InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

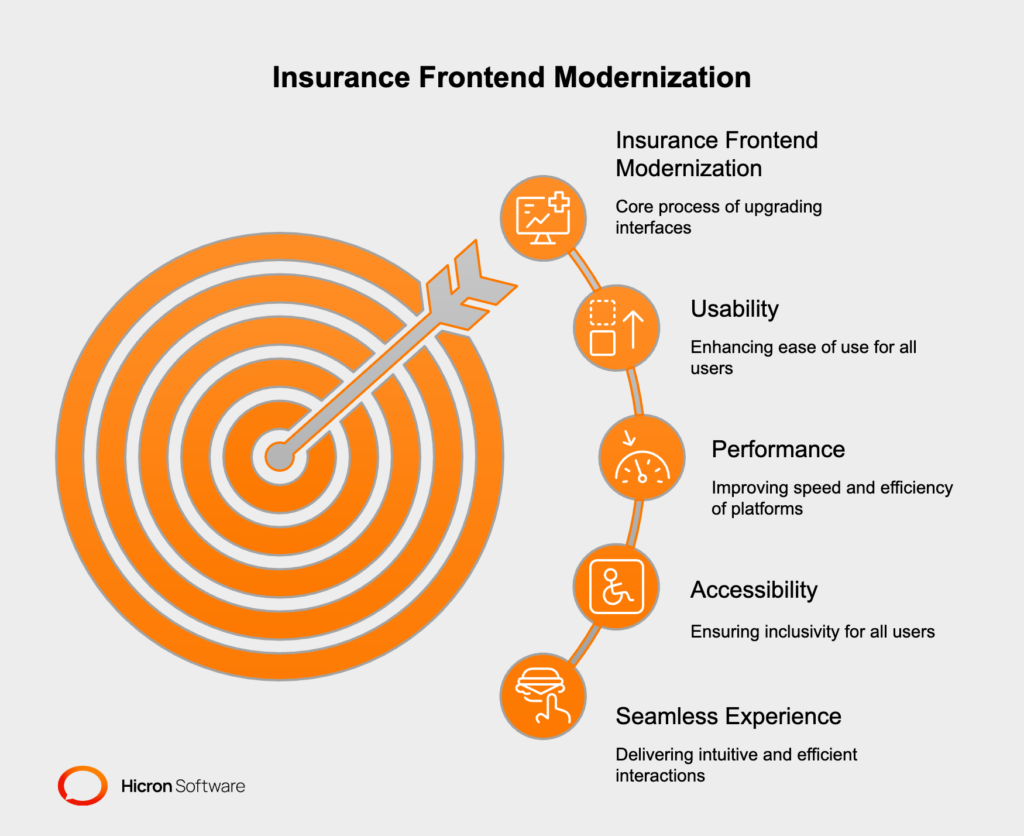

Insurance frontend modernization has become a critical priority in today’s fast-paced digital landscape, where customer expectations are higher than ever. Outdated frontends, plagued by poor usability, sluggish performance, and a lack of responsiveness, frustrate users and hinder operational efficiency.

As customers increasingly demand intuitive, and mobile-friendly experiences, insurers must embrace insurance frontend modernization to stay competitive, enhance user satisfaction, and streamline workflows. This transformation is not just about aesthetics—it’s about creating a robust, future-ready insurance software that aligns with both business goals and customer needs.

Insurance frontend modernization refers to the process of upgrading and transforming the user-facing interface of insurance platforms to meet modern standards of usability, performance, and accessibility. It involves redesigning and enhancing the digital touchpoints that customers and employees interact with, such as websites, mobile apps, and portals, to deliver an intuitive and efficient experience.

By implementing step-by-step forms and progress indicators, insurers can guide users through these tasks with clarity and ease. This not only reduces errors but also enhances user confidence, leading to higher satisfaction and retention rates.

Optimizing for mobile involves creating thumb-friendly navigation, ensuring fast load times, and designing layouts that adapt effortlessly to different screen sizes. A mobile-first approach ensures that users can access and interact with the platform anytime, anywhere, without compromise.

|

Strategy |

Description |

Benefits |

|

Streamlining User Workflows |

Simplify complex processes like claims submission and policy updates using step-by-step forms and progress indicators. |

Reduces errors, enhances user confidence, and improves satisfaction and retention rates. |

|

Responsive and Mobile-First Design |

Ensure experiences across devices with responsive layouts. Optimize for mobile with thumb-friendly navigation and fast load times. |

Provides accessibility anytime, anywhere, and ensures a smooth user experience on all devices. |

|

Consistency Across Platforms |

Maintain a unified look and feel across web, mobile, and app interfaces. Use consistent design patterns for navigation, buttons, and forms. |

Builds trust, reinforces brand identity, and creates a cohesive user experience. |

|

Improving Visual Hierarchies |

Highlight key information like premiums, deadlines, and coverage details using bold fonts, color coding, and whitespace to reduce cognitive load. |

Helps users focus on critical information and make informed decisions without feeling overwhelmed. |

|

Accessibility and Inclusivity |

Adhere to WCAG standards and design for diverse demographics, including older and non-tech-savvy users. |

Broadens platform reach, ensures usability for all, and empowers users to interact confidently. |

By implementing these strategies, insurers can modernize their frontends to deliver exceptional user experiences, meet evolving customer expectations, and maintain a competitive edge in the digital age.

Addressing the security aspect in modernizing an insurance frontend is critical to protect sensitive data, ensure compliance, and build user trust.

By integrating these measures, insurers can ensure their modernized front-end is secure, compliant, and resilient against evolving threats. Below, you have enhanced information on why such security measures are important for insurance frontend modernization.

|

Category |

Action |

Details |

|

Authentication Mechanisms |

Implement robust methods like MFA, biometric login, and SSO |

Enhance access security and reduce unauthorized access risks. |

|

Data Encryption |

Encrypt data in transit and at rest using TLS and AES |

Ensure sensitive information is protected during transmission and storage. |

|

|

Use end-to-end encryption |

Safeguard data from user devices to backend systems. |

|

API and Middleware Security |

Secure APIs with authentication tokens, API gateways, and rate limiting |

Prevent unauthorized access and abuse of APIs. |

|

|

Regularly update middleware |

Address vulnerabilities and ensure secure integration. |

|

Audits and Testing |

Conduct regular security audits and penetration testing |

Identify and address potential risks proactively. |

|

|

Perform code reviews |

Ensure secure coding practices are followed. |

|

Compliance with Standards |

Adhere to regulations like GDPR, HIPAA, or PCI DSS |

Meet legal and industry requirements for data protection. |

|

|

Ensure WCAG compliance |

Make the platform accessible and secure for all users. |

|

Cyber Threat Protection |

Deploy firewalls, IDS, DDoS protection, and anti-malware tools |

Safeguard the platform against cyberattacks and malicious activities. |

|

Session and Access Control |

Use session timeouts and secure cookies |

Protect user sessions from unauthorized access. |

|

|

Implement role-based access control (RBAC) |

Limit data access based on user roles and responsibilities. |

|

Incident Response Plan |

Develop a comprehensive plan to address breaches swiftly |

Minimize damage and recovery time in case of security incidents. |

|

|

Train employees to recognize and mitigate threats |

Build a proactive security culture within the organization. |

|

Continuous Monitoring and Updates |

Use real-time monitoring tools for threat detection |

Identify and respond to suspicious activities promptly. |

|

|

Regularly update software, frameworks, and libraries |

Patch vulnerabilities and maintain a secure platform. |

|

User and Employee Education |

Educate users on creating strong passwords and recognizing phishing attempts |

Empower users to protect their accounts and data. |

|

|

Provide security awareness training for employees |

Reduce risks from human error and social engineering attacks. |

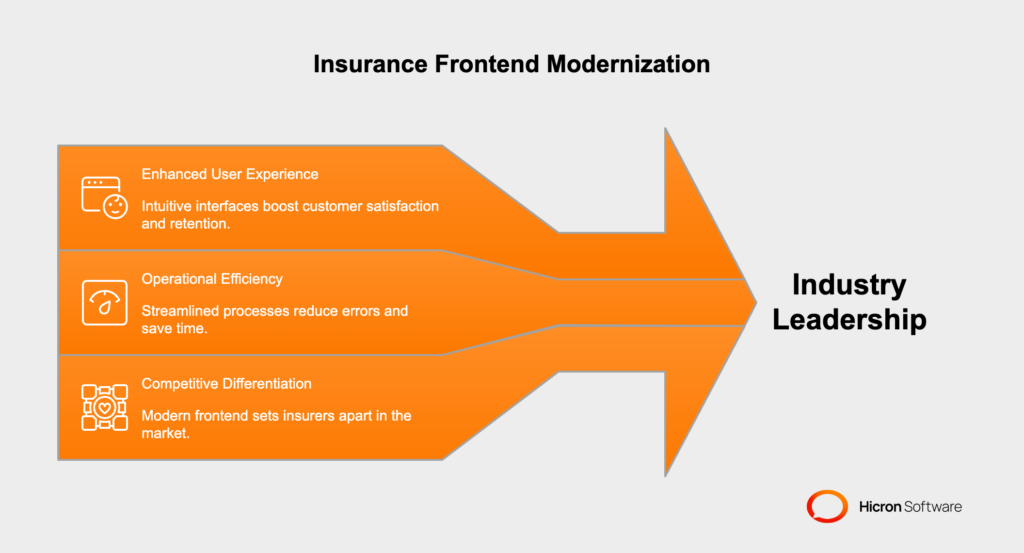

Modernizing the insurance frontend delivers transformative benefits that align with evolving customer expectations and industry demands.

By implementing intuitive navigation and faster workflows, insurers can enhance the user experience, making insurance platforms more accessible and user-friendly. This leads to increased customer satisfaction and retention, as users are more likely to engage with an efficient insurance interface.

Insurance front-end modernization enhances operational efficiency by minimizing manual errors and streamlining processes such as claims submission and policy updates online. These enhancements save time and allow teams to focus on higher-value tasks. In a competitive insurance market, a modernized frontend serves as a key differentiator, showcasing the company’s commitment to insurance digital transformation and customer-centric design.

By embracing frontend modernization strategies, insurers can position themselves as industry leaders, delivering platforms that are not only functional but also future-ready.

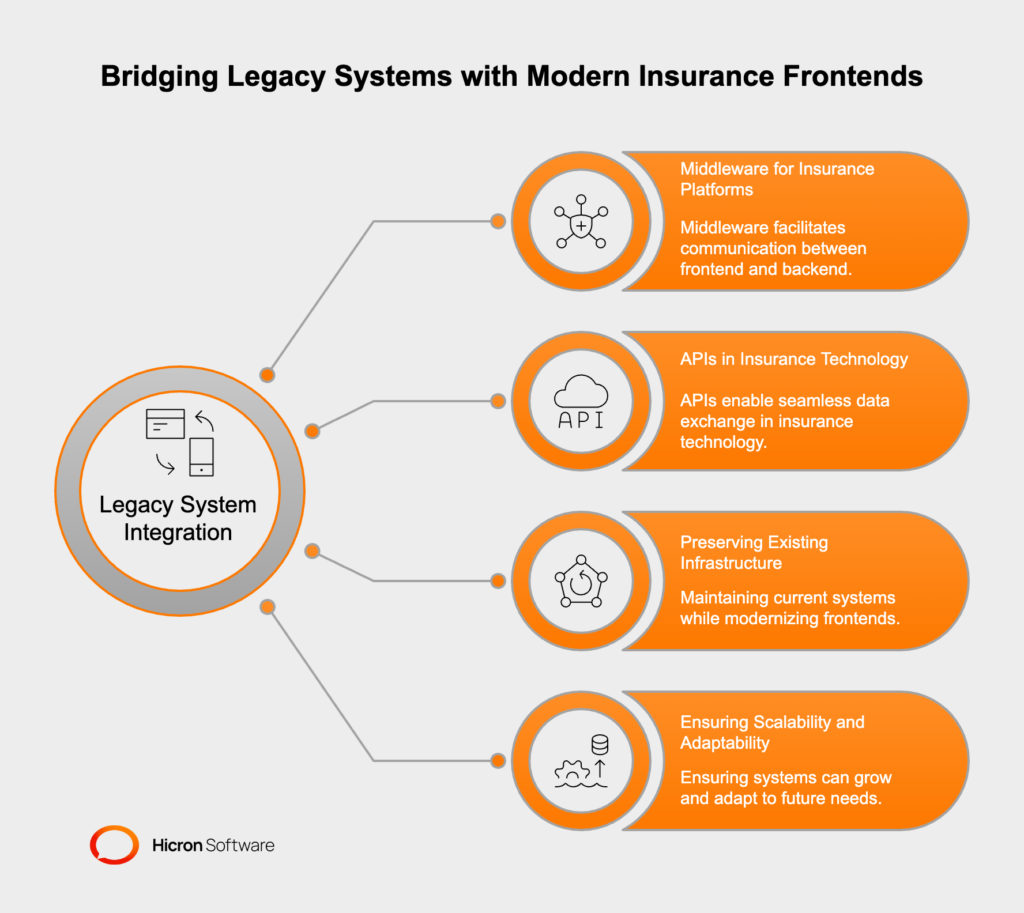

One of the most notable challenges in modernizing insurance frontends is ensuring legacy system integration. Many insurers rely on older backends that are not inherently compatible with modern technologies.

To overcome this, leveraging middleware for insurance platforms and APIs in insurance technology can bridge the gap, enabling smooth communication between the insurance frontend and backend systems. This approach preserves existing infrastructure, ensuring scalability and adaptability for future updates.

Modernization projects can be resource-intensive, posing challenges for insurers with limited budgets. Adopting an incremental approach to insurance frontend modernization allows organizations to spread out costs and reduce risks.

|

Aspect |

Details |

Examples/Steps |

|

Assess and Prioritize |

Conduct a thorough audit of the existing frontend to identify pain points and prioritize high-impact areas, such as responsive design for insurance platforms or streamlined user workflows. Focus on features that directly enhance user experience and operational efficiency. |

Identify areas like mobile responsiveness, workflow simplification, and navigation improvements. |

|

Phased Implementation |

Break the project into smaller, manageable phases to reduce risks and spread costs. |

|

|

Leverage Existing Resources |

Maximize the use of existing tools, platforms, and expertise to reduce costs and avoid complete overhauls. |

Use middleware for insurance platforms to bridge gaps between old and new systems. |

|

Collaborate with Vendors |

Partner with technology vendors offering flexible pricing models, such as pay-as-you-go or subscription-based services, to manage upfront costs. |

Work with vendors specializing in insurance technology trends and frontend modernization strategies. |

|

Monitor and Optimize |

Continuously track the performance of implemented changes and adjust the strategy as needed. Use data analytics to measure ROI and identify areas for further improvement. |

Regularly review metrics like user engagement, system performance, and operational efficiency. |

By prioritizing high-impact areas, such as responsive design for insurance platforms or streamlined user workflows, insurers can achieve measurable improvements without overwhelming their resources. This phased strategy ensures a balance between innovation and financial sustainability.

Navigating regulatory requirements is a critical aspect of insurance digital transformation. Compliance with industry standards and legal frameworks must be integrated into the insurance frontend design.

By embedding features that adhere to WCAG accessibility standards and other regulatory guidelines, insurers can guarantee their platforms are both user-friendly and legally compliant. Examples of such features are in the table below.

|

Aspect |

Examples of WCAG Features |

|

Screen Reader Compatibility |

Use ARIA labels and semantic HTML to ensure visually impaired users can access all content. |

|

Keyboard Navigation |

Enable full navigation via keyboard for users with motor impairments. |

|

Adjustable Font Sizes |

Allow users to modify text size for better readability. |

|

Color Contrast Optimization |

Ensure high-contrast color schemes to improve visibility for users with visual impairments. |

|

Alt Text for Images |

Provide descriptive alt text for all images to make visual content accessible to screen readers. |

|

Error Identification and Suggestions |

Highlight form errors clearly and offer corrective suggestions to guide users. |

|

Accessible Forms |

Design forms with clear labels, instructions, and logical tab order to simplify tasks like claims submission. |

This features mitigate risks and builds trust with users by demonstrating a commitment to inclusivity and transparency. By prioritizing accessibility, insurers can broaden their platform’s reach and ensure compliance with legal and ethical standards.

Measuring the success of insurance frontend modernization involves tracking key performance indicators (KPIs) and metrics that reflect improvements in user experience, operational efficiency, and overall business outcomes.

Here’s a table summarizing how to measure insurance frontend modernization with KPIs:

|

Category |

Metric |

Description |

|

User Experience Metrics |

Customer Satisfaction (CSAT) |

Use surveys or feedback forms to gauge user satisfaction with the new frontend. |

|

Net Promoter Score (NPS) |

Measure how likely users are to recommend the platform to others. |

|

|

Task Completion Rate |

Track the percentage of users successfully completing tasks like claims submission or policy updates. |

|

|

Time on Task |

Measure how long it takes users to complete specific actions. |

|

|

Error Rate |

Monitor the frequency of user errors during interactions. |

|

|

Operational Efficiency |

Processing Time |

Measure the time taken to complete backend processes like claims approval or policy issuance. |

|

Employee Productivity |

Track how the modernized frontend impacts employee efficiency. |

|

|

Reduction in Manual Errors |

Assess the decrease in errors caused by outdated systems or inefficient workflows. |

|

|

Performance Metrics |

Page Load Time |

Ensure the frontend loads quickly across all devices. |

|

System Uptime |

Monitor the reliability of the platform and minimize downtime. |

|

|

Mobile Responsiveness |

Test how well the platform adapts to different screen sizes and devices. |

|

|

Engagement Metrics |

User Retention Rate |

Measure how many users return to the platform after their first interaction. |

|

Bounce Rate |

Track the percentage of users leaving the platform without interacting further. |

|

|

Session Duration |

Monitor how long users stay on the platform during a single visit. |

|

|

Business Impact Metrics |

Customer Retention Rate |

Measure the percentage of customers who continue using the platform after modernization. |

|

Conversion Rate |

Track how many users complete desired actions, such as purchasing a policy or renewing coverage. |

|

|

Revenue Growth |

Assess the impact of modernization on overall revenue. |

|

|

Accessibility Metrics |

WCAG Compliance Score |

Evaluate how well the platform adheres to accessibility standards. |

|

Feedback from Diverse User Groups |

Collect input from users with disabilities or varying tech proficiency. |

|

|

Analytics and Feedback |

Heatmaps and Click Tracking |

Analyze user behavior, such as where they click or spend the most time. |

|

A/B Testing Results |

Compare the performance of the modernized frontend against the old version. |

|

|

User Feedback |

Continuously gather qualitative feedback to identify areas for further refinement. |

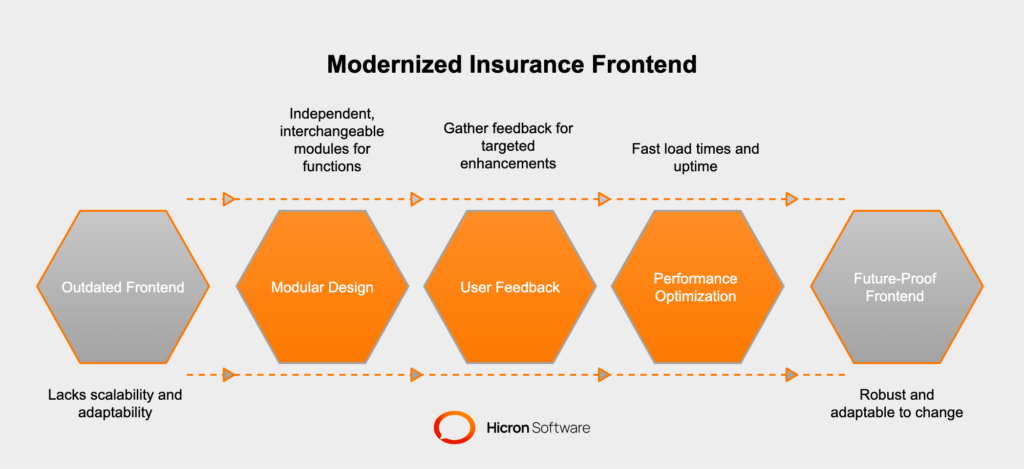

To ensure longevity and adaptability, future-proofing the modernized insurance frontend requires a strategic focus on scalability, user-centric design, and performance. Building modular and scalable designs allows for easy updates and expansions as technology evolves and user needs change. This approach ensures that the insurance software remains relevant and capable of integrating new features, such as APIs in insurance technology or middleware for insurance platforms, without requiring a complete overhaul.

Providing modular design in insurance involves creating a system architecture that is composed of independent, interchangeable modules, each responsible for specific functions. Examples include:

Modular design ensures that updates and changes can be implemented without disrupting the entire system. To future-proof modernized insurance frontends, modularity must be combined with scalability, enabling enhancements to keep pace with evolving technology and user expectations.

A modular design approach incorporates clear interface boundaries between components, enabling the integration of new technologies through APIs or middleware without necessitating extensive rewrites.

Modular design methodology supports adaptability, allowing insurers to quickly respond to market demands and regulatory changes. By fostering flexibility and maintaining high performance, a modular strategy ensures that insurance platforms remain durable, user-centric, and equipped to handle the complexities of the digital age.

Continuously gathering user feedback is essential for refining and improving the modernized insurance frontend. By leveraging data analytics and conducting regular usability testing, insurers can pinpoint areas of pain and implement targeted enhancements that align with user expectations and business objectives. This iterative process improves the user experience in insurance software and fosters customer loyalty by demonstrating a commitment to meeting their needs.

Performance optimization is another critical component of future-proofing. Ensuring

for insurance platforms guarantees a smooth and efficient experience for users across all devices. By prioritizing operational efficiency in insurance frontend modernization, insurers can maintain a competitive edge in a rapidly evolving digital landscape.

By adopting these strategies, insurers can create a modernized frontend that is robust and adaptable positioned to thrive in the face of future challenges and opportunities.

Modernizing the insurance frontend is not just about enhancing customer experience; it also impacts operational efficiency and employee satisfaction. A modern frontend with faster processing times ensures that tasks such as claims management, policy updates, and customer inquiries are handled swiftly and accurately. This efficiency reduces bottlenecks, minimizes errors, and allows employees to focus on higher-value tasks rather than being bogged down by outdated systems.

Moreover, working with a modern, intuitive interface boosts employee morale and productivity. When employees have access to tools that are user-friendly and responsive, it creates a more enjoyable and less frustrating work environment. Features like streamlined workflows, real-time data access, and automated processes empower teams to perform their roles more effectively, leading to higher job satisfaction and retention rates.

The key to achieving these benefits lies in adopting a modular modernization approach. Instead of undertaking a complex and resource-intensive rewriting project, insurers can focus on incremental updates. By leveraging APIs, middleware, and scalable architectures, organizations can modernize their frontends in phases, ensuring minimal disruption to operations while reaping the benefits of improved performance and usability.

This approach accelerates the modernization process and ensures that the insurance tech stack remains adaptable to future needs, making it a win-win for both employees and the organization. Start your win strategy today with us.

Modernizing the insurance frontend is essential to meet evolving customer expectations, improve user experience, enhance operational efficiency, and stay competitive in the digital age.

Key strategies include streamlining user workflows, adopting responsive and mobile-first design, ensuring consistency across platforms, improving visual hierarchies, and adhering to WCAG accessibility standards.

Modular design allows for independent updates to specific components, such as claims management or payment processing, without disrupting the entire system. This ensures scalability, flexibility, and easier integration of new technologies.

Common challenges include integrating legacy systems, managing costs and resources, and ensuring compliance with industry standards and regulations.

By reducing manual errors, streamlining processes like claims submission and policy updates, and enabling faster processing times, modernization allows teams to focus on higher-value tasks and improves overall efficiency.

Accessibility ensures that platforms are usable for individuals with disabilities and diverse demographics. Features like screen reader compatibility, keyboard navigation, and adjustable font sizes broaden the platform’s reach and ensure compliance with WCAG standards.

Future-proofing involves adopting modular and scalable designs, leveraging APIs and middleware, optimizing performance, and continuously gathering user feedback to refine and adapt the platform to evolving needs.