Why Legacy System Modernization in Insurance is Critical

- May 27

- 40 min

The insurance industry is undergoing a significant transformation, driven by rapid technological advancements and the evolving expectations of policyholders. At the heart of this transformation lies the modernization of back-office operations, an often-overlooked yet essential component of an insurer’s success.

Whether it’s streamlining claims processing, enhancing data accuracy, or improving customer service, modernizing back-office processes can significantly improve operational efficiency and differentiate companies in the competitive insurance and InsurTech landscape.

Traditional insurance operations face several challenges that hinder growth and efficiency. Outdated systems, manual workflows, and siloed data are common hurdles that slow operations and increase the risk of errors and compliance issues.

For instance, legacy systems struggle to integrate with emerging technologies, such as AI-powered claims automation and predictive analytics, leaving insurers at a disadvantage in addressing customer needs swiftly and accurately.

To overcome these obstacles, forward-thinking insurers invest in digital transformation strategies. From implementing custom insurance software development and claims automation software to integrating AI and EDI for better data management, these solutions are game-changers for back-office efficiency.

This article will explore the top strategies that leading insurance tech companies, insurtech startups, and life insurance tech firms use to revolutionize their back-office operations. Whether you’re a part of an established insurance business or an emerging player in the InsurTech hub, these insights will guide you toward scalable, future-proof solutions tailored for success.

Modernizing back-office operations isn’t just a nice-to-have for insurance companies; it’s an absolute necessity. With emerging technologies redefining how businesses operate and policyholder expectations evolving rapidly, insurers must transition away from outdated processes to remain competitive. Let’s explore why back-office modernization is critical and the challenges it addresses.

When you think of innovation in insurance, it’s easy to picture sleek apps and AI chatbots. But behind the scenes, the efficiency of back-office operations sets the foundation for success.

Claims processing, data management, compliance, and underwriting happen in the back office, and even the most polished front-end experiences can crumble if the back-end can’t deliver. Whether you’re a traditional player or an ambitious InsurTech startup, modernizing these systems is essential to improve speed, accuracy, and customer satisfaction.

Operational inefficiencies are a major drain, often caused by fragmented workflows and outdated tools that can’t keep up.

For instance, many insurers still rely on legacy software that hasn’t been updated in decades. These outdated systems can result in slow processing times, human errors, and team miscommunication. When an insurer spends hours reconciling data or handling claims manually, it can’t focus on high-priority tasks like improving customer relationships or expanding offerings.

By building scalable systems, such as custom insurance software tailored to specific needs, insurers can unlock efficiencies that were impossible with older technology.

Manual workflows are time vampires. Imagine an adjuster spending days poring over stacks of paper policies to validate a single claim. That’s not just inefficient; it’s demoralizing for employees and frustrating for customers waiting for resolutions.

Automation tools such as AI in claims processing or digital claims management systems can eliminate repetitive tasks and free up teams to focus on higher-value work. For example, AI algorithms can swiftly analyze claims data, detect potential fraud, and approve low-risk claims with minimal human intervention.

Being stuck with old technology doesn’t come cheap. The cost of maintaining legacy systems often outweighs the investment required for modernization. Many insurers spend an unnecessarily large part of their budget patching outdated tools instead of upgrading to modern alternatives, such as cloud technology for insurance. Additionally, manual error rates in legacy workflows can lead to costly mistakes, such as overpaid claims or penalties resulting from compliance issues.

Investing in insurance software development services, such as tailored solutions for handling claims or managing policies, can significantly reduce these costs while offering long-term scalability.

Customer expectations today are worlds apart from what they were a decade ago. Policyholders now expect instant updates on claims, personalized recommendations, and seamless digital experiences. Think of it this way: nobody wants to wait three weeks for a claim decision when tech-savvy companies like InsurTech startups offer same-day resolutions.

Modern systems leverage tools like predictive analytics for insurers and AI-driven customer insights to anticipate consumer needs. For instance, a life insurance company can use data to recommend tailored coverage options during key life events like marriage or homebuying, making interactions more meaningful and relevant.

The faster an insurer can process claims or approve new policies, the happier their customers will be. A modernized back office equipped with claims automation software accelerates these processes, often reducing turnaround times from weeks to days or hours. This not only enhances the customer experience but also fosters loyalty in an industry where long-term trust is crucial.

Today’s customers have grown accustomed to the convenience of tech, whether booking a ride with a few clicks or receiving instant recommendations on online shopping platforms. Their expectations from insurers are no different. Frustrating workflows, such as redundant form submissions or frequent status inquiries, can alienate policyholders.

Companies are adopting next-gen solutions that provide end-to-end transparency and ease of use to meet these demands. From smart workflows powered by EDI software to automated updates through chatbots, modernization makes it easier for policyholders to interact with insurers while reducing employee workloads.

The insurance industry operates in one of the most heavily regulated environments. New laws and compliance requirements, such as updated privacy standards, necessitate systems that can adapt quickly. Unfortunately, older platforms aren’t robust enough to accommodate such changes without extensive (and expensive) overhauls.

Using enterprise-grade insurance technology solutions built to be flexible helps insurers remain compliant with less stress, even as regulations shift. Automated compliance checks and real-time alerts are examples of how modern tech eases this burden.

Meeting regulatory requirements in the insurance industry is critical, but legacy workflows often challenge compliance. Outdated systems struggle with accuracy and can also expose insurers to significant risks. Below, we break down the main compliance hurdles created by legacy systems and how modern solutions can address them.

#1 Siloed data creates regulatory blind spots

Legacy systems often isolate data across multiple disconnected platforms, resulting in gaps in compliance monitoring. For example, an insurer might store customer data for claims, underwriting, and policy management in different systems. Ensuring consistent updates across these silos becomes a logistical burden, increasing the chance of non-compliance.

Imagine implementing new privacy standards, like GDPR, across fragmented databases. The inability to seamlessly integrate customer data can result in outdated or incomplete records, leaving insurers vulnerable to hefty fines.

Modern policyholder data management systems solve this issue by centralizing and synchronizing real-time data. Insurers can achieve a unified view of their operations, making auditing processes easier and allowing them to remain compliant without scrambling.

#2 Lack of real-time change tracking

Older platforms often fail to track and log changes effectively, making compliance reviews time-consuming. Regulatory audits demand transparency and detailed records of transactions. Insurers are forced into labor-intensive manual reviews without a real-time tracking system, which are prone to missed details and errors.

Consider a scenario where an underwriting decision requires examination for compliance. Legacy workflows often involve piecing together data from various outdated systems, resulting in incomplete or inaccurate findings.

Cloud-based insurance platforms now allow for real-time tracking and logging of changes. By integrating automated compliance features, insurers can generate audit-ready reports with just a few clicks, saving time and avoiding costly mistakes.

#3 Privacy risks in handling sensitive data

Compliance with modern privacy regulations, such as HIPAA or CCPA, becomes particularly challenging with legacy systems. Inefficient workflows often lead to the mishandling of sensitive customer data, including health and financial records. For instance, an outdated claims system might inadvertently expose private information through unsecured processes, resulting in significant reputational and financial damage.

By investing in fraud detection software and data security solutions, insurers can ensure sensitive data remains protected at all times. Automated redaction tools and encryption technologies help minimize the risk of exposure, allowing companies to comply with data protection standards stress-free.

#4 Slow adaptation to regulatory changes

The insurance industry is constantly changing, with new laws and compliance standards changing how businesses operate. Legacy systems are notoriously rigid and struggle to adapt swiftly when regulations evolve. This sluggishness can delay insurers from making necessary updates, such as implementing revised underwriting rules or incorporating updated privacy policies.

For example, when telemedicine transformed healthcare, many insurers working with outdated systems couldn’t readily accommodate new claim types or integrate telemedicine benefits into existing policies. This put them at a significant disadvantage in serving policyholders.

Modern solutions, such as custom insurance software development, overcome these bottlenecks by offering flexible and scalable platforms. Insurers can roll out updates seamlessly, ensuring they stay ahead of regulatory requirements while remaining competitive.

#5 Inefficient audit and compliance reporting

Conducting audits with legacy workflows often feels like searching for a needle in a haystack. Insurers must sift through mountains of data without centralized or automated tools to identify compliance gaps. This inefficiency not only consumes time but also increases the likelihood of incomplete reporting, leaving insurers vulnerable to fines and legal challenges.

Leading insurance IT consulting services help insurers implement robust compliance reporting tools and systems. These solutions generate detailed, audit-ready insights in real time, highlighting potential issues before they escalate. By utilizing predictive analytics and automated alerts, insurers can proactively mitigate risks rather than reacting to regulatory penalties.

#6 Elevated financial and reputational costs

Non-compliance doesn’t just lead to fines. It can have lasting effects on an insurer’s reputation and customer trust. A compliance violation, such as exposing sensitive data due to an outdated platform, could result in policyholders losing faith in the company. This loss of trust can snowball into customer churn and decreased profitability.

Consider the case of an insurer facing penalties due to errors in claim processing. Beyond the immediate financial loss, publicized compliance failures can signal inefficiency and unreliability, turning away potential policyholders.

By adopting insurance technology solutions, companies can not only reduce these risks but also build a reputation for operational excellence. Scalable systems that adapt to emerging compliance needs position insurers as leaders in a highly competitive market.

The insurance industry isn’t static. Emerging trends, such as telematics in automotive insurance, digital healthcare integration, and usage-based insurance applications, are paving the way for insurers to rethink their offerings. However, insurers risk being left behind without systems that can scale, evolve, and integrate with these innovations.

For instance, insurers focusing on property insurance software need tools capable of handling disaster claims powered by predictive analytics. Similarly, life insurance companies are leveraging telemedicine integrations to offer more personalized customer health assessments and pricing models.

Future-proof systems must support these trends and adapt quickly as new opportunities arise. Whether integrating IoT to improve real estate risk assessments or deploying AI for fraud detection, insurers will require platforms specifically designed for agility.

Consider a leading InsurTech company using cloud technology to update policies and roll out new regulations instantly across regions. This ability to scale and adapt gives insurers the competitive edge needed in an industry undergoing constant disruption.

Modernizing back-office operations isn’t just about cutting costs or streamlining workflows; it’s about laying the groundwork for resilience and innovation in a rapidly transforming industry. Whether you’re part of a legacy provider or an InsurTech disruptor, now’s the time to build a smarter, faster, and more customer-centered back office. The results? Happier policyholders, more engaged employees, and a stronger bottom line.

The insurance industry has reached a tipping point where modernizing back-office operations is no longer optional. Optimizing processes is crucial in an environment of increasing competition, heightened customer expectations, and evolving regulatory demands. Below, we explore top strategies to overhaul back-office workflows and drive efficiency, scalability, and customer satisfaction.

Automation transforms the insurance back office by eliminating redundant tasks and speeding up processes. Simple tasks, such as data entry and document processing, can now be automated, freeing employees to focus on higher-value work.

For example, insurers can utilize Robotic Process Automation (RPA) to automate repetitive tasks, such as digitizing paper documents or processing payments. This not only improves efficiency but also enhances the accuracy of routine activities. Automation lays the foundation for faster, smarter workflows that scale with the business’s growth.

Claims processing and policy issuance are two of the most resource-intensive tasks in the insurance industry. Automation tools can streamline these processes dramatically.

Imagine a scenario where a customer submits an accident claim. Instead of waiting days for manual verification, an automated workflow accesses the policy details, checks eligibility, and processes the claim approval in minutes. Similarly, automating policy issuance shortens the time it takes to deliver coverage to new policyholders, enhancing customer satisfaction.

By automating these pivotal processes, insurers can reduce turnaround times, boost customer confidence, and stay ahead of competitors.

Human errors can be costly, particularly in data-sensitive industries such as insurance. Mistakes in underwriting, billing, or claims processing can result in financial losses or damage to a reputation.

Automation systems help eliminate these errors by standardizing and validating information at every step. For instance, automating the entry of client details ensures that applications are completed with consistent and accurate data, reducing discrepancies and preventing potential compliance violations.

Fragmented systems are one of the biggest hurdles for insurers seeking to achieve efficiency. When claims, underwriting, and customer data are stored in separate systems, workflows suffer from delays and inconsistencies. Integrated systems create a cohesive back office that operates like a well-oiled machine.

For example, integrating customer relationship management (CRM) software with claims and policy platforms ensures that all departments can access up-to-date client information. This unified view simplifies task handoffs and strengthens communication across teams.

Operational silos often lead to miscommunication, redundant efforts, and delays. Breaking down these silos allows for better collaboration and smoother workflows.

For instance, when underwriting data is synced with claims processing and financial operations, decision-making becomes quicker and more informed. A more collaborative environment ensures that all teams are aligned on goals, timelines, and customer needs, fostering better outcomes for insurers and policyholders.

Every department in an insurance company relies on data; however, when that data is inconsistent or duplicated, it creates significant roadblocks. A lack of data consistency can lead to conflicting records, ultimately undermining operational efficiency and effectiveness.

Modern data management systems consolidate and standardize information across all platforms. For example, when claims adjusters, underwriters, and customer service representatives all access a single source of truth, they can act with confidence, knowing the information is accurate and up-to-date.

Artificial Intelligence (AI) and predictive analytics are becoming game changers for modern insurers. These tools help identify patterns, predict trends, and optimize workflows.

For example, AI can analyze historical claims data to detect fraud, identify high-risk cases, or suggest more efficient resolutions. Predictive analytics can forecast premium trends or customer demand, enabling insurers to stay proactive in a competitive environment.

Using AI to identify processing bottlenecks

AI goes beyond simple automation, providing insights into where operations are slowing down. By analyzing workflow data, AI tools identify processing bottlenecks and recommend strategies for improvement.

For instance, AI might reveal that claim approvals are delayed at a specific review stage, prompting managers to add more resources to address the issue. These insights lead to faster, more streamlined operations and better service for policyholders.

Understanding and anticipating client needs is a game-changer in the insurance industry. Predictive tools utilize advanced data analytics and modeling to enable insurers to stay ahead of customer demands while optimizing internal workflows. Below, we examine this strategy in detail, breaking it down into smaller components for clarity.

#1 Understanding predictive tools and their role

Predictive tools leverage historical data, machine learning algorithms, and real-time analytics to identify trends and forecast future outcomes. These tools are invaluable for insurers dealing with large volumes of data from claims, policies, purchases, and external market trends.

For instance, an insurance company can analyze policyholder behavior, such as payment patterns or types of policies purchased, to determine when they might be considering a renewal or upgrade. Similarly, external data, such as weather forecasts or industry reports, can help predict a rise in claims in certain regions or for specific events, such as floods or storms.

By processing this data efficiently, insurers can take a proactive approach that enhances service delivery and operational planning.

#2 Anticipating client behavior

One of the primary applications of predictive tools is understanding when and how clients may need particular services. For instance, analyzing a customer’s transactions and claims history can reveal patterns, such as frequent claim activity leading up to a policy renewal.

Imagine a scenario where a policyholder has recently purchased a car but only has minimum liability coverage. Using predictive analytics, the system may flag this account as a candidate for upselling an additional coverage plan, such as collision insurance.

This targeted approach not only increases cross-selling opportunities but also ensures that the client receives appropriate coverage tailored to their changing needs.

Such forecasting capabilities enable insurers to offer personalized services, strengthening customer relationships and boosting retention rates.

#3 Optimizing workflows and improving efficiency

Predictive tools also play an essential role internally by streamlining workflows across underwriting, claims processing, and customer service functions.

#4 Claims processing projections

Take claims processing, for example. Predictive models can assess incoming claims and categorize them based on complexity or likelihood of fraud. Low-risk claims can be fast-tracked, significantly reducing processing times, while high-risk claims are flagged for detailed review.

For instance, an insurer might notice a seasonal spike in claims during winter storms. By analyzing historical data, the system can predict the volume of claims, enabling the team to allocate additional resources in advance and prevent bottlenecks during the busy season.

#5 Underwriting support

Predictive tools also assist underwriters by providing risk forecasts. For example, if a new policyholder is flagged as high risk based on similar profiles from previous years, underwriters can adjust premiums or policy terms accordingly. This reduces future claim liability and ensures the insurer maintains a healthy bottom line.

#6 Customer service enhancements

Predictive analytics can identify common questions or issues that customers face during specific periods, such as open enrollment or renewal times. With this insight, insurers can implement proactive communication strategies, such as reminders or educational resources, to address these areas before they escalate into service complaints.

#7 Real-time predictive insights

One of the standout features of modern predictive tools is their ability to provide real-time insights. Unlike static reports, these tools process ongoing data streams, enabling insurers to react to changes as they occur.

For example, during natural disasters, predictive tools can analyze weather data combined with policyholder addresses to estimate areas that are likely to experience an influx of claims. This enables insurers to proactively deploy resources to affected areas, including adjusters and support staff. This readiness not only improves service but also fosters customer trust.

#8 Improving customer satisfaction

Predictive tools enable insurers to move beyond reactive service models, allowing them to address problems before they arise. By anticipating needs, insurers can deliver personalized recommendations that make clients feel valued.

Consider a family whose life circumstances have changed, such as the birth of a child. Predictive models suggest that additional life insurance coverage or a tailored plan may provide greater financial security. This proactive outreach instills confidence in clients, demonstrating that their insurer understands and values their evolving needs.

Various predictive tools and platforms are helping insurers maximize the value of their data. Here are a few examples and how they’re applied in the industry:

Customer segmentation platforms: Tools like SAS Customer Intelligence use predictive analytics to segment policyholders based on behavior, demographics, and preferences. This segmentation allows insurers to target marketing and outreach efforts with pinpoint accuracy.

Claim fraud detection systems: AI-powered solutions, such as Shift Technology, analyze claim patterns to identify anomalies that may indicate fraudulent activity. For instance, if a specific car repair shop repeatedly appears in claims with inflated estimates, the system can flag it for review, reducing financial losses.

Renewal and retention prediction tools: Predictive models in CRM systems, such as Salesforce Einstein, can help insurers identify when a client is at risk of not renewing their policy. These insights enable insurers to offer timely incentives or better plans to increase retention.

By adopting predictive tools, insurers can achieve a forward-looking strategy that balances operational efficiency with exceptional customer service. These tools streamline processes and empower companies to develop deeper, more personalized relationships with their clients.

The shift to cloud-based technology has revolutionized the management of back-office operations. Cloud platforms enable insurers to store and access data from anywhere, offering unparalleled flexibility for teams.

For instance, remote claims adjusters can input their findings directly into a centralized cloud platform, ensuring the claims process doesn’t slow down due to physical constraints. This adaptability is crucial in today’s fast-paced, customer-centric environment.

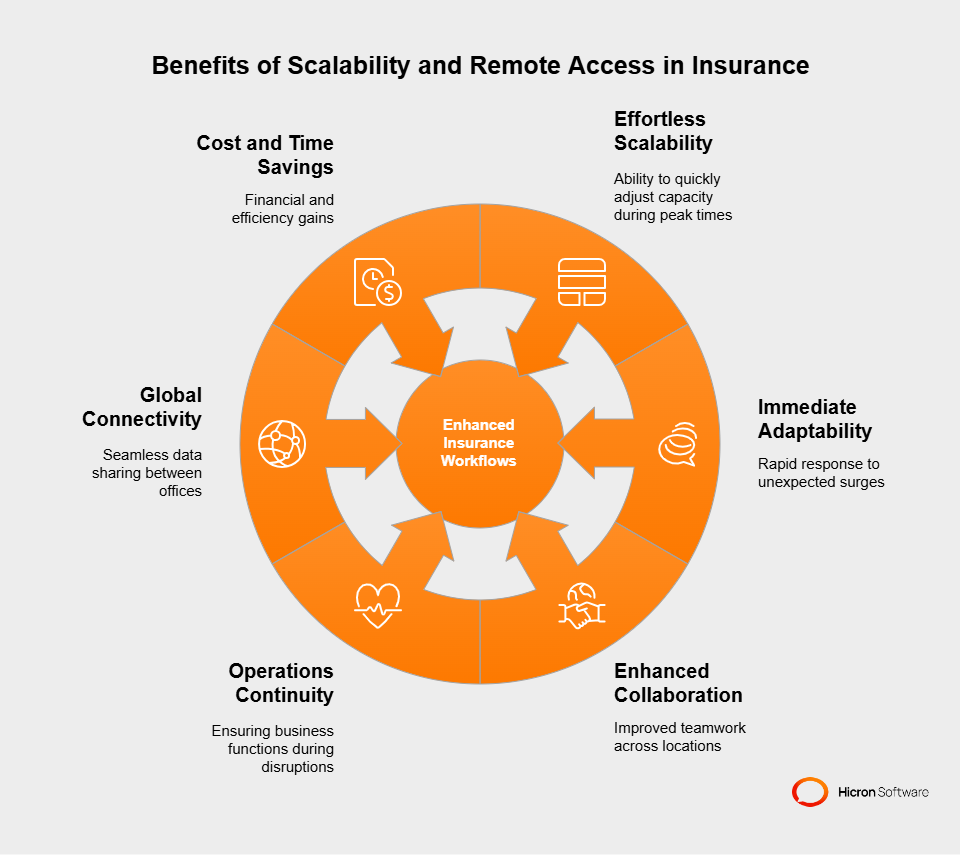

Modern insurance workflows require dynamic solutions that adapt to fluctuating demands and complex operational needs. Scalability and remote access provided by cloud solutions serve as powerful tools to tackle these challenges. Here’s a detailed breakdown of their benefits along with practical examples.

The insurance industry frequently experiences spikes in activity due to seasonal events, natural disasters, or the introduction of new products. Legacy systems struggle to handle these surges, resulting in slower response times and potential service disruptions.

Cloud-based solutions solve this by offering elastic scalability. Insurers can quickly scale up their system capacity to handle increased workloads without incurring costly hardware investments.

Example: During hurricane season, property insurance providers typically receive a flood of claims. Instead of purchasing additional servers to accommodate this temporary rise, cloud platforms allow insurers to allocate more resources on demand. Once the claims volume subsides, they can scale back down, ensuring cost efficiency and uninterrupted service.

Additionally, scalability supports long-term business growth. Whether rolling out a new insurance product or entering a new market, insurers can expand their operations seamlessly without extended lead times for infrastructure upgrades.

Natural disasters aren’t the only cause of unpredictability in the insurance world. Insurers may face sudden events, such as economic changes, litigation surges, or shifts in customer behavior, that create unexpected demands.

Cloud solutions enable insurers to respond swiftly, maintaining stable operations regardless of external pressures.

Example: Many insurers dealt with a surge in health insurance claims during the pandemic. Those with cloud-based systems were able to scale up their capacity instantly to accommodate remote claim submissions and new policies, enabling them to meet customer expectations despite the volume spike. Without cloud capabilities, they would have risked delays and strained customer relationships.

Remote access has become a business-critical feature with insurers managing global operations or field-based teams. Employees require secure and reliable access to workflows and data, regardless of their location.

Remote access empowers individual productivity and fosters collaboration across geographically dispersed teams.

Example: A claims adjuster in the field can use a mobile app to upload real-time assessments, including photos and reports, directly to a cloud-based claims system. Simultaneously, the underwriting team at headquarters can begin processing the claim without missing a beat. This streamlined collaboration reduces delays and enhances service quality.

Unpredictable events, such as system outages, natural disasters, or public health crises, can disrupt insurers operating on traditional infrastructure. Remote access ensures the business can continue functioning under these conditions.

Example: During the COVID-19 pandemic, insurers with remote-enabled systems suffered fewer disruptions. Employees could access back-office systems securely from home, ensuring claims were processed and policies managed without significant downtime. This adaptability has since become a baseline expectation for businesses in the insurance industry.

Insurance providers operating in multiple regions need centralized systems to ensure consistency and efficiency. Cloud solutions simplify this by enabling real-time data sharing and integration between offices.

Example: A global insurance company managing disaster claims in Asia might rely on a U.S.-based team for support. With cloud technology, employees across offices can work collaboratively on the same platform, accessing live updates, reports, and customer data in real-time. This level of coordination is not possible with legacy systems.

Beyond operational advantages, scalability and remote access also contribute to financial efficiency. Insurers no longer need to invest in physical infrastructure for peak usage scenarios, and they do not face delays due to limited capacity.

For insurers, integrating scalable and remote-enabled technology is not just about improving workflows; it’s about delivering reliability, retaining customer trust, and staying future-ready in an industry that demands constant adaptation.

Legacy insurance systems require constant maintenance, which can consume budgets and lead to frequent disruptions. Transitioning to modern IT infrastructure reduces these costs by replacing outdated technology with more reliable, efficient solutions designed to handle modern insurance demands and operations.

Cloud-based platforms, for example, reduce dependence on on-premise servers, cutting down IT maintenance requirements. Insurers also benefit from automatic updates, ensuring they always have access to the latest features and security protocols without additional investment.

Modernizing insurance back-office is no longer about following trends–it’s about staying competitive and future-proofing your operations. By adopting these strategies, insurers can streamline processes, meet customer expectations, and lay the groundwork for sustainable growth in an evolving industry.

Modernizing insurance’s back-office processes offers many advantages, including streamlining operations, improving efficiency, and ultimately leading to better service delivery. Below, we break down the key benefits into comprehensive sections with practical examples to help illustrate the value of modernization.

#1 Streamlining day-to-day operations

Outdated, manual processes often create redundancies and inefficiencies in routine tasks. Modernized back-office systems simplify these tasks, automating repetitive steps and ensuring smoother day-to-day operations.

Example: Modern workflow automation tools can handle tasks such as inputting customer data or uploading claims documents, freeing employees from time-consuming data entry tasks. This also minimizes errors, ensuring more accurate client records and claims processing.

#2 Faster processing for claims, policies, and renewals

Speed is important when it comes to insurance claims, policy issuance, and renewals. Modern systems drastically reduce the time it takes to process these tasks.

Example: A cloud-based claims management system can flag low-risk claims for automatic approval within hours, rather than days. Similarly, automated systems can identify renewal deadlines and automatically generate client reminders or offers, thereby improving retention rates and customer satisfaction.

This faster turnaround translates to happier clients who receive their payouts and policy updates promptly.

#3 Simplified workflow management across the organization

Modern platforms centralize workflows, creating an integrated system where tasks are visible and accessible to all relevant teams. This eliminates the confusion and delays caused by siloed operations and outdated communication methods.

Example: A unified management tool allows claims adjusters, underwriters, and the financial team to access and update the same files in real-time. This ensures everyone works with the same information, reducing back-and-forth and miscommunication.

#4 Enhancing operational transparency

Transparency is key for effective insurance back-office management. Modern systems offer clear visibility into workflows, ensuring every task is easily trackable and accountable.

Example: Insurance companies using advanced workflow software can generate dashboards that show the status of claims, pending renewals, and compliance tasks. Managers can quickly identify bottlenecks or inefficiencies and address them proactively. Transparency like this fosters trust across teams and ensures smoother overall operations.

#5 Real-time access to key performance metrics

With digitized workflows, insurers can monitor performance metrics in real-time, gaining invaluable insights into their operations.

Example: A modern analytics platform might display metrics like claim processing times, policy issuance rates, or customer satisfaction scores. Viewing this data in real-time allows insurers to quickly adapt to challenges, such as a rise in pending claims or longer processing durations during peak seasons.

These insights support strategic decision-making, as leadership can base goals and resource allocation on up-to-date data.

#6 Improved reporting for regulatory and internal compliance

Compliance is one of the most significant challenges insurers face, given the industry’s stringent regulations. Modern technology simplifies insurance compliance by automating reporting and data tracking.

Example: Compliance software can monitor regulations and automatically flag discrepancies in data, ensuring insurers remain compliant with minimal manual effort. Insurers can instantly generate accurate, detailed reports when reporting to regulators, avoiding penalties and maintaining trust.

Additionally, internal compliance is enhanced because workflows are documented digitally, creating an audit trail that is easily reviewed and validated.

#7 Reducing administrative workloads

Manual administrative work can consume a significant portion of an employee’s time, leaving little room for strategic or creative tasks. By automating repetitive administrative duties, modern systems significantly reduce this burden.

Example: Tools that digitize document storage and retrieval eliminate the need to manually sift through filing cabinets or shared drives. Automating appointment scheduling, email reminders, and routine client updates further lightens the administrative load, allowing employees to focus on more critical work.

#8 Freeing teams to focus on high-value tasks

Modern systems automate low-priority tasks, enabling teams to focus their time and energy on high-value activities, such as crafting personalized insurance plans or improving client relationships.

Example: Without the distraction of entering claims data or monitoring manual workflows, employees can dedicate time to innovating new products or tailoring insurance offerings to meet specific client needs. This adds direct value to the company while improving career satisfaction for employees.

#9 Improving employee productivity and morale

When employees work with clunky, inefficient systems, productivity suffers–so does morale. Modernized systems improve productivity by making tools intuitive and efficient, reducing frustration and creating a more enjoyable work environment.

Example: Tools that provide real-time collaboration empower teams to work efficiently in the office or the field. Employees can focus on meaningful work instead of struggling with outdated technology, leading to increased job satisfaction.

Furthermore, happier employees yield better outcomes for the company, including higher client retention rates and improved overall performance.

Modernizing insurance back-office processes isn’t just about upgrading technology. It’s about enhancing every facet of operations to improve speed, transparency, compliance, and employee satisfaction. With these tools and systems in place, insurance companies can deliver better experiences for employees and customers while staying ahead in a competitive market.

Modernizing an insurance back office is crucial for enhancing operational efficiency, lowering costs, and meeting the industry’s evolving demands. But where do you start? Follow these actionable steps to ensure a smooth and impactful transition to a modern back office.

Before making changes, it’s essential to map out your existing workflows to gain a clear understanding of your operations. This involves documenting every process, from claims processing to policy issuance, and identifying how tasks flow from start to finish.

Example: Claim approvals involve too many manual steps, prolonging resolution times. By reviewing these workflows, you can pinpoint challenges and opportunities for streamlining.

Once workflows are outlined, focus on areas causing delays, errors, or inefficiencies. Common pain points include redundant manual data entry, limited communication between departments, or outdated software that doesn’t integrate well with other tools.

Example: If renewals are often delayed because underwriters need to manually cross-check policy details, this could indicate that automation tools or centralized platforms are required. Addressing these gaps improves overall workflow efficiency.

Not all issues are equally urgent. Evaluate where modernization will bring the financial or operational benefits. Start by tackling the processes that significantly affect customer satisfaction, employee productivity, or regulatory compliance.

Example: Automating claims processing may save more time and resources than updating your internal communication systems, so it should be prioritized first.

Choose a technology partner who understands the specific challenges of the insurance industry. These experts can help you select the right tools and strategies to meet your needs.

Example: Your technology partner might recommend AI-driven claim management systems that can analyze and process claims more accurately, while also reducing processing times. The right partner can also ensure seamless integrations with existing systems.

Modernizing back-office processes requires specialized expertise in workflow automation and management. Specialists in this field can help reduce redundancies and integrate new solutions into your operations with minimal disruptions.

Example: An automation consultant might implement robotic process automation (RPA) tools to automate repetitive tasks, such as form validation or policy data entry. This results in faster processing and fewer errors.

Off-the-shelf solutions may not address every company’s unique challenges. Working with experts to customize systems to fit your business model, workflows, and industry regulations is essential.

Example: If you specialize in insuring small businesses, you might need an underwriting platform tailored for quick, high-volume assessments. Customization ensures your tools work seamlessly with your operations.

Even the most advanced tools will fail if employees don’t know how to use them. Training staff is critical to ensuring a successful transition. This involves not just technical training but also creating a culture that embraces change.

Example: After introducing a cloud-based claims system, you could run training sessions tailored to each department and provide ongoing support as employees adjust.

Continuous engagement with your teams ensures they understand the benefits of the new tools and are prepared to maximize their potential. Highlight how these changes will make tasks faster, easier, and less prone to errors.

Example: Organizing workshops or providing interactive tutorials for a new collaboration platform can show employees how it streamlines communication and reduces manual tasks.

The final step is to create a transition plan that minimizes disruptions during the implementation of the new system. Communicate timelines, set expectations, and provide consistent updates to all stakeholders.

Example: During the phased rollout of an automated policy issuance system, schedule pilot testing in select offices and collect feedback before scaling up to the entire organization. This helps identify and resolve issues early.

By breaking down the process into these clear, actionable steps, insurers can approach modernization systematically and successfully. A well-executed overhaul not only improves operational efficiency but also positions your business for growth in an increasingly competitive market.

Challenge: The client, a leading U.S. brokerage and insurance provider, needed a robust, scalable, and cost-effective back-office system to efficiently manage a wide range of financial products and services. Operational excellence and accuracy were critical to their business model.

Solution: WNS implemented a comprehensive lifecycle management system designed for portfolio and financial products. This involved automating key processes, including account setup, client administration, and advisor compensation. The solution was engineered to deliver high accuracy and scalability while integrating seamlessly with the client’s operations.

Results:

This transformation, delivered by WNS, positioned the client to operate more efficiently and effectively meet customer demands.

Challenge: A health insurance company in California faced difficulties in managing its back-office operations. With growing demands, the client spent more time servicing existing customers, which hindered their ability to focus on acquiring new business. This inefficiency became a major bottleneck to growth.

Solution: Flatworld Solutions addressed this by taking over 80% of the client’s back-office operations. This involved deploying dedicated resources and implementing customized strategies to manage administrative tasks. Their approach freed up internal teams to concentrate on strategic areas, such as acquiring new customers.

Results:

The tailored solutions from Flatworld Solutions provided the scalability and flexibility needed to propel the client’s business forward.

Challenge: Manual data entry, payroll, and benefits management processes were slowing down operations and introducing errors. These repetitive tasks consumed a significant amount of time, creating inefficiencies across departments.

Solution: Stepwise introduced automation tools, including solutions from platforms like make.com, to replace manual workflows with automated processes. This streamlined operations and significantly minimized human interventions in critical tasks.

Results:

Stepwise’s innovative approach allowed the client to refocus employees on strategic initiatives while ensuring greater operational accuracy.

These case studies highlight the transformative impact of back-office modernization and automation, demonstrating quantifiable improvements in efficiency, accuracy, and customer satisfaction.

Modernizing back-office processes in the insurance industry reshapes how companies operate and deliver value. Emerging AI and machine learning trends offer powerful predictive insights, enabling businesses to manage risks and streamline operations proactively.

The automation of repetitive tasks frees up resources, improving both efficiency and employee focus, while the growth of end-to-end insurance platforms is creating unified technology solutions that are both scalable and future-ready.

By integrating these innovations, insurance companies can streamline workflows, improve accuracy, and scale operations efficiently. These advancements address current demands, enabling businesses to stay competitive in an evolving market.

Curious about how these trends could transform your organization? Discover how tailored solutions simplify your operations and prepare you for tomorrow’s challenges. Reach out to explore customized strategies for modernizing your back-office systems today.