InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 7 min

Core IT modernization in insurance refers to upgrading outdated legacy systems to modern, integrated technologies. This transformation enhances operational efficiency, improves customer experiences, and ensures insurers stay competitive in a digital-first marketplace.

Core IT modernization in insurance goes beyond technology; it transforms how insurers operate and engage with their customers. Modernization is the key to securing a thriving future in the dynamic insurance industry.

Key takeaways:

Modernizing core IT is vital for insurers to stay competitive. Upgrading legacy systems drives efficiency, enhances customer satisfaction, and enables quick adaptation in a digital world.

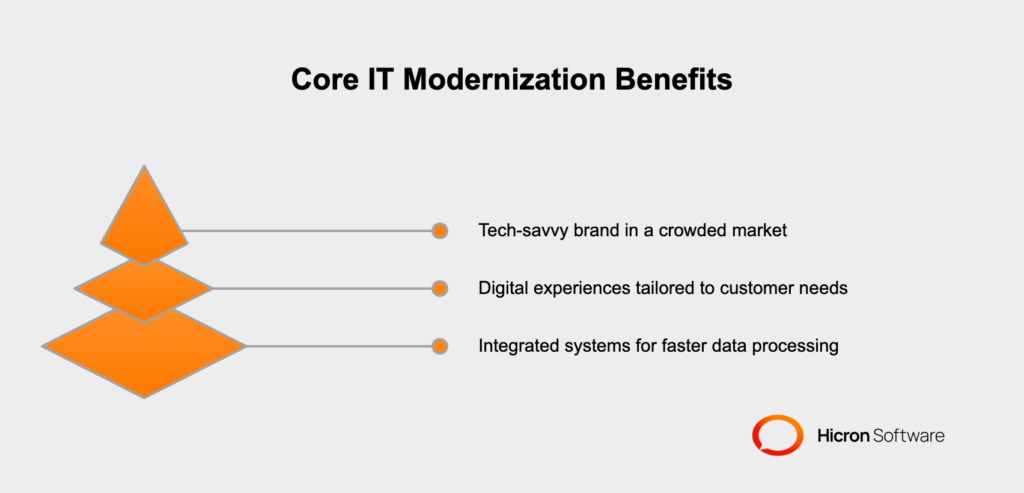

Legacy systems, often siloed and outdated, create inefficiencies that slow down workflows and decision-making. By investing in core IT modernization, insurers can replace cumbersome processes with integrated, automated solutions. Modern platforms enable faster data processing, reduce redundancies, and empower teams to focus on high-value activities rather than tedious manual tasks. The result? Greater operational agility and reduced administrative costs.

Today’s customers expect digital experiences at every touchpoint, whether they’re purchasing a policy, filing a claim, or seeking support. With insurance digital transformation, insurers can build platforms tailored to customer needs. Features like self-service portals, real-time updates, and personalized recommendations foster trust and satisfaction. Ultimately, modern IT systems lay the foundation for more responsive and intuitive customer interactions.

The insurance landscape is evolving rapidly, with innovative startups challenging traditional players. Legacy system modernization equips insurers with the tools to counter these disruptors. Advanced analytics, cloud computing, and AI-driven insights derived from modern IT can drive smarter business decisions, unlocking new growth opportunities. By positioning themselves as tech-savvy and customer-centric, insurers can distinguish their brand in a crowded marketplace.

The path to modernizing insurance IT systems is fraught with challenges that can derail even the most well-intentioned initiatives. From aligning business and IT goals to integrating outdated technologies with modern innovations, insurers face complex hurdles. Below is a detailed breakdown of the challenges and solutions.

|

Challenge |

Description |

Solutions |

|

Misalignment Between IT and Business Goals |

Lack of alignment between IT initiatives and business objectives leads to wasted resources and missed opportunities. IT teams may focus on cutting-edge tools, while business leaders prioritize customer acquisition strategies, causing diluted project outcomes and stakeholder frustration. |

Continuous communication and collaborative planning to ensure technology upgrades directly support strategic business goals. |

|

Tech Stack Obsolescence |

Many insurers rely on outdated tech stacks that are not scalable or compatible with emerging technologies like cloud computing, AI, and data analytics. Legacy systems create roadblocks, including compatibility issues, data silos, and resistance to change. |

A phased approach emphasizing interoperability and investing in technologies that future-proof operations. |

|

Managing Large-Scale Programs |

IT modernization programs are complex, involving multiple teams, timelines, and deliverables. Lack of coordinated oversight can lead to delays, budget overruns, and challenges from evolving priorities or regulatory changes. |

Implement robust governance structures, flexible project plans, and tools that promote cross-functional collaboration. |

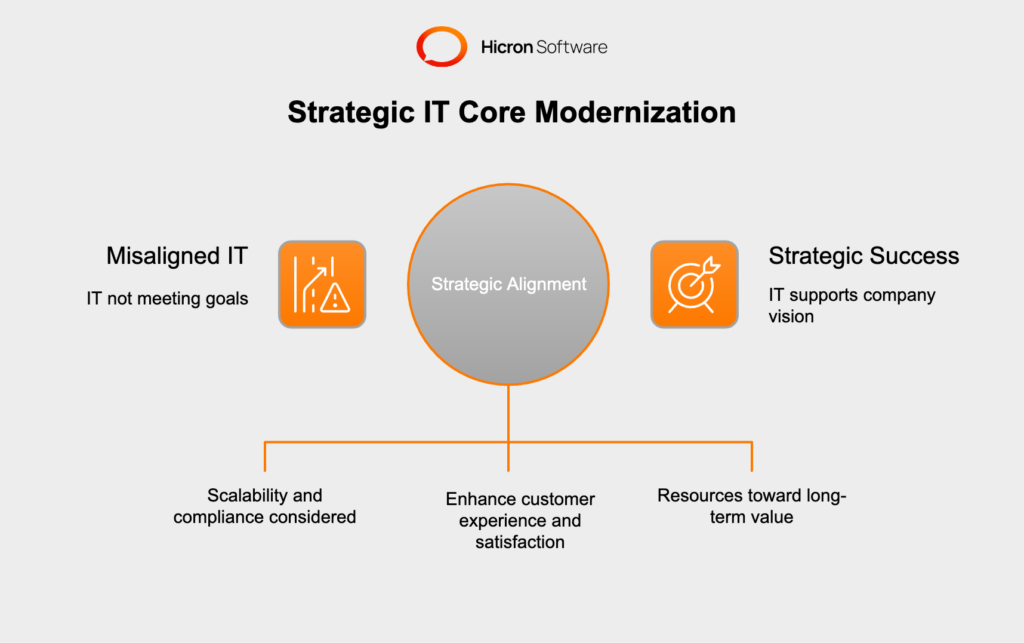

One major issue in insurance technology transformation is the lack of alignment between IT initiatives and business objectives. We witnessed this in the projects we led. Without a shared vision, IT projects can stray from addressing core insurance business needs, leading to wasted resources and missed opportunities.

For instance, IT teams might focus on implementing modern tools, while business leaders prioritize customer acquisition strategies. This misalignment can dilute project outcomes, causing frustration among stakeholders and reducing the overall impact of modernization efforts. Achieving IT and business alignment requires continuous communication and collaborative planning to ensure that technology upgrades directly support strategic business goals. The vital role of the business analyst is key here in clarifying business needs and translating them into IT plans.

Another challenge is legacy system modernization. Many insurers rely on outdated tech stacks that are neither scalable nor compatible with emerging technologies. These legacy insurance systems create roadblocks in integrating advanced solutions like cloud computing, artificial intelligence, and data analytics.

Modernizing an insurance tech stack often involves navigating complex scenarios where legacy systems must coexist with new platforms during the transition.

can all slow down progress.

To overcome these hurdles, insurers need a phased approach that emphasizes interoperability while investing in technologies that enhance their operations. Here, once again, business analysis and IT consulting help prioritize and draft a roadmap.

The scale and complexity of IT modernization programs in insurance present their own sets of challenges. Managing multiple teams, aligning timelines, and ensuring consistent deliverables across departments can overwhelm even the most experienced project managers.

Insurance IT challenges are compounded when there’s a lack of coordinated oversight, causing delays and budget overruns. Evolving priorities and unforeseen obstacles, such as regulatory changes, can further complicate program management.

Effective strategies for managing IT modernization programs include robust governance structures, flexible project plans, and leveraging tools that promote cross-functional collaboration.

By addressing these challenges head-on, insurers can pave the way for successful IT modernization initiatives. Aligning IT with business goals, adopting modern technologies, and efficiently managing complex programs will help insurers unlock the full potential of their digital transformation efforts.

IT core modernization is a critical step for insurance companies aiming to stay relevant in a fast-evolving digital landscape. Yet, not every transformation succeeds. Many core insurance modernization initiatives end in overwhelming failure, offering valuable insights into the common pitfalls of such endeavors. By examining these failures, insurers can better anticipate challenges and improve their chances of success. Below is a table of the most common failures and feasible remedies.

|

Key Challenge |

Description |

Lesson Learned |

|

Poor Planning and Ambiguous Objectives |

Insufficient planning or lack of clear objectives often leads to missed deadlines, scope creep, and cost overruns. |

Establish continuous communication and collaborative planning to align IT initiatives with strategic business goals, ensuring technology upgrades directly support core objectives. |

|

Vendor Mismanagement |

Selecting the wrong vendor or lack of oversight can result in technology mismatches, poor quality, or wasted resources. |

Choosing vendors that fit strategic needs, while establishing clear performance metrics and maintaining consistent communication, ensures alignment with organizational goals. |

|

Resistance to Change |

Employees may be reluctant to adopt new systems or processes, hampering the transformation’s effectiveness. |

Implementing strong change management by focusing on early engagement, ongoing training, and encouraging open communication ensures a smoother transition and greater adoption of new initiatives. |

|

Overlooking Compatibility Issues |

Integration challenges between insurance legacy and modern systems can slow down progress and limit project success. |

Planning for compatibility, utilizing testing environments, and phasing rollouts help address and resolve issues proactively, ensuring a successful implementation process. |

|

Unrealistic Expectations |

Expecting immediate results without allowing time for adoption or process adjustments can lead to premature project abandonment. |

Recognizing insurance core IT modernization as a long-term investment, while regularly tracking progress and adapting plans based on outcomes, ensures sustained success and continuous improvement. |

Successfully modernizing insurance core IT systems requires a thoughtful approach to overcome common obstacles. By implementing effective strategies, insurers can enhance operations, meet customer expectations, and remain competitive. Here are three key strategies to address IT modernization challenges.

Achieving IT and business alignment is critical for modernization success. Misaligned goals often result in wasted resources and underwhelming outcomes. The solution lies in creating a shared vision across departments.

By fostering collaboration and maintaining a clear vision, insurers can align modernization efforts with overarching business strategies, leading to better project outcomes.

Legacy systems often hinder progress, making it essential to invest in a modern and adaptable tech stack. Future-proof solutions enable insurers to stay competitive in an evolving digital landscape.

Modernizing the insurance tech stack with scalable, customizable technologies provides the foundation for long-term growth and adaptability in a competitive market.

Large IT modernization programs can quickly become overwhelming without effective management strategies. Breaking projects into manageable phases and adopting agile methodologies can help eliminate complexities.

By focusing on proactive and flexible management, insurers can streamline large-scale modernization efforts and increase the likelihood of success.

|

Topic |

Key Points |

Benefits |

|

Aligning IT and Business Objectives |

|

Fosters collaboration, ensures alignment with business strategies, and leads to better project outcomes. |

|

Building a Future-Proof Tech Stack |

|

Provides scalability, adaptability, and a strong foundation for long-term growth in a competitive market. |

|

Effective Program Management |

|

Simplifies complex projects, reduces risks, and ensures the timely and efficient delivery of modernization initiatives. |

Overcoming IT modernization challenges requires a strategic blend of collaboration, innovation, and structured management. Aligning IT and business objectives ensures that efforts drive impactful results. By adopting these strategies, insurers can transform their operations and thrive in a competitive digital environment.

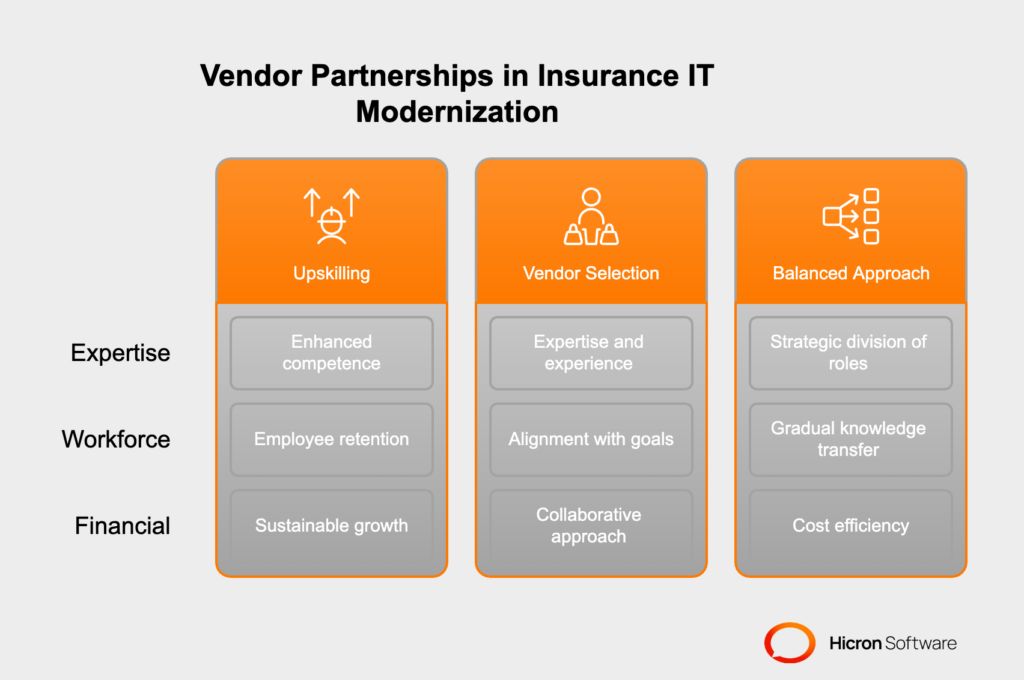

Vendor partnerships play a pivotal role in enabling successful insurance IT transformation. By combining internal expertise with external capabilities, insurers can accelerate modernization efforts while building more versatile teams. Here’s how upskilling, vendor selection, and a balanced approach can drive impactful results.

Transforming IT infrastructure often requires skill sets that may not exist within existing teams. Upskilling employees ensures your staff is equipped to manage new systems and technologies.

Building a culture of continual learning empowers insurers to internalize the benefits of IT transformation while ensuring they’re prepared for ongoing technological evolution.

The value of vendor partnerships in insurance IT cannot be overstated. The right partners bring specialized knowledge, streamlined processes, and the capacity to implement solutions efficiently.

Effective vendor partnerships function as extensions of your own teams, providing the resources needed to modernize your IT systems.

To maximize the benefits of insurance IT transformation, finding the right balance between in-house capabilities and vendor contributions is crucial.

This balanced strategy ensures agility and adaptability, enabling insurers to innovate quickly without sacrificing operational independence.

Upskilling your workforce, forming strong vendor partnerships, and achieving a balance between internal and external capabilities are key to successful insurance core IT transformation. These steps ensure a smoother modernization process and position insurers to maintain competitiveness in an evolving digital landscape.

For insurers, core IT modernization is not just a technological upgrade; it’s a strategic investment that must align with long-term business goals. Ensuring that modernization efforts are adaptable and strategically focused is critical for achieving sustainable growth and maximizing the impact of digital transformation initiatives. Here’s how insurers can align their modernization strategies with their overarching objectives:

Aligning core IT modernization in insurance with long-term objectives starts with a clear understanding of where the organization is headed. Technology upgrades should directly support the company’s vision and help achieve key milestones.

By aligning IT transformation with the company’s broader goals, insurers can ensure that every initiative contributes to sustained, strategic success.

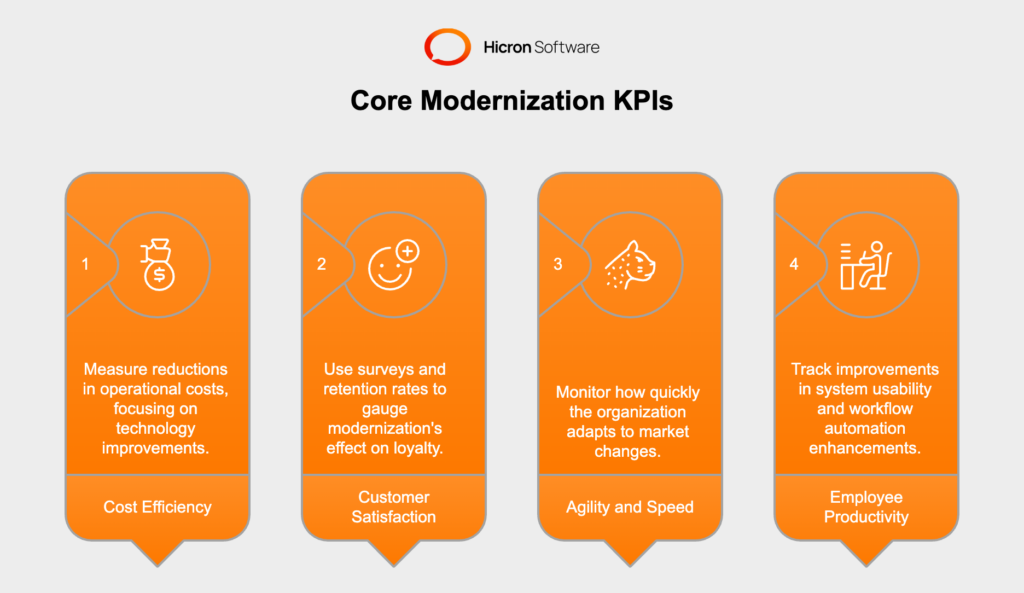

Measuring success through clear key performance indicators (KPIs) is essential for tracking the impact of insurance core modernization efforts. These metrics provide actionable insights and help align ongoing projects with long-term objectives.

Regular KPI evaluations create a feedback loop that ensures insurance modernization projects stay on track and aligned with business objectives.

Insurance IT core modernization efforts should set the stage for long-term adaptability, enabling insurers to respond to changing market conditions and emerging opportunities.

Insurers that prioritize adaptability can maintain a competitive edge as they grow and evolve in an increasingly digital world.

Aligning insurance core IT modernization efforts with long-term objectives ensures that every initiative drives sustainable growth, measurable impact, and future readiness. By focusing on strategic alignment, tracking progress with meaningful KPIs, and fostering adaptability, insurers can unlock the true potential of their digital transformation and achieve lasting success in a competitive industry.

Insurance IT transformation comes with challenges like aligning IT with business goals, updating legacy systems, and managing complex projects. Overcoming these obstacles requires a strategic approach:

Treat modernization as a long-term investment and track success using KPIs such as cost savings and customer satisfaction. With clear goals and smart strategies, insurers can turn challenges into opportunities and achieve lasting success. Start today!

Core IT modernization enhances operational efficiency, improves customer satisfaction, and ensures insurers remain competitive in a digital-first marketplace.

Common challenges include misalignment between IT and business goals, outdated tech stacks, and managing large-scale modernization programs.

By fostering collaboration between IT and business leaders, setting shared goals, and using performance metrics to track progress.

Adopting modular, scalable, and cloud-based solutions while ensuring interoperability with existing systems.

By tracking KPIs such as cost savings, customer satisfaction, operational efficiency, and employee productivity.

Vendors provide specialized expertise, streamline processes, and complement internal teams, enabling faster and more efficient modernization.

By investing in scalable solutions, staying informed about industry trends, and treating modernization as an ongoing process rather than a one-time project.