InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

Digital customer engagement platforms for insurance become essential tools for building lasting policyholder relationships. Insurance companies recognize that traditional communication methods no longer meet evolving customer expectations, making customer engagement solutions for insurance a critical competitive advantage.

Understanding how to implement and use these digital customer engagement platforms effectively can mean the difference between thriving in today’s market and watching customers migrate to more digitally sophisticated competitors. This comprehensive guide breaks down everything insurance professionals need to know about selecting, implementing, and maximizing the value of modern insurance software designed specifically for customer engagement.

Key takeaways:

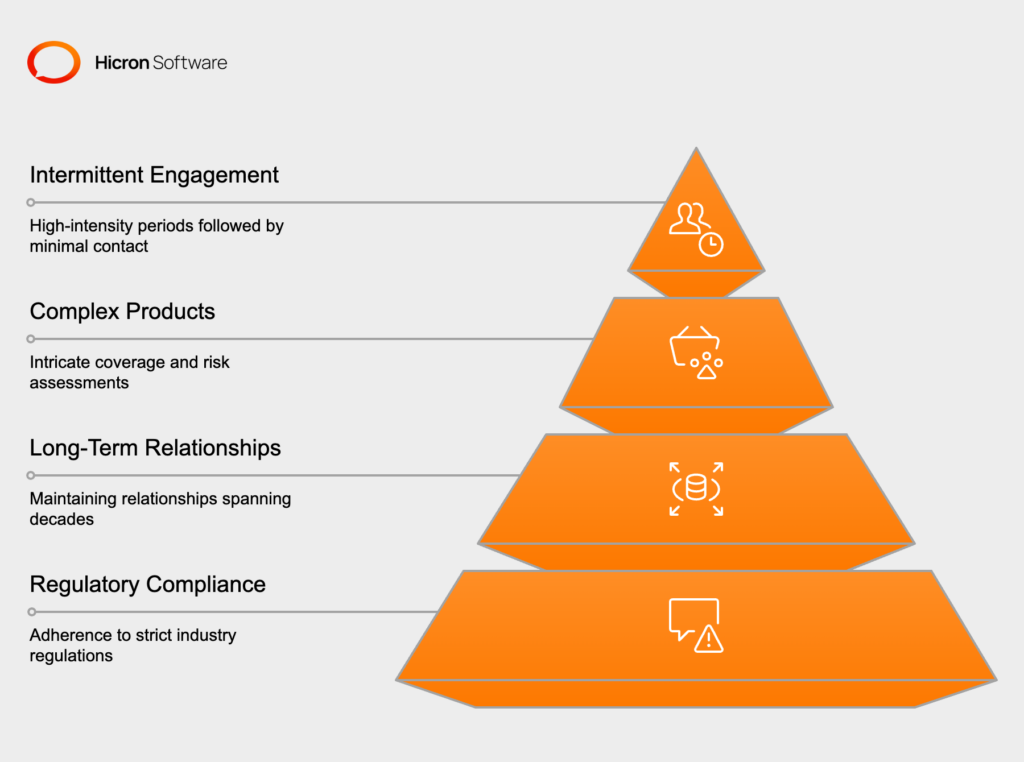

Before exploring specific platform capabilities, let’s examine why insurance requires a specialized approach to customer engagement that differs significantly from other industries. Insurance customer relationships follow what industry experts call “episodic engagement patterns” that create unique challenges for traditional customer relationship management approaches.

Key characteristics of insurance customer engagement include:

A comprehensive customer engagement platform for insurance must accommodate these unique patterns while providing seamless experiences that build trust and demonstrate value even during quiet periods. Think of it as maintaining a trusted advisor relationship that can instantly reactivate with full context after months or years of minimal interaction.

Effective insurance customer engagement platforms integrate three fundamental pillars that work together to create cohesive customer experiences. Understanding how these components interconnect helps insurance professionals make informed platform selection decisions and optimize implementation strategies.

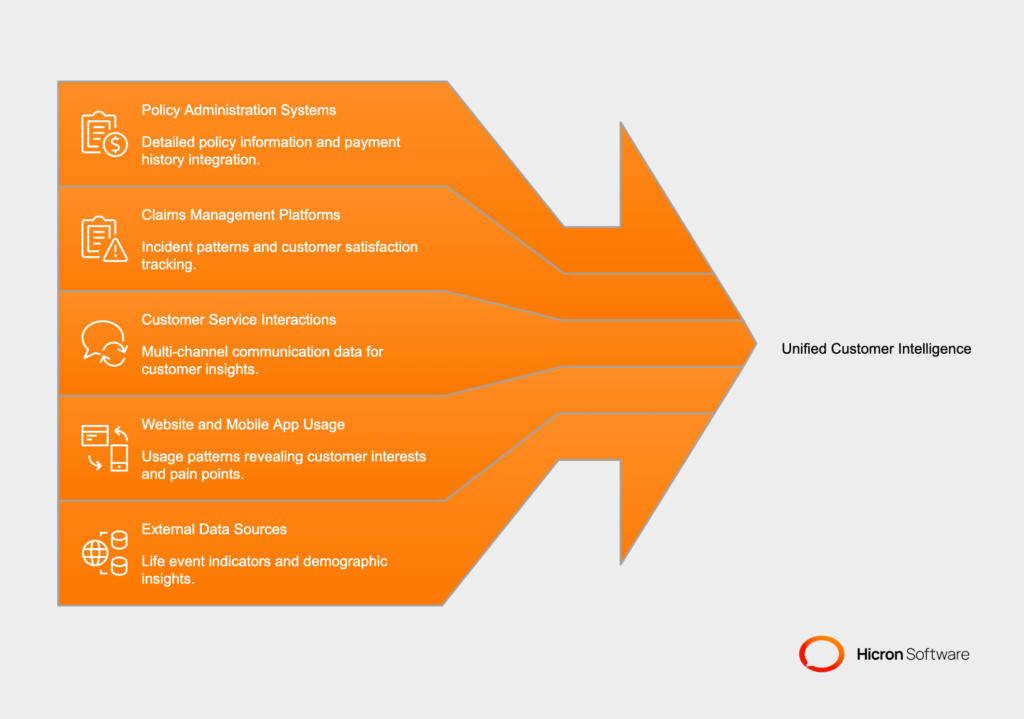

The first pillar involves creating comprehensive customer profiles that extend far beyond basic policy information to include behavioral patterns, interaction preferences, and predictive insights about future needs. Modern insurance software captures data from every digital touchpoint to build what industry leaders call “customer digital twins” – complete representations of each policyholder’s relationship with your company.

Essential data integration points include:

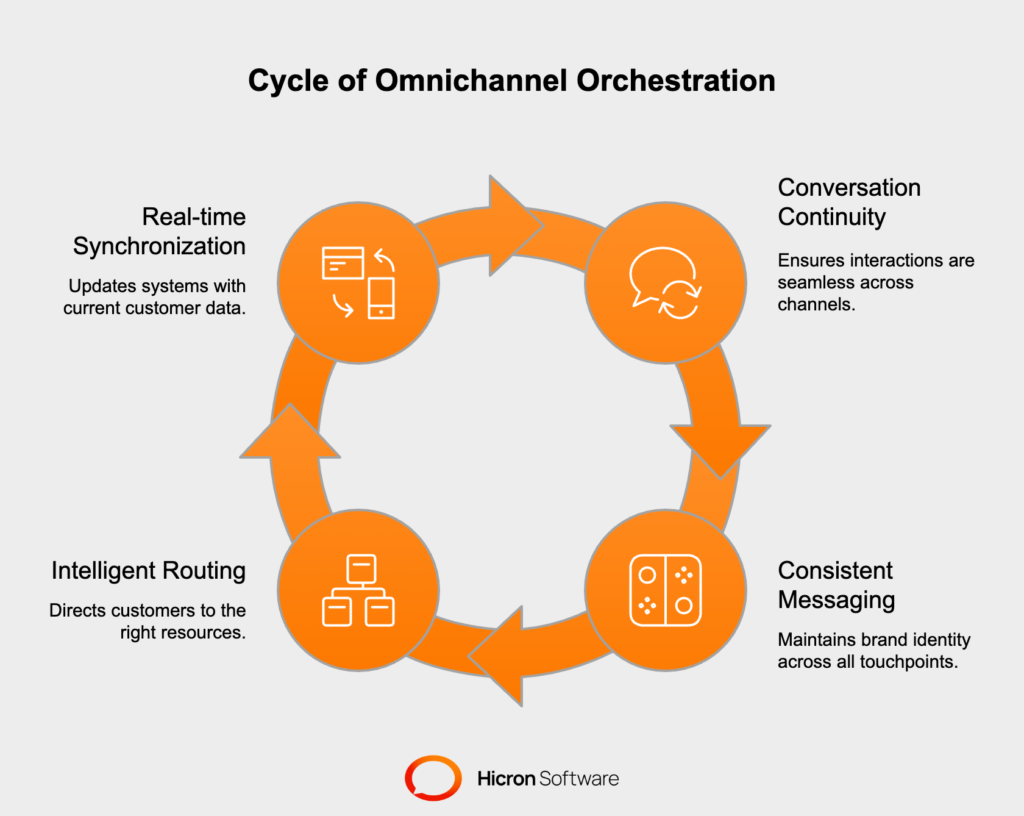

The second pillar ensures that customer conversations flow between different communication channels without losing context or requiring customers to repeat information. This orchestration capability becomes particularly crucial in insurance, where customers might research policies online, discuss options over the phone, and complete transactions through mobile applications.

Successful omnichannel orchestration delivers:

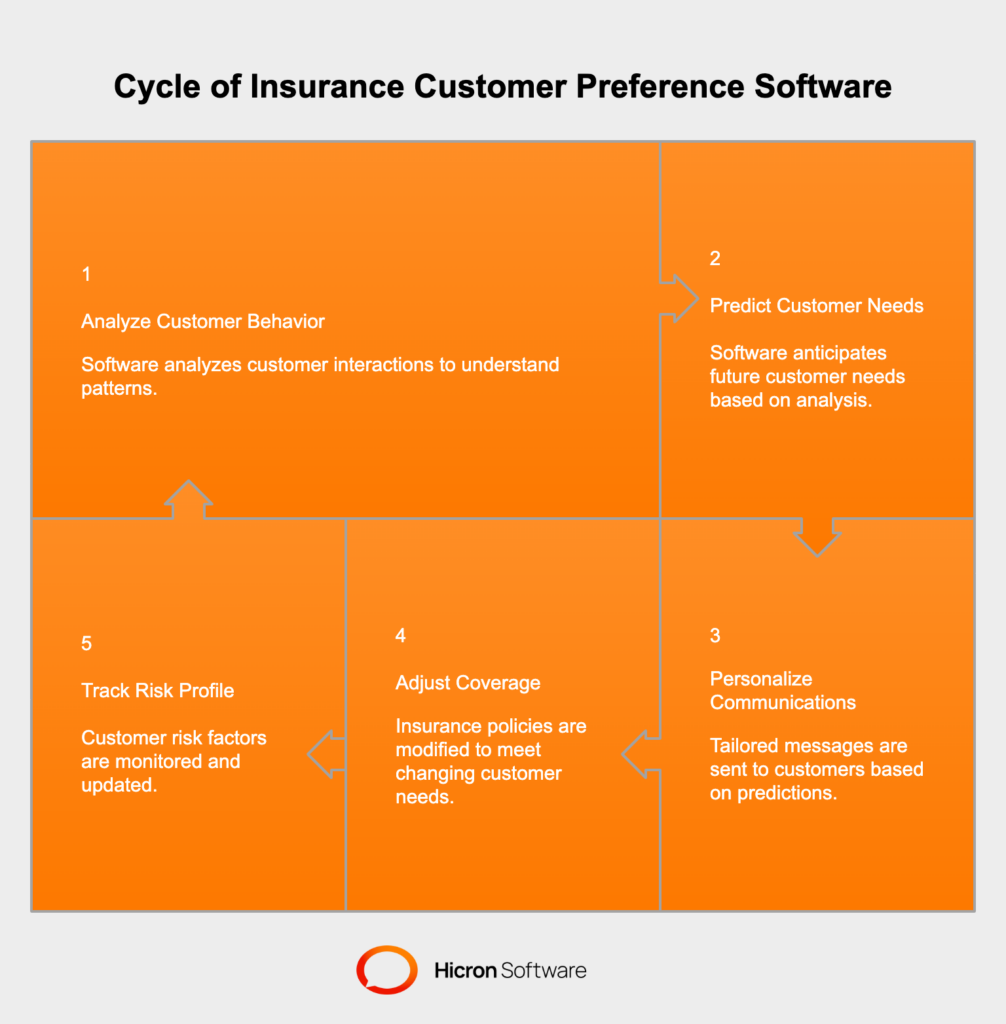

The third pillar leverages artificial intelligence and machine learning to transform raw customer data into meaningful, personalized experiences that feel natural and valuable. Insurance customer preferences software within this pillar learns from customer behavior patterns to predict needs and automate appropriate responses.

Advanced automation capabilities include:

Insurance customer preferences software represents a substantial evolution from traditional customer relationship management systems by focusing on understanding and predicting customer needs rather than simply storing historical information. This transformation enables insurance companies to shift from reactive customer service to proactive relationship building.

Consider how this software handles a common scenario: when the platform detects that a customer frequently accesses their auto policy details combined with searches about relocating to a different state, it automatically triggers personalized communications about coverage requirements in their new location. This proactive approach demonstrates value to customers while creating opportunities for policy adjustments or additional coverage sales.

Key transformation areas include:

The software also enables sophisticated segmentation strategies that go beyond traditional demographic categories to include behavioral and preference-based groupings. Young professionals with similar coverage needs might have completely different communication preferences and engagement patterns, requiring tailored approaches that traditional segmentation methods cannot accommodate.

The success of any user experience platform for insurance depends critically on interface design that makes complex insurance concepts accessible and engaging for customers with varying levels of insurance knowledge. Traditional insurance interfaces often overwhelm customers with industry jargon and complicated navigation paths that create frustration and abandonment.

When insurance companies improve user interface insurance design, they address fundamental barriers that prevent customers from fully utilizing available services and self-service capabilities. Effective interface optimization reduces customer service workload while increasing customer satisfaction and engagement levels.

Essential interface optimization strategies include:

Successful interface design also incorporates feedback mechanisms that continuously improve user experience based on actual customer behavior and pain points. Heat mapping, user session recordings, and A/B testing capabilities help identify areas where customers struggle and inform iterative improvements.

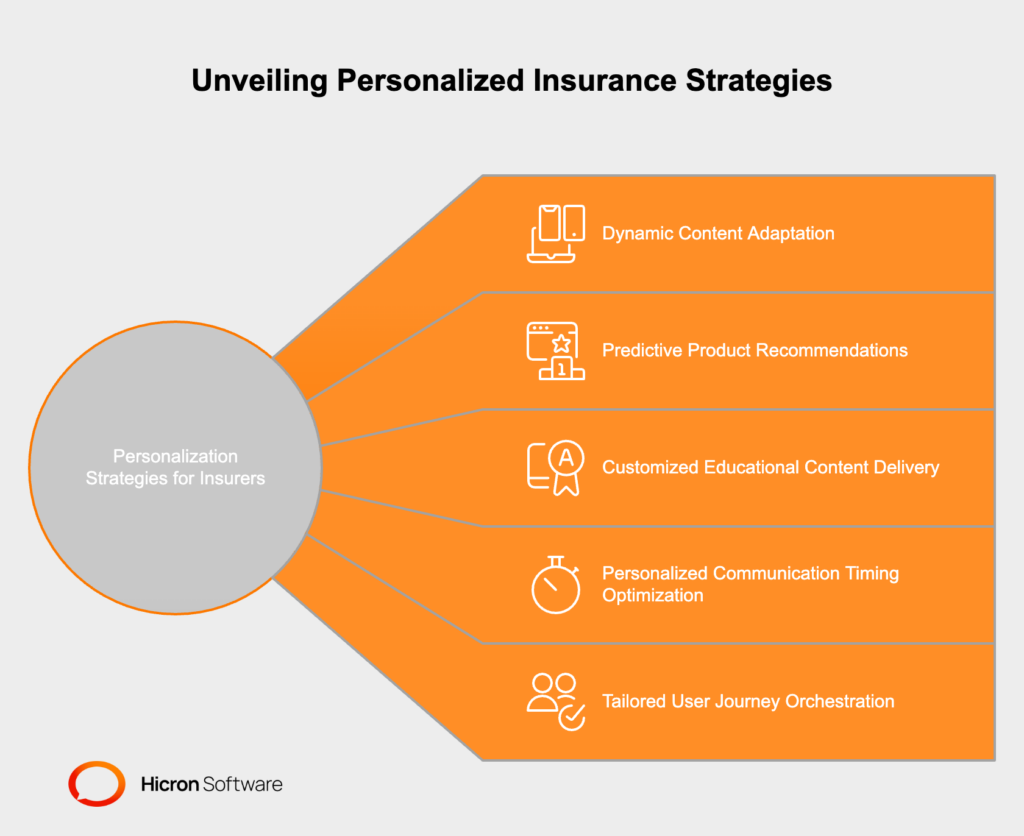

Personalized engagement for insurers goes far beyond inserting customer names into email templates or sending generic birthday messages. Sophisticated personalization leverages comprehensive customer data to create communications and experiences that feel specifically crafted for each individual’s unique circumstances and preferences.

Effective personalization strategies recognize that insurance customers exist in different life stages with varying risk profiles, coverage needs, and communication preferences. A young professional with basic auto coverage requires different engagement approaches than a family with multiple policies and recent claims experience.

Advanced personalization techniques include:

The most successful personalization strategies also incorporate feedback loops that continuously refine customer profiles based on engagement responses and explicit preference updates. This creates increasingly accurate personalization over time while respecting customer privacy and communication preferences.

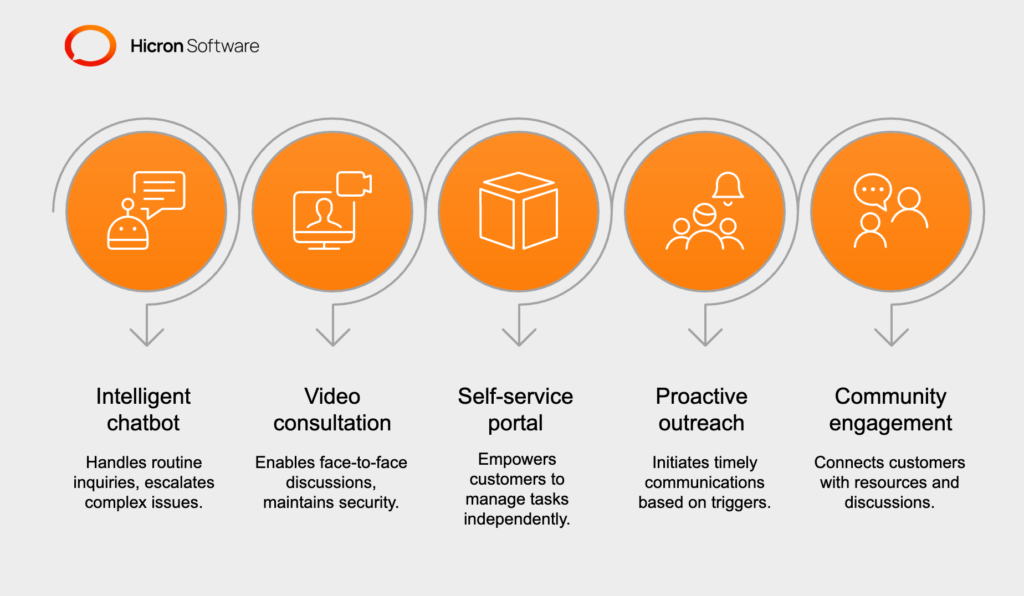

Comprehensive policyholder interaction and engagement tools create multiple pathways for customers to connect with your company according to their preferred communication styles and immediate needs. The key lies in providing seamless integration between different interaction modes while maintaining conversation continuity and context throughout the customer journey.

Modern interaction tools recognize that customer preferences vary not only between individuals but also based on the specific nature of their insurance needs at any given moment. Simple policy questions might be perfectly suited for chatbot interactions, while complex claims discussions require human expertise with full access to customer history and context.

Essential interaction tool categories include:

These tools also incorporate sophisticated workflow automation that ensures no customer inquiry falls through cracks while maintaining the personal touch that successful insurance relationships require. When customers submit claims, the platform automatically initiates appropriate communication sequences, schedules necessary follow-ups, and coordinates between different departments involved in resolution.

The most effective insurance customer engagement platforms utilize composable architecture that allows different components to work together harmoniously while maintaining flexibility to adapt as business needs evolve. This architectural approach proves particularly important for insurance companies because existing technology ecosystems typically include specialized systems for policy administration, claims management, underwriting, and regulatory compliance.

Understanding the technical foundation helps insurance professionals make informed decisions about platform selection and implementation strategies. The architecture must support both current operational requirements and future growth while ensuring security and compliance with industry regulations.

Critical architectural components of the insurance customer engagement platform:

Successful implementations focus on creating what industry experts call “data harmony” rather than simply connecting disparate systems. This involves establishing common data definitions, ensuring information quality, and maintaining synchronization that keeps all platforms aligned with accurate, current customer information.

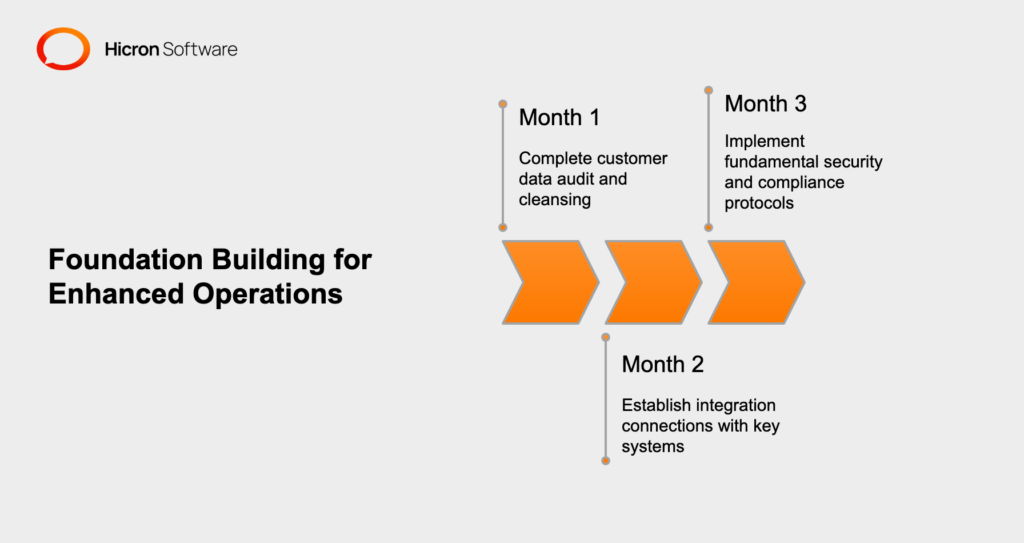

Implementing customer engagement solutions for insurance requires strategic planning that balances immediate operational improvements with long-term capability development. The most successful implementations follow phased approaches that build foundational capabilities before adding sophisticated personalization and predictive features.

Phase 1: Foundation Building (Months 1-3)

The initial implementation of the insurance customer engagement platform phase focuses on establishing core data integration and basic automation capabilities. This includes connecting existing customer databases, implementing basic workflow automation, and training team members on platform fundamentals.

Key activities during foundation building:

Phase 2: Personalization Development (Months 4-6)

The second phase of the insurance customer engagement platform builds upon foundational capabilities to introduce customer segmentation, personalized communications, and enhanced self-service options. This phase typically delivers the most visible improvements in customer experience and operational efficiency.

Key activities during personalization development:

Phase 3: Predictive Optimization (Months 7-12)

The final implementation phase of the insurance customer engagement platform introduces sophisticated predictive capabilities that anticipate customer needs and proactively address potential issues. This phase transforms the platform from reactive customer service to strategic relationship building.

Key activities during predictive optimization:

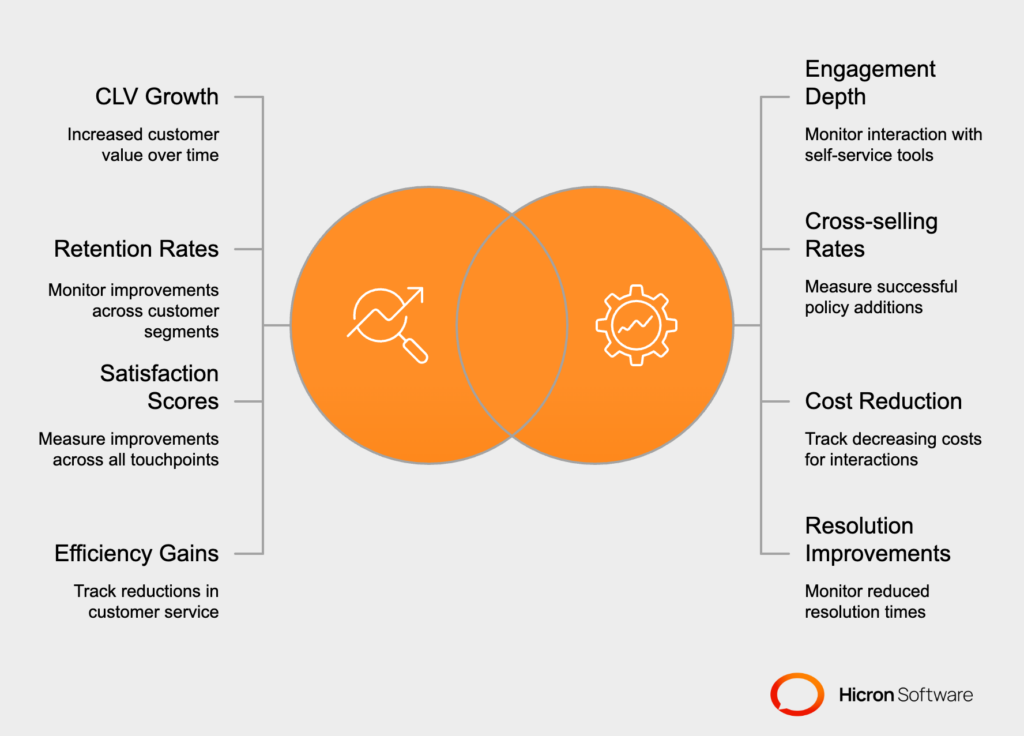

Measuring the effectiveness of modern insurance software requires metrics that capture both immediate operational improvements and long-term relationship building success. Traditional marketing metrics like email open rates remain important, but insurance companies need broader measurement frameworks that reflect the true impact on customer relationships and business outcomes.

Primary Performance Indicators:

Secondary Performance Indicators:

The most successful measurement strategies also incorporate customer feedback mechanisms that provide qualitative insights into relationship quality improvements that quantitative metrics might miss.

|

Platform Name |

Key Features |

Benefits |

|

InsuredMine |

|

|

|

Zywave Client Engagement Suite |

|

|

|

HubSpot CRM |

|

|

|

Relativity6 |

|

|

|

GloveBox |

|

|

As insurance companies evaluate different platforms, considering long-term evolution potential helps ensure investments remain valuable as customer expectations and technology capabilities continue advancing. The most successful platform selections support predictable capability development that grows with organizational sophistication.

Evolution Path Considerations:

Understanding the typical evolution of insurance customer engagement platforms helps inform selection decisions that support long-term success, rather than requiring costly replacements as capabilities mature. Most insurance companies follow predictable development paths that begin with operational efficiency, progress to personalization at scale, and ultimately enable predictive engagement that anticipates customer needs.

Technology Trend Alignment:

Successful insurance customer engagement platforms incorporate emerging technologies like artificial intelligence, machine learning, and advanced analytics in ways that enhance rather than complicate customer relationships. Look for platforms that demonstrate clear roadmaps for incorporating technological advances while maintaining focus on insurance-specific needs.

Regulatory Adaptation Capabilities:

Insurance regulations continue evolving, particularly around data privacy, communication requirements, and customer protection. Platforms must demonstrate ability to adapt to regulatory changes without requiring complete reconfiguration or compromising customer experience quality.

The insurance industry’s competitive landscape increasingly favors companies that master digital customer engagement platform for insurance capabilities while maintaining the personal relationships that define successful insurance partnerships. These platforms represent far more than technology implementations – they enable fundamental transformations in how insurance companies build and maintain valuable customer relationships throughout entire policy lifecycles.

Successful implementation of customer engagement solutions for insurance requires strategic thinking that balances immediate operational improvements with long-term relationship-building objectives. The companies that invest thoughtfully in comprehensive platforms today position themselves advantageously as customer expectations continue evolving and competitive pressures intensify.

The question facing insurance professionals isn’t whether to implement these capabilities, but how quickly they can do so while ensuring the solutions truly serve customer needs and business objectives. The most successful implementations focus on creating genuine value for customers while building sustainable competitive advantages that strengthen over time.

A digital customer engagement platform for insurance is a comprehensive software solution that orchestrates all customer interactions across multiple communication channels while maintaining complete context and personalization. Unlike generic customer relationship management systems, these platforms are specifically designed to handle insurance industry requirements including regulatory compliance, complex product explanations, and episodic engagement patterns typical of insurance customer relationships.

Customer engagement solutions for insurance go beyond traditional CRM functionality by incorporating insurance-specific features like policy administration integration, claims workflow automation, regulatory compliance tools, and predictive analytics designed for insurance customer behavior patterns. These platforms understand the unique challenges of maintaining customer relationships that may have extended periods of minimal contact followed by intensive engagement during claims or policy changes.

When evaluating modern insurance software for customer engagement, prioritize platforms that offer robust integration with existing insurance systems, comply with industry regulations, provide sophisticated automation capabilities, and demonstrate clear evolution roadmaps. Key features should include omnichannel communication orchestration, predictive customer analytics, personalization engines, and comprehensive reporting capabilities that track both operational efficiency and relationship quality metrics.

Insurance customer preferences software transforms customer relationships by learning from behavior patterns to predict needs and personalize interactions accordingly. Instead of treating all customers identically, the software adapts communication timing, content, and channels based on individual preferences and circumstances. This creates more relevant, valuable interactions that strengthen customer loyalty and increase lifetime value.

When insurance companies improve user interface insurance design, they reduce customer frustration, decrease support call volume, increase self-service adoption, and improve overall customer satisfaction. Better interfaces make complex insurance concepts more accessible, enable customers to complete tasks independently, and create positive experiences that strengthen customer relationships and reduce operational costs.

Personalized engagement for insurers increases business results by creating more relevant customer experiences that drive higher engagement rates, improved retention, increased cross-selling success, and stronger customer advocacy. When customers receive communications and offers that feel specifically relevant to their situations, they respond more positively and maintain longer, more profitable relationships with insurance companies.

The most effective policyholder interaction and engagement tools combine multiple communication channels with intelligent automation and human expertise. Essential tools include chatbots for routine inquiries, video consultation capabilities for complex discussions, self-service portals for independent task completion, proactive outreach automation, and seamless escalation protocols that connect customers with appropriate specialists when needed.

Insurance customer engagement platforms typically integrate with existing systems through APIs (Application Programming Interfaces) that enable real-time data sharing between platforms. The most effective integrations create unified customer views that combine information from policy administration, claims management, billing systems, and customer service platforms while maintaining data accuracy and regulatory compliance.

Measure ROI from insurance customer engagement platforms using both quantitative and qualitative metrics. Key performance indicators include customer lifetime value growth, policy retention rate improvements, operational efficiency gains, and customer satisfaction score increases. Secondary metrics should track engagement depth, cross-selling success rates, cost per interaction reductions, and time to resolution improvements across all customer touchpoints.

Most insurance companies implement customer engagement solutions for insurance over 6-12 months using phased approaches. The first phase (months 1-3) focuses on foundation building and basic integration. The second phase (months 4-6) adds personalization and advanced automation capabilities. The final phase (months 7-12) introduces predictive features and sophisticated analytics. This phased approach allows teams to develop expertise while delivering incremental value throughout implementation.