Modernizing Insurance Frontends with Java-Based Frameworks like Vaadin

- June 07

- 13 min

The insurance industry has been a pillar of financial security, but it’s no secret that many processes have struggled to keep pace with modern demands. Legacy systems, slow claims processing, and outdated customer interaction methods have often challenged insurers and frustrated policyholders. Today, the game is changing. The push for digital transformation is stronger than ever, driven by the need for faster, more seamless service and personalized customer experiences.

See what Electronic Data Interchange (EDI) and Artificial Intelligence (AI) have for you. These two technologies are reshaping insurance workflows at every level. EDI streamlines how insurers exchange data, while AI brings intelligence, accuracy, and automation to tasks once bogged down by inefficiency. Together, they form the backbone of modern InsurTech solutions, enabling insurers to move faster, work smarter, and deliver better customer value.

This intersection of EDI, AI, and insurtech isn’t just a technological upgrade; it’s the foundation for a future where insurers can outsmart industry challenges and foster stronger, more agile businesses. From improving claims accuracy to revolutionizing customer touchpoints, their combined potential is nothing short of transformative. Let’s explore how this powerful trio drives innovation and reshapes the insurance landscape.

EDI is much more than just a data exchange tool. It’s critical to modernize insurance practices, paving the way for smoother operations and better experiences for policyholders and industry professionals.

Electronic Data Interchange (EDI) is the structured exchange of data between computer systems using standardized formats. Within the insurance sector, EDI streamlines the flow of information, ensuring that critical data such as policy details, claims information, and enrollment updates can move efficiently between insurers, agents, brokers, and third parties.

Standardization is the backbone of EDI, allowing all parties to exchange information consistently and reliably. Take EDI 834, for example. This format is commonly used for health insurance enrollments and provides a uniform way to communicate enrollment details between employers and insurance providers. Other widely used EDI standards include EDI 837 for healthcare claims and EDI 846 for inventory inquiries.

An example of EDI in action is how it eliminates the need for manual entry in claims processing. Instead of an agent manually inputting client information, the system automatically sends and receives data in an error-free format, dramatically reducing processing time. Whether it’s policy underwriting, renewals, or claim reimbursements, EDI makes communication between stakeholders faster.

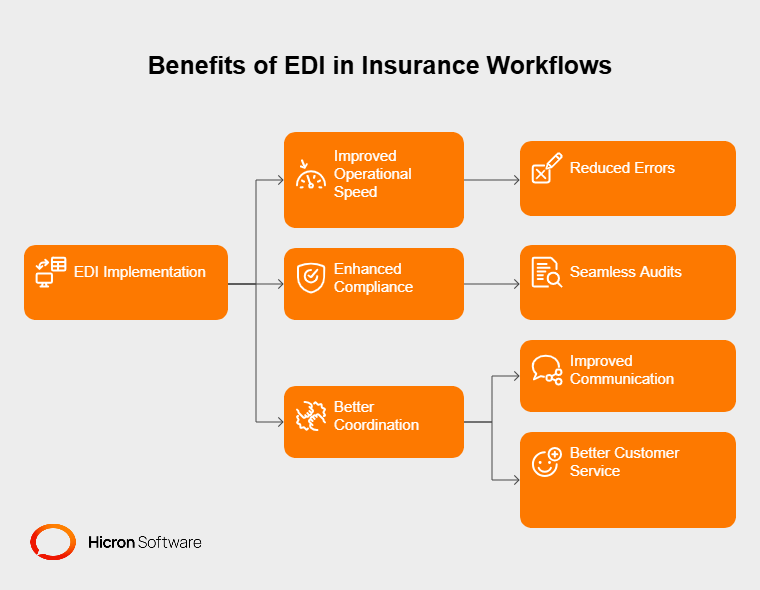

The use of EDI in the insurance industry isn’t just about convenience; it’s about transforming how operations are performed. Here’s how EDI benefits workflows:

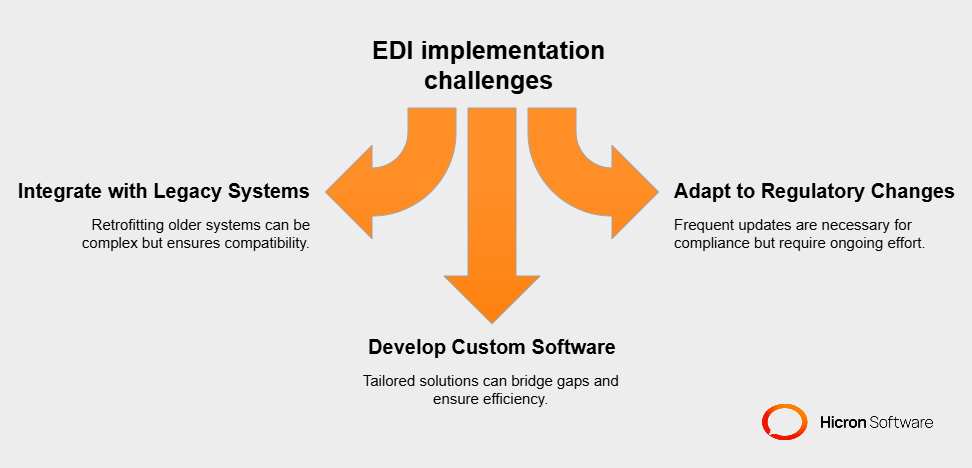

While EDI’s advantages are clear, implementation is not without hurdles. Insurers often face challenges like:

To tackle these challenges, insurers must partner with experienced software developers specializing in creating scalable, future-ready EDI systems. By doing so, they can harness EDI’s full potential while addressing operational bottlenecks and compliance demands.

AI is not just a tool but an enabler of more competent, customer-centric insurance practices. Combined with EDI and implemented responsibly, it can revolutionize the industry while addressing its challenges head-on.

Artificial Intelligence (AI) is proving to be a game-changer in the insurance industry, redefining how insurers process data and make decisions. With its ability to analyze vast amounts of complex information swiftly and accurately, AI drives efficiency and innovation like never before.

Take underwriting, for instance. Traditionally, this has been a time-consuming process requiring manual evaluation of risk factors. AI-powered algorithms can now automatically assess risks, analyze historical data, and make precise underwriting decisions in seconds. Similarly, in fraud detection, AI excels at identifying unusual patterns and anomalies within claims data, flagging potentially fraudulent activity that might go unnoticed with conventional methods.

Personalized policy recommendations are another area where AI is making waves. By analyzing customer preferences, behaviors, and life stages, AI-enabled systems can help insurers craft bespoke insurance products, ensuring each customer gets exactly what they need. These innovations not only streamline operations but also transform the customer experience.

When paired with Electronic Data Interchange (EDI), AI takes efficiency to a whole new level. Think of EDI as the structured framework for transferring data between insurance systems and AI as the intelligent engine that maximizes the value of that data.

For example, AI enhances EDI processes by detecting errors or inconsistencies in real-time, preventing inaccuracies from disrupting workflows. It can also identify trends and patterns within EDI transactions, offering actionable insights that help insurers make data-driven decisions.

Beyond error detection, AI automates routine tasks like claims validation and premium adjustments. For instance, when a claim is submitted, AI can cross-reference it with policy terms, validate its legitimacy, and even calculate reimbursement amounts automatically. With EDI’s ability to standardize and transmit this information across stakeholders, insurers can achieve unparalleled speed and accuracy in their operations.

While the benefits of AI in insurance are undeniable, it’s essential to acknowledge the limitations and challenges that come with its adoption.

One significant concern is the risk of bias in AI algorithms. Since AI learns from historical data, it can inadvertently reinforce existing biases, leading to unfair outcomes in processes like underwriting or claims approval. Addressing these biases requires continuous monitoring and fine-tuning of AI models.

Data privacy is another critical issue. Insurance workflows often handle highly sensitive personal information, and the integration of AI raises concerns about how this data is used, stored, and shared. To build trust, insurers must adopt stringent data security practices and comply with regulations to protect customer information.

To deploy AI responsibly, insurers can focus on a few key strategies:

Insurtech, short for “insurance technology,” is revolutionizing how the insurance industry operates. At its core, insurtech blends traditional insurance practices with cutting-edge technologies to create innovative products, services, and workflows. Its scope goes beyond digital transformation; it reimagines the very structure of insurance by leveraging tools like mobile apps, machine learning, blockchain, and advanced analytics.

Why is this relevant? Because the insurance landscape is evolving rapidly, traditional methods often cannot meet modern consumer demands. Insurtech solutions bring much-needed agility and user-centric design to the table. For example, microinsurance products, which allow consumers to insure specific items briefly, have emerged thanks to insurtech advancements. Similarly, telematics-based car insurance customizes premiums based on actual driving data, allowing for more personalized and fair pricing.

This wave of innovation isn’t just about convenience; it’s reshaping how insurance is perceived. Insurtech is making insurance more accessible, transparent, and flexible, bridging the long-standing gap between rigid processes and the fast-changing technological world.

To fully realize the potential of insurtech, technologies like Electronic Data Interchange (EDI) and Artificial Intelligence (AI) play a crucial role. EDI simplifies the exchange of information between insurers, agents, and customers by providing standardized data formats. Coupled with AI, it becomes even more powerful, enabling real-time error detection, intelligent data analysis, and process automation.

For instance, while EDI ensures that policy or claims information moves error-free, AI works in the background to analyze trends, improve claims accuracy, and enhance fraud detection capabilities. This dual-tech approach has become the backbone of modern insurtech tools, eliminating bottlenecks and creating smarter workflows.

The result? Claims are processed faster, customer experiences are personalized, and insurers can focus on value-driven tasks rather than administrative burdens. This synergy illustrates the transformational potential of merging traditional insurance operations with advanced insurtech solutions.

The insurtech wave is both a challenge and an opportunity for traditional insurers. Those willing to adapt and innovate stand to gain a significant competitive edge. By incorporating insurtech strategies, insurers can modernize their aging legacy systems, automate repetitive tasks, and deliver a more seamless customer experience.

Collaboration is key here. Traditional insurers must partner with technology experts, like custom software developers, who understand the insurance sector’s unique challenges. These partnerships can lead to tailored solutions that address specific needs, whether streamlining underwriting processes or creating user-friendly platforms for policyholders.

Another essential strategy involves leveraging insurtech hubs, which serve as incubators for innovation. These hubs connect insurers with startups, investors, and tech visionaries dedicated to transforming the industry. Such collaborations can pave the way for cutting-edge tools and services that keep insurers ahead in a rapidly changing marketplace.

The message is clear: traditional insurers who embrace insurtech have the chance to remain relevant and leaders in a world driven by technological innovation. By combining a forward-thinking mindset with strategic partnerships, they can harness the best of what insurtech offers and thrive in this transformation era.

The insurance industry thrives on precision, efficiency, and adaptability. While off-the-shelf software solutions might offer a quick fix, they often fail to deliver the level of customization insurers need to address their unique challenges. That’s where custom software development becomes a game-changer.

Unlike generic platforms, custom software is tailored to align with an insurer’s operational requirements and long-term goals. It provides flexibility, allowing companies to integrate features that cater directly to their business model and customer expectations. For example, a life insurance tech company might need a claims processing system to handle particular payout conditions. At the same time, a commercial insurer may prioritize tools for handling real-time risk assessment.

Customization also empowers insurers to scale their operations efficiently. Off-the-shelf solutions may struggle to adapt as your customer base or data demands grow, but bespoke platforms are designed with scalability in mind. This ensures that as your business evolves, your software does, too, providing consistent, efficient performance.

Beyond functionality, custom platforms also grant insurers the ability to maintain a competitive edge. By incorporating innovative technologies like AI for predictive analytics or EDI for seamless data exchange, insurers can set themselves apart in an increasingly digital marketplace.

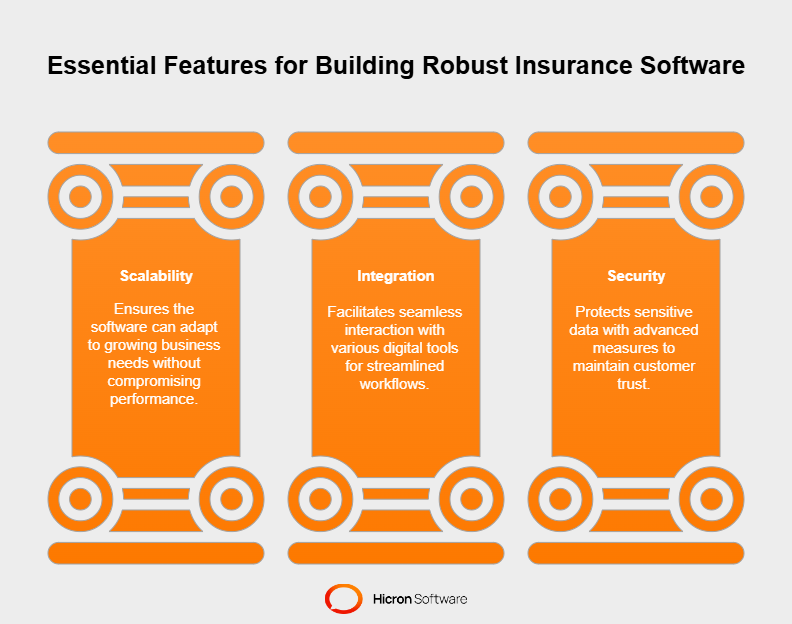

The success of any insurance platform lies in its ability to meet the complex needs of the industry while remaining future-ready. Here are some of the key features to look for in reliable insurance software:

#1 Scalability for growth: A robust insurance platform should be able to adapt as your business scales. Whether handling a surge in policyholder data or meeting higher claims volumes, scalable software ensures smooth operations without compromising speed or accuracy. This scalability is vital in today’s environment, where customer expectations and data loads are constantly growing.

#2 Integration-friendly ecosystems: Modern insurance operations rely on a network of digital tools, from EDI standards for data exchange to AI-driven analytics for fraud detection and personalization. A well-designed insurance software platform acts as a hub, seamlessly integrating with these tools to streamline workflows. For instance, integration with EDI ensures accurate and efficient data transmission between stakeholders, while AI enhances decision-making across functions like underwriting and claims processing.

#3 Enhanced security measures: Given the sensitive nature of policyholder data, security is non-negotiable for insurance software. Reliable platforms incorporate advanced encryption, multi-factor authentication, and compliance with industry regulations to protect against cyber threats. This focus on security safeguards data and enhances customer trust in an increasingly digital insurance landscape.

Custom software development empowers insurers to go beyond “one-size-fits-all” solutions, enabling them to innovate, scale, and secure their operations confidently. By investing in tailored platforms with these essential features, insurers can position themselves as leaders in a market where technological advancements and customer demands are reshaping the industry.

The insurance industry is poised for a significant transformation, with technologies like EDI, AI, and insurtech driving unprecedented changes.

One of the most important emerging trends is the shift toward real-time data exchange and dynamic policy management. Insurers are moving away from static, one-size-fits-all solutions and adopting systems that adjust real-time policies based on live data. For instance, telematics in auto insurance allows for dynamic premium adjustments based on actual driving behaviors, offering policyholders greater control while helping insurers better manage risk.

Advanced Artificial Intelligence is another force shaping the future. Predictive analytics, powered by AI, is revolutionizing risk assessment by analyzing historical data to forecast potential risks accurately. This improves underwriting and enhances fraud detection capabilities, enabling insurers to act proactively. Imagine an AI system identifying weather patterns that signal an increased risk of property damage, helping insurers preemptively support policyholders in high-risk areas.

One of the most exciting innovations is the integration of blockchain with EDI processes. Blockchain’s decentralized and tamper-proof nature ensures that all data exchanges are secure, transparent, and immutable. When applied to insurance workflows, blockchain enhances trust among stakeholders, from insurers to policyholders, by creating a verifiable audit trail for all transactions. Whether managing claim histories or ensuring compliance with regulatory requirements, EDI enhanced by blockchain delivers unmatched reliability.

Traditional insurers must adopt a forward-thinking approach to thrive in this rapidly evolving landscape. One key step involves modernizing legacy systems to enhance flexibility and integration capabilities. Insurers need to break free from outdated infrastructure that can’t support the demands of real-time data exchange or advanced AI functionalities. By investing in scalable and adaptable technology, they can future-proof their operations.

Check our case study about modernizing insurance app.

Partnerships will also be pivotal. Insurers can no longer afford to work in isolation; collaborating with tech-savvy software developers and insurtech startups is essential to driving innovation. These partnerships bring expertise in cutting-edge technologies like predictive AI, blockchain, and custom platform development, enabling traditional insurers to stay competitive while focusing on their core services. Insurtech hubs, in particular, offer a fertile ground for forming these alliances and co-developing solutions tailored to the insurance sector’s unique challenges.

Additionally, fostering a culture of continuous learning and adaptability within organizations will ensure a smooth transition into these advancements. By equipping teams with the skills and tools to leverage new technologies, insurers can align their workforce with the demands of a digital-first future.

The convergence of EDI, AI, and insurtech signals a thrilling new chapter for the industry. Insurers who proactively embrace these trends will keep pace with innovation and deliver smarter, faster, and more customer-centric services. The time to act is now, as the future of insurance becomes increasingly defined by technology.

The insurance industry is undeniably undergoing a digital revolution. Companies are on a quest to modernize and remain competitive, from integrating technologies like EDI and AI to adopting insurtech solutions. However, the path to transformation isn’t without its hurdles. Implementing large-scale digital initiatives often presents significant challenges, ranging from technical complexities to organizational resistance.

One of the most pressing difficulties is integrating modern systems with existing legacy infrastructures. These older systems were not designed to support today’s flexible and data-driven technologies, creating compatibility issues that often slow progress. Additionally, transitioning from tried-and-tested methods to tech-driven workflows can sometimes be met with hesitation from employees and stakeholders, further complicating the initiative.

Given these challenges, insurers must set realistic expectations when pursuing digital transformation. While adopting cutting-edge technology can lead to incredible efficiency gains, these improvements take time to materialize. Achieving a meaningful return on investment (ROI) often requires careful planning and strategic execution. Understanding that operational shifts, like streamlining data exchange or automating manual tasks, are gradual rather than instantaneous can help insurers maintain focus and minimize frustration.

This is where a phased approach becomes invaluable. Instead of attempting a complete overhaul, insurers can break their transformation into manageable stages. For example, they could begin by modernizing a specific process, such as claims processing, before expanding to other areas like underwriting or customer experience. A step-by-step strategy reduces the risk of disruptions while allowing organizations to learn and adapt with each implementation stage.

Expert guidance is another critical factor in easing the transformation process. Partnering with technology specialists or consultants who understand the insurance industry and digital innovation can make all the difference. These experts can help insurers identify solutions that align with their unique operational needs, mitigate potential risks, and optimize their systems for long-term success.

Digital transformation in insurance is undoubtedly a complex endeavor, but it’s also one filled with promise. By acknowledging the challenges, setting realistic expectations, and adopting a phased approach with the right guidance, insurers can overcome obstacles and build a future-ready organization. Transformation doesn’t happen overnight, but persistence and strategy can lead to remarkable outcomes.

The transformation of the insurance industry is both an exciting and challenging journey. With the rapid advancements in EDI, AI, and insurtech, insurers have an unparalleled opportunity to evolve their operations, improve customer experiences, and stay ahead in an increasingly competitive market. But as with any significant shift, knowing where to begin and navigating the complexities can feel overwhelming.

That’s where we come in. I know everybody would say that, but we understand insurers’ unique challenges and are here to help. Whether you’re looking to streamline your claims processes, enhance risk assessments with predictive analytics, or build secure, integration-friendly platforms, our team specializes in custom software development designed just for you. By combining technical expertise with deep industry knowledge, we can craft solutions that align perfectly with your goals. It’s up to you if you wanna reach your solution right now.

We invite you to connect with us for a consultation. This is your chance to share the specific hurdles you’re facing and explore how tailored technologies can drive real impact for your business. Together, we can chart a roadmap that brings clarity and confidence to your transformation efforts.

The future of insurance is being written today, and it belongs to those ready to innovate. With the right technology, expertise, and mindset, you can lead the way in this era of change. Take that first step toward creating a smarter, more agile insurance operation. The tools, the expertise, and the support are all here waiting for you. Let’s work together to build a bright future for your organization and customers.