Custom InsurTech Solutions that Give You a Competitive Edge

- March 26

- 39 min

Definition: Cloud technology delivers computing services, such as storage, software, and processing power, over the internet, enabling remote access, scalability, and cost efficiency.

Insurance tech is at the forefront of navigating rapid change and rising demands. For companies in the insurtech industry, scalability has become essential for innovating quickly, integrating advanced insurance software development, and meeting shifting customer expectations.

This article examines how cloud technology is transforming insurance by enabling scalable, secure, and adaptable IT systems. Learn why scalability matters, how cloud-based insurance software development fosters agility and cost efficiency, and the role of advanced security in this evolution.

Discover how scalable, cloud-powered insurtech solutions are shaping the future of the industry.

For insurance tech companies and the insurtech industry, staying relevant means being built for scale. The capacity to adapt and evolve is essential in an era defined by digital transformation for insurance, rising compliance standards, and shifts driven by innovative insurtech solutions. Scalability empowers insurers, insurtech startups, and insurance software developers to exceed policyholder expectations, manage increasing claims, and rapidly bring new insurance products to market.

Cloud technology for insurance is now at the heart of this transformation. By leveraging custom insurance software development and cloud-based insurtech solutions, organizations can modernize their core platforms, enhance insurance data security, and reduce operational costs. The result is agile, future-proof insurance systems, equipped to thrive in a changing insurtech landscape.

The insurance sector is experiencing an unprecedented surge in demand, driven by rising client expectations, increasing numbers of policyholders, and the need for faster claims processing. For insurance companies to thrive under these pressures, scalable systems are no longer optional—they are essential.

By leveraging tools from the insurtech industry and adopting scalable insurance IT systems, companies can efficiently handle growing workloads. Scalable solutions, such as advanced insurance software development platforms, enable firms to expand their operational capacity on demand, whether processing a spike in claims or accommodating a surge in new policy applications. This adaptability eliminates bottlenecks, ensuring seamless customer service.

Insurance tech companies are also finding that scalability fosters not only operational efficiency but also innovation. With the flexibility to allocate resources dynamically, they can test and launch new products without overstretching existing systems. Ultimately, scalable systems enable firms to remain competitive and meet customer expectations, even as demand continues to grow.

By adopting cloud-powered scalability, insurers future-proof their operations, enabling growth without sacrificing efficiency or quality. This capability positions them as leaders in a rapidly evolving marketplace.

For insurance tech companies, efficiently managing the rising number of policyholders and claims is a top priority. Scalability plays a vital role in ensuring operations remain smooth even as volumes grow. Scalable systems, particularly those equipped with claims automation software, allow insurers to process more claims accurately and quickly, without creating bottlenecks.

The insurtech industry has revolutionized the management of policy and claims data. Advanced insurance software development provides tools for automating repetitive tasks, streamlining workflows, and enabling real-time data processing. This not only reduces administrative burdens but also improves the accuracy and timeliness of claim resolutions, which enhances customer satisfaction.

For example, cloud-enabled systems can dynamically scale IT resources during peak periods, such as natural disasters or open enrollment seasons.

This flexibility ensures that increased demand does not lead to service delays or downtime. Furthermore, by automating claims processes, insurers can mitigate human error and focus on more complex cases requiring specialized attention.

With scalable, cloud-based solutions, insurance companies can handle growth with confidence, providing seamless service while maintaining operational efficiency. This ensures they remain competitive in an increasingly dynamic and customer-centric market.

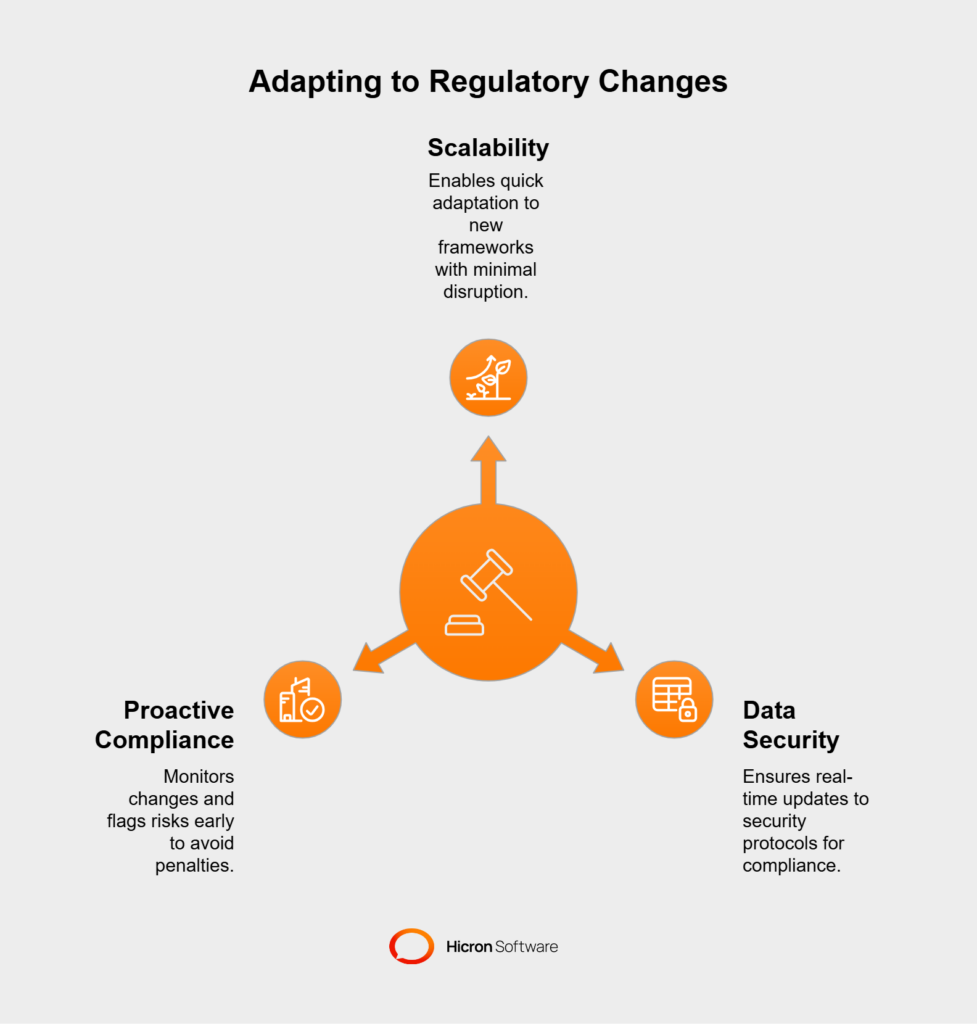

The insurance industry operates under continuously evolving regulations and compliance standards. Keeping up with these changes can be challenging, particularly for companies relying on outdated systems. Scalability, supported by advanced technologies such as custom insurance software and cloud solutions, provides a practical way to ensure compliance while maintaining operational efficiency.

With scalable insurance software development, companies can swiftly adapt to new regulatory frameworks. Whether it involves updating data reporting procedures, integrating new compliance workflows, or aligning with revised auditing requirements, scalable systems provide the flexibility needed to implement changes with minimal disruption.

One significant advantage is enhanced insurance data security. Scalable, cloud-based solutions enable real-time updates to security protocols, ensuring sensitive policyholder and claims data meet the latest compliance standards.

Additionally, custom insurance software tailored to specific regulatory environments can simplify the process of adhering to regional laws and regulations.

For firms in the insurtech industry, scalability is also a driver of proactive compliance. Automated tools can monitor regulatory changes and flag potential risks early, helping insurers avoid costly fines or reputational harm. Overall, scalable solutions allow insurance companies to remain agile, compliant, and secure—a critical combination in today’s fast-changing regulatory landscape.

Innovation is the lifeblood of the insurance industry, especially as competition intensifies and customer expectations evolve. Scalability provides the foundation for insurance companies to continuously innovate and grow, enabling them to adapt quickly to market needs while staying ahead of industry trends.

With scalable infrastructure, insurers can rapidly develop and deploy new products tailored to niche markets. Custom insurance software development plays a pivotal role, enabling companies to design unique solutions that stand out in the crowded insurance technology (insurtech) space.

Startups and established insurance tech companies alike can experiment with groundbreaking offerings without worrying about system constraints or resource limitations.

Scalability also enhances customer experiences by supporting personalized services and seamless digital interactions. Cloud-powered systems can handle surges in user activity, ensuring consistent and high-quality service delivery during peak times. This agility contributes to building stronger customer relationships and fosters brand loyalty.

Furthermore, scalable systems drive digital transformation for insurance companies by integrating cutting-edge technologies, such as AI, predictive analytics, and telematics. These tools unlock data-driven insights that improve decision-making and risk management, creating a competitive edge in the rapidly evolving insurtech ecosystem.

By prioritizing scalability, insurers position themselves not only for sustained growth but also as pioneers of innovation in an increasingly tech-driven industry.

The ability to develop and launch new products swiftly is a game-changer for insurance companies operating in today’s dynamic market. Flexible and scalable systems underpin this capability, enabling insurers to adapt quickly to emerging market trends and shifting customer expectations.

Custom insurance software plays a critical role by providing tailored solutions that align with specific product requirements and operational needs. Insurtech startups and established insurance tech companies alike leverage these systems to gain a competitive edge. Modern insurance software development services focus on creating adaptable platforms that facilitate the rapid prototyping and deployment of new offerings.

Such flexibility is essential for exploring innovative product categories, targeting niche markets, and responding to external factors such as regulatory changes or economic shifts. Scalable systems ensure that resources, such as IT infrastructure and customer support, can expand seamlessly to match the demands of newly launched products, avoiding performance bottlenecks.

By investing in flexible, cloud-based solutions, insurers can significantly reduce time-to-market while enhancing their capacity for experimentation and innovation. This approach allows insurance companies to stay agile, deliver exceptional customer experiences, and maintain their position as leaders in the insurtech industry.

Digital transformation is a catalyst for innovation and growth in the insurance sector, and scalability lies at its core. By modernizing outdated systems with cloud-based insurance technology solutions, insurers can integrate advanced tools such as AI and predictive analytics into their operations.

These technologies enable firms to analyze vast amounts of data in real-time, anticipate market trends, and make informed decisions that drive a competitive advantage. Scalability enables the seamless adoption of these innovations, ensuring that insurers can dynamically expand their capabilities as new technologies emerge.

For instance, AI in insurance enhances claims processing by automating repetitive tasks, reducing errors, and improving efficiency.

Similarly, predictive analytics enables insurers to assess risks with precision, resulting in more accurate underwriting and enhanced loss prevention strategies.

Insurance software modernization also enhances customer experiences by enabling personalized interactions and faster service delivery. With flexible, cloud-powered infrastructure, companies can process high volumes of transactions without compromising performance, ensuring customer satisfaction even during demand peaks.

Cloud technology equips insurance companies with the tools to scale operations, enhance security, and optimize costs. By leveraging flexible IT resources, insurers can handle demand fluctuations, support growth without heavy hardware investments, and ensure compliance with strict data protection standards.

| Benefit | Description |

| Scalability | Dynamically scale IT resources to meet demand fluctuations. |

| Security | Advanced encryption and real-time threat detection for data protection. |

| Cost-Efficiency | Pay-as-you-go models reduce infrastructure costs. |

| Operational Efficiency | Automate processes and optimize resource allocation. |

Cloud technology allows insurance companies to scale their IT resources dynamically. This ensures they can handle usage peaks, such as during open enrollment periods, and scale down during lulls, optimizing resource allocation.

By leveraging scalable cloud solutions, insurers can support growth without the need for expensive hardware investments. This flexibility is especially valuable for insurtech startups and insurance tech companies looking to expand rapidly.

Cloud platforms offer advanced security protocols, including real-time threat detection and automated updates. These features help insurers protect sensitive policyholder data and maintain compliance with industry standards for data protection.

Custom insurance software integrated with cloud technology ensures that security measures are always up-to-date, reducing vulnerabilities and enhancing customer trust.

Cloud technology reduces IT infrastructure overheads by eliminating the need for on-premises servers. Insurers can adopt pay-as-you-go models, which optimize spending and align costs with actual usage.

This cost-effective approach allows insurance companies to allocate resources more efficiently, focusing on innovation and customer experience rather than infrastructure maintenance.

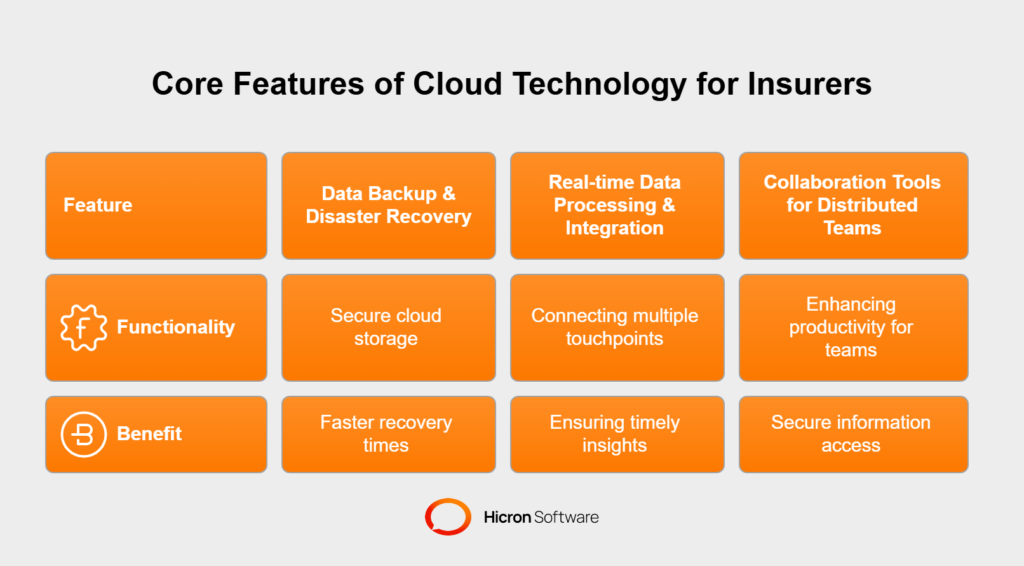

Cloud technology is transforming the insurance industry by providing scalable, secure, and efficient solutions. It empowers insurers to streamline operations, improve decision-making, and enhance collaboration across teams. Below, we explore the core features that make cloud technology indispensable for modern insurers.

Ensuring the safety and availability of critical data is a top priority for insurers. Cloud technology offers robust solutions to protect data and facilitate quick recovery from disruptions.

Ensuring business continuity with secure cloud storage

Data loss can be devastating for insurers, resulting in significant financial losses and reputational damage. Cloud storage ensures that critical insurance data is securely backed up, protecting against risks such as cyberattacks, natural disasters, or hardware failures.

For example, insurers using cloud platforms like AWS or Microsoft Azure benefit from automated backups and encryption protocols that meet industry compliance standards.

According to a report by Veeam, 95% of organizations using cloud-based backup solutions report faster recovery times and a reduction in data loss incidents.

Additionally, cloud storage allows insurers to store vast amounts of data cost-effectively. This scalability ensures that as data grows—whether from customer records, claims, or IoT devices—insurers can expand their storage without significant upfront investments.

Faster recovery times during system outages

System outages can disrupt operations and erode customer trust. Cloud-based disaster recovery solutions enable insurers to restore operations, often within minutes.

For instance, a mid-sized U.S. insurer implemented a cloud-based disaster recovery system, reducing downtime from 8 hours to just 15 minutes during a server failure. This agility ensures that customer service remains uninterrupted, even during unexpected disruptions.

Moreover, cloud platforms often include built-in redundancy, meaning data is stored across multiple locations. This ensures that even if one data center experiences an issue, operations can continue seamlessly from another location.

Cloud technology enables insurers to process and integrate data in real time, creating a seamless flow of information across the insurance ecosystem. This capability drives faster decision-making and improves customer experiences.

Connecting multiple touchpoints within the insurance ecosystem

The insurance industry involves numerous interconnected processes, from underwriting to claims management. Cloud technology enables seamless integration of these touchpoints, creating a unified ecosystem.

For example, insurers can integrate telematics data from vehicles directly into their claims systems. This allows for faster claims processing and more accurate assessments.

A study by Capgemini found that insurers using real-time data integration reduced claims processing times by 25%.

Additionally, cloud platforms support API integrations, enabling insurers to connect with third-party services such as fraud detection tools or customer relationship management (CRM) systems. This connectivity enhances operational efficiency and improves customer experiences.

Ensuring timely insights to improve decision-making

Real-time data processing enables insurers to gain actionable insights, allowing them to make informed decisions promptly.

For instance, during natural disasters, insurers can use real-time weather data to proactively reach out to policyholders in affected areas, offering support and expediting claims.

According to PwC, insurers leveraging real-time analytics see a 20% improvement in customer satisfaction and a 15% reduction in operational costs. This capability not only enhances decision-making but also positions insurers as proactive and customer-centric organizations.

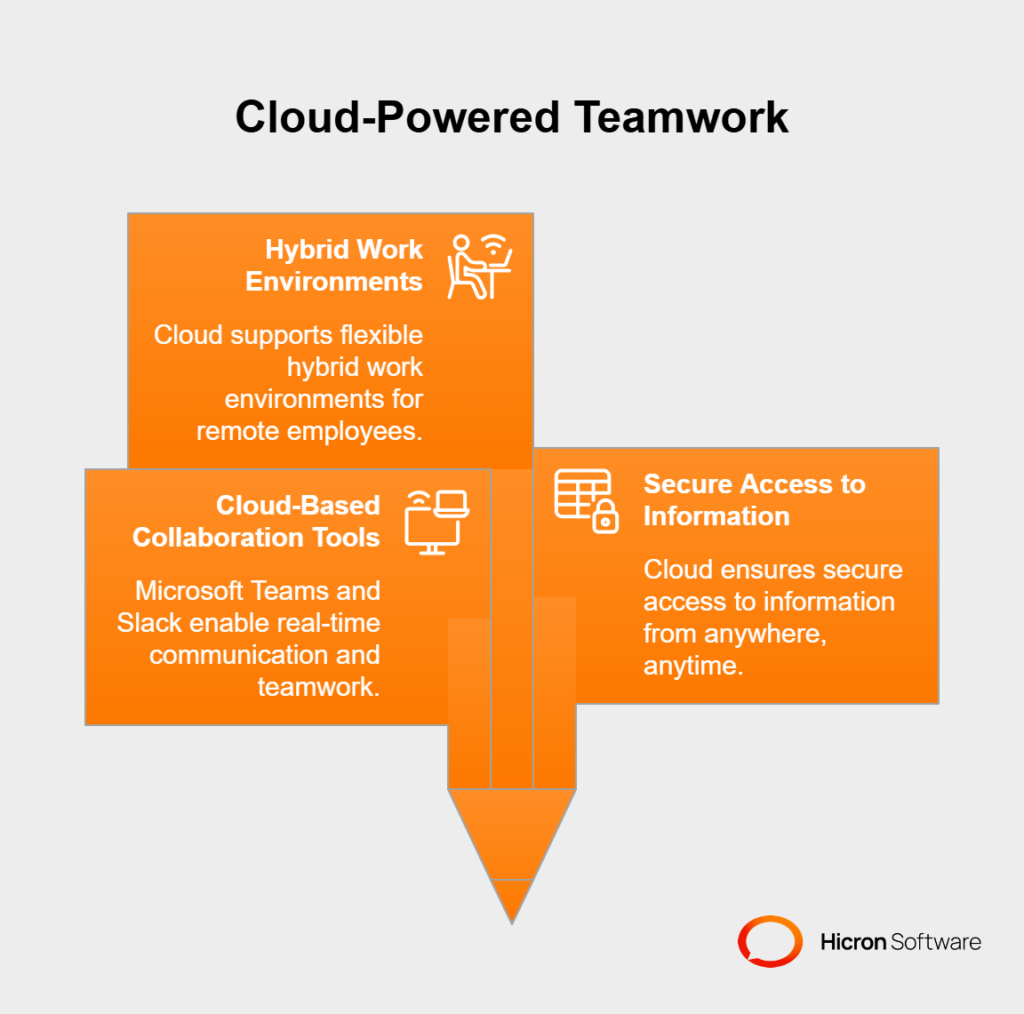

With teams often spread across multiple locations, cloud technology provides tools that enhance collaboration, improve productivity, and ensure secure access to information from anywhere.

Enhancing productivity for globally dispersed team members

With teams often spread across multiple locations, cloud-based collaboration tools like Microsoft Teams or Slack enable seamless communication and teamwork. These tools enable employees to share updates, access documents, and collaborate on projects in real-time.

For example, a global insurer implemented cloud-based collaboration tools, resulting in a 30% increase in productivity across its claims and underwriting teams. This improvement was attributed to faster information sharing and reduced decision-making delays.

Additionally, cloud platforms support hybrid work environments, allowing employees to work from anywhere without compromising security. This flexibility is especially valuable in today’s workforce, where remote work has become the norm.

Secure access to information from anywhere, anytime

Cloud technology enables employees to securely access critical information from any device, at any time, and from anywhere. This is particularly beneficial for field agents or claims adjusters who need to access data while on the move.

For instance, a claims adjuster using a cloud-based system can upload photos, update claim details, and communicate with the underwriting team in real-time. This not only speeds up the claims process but also improves customer satisfaction.

Moreover, cloud platforms employ advanced security measures, such as multi-factor authentication and data encryption, to protect sensitive information. According to Gartner, 70% of organizations using cloud solutions report improved data security compared to on-premises systems.

Implementing cloud technology in the insurance industry requires careful planning, strategic decision-making, and a focus on long-term scalability and growth. Below, we outline the key steps and considerations to ensure a smooth transition to cloud-based systems.

Selecting the right cloud model and vendor is critical to meeting the unique needs of the insurance industry. This decision impacts scalability, security, and overall operational efficiency.

Comparing public, private, and hybrid cloud models

Each cloud model offers distinct advantages, and insurers must evaluate which aligns best with their goals.

For example, a large European insurer adopted a hybrid cloud model to comply with GDPR regulations, leveraging public cloud scalability for customer-facing applications.

| Cloud Model | Advantages | Disadvantages | Best For |

| Public Cloud | Cost-effective, scalable | Less control over data security | Non-sensitive operations |

| Private Cloud | Enhanced security, full control | Higher costs, limited scalability | Core systems like claims processing |

| Hybrid Cloud | Balances cost and security | Complex to manage | Balancing compliance and flexibility |

Selecting vendors aligned with industry-specific needs

Not all cloud vendors are created equal, and insurers must choose partners who understand the unique challenges of the industry.

Key considerations include:

For instance, Microsoft Azure offers industry-specific solutions tailored to the insurance industry, including AI-driven fraud detection and claims automation tools.

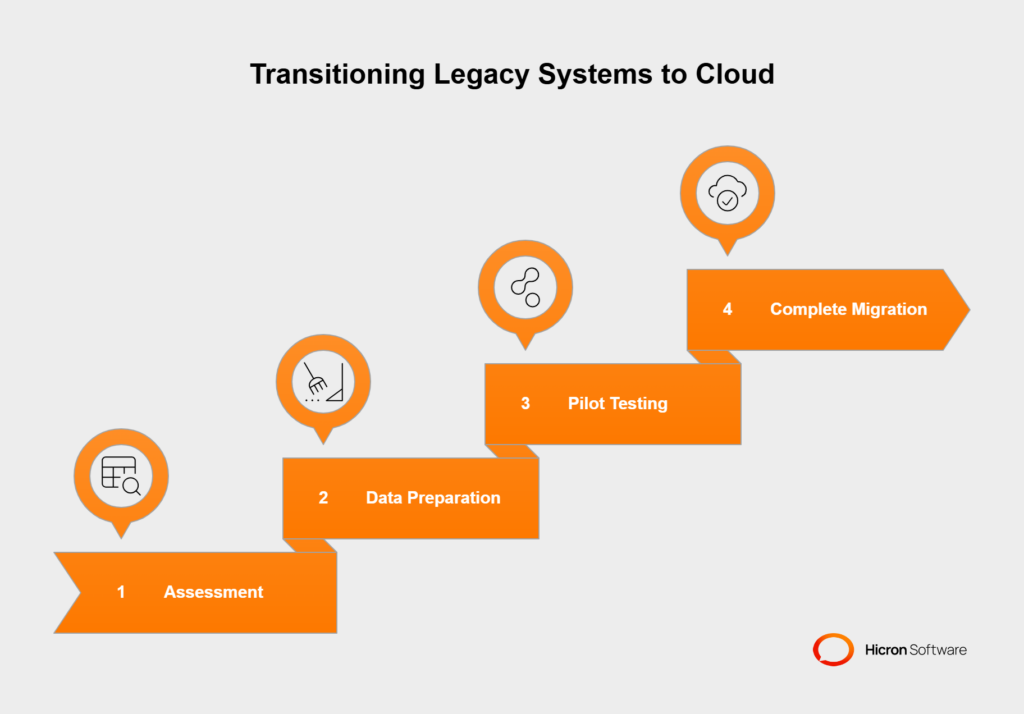

Migrating to the cloud can be complex, especially for insurers with legacy systems. A well-planned approach minimizes disruptions and ensures a smooth transition.

Step-by-step strategies for transitioning legacy systems

Legacy systems often form the backbone of insurance operations, but they can hinder scalability and innovation. Transitioning these systems to the cloud requires a phased approach:

For example, a U.S.-based insurer successfully migrated its claims processing system to the cloud in phases, resulting in a 40% reduction in downtime and a 25% improvement in processing speed.

Common challenges and how to overcome them

Cloud migration is not without its challenges, but proactive planning can mitigate risks.

A study by McKinsey found that insurers who proactively addressed these challenges during migration saw a 30% faster adoption rate and fewer operational disruptions.

| Challenge | Solution |

| Data Security Concerns | Implement encryption, multi-factor authentication, and regular audits. |

| Downtime During Migration | Schedule migrations during off-peak hours and use backup systems. |

| Resistance to Change | Engage stakeholders early and provide training on the benefits of cloud computing. |

Successful cloud implementation depends on the people using it. Training and fostering a culture of innovation are essential for maximizing the benefits of cloud technology.

Upskilling employees on cloud technologies

Employees require the right skills to effectively leverage cloud platforms. This includes training on:

For example, a global insurer partnered with a cloud vendor to provide hands-on training sessions for its IT and operations teams, resulting in a 20% increase in productivity within six months.

The insurance industry is leveraging scalable cloud solutions to address critical challenges, including operational inefficiencies, rising customer expectations, and the need for real-time data processing. These technologies are not just about modernization—they enable insurers to automate processes, enhance customer experiences, and refine risk management strategies. Below, we explore how cloud solutions are transforming key areas of the insurance sector.

| Application Area | Cloud Solution | Impact |

| Claims Processing | AI-driven automation | Faster claims resolution, reduced errors |

| Policyholder Experience | Cloud-based CRM systems | Personalized interactions, improved loyalty |

| Risk Assessment | Predictive analytics | Better underwriting, proactive risk management |

Claims processing is one of the most resource-intensive operations in the insurance industry. Traditional methods often involve manual data entry, paper-based workflows, and siloed systems, leading to delays and errors. Scalable cloud solutions are revolutionizing this process by introducing automation and real-time data integration.

Streamlining claims workflows

Cloud-based claims platforms enable insurers to automate repetitive tasks such as document verification, fraud detection, and payment processing.

For example, Optical Character Recognition (OCR) technology integrated into cloud systems can extract data from claim forms and validate it against policy details in seconds.

This eliminates the need for manual intervention, reducing processing times from weeks to mere hours. Additionally, cloud platforms enable seamless collaboration among adjusters, underwriters, and third-party vendors, ensuring that claims are resolved efficiently.

Case studies of cloud automation success

A leading European insurer has implemented a cloud-based claims management system that leverages AI to analyze photos of car accidents submitted by policyholders. The AI assesses the extent of the damage and provides an instant estimate for repairs, reducing claim settlement times by 60%. This innovation not only improved operational efficiency but also boosted customer satisfaction scores by 35%.

In another example, a U.S.-based health insurer implemented a cloud-powered fraud detection tool that analyzes claims in real-time. By identifying suspicious patterns, such as duplicate claims or unusual billing codes, the system has saved the company millions of dollars annually in fraudulent payouts.

These case studies highlight the transformative potential of cloud automation in streamlining claims processes and safeguarding insurers’ bottom lines.

In today’s competitive insurance market, delivering a superior customer experience is no longer optional—it’s a necessity. Scalable cloud solutions empower insurers to meet rising customer expectations by enabling personalized interactions and ensuring seamless support during periods of high demand.

Personalized customer interactions

Cloud-enabled Customer Relationship Management (CRM) systems allow insurers to create highly personalized experiences for their policyholders. By analyzing data such as policy history, claims activity, and customer preferences, insurers can offer tailored recommendations and proactive support.

For instance, a life insurance provider might use cloud analytics to identify customers nearing retirement age and suggest relevant policy upgrades or annuity options.

AI chatbots hosted on cloud platforms further enhance personalization by providing instant, context-aware responses to customer inquiries. These chatbots can handle routine tasks, such as policy updates or claim status checks, freeing up human agents to focus on more complex issues. The result is a seamless and efficient customer experience that fosters trust and loyalty.

Scaling call center operations

During peak periods, such as natural disasters or open enrollment seasons, call centers often face overwhelming demand. Cloud-based contact center solutions offer the scalability necessary to handle these surges effectively.

For example, during a recent hurricane, a major U.S. insurer used a cloud platform to onboard additional remote agents within hours, ensuring that policyholders received timely assistance.

These systems also integrate with AI tools to prioritize urgent cases, such as property damage claims, and route them to the most qualified agents. By leveraging cloud technology, insurers can maintain high service levels even during crises, reinforcing their commitment to customer care.

Risk assessment and fraud detection are critical areas where scalable cloud solutions are making a significant impact. By leveraging real-time data and advanced analytics, insurers can identify potential risks and fraudulent activities with greater accuracy and speed.

Leveraging cloud data for real-time fraud analytics

Fraudulent claims cost the insurance industry billions of dollars annually, but cloud-powered analytics tools are helping insurers combat this issue. These tools aggregate and analyze vast amounts of data in real-time, identifying patterns and anomalies that may indicate potential fraud.

For example, a cloud-based fraud detection system can cross-reference claims data with external sources, such as social media activity or public records, to flag inconsistencies.

Machine learning algorithms continuously improve their accuracy by learning from past cases, enabling insurers to detect even the most sophisticated fraud schemes.

One notable success story involves a global property insurer that implemented a cloud-based fraud detection platform. The system identified a suspicious pattern of claims involving staged accidents, which led to the discovery of a fraud ring and resulted in the company saving over $10 million in payouts.

Enhancing risk management strategies with AI and Machine Learning

Risk management is another area where cloud technology is driving innovation. By integrating AI and machine learning into their risk assessment processes, insurers can analyze complex datasets to predict potential risks and develop proactive strategies.

For instance, insurers can use cloud-based AI tools to assess the risk of natural disasters, such as hurricanes or wildfires, by analyzing historical weather data, satellite imagery, and real-time environmental conditions. This allows them to adjust premiums, allocate resources, and provide policyholders with timely warnings.

Additionally, machine learning models can evaluate individual policyholder behavior to identify high-risk customers.

For example, a health insurer might use wearable device data to assess lifestyle risks, such as smoking or lack of physical activity, and offer personalized wellness programs to mitigate those risks.

Scalability is a cornerstone of modern insurance operations, enabling companies to adapt to crises, meet surging demands, and reduce costs while expanding their capabilities. Cloud technology has proven to be a transformative tool, helping insurers thrive under pressure and achieve measurable success. Below, we explore real-world examples of how cloud platforms have delivered results.

The insurance industry has faced significant challenges in recent years, from global pandemics to natural disasters. Cloud platforms have been instrumental in helping insurers maintain stability and deliver uninterrupted services during these critical times.

How cloud platforms helped maintain stability during the pandemic?

During the COVID-19 pandemic, UnitedHealth Group, one of the largest health insurers in the U.S., leveraged its cloud-based infrastructure to transition 90% of its workforce to remote operations within two weeks. This rapid shift ensured that claims processing, customer support, and policy renewals continued without disruption. The company also utilized cloud-powered analytics to monitor and predict healthcare trends, allowing it to adjust policies and provide timely support to its policyholders.

In Europe, Allianz, a global insurance leader, saw a 300% increase in online policy applications during the pandemic. By utilizing its cloud-based customer portal and AI-driven chatbots, Allianz managed the surge seamlessly. The company reduced response times by 40% and achieved a 25% increase in customer satisfaction scores, demonstrating the scalability and efficiency of its cloud infrastructure.

Real-world examples of thriving under high demand

Case no.1: Natural disasters often lead to a surge in claims, testing the scalability of insurers’ operations. Following the devastating Australian wildfires in 2020, QBE Insurance Group faced a 200% increase in claims. By leveraging its cloud-based claims management system, QBE processed 80% of claims within 48 hours—an industry-leading performance compared to the typical 10-day average.

Case no.2: During Hurricane Ida in 2021, State Farm used cloud-powered analytics to prioritize high-risk claims and allocate resources effectively. The company’s cloud platform enabled real-time collaboration between adjusters, underwriters, and contractors, reducing claim resolution times by 50%. This not only minimized customer frustration but also reinforced State Farm’s reputation for reliability during crises.

Cloud technology offers insurers a dual advantage: significant cost savings and the ability to innovate and expand services. By transitioning to the cloud, companies can eliminate the need for expensive on-premises infrastructure and pay only for the resources they use.

Companies that transitioned to the cloud to save costs and innovate

Case no.1: Aviva, a leading UK-based insurer, transitioned its IT infrastructure to the cloud as part of a digital transformation initiative. This move reduced operational costs by 30%, resulting in annual savings of millions for the company. Aviva reinvested these savings into developing new digital tools, including a mobile app for policy management and a telematics-based pricing model. Within a year, the company reported a 25% increase in customer retention and a 15% growth in new policy sales.

Case no.2: In the U.S., Munich Re, a global reinsurer, adopted a hybrid cloud model to optimize its data storage and analytics capabilities. By moving 70% of its workloads to the cloud, Munich Re reduced IT expenses by $5 million annually. The company also gained the flexibility to scale its operations during peak periods, such as natural disasters, ensuring uninterrupted service to its clients.

Metrics that demonstrate transformation success

The impact of cloud adoption is evident in the measurable results achieved by insurers:

These examples and metrics highlight the transformative power of cloud-driven scalability, proving that it’s not just a theoretical advantage but a practical solution that delivers real-world results.

As the insurance industry continues to evolve, cloud technology is poised to play an even greater role in driving innovation and efficiency. Emerging trends such as multi-cloud architectures, AI-driven platforms, and serverless computing are shaping the future of insurance operations. These advancements promise to enhance scalability, improve decision-making, and simplify complex processes, ensuring insurers remain competitive in a rapidly changing landscape.

| Trend | Description | Impact |

| Multi-Cloud Architectures | Use multiple cloud providers for flexibility and resilience. | Reduced downtime, enhanced performance. |

| AI-Driven Platforms | Integrate AI for advanced analytics and automation. | Improved decision-making, fraud detection. |

| Serverless Computing | Simplify application development and scale resources automatically. | Faster innovation, cost savings. |

The adoption of multi-cloud and hybrid cloud models is gaining momentum in the insurance sector. These architectures allow insurers to leverage the strengths of multiple cloud providers while maintaining flexibility and control over their data and applications.

The shift towards flexible, interconnected cloud models

Multi-cloud and hybrid architectures enable insurers to distribute workloads across multiple cloud environments, optimizing performance and cost efficiency.

For example, an insurer might utilize a public cloud for customer-facing applications, while maintaining sensitive policyholder data in a private cloud for enhanced security.

This interconnected approach ensures that insurers can adapt to changing business needs without being locked into a single vendor.

Benefits of diversifying cloud resources for insurers

Diversifying cloud resources reduces the risk of downtime and enhances resilience. In the event of a service disruption with one provider, insurers can seamlessly shift operations to another cloud platform, ensuring uninterrupted service. Additionally, this approach enables insurers to leverage specialized tools and services provided by various providers, including advanced analytics and AI capabilities, thereby further enhancing their operational efficiency.

AI-driven cloud platforms are transforming the way insurers analyze data, predict trends, and make decisions. By integrating AI into their cloud infrastructure, insurers can unlock new levels of insight and automation.

Supporting advanced analytics and predictive insights

AI-powered cloud platforms enable insurers to process vast amounts of data in real time, uncovering patterns and trends that were previously difficult to detect.

For instance, predictive analytics can help insurers identify emerging risks, such as climate-related events, and adjust their underwriting strategies accordingly.

This not only improves risk management but also enhances profitability.

Enabling proactive decision-making through AI integration

AI integration allows insurers to move from reactive to proactive decision-making.

For example, an AI-driven claims system can predict potential fraud based on historical data and flag suspicious claims for further investigation.

Similarly, AI tools can provide personalized policy recommendations to customers, improving satisfaction and retention. These capabilities position insurers as forward-thinking and customer-centric organizations.

Serverless computing is an emerging trend that simplifies application development and deployment, making it an attractive option for insurers looking to innovate quickly.

Simplifying application development and deployment

With serverless computing, insurers can focus on building and deploying applications without worrying about managing the underlying infrastructure. This approach reduces development time and costs, enabling insurers to introduce new products and services to the market more quickly.

For example, a serverless architecture can be used to develop a chatbot for customer support, enabling rapid deployment and scalability.

Leveraging serverless models for elastic scalability

Serverless models offer elastic scalability, meaning resources are automatically allocated based on demand. This is particularly beneficial during peak periods, such as natural disasters or open enrollment seasons, when insurers experience a surge in customer interactions. By leveraging serverless computing, insurers can ensure that their systems remain responsive and efficient, even under the most demanding workloads.

Cloud technology is revolutionizing the insurance industry, offering scalable solutions that enhance efficiency, improve customer experiences, and foster innovation. From multi-cloud architectures to AI-driven platforms and serverless computing, these advancements are equipping insurers to thrive in an increasingly dynamic and competitive landscape.

As the industry continues to evolve, staying ahead means embracing the potential of scalable cloud solutions. If you’re considering the next steps in modernizing your operations, our specialists are here to help. Feel free to contact us to discuss how cloud technology can support your business goals and unlock new opportunities.

Cloud technology is a method of storing, managing, and accessing data and software over the internet, rather than on a local computer or server. It enables businesses to utilize computing resources as needed and from anywhere, making operations more flexible and efficient.

Cloud technology is important because it allows companies to quickly adapt to changing needs, reduce IT costs, and improve collaboration. It provides secure access to data, helping businesses stay competitive in the digital age.

Cloud technology helps insurance companies work more efficiently by allowing them to process data faster, automate routine tasks, improve customer service, and scale their operations to handle more claims and customers as needed.

Cloud technology for insurance refers to the use of cloud-based platforms and services to store, manage, and analyze data, as well as to run software applications. It enables insurance companies to enhance scalability, improve operational efficiency, and deliver a better customer experience by leveraging flexible and secure IT resources.

Scalability ensures that insurance companies can handle growing workloads, such as an increase in policyholders or claims, without compromising performance. This adaptability allows insurers to meet customer demands, comply with regulatory changes, and introduce new products without overburdening their systems.

Cloud technology enables insurers to scale IT resources dynamically in response to demand. During high-demand periods, such as natural disasters or open enrollment seasons, cloud platforms can automatically allocate additional resources. This ensures seamless operations and consistent service quality, even during periods of high activity.

Custom insurance software development creates tailored solutions that address specific operational needs. These systems are designed to integrate efficiently with cloud platforms, enabling insurers to scale their operations effortlessly while maintaining compliance, security, and performance.

Cloud technology is the backbone of digital transformation in the insurance industry, enabling companies to modernize legacy systems, enhance data processing capabilities, and adopt advanced technologies such as AI and predictive analytics. This helps insurers improve decision-making, optimize workflows, and deliver personalized experiences.

AI-driven cloud platforms transform insurance operations by enabling advanced analytics, fraud detection, and predictive insights. For instance, AI solutions can automate claims processing, identify patterns in customer behavior, and assess risks more accurately, resulting in improved customer satisfaction and enhanced risk management.

Serverless computing allows insurers to focus on building applications without worrying about managing the underlying infrastructure. This simplifies development, reduces costs, and provides elastic scalability, making it easier to handle fluctuating operational demands, such as customer support surges or spikes in claims processing volume.

Cloud platforms provide robust security features, including encryption, multi-factor authentication, and real-time threat monitoring. These features enable insurers to protect sensitive policyholder data, comply with regulations, and mitigate risks associated with cyber threats.

Yes, cloud platforms simplify compliance by providing tools for secure data management, automated reporting, and real-time updates to regulatory frameworks. Insurers can rely on cloud technology to quickly adapt to new regulations while reducing the risk of non-compliance.

Cloud technology provides the flexibility and scalability that insurtech companies need to experiment with innovative solutions, such as telematics-based insurance, AI-powered chatbots, and personalized policy offerings. This fosters a culture of innovation, allowing companies to stay ahead of market trends and deliver more value to customers.

Common challenges include data migration from legacy systems, ensuring data security, managing costs, and overcoming employee or stakeholder resistance to change. However, these challenges can be addressed with strategic planning, phased implementation, and robust training programs.

Insurers should consider factors such as scalability, security, compliance capabilities, cost-effectiveness, and vendor expertise when evaluating insurance-specific solutions. Hybrid models, which combine public and private cloud features, are often ideal for striking a balance between flexibility and security.

Absolutely. Cloud technology offers cost-effective, pay-as-you-go models that make it accessible for smaller insurance companies and insurtech startups. The flexibility and scalability of cloud solutions allow them to grow efficiently and compete with larger players.

The future of cloud technology in insurance includes greater adoption of multi-cloud and hybrid models, AI-driven analytics, and serverless computing. These advancements will further enhance scalability, automation, and innovation, enabling insurers to stay adaptive in an increasingly dynamic market.

Insurers should begin by assessing their current IT systems, identifying areas for improvement, and selecting a suitable cloud platform. Collaborating with experienced insurance software developers and cloud consultants can streamline the implementation process, ensuring a successful transition.