InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

UX strategy for insurance is a comprehensive plan that focuses on creating user-friendly experiences for both employees and customers by addressing their unique needs and pain points. It combines insurance UX design principles with digital tools to enhance customer experience in insurance and improve employee efficiency, driving operational success and satisfaction.

In today’s competitive landscape, a robust UX strategy for insurance is no longer optional; it’s a necessity. Insurers face the dual challenge of delivering unified insurance user experiences for both employees and customers. On one hand, employee experience in insurance relies on efficient internal tools to streamline workflows and reduce errors. On the other, customer experience in insurance demands intuitive, transparent platforms that simplify policy management and claims processes.

Focusing on just one side; whether internal or external UX; can lead to inefficiencies, slower operations, and dissatisfied users. By prioritizing balanced insurance UX design, companies can achieve operational excellence while meeting the growing expectations of a digitally savvy audience, driving both loyalty and long-term success.

A UX strategy for insurance is a comprehensive approach to designing and implementing experiences that address the needs of both employees and customers. By focusing on insurance user experience, this strategy ensures that internal tools and external platforms are optimized to deliver efficiency, satisfaction, and smooth interactions. It plays a critical role in insurance digital transformation, bridging the gap between operational efficiency and customer-centric design to meet the demands of a rapidly evolving industry.

The Dual Focus of Insurance UX: Internal and External Applications

A successful UX strategy for insurance requires equal attention to both internal and external UX.

By addressing both internal and external needs, insurers can create a cohesive insurance UX design that benefits all stakeholders.

The success of an insurance user experience strategy lies in balancing the needs of employees and customers. Neglecting one side can have a ripple effect on the other. For instance, poor internal UX, such as outdated tools or inefficient workflows, can lead to slower claims processing, directly impacting customer experience in insurance. Similarly, a lack of user-friendly external platforms can increase the workload for employees, as customers turn to support teams for assistance with basic tasks.

By improving internal and external UX in insurance, companies can achieve operational excellence while fostering customer satisfaction and loyalty. This balance a competitive advantage and a necessity.

Consistency is a crucial element of any successful UX strategy in the insurance industry. Maintaining uniformity across digital platforms, customer touchpoints, and service processes creates a trustworthy experience for users.

By staying consistent in their UX strategy, insurance companies not only establish a sense of reliability but also reinforce their brand identity, ultimately driving long-term customer loyalty and operational success.

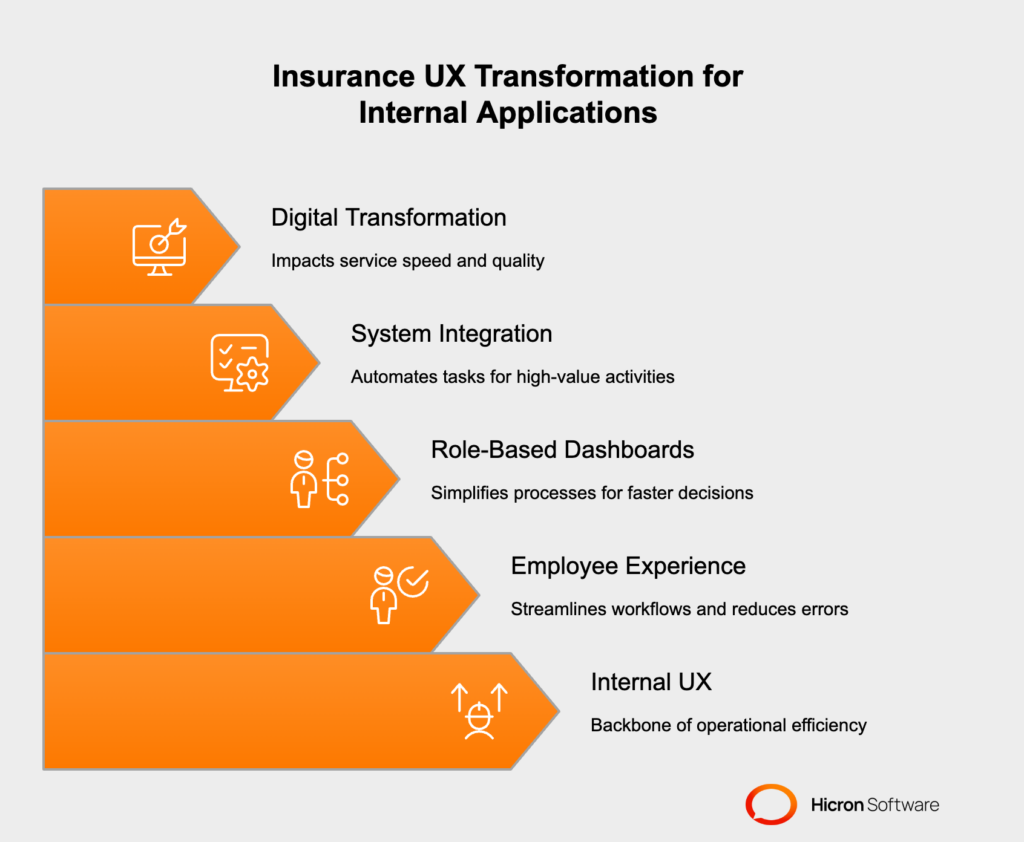

A well-designed internal UX is the backbone of operational efficiency in the insurance industry. By focusing on employee experience in insurance, companies can equip their teams with tools that streamline workflows, reduce errors, and improve overall productivity.

For example, role-based dashboards tailored to claims adjusters or underwriters can simplify complex processes enabling faster decision-making and reducing bottlenecks.

Integrating systems and automating repetitive tasks ensures that employees can focus on high-value activities, ultimately enhancing the insurance user experience for both staff and customers. A strong internal UX is a critical component of insurance digital transformation, as it directly impacts the speed and quality of service delivery.

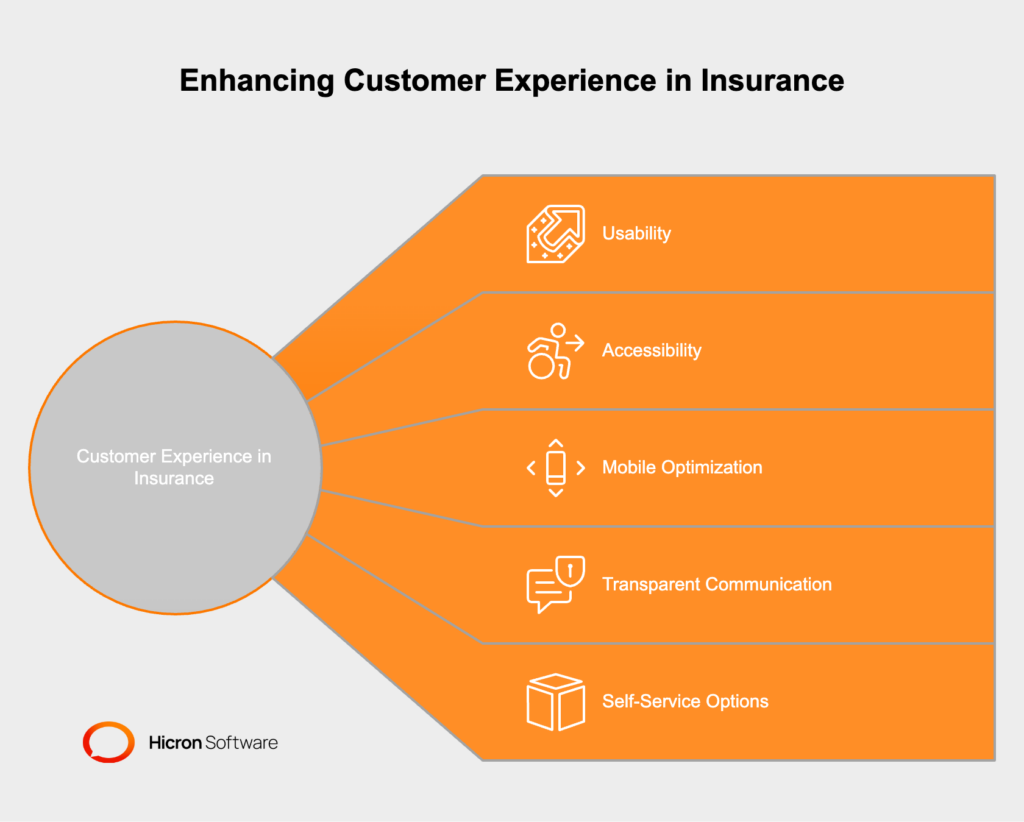

On the external side, customer experience in insurance hinges on the usability and accessibility of digital platforms. Intuitive customer portals are essential for simplifying policy management, claims filing, and accessing support.

Features like

empower policyholders to take control of their insurance needs without unnecessary friction. A well-executed insurance UX design strategy builds trust and loyalty. It also reduces the workload for employees by minimizing customer support inquiries.

By prioritizing simplicity and transparency, insurers can create a great insurance user experience that meets the expectations of today’s digitally savvy customers.

Measuring the success of a UX strategy for insurance requires tracking key performance indicators for both internal and external UX.

By continuously monitoring these metrics, insurers can identify areas for improvement and ensure their UX strategy for insurance remains aligned with both employee and customer expectations. This data-driven approach is key to improving internal and external UX in insurance and achieving long-term success.

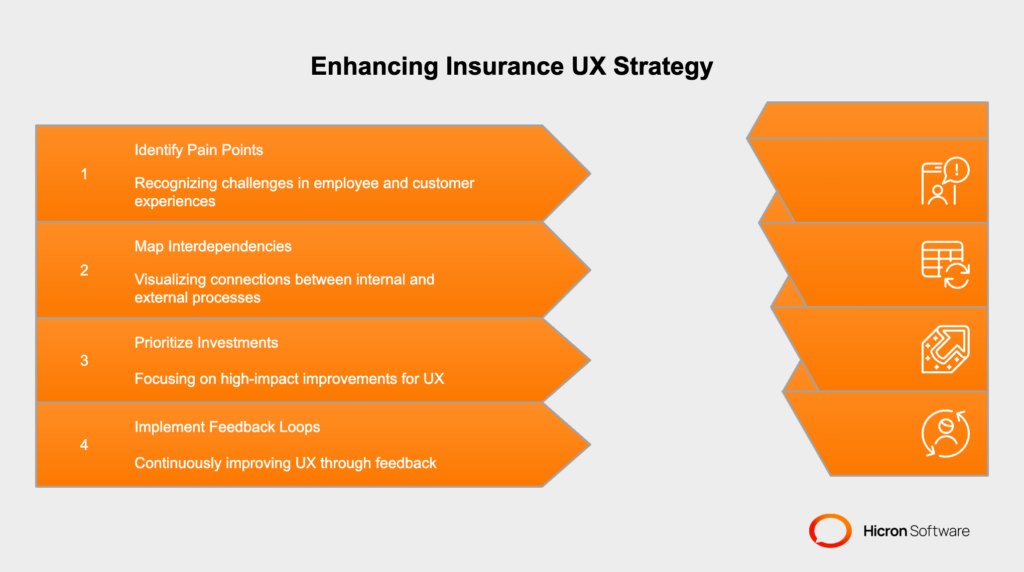

Creating a successful UX strategy for insurance requires a structured approach that addresses both internal and external UX. By focusing on the needs of employees and customers, insurers can design experiences that drive operational efficiency and customer satisfaction. Below are the key steps to build a unified strategy that aligns with the goals of insurance digital transformation.

The first step in building a UX strategy for insurance is to gather insights from both employees and customers. Conducting thorough user research helps identify pain points and unmet needs in the employee experience in insurance and the customer experience in insurance.

For employees, this might involve understanding challenges with internal tools, such as claims processing systems or dashboards. For customers, it could mean identifying frustrations with policy management or claims filing processes. By addressing these insights, insurers can lay the foundation for a more effective insurance user experience.

Step two involves mapping the interdependencies between internal workflows and external experiences. For example, the speed and accuracy of claims processing; a critical aspect of customer experience in insurance; often depend on the efficiency of internal tools used by employees.

By visualizing these connections, insurers can better understand how internal and external UX impact one another and identify opportunities to streamline processes. This step is essential for creating a cohesive insurance UX design that benefits all stakeholders.

Once pain points and interdependencies are identified, the next step is to prioritize investments in areas that deliver the greatest impact. For instance, automating claims processing improves employee experience in insurance by reducing manual tasks. It also enhances customer experience in insurance by speeding up resolution times. By focusing on high-impact improvements, insurers can maximize the value of their UX strategy for insurance while advancing their insurance digital transformation goals.

The final step is to implement feedback loops that allow for continuous improvement of both internal and external interfaces. Regularly collecting feedback from employees and customers ensures that the insurance user experience evolves to meet changing needs.

Testing and iterating based on this feedback help refine tools and platforms, ensuring that the UX strategy for insurance remains effective and relevant over time. This iterative approach is key to improving internal and external UX in insurance and maintaining a competitive edge.

To further strengthen your UX strategy for insurance, consider these additional steps:

Case Study 1: Modernizing Internal Tools for Enhanced Operations

HDI Group partnered with Hicron Software to modernize their 20-year-old policy application, a critical tool for managing contracts, drafting policy documents, and issuing invoices. The outdated system caused inefficiencies and communication gaps between IT and business teams. Hicron’s approach included:

The result was a streamlined internal tool that enhanced employee experience in insurance, enabling faster claims processing and better customer service.

Case Study 2: Redesigning and Securing Service Portal for Medical Liability Claims

Hicron Software also collaborated with HDI to modernize a legacy medical claims application used for managing sensitive health data related to hospital liability claims. Key highlights included:

This transformation not only ensured compliance with German regulations but also elevated the customer experience in insurance by providing a more reliable and user-friendly platform.

From these case studies, several actionable insights emerge:

|

Lesson |

Insight |

|

Balance Internal and External UX |

Modernizing internal tools directly impacts external customer satisfaction by improving service delivery. |

|

Invest in Technology Upgrades |

Legacy systems hinder both employee experience in insurance and customer experience in insurance. Upgrading to modern, secure platforms is essential for insurance digital transformation. |

|

Collaborate Across Teams |

Bridging communication gaps between IT and business teams ensures that technology aligns with operational goals. |

|

Focus on Compliance and Security |

Especially in regulated industries like insurance, compliance with local regulations is critical for maintaining trust and operational efficiency. |

A balanced UX strategy for insurance is essential for navigating the challenges of a rapidly evolving industry. By addressing both internal and external UX, insurers can enhance operational efficiency, improve customer satisfaction, and maintain a competitive edge.

Insurers must evaluate their current insurance UX design to identify gaps and prioritize improvements. A balanced approach to improving internal and external UX in insurance not only future-proofs operations but also strengthens customer relationships in an increasingly digital world. Get in touch!

A UX strategy for insurance is a comprehensive approach to designing and implementing experiences that address the needs of both employees and customers, ensuring operational efficiency and customer satisfaction.

Balancing internal and external UX ensures that employee tools are efficient and customer platforms are user-friendly, preventing inefficiencies, slower operations, and dissatisfaction on both sides.

Modernizing internal UX streamlines workflows, reduces errors, and enhances employee productivity, enabling faster decision-making and better service delivery.

Features like mobile optimization, transparent communication, and self-service options are critical for simplifying policy management, claims filing, and support access.

Internal metrics include employee productivity and error rates, while external metrics focus on customer satisfaction scores (CSAT) and retention rates.

By addressing both internal and external UX, insurers can enhance efficiency, improve customer satisfaction, and maintain a competitive edge in a digital-first landscape.