InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

Thanks to InsurTech, the way insurance works is changing faster than ever. From smarter claims automation powered by AI to custom-built insurance software, technology transforms how insurers operate and what customers expect. It’s more than just keeping up with the times; it’s about rethinking the whole game and delivering faster, more personalized, and more efficient solutions.

For insurance companies, the message is clear: keeping pace with these trends isn’t just a good idea; it’s essential for staying competitive. Digital transformation in insurance, predictive analytics, and other innovations have moved from “nice-to-have” to business-critical. Falling behind isn’t an option anymore because, in this industry, agility and technology are driving future success.

But this isn’t a solo effort. Companies need guidance to make the most out of what InsurTech offers. That’s where consulting expertise comes in. By aligning cutting-edge tech with your business goals, consultants can help smooth the transition and maximize results. Whether exploring scalable digital tools or venturing into the fast-growing InsurTech industry, staying ahead is all about combining the right tech with the right strategy.

Staying relevant in today’s insurance industry means more than just offering good policies. It’s about adapting to a world where technology drives operational efficiency and customer satisfaction. InsurTech, with its cutting-edge solutions like AI-driven claims processing and custom insurance software development, is giving insurers the tools they need to thrive in an increasingly competitive market.

Operationally, advanced insurance tech simplifies and speeds up claims management and risk assessment processes. Automation reduces manual tasks, improving accuracy and saving time for insurers and customers. Policyholders can benefit from InsurTech’s enhanced experience by streamlining services, offering personalized products, and enabling quicker support. Happy customers, in turn, lead to loyalty and positive growth.

Yet the benefits go beyond efficiency. Companies tapping into the latest InsurTech trends, such as digital transformation for insurance or predictive analytics, gain a substantial competitive edge. These innovations allow insurers to better understand market demands, anticipate risks, and design tailored solutions that stand out. They don’t just keep up with the competition; they set the pace for what’s next in the insurance industry.

The flip side? Companies that resist change or delay adopting new technologies risk falling behind. Operating with outdated systems puts them at a disadvantage regarding efficiency and customer experience and limits their adaptability in an industry that’s evolving rapidly. Fueled by innovative InsurTech, future-focused strategies are no longer optional but necessary for insurance companies aiming to lead rather than lag.

The InsurTech industry is pushing boundaries with innovative technologies redefining how insurance companies operate. These trends are more than buzzwords; they’re tools helping insurers revolutionize processes, improve customer experiences, and stay ahead of the competition. Here’s a look at some of the game-changing developments transforming the landscape.

AI is at the heart of the insurtech industry, powering smarter solutions. From claims automation to fraud detection, AI in insurance software enhances decision-making and operational efficiency. It helps insurers process claims faster, identify suspicious activity proactively, and even tailor offerings based on customer behaviors.

Blockchain technology is reshaping insurance tech by offering unmatched transparency and security. Immutable records ensure more accurate claims handling and policy management while reducing fraud risks. Blockchain’s decentralized structure also transforms how insurers handle sensitive data, building greater trust with policyholders.

The Internet of Things (IoT) allows insurers to monitor real-time data and offer personalized solutions. For instance, telematics insurance technology in the auto sector will enable companies to design usage-based insurance where premiums are customized based on driving habits. This encourages safer practices and aligns coverage with actual customer needs.

Analyzing vast data sets gives insurers deeper insights into risk management. Predictive analytics for insurers allows companies to spot patterns, anticipate potential risks, and recommend tailored products. It also plays a significant role in identifying fraud before it happens, saving insurers time and resources.

Embedded insurance disrupts traditional coverage by integrating protection directly into customers’ products or services. Whether adding travel insurance when booking a flight or electronics coverage during a purchase, this innovation makes buying protection frictionless. Similarly, digital payment integrations streamline how premiums and claims are managed, offering faster and more user-friendly solutions.

These trends are not just shaping the insurtech industry but are becoming the backbone of a digital transformation for insurance. Companies that invest in these technologies and align them with strategic objectives are paving the way for long-term agility and growth, while those that hesitate risk losing ground in a rapidly advancing marketplace.

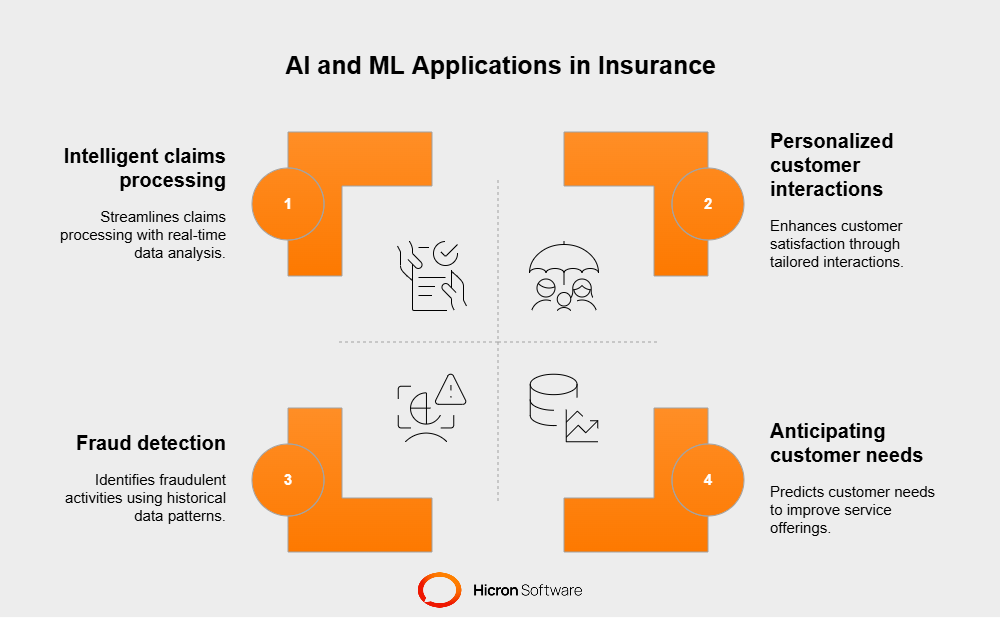

Artificial intelligence (AI) and machine learning (ML) are no longer futuristic concepts; they have become essential tools for the modern insurance industry. Their ability to analyze data, automate processes, and predict outcomes transforms every stage of the insurance workflow, from claims processing to customer interactions. Here’s a closer look at how these technologies are reshaping the industry.

AI in insurance software drastically reduces the time and costs associated with claims and underwriting. Claims automation software powered by AI processes data in real-time, rapidly verifies documents, spots inconsistencies, and delivers decisions quicker than traditional methods. This speed not only improves operational efficiency but also enhances customer satisfaction.

Similarly, underwriting is becoming more precise through AI-driven tools that analyze vast datasets. From credit scores to health information, AI evaluates risk profiles more accurately, enabling insurers to make informed decisions and offer fairer premiums.

AI is also a game-changer in tackling the perennial problem of insurance fraud. Fraud detection software for insurance uses machine learning to identify red flags and unusual behavior patterns that may indicate fraudulent activity. For example, predictive models analyze previous fraud cases to recognize similarities in new claims, helping insurers act quickly and save valuable resources.

Machine learning takes customer service to the next level by predicting behavior based on historical data. Insurers can anticipate customer needs and develop bespoke solutions by studying buying habits, claim history, and social patterns. Predictive analytics for insurers is helping businesses move from reactive to proactive, creating opportunities for better engagement and product offerings.

AI-powered claims automation and customer service solutions enable more profound, meaningful interactions. For instance, virtual assistants and chatbots use AI to address customer queries efficiently while providing personalized advice. When integrating AI with advanced analytics, companies can offer tailored policies or even send proactive reminders about coverage adjustments that fit a customer’s changing situation.

Picture this scenario: a policyholder who consistently practices safe driving habits. Through telematics insurance technology, their driving behavior is monitored and analyzed. This data is more than just numbers; it provides actionable insights. Machine learning algorithms can process this information to highlight patterns, such as adherence to speed limits or safe braking practices. These insights allow the insurer to reward customers with personalized discounts or other driving-related incentives. This approach encourages safer driving across their client base and strengthens customer satisfaction by aligning premiums with individual behaviors.

Another compelling example comes from healthcare insurance. Imagine a system where AI in insurance software analyzes a policyholder’s health records, lifestyle information, and claim history. Based on this data, the AI sends timely notifications to customers, reminding them about overdue routine medical tests or check-ups. For instance, a nudge about scheduling an annual health screening can improve preventative care measures and potentially avoid costly medical interventions later. This proactive approach ensures better health outcomes while showcasing the insurer’s commitment to customer well-being.

Customer service is at the heart of any insurance provider’s success, and AI-powered chatbots are changing the game. These virtual assistants handle inquiries 24/7, from policy information requests to claim status updates. Using natural language processing, these bots offer human-like responses, resolving simple issues instantly and escalating complex ones to human agents. This creates a seamless customer experience while reducing insurers’ operational overheads.

Traditionally, insurance pricing has been static, but machine learning models enable dynamic pricing in insurance. By analyzing various factors—including customer behavior, market trends, and risk probabilities—AI can suggest personalized premiums that reflect real-time conditions.

For instance, a homeowner in a low-risk area during mild weather might see lower premiums, while someone in a flood-prone zone during storm season might pay more. This approach ensures fairness and profitability while maintaining transparency.

Natural disasters pose enormous challenges for insurers. AI-powered insurance tools are now being used to assess potential risks in real time. By analyzing satellite imagery, weather data, and historical event patterns, these tools can predict areas likely to be affected by hurricanes, wildfires, or floods. Insurers can use these insights to adjust their portfolios, prepare for claims influxes, or even provide warnings to at-risk customers, minimizing financial and human losses.

AI’s ability to sift through data at lightning speed makes it an invaluable tool in combating fraud. For example, machine learning algorithms can scan claims for anomalies, such as repeated patterns or falsified documentation. A software tool might flag a suspicious claim for a policyholder reporting multiple “lost” valuables. This saves insurers millions and deters fraudsters from exploiting the system.

Insurers are now leveraging advanced AI algorithms to create more accurate risk profiles. For example, policyholders with lifestyle data that indicates high engagement in risky activities, such as extreme sports, may receive customized plans that balance cost and coverage. Similarly, businesses with strong safety records might receive lower commercial insurance premiums. This approach balances fairness with profitability.

Insurers can use data from IoT devices to monitor the health of homes and commercial properties. For example, a sensor tracking water pressure could predict and alert homeowners of an impending pipe burst. Machine learning evaluates patterns, identifies potential maintenance issues, and notifies customers so they can address the problem before it escalates into a claim-worthy incident. By preventing damage, insurers cut costs while showing customers they care.

The ability to offer hyper-personalized insurance solutions through AI-driven insights is changing how companies engage with clients. Whether by rewarding safe behaviors, tailoring premiums, or preventing disasters, AI and machine learning make insurance a transactional service and a partnership. This fosters deeper trust, better outcomes, and stronger loyalty in a fiercely competitive field.

Incorporating these technologies into their strategies allows insurers to anticipate customer needs, streamline operations, and stay on the cutting edge of innovation. Those who invest in AI-powered solutions today will define the industry’s future.

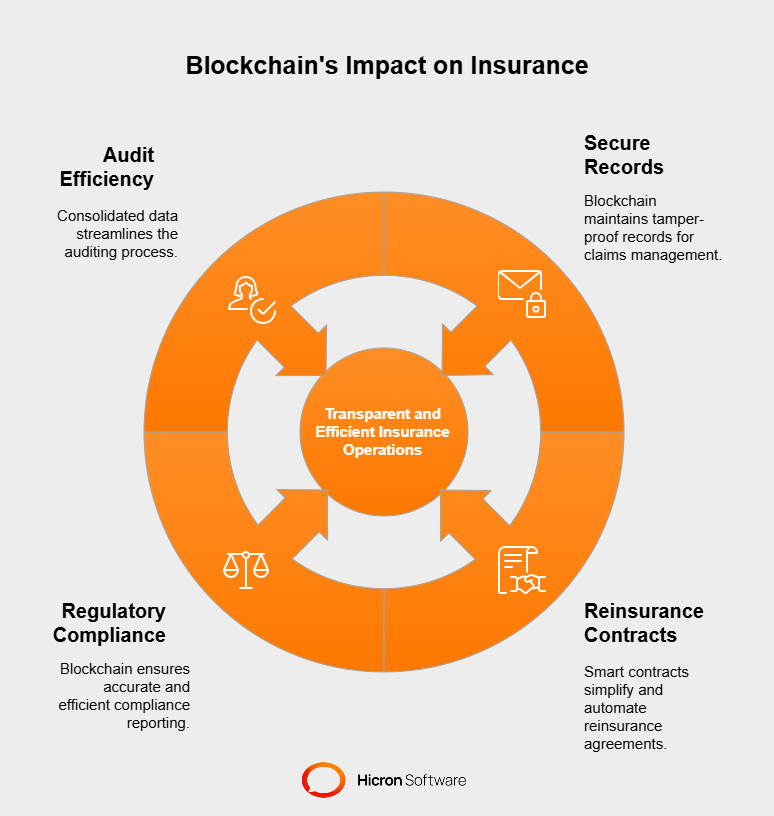

Blockchain is transforming the insurance industry by addressing key challenges such as fraud, inefficiency, and compliance gaps. With its decentralized and secure framework, it offers practical solutions that improve processes and build trust.

A significant advantage of blockchain is its ability to maintain secure, tamper-proof records for claims management. Every update or transaction related to a claim is permanently documented on the blockchain, ensuring that no unauthorized changes can occur without being detected. For instance, disputes over altered claims or backdated documents are significantly reduced. Both insurers and policyholders benefit from this reliable record-keeping method, making the claims process straightforward and transparent.

Reinsurance processes, which often include multiple parties and detailed contracts, can become unnecessarily complicated. Blockchain addresses this by creating a shared digital ledger that all parties can access. Smart contracts play a crucial role here, executing agreements automatically once certain conditions are met. For example, when an insurer needs to pass financial responsibility to a reinsurer, blockchain ensures efficient transactions, minimizing delays and miscommunication.

Meeting regulatory requirements is a constant challenge in the insurance sector, and blockchain can streamline this process. Its ability to record time-stamped, secure transactions allows for seamless tracking and reporting. Insurers can demonstrate compliance more efficiently, and regulators can access the required data quickly. Additionally, automated reporting can save companies significant time and reduce the chances of human error, ensuring accuracy and reliability.

Audits can be time-consuming, mainly when records are scattered across multiple systems. Blockchain simplifies the process by consolidating transaction data into a single, secure location. Blockchain records’ clear and chronological nature allows auditors to verify information quickly and precisely. This reduces the time spent on manual checks and ensures all necessary data is easily accessible.

Blockchain’s secure and transparent framework is gradually redefining insurers’ operations. This technology practically tackles complex processes, from managing claims to handling reinsurance and ensuring compliance. By adopting blockchain, insurers aren’t just addressing current challenges; they are creating a foundation for more transparent and efficient operations in the future.

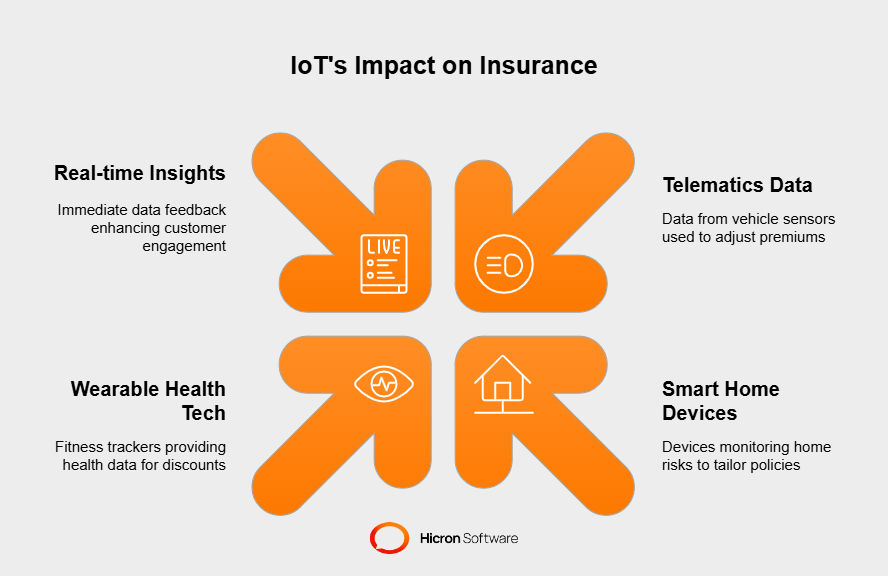

The Internet of Things (IoT) is reshaping how insurance companies design their offerings, making policies more personalized and data-driven. With IoT devices providing real-time insights, insurers can create flexible, usage-based insurance policies and improve risk management, all while enhancing customer engagement.

IoT technology allows insurers to move away from static, one-size-fits-all policies toward tailored, usage-based models. For instance, telematics devices installed in vehicles track driving habits such as speed, acceleration, and braking. This data helps insurers adjust premiums based on individual behavior, rewarding safe drivers with lower rates. Similarly, in home insurance, smart devices like water leak detectors monitor environmental risks, enabling homeowners to pay premiums that reflect the actual condition of their property.

IoT has a profound impact on health and life insurance as well. Wearable health devices, such as fitness trackers and smartwatches, collect data on activity levels, heart rate, sleep patterns, and more. Insurers can use this data to offer discounts or incentives to policyholders who demonstrate healthy lifestyles. For example, a customer who meets fitness goals might receive reduced premiums or wellness rewards. These initiatives personalize insurance policies and encourage healthier habits, fostering a win-win dynamic for both parties.

Another significant advantage of IoT in insurance is proactive risk management. Insurers can identify potential risks by continuously monitoring data from IoT-enabled devices before they develop into bigger issues. For example, connected home systems can detect early signs of fire, water damage, or security breaches, alerting homeowners and insurers simultaneously. Similarly, in health insurance, IoT-enabled devices can flag abnormal vital signs, allowing for early medical intervention. This proactive approach reduces claims’ frequency and severity, benefiting insurers and customers.

IoT devices also create opportunities for insurers to engage more deeply with their policyholders. Through real-time monitoring and feedback, insurers can provide personalized recommendations and reminders, such as health tips or home maintenance alerts. Additionally, apps connected to IoT devices offer customers immediate access to their data, fostering transparency and trust. By shifting the relationship from transactional to interactive, insurers position themselves as partners in their customers’ well-being.

The rapid evolution of technology presents vast opportunities for insurers, but adopting new solutions isn’t always straightforward. Without a clear strategy, chasing trends can lead to inefficiencies, wasted resources, or misaligned priorities. This is where expert consulting becomes invaluable. Consulting services enable insurers to adopt innovations that deliver tangible results by bridging the gap between emerging technologies and business objectives.

Consultants play a crucial role in helping insurers navigate the endless array of technologies available today. Their expertise allows them to assess each business’s unique requirements and recommend tailored solutions. For example, an insurer aiming to enhance customer service might be advised to implement AI-powered chatbots, while another seeking to lower operational costs could focus on automating claims processing. By understanding industry trends and the company’s needs, consultants ensure that the chosen technologies align with the organization’s goals.

Adopting technology for innovation alone can backfire without a solid strategy. Expert consultants help insurers evaluate and prioritize tools that solve immediate challenges and support long-term objectives. For instance, in the case of dynamic pricing models using machine learning, consultants ensure that these systems are implemented in a way that aligns with overall revenue goals while maintaining customer trust. This strategic approach prevents technology from becoming a distraction and positions it as a driver of measurable success.

Consulting expertise has proven essential for insurers looking to leverage technology effectively. By offering tailored guidance, consultants have helped businesses transform their operations across various insurance areas. Below are a few detailed examples illustrating the role of consulting in driving success.

A mid-sized health insurer faced significant challenges in assessing risk for underinsured populations. Consulting experts recommended leveraging wearable health technology and predictive analytics to address the issue. The insurer could gain better insights into policyholder health by implementing fitness trackers and analyzing data such as activity levels and heart rate. This reduced underwriting risks while enabling the company to design personalized policies to encourage healthier lifestyles. The consulting team provided strategic planning to integrate these tools seamlessly, ensuring both effectiveness and ease of adoption.

A global property insurance provider sought to enhance its claims process, which was hindered by inefficiencies and delays. Under the guidance of consultants, the company adopted blockchain solutions to create a transparent, tamper-proof system for recording claims. The decentralized ledger allowed all parties, including insurers and policyholders, to track the progress of claims in real time. This sped up payouts and minimized disputes by maintaining a clear, verifiable record of transactions. The consultants were pivotal in selecting the right technology partners, ensuring compliance with regulations, and training staff to adapt quickly to the new system.

A regional auto insurer wanted to improve customer engagement and reduce churn. Consultants identified AI-powered chatbots as a practical solution to achieve these goals. By implementing chatbots capable of answering common queries, assisting with policy updates, and offering personalized recommendations, the insurer significantly enhanced its customer service experience. Additionally, consultants helped integrate machine learning algorithms into the chatbot system, enabling smarter, context-aware responses over time. This created a more engaging experience for policyholders while allowing staff to dedicate their time to more complex customer needs.

A large life insurance company struggled with increasing fraudulent claims that undermined its profitability. Consulting experts suggested deploying machine learning models to detect fraud patterns and flag suspicious activities. These advanced systems analyzed claims data to identify anomalies such as inflated medical bills or inconsistent documentation. With the consultants’ guidance, the insurer implemented automation tools that could alert investigative teams in real time. The result significantly reduced fraudulent activities, saving the insurer millions while reinforcing its commitment to fairness.

A multi-line insurer was experiencing high operational costs due to outdated IT systems. With the help of consultants, the company migrated its core processes to a cloud-based infrastructure. The consultants devised a phased roadmap to minimize disruptions while transitioning to more scalable and efficient systems. Cloud technology enabled the insurer to store and process data more efficiently, eliminate redundant workflows, and provide employees with remote access to essential tools. The move cut costs and enhanced operational flexibility, giving the insurer a competitive edge.

These examples underline the importance of consulting in aligning technological adoption with strategic business goals. Whether it’s introducing the right tools for customer engagement, improving fraud detection, or streamlining claims processes, consulting services offer insurers a roadmap to drive change effectively. By identifying the appropriate solutions and ensuring a smooth implementation, consultants help insurers harness technology to unlock long-term value and stay ahead in a competitive industry.

The real value of consulting lies in its ability to bring clarity and focus. By grounding decisions in both data and strategy, consultants empower insurers to optimize technology investments. Whether adopting IoT for proactive risk management, blockchain for transparency, or advanced analytics for customer insights, expert advice ensures that these solutions align with business outcomes.

With the right consulting support, insurers can confidently innovate without losing sight of their goals. Guided by clear priorities and informed by industry expertise, they create a technology roadmap that strengthens their market position and delivers lasting value.

The digital transformation of the insurance industry has brought remarkable opportunities, but it has also introduced new complexities in regulatory compliance. Insurers now manage vast amounts of sensitive customer data, making adherence to data privacy standards, such as the General Data Protection Regulation (GDPR), more essential and challenging than ever. To stay compliant while minimizing risks, insurers must leverage modern InsurTech tools and adopt forward-thinking strategies.

Insurers accumulate extensive personal data, including financial details, health records, and behavioral insights, to provide personalized services. This responsibility, however, comes with heightened scrutiny from regulators and consumers alike. Non-compliance with laws like GDPR, which enforces strict rules on data handling and grants customers more control over their information, can lead to hefty penalties and reputational damage.

Beyond GDPR, insurers face challenges aligning with region-specific standards, such as California’s Consumer Privacy Act (CCPA) or Brazil’s General Data Protection Law (LGPD). The key hurdle lies in balancing the use of data to enhance services and the ethical and secure collection, storage, and processing of that data.

InsurTech solutions are indispensable in helping insurers meet compliance requirements with greater accuracy and efficiency. Real-time monitoring tools, for instance, can flag potential breaches or inconsistencies as they occur, allowing companies to address issues proactively. Automated data encryption systems ensure that sensitive information remains secure, while consent management platforms track and manage customer permissions seamlessly.

Additionally, advanced reporting systems integrated into InsurTech platforms simplify the task of meeting audit and regulatory reporting requirements. These tools automatically compile relevant data, generate compliance reports, and ensure timely submissions to authorities, reducing insurers’ administrative burdens.

For example, AI-powered analytics platforms can identify patterns that indicate non-compliance or inefficiencies in data-handling procedures. Insurers can refine their operations by gaining deeper insights into where gaps exist while staying ahead of potential regulatory challenges.

To remain compliant in a rapidly changing regulatory landscape, insurers must adopt a proactive, rather than reactive, approach. Strategies to future-proof operations include:

Adhering to stringent regulations isn’t just about avoiding penalties; it’s also an opportunity to build trust with policyholders. Customers are increasingly conscious of how their data is handled, and insurers that demonstrate a commitment to privacy and transparency can foster stronger relationships.

By integrating the latest InsurTech tools, staying vigilant about shifting regulatory demands, and fostering a culture of compliance, insurers can turn challenges into opportunities. This agile approach safeguards businesses from legal risks and positions them as responsible custodians of their customers’ trust in an increasingly digital world.

The insurance industry operates in a fast-paced world where market dynamics, technological advancements, and environmental factors continually reshape the landscape. To stay ahead, insurers must adopt a forward-thinking approach by implementing scalable, adaptable systems that ensure long-term growth and stability. Innovation and flexibility are no longer optional but essential for building a resilient and competitive business framework.

One of the core pillars of future-proofing lies in building systems that can evolve alongside the business and broader industry challenges. Legacy systems, while dependable in the past, often hinder growth due to their inability to adapt quickly to new technologies or increased demands. Insurers who invest in scalable solutions, such as cloud infrastructure and modular platforms, lay the groundwork for agility and responsiveness.

For instance, cloud-based solutions allow insurers to expand data storage and processing capabilities as their operations grow. Modular platforms enable insurers to integrate new technologies, such as AI-driven analytics or blockchain for claims processing, without overhauling their entire system. This adaptability empowers businesses to remain nimble, minimize operational disruptions, and explore innovative tools to enhance their services.

Traditional risk assessment models are no longer sufficient in an era of escalating climate hazards and rapid economic changes. To future-proof their operations, insurers must integrate data-driven models that account for emerging risks. This includes climate change implications, from rising sea levels to extreme weather events, which have already started to reshape the scope and frequency of insurance claims.

Sophisticated risk models powered by AI and machine learning can analyze vast datasets, such as climate patterns and real-time market trends. These tools predict risks more accurately and allow insurers to price policies and allocate resources more effectively. For example, flood insurance insurers can utilize predictive models to determine pricing based on historical rainfall patterns and the expected frequency of floods in specific regions.

Similarly, market volatility due to factors like inflation, currency fluctuations, or geopolitical shifts demands that insurers adopt dynamic pricing models. These models continuously adjust premiums to reflect market conditions, ensuring profitability while remaining competitive in unpredictable economic environments.

Resilience is a critical attribute for insurers navigating uncertainty. To prepare for the unknown, companies must adopt a two-pronged approach: strategy diversification and operational flexibility.

For insurers seeking to build resilience and remain competitive in uncertain environments, the following steps can be invaluable:

The rise of InsurTech has transformed how insurers connect with their policyholders, putting customer experience at the forefront. By leveraging cutting-edge digital tools, insurers can offer faster, more personalized, and more convenient services. From mobile apps to real-time claim updates, InsurTech is eliminating traditional pain points and setting a new standard for customer satisfaction.

Modern policyholders expect intuitive tools that simplify their insurance needs, and InsurTech is delivering on those expectations. Mobile apps and self-service portals are prime examples of how insurers empower customers to take charge of their policies.

These innovations make insurance processes less intimidating and more accessible, fostering customer trust and loyalty.

Speed and transparency are critical in times of need, particularly when filing claims. InsurTech solutions have introduced real-time claim updates that allow customers to track the status of their claims from submission to resolution. Push notifications and progress trackers provide peace of mind and eliminate the frustration of waiting for information.

Additionally, insurers have embraced AI-driven chatbot technology to enhance customer engagement. These chatbots deliver instant support by answering frequently asked questions, guiding users through claims submissions, and recommending suitable coverage options based on individual needs. Available 24/7, these virtual assistants provide quick resolutions for common queries while redirecting complex issues to human agents, ensuring seamless service at every step.

Insurers are increasingly adopting digital ecosystems to offer cohesive, multi-channel experiences. These ecosystems integrate mobile, desktop, and in-person touchpoints to provide a consistent and user-friendly customer journey.

The result is a frictionless experience that meets the demands of modern customers for speed, convenience, and flexibility.

Successful integration of InsurTech solutions requires more than adopting the latest technology; it demands a structured, strategic approach. Insurers striving to remain competitive must evaluate their current systems, identify growth opportunities, and implement tailored solutions aligning with their strategic goals. Here’s how insurers can build a practical roadmap for InsurTech success.

A critical first step is conducting a thorough evaluation of existing systems. Insurers must explore whether their infrastructure supports scalability, efficiency, and seamless customer interactions. Outdated or fragmented systems often lead to challenges such as process inefficiencies, data silos, and limited flexibility.

During this assessment, insurers should ask key questions:

By identifying specific weaknesses, insurers can pinpoint the areas where technology upgrades will deliver the most impact, whether improving operational efficiencies, enhancing customer experiences, or mitigating risks.

The complexity of implementing InsurTech solutions makes partnering with consulting experts a valuable move. Consultants bring specialized knowledge that helps insurers choose the best tools and align these technologies with long-term objectives.

For example, while one insurer may benefit from leveraging AI to refine underwriting processes, another might prioritize adopting IoT technology to assess real-time risks for customers. Consulting experts help diagnose these unique needs and create customized strategies that maximize the return on investment.

Additionally, consultants can oversee the entire implementation process. From identifying the right vendors and coordinating technology integration to training employees and monitoring performance, their expertise expedites progress while minimizing disruptions. This strategic partnership ensures that every technological upgrade supports the company’s overarching business goals.

After implementation, the work doesn’t stop. Continuous monitoring and optimization ensure that technologies remain effective and adaptable in a rapidly evolving industry.

Here’s how insurers can sustain their InsurTech success:

An optimized InsurTech strategy doesn’t just deliver operational improvements; it future-proofs the business against market shifts, regulatory changes, and rising customer expectations. By assessing current systems, seeking expert advice, and committing to ongoing system optimization, insurers can build a robust foundation for sustained growth and innovation in the digital age. Through careful planning and a proactive mindset, insurers can confidently lead the way in a rapidly transforming industry.

The integration of InsurTech solutions has sparked remarkable transformations for insurers worldwide. By adopting innovative technologies, companies have streamlined operations and achieved measurable outcomes such as higher customer retention, reduced costs, and faster service delivery. These case studies illustrate the potential of InsurTech to redefine the insurance landscape.

A mid-sized auto insurance company faced slow claims processing times, often leading to customer dissatisfaction and increased administrative costs. To address these issues, the company implemented AI-powered claims automation.

By leveraging machine learning algorithms, the system could accurately assess damage reports and process small to mid-level claims in minutes rather than days.

This transformation yielded significant results:

Best practice: A key to success was conducting staff training to ensure employees could effectively manage the AI system. The insurer avoided errors by integrating manual oversight with AI tools and ensured a seamless transition.

A health insurance provider sought to boost customer retention by offering personalized services. With the guidance of consulting experts, the company implemented a data analytics platform connected to wearable health technology. The platform collected real-time data on policyholders’ activity levels, allowing the insurer to reward healthy behavior with premium discounts.

Within the first year of adoption, the insurer experienced the following:

Best practice: The insurer involved customers early in the technology rollout, educating them on device usage and the benefits of participation while addressing data privacy concerns. This proactive communication built trust and drove adoption.

A global property insurance firm faced challenges in assessing underwriting risks for large industrial clients. The company collected real-time data on equipment conditions and safety protocols in insured properties by leveraging IoT-enabled sensors. This data enabled predictive risk evaluation, leading to more accurate underwriting decisions.

Key results included:

Best practice: The company collaborated with technical experts to seamlessly integrate IoT devices into client operations. Regular communication and troubleshooting support established strong buy-in from industrial clients.

While these examples highlight success, InsurTech integration often comes with challenges. Common hurdles include resistance to change, data migration complexities, and ensuring employee proficiency with new systems. Best practices for overcoming these challenges include:

These case studies demonstrate that insurers can achieve significant operational improvements through the thoughtful application of InsurTech solutions. Whether through faster claims, personalized policies, or precise underwriting, technology is indispensable to driving innovation and delivering better customer outcomes. By following best practices and addressing challenges proactively, insurers can harness technology to remain competitive and sustainable in an evolving market.

The insurance industry is at a critical crossroads where technological advancements reshape the competitive landscape and redefine customer expectations. Adopting InsurTech solutions is no longer a luxury but a necessity for insurers aiming to remain relevant, efficient, and customer-centric. By leveraging innovations such as AI, IoT, and advanced data analytics, companies can enhance operational efficiency, deliver personalized experiences, and build stronger relationships with policyholders.

Partnering with consulting experts is key to navigating this transformation effectively. Their insights and tailored strategies enable insurers to meet regulatory demands, optimize systems, and align technological upgrades with long-term business goals. With the right guidance, insurers can mitigate risks, overcome implementation challenges, and unlock the full potential of InsurTech solutions.

Now is the time to act. The pace of industry evolution waits for no one, and early adopters stand to gain the advantages of agility, innovation, and increased market share. By prioritizing digital transformation today, insurers can future-proof their businesses, meet the demands of tomorrow’s policyholders, and remain steadfast in a rapidly changing world. The opportunity to lead the charge in an innovative, customer-focused insurance landscape has never been more attainable. Will your organization take the first step?