Modernizing Insurance Frontends with Java-Based Frameworks like Vaadin

- June 07

- 13 min

Definition: Insurance fraud detection software is an AI-powered tool that identifies and prevents fraudulent claims, ensuring accuracy and efficiency in the insurance process.

Insurance fraud detection software in the era of AI is transforming how insurers combat fraudulent claims. Leveraging machine learning and data analytics, these systems reduce losses and boost operational efficiency. Discover how insurance fraud detection software is redefining the industry.

With AI, the insurtech industry combats increasingly tech-savvy fraudsters, protecting policyholders and building trust through transparency and reliability.

Insurance fraud is a billion-dollar problem that continues to erode the insurance industry’s financial stability. Whether it’s exaggerated claims, staged accidents, or even outright fabrications, fraud impacts insurers, policyholders, and the entire ecosystem.

For years, insurance companies have relied on traditional methods to detect deception. While these approaches were effective to an extent, they often required painstaking manual reviews, reactive strategies, and left considerable room for error. However, old solutions are no longer enough in a world where fraudsters are becoming increasingly tech-savvy.

To make a change, enter AI. Insurance tech has taken a giant leap forward by integrating artificial intelligence and machine learning. These cutting-edge tools are reshaping the way fraud is detected.

Forget slow manual processes—AI in insurance offers fraud detection software that analyzes voluminous data sets in seconds, identifies unusual patterns, and flags suspicious claims accurately. AI systems improve fraud detection accuracy by more than 50% compared to traditional methods. Additionally, AI can help reduce fraud detection costs by 30%, making it both effective and cost-efficient. Faster claim resolutions reduced financial losses and a stronger shield against evolving threats.

The transformation is far from just technical. It’s a paradigm shift for the entire insurtech industry. With AI leading the charge, we’re witnessing a powerful union of software development, insurance web application development, predictive analytics, and real-time insights that allow insurers to stay ahead of the game. Fraud won’t stop, but with AI-powered innovation, neither will the fight to eradicate it.

| Aspect | Traditional Methods | AI-Powered Methods |

| Speed | Slow, manual reviews | Real-time analysis |

| Accuracy | Prone to human error | High accuracy with machine learning |

| Scalability | Limited by human resources | Scalable to handle millions of claims |

| Fraud Detection Approach | Reactive (after fraud occurs) | Proactive (detects fraud before payouts) |

| Cost | High operational costs | Cost-effective automation |

Artificial Intelligence, or AI, is revolutionizing nearly every industry it touches, and the insurance sector is no exception. At its core, AI refers to machines and systems that mimic human intelligence, enabling them to learn, reason, and make decisions.

When applied to fraud detection software in the insurance industry, AI becomes an invaluable ally. With fraud costing insurers billions of dollars each year, the need for more innovative solutions, such as AI, is more urgent than ever.

AI in insurance fraud detection software works hand-in-hand with machine learning. These models are designed to analyze vast amounts of data efficiently, sifting through intricate patterns and spotting anomalies that might otherwise go unnoticed.

For instance, machine learning can compare thousands of claims, identifying unusual details or discrepancies that indicate potential fraud. Whether it’s detecting multiple claims for a single accident or recognizing abnormally high medical payouts, these systems excel at finding red flags in complex datasets.

One of the most significant advantages of AI is its ability to process data at lightning speed, outpacing even the most experienced human teams. Traditional fraud detection methods, like manual reviews, are time-consuming and prone to human error.

Insurance fraud detection software, powered by AI, for the insurance industry can handle millions of data points in real-time, scouring digital trails and detecting signs of fraudulent activity before it becomes a larger issue. Beyond speed, these systems continuously evolve by learning from new data, sharpening their accuracy over time.

The application of AI doesn’t just stop at identifying fraud. It transforms the entire detection process, allowing insurers to respond proactively rather than reactively. With AI, companies in the insurtech industry can protect their bottom line, maintain trust with their policyholders, and tackle an evolving threat with unmatched precision.

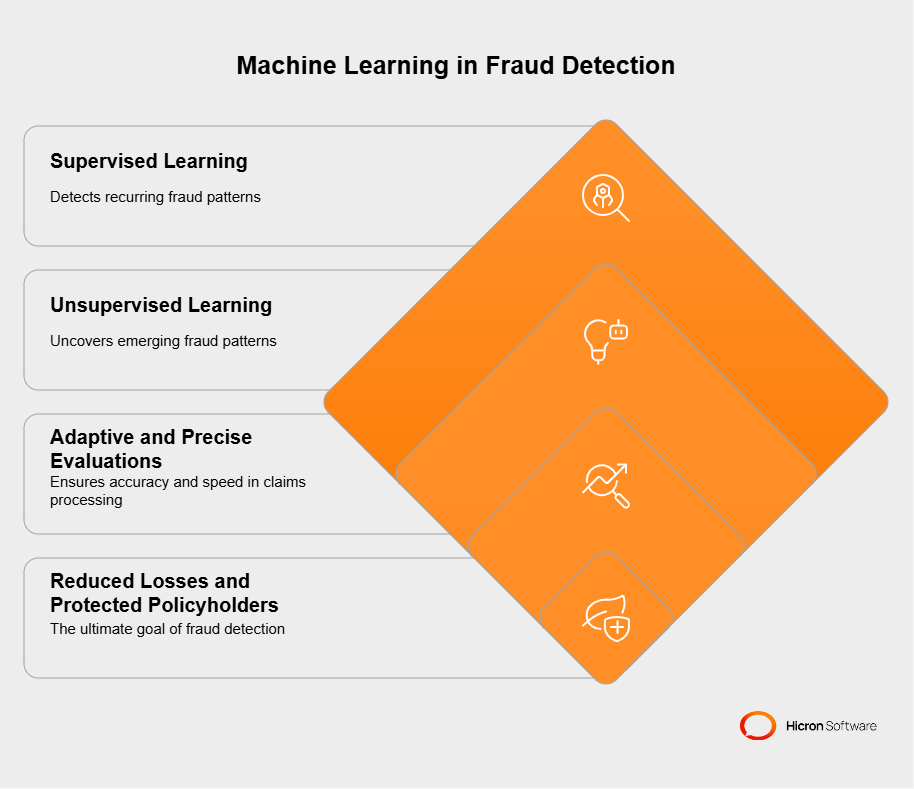

Machine learning has become a game-changing tool in the insurance industry, particularly in combating fraud. These intelligent algorithms are revolutionizing how insurers analyze claims data by efficiently detecting unusual patterns that might signal fraudulent behavior.

This advanced approach lays the groundwork for enhanced protection against increasingly sophisticated threats.

| Technique | Description |

| Supervised Learning | Uses historical data to identify known fraud patterns. |

| Unsupervised Learning | Detects new fraud techniques by analyzing anomalies in data. |

| Predictive Analytics | Identifies high-risk claims based on historical trends and patterns. |

| Real-Time Analytics | Processes claims instantly to flag suspicious activity. |

| Image Recognition | Analyzes photos for discrepancies in damage claims. |

One of the most effective applications of machine learning in insurance is through supervised learning. These models are trained using historical data that includes examples of both fraudulent and legitimate claims. The algorithm identifies red flags in new claims by learning from these datasets.

For example, if a claim closely resembles past fraudulent activity, such as unusually high repair costs or repeated treatments for the same injury, it triggers an alert. This system helps insurers proactively flag and investigate questionable claims before payouts are made, saving time and resources.

While supervised learning identifies known patterns, unsupervised learning dives into the unknown. Unlike its counterpart, this method doesn’t rely on pre-labeled data. Instead, it looks for hidden relationships, anomalies, and previously undetected patterns within the claims data.

For instance, unsupervised learning can uncover suspicious clusters of claims from the same location or identify a sudden spike in a particular payout category. This approach is invaluable for discovering new fraud techniques and staying ahead of crafty fraudsters who constantly develop ways to outsmart traditional detection systems.

Together, supervised and unsupervised learning form a powerful combination. Supervised learning leverages past knowledge to detect recurring fraud patterns, while unsupervised learning uncovers emerging threats. This dual approach strengthens fraud detection software for insurance, making it more robust and adaptive.

As advancements in AI and claims processing evolve, machine learning continues to refine and enhance its accuracy. It ensures faster, more precise evaluations and adapts to changing risks, ultimately helping insurers reduce losses and protect honest policyholders.

Traditional systems often flag legitimate claims as fraudulent, wasting valuable resources and creating frustration for honest policyholders. AI, however, is changing the game. Fraudulent insurance claims cost the U.S. insurance industry a staggering $308.6 billion annually. By adopting AI-driven fraud detection, insurers could save between $80 billion and $160 billion by 2032, highlighting the transformative potential of these technologies.

By improving the precision of detection processes, AI minimizes these false alarms and ensures that suspicious claims are more accurately identified.

| Benefit | Description |

| Enhanced Accuracy | AI minimizes false positives and ensures legitimate claims are prioritized. |

| Real-Time Analysis | Processes vast datasets instantly to detect fraud as it happens. |

| Cost Savings | Reduces operational costs by automating manual processes. |

| Improved Customer Trust | Builds transparency and fairness by reducing fraudulent payouts. |

| Faster Claim Resolutions | Speeds up the claims process for honest policyholders. |

AI in insurance fraud detection software uses advanced algorithms and machine learning to refine its decision-making. Unlike manual reviews or rule-based systems, AI evolves with every new dataset. It learns not just to catch fraudulent claims but also to differentiate them from genuine ones.

For example, fraud detection software for insurance can analyze behavior patterns, historical records, and claim details simultaneously, flagging only those that show signs of anomaly. This sharpens accuracy and significantly reduces the number of false positives.

Predictive analytics takes AI’s precision a step further. This technology identifies high-risk claims by analyzing historical data and spotting trends before they become a problem. For instance, insurers can predict the likelihood of fraud in claims based on patterns such as repeated submissions or anomalies in reported damages.

This proactive approach enables insurers to prioritize and investigate claims with a higher likelihood of fraud, thereby streamlining the entire process.

The numbers don’t lie. AI-driven fraud detection software have shown remarkable improvements in real-world applications.

A leading insurance tech company recently implemented AI-based predictive analytics, resulting in a 40% reduction in false positives. Additionally, another insurer using custom fraud detection software saw a 25% increase in fraud identification accuracy within the first year of deployment.

These improvements save time and resources, preserving trust with policyholders who experience fewer unnecessary delays.

With its ability to learn and adapt, AI enhances the accuracy of identifying insurance fraud. It enables insurers to focus on genuine risks while streamlining workflows and delivering a more seamless customer experience. Thanks to the precision of AI-powered systems, the days of blanket suspicion are over.

Fraud can be a costly problem for insurers, and identifying it quickly is critical to preventing financial losses and protecting honest policyholders. AI is transforming this process by significantly accelerating fraud detection timelines. Through its ability to conduct real-time analysis of claims data, automate routine checks, and make instant decisions, AI allows insurers to stay ahead of bad actors while improving operational efficiency and customer satisfaction.

One of AI’s standout capabilities is its ability to perform real-time analysis. Traditional insurance fraud detection methods often involve lengthy processes, such as manually reviewing claims over several days or weeks, which can be time-consuming and inefficient. Conversely, AI processes vast amounts of claims data instantly, flagging potentially fraudulent activity as soon as it appears.

For example, imagine an insurer receiving a claim for a luxury car stolen under unusual circumstances. AI-based fraud detection software analyzes the details instantly, cross-referencing it with geolocation data, similar claims in the area, and even the claimant’s history.

If the insurance fraud detection software finds correlations with known fraud schemes or flags inconsistencies in the documentation, it can raise an alert within seconds. This enables the insurer to act quickly by requesting additional information or starting an investigation, saving both time and resources.

Routine insurance fraud detection tasks are often time-consuming and repetitive, but essential for any insurance operation. AI excels at automating these routine checks, taking over tasks that typically require hours of manual labor.

For instance, claims automation software can verify basic information such as policy completeness, claimant identity, and the consistency of reported damages against historical trends. It may also match claims details against databases of past fraudulent cases to identify red flags.

Take the case of staged automobile accidents. AI can scan for patterns in claims, such as multiple claims involving the same vehicles or claimants. It could also detect identical repair estimates or suspiciously similar injury reports across policyholders. By automating this level of scrutiny, AI allows human investigators to focus on broader, more intricate fraud cases, such as organized crime rings targeting insurers.

Insurance companies often face heightened claims activity, especially after hurricanes, wildfires, or major public incidents. Manually processing a flood of claims strains human resources and increases the risk of fraudulent activity slipping through the cracks. Here, AI proves invaluable.

For example, insurers might receive thousands of claims following a natural disaster in a single day. AI-powered fraud detection systems can scrutinize each claim as it arrives, looking for unusual patterns or inconsistencies in the data. A claim for water damage submitted alongside duplicate claims from the same address or neighborhood might raise a red flag and be escalated for further investigation.

Meanwhile, legitimate claims can move swiftly through the system and toward settlement, maintaining a seamless customer experience for those who need help urgently.

This quick, data-driven decision-making isn’t just for bulk claims. It’s also vital in individual urgent cases.

For instance, if someone files for medical coverage after an accident requiring immediate treatment, AI insurance fraud detection software can verify the claimant’s policy, assess the claim’s validity, and approve disbursement within minutes.

This ensures the policyholder receives timely support, aided by a system that strikes a balance between speed and due diligence.

By blending speed, accuracy, and adaptive learning, AI has transformed fraud detection in insurance. Real-time analysis enables insurers to address risks promptly, automated checks streamline processing while minimizing human error, and instant decision-making ensures swift action even in high-pressure scenarios.

These capabilities empower insurers to safeguard their operations while providing genuine claimants with a smoother and faster resolution process.

Insurance fraud is a persistent challenge, costing the industry billions annually. However, advancements in artificial intelligence enable insurers to detect and prevent fraud more effectively.

From evaluating claims using image verification to leveraging predictive analytics, AI provides powerful tools to combat fraudulent activities across multiple insurance industry sectors. Below are detailed case studies from the automotive, healthcare, and property insurance sectors that illustrate the impact of these AI-powered solutions.

Imagine a policyholder submits a claim for extensive car damage following an accident. Traditionally, this would require a physical vehicle inspection, a process prone to delays and potential errors. However, insurers using AI-powered image verification can now evaluate claims almost immediately.

AI tools analyze photos submitted by the claimant, cross-referencing them with historical damage reports and accident data to provide accurate assessments. Advanced image recognition technology can spot discrepancies, such as staged damage or edited photographs, providing an immediate red flag for fraud. Additionally, these systems can integrate telematics insurance technology, such as black box data or GPS reports, to confirm the plausibility of the incident.

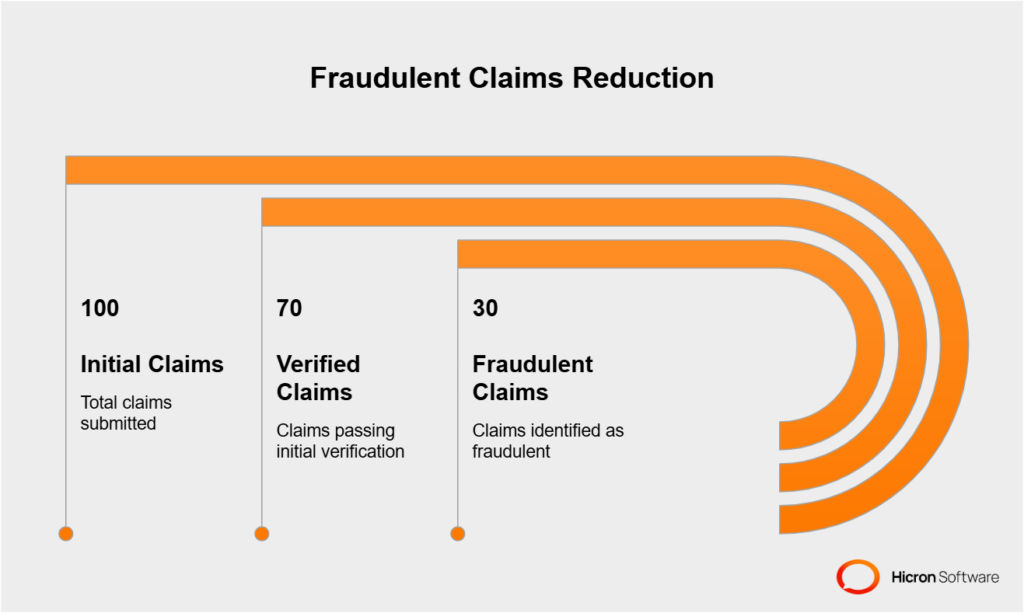

A leading insurer applied this approach alongside AI-driven automotive insurance software solutions. Automating claim reviews and integrating telematics data resulted in a nearly 30% reduction in fraudulent claims. This not only saved the company millions in payouts but also sped up settlements for honest policyholders, creating a seamless and trustworthy claims process.

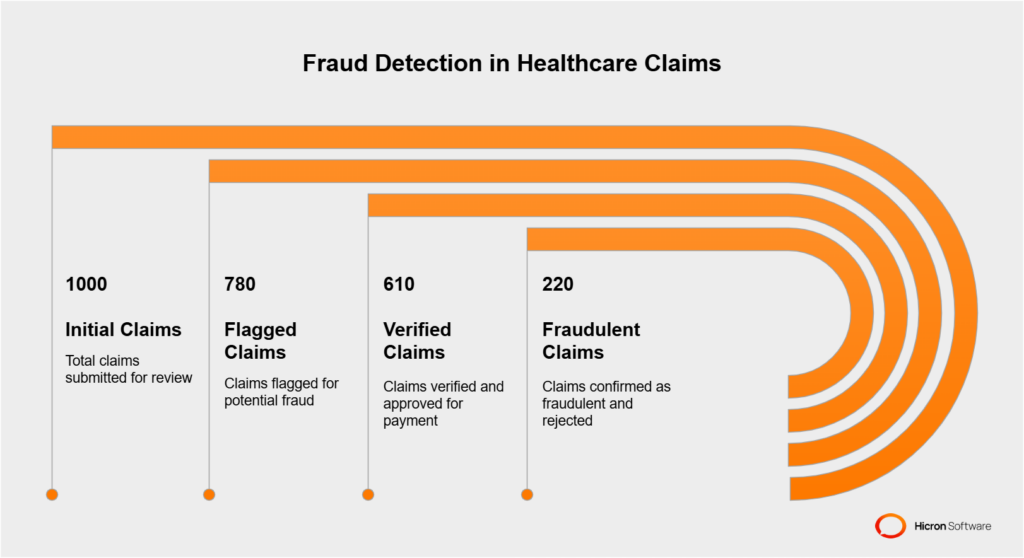

Healthcare insurance fraud, including duplicate billing or inflated procedures, is one of the industry’s costliest challenges. AI-driven medical insurance software solutions are making impressive strides in addressing these issues. These systems carefully analyze claims for inconsistencies, employing automated processes to spot errors that could signal fraud.

For instance, telemedicine insurance integration ensures accuracy and compliance. When claims involve telehealth visits, AI compares billing codes and checks for duplications or irregularities. Automated systems also flag patterns where specific providers or procedures may show abnormally high billing, prompting further review.

A notable example of success comes from a health insurer that implemented AI-powered tools in its fraud detection strategy. By flagging claims with inflated procedures or ghost patients (fraudulent charges for non-existent policyholders), the company reduced fraud by 22% in six months.

This enabled the company to maintain precise oversight while enhancing its healthcare insurance automation to be more patient-centric, ultimately benefiting both insurers and policyholders.

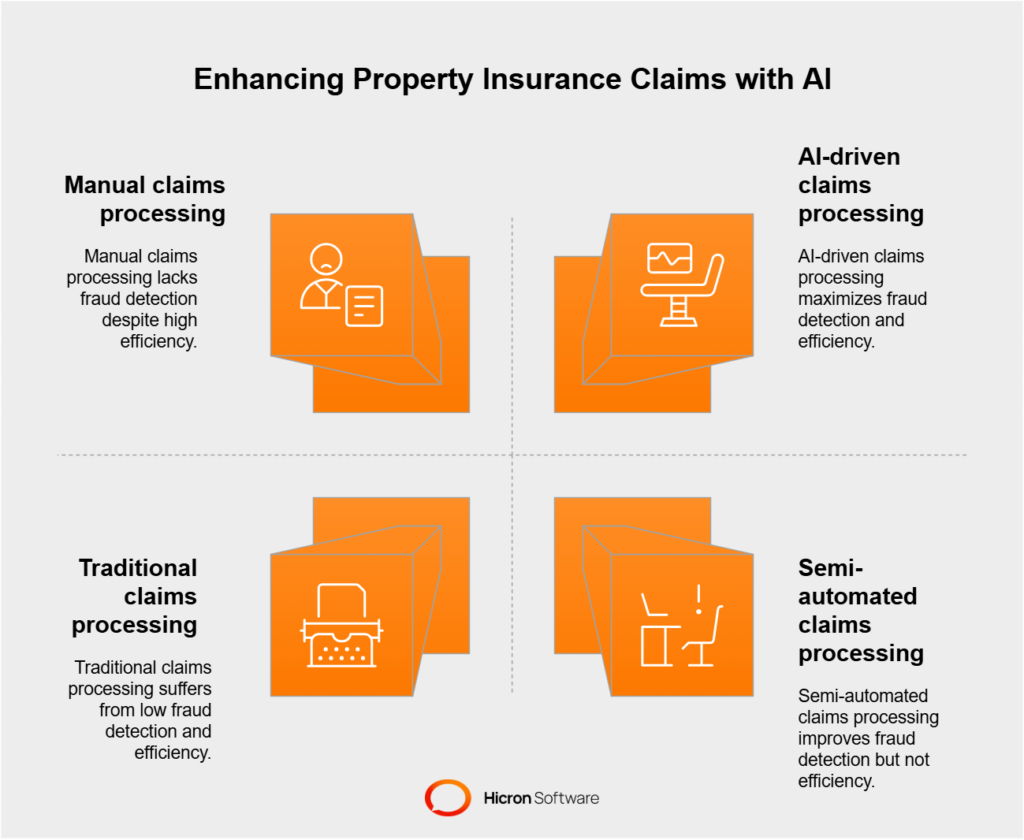

Property insurance fraud often spikes following natural disasters when claims flood in for damages caused by hurricanes, wildfires, or other catastrophic events. AI has become an invaluable asset in managing disaster claims while reducing losses due to fraud.

By combining real estate insurance automation with machine learning and aerial imagery, insurers can verify the accuracy of property damage claims.

For example, AI programs compare post-disaster imagery to satellite data taken before the event. This allows insurers to confirm that reported damages align with the actual impact of the disaster. Additionally, predictive analytics tools assess claim patterns to identify outliers, such as claims from areas unaffected by the event.

In one instance, a large property insurance company adopted AI-assisted disaster claims management tools after a major hurricane. Their system flagged over 15% of incoming claims as suspicious due to inconsistencies in the reported damage.

By focusing on claims backed by verifiable data, the company ensured payouts went only to genuine claimants, saving over $10 million in potential fraud losses. Furthermore, this streamlined approach allowed them to process and close claims more efficiently, improving customer satisfaction.

| Sector | AI Application | Result |

| Automotive Insurance | Image recognition for damage claims | 30% reduction in fraudulent claims |

| Healthcare Insurance | Telemedicine integration to detect duplicate billing | 22% fraud reduction in 6 months |

| Property Insurance | Satellite imagery to verify disaster-related claims | $10M saved in fraud losses |

Implementing AI insurance fraud detection software isn’t just about catching fraudsters; it’s redefining how insurers operate. Fraud detection software for insurance, such as claims automation tools and custom insurance software, has enabled companies to:

AI is revolutionizing fraud detection by combining precision, scalability, and speed. Whether it’s identifying exaggerated car damage, flagging inflated medical claims, or verifying property loss after a disaster, these AI-driven solutions are reshaping the insurance industry.

Fraud detection software for insurance, combined with tailored tools like claims automation and predictive analytics, empowers insurers to combat fraud while delivering better outcomes for honest policyholders. As the industry continues to innovate, AI is the foundation for a more secure, efficient, and customer-centric future in the insurance sector.

Fraud has long been a significant headache for the insurance industry, draining billions of dollars annually. But thanks to AI-powered fraud detection systems, things are taking a turn for the better.

These advanced tools aren’t just catching fraudsters; they’re completely reshaping how insurers work. The benefits aren’t just for the companies, either—policyholders get a slice of the pie, too. Let’s examine how these intelligent systems are making life easier for everyone involved.

One of the most significant advantages of AI-driven insurance fraud detection is its ability to drastically cut operational costs. Traditional fraud investigations often involve extensive manual work, including interviews, on-site inspections, and reviewing large amounts of data. These processes take time, money, and manpower, forcing insurers to keep up with claim volumes.

With AI, much of this burden is eliminated. Claims automation software enables insurers to process claims more efficiently, utilizing predictive analytics to flag only the most suspicious cases for further review and investigation.

Insurance fraud detection software can analyze vast datasets in minutes, identifying patterns or inconsistencies that would take humans hours or days to detect. This efficiency reduces the need for large investigative teams and accelerates the resolution process.

Furthermore, these systems prevent overpayments by accurately flagging fraudulent claims before reimbursements are issued.

For example, an insurer utilizing AI in claims processing can identify duplicate medical claims or fraudulent property damage, thereby saving millions in unwarranted payouts.

These cost savings can then be reinvested into improving services or offering more competitive policies, keeping insurers ahead of the curve in an increasingly competitive market.

AI-enabled fraud detection in insurance isn’t just about savings; it’s about fairness. These systems build trust with policyholders by ensuring claims are processed accurately and swiftly. No one likes waiting weeks or months for a decision on their claim, especially if their situation is dire. AI ensures faster and more precise resolutions, demonstrating to customers that their insurer values transparency and reliability.

For instance, by utilizing advanced claims automation and fraud detection tools, companies can quickly distinguish between honest claims and fraudulent ones. This minimizes delays for legitimate policyholders while holding fraudsters accountable.

Trust also grows when customers see that their policy premiums aren’t inflated due to fraudulent activity. When insurers stay ahead of fraud, they can avoid passing unnecessary costs onto their policyholders, keeping pricing fair and policies attractive. Over time, this fosters loyalty and strengthens the relationship between the insurer and the policyholder.

Fraud doesn’t just harm insurers financially; it often brings legal complications that can consume additional resources. Disputed claims or accusations of fraud can escalate into lawsuits, straining client relationships and damaging an insurer’s reputation. AI-powered systems mitigate these risks by proactively identifying fraud.

By catching fraudulent claims early, these systems reduce the likelihood of disputes escalating into costly litigation. Insurers can rely on comprehensive data and AI-generated insights to confidently identify and reject fraudulent claims, as well as negotiate effective resolutions. Additionally, these systems provide a digital trail, showcasing the steps taken and the evidence collected. This level of transparency serves as solid backing should a rejection face legal challenges.

Proactive fraud detection also minimizes the chance of mistakenly accusing genuine policyholders of fraud, another common precursor to litigation. AI tools, such as fraud detection software for insurance and custom analytics platforms, ensure more nuanced evaluations, reducing errors caused by human bias or oversight.

AI is not just a tool; it’s a partner in transforming the insurance industry. AI-powered fraud detection software pave the way for a more effective and equitable insurance process by reducing manual investigations, preventing overpayments, fostering transparency, and lowering litigation risks.

Adopting claims automation software and bespoke fraud detection solutions will continue to position insurers as trusted, forward-thinking partners for their customers, future-proofing the industry against evolving threats.

AI in fraud detection has been a game-changer for the insurance industry, but like any powerful tool, it comes with its challenges and limitations. To truly harness AI’s potential in insurance, it’s essential to understand and address these hurdles effectively. Below, we examine some key challenges and provide strategies to address them.

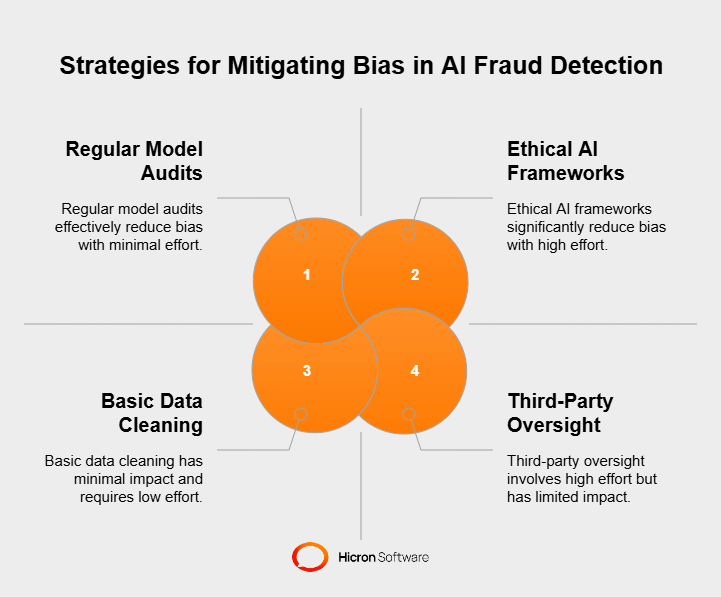

One major challenge in AI-powered fraud detection is the presence of bias in machine learning models. AI systems learn from the data they’re trained on, and if that data contains historical biases, the AI can perpetuate or even amplify those biases.

For example, if past claims data reveals systemic errors or bias, the AI may unfairly flag certain claims or policyholders, resulting in inaccurate decisions.

This issue isn’t just a technical hiccup; it’s a serious concern that could erode trust between insurers and their customers. An AI system that repeatedly misjudges or discriminates against specific claims risks losing credibility and alienating honest policyholders.

Mitigation strategies

To tackle bias, insurers must prioritize regularly auditing and retraining their machine learning models using up-to-date, diverse, and high-quality datasets. Introducing ethical AI frameworks can also help by setting guidelines for fairness, accountability, and transparency in how AI systems make decisions. Collaboration with third-party oversight agencies or experts can ensure the models meet unbiased and inclusive standards.

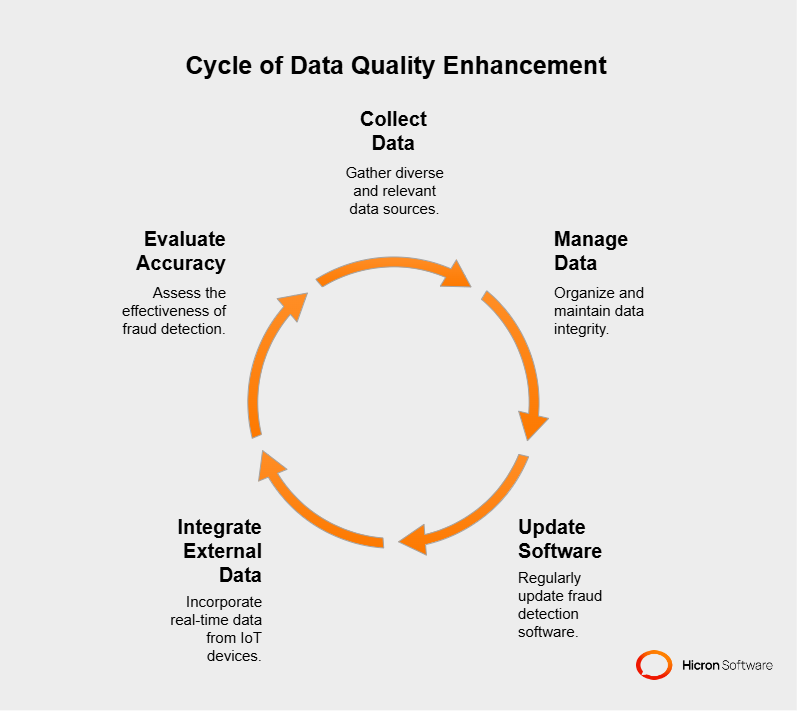

AI systems thrive on data, but not all data is created equal. When it comes to fraud detection, the quality of the data fed into these systems is critical.

Poorly labeled, incomplete, or inconsistent data can lead to inaccurate predictions and wrongfully flagged claims. Additionally, relying on outdated information can render AI less effective in detecting new or evolving forms of fraud.

Mitigation strategies

Insurers need robust data collection and management processes to overcome this obstacle. Partnering with insurance software developers to create tailored solutions ensures better accuracy and data organization.

Regularly updating fraud detection software with historical and current claim data improves AI performance. Additionally, integrating external data sources, such as IoT or telematics technology, can provide richer, real-time inputs for more accurate evaluations.

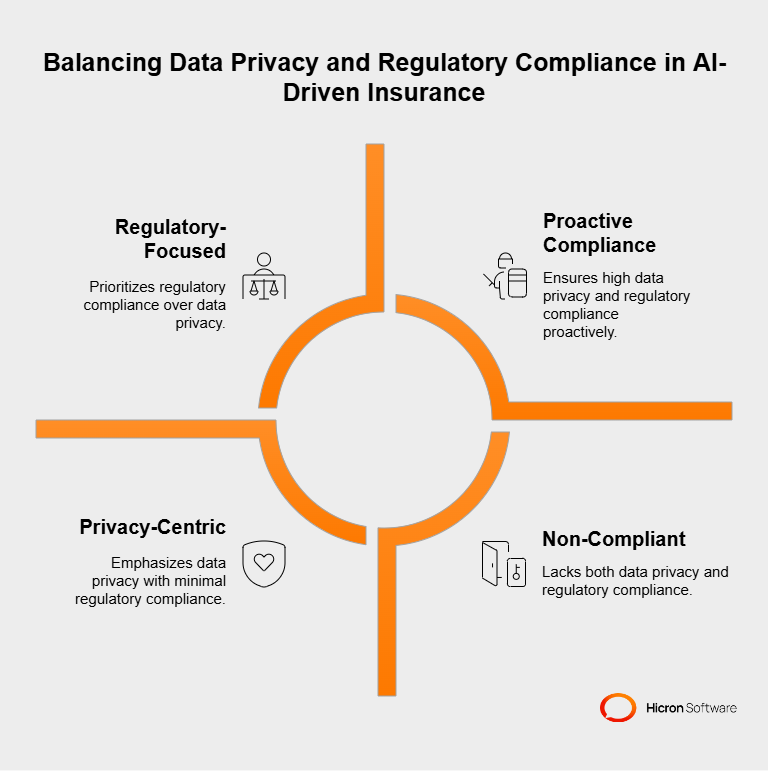

AI-powered fraud detection tools often handle massive amounts of sensitive information, such as policyholder details, financial records, and medical histories. While these tools are designed to analyze and detect suspicious behavior, they raise significant concerns about data privacy and security. Insurers must also navigate complex regulatory landscapes governing the collection, storage, and use of personal data.

Failure to comply with data protection regulations, such as GDPR or HIPAA, can result in substantial fines and reputational damage. Even beyond compliance, data breach or misuse could destroy customer trust and deter policyholders from engaging with AI-enhanced systems.

Mitigation strategies

To address these issues, insurers must design AI systems prioritizing privacy from the ground up. Implementing data anonymization techniques ensures personal details can’t be traced back to specific individuals while still allowing systems to detect patterns. Robust encryption protocols and secure storage solutions provide an additional layer of protection for sensitive information.

Working with insurance IT consultants and legal teams to ensure ongoing compliance is equally important to staying ahead of regulatory changes. Transparency is key here. Insurers should proactively communicate with policyholders about how their data is used, stored, and protected.

AI is not a “set it and forget it” technology. Over time, fraud patterns evolve, new techniques emerge, and regulatory environments shift. Failing to update AI models regularly can make systems vulnerable to outdated threats and less effective against innovative forms of fraud.

Mitigation strategies

Regular updates and improvements to AI models are non-negotiable. Insurers should consider forming partnerships with leading insurtech companies specializing in fraud detection software to stay at the forefront of innovation. AI systems should also be designed with scalability and flexibility to adapt to new requirements quickly.

On a broader level, adopting ethical AI frameworks ensures that AI systems operate in a responsible manner. These frameworks can guide everything from data usage to decision-making transparency, holding insurers accountable for how AI impacts their policyholders and bottom lines.

| Challenge | Description | Solution |

| Bias in Machine Learning | Historical biases in training data can lead to unfair decisions. | Regular audits and retraining with diverse data. |

| Data Privacy Concerns | Handling sensitive policyholder information raises privacy issues. | Use data anonymization and encryption. |

| High-Quality Data Needs | Poorly labeled or outdated data reduces AI effectiveness. | Implement robust data collection processes. |

| Evolving Fraud Techniques | Fraudsters constantly develop new methods. | Regularly update AI models to adapt. |

While AI brings undeniable benefits to fraud detection, addressing its challenges is critical to realizing its full potential. Reducing bias, ensuring high-quality data, protecting privacy, and adhering to evolving regulations aren’t just technical issues; they’re ethical responsibilities that impact insurers and their customers.

By combining regular updates, ethical AI practices, and robust data management, insurers can strike the right balance between innovation and responsibility. The house of insurtech is being built with AI as a core pillar, and addressing these challenges will ensure a stronger, more trustworthy foundation for everyone involved.

The future of fraud detection in the insurance industry is revolutionary. With technology continually pushing boundaries, AI-powered fraud detection is poised to become even smarter, faster, and more reliable. From blockchain integration to IoT data utilization and generative AI advancements, the roadmap ahead is filled with opportunities to make fraud almost impossible to slip through the cracks. Here’s a glimpse into what’s on the horizon.

Blockchain technology could play a pivotal role in strengthening fraud detection efforts. Known for its ability to create secure, tamper-proof records, blockchain’s decentralized nature offers insurers a reliable way to verify the authenticity of claims and transactions. For instance, insurers could use blockchain in insurance to track a policy’s or claim’s lifecycle.

Imagine every step of an automotive insurance claim, from filing to payout, recorded on a blockchain ledger. This creates an immutable trail, making it nearly impossible for fraudsters to forge documents, alter details, or manipulate accident timelines. Furthermore, integrating blockchain with current AI systems could streamline verification processes, ensuring faster and more accurate claim approvals for honest policyholders.

The Internet of Things (IoT) is rapidly transforming how insurers understand and manage risk, and its role in fraud detection is growing, too. Connected devices, such as telematics systems in vehicles or smart home sensors, provide real-time data that can be used to validate claims.

Take telematics in auto insurance, for example. These devices monitor driving behavior, vehicle location, and crash impact metrics. If someone files an accident claim, IoT data can cross-check the reported incident’s time, location, and severity against actual telemetry records.

This deeper context enables insurers to quickly identify discrepancies, distinguishing between actual accidents and staged or exaggerated claims.

Similarly, smart home devices are proving invaluable for property insurance. If a water leak is claimed but no sensor data supports it, insurers can flag the case for further investigation. The future will see IoT embedded across more insurance sectors, creating a web of interconnected fraud detection points that leave little room for manipulation.

Perhaps the most exciting developments in fraud detection are generative AI and deep learning models. These advanced technologies push the boundaries of adaptive fraud detection, allowing systems to learn, evolve, and counter increasingly sophisticated fraud schemes.

Deep learning techniques enable AI to analyze vast amounts of unstructured data, such as claim narratives, social media activity, and even digital behavior patterns, to spot anomalies that traditional methods might miss.

For example, adaptive AI systems could identify organized fraud rings by connecting seemingly unrelated claims based on hidden patterns.

Generative AI, on the other hand, enables insurers to simulate fraud scenarios, thereby exposing risks and vulnerabilities within their systems. By generating fake yet realistic claims for testing, insurers can stress-test their software and fortify defense mechanisms.

Over time, these fraud detection tools will become more attuned to subtle signals and emerging fraud tactics, staying one step ahead of bad actors.

For insurers, the decision to implement AI for fraud prevention is no longer optional; it’s vital for staying competitive and future-proofing their business. Falling behind in this tech-driven race could mean lost opportunities, increased inefficiencies, and damage to customer trust.

By investing in AI-powered fraud prevention technology, insurers can protect their operations and differentiate themselves in a rapidly evolving market. Here’s why the case for AI adoption is stronger than ever.

In today’s competitive landscape, insurers that lag in adopting advanced AI systems risk becoming obsolete. Competitors armed with scalable AI solutions detect fraud faster, streamline processes, and deliver superior customer experiences. This doesn’t just give them an edge in cost management or fraud detection efficiency; it positions them as industry leaders customers want to trust.

The consequences of failing to modernize are severe. Fraudulent claims cost the insurance industry billions annually, and manual or outdated systems simply can’t keep up with the speed and complexity of emerging scams.

Without advanced technologies, insurers risk paying out fraudulent claims, depleting their resources while losing credibility with honest policyholders. Over time, this inefficiency can erode market share as customers and stakeholders shift their attention to forward-thinking providers.

AI in insurance isn’t just a tool for fraud detection; it’s an investment with profound long-term benefits.

Here’s how AI delivers return on investment (ROI) across multiple dimensions:

While the upfront cost of implementing AI tools may seem daunting, the savings from fraud prevention, operational efficiency, and improved customer retention directly contribute to a strong and sustained return on investment (ROI). Additionally, as these systems scale and evolve, their value continues to grow, helping insurers stay ahead in the long term.

One of the biggest hesitations insurers face when adopting AI is knowing how and where to start. Implementing scalable AI solutions doesn’t have to be overwhelming. By partnering with experienced technology providers, insurers can effectively integrate tailored systems to meet their unique needs.

The insurance industry’s battle against fraud escalates, and the tools of the past can’t compete with the fraudsters of the future. AI-powered fraud prevention isn’t just an upgrade; it’s a necessity. By adopting these tools now, insurers can position themselves as leaders in innovation, build trust with policyholders, and protect their bottom line in ways previously impossible.

The choice is clear. Insurers can either invest in AI, secure their future, and set the gold standard for fraud prevention, or risk falling behind as competitors outpace them in technology and customer trust. With scalable AI solutions, insurers can take fraud prevention to the next level while solidifying their place in an increasingly data-driven world.

AI is revolutionizing fraud detection in insurance, introducing faster, smarter, and more reliable tools. It’s not just about catching fraudsters; it’s about creating a fair system for everyone. Imagine being able to spot suspicious claims instantly, while ensuring honest customers receive the smooth service they deserve—that’s the promise AI delivers.

Adopting AI isn’t just a nice-to-have; it’s necessary if insurers want to stay ahead of the curve. Competitors are already utilizing these tools to reduce costs, streamline processes, and enhance customer loyalty. Falling behind isn’t an option. For insurers, this is about building a future where fairness, efficiency, and innovation work hand in hand.

If you haven’t started exploring AI-driven solutions yet, now’s the time. These tools can help protect your operations, reduce risks, and build customer trust. It’s a big step forward that guarantees a stronger, smarter future for your business.

AI-powered fraud detection in insurance refers to the use of artificial intelligence and machine learning technologies to identify and prevent fraudulent activities. These systems analyze large volumes of data, detect unusual patterns, and flag potentially suspicious claims, enabling insurers to act quickly and accurately.

AI enhances fraud detection by automating data analysis, identifying complex patterns that are often missed by manual methods, and learning from past fraud cases to improve accuracy over time. Using techniques like predictive modeling and anomaly detection, AI can reduce false positives and improve efficiency in fraud investigations.

The key benefits include:

Insurance fraud detection software combines AI, machine learning, and data analytics to evaluate claim information. It compares this data against historical patterns and known fraud indicators, quickly identifying anomalies or red flags. These insights help insurers flag suspicious activities with greater speed and precision.

Insurance fraud detection software faces some common challenges:

While AI-powered fraud detection software significantly reduces fraudulent claims, it may not eliminate them entirely. Fraudsters constantly evolve their tactics, requiring continuous updates to AI models. However, AI enhances insurers’ ability to stay ahead by identifying even sophisticated schemes.

Machine learning enables AI systems to improve over time. It processes historical data to identify trends and anomalies, allowing the system to recognize new fraud patterns as they emerge. The more data the model analyzes, the smarter and more effective it becomes at detecting fraud.

While insurance companies are primary beneficiaries, industries like healthcare, banking, and e-commerce also use AI fraud detection systems to combat fraudulent activities. These tools are particularly valuable in any sector where large volumes of transactions occur.

AI is revolutionizing the insurance industry by automating repetitive tasks, personalizing customer experiences, and improving risk assessment. Tools like AI-powered fraud detection software contribute to safer, more efficient, and customer-focused insurance operations.

Insurance fraud detection software is a tool designed to identify and prevent fraudulent activities within the insurance industry. Using advanced technologies like machine learning and AI, it analyzes vast amounts of data to detect anomalies, flagging suspicious claims or behaviors. By studying historical patterns and real-time data, the software helps insurers proactively combat fraud while minimizing false positives.

The primary benefits include cost savings through reduced fraudulent payouts, improved efficiency in claims processing, and enhanced accuracy in detecting potential fraud. Insurance fraud detection software also strengthens trust with customers by ensuring fairness and reinforces regulatory compliance by maintaining high data integrity in fraud prevention strategies.

Yes, small insurance companies can significantly benefit from fraud detection software. These tools help streamline operations by automating fraud checks, making fraud prevention accessible without the need for extensive in-house resources. Additionally, the scalability of modern software solutions ensures that small insurers can adapt the technology to fit their specific needs and budgets.