Modernizing Insurance Frontends with Java-Based Frameworks like Vaadin

- June 07

- 13 min

Legacy insurance systems refer to outdated or older technology platforms and software used by insurance companies to manage their operations. These systems were often developed decades ago and are built on older programming languages, hardware, and architectures. While they may still perform essential functions, they often lack the flexibility, scalability, and integration capabilities required to meet modern business needs.

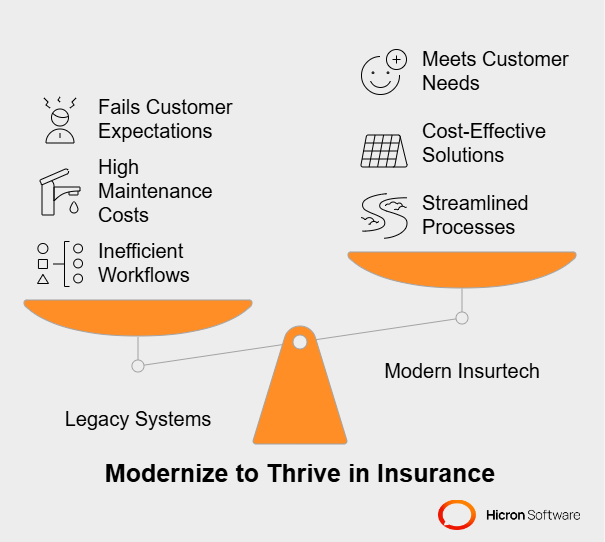

Legacy insurance systems are holding the insurance industry back in a world where technology and customer expectations are evolving rapidly. Once the backbone of operations, these outdated systems now struggle to keep up with the demands of modern, digital-first customers. Insurers relying on legacy systems face challenges like inefficiency, high maintenance costs, and an inability to deliver customer-centric services.

This article explores how transitioning from legacy insurance systems to insurtech platforms can revolutionize insurance operations. You will discover the challenges of legacy systems, the benefits of digital transformation, and actionable steps to future-proof insurance with insurtech.

Legacy insurance systems were once the backbone of insurance operations, managing tasks like policy administration, claims processing, and customer data storage. However, as the industry evolves, these outdated systems have become more of a hindrance than a help. Let’s break down why they’re holding insurers back.

Legacy systems often run on older hardware and software that weren’t designed to handle the complexities of today’s digital world. These slow and rigid systems make it difficult to scale or adapt to new requirements.

This can lead to frustration for employees as they juggle inefficient workflows and patchwork fixes just to keep things running. Worse still, the time spent navigating these clunky systems reduces the overall efficiency of operations. Instead of focusing on innovation or customer satisfaction, insurers are often stuck maintaining systems that are well past their prime.

Maintaining legacy insurance systems is expensive. Since these platforms are often built with older technology, finding skilled professionals to support them becomes increasingly complex and costly. Updates require time and effort, and any integration with modern tools or platforms can feel like forcing a square peg into a round hole.

Legacy insurance systems lack flexibility. They’re not designed to easily implement new features or keep up with modern demands, such as real-time data analysis or customer-focused mobile apps. This inflexibility disadvantages insurers, particularly when competing with nimble Insurtech startups built around agility and scalability.

Today’s customers are accustomed to instant gratification. Whether transferring money or shopping online, they expect fast, personalized services. Legacy insurance systems can’t keep up with these expectations in the insurance space.

For example, when filing claims, customers want real-time updates and efficient resolutions, not lengthy wait times caused by outdated processes.

Insurance legacy systems also struggle to create a cohesive customer experience, often segregating data across different departments. This disconnect can result in errors or inconsistencies that frustrate policyholders and damage trust.

To remain competitive, insurers need to do more than keep up; they need to anticipate client needs and deliver higher-value experiences. Insurance legacy systems don’t have the tools or flexibility to make that happen.

| Feature | Legacy Systems | Insurtech Platforms |

| Cost | High maintenance costs | Lower operational costs |

| Flexibility | Rigid and outdated | Scalable and adaptable |

| Customer Experience | Slow and disconnected | Fast and personalized |

| Technology | Outdated infrastructure | AI, EDI, and cloud-based |

Sticking with insurance legacy systems is like anchoring a ship in shallow waters. It might keep things steady for a while, but it also limits your options. By letting go of these outdated systems and adopting modern Insurtech platforms, insurers can overcome operational inefficiencies, reduce maintenance costs, and meet the demands of today’s savvy, digital-first customers. Transitioning away from legacy systems is about future-proofing the insurance business for the challenges and opportunities ahead.

The world is moving fast, and so is the insurance industry. What worked ten years ago may no longer cut it in today’s competitive and tech-driven market. For insurers hesitant to modernize legacy systems, the message is clear: digital transformation is no longer just an option. It’s essential for survival and growth. Here’s why.

Modern customers have high expectations when it comes to service. They want quick responses, interactions, and personalized solutions. Not just in retail or entertainment, but in every corner of their lives, including insurance. Think of companies like ride-hailing apps or one-click shopping giants; they’ve set the bar for convenience and speed. Now, customers expect the same from their insurers.

Digital transformation enables insurers to adopt more agile and customer-centric business models. With tools like AI and predictive analytics, companies can

Offering this fast, tailored service isn’t just a nice-to-have anymore; it’s the baseline for staying relevant.

If there’s one thing that should push legacy insurers toward digital transformation, it’s the rise of competitors who already get it. Insurtech is revolutionizing the industry by offering innovative, tech-forward solutions. From AI-powered claims processing to usage-based insurance models that rely on telematics, these companies are rewriting the rules.

For example, Insurtech platforms allow policyholders to file claims within minutes, track their status in real-time, and receive payouts quickly. These streamlined processes attract customers and cut operational costs for the company.

Without similar capabilities, traditional insurers risk losing market share to these nimble newcomers who use tech as a competitive advantage.

It’s not just customers and competitors driving the need for change; regulators are also getting involved. Around the world, the insurance industry is being pushed toward

Whether it’s new privacy laws, stricter fraud detection protocols, or mandates for digital data submissions, insurers must be digitally equipped to meet these demands.

For example, real-time data management is becoming necessary, especially in claims processing and compliance reporting areas. Legacy systems that can’t handle these requirements leave insurers vulnerable to fines and make them less reliable in the eyes of regulators and customers alike.

Insurers must prioritize digital transformation to stay competitive, meet growing customer expectations, and comply with new regulations. It’s no longer about “if” but “when” and “how.” By committing to these changes, insurers can redefine their future, winning trust and delivering value in ways that were previously impossible with outdated systems.

Insurtech platforms come in as innovative solutions that are designed from the ground up to take on the inefficiencies of legacy insurance systems. They replace them with smarter, faster, and more adaptable tools. What makes Insurtech so much better than the legacy systems insurers have relied on for years?

Unlike legacy insurance systems, which often require time-consuming manual processes and endless workarounds, Insurtech platforms are built to simplify and enhance every part of the insurance process. They’re intuitive, scalable, and incredibly efficient.

With an Insurtech platform, insurers can offer real-time support, personalized recommendations, and claims processing. Compare that with clunky legacy systems that often leave customers waiting for days (or even weeks) for updates, and it’s clear why Insurtech is the better choice.

Modern insurtech platforms are designed with growth and change in mind. They can adjust quickly as new regulations or market trends emerge, which legacy systems can’t do without costly workarounds.

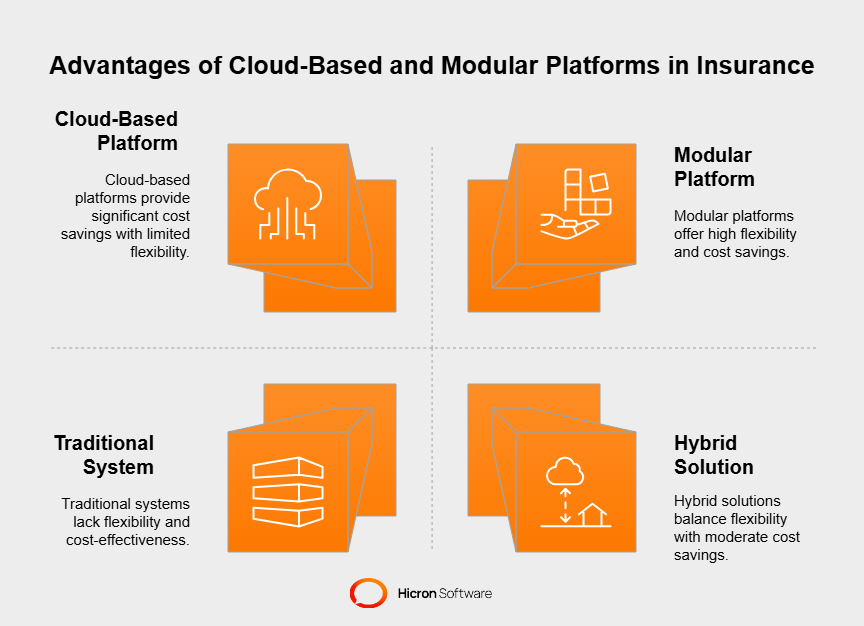

One of the standout features of many Insurtech platforms is their cloud-based technology. Moving to the cloud offers many advantages for insurers, starting with accessibility. With data securely stored in the cloud, teams can collaborate and access information from anywhere. This is especially valuable for remote operations or businesses with multiple office locations.

Cloud-based models also provide another critical advantage: cost savings. Insurers can allocate their resources toward innovation and growth by eliminating the need for on-premises servers and constant IT maintenance, rather than just keeping outdated systems running.

Building modular insurance platforms, unlike one-size-fits-all systems, enable insurers to select only the necessary features. Whether it’s automated claims processing, advanced analytics, or fraud detection tools, they can start small and scale as their needs evolve. This flexibility ensures that insurers invest in solutions that provide real, immediate value without being bogged down by unnecessary features.

Insurtech platforms don’t just make individual processes easier; they transform the entire way workflows and data exchanges are managed. For instance, technologies like Electronic Data Interchange (EDI) allow insurers to share data with brokers, agents, and even customers in a standardized and efficient way. This eliminates the silos that often plague legacy systems, ensuring that everyone involved in the insurance process has access to real-time, accurate information.

Insurtech platforms can integrate with AI tools, making processes such as claims handling faster and more accurate. Imagine a system that can instantly detect inconsistencies in claims or flag potential instances of fraud, all while reducing your team’s manual workloads.

Automation plays a massive role in reshaping operational efficiency. Tasks that used to take hours or days, such as underwriting policies or updating customer information, can now be done in a fraction of the time. With less time spent on repetitive tasks, insurers can focus on delivering more value to their customers and staying ahead of the competition.

Insurtech platforms aren’t just about replacing insurance legacy systems; they’re about reimagining what’s possible in the insurance industry. By leveraging cloud-based, modular, and automation-enabled technologies, insurers can streamline operations, reduce costs, and provide a customer-first experience that was previously out of reach.

Technology has reshaped the insurance industry, demanding faster, smarter, and more adaptable solutions. At the heart of this evolution are two critical tools: Electronic Data Interchange (EDI) and Artificial Intelligence (AI). Combined with custom software, these technologies redefine how insurers operate by driving agility, efficiency, and improved customer experiences.

Communication in the insurance world is a complex dance among insurers, brokers, agents, and customers. Traditionally, it’s been cluttered with manual processes, inconsistent file formats, and delays. EDI changes the game by enabling standardized data exchanges.

With EDI, all parties involved can transmit critical information, such as claims, policy updates, and billing data, in a quick and reliable standardized format. This eliminates errors often caused by manual data entry or incompatible systems.

For example, instead of brokers emailing or calling insurers to confirm a client’s policy status, EDI automates the update, reducing back-and-forth communication.

EDI also drives better data accuracy. Since information is shared directly and automatically through streamlined systems, mismatched or incomplete data becomes far less likely. This ensures that insurers and their partners can make faster, better-informed decisions, benefiting policyholders and internal teams.

Artificial Intelligence takes EDI capabilities to the next level by adding speed, intelligence, and predictive power to insurance operations. With AI-enabled tools, insurers can automate time-consuming, repetitive tasks, freeing up their teams to focus on higher-value activities.

Take claims processing, for example. AI algorithms can assess incoming claims, flag inconsistencies, and even approve straightforward cases without manual intervention. This reduces processing times and ensures accuracy. AI tools analyze data for complex claims to guide adjusters, providing actionable insights to expedite resolutions.

AI also excels at spotting patterns and predicting risks. Insurers can use predictive analytics to assess a customer’s likelihood of filing a claim or identify high-risk areas for underwriting. This level of insight helps companies personalize policies and optimize pricing strategies, making their offerings more competitive while managing risks more effectively.

Custom software solutions integrating EDI and AI have transformed insurance operations in measurable ways. Below are examples of how tailored solutions addressed industry-specific challenges and delivered impressive results.

Case no.1: Streamlining claims processing for a commercial insurance firm

The challenge: A commercial insurance company struggled with slow claims processing due to siloed legacy systems. This inefficiency resulted in delays in approving claims and poor communication among brokers, adjusters, and internal teams.

The solution: To simplify data exchange between stakeholders, a custom software platform with integrated EDI was developed. The system allowed real-time updates on claims, policies, and payments. AI capabilities were added to automate fraud detection and flag claim inconsistencies, reducing manual reviews.

The results:

Case no.2: Accelerating underwriting for a life insurance provider

The challenge: A life insurance company faced long application-to-policy timelines due to manual underwriting processes. Applications were taking weeks to process, frustrating customers and increasing operational costs.

The solution: A custom AI-driven underwriting system was introduced to automate key processes. Tasks like risk assessment, document verification, and policy generation were completely streamlined. EDI enabled the exchange of information with third-party vendors, such as medical record systems and credit bureaus, to speed up data collection.

The results:

Case no.3: Enhancing IoT integration in property insurance

The challenge: A property insurance provider wanted to leverage IoT devices for real-time risk monitoring but struggled to integrate large data streams from devices such as temperature sensors and security systems. Legacy systems could not process and analyze this information efficiently.

The solution: By developing a cloud-based, modular platform, the insurer could integrate IoT data with EDI for automated updates and sharing of key information. AI tools analyzed real-time sensor alerts to detect potential risks, like water leaks or fire hazards.

The results:

Case no.4: Optimizing auto insurance claims with usage-based data

The challenge: An auto insurer wanted to implement a usage-based insurance model but couldn’t handle the data from telematics devices in their legacy systems. Issues with processing, storing, and analyzing the data created bottlenecks.

The solution: A custom EDI-enabled solution was developed to integrate real-time telematics data, including mileage and driving patterns, into the claims and policy management systems. AI algorithms analyzed this data to assess driver risk profiles and automatically adjust premiums.

The results:

These examples demonstrate the potential of integrating EDI, AI, and customized software solutions in the insurance industry. Whether automating repetitive tasks, processing large data streams, or facilitating real-time collaborations, tailored systems empower insurers to operate with unmatched agility. These results aren’t just improvements, but strategic shifts that enable companies to remain competitive in a rapidly evolving market.

What’s truly exciting about EDI and AI isn’t just the immediate impact on efficiency; it’s the long-term adaptability that comes with it. These tools enable insurers to keep up with innovations, from telematics in automotive insurance to IoT-enabled risk monitoring for property insurance.

For instance, integrating IoT data with EDI can simplify how insurers manage real-time information from policyholders, such as mileage for usage-based car insurance or temperature monitoring for property coverage. AI ensures this data is analyzed and acted upon instantly, giving insurers new ways to personalize policies and reduce risks.

EDI and AI are more than tools; they’re enablers of digital transformation. With custom-built software that incorporates these technologies, insurers can declutter their workflows, uncover actionable insights, and delight customers with faster, more accurate services. Whether automating claims processing, improving communication, or future-proofing for new technologies, custom solutions pave the way for agility in a constantly changing industry.

To thrive in the tech-driven insurance landscape, it’s clear that leveraging EDI, AI, and tailored software isn’t just a smart move; it’s a necessity. The possibilities are vast, and the opportunities to differentiate your business in the modern market are greater than ever.

Digital transformation is no longer a choice; it’s a requirement for any insurance company aiming to grow and stay competitive. The rapid surge in customer demands and the explosion of data have made scalability critical for modern insurance operations. Here’s how scalable solutions, Insurtech platforms, automation, and AI create a foundation for growth.

The insurance industry thrives on data. From customer profiles and claims to policy documents and external risk factors, the sheer volume of information continues to grow. At the same time, customer expectations for speed and personalization have risen dramatically.

Scalable insurance solutions ensure that your business doesn’t slow down as your customer base expands and data multiplies. Without scalability, you’ll face bottlenecks in processing claims, managing policies, or communicating with brokers. Well-implemented digital systems allow you to serve more customers without a proportional cost increase, setting the stage for steady growth.

Insurtech platforms are game-changers for insurers looking to enhance their workflows as they grow. These platforms integrate cutting-edge technologies, like cloud computing and advanced analytics, to streamline processes.

For example, with Insurtech platforms, brokers and agents can access centralized systems to update policies in real time. Policyholders can securely upload documents and monitor the progress of their claims with transparency.

Insurtech platforms are designed with flexibility, allowing companies to integrate new tools or expand to new regions without significant downtime or costs.

One key benefit is workflow automation. Processes such as underwriting, policy renewals, and compliance can be handled more efficiently and with fewer errors. This reduces administrative overheads, allowing your team to focus on strategic initiatives rather than manual, repetitive tasks.

AI and automation are at the core of scalable digital transformation strategies. Here’s how they make growth easier and more cost-effective for insurance businesses:

Think of a scalable insurance operation as a well-oiled machine that adapts to new challenges. Imagine processing thousands of claims during a natural disaster without delays, onboarding new customers in new markets with minimal setup, or integrating new technologies without disrupting existing workflows.

This vision is achievable through digital transformation. By investing in scalable solutions, leveraging Insurtech platforms, and harnessing AI and automation, insurers can ensure they grow without limits.

Achieving scalability is more than handling larger volumes of data or increasing capacity. It’s about future-proofing your insurance operations to remain agile, cost-efficient, and customer-focused. Building this foundation today supports growth tomorrow and sets your business apart in an increasingly crowded market. With digital transformation, the sky’s the limit for what your insurance firm can achieve.

The transition from outdated legacy systems to agile Insurtech platforms is revolutionizing the insurance industry. Insurers who make this shift gain access to a world of opportunities, from improved efficiency to enhanced customer satisfaction and long-term cost savings.

|

Key benefits |

Details |

|

Improved Operational Efficiency |

|

|

Enhanced Customer Experiences |

|

|

Cost Savings and Flexibility |

|

The insurance industry is more competitive than ever, with tech-savvy startups revolutionizing traditional business models. By adopting Insurtech, you future-proof your operations and equip your business to thrive in this evolving market.

For example, companies utilizing predictive analytics and AI for fraud detection reduce losses and gain a reputation for reliability and trustworthiness. This creates a virtuous growth cycle, as satisfied customers spread the word and competitors struggle to keep up.

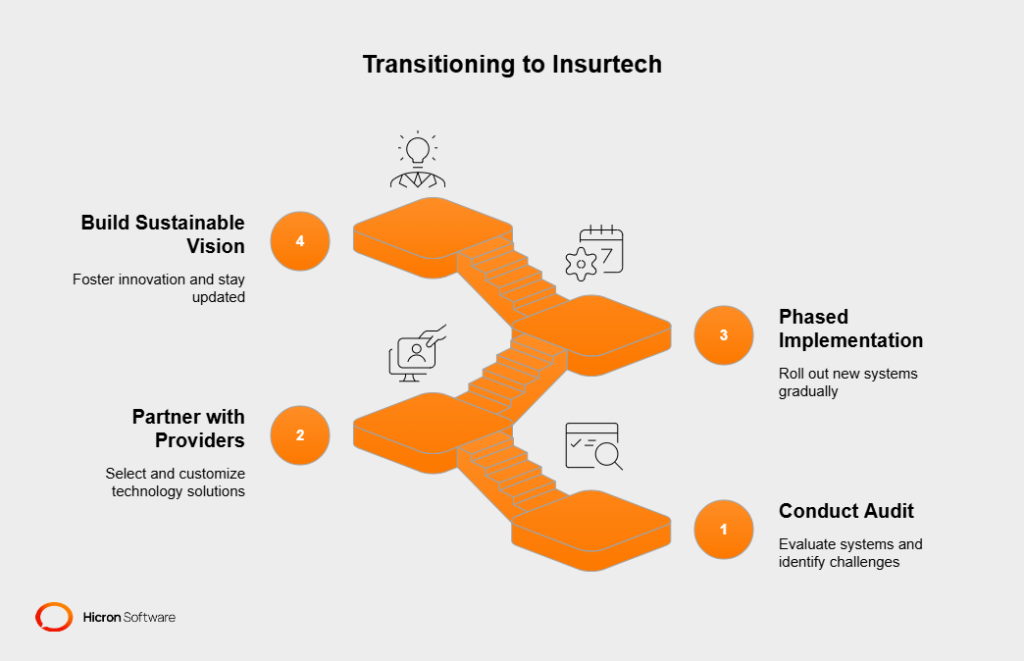

Transitioning to Insurtech might seem daunting, but with a clear plan, it can be a smooth and rewarding process. Insurers can take actionable steps to modernize their operations, boost efficiency, and remain competitive.

The first step towards adopting Insurtech is understanding where your current systems stand and identifying the challenges that must be addressed.

Every insurance business is unique, so there’s no one-size-fits-all Insurtech solution. Partnering with the right technology providers ensures your transition aligns with your goals and industry needs.

Switching from legacy systems isn’t something that happens overnight. A phased approach can reduce disruptions to your operations while gradually introducing staff to the new systems.

The shift to Insurtech isn’t just about new tools; it’s a cultural change that promotes innovation and flexibility in the organization.

Imagine a world where insurers are not just problem-solvers but preventers, stepping in before accidents or issues arise. Integrating IoT (Internet of Things) devices with predictive analytics makes this vision a reality, transforming the insurance landscape.

Beyond risk prevention, IoT is fostering a deeper relationship between insurers and policyholders. For instance, wearable devices like fitness trackers go beyond capturing health data. They enable insurers to deliver value-added services such as wellness tips or personalized health warnings, building a more connected, advisory role in people’s lives. Over time, this creates a sense of trust, as customers view their insurer as a partner invested in their well-being.

One of the most exciting aspects of IoT is its potential for adaptation. Whether sensors issue alerts about oncoming storms or smart systems automatically secure homes during extreme weather, these technologies are reshaping how insurers address emerging risks. The insights from this real-time data also help craft dynamic pricing models, reward users for taking preventive measures, and ultimately foster a healthier relationship between risk and responsibility.

IoT is no longer just a tool for reactive claims management. By enabling insurers to proactively support their customers with insights, warnings, and incentives, IoT is cementing its role as a fundamental driver of the next chapter in digital insurance.

The insurance industry is at a pivotal juncture. The era of legacy systems has served its time, but their limitations no longer align with the speed, efficiency, and personalization that modern customers demand. Transitioning to Insurtech is no longer just an option; it’s necessary for those looking to remain competitive, relevant, and future-ready.

For insurers, the path forward is clear. Adopting technologies like Electronic Data Interchange (EDI) for streamlined communication and artificial intelligence (AI) for intelligent decision-making can form the foundation of digital transformation. These tools not only enhance operational efficiency but also enable insurers to deliver faster, more personalized services that align with the expectations of today’s customers.

The promise of Insurtech extends beyond operational improvements. It’s about redefining the role of insurance in people’s lives. By aligning innovation with customer needs, insurers can create relationships built on trust, transparency, and proactive support. The result? An industry that isn’t just reactive to risks but one that actively partners with customers to help prevent them, paving the way for a more connected and customer-focused future.

The road to transformation may seem challenging, but the rewards far outweigh the effort. By taking that first step to modernize systems or applications and invest in next-generation technologies, insurers evolve and lead the charge into an exciting new chapter for the industry. The future is digital, customer-centric, and full of opportunities. The time to act is now.

Legacy Insurance Systems are outdated technologies used by insurers for tasks like claims processing and policy management. They lack the flexibility and efficiency of modern Insurtech platforms.

Replacing Legacy Insurance Systems with Insurtech solutions helps insurers reduce costs, improve efficiency, and meet customer expectations for fast, digital-first services.

Insurtech uses advanced technologies like AI and EDI to streamline insurance operations, automate workflows, and deliver personalized, customer-centric services.

Digital transformation modernizes insurance operations, enabling faster claims processing, real-time data access, and improved customer satisfaction.

AI automates claims processing, enhances fraud detection, and provides predictive analytics, helping insurers make faster, data-driven decisions.

EDI (Electronic Data Interchange) automates data sharing between insurers, brokers, and customers, improving accuracy, speed, and operational efficiency.

Insurtech platforms offer scalability, cost savings, faster claims processing, and better customer experiences through automation and cloud-based solutions.

Insurers can begin by auditing their systems, partnering with Insurtech providers, and implementing scalable, cloud-based platforms in phases.

Legacy systems are expensive to maintain, inflexible, and unable to meet modern customer demands for fast, digital services.

Insurtech platforms provide real-time updates, personalized policy options, and seamless digital experiences through mobile apps and chatbots.