementing personalized insurance solutions have seen customer retention rates increase by 60% and new sign-ups rise by 20%. These tailored offerings not only boost loyalty but also position insurers as customer-centric leaders in a competitive market.

The success of modern insurance operations hinges on the ability to make informed decisions based on data. However, traditional systems often provide limited insights, restricting insurers’ capacity to innovate or mitigate risks. Custom insurance software solutions bridge this gap by delivering actionable insights tailored to insurers’ needs.

With advanced analytics, insurers can identify emerging opportunities, like expanding into underserved markets or introducing niche products. At the same time, predictive analytics powered by tailored tools can help flag potential risks before they become costly.

For example, fraud detection systems can analyze patterns in claims submissions, enabling insurers to proactively address anomalies.

Similarly, climate-focused analytics tools can help property insurers forecast risks related to extreme weather, enabling more accurate underwriting and pricing.

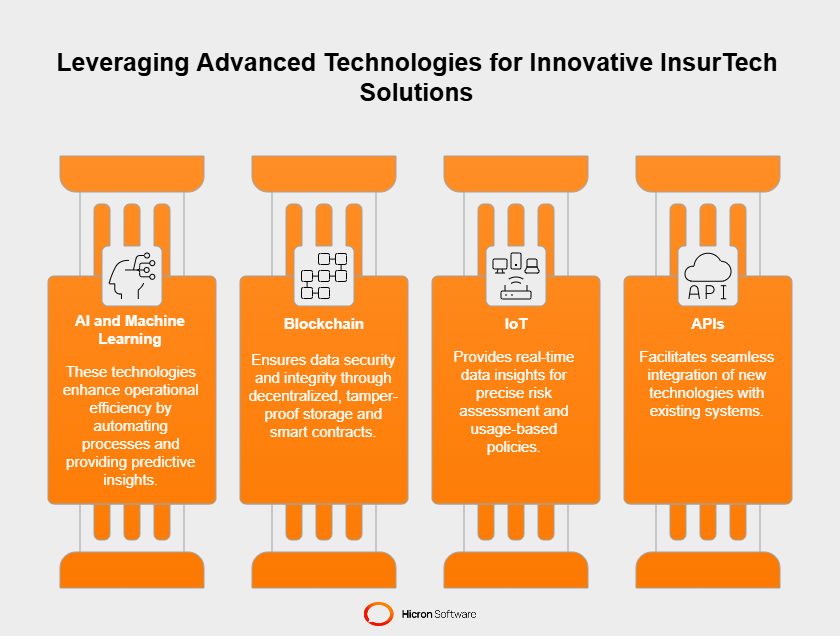

Developing custom InsurTech solutions requires leveraging cutting-edge technologies to address specific industry challenges while driving operational efficiency and innovation.

| Technology | Adoption Rate | Use Case |

| AI and Machine Learning | Widely adopted for claims processing

and underwriting. |

Speeds up claims processing and

improves underwriting accuracy. |

| IoT (Internet of Things) | 45% of insurers use IoT devices for usage-based insurance. | Telematics monitors driving

behavior; wearables track health metrics. |

| Predictive Analytics | Increasingly used to forecast risks

and customer behavior. |

Reduces claim frequency by 15% and improves pricing accuracy. |

| Blockchain | Emerging adoption for secure data management and fraud prevention. | Simplifies multi-party transactions and ensures

data integrity. |

| APIs | Essential for integrating custom

solutions with legacy systems. |

Enables seamless communication

between old and new systems. |

From AI to IoT, these tools play a significant role in enabling insurers to adapt, grow, and lead in an increasingly competitive InsurTech industry.

Artificial intelligence (AI) and machine learning are revolutionizing insurers’ operations. These technologies analyze vast amounts of data to unearth patterns, predict outcomes, and automate complex processes. For example, AI-powered claims management systems can evaluate claims faster and more accurately, reducing errors and speeding up settlements. Machine learning, on the other hand, can enhance underwriting by identifying subtle risk factors that traditional methods might miss.

Predictive analytics further empowers insurers to make proactive decisions. These tools can forecast future trends by analyzing historical data, such as potential customer churn or emerging market risks.

For instance, insurers can use predictive models to tailor premium pricing for high-risk groups or predict fraud patterns before they impact profitability.

These precise insights allow for better resource allocation and stronger financial performance.

Data integrity and security are critical in an industry that handles vast amounts of sensitive information. Blockchain technology addresses these concerns by providing a decentralized and tamper-proof system for data storage and sharing. Through smart contracts, blockchain can automate policy execution while ensuring compliance with agreed-upon terms.

For instance, blockchain can simplify multi-party transactions in reinsurance by creating a transparent and auditable record of all processes.

Additionally, the technology is increasingly applied in claims management to verify and process legitimate claims without human intervention, reducing fraud and administrative costs.

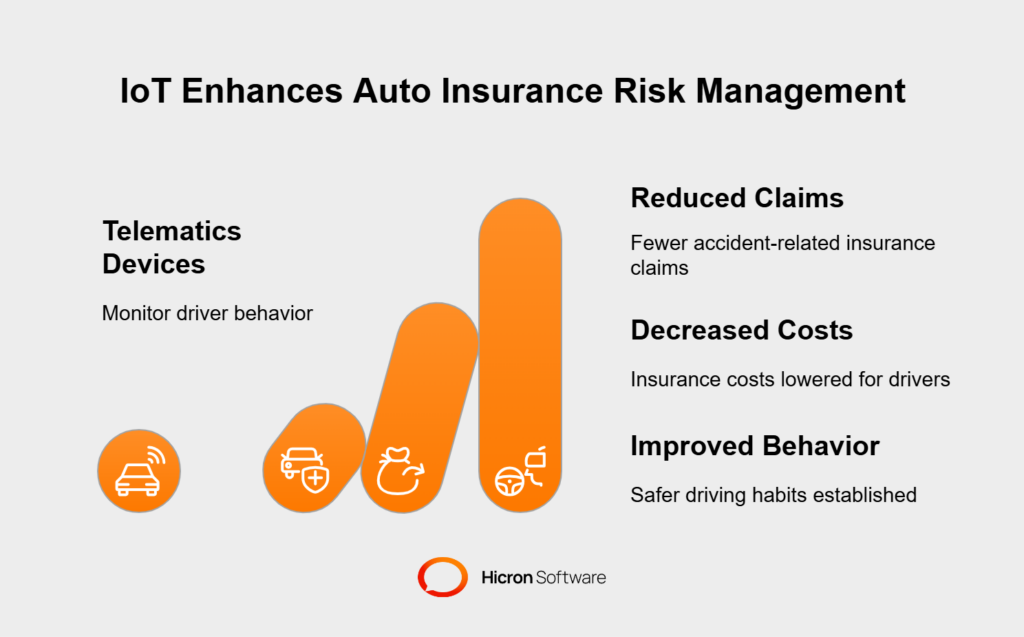

The Internet of Things (IoT) is transforming the speed and accuracy of data collection in insurance operations. IoT devices, such as telematics in vehicles, wearable health monitors, and home sensors, provide real-time insights that insurers can use to assess risk more precisely and develop usage-based automotive insurance policies.

For example, automotive insurers utilize telematics devices to monitor driving behavior and reward safe drivers with lower premiums.

Similarly, health insurers use wearable devices to encourage healthier lifestyles by offering discounts or rewards to users who meet specific activity goals. This dynamic approach enhances customer engagement while promoting more effective risk management practices.

Integrating custom insurance software solutions with existing systems is one of the biggest hurdles for insurance companies, especially those reliant on legacy technology. Application Programming Interfaces (APIs) provide a bridge that allows new, innovative tools to connect seamlessly with older systems.

APIs enable insurers to add functionalities such as customer self-service portals, automated claims tracking, or advanced analytics dashboards without overhauling their entire IT infrastructure. For example, an insurer can implement an AI-driven chatbot for customer support that communicates effortlessly with the company’s database using APIs. This flexibility reduces implementation time and maximizes the usefulness of both old and new systems.

By adopting these cutting-edge technologies, insurers can overcome industry-specific challenges and differentiate themselves in the marketplace. AI, machine learning, blockchain, IoT, and APIs provide the tools to optimize operations, enhance customer satisfaction, and future-proof businesses. For insurers seeking tailored InsurTech solutions, strategically integrating these technologies ensures a robust, adaptable foundation for long-term growth and success.

By learning from these success stories, insurance companies can better understand how to apply custom InsurTech solutions to their unique challenges and thrive in an increasingly competitive InsurTech industry.

Challenge: Inefficiencies in claims processing

A mid-sized property insurance company faced significant delays in its claims processing system. The process relied heavily on manual data entry and review, leading to extended turnaround times and customer dissatisfaction.

Tailored approach: The company partnered with an experienced InsurTech solution provider to develop a custom AI-powered claims management platform. The tailored solution included automatic document scanning, fraud detection algorithms, and workflow automation designed to align with the insurer’s specific operational needs. This custom insurance software solution was built to address the bottlenecks in their claims process while ensuring scalability for future growth.

Measurable outcomes: The implementation of the custom InsurTech solution delivered remarkable results:

Additionally, the automation enabled claims adjusters to focus on resolving complex cases, resulting in a significant improvement in overall productivity and operational efficiency.

Lessons learned: This case study highlights the transformative power of custom InsurTech solutions in addressing industry-specific challenges. By identifying bottlenecks and leveraging AI-powered automation, insurers can save time, reduce costs, and enhance customer trust. Partnering with a skilled InsurTech solution provider ensures that tailored technologies align with business goals, providing a sustainable competitive edge in insurance technology.

Challenge: High churn rates due to generic offerings

A health insurance provider faced high churn rates as customers felt the plans were too generic and struggled to see added value for their investment. The lack of personalization made it difficult for the insurer to retain clients in an increasingly competitive InsurTech industry.

Tailored approach: The insurer partnered with an InsurTech solution provider to implement a custom AI-based analytics platform. This tailored solution analyzed customer data, including preferences, health history, and feedback, to create personalized health plans. Additionally, the platform introduced behavioral incentives, such as rewards for meeting fitness goals, to encourage healthier lifestyles and increase engagement.

Measurable outcomes: The implementation of the custom InsurTech solution delivered impressive results:

These outcomes not only improved the insurer’s bottom line but also strengthened customer loyalty and satisfaction.

Lessons learned: This case study highlights the importance of leveraging custom InsurTech solutions to prioritize personalization. By focusing on customer-centric services, insurers can retain clients, attract new ones, and foster lasting loyalty. Partnering with a skilled InsurTech solution provider ensures that tailored technologies align with customer needs, providing a sustainable competitive edge in insurance technology.

Challenge: Inadequate risk assessment and pricing policies

A commercial auto insurer faced challenges in minimizing risk and reducing costly claims caused by unsafe driving practices. Its traditional risk assessment and pricing policies were insufficient for accurately identifying individual driver behavior, leading to inefficiencies and higher claim costs.

Tailored approach: The insurer partnered with an InsurTech solution provider to develop a custom IoT solution using telematics devices provided to fleets. These devices monitored driver behavior, including speed, braking patterns, and distraction levels. The collected data was integrated into a predictive analytics platform for real-time risk assessment, enabling the insurer to identify and address risky behaviors proactively.

Measurable outcomes: The implementation of the custom InsurTech solution delivered outstanding results:

These measurable outcomes not only reduced costs but also positioned the insurer as a proactive partner in safety and prevention.

Lessons learned: This case study highlights the transformative potential of IoT technology in enhancing risk management practices. When paired with real-time analytics, IoT solutions encourage safer behaviors, reduce costs, and establish insurers as leaders in safety and prevention. Partnering with a skilled InsurTech solution provider ensures that tailored technologies align with business goals, providing a sustainable competitive edge in insurance technology.

The Internet of Things (IoT) is revolutionizing risk management in the insurance industry. IoT devices, such as telematics in vehicles and wearable health monitors, provide real-time data that insurers can use to assess risk more accurately and develop usage-based insurance policies. Currently, 45% of insurers are leveraging IoT to offer innovative solutions like usage-based automotive insurance.

For example, telematics devices can monitor driving behavior, rewarding safe drivers with lower premiums.

This approach not only incentivizes safer habits but also reduces claim frequency. Insurers using IoT and predictive analytics have reported a 15% reduction in claim frequency, highlighting the transformative potential of these technologies in improving risk assessment and prevention.

Implementing custom InsurTech solutions requires a strategic approach to ensure success and maximize ROI. By following these best practices, insurers can effectively address their unique challenges and gain a competitive edge in insurance technology.

#1 Collaborate closely with InsurTech solution providers: In each case study above, insurers achieved success by partnering with experienced InsurTech solution providers to co-create tailored solutions. Clear communication about goals, challenges, and desired outcomes is essential for developing custom insurance software solutions that align with business needs. Collaboration ensures that the final product addresses specific pain points and delivers measurable value.

#2 Focus on measurable KPIs: Measurable key performance indicators (KPIs) should guide every customization effort. Whether the goal is to improve claims processing speed, boost customer satisfaction, or achieve cost savings, tracking metrics ensures that the implementation delivers tangible results. For example, insurers can monitor metrics like claim resolution times, customer retention rates, or operational cost reductions to evaluate the success of their custom InsurTech solutions.

#3 Start small, scale when proven: Pilot programs are a critical step in implementing custom insurance software. By starting small, insurers can test solutions, gather insights, and make adjustments before scaling up. This approach minimizes risks, optimizes performance, and ensures that the technology is fully aligned with operational goals. For instance, testing a telematics-based usage-based insurance program with a small fleet before rolling it out to all customers can provide valuable feedback and improve outcomes.

#4 Adopt an agile mindset: Flexibility is key to thriving in the dynamic InsurTech industry. Insurers must adopt an agile mindset, prepared to adapt their technology and strategies as market conditions evolve and customer needs change. This includes leveraging scalable, custom insurance software solutions that can grow with the business, as well as integrating emerging technologies such as AI, IoT, and blockchain to stay ahead of the competition.

Transitioning to custom InsurTech solutions can seem daunting for many insurers, especially when concerns about cost, resource allocation, and organizational readiness arise. However, by addressing these hesitations and leveraging thoughtful strategies, insurers can successfully implement tailor-made insurance technologies that drive long-term results.

One of the most common barriers to adopting custom insurance software solutions is the perception of high upfront costs. Insurers often worry about the expense of development, integration, and training, particularly for smaller organizations with limited budgets.

However, focusing on the return on investment (ROI) rather than just the initial outlay can shift this perspective. Customized InsurTech solutions are designed to reduce inefficiencies, minimize redundancies, and optimize critical processes, such as claims management and underwriting. These improvements result in long-term savings that often outweigh the initial investment.

To manage financial and resource constraints, insurers can adopt a phased implementation approach. By rolling out the solution in smaller, manageable steps, companies can reduce the immediate impact on finances and operations while gaining quick wins that build momentum for further adoption.

For instance, starting with automating a single process, like claims, and expanding to underwriting later ensures that costs and resources are spread over time.

One of the most common barriers to adopting custom insurance software solutions is the perception of high upfront costs. Insurers often worry about the expense of development, integration, and training, particularly for smaller organizations with limited budgets.

However, focusing on the return on investment (ROI) rather than just the initial outlay can shift this perspective. Customized InsurTech solutions are designed to reduce inefficiencies, minimize redundancies, and optimize critical processes, such as claims management and underwriting. These improvements result in long-term savings that often outweigh the initial investment.

To manage financial and resource constraints, insurers can adopt a phased implementation approach. By rolling out the solution in smaller, manageable steps, companies can reduce the immediate impact on finances and operations while gaining quick wins that build momentum for further adoption.

For instance, starting with automating a single process, like claims, and expanding to underwriting later ensures that costs and resources are spread over time.

The successful implementation of custom InsurTech solutions requires a strategic, long-term approach. Focusing solely on immediate needs can lead to disjointed solutions that fail to deliver lasting impact.

Implementation efforts should be guided by a clear roadmap aligned with organizational goals. This roadmap should include defined milestones and performance metrics, ensuring measurable progress and alignment with long-term objectives. It’s equally important to remain adaptable, making adjustments as market conditions and organizational needs evolve.

For example, a long-term plan might start with creating a robust data management system, which serves as the foundation for advanced analytics and AI-powered tools in later stages.

As mentioned earlier, phased implementation is a practical way to balance long-term vision with short-term goals. Each phase can be evaluated for success, providing valuable insights and refining strategies for subsequent rollouts.

While the challenges of adopting custom InsurTech solutions are real, they’re far from insurmountable. With clear communication, thoughtful planning, and a commitment to long-term value, insurers can overcome these barriers and unlock the full potential of tailored insurance technologies.

By addressing cost concerns with a focus on ROI, engaging employees to reduce resistance, and planning with a phased, vision-oriented approach, organizations can set themselves up for lasting success. Ultimately, overcoming these barriers isn’t just about implementing technology but also about creating a smarter, more agile, and customer-focused future.

Custom InsurTech solutions are not only about addressing current challenges but also about preparing for the future of the insurance industry. By aligning with emerging trends like hyper-automation and predictive services, insurers can set a strong foundation for long-term agility and innovation.

Personalization sits at the core of future-forward insurance strategies. Customers increasingly expect experiences, policies, and pricing that are tailored to their specific needs. Hyper-automation, which combines advanced technologies such as artificial intelligence (AI), machine learning, and robotic process automation (RPA), enables insurers to meet these demands quickly and accurately.

For instance, hyper-automation can analyze a customer’s behavior and life events to proactively recommend policy adjustments. Paired with predictive services, insurers can anticipate customer needs, such as suggesting health insurance upgrades based on data from wearable devices or highlighting auto policy savings for safer drivers. By staying ahead of customer demands, insurers not only meet expectations but also strengthen loyalty.

These trends emphasize the need for tailored InsurTech solutions as the industry evolves. The ability to deliver personalized and seamless experiences will become the gold standard for competitive edge in insurance technology.

The key to long-term success with custom insurance software solutions lies in continuous improvement. A one-and-done approach no longer suffices in a rapidly changing industry. Insurers must regularly evaluate their tailored technologies to remain efficient and aligned with customer expectations and market demands.

Iteration is critical in this process. Whether upgrading predictive analytics models with fresh data or refining customer-facing chatbots based on user feedback, insurers must be proactive in maintaining and enhancing their systems. This commitment to keeping solutions relevant improves operational performance and builds a reputation for consistency and reliability.

For example, an insurer using IoT devices to track real-time risks must make iterative updates to incorporate new device capabilities or data sources.

This ensures that the system remains state-of-the-art and scalable for future needs.

Insurers that invest in custom InsurTech solutions with an eye on the future position themselves as forward-thinking industry leaders. This leadership isn’t just about having the latest technology but leveraging it to redefine customer-centricity and operational excellence.

By adopting a strategic approach, such as integrating cutting-edge analytics and predictive tools, insurers can demonstrate their ability to stay ahead of the curve. Sharing success stories, innovative solutions, and customer-focused results through thought leadership platforms strengthens brand authority and sets a benchmark for others in the industry.

Additionally, insurers who lead the charge in tailoring technologies can shape industry standards, influencing how technology enhances value for customers and the broader market. Companies with this kind of foresight are seen as pioneers, trusted by customers, partners, and stakeholders.

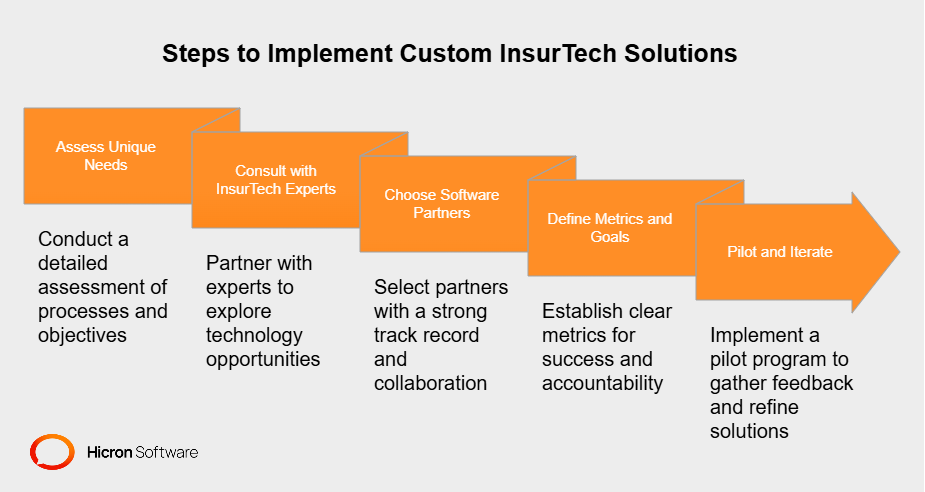

Adopting custom InsurTech solutions can transform insurers’ operations, but knowing where to start is crucial. Taking the initial steps ensures your organization is set on a path to successfully meeting its goals and maximizing the potential of tailored insurance technologies. Here’s how to get started.

The journey toward custom insurance software solutions begins with a detailed assessment of your existing processes, pain points, and opportunities. Conduct an internal audit to identify inefficiencies, such as delayed claims processing or high customer churn rates. At the same time, consider your long-term objectives. Are you aiming to enhance customer experiences, improve risk assessment accuracy, or reduce operational costs?

Engage key stakeholders across departments to gather insights and develop a comprehensive picture of priorities. This collaborative approach ensures the solution aligns with the organization’s overarching needs while addressing specific challenges.

Partnering with experienced InsurTech solution providers can streamline your path forward. These specialists understand the technology landscape and can help identify opportunities you might not be aware of.

An initial consultation could involve reviewing your operations, outlining the potential benefits of tailored InsurTech solutions, and identifying hurdles to implementation. For example, experts might recommend leveraging AI to automate underwriting or IoT to manage real-time risks for commercial clients. Their insights will help you build a clear and achievable roadmap toward modernization.

Furthermore, their experience with industry-specific challenges enables them to anticipate potential pitfalls, ranging from regulatory compliance to integration with legacy systems, and provides strategies to mitigate them.

Selecting the right software partner is the most critical decision in the customization journey. The partner you choose will play a pivotal role in designing, developing, and maintaining the custom insurance software, so making an informed choice is important.

Look for partners with a strong track record in the insurance industry and a portfolio demonstrating successful projects with similar organizations. Beyond technical expertise, prioritize vendors who emphasize collaboration and transparency. Open communication from the beginning helps ensure the solution meets your expectations and objectives.

During your evaluation, assess their ability to offer long-term support and continuous improvements. Your chosen partner should deliver the initial solution and provide updates and enhancements as your business grows and market dynamics evolve.

Before proceeding with development, establish clear metrics for success. Whether you aim to reduce claim processing times by a specific percentage, increase customer satisfaction scores, or lower administrative costs, having measurable goals ensures accountability and provides benchmarks for progress.

Regularly revisiting these metrics will also help refine and adapt the solution as needed, ensuring it remains aligned with your evolving operational needs.

Rather than implementing a solution organization-wide from day one, consider starting with a pilot program. Testing the system within a smaller scope, such as a specific department or product line, allows you to gather feedback and refine the solution. It also minimizes disruption to daily operations, making the transition smoother for your entire organization.

Taking the first steps toward custom InsurTech solutions requires careful planning and collaboration. By assessing your needs, consulting with experts, and partnering with the right InsurTech solution provider, you lay a strong foundation for tailored insurance technologies to thrive within your organization. With clear goals, the right partners, and a phased approach, insurers can unlock the full potential of customized solutions and position themselves for long-term success.

Adopting custom InsurTech solutions enables insurers to tackle their unique challenges with confidence and accuracy. Whether simplifying claims management or providing customers with a more personalized experience, these tailored technologies deliver real, impactful benefits. They help make processes smoother, customers happier, and operations better overall.

But here’s the bigger picture: Custom solutions aren’t just about fixing today’s problems. They’re a long-term investment that can set you up for lasting success. By tapping into trends like hyper-automation and predictive analytics, you’ll stay ahead of the competition and build a real competitive edge in insurance technology. With these tailored strategies, you gain the flexibility and insight to keep up with shifts in the industry and deliver what your customers need, even as their expectations evolve.

Unlocking the full potential of these tools starts with taking action. Begin by determining what your organization requires. Contact InsurTech experts who can help you see the opportunities and challenges ahead. Don’t cut corners when selecting the right software partners. A step-by-step approach, with constant tweaks and improvements, will help you maximize your investment. It’s not just about ROI; it’s about building a future where your company leads the way.

There’s no better time than now to get started. Custom solutions aren’t just a way to improve performance today; they’re about preparing your business for tomorrow. By investing in the right technology, you’re future-proofing your operations and truly redefining what it means to innovate and put customers first in a fast-changing world.

InsurTech solutions use advanced technologies like AI, blockchain, and IoT to innovate and optimize processes in the insurance industry. They streamline tasks such as claims processing, underwriting, and fraud detection while improving customer service.

Custom InsurTech solutions are tailored technologies designed to meet the specific operational and strategic needs of insurance companies. These solutions can automate workflows, improve customer interactions, and provide flexible tools to address regulatory compliance and industry challenges.

InsurTech, short for “insurance technology,” refers to the use of technology to enhance the insurance business. It focuses on automating workflows, personalizing services, and leveraging data analytics for better decision-making.

The InsurTech process involves:

Insurance: The business of providing financial protection from risks like accidents, health issues, or property damage.

InsurTech: The application of technology to modernize and enhance the insurance process, making it more efficient and customer-friendly.

Yes, InsurTech is a subset of fintech (financial technology). While fintech broadly covers technology used to improve financial services, InsurTech focuses specifically on the insurance sector.

Reinsurance solutions involve insurers transferring some of their risks to another insurance entity (the reinsurer). This helps insurers manage large claims and protect their financial stability. InsurTech further innovates reinsurance by automating risk analysis and integrating smart contracts.

The main goal of InsurTech is to make insurance more efficient, accessible, and customer-centric through technology. It aims to lower operational costs, enhance accuracy, and offer personalized solutions to meet evolving customer needs.

Custom solutions allow insurers to streamline complex processes like claims processing and risk assessment while delivering personalized customer experiences. This improves efficiency, reduces costs, and helps insurers adapt quickly to market changes, giving them a significant advantage over competitors using generic systems.

Off-the-shelf systems often lack the flexibility to address the specialized demands of various insurance sectors. They may not fully align with an insurer’s workflows, compliance requirements, or customer expectations, leading to inefficiencies and missed growth opportunities.

All sectors of the insurance industry, including life, health, automotive, and property insurance, benefit from custom solutions. These solutions enable firms to address sector-specific challenges, such as integrating telematics for usage-based auto insurance or using predictive analytics for risk assessment in property coverage.

Custom InsurTech solutions leverage tools like AI and IoT to deliver highly personalized services. For instance, insurers can create usage-based policies, provide quicker claims processing, and use predictive analytics to offer tailored products that meet individual customer needs, boosting overall satisfaction and loyalty.

Yes, these solutions are designed with scalability in mind. They can adapt to the growing needs of an organization, ensuring they remain effective even as industries, regulations, and operational demands evolve.

Implementation starts with a thorough assessment of business needs and objectives. Insurers typically collaborate with experienced InsurTech providers to design, develop, and integrate customized solutions. The process includes testing, training, and ongoing support to ensure seamless operation.

Technologies like AI, machine learning, blockchain, and IoT are integral to custom solutions. They enable automation, improve accuracy, enhance data security, and provide real-time insights, all of which help insurers operate more efficiently and effectively.

Investing in custom solutions can significantly boost ROI by reducing operational costs, minimizing manual errors, and improving customer retention. Insurers also benefit from faster claims processing and better compliance management, which contribute to long-term profitability.

Insurance companies should collaborate with reputable InsurTech providers experienced in creating tailored solutions. The right partner will understand industry-specific challenges and deliver flexible, innovative systems designed to meet both current and future needs.