Modernizing Insurance Frontends with Java-Based Frameworks like Vaadin

- June 07

- 13 min

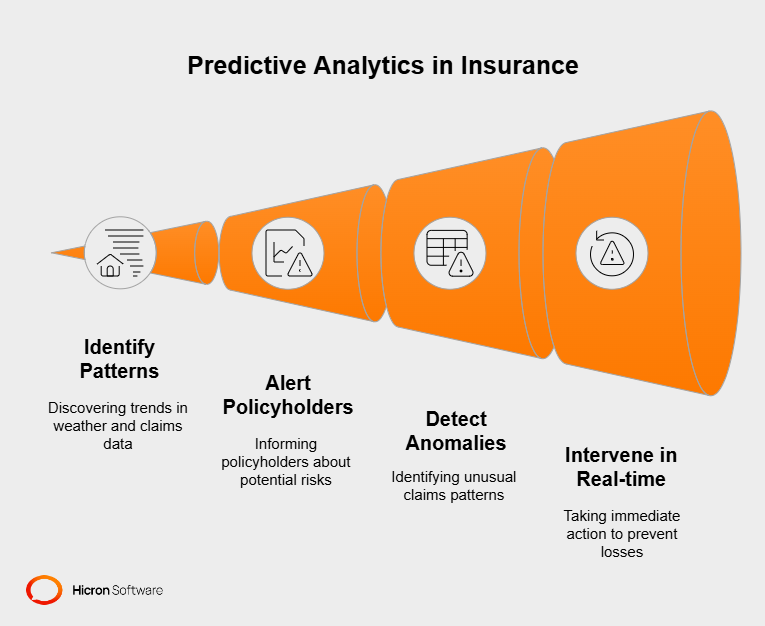

Predictive analytics is reshaping the way the insurance industry approaches risk management. By harnessing the power of advanced data analysis, insurers can not only anticipate potential risks but also refine decision-making processes, driving smarter strategies.

Traditional methods, which rely on historical data and broad assumptions, often fail to address the dynamic challenges faced by today’s insurance technology landscape. Enter predictive analytics—a game-changer that merges cutting-edge technology with the expertise of the insurtech industry to deliver precision and agility.

This digital transformation for insurance doesn’t just enhance accuracy; it opens up possibilities for customization, automation, and efficiency at levels previously thought unreachable.

From revolutionizing insurance claims processes to building resilient strategies for life and commercial insurance, predictive analytics equips insurers with the tools to thrive in a rapidly evolving landscape. It’s not just an upgrade; it’s a complete rethink of how risks are understood and managed in modern insurance.

Predictive analytics is transforming the insurance landscape, equipping insurers with the tools to assess and manage potential risks with greater accuracy and precision.

By combining data science, advanced algorithms, and industry expertise, this technology enables insurance companies to make more informed decisions, reduce uncertainty, and improve outcomes for both the business and the policyholder. Below, we explore the many ways predictive analytics is revolutionizing insurance, from risk anticipation to claims management.

One of the most significant benefits of predictive analytics in insurance is its ability to identify risks well in advance of their manifestation. By analyzing historical data, trends, and current variables, insurance tech leverages advanced modeling to alert insurers to possible threats.

For example, a life insurance tech company might analyze health data trends to predict epidemics or regional health risks, allowing them to adapt their policies or prepare resources in advance.

With predictive analytics, insurers cannot only react to disasters or loss events but also anticipate and prevent them. Instead, they act proactively, identifying weak signals and patterns that might otherwise go unnoticed.

This anticipatory approach has become a game-changer across the insurtech industry, particularly in areas like disaster claims management, healthcare insurance automation, and real estate risk assessment.

Predictive models use machine learning, artificial intelligence (AI), and Big Data techniques to unearth emerging threats. These tools analyze massive amounts of data—from weather patterns to social behaviors—to pinpoint risks in insurance that traditional methods might miss.

For instance, medical insurance software solutions can identify disease prevalence based on patient data, while telematics insurance technology can detect trends in unsafe driving behaviors.

These insights empower insurance software developers to create AI-driven systems that adapt and evolve in real time. With predictive analytics, an insurtech business gains a more nuanced view of factors influencing claims, policies, and pricing decisions.

Traditional risk management in the insurance sector often involves a degree of educated guessing. Predictive analytics significantly reduces this uncertainty, providing insurers with clear, data-driven insights. By analyzing patterns and probabilities, insurers can confidently decide where to allocate resources or adjust coverage.

Digital transformation for insurance not only streamlines processes but also delivers predictive capabilities through AI-driven systems. This helps insurers handle everything from catastrophe modeling to fraud detection with more certainty and efficiency.

Underwriting has historically relied on experience and basic statistical models, but predictive analytics pushes this process into a new realm of sophistication. Insurance software development companies now create tools that allow underwriters to assess an individual’s risk profile with unprecedented accuracy.

By combining external data (such as environmental factors) with internal company records, underwriters can create tailored insurance products that better meet customer needs. Predictive analytics ensures that policies are not only profitable for insurers but also fair for policyholders.

Accurate risk assessment forms the backbone of the insurtech industry. With predictive analytics, insurers can analyze complex sets of variables to draw detailed conclusions about potential risks and exposures. For example, usage-based insurance applications in automotive insurance can evaluate risk factors such as mileage, driver habits, and road conditions.

Scalable insurance IT systems also integrate predictive tools that allow insurers to refine models continuously. This ensures that risk assessments remain accurate even as conditions evolve.

Pricing has always been a delicate balance in the insurance industry. Too high, and customers flee; too low, and it may hurt profitability. Predictive analytics provides a clearer understanding of individual risk profiles, leading to more precise and equitable pricing.

For example, property insurance software can analyze geographic risk factors, such as flood zones or wildfire risk.

Similarly, predictive analytics for insurers enable life insurance companies to evaluate customer health data, aligning premiums more closely with actual risk. By setting fair pricing, insurers can build stronger relationships with their clients while maintaining financial stability.

Claims processing can be time-consuming and costly, but predictive analytics is set to change that. Advanced claims automation software equips insurers with tools to process claims more efficiently, reduce bottlenecks, and enhance accuracy.

Digital claims management integrates predictive models to identify claims at risk of delay or dispute. For instance, customized insurance technology can recommend faster solutions for high-priority claims or automate lower-risk claims entirely.

Fraudulent claims cost the insurance industry billions each year, but predictive analytics is turning the tables on fraudsters. AI in insurance software analyzes anomalies in claims data to identify potential fraud in real-time.

For example, fraud detection software for insurance can identify patterns, such as repeated claims from the same individual or discrepancies in reported timelines.

These insights enable insurers to act swiftly, reducing payouts on fraudulent claims and deterring future scams.

Predictive analytics also enables insurers to optimize resource allocation in claims management. By utilizing historical data, insurers can accurately predict which claims are likely to require extensive investigation, mediation, or legal assistance.

For example, a house of insurtech innovators is developing tools that prioritize high-value claims for personal attention while automating straightforward cases.

This approach not only streamlines operations but also improves customer satisfaction by ensuring prompt resolution.

Predictive analytics is revolutionizing the insurance industry, empowering companies to anticipate risks, streamline processes, and deliver exceptional services. This transformation wouldn’t be possible without a set of advanced technologies driving these intelligent forecasting tools.

From artificial intelligence to IoT devices, here’s a detailed look at the core technologies enabling predictive analytics and how they’re reshaping insurance practices.

At the heart of predictive analytics are artificial intelligence (AI) and machine learning (ML), technologies that can analyze vast datasets, learn from patterns, and improve over time. AI and ML are crucial for making insurance smarter and more proactive.

One standout feature of machine learning is its ability to learn continuously. Over time, ML models evolve, becoming increasingly accurate at identifying potential risks. Continuous learning ensures that insurers stay up-to-date with changing market dynamics and emerging threats.

For instance, an AI-powered system might notice a rise in vehicle break-ins in a specific zip code, allowing insurers to adjust premiums or offer targeted coverage options proactively.

Big data takes predictive analytics to the next level by delivering insights from vast quantities of information, both structured and unstructured. Streams of data from social media, weather patterns, economic indicators, and claim histories all feed into big data systems.

The ability to process and analyze large datasets enables insurers to understand risks with precision, offering more personalized policies and enhanced fraud detection.

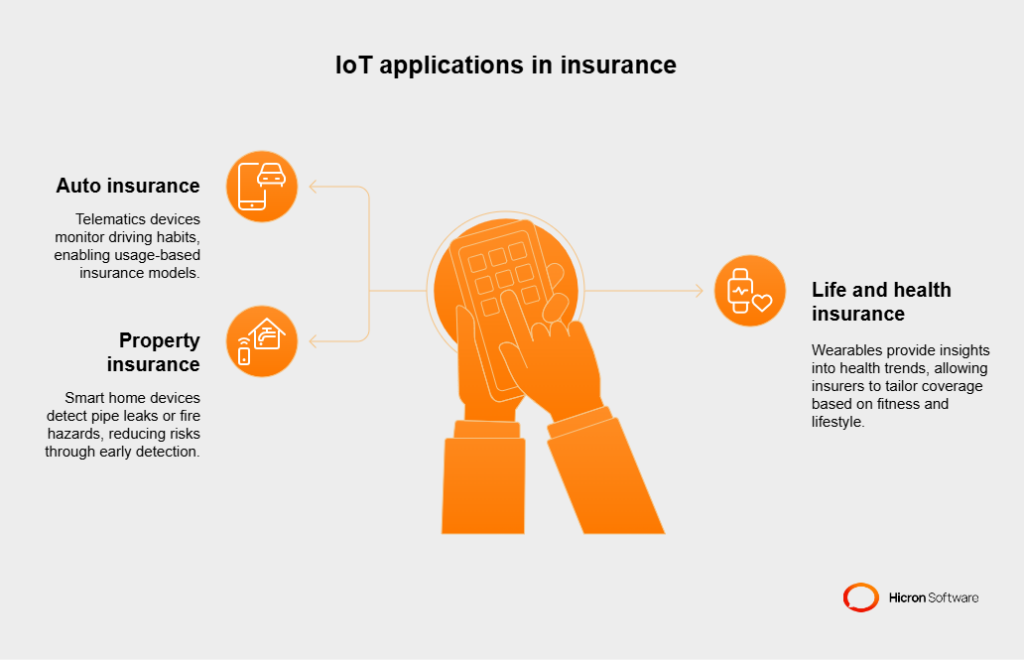

The Internet of Things (IoT) is one of the most exciting contributors to modern predictive analytics. Devices such as telematics sensors in cars, wearable health trackers, and smart home systems generate real-time data that insurers can use to dynamically assess risks.

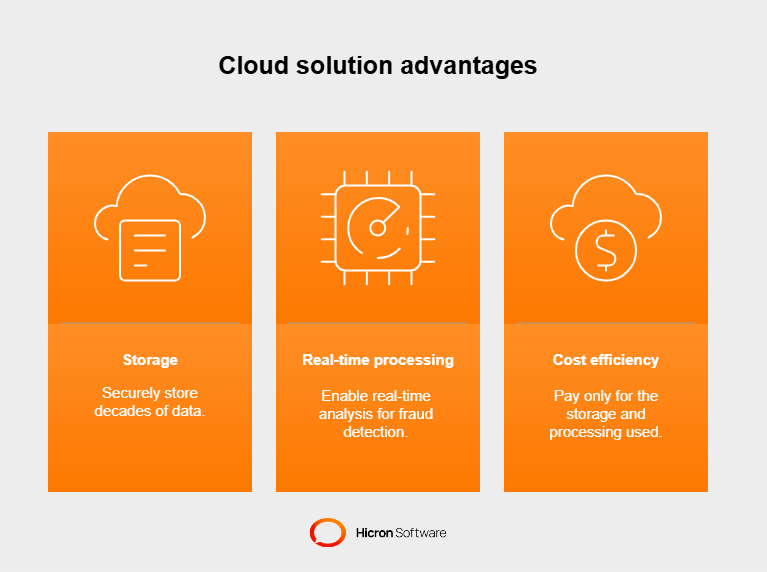

Insurance data is colossal and continuously growing. Cloud technology has emerged as the backbone of predictive analytics, providing the scalability and flexibility necessary to handle large datasets.

#1 Storage capabilities: Insurers can store decades of data securely without investing in expensive infrastructure.

#2 Real-time processing: Cloud-based systems enable real-time analysis, crucial for detecting fraud or responding to policyholder needs instantly.

#3 Cost efficiency: With scalable solutions, insurers only pay for the storage and processing power they use.

Enhancing accessibility and collaboration across teams

The convergence of technologies, including AI, big data, IoT, and cloud computing, is driving a smarter and more agile insurance industry. Together, they empower insurers to identify risks before they arise, predict customer behaviors, and make data-driven decisions that benefit both policyholders and companies.

Predictive analytics is transforming the insurance industry’s approach to risk, integrating innovative technologies to forecast potential issues, minimize losses, and deliver personalized customer solutions. Insurers now have the power to act preemptively rather than reactively by leveraging vast data sets and real-time insights.

Below is a comprehensive look at how predictive analytics is applied effectively in risk mitigation, supported by real-life scenarios and compelling examples.

Natural disasters, including hurricanes, floods, and wildfires, pose significant challenges for insurers. Predictive analytics enables companies to model potential catastrophes, providing accurate forecasts of both physical and financial impacts.

For example, models using historical weather data and current meteorological patterns can simulate hurricane seasons, detailing expected storm paths and potential damage zones. Insurers can use these insights to price policies more accurately and allocate resources where they’re needed most.

During Hurricane Harvey in 2017, some insurers used predictive models to forecast flooding patterns in Texas. This enabled them to warn policyholders in high-risk areas proactively, streamline claims processes, and reduce logistical delays in deploying resources. By preparing in advance, insurers saved millions in operational costs while providing quicker relief to affected customers.

Predictive analytics doesn’t just estimate potential financial losses; it also evaluates regional and demographic impacts. This is particularly useful for property insurance and disaster planning.

Practical applications:

An insurance company in California utilized AI-driven predictive analytics to assess wildfire risks. By mapping wind patterns and vegetation density, they identified communities at high risk and provided them with preventative measures, such as fire-resistant roofing or vegetation clearing guidelines. These efforts significantly reduced claims post-disaster and improved customer trust.

The power of predictive analytics lies in its ability to anticipate and minimize high-cost risks.

Here are two compelling examples:

Understanding customer actions and needs is crucial for dynamic risk mitigation. Predictive analytics provides insurers with valuable insights into patterns such as renewal rates, cancellations, and premium adjustments.

Predicting policy lapses and retention risks

Data analytics models compile data on policyholder history, life events, and interactions. This enables insurers to:

Tailoring personalized policy solutions to reduce attrition

Predictive insights help insurers design customized solutions for policyholder retention. Instead of blanket offers, insurers can focus on high-value customers with specific needs, boosting satisfaction and loyalty.

Consider a health insurance company that noticed younger policyholders were not renewing policies after two years.

Analysis revealed these policyholders were attracted to competitors offering wellness benefits. The company responded by launching a wellness-focused plan that included gym memberships and fitness tracking incentives, which resulted in a 30% improvement in retention.

Competing in the insurtech industry means staying ahead of shifting market dynamics. Predictive models analyze vast amounts of market data, enabling insurers to adapt to new opportunities and respond to emerging challenges.

#1 Identify upcoming trends, such as the growing demand for telematics in auto insurance or personalized health insurance plans.

#2 Predict shifts in customer expectations, such as preferences for more sustainable or digital-first insurance solutions.

#3 Analyze pricing strategies to maintain competitive positioning.

#4 Spot gaps in competitors’ offerings, such as underserved demographics or regions ripe for expansion.

An insurer analyzed its competitors’ data and discovered that minimal telematics-based coverage was offered in semi-rural areas. They launched affordable, usage-based policies targeting drivers in these areas, gaining a significant market share within the first year.

Predictive analytics continues to evolve, offering insurers the ability not only to reduce risks but also to deliver greater value to their customers. By merging AI, big data, and IoT technologies, insurers can manage risks with unparalleled precision and forethought.

From safeguarding against natural disasters to enhancing customer experiences, predictive analytics is driving the modernization of the insurance landscape. This transformation is more than a trend; it’s the foundation of smarter, scalable, and more customer-centric risk management practices.

The insurance industry is undergoing a transformation, driven by advancements in predictive analytics. This cutting-edge technology enables insurers to make informed decisions, mitigate risks, and foster stronger relationships with policyholders. By harnessing vast data sets and advanced algorithms, insurance companies can prevent losses, optimize operations, and create a more customer-centric approach to risk management.

Here’s a closer look at the key benefits of predictive analytics and how they’re shaping the future of insurance.

One of the most crucial advantages of predictive analytics is its ability to minimize financial losses by identifying risks early. By studying historical claim patterns, market fluctuations, and real-time data, predictive tools can identify emerging threats before they escalate into costly problems.

For instance, an insurer specializing in property coverage may utilize these tools to anticipate flood risks in specific regions following a season of heavy rainfall. By alerting policyholders in advance, they avoid costly claims and help protect the insured property.

A real-world example includes the use of predictive analytics by insurers during Hurricane Harvey. They leveraged models to forecast areas most likely to experience severe flooding, enabling the targeted deployment of resources and streamlining emergency claims processes. This kind of proactive approach elevates the role of insurers from responders to preventers, saving both money and reputations.

Fast and informed responses are vital during high-risk situations, and predictive analytics equips insurers with tools to deliver real-time alerts.

For example, telematics devices in vehicles can monitor driving behavior and flag risky actions such as sudden braking or speeding.

This data enables insurers to provide immediate feedback to drivers, thereby reducing the occurrence of accidents and, consequently, claims. Additionally, insurers who integrate weather and geological data into their systems can issue warnings to policyholders in earthquake-prone areas based on fault line activity.

These real-time capabilities are not just about minimizing losses; they also demonstrate the insurer’s commitment to protecting its policyholders, enhancing trust, and improving customer satisfaction.

Predictive analytics directly contributes to robust cost savings by refining decision-making processes. Fraud detection is a prime example of its impact. With machine learning algorithms, insurers can analyze vast amounts of claim data to identify anomalies that suggest fraudulent activity. This prevents significant financial losses associated with fraudulent claims, allowing insurers to protect their bottom line.

For instance, a health insurance company once reduced fraudulent payouts by 15% in a single year after implementing predictive models to flag suspicious claims.

Beyond fraud detection, data-driven decisions also optimize claims payments, ensuring fair yet accurate estimations that maintain customer satisfaction without overextending resources.

Resource management is often a complex challenge for insurers, especially when dealing with disaster scenarios or high volumes of claims. Predictive analytics simplifies this process by analyzing trends in workloads and operational demands. Such insights help insurers deploy the right resources where they’re needed most, whether that’s prioritizing high-value claims or preparing for potential catastrophic events.

Take the example of emergency aid allocation during natural disasters. With predictive models, insurers can preemptively position emergency units and relief resources in regions most likely to suffer damage, reducing delays in post-disaster assistance.

Not every policy or policyholder presents the same level of risk, and predictive analytics allows insurers to allocate resources accordingly.

For instance, in auto insurance, insurers can use telematics to identify drivers with high-risk behaviors.

By focusing safety interventions and incentive programs on this group, insurers not only improve individual safety but also reduce overall claims from this demographic.

Similarly, in health insurance, lifestyle and wellness data help identify individuals who are more likely to incur high medical costs. Insurers can then provide these policyholders with customized wellness programs, helping improve their health outcomes while reducing claims.

The integration of predictive analytics transforms traditionally siloed insurance processes into cohesive, seamless operations. Automated tools powered by predictive insights can automate repetitive tasks, such as claims verification.

This significantly reduces processing times while improving accuracy. For underwriting, predictive models provide instant assessments of risk based on historical data, cutting what would normally be weeks-long processes into mere days.

This approach not only benefits insurers in terms of cost savings but also enhances the customer experience through faster responses and fewer bottlenecks.

Modern customers expect a tailored experience, and predictive analytics empowers insurers to exceed these expectations. By analyzing policyholder data, insurers can predict customer needs and make proactive recommendations.

For instance, a travel insurance provider might analyze trends in political or environmental instability to offer dynamic coverage options suited to specific destinations.

Health insurance providers can also utilize predictive models to recommend wellness incentives or personalized fitness programs, transforming a traditionally reactive industry into one that actively enhances the quality of life for its customers.

Gone are the days of one-size-fits-all solutions in insurance. Predictive analytics enables the creation of personalized risk management plans tailored to each policyholder.

For example, a regional insurer identified a pattern among its high-risk wildfire policyholders and created a tailored plan encouraging preventive measures, such as fireproofing homes or removing flammable vegetation.

Policyholders who complied with these measures were rewarded with reduced premiums, creating a win-win situation.

Through these personalized measures, policyholders feel valued and immune from the common frustrations of generic policy terms, while insurers benefit from reduced claims and enhanced loyalty.

Transparency is crucial in the insurance industry, and predictive analytics enable insurers to achieve unparalleled accuracy and clarity. By basing premium calculations, risk assessments, and coverage adjustments on detailed data, insurers can communicate openly with customers about the rationale behind their decisions. This fosters trust and confidence, especially among younger, data-savvy generations.

For instance, when an insurer explains an individual’s premium adjustment by demonstrating clear data trends and logical predictions, the customer feels informed and treated fairly, which reduces potential disputes and promotes long-term loyalty.

The insurance industry is constantly evolving, driven by the need for accurate risk predictions and efficient operational strategies. Predictive analytics stands at the forefront of this transformation, enabling data-driven decision-making and enhanced risk management. However, successfully implementing predictive analytics in insurance requires careful planning and execution. Below are the essential steps insurers can follow to harness the full potential of predictive analytics.

A robust data infrastructure is the foundation of any predictive analytics initiative. Insurers must ensure they have the tools and systems needed to collect, store, and manage large volumes of data effectively. This infrastructure should be scalable, secure, and capable of handling a variety of data types, from structured customer records to unstructured social media data.

Key considerations include:

A dependable data infrastructure ensures that the shiny tools and algorithms don’t falter due to instability or data gaps.

Predictive analytics thrives when all relevant data resides in a centralized system, eliminating silos that can hinder performance. Centralized data ensures smoother processing, better insights, and minimal inconsistencies.

For example, combining sales data, claims histories, and policyholder demographics enables insurers to develop more comprehensive models. Modern data lakes and warehousing solutions are valuable tools for unifying disparate datasets.

One insurer significantly reduced claim processing times by integrating customer interaction data with underwriting systems, allowing predictive models to deliver instant risk profiles.

Even the most advanced analytics solutions cannot produce accurate results if poor-quality data is fed into the system. Data accuracy, completeness, and consistency are paramount for reliable predictions. Regular audits and clean-up processes are crucial for maintaining data quality.

Steps to ensure data quality include:

For instance, one insurer discovered that errors in customer address data resulted in miscalculations of flood risk. Implementing data cleaning protocols resolved this issue and improved the reliability of predictions.

Collaborating with industry leaders in predictive analytics ensures access to proven methodologies and advanced tools. External experts bring domain knowledge and technical expertise that may not exist in-house, helping insurers avoid common pitfalls.

Partnerships with analytics firms can lead to quicker implementation of models tailored for insurance-specific scenarios, such as catastrophe modeling or fraud detection. These alliances also ease the learning curve for internal teams.

Aside from partnering with organizations, insurers should actively engage with specialists who design and implement predictive models. These professionals understand how to tailor algorithms to meet an insurer’s unique needs, ensuring models align with the business context.

A collaborative approach ensures:

By maintaining ongoing cooperation with analytics consultants, insurers can refine their predictions and quickly adapt to shifting market dynamics.

Every insurer faces unique sets of risks, driven by factors such as geography, customer demographics, and the type of coverage offered. Predictive models must be customized to address these unique scenarios.

For example, an insurer offering health coverage can tailor models to use wellness data for predicting claims. In contrast, a property insurer may focus on incorporating regional weather patterns to estimate risks. Customization ensures optimal results and makes predictions more actionable.

Predictive analytics tools are only as valuable as the people using them. Frontline teams, such as underwriters, claims processors, and sales representatives, must be adequately trained to interpret and apply the insights generated by these models.

Effective training programs should include:

For example, an underwriting team trained to understand predictive insights could assess risks more quickly and precisely, reducing policy issuance times.

Modern analytics platforms are constantly evolving, requiring employees to be proficient in their use. Upskilling ensures staff remain agile and capable of leveraging new features and updates as they emerge.

Organizations can invest in certification programs and hands-on training on advanced platforms, such as predictive modeling tools and AI software, to enhance their capabilities. Not only does this improve efficiency, but it also empowers employees to identify innovative applications for predictive insights.

Beyond technical upskilling, insurers must carefully manage the cultural shift that accompanies the adoption of predictive analytics. This includes addressing resistance to change, emphasizing the benefits of new processes, and ensuring employees feel supported during the transition.

Change management strategies might include:

Without deliberate efforts to encourage adoption, even the most powerful tools can end up underutilized. Proactive change management builds confidence and excitement among employees, ensuring analytics becomes an integral part of the organization’s DNA.

By following these steps, insurers can successfully implement predictive analytics and unlock their full potential. Whether it’s reducing risks with real-time alerts, improving operational efficiencies, or creating personalized customer experiences, predictive analytics offers the tools insurers need to thrive in an increasingly competitive market.

A structured and thoughtful approach not only ensures smooth adoption but also positions insurers to lead the digital transformation in the insurance industry.

|

Step |

Details |

Key Takeaways |

|

Building a Strong Data Infrastructure |

Establish scalable, secure systems to manage structured and unstructured data. Migrate to cloud platforms and ensure compliance with regulations like GDPR or HIPAA. |

A robust infrastructure is essential for stable and accurate analytics processes. |

|

Centralizing Data |

Use data lakes or warehousing solutions to integrate sales, claims, and demographics data, eliminating silos for better insights. |

Centralized data enables smoother analytics and comprehensive modeling. |

|

Ensuring Data Quality |

Perform validation checks, address duplicates, and standardize formats to maintain accuracy and consistency. |

High-quality data ensures reliable predictions and avoids costly errors. |

|

Partnering with Analytics Experts |

Collaborate with industry leaders to access advanced tools and methods. Tailored solutions optimize implementations for specific insurance use cases. |

External expertise accelerates deployment and improves analytical precision. |

|

Collaborating with Specialists |

Engage specialists to design predictive models that align with business needs, such as reducing churn or fraud detection. |

Collaboration ensures models are effective, transparent, and actionable. |

|

Customizing Models |

Adapt predictive models to account for factors like geography, customer demographics, and coverage types for unique risk profiles. |

Customization enhances relevance and usability of predictions. |

|

Training Teams |

Conduct workshops on dashboards, case studies, and predictive insights application for underwriters, claims processors, and sales teams. |

Training empowers teams to apply predictive insights effectively. |

|

Upskilling Employees |

Offer certification programs and hands-on training for advanced platforms like AI tools to enhance employee expertise. |

Upskilling promotes agility and innovation in analytics applications. |

|

Driving Adoption Through Change Management |

Engage employees early, emphasize benefits, and share success stories to overcome resistance and support process transitions. |

Effective change management fosters a data-driven culture and smooth adoption of analytics. |

Predictive analytics is more than just a buzzword in the insurance industry; it’s a pivotal tool transforming risk assessment, fraud detection, and customer service. Insurers are leveraging the vast potential of data to anticipate risks, minimize losses, and optimize operations. This blog explores real-world case studies that demonstrate the tangible impact of predictive analytics, highlighting how it mitigates catastrophic losses, reduces financial risks, and fosters trust among policyholders.

A leading property insurance company faced mounting financial risks due to recurrent hurricanes in coastal regions. By integrating predictive analytics into their risk assessment strategy, they began using weather data, historical claims, and geographic hazard information to model the potential impact of each hurricane season.

When Hurricane Florence threatened the U.S. East Coast, their predictive model projected a significant concentration of high-risk policyholders in flood-prone areas. Using this insight, the company proactively informed affected customers, shared mitigation tips, and collaborated with local suppliers to provide protective materials, such as sandbags.

The outcome: This proactive approach led to a 15% decrease in overall claims compared to previous hurricanes. Policyholder satisfaction surged due to the company’s foresight and assistance, building long-term customer loyalty.

A regional insurer specializing in rural properties implemented predictive technology to combat wildfire risks. They combined geospatial data, weather patterns, and vegetation coverage to predict high-risk fire zones months in advance.

Before the infamous California wildfires of 2020, the insurer identified properties surrounded by poorly maintained vegetation. Predictive analytics flagged these clients as high-risk, prompting the company to issue alerts along with actionable steps, such as creating defensible space and clearing brush.

The outcome: While surrounding insurers faced record-breaking claims, this company reduced its wildfire-related losses by over 20%. Additionally, retention rates improved as policyholders appreciated the insurer’s proactive measures.

A global health insurer struggled with an increasing volume of fraudulent claims, which were eroding profitability. Predictive analytics presented a solution. By analyzing historical claims data using machine learning algorithms, they identified patterns indicative of fraud, such as high claim frequencies or unusual treatment codes.

The outcome: Within the first year of implementation, the insurer flagged $10 million worth of claims as potentially fraudulent. After manual audits confirmed 85% accuracy in the algorithm’s predictions, the insurer saved $8.5 million in unnecessary payouts.

An auto insurance firm adopted predictive analytics driven by vehicle telematics to reduce claims leakage and address fraudulent claims. Data from sensors in insured vehicles captured information like speed, location, and impact forces during accidents.

During investigations, this data revealed inconsistencies in multiple fraudulent claims, including exaggeration of damage or staged collisions. Predictive models automate red-flagging of dubious claims, cutting review times in half.

The outcome:

A life insurance company was experiencing rising policy lapse rates, resulting in significant revenue loss. Predictive analytics was deployed to identify policyholders most likely to drop coverage. The solution analyzed demographic data, payment histories, and customer engagement levels.

It flagged customers at “high lapse risk,” enabling the company to reach out with tailored incentives, such as premium reductions or flexible payment plans.

The outcome:

A travel insurance provider sought to handle claims more effectively following delays and dissatisfaction during peak seasons. They implemented predictive analytics to categorize claims based on complexity, routing simple cases to automated systems while assigning complex cases to experienced adjusters.

At the same time, predictive models analyzed claim timelines to estimate resolution times, ensuring policyholders received transparent updates.

The outcome:

Predictive analytics has proven itself to be a vital tool in the insurance industry, delivering measurable benefits in risk mitigation, fraud detection, and customer retention.

From preventing catastrophic losses to building trust through transparency, these case studies demonstrate how insurers utilize predictive insights to remain competitive in a rapidly evolving market.

By implementing data-driven strategies, insurers can not only optimize profits but also create stronger and more meaningful relationships with their customers. For those still considering adoption, the results are clear—predictive analytics is not just an advantage; it’s a necessity in modern insurance.

Predictive analytics is not just reshaping the insurance industry today; it is paving the way for an even more dynamic and innovative future. With advancements in AI and emerging technologies, insurers are poised to unlock unprecedented accuracy and efficiency in risk management. Real-time analytics, powered by AI-driven tools, promise to revolutionize decision-making, making it faster and more precise than ever before.

Beyond improvements in operational efficiency, these technologies will enable insurers to remain agile in an unpredictable risk landscape, adapting to evolving customer needs and industry challenges with ease. The integration of predictive insights with instant decision-making platforms will also allow companies to move from reactive approaches to proactive, customer-focused strategies.

For insurers, the path forward is clear. By fully embracing the potential of predictive analytics, they will not only transform their businesses but also the experiences of their policyholders. This is an exciting time for the industry, where technology and insight converge to build a safer, more resilient future. Now is the time to explore, innovate, and lead with a data-driven vision. Get in touch!