Why Domain Expertise Is Key in Insurance Software Development

- May 26

- 35 min

The insurance industry is often burdened by outdated user interfaces that frustrate customers and slow down operations. Clunky, unresponsive frontends can make tasks like policy management or claims submission unnecessarily complicated, eroding trust and driving users toward competitors. For insurers, these inefficiencies translate into lost opportunities and increased costs, creating a pressing need to modernize insurance UI.

Aligning UI advancements with broader insurance business objectives is not just about aesthetics; it’s a way to enhance operational performance and meet evolving customer expectations. By focusing on modernization efforts that prioritize both functionality and efficiency, insurance providers can create applications that solve core business challenges while delivering seamless user experiences.

Strategic frontend optimization insurance efforts are game-changing. They not only improve navigation and reduce friction but also enable faster processes and better collaboration between IT teams and business leaders. With the right approach, insurers can transform legacy systems into powerful tools that boost productivity, foster customer loyalty, and position businesses for long-term growth.

For insurance companies, user interfaces serve as the primary point of interaction between customers and services. Unfortunately, outdated systems with slow navigation, poor design, and inconsistent functionality create barriers that frustrate users and erode trust. When customers struggle to access policy information or file claims smoothly, it leaves a lasting negative impression, and many will turn to competitors offering more streamlined experiences.

Beyond customer dissatisfaction, legacy insurance applications also pose usability and operational challenges. Older systems often suffer from slow response times, unclear workflows, and disjointed designs that fail to address modern business needs. For employees, these inefficiencies translate into increased errors, time wasted on manual tasks, and poor collaboration across departments. Outdated interfaces can also hinder IT teams, making updates, maintenance, and integrations more complex than necessary.

This is where insurance frontend optimization becomes pivotal. By redesigning and repositioning the user interface, insurers can resolve many of these challenges. Modern UIs bridge functional inefficiencies by

An optimized frontend can also streamline the flow of information between systems, making it easier for teams to work together and ensuring that customer data is accessible in real-time.

Well-executed insurance UI modernization aligns frontend improvements with backend capabilities, creating a better insurance ecosystem. When business leaders and IT teams collaborate on redesign strategies, they open the door to operational gains, including

These improvements reduce user frustration and build trust and loyalty, giving companies a competitive edge in a demanding market.

With the right focus on insurance UI modernization, insurance providers can turn their platforms into efficient and engaging tools. This fosters not only exceptional user experiences but also enhanced productivity and long-term growth opportunities.

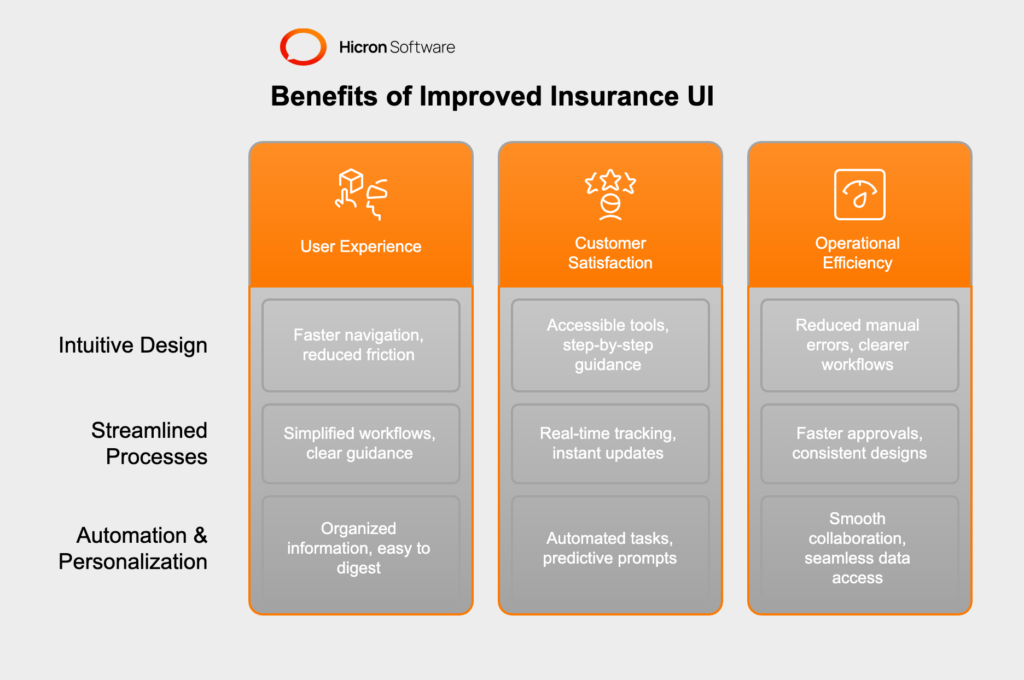

Upgrading the user interface of insurance applications not only enhances the experience for customers but also strengthens internal processes and team collaboration. A modernized UI fosters a seamless interaction between users and the system, creating measurable advantages across three key areas.

An intuitive insurance interface is crucial for keeping users engaged and satisfied. Modern UIs focus on faster navigation and reducing friction, ensuring customers can easily perform tasks like viewing policy details, submitting claims, or making updates. By simplifying workflows, insurers ensure that even complex actions are effortless for users. Features such as clearly labeled menus, quick search functions, and consistent design patterns guide customers through processes with confidence and ease.

Additionally, intuitive UIs reduce confusion, allowing users to complete tasks efficiently without needing external help. For example, a well-designed dashboard might group relevant information, like policy overviews or claim statuses, in an organized format that’s easy to digest. Faster and smoother digital experiences build trust while minimizing frustrations that may otherwise push customers to alternate providers.

Improved interfaces empower customers by making tools and features more accessible. For instance, streamlined claims submission processes with step-by-step guidance ensure policyholders face fewer hurdles during stressful times. Features like real-time claim tracking or instant status updates enhance transparency, reinforcing reliability and trust.

Similarly, automating repetitive tasks, such as renewing policies or filing routine updates, makes the service faster and error-free. Adding personalization options, such as FAQs, chatbots, or predictive prompts, caters to individual preferences, creating a sense of care and attention. When customers can perform vital tasks quickly and without errors, the perception of the insurance provider improves, turning satisfied users into loyal advocates.

The impact of a modernized UI isn’t limited to customers; it also revolutionizes day-to-day operations for insurers. An upgraded interface reduces manual errors by automating core tasks and guiding staff with clearer workflows. For example, tools that validate input data in real-time prevent incorrect submissions, saving time and resources on corrections.

Efficient UIs also enable faster approval processes, as optimized navigation and consistent designs reduce the learning curve for employees. When the insurance frontend is tightly aligned with backend operations, the result is smoother collaboration between IT and business departments. Teams can access data seamlessly, resolve queries faster, and focus on strategic goals instead of handling system inefficiencies. By focusing on insurance UI performance, insurers can drive internal efficiencies that translate to better external results.

Modernizing the frontend of insurance applications requires a strategic approach that aligns business objectives with user expectations. By implementing the right frameworks and focusing on efficiency, insurers can create scalable, user-friendly systems. Below are key strategies for achieving frontend optimization insurance transformation.

Before embarking on insurance frontend updates, it’s essential to map each application’s functionality to specific business goals. Every insurance module in the system should serve a clear purpose, supporting tasks like policy management, claims processing, or customer updates. Conducting a thorough evaluation helps identify high-value features to prioritize and eliminate redundancies that clutter the interface.

For instance, if a module for generating quotes is underused or unnecessarily complicated, its functionality can be streamlined or consolidated with related features. This approach ensures modernization efforts are not only user-centric but also contribute to operational efficiency and ROI. Clear alignment between UI features and business goals keeps projects focused and ensures measurable results.

Insurance platforms often handle complex functions, but that doesn’t mean the interface needs to feel overwhelming. By simplifying design while preserving core functionality, insurers can create systems that are intuitive yet powerful. One effective strategy is to establish cohesive, reusable design patterns that improve predictability.

Consistent navigation menus, form layouts, and button placements allow users to quickly learn and use the application without confusion. This predictability reduces friction and minimizes errors by guiding users naturally through workflows. For example, presenting policy details with an easy-to-follow information hierarchy ensures customers can locate key data without extensive searching.

By making tasks simple without compromising robust functionality, insurers can meet the needs of both novice users and seasoned professionals.

A slow or unresponsive insurance application can frustrate users and negatively impact customer retention. Frontend performance should, therefore, be a top priority in any modernization effort. Optimizing insurance UI performance, utilizing resources efficiently, compressing data, and implementing efficient coding practices can help reduce page load times and enable smoother user interactions.

The insurance application should be tested across various devices and browsers to ensure it performs consistently. A responsive design that adapts seamlessly to desktop, tablet, and mobile screens guarantees a positive experience for all users. Taking steps like lazy loading images or caching frequently-used data enables applications to handle high volumes of traffic without sacrificing speed.

One of the most effective ways to accelerate and standardize insurance frontend modernization is by using UI frameworks. Frameworks like Angular, React, and Vue.js provide pre-built components, templates, and tools that simplify development while ensuring design consistency across applications. Frameworks like Angular and React simplify development while ensuring the standardization needed for frontend optimization insurance projects.

For insurance providers, these frameworks allow teams to implement advanced features, like real-time form validation or dynamic dashboards, without reinventing the wheel. The modular design of frameworks also makes it easier to scale applications as user demands evolve over time. With built-in libraries and support for cross-platform consistency, frameworks help create scalable, responsive interfaces that cater to diverse user needs.

|

Strategy |

Description |

Key Benefits |

|

Start With Business Alignment |

Map each application’s functionality to specific business goals and eliminate unnecessary features. |

Ensures modernization efforts align with business objectives, improves focus, and boosts ROI. |

|

Simplify Without Losing Functionality |

Establish cohesive, reusable design patterns to create intuitive and user-friendly interfaces. |

Reduces user confusion, minimizes errors, and creates predictable workflows for a seamless experience. |

|

Focus on Frontend Performance |

Optimize resources, compress data, and test applications across devices to enhance responsiveness. |

Enhances user satisfaction with faster load times and smooth interactions across all platforms. |

|

Leverage UI Frameworks |

Use frameworks like Angular, React, or Vue.js to simplify development and ensure design consistency. |

Accelerates implementation, supports scalability, and creates advanced features with less effort. |

For an insurance application to perform optimally, the harmony between frontend and backend systems is crucial for maximizing insurance UI performance. Strong collaboration, robust APIs, and streamlined examples ensure integrated and efficient systems that satisfy both user and business needs.

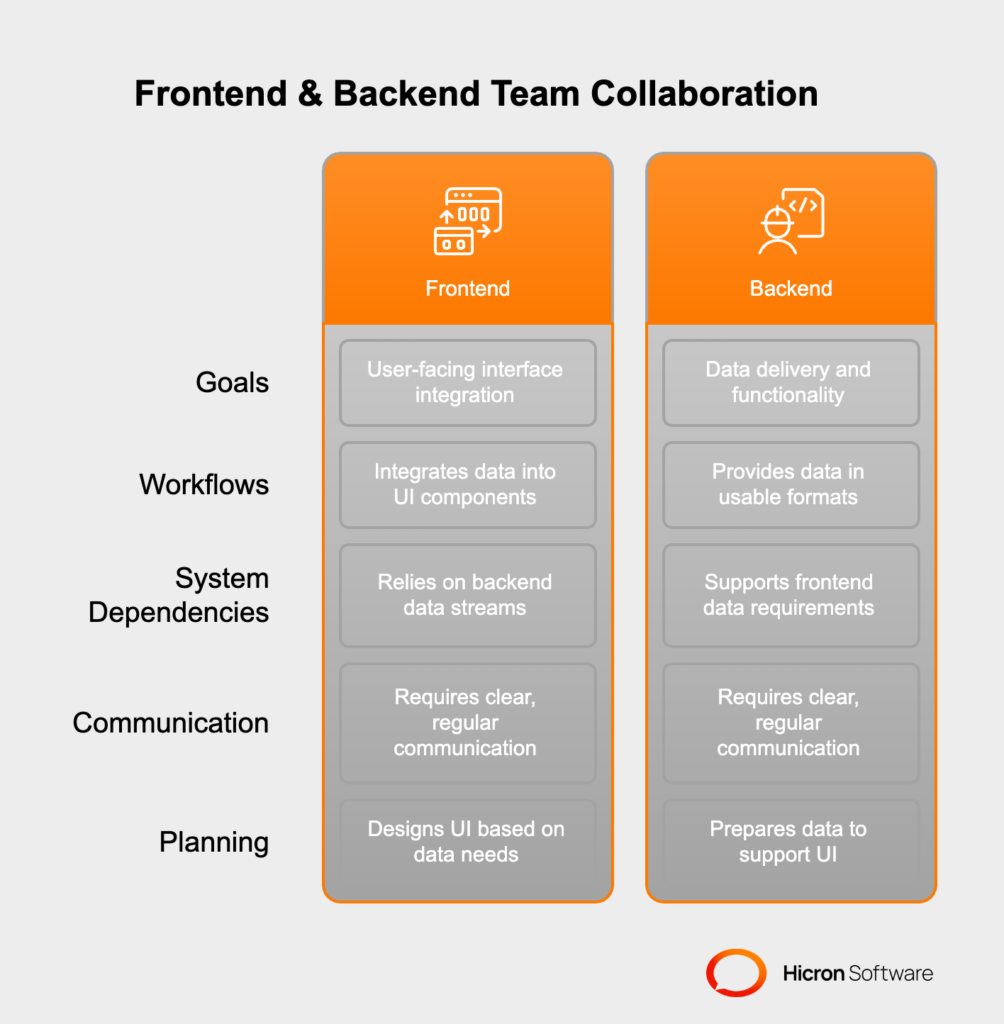

Effective collaboration between frontend and backend teams ensures the success of modernization projects. Both teams must have a shared understanding of goals, workflows, and system dependencies.

Early alignment allows backend developers to provide data in formats that frontend teams can easily integrate into user-facing interfaces. Regular cross-functional meetings, clear documentation, and communication tools streamline the coordination process, helping to resolve potential mismatches between data functionality and UI needs before they arise.

For example, if the frontend team designs a policy dashboard while the backend team delivers incomplete or delayed data streams, users will face frustration. Collaborative planning avoids such scenarios by ensuring backend systems are prepared to support the user experience without disruptions.

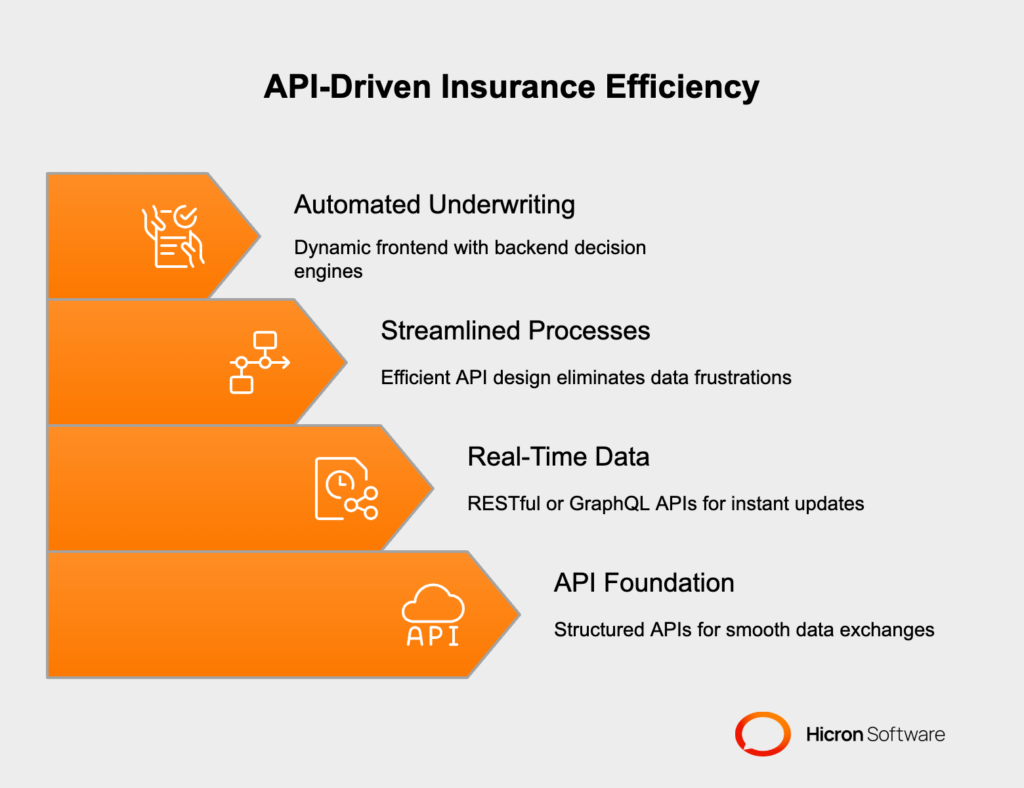

Building and optimizing APIs is a key step in bridging the frontend and backend systems. Well-designed APIs facilitate smooth data exchanges, allowing the frontend to fetch user data, policy details, or claim statuses instantly. APIs should be structured to

For insurance contexts, RESTful or GraphQL APIs can deliver real-time data updates and integrations across various platforms. For instance, a streamlined claims process could allow users to upload documents on the frontend and see immediate status changes powered by backend API responses. By prioritizing efficient API design, insurers can eliminate frustrations caused by inconsistent or lagging data flows.

Streamlined integration between frontend and backend systems has already proven successful in the industry. Consider an insurance provider automating their underwriting process. By aligning a dynamic frontend interface with backend decision engines through APIs, the insurer could offer instant policy approvals.

Strong frontend-backend collaboration and integration elevate both user experience and operational efficiency. With strategic planning and execution, insurers can create robust systems that not only meet customer expectations but also drive long-term growth.

Modernizing an insurance user interface doesn’t need to be a disruptive, all-or-nothing process. By adopting incremental improvements, insurers can enhance their systems gradually, minimizing risks and ensuring business continuity. This approach reduces downtime and enables teams to test and refine updates step-by-step, yielding optimal results.

Phased rollouts and continuous, minor adjustments ensure sustainable modernization, reducing risks and maintaining high insurance UI performance over the long term. Instead of overhauling the entire interface in one go, insurers can focus on updating specific modules or features first. For example, a provider might start with improving the quote generation tool before moving on to policy management features. This ensures that critical elements remain functional, giving users time to adapt while changes are introduced gradually.

Phased rollouts also provide valuable breathing room to identify and address potential issues early. Teams can monitor system performance and user feedback throughout each phase, reducing the risk of introducing widespread problems that require extensive troubleshooting. This deliberate, step-by-step approach keeps workflows efficient while maintaining user trust and satisfaction.

Iterative improvements rely heavily on input from real users. Engaging policyholders, agents, and employees in regular testing cycles ensures that updates are intuitive and meet actual user needs. Tools like online surveys, usability testing sessions, and interviews allow insurers to capture direct feedback on new features and functionality.

For instance, before fully releasing a redesigned claims submission feature, insurers might conduct user tests to confirm its simplicity and effectiveness. If the feedback identifies areas of confusion, developers can make targeted adjustments before wider deployment. This feedback loop allows modernization efforts to remain user-focused while avoiding costly mistakes.

Small, ongoing updates may seem incremental, but they can deliver substantial long-term benefits. By making regular adjustments, insurers can constantly improve usability, ensuring the interface evolves alongside user expectations and technological trends. For example, automating form fields one release at a time may seem like a small change, but it enhances the overall experience over time.

Continuous updates also lower the risk of falling behind competitors who may launch modern systems more rapidly. Gradual modernization avoids the stress of periodic, large-scale overhauls by maintaining a steady momentum of progress. This lets insurers stay agile, responsive, and relevant while keeping their operations stable.

|

Strategy |

Description |

Benefits |

|

Phased Rollouts for Maximum Stability |

Conduct small, step-by-step updates instead of a full-scale overhaul. Focus on improving specific modules or features (e.g., quote generation tool) gradually. Monitor performance and user feedback at each phase to identify and address issues early. |

|

|

Incorporating User Testing and Feedback |

Engage policyholders, agents, and employees in regular testing cycles. Collect feedback through surveys, usability tests, and interviews to refine and validate new updates before wide deployment. |

|

|

Building Long-Term Value Through Continuous Change |

Make small, ongoing updates to keep the interface evolving with user expectations and technological trends. Examples include automating form fields or enhancing usability incrementally. |

|

The evolution of insurance UI is set to reshape how customers and businesses interact with applications. By adopting innovative designs and advanced technologies, insurers can create interfaces that are scalable, intelligent, and personalized. Below are key trends driving the future of insurance UI.

Insurance modular UI design is becoming a foundational approach for insurance applications. This strategy involves creating flexible, reusable components that can be easily rearranged or updated as business needs change. For example, instead of hard-coding separate pages for quotes, policies, and claims, insurers can use modular elements like widgets or dynamic content blocks. These can be adapted to fit different workflows and repurposed to add new features without requiring a complete redesign.

This adaptability reduces development time and ensures that interfaces can scale as insurers expand their offerings or adapt to market demands. Modular insurance designs support faster personalization, allowing applications to cater to individual user needs without overhauling the entire system.

Artificial intelligence (AI) and machine learning (ML) are unlocking opportunities for dynamic and intelligent insurance UIs. Predictive algorithms can analyze user behavior and needs, offering proactive solutions and recommendations. For instance, an AI-powered claims dashboard might predict the documents a customer will need to upload based on their case type, reducing processing times and improving the experience.

Similarly, ML-powered UIs can help insurers automate routine processes, like calculating policy premiums or flagging potential fraud, all while enhancing user interactions. These technologies transform static interfaces into proactive systems that guide users through tasks intuitively, making applications feel smarter and more responsive.

Today’s users expect applications to match their specific preferences and needs. Personalized UIs focus on delivering tailored experiences built around individual user data, behaviors, and preferences. Insurance platforms can achieve this by using automation and user-centric designs to adapt interfaces in real time.

For example, policyholders could log in to dashboards that surface the most relevant features, such as renewal reminders for expiring policies or offers customized to their insurance history. Automation can further enhance engagement by streamlining user input, such as pre-filling fields based on stored data. These small but impactful changes make interactions smoother, increasing satisfaction and loyalty.Drive Success Through Strategic UI Modernization in Insurance

Trends like modular UI design, predictive technologies such as AI/ML, and personalized, user-centric interfaces will push the boundaries of insurance UI performance in the years to come.

Modernized insurance UI applications isn’t just about keeping up with technology trends; it’s a strategic move that delivers measurable results. By aligning frontend UI efforts with overarching business objectives, insurers can create systems that enhance functionality, foster seamless user experiences, and ultimately drive customer satisfaction. Such improvements don’t only delight policyholders but also streamline internal processes, boosting operational efficiency across the board.

Incremental UI modernization stands out as a practical and effective approach for sustained progress. Small, calculated updates minimize operational risks while ensuring adaptability to ongoing changes in user expectations and market demands. These efforts, coupled with leveraging cutting-edge technologies and design frameworks, set the stage for improved ROI and long-term competitive success.

Now is the time for leaders to take action. Evaluating existing insurance applications and identifying opportunities for modernization can unlock immense value. Begin with phased improvements and leverage user feedback to guide the way. By adopting these strategies, insurers can transform their digital platforms into powerful tools that meet customer needs while achieving operational excellence. The future of insurance UI lies within your hands—take the first step today.

Modernizing insurance UI significantly enhances operational efficiency by automating core tasks, reducing manual errors, and improving workflows for employees. For instance, features like real-time data validation reduce incorrect submissions, saving time and resources on corrections. Optimized UIs also streamline approval processes and improve collaboration between IT and business teams by ensuring seamless access to data and consistent workflows. These upgrades enable teams to focus on strategic objectives rather than navigating system inefficiencies.

Frontend optimization ensures a smoother, faster, and more intuitive user experience, which is key to customer satisfaction. By implementing simplified workflows, responsive interfaces, and easy navigation, users can complete tasks like claims submissions or policy updates without friction. Features such as real-time claim tracking, automated assistance, or pre-filled forms reduce frustration and empower customers to manage their insurance needs independently. The result is increased trust, loyalty, and positive customer perception.

APIs are essential for bridging the gap between frontend and backend systems in insurance applications, enabling seamless data exchanges. Well-designed APIs allow realtime data retrieval for tasks like fetching policy details or updating claim statuses, ensuring smooth integration across platforms. They minimize delays, prevent data bottlenecks, and allow for scalability as application needs grow. APIs also allow insurers to add advanced capabilities, such as instant underwriting approvals or live status updates, without overhauling the existing infrastructure.

Adopting incremental UI modernization allows insurers to enhance their systems gradually, minimizing operational risks and downtime. Phased rollouts provide opportunities to test, refine, and adapt updates based on user feedback and system behavior, reducing costly errors. This approach also supports continuous improvement, ensuring the UI evolves with user expectations and technology trends. Incremental changes keep workflows stable and prevent the disruption caused by large-scale overhauls, keeping insurers agile and competitive.

To implement modular UI designs effectively in insurance applications, insurers should focus on creating reusable, flexible components that cater to diverse workflows and tasks. For example, instead of developing separate pages, use widgets or content blocks that can adapt to various modules, such as claims tracking or policy management. By prioritizing modularity, interfaces scale easily as user needs evolve, reducing development time. Modular designs also ensure faster personalization and simplified updates, allowing insurers to remain adaptable in a dynamic market.