InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

Marine insurance risk assessment plays a vital role in identifying and managing potential threats in the maritime industry. By leveraging advanced marine insurance software and risk assessment tools, businesses can streamline processes and minimize uncertainties.

Software supports marine insurance risk assessment by utilizing advanced data analysis, predictive modeling, and real-time monitoring tools. It processes extensive data sets, including past incidents, weather patterns, shipping routes, and cargo specifics, to detect trends and assess potential risks.

This technological integration creates a more efficient and responsive risk assessment process in marine insurance.

Key takeaways:

This article explores how software is transforming marine insurance risk assessment. We’ll explore the technologies driving this change, the practical applications that are reshaping industry standards, and the best practices for leveraging these tools.

Whether you’re an insurer, a logistics professional, or a business owner, this guide is designed to help you navigate the future of risk assessment with confidence and precision. We emphasize the crucial role of risk assessment in protecting maritime businesses against financial losses.

Navigating the unpredictable seas of maritime trade comes with its fair share of risks. From weather-related disruptions to cargo mishandling and geopolitical uncertainties, the stakes are high in safeguarding vessels, cargo, and financial interests. That’s where marine insurance plays a crucial role, offering a safety net to businesses in an industry where unpredictability reigns.

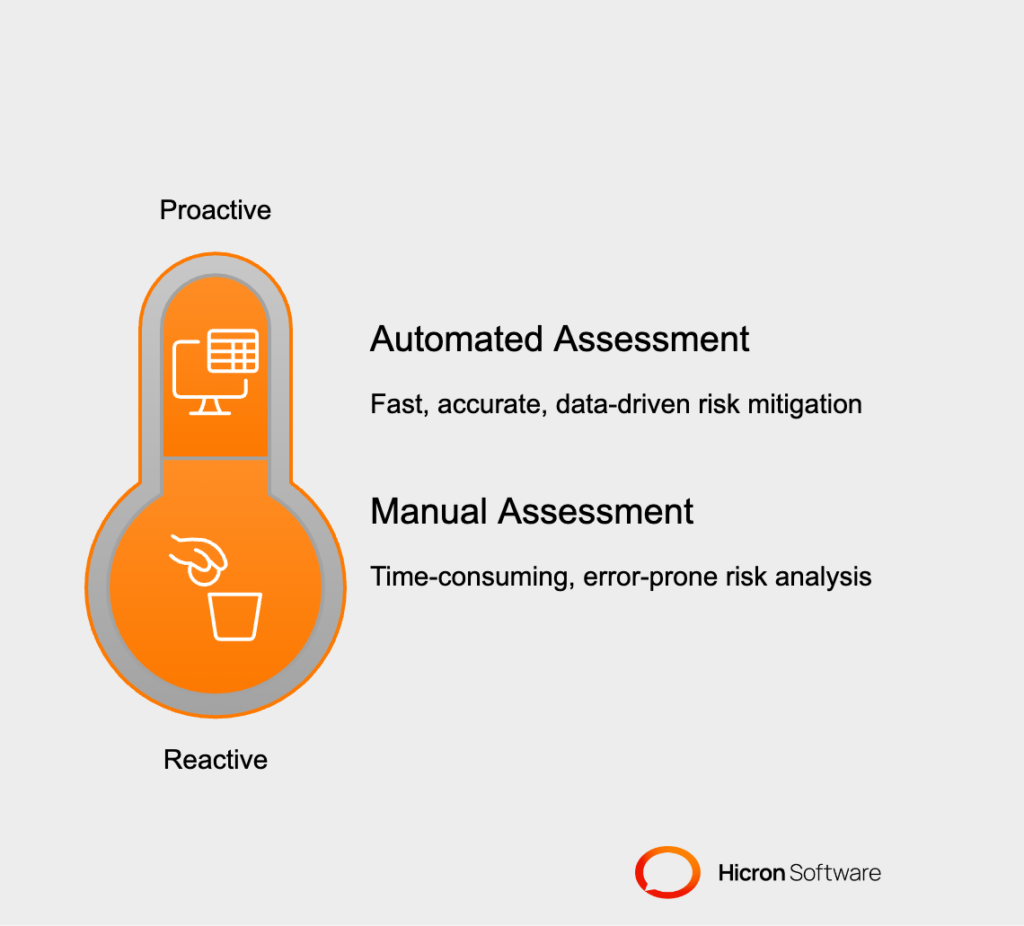

However, traditional methods of assessing these risks often fall short. Manual processes can be time-consuming, prone to human error, and unable to keep up with the complexities of modern shipping.

The good news? Software solutions are leading a revolutionary shift in marine insurance risk assessment. By harnessing the power of data analytics, artificial intelligence (AI), Internet of Things (IoT), and blockchain technology, businesses can now access faster, more accurate, and proactive tools to manage and mitigate risks effectively.

Explore: How to Analyze Premium Models for Risk-Based Marine Insurance

Successfully managing risks in the maritime industry requires precision, speed, and strict compliance with complex regulations. Software solutions have emerged as essential tools to meet these demands, transforming the way risk assessment is approached. Here’s how software is making a significant impact:

Accurate risk assessments are crucial for minimizing potential losses. Software offers unmatched precision by leveraging data analytics and machine learning capabilities. These tools can process vast volumes of data, such as historical claims, vessel performance metrics, and shipping routes, quickly and without human error. For example, an insurer can analyze patterns in past cargo damage claims to pinpoint high-risk scenarios. This level of insight allows marine businesses to make data-driven decisions, reducing the likelihood of oversight.

Traditional risk assessment methods can be time-consuming, often relying on manual processes that delay decisions. Software changes the game by offering real-time monitoring and predictive tools. For instance, IoT sensors installed on a vessel can instantly relay environmental data, such as weather conditions or potential mechanical failures. Simultaneously, AI-powered tools can predict risks like extreme weather disruptions or piracy hotspots, giving businesses the ability to act proactively. This agility enhances safety while saving both time and money.

The shipping industry operates under a web of international laws and regulations designed to ensure safety and environmental protection. Keeping up with these standards can be overwhelming, particularly for businesses operating on a global scale. Software simplifies this process by maintaining up-to-date databases of regulations and automating compliance checks. For example, blockchain technology can assist insurers in verifying documentation and supply chain adherence with transparency. This not only reduces the risk of penalties but also builds trust with stakeholders.

By integrating software into risk assessment practices, marine insurers and businesses are safeguarding their present operations and paving the way for a safer, more efficient future. Combining accuracy, speed, and compliance ensures that they can stay resilient in an industry defined by constant challenges.

The technological advancements that have emerged in recent years are reshaping risk assessment practices in marine insurance. By integrating cutting-edge tools like data analytics, artificial intelligence (AI), and Internet of Things (IoT), insurers and maritime businesses are achieving new efficiency, accuracy, and security levels. Here’s a closer look at how each technology plays a pivotal role:

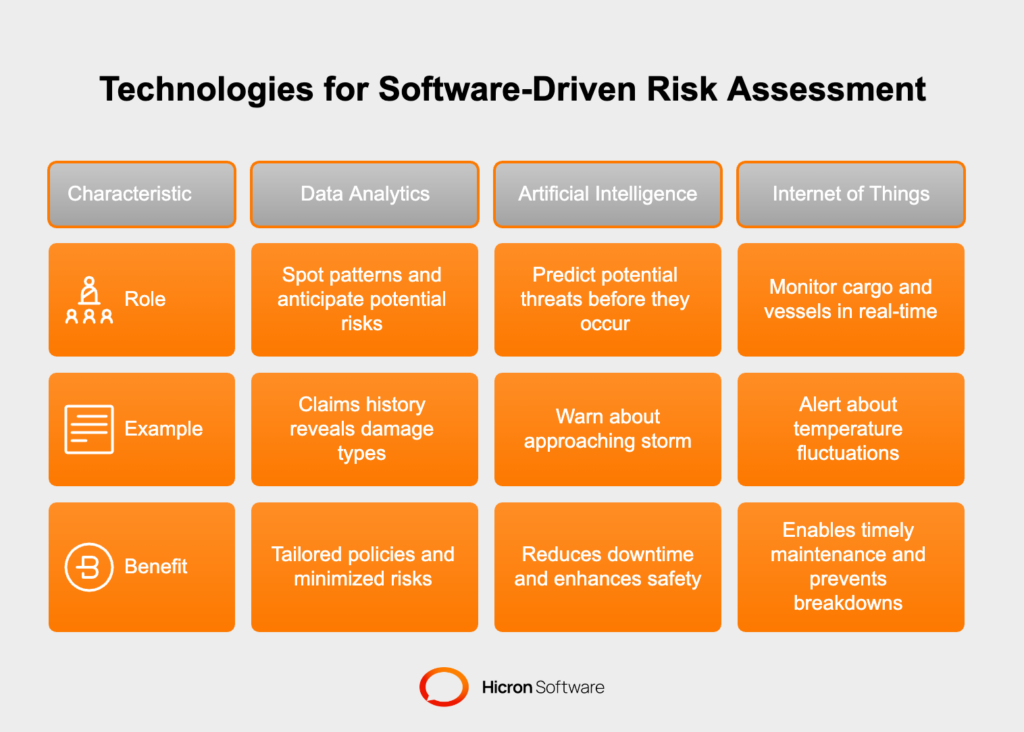

Data analytics has become the backbone of modern risk assessment by enabling better decision-making through meaningful insights. Analyzing large datasets helps insurers spot patterns and anticipate potential risks. For example, claims history can reveal recurring damage types tied to specific shipping routes or cargo types. Such insights empower underwriters to develop tailored policies while helping businesses adjust their operational strategies to minimize risks.

Artificial intelligence enhances risk analysis by predicting potential threats before they occur. AI systems excel at processing dynamic data, like evolving weather patterns or geopolitical developments, to forecast hazards such as hurricanes or piracy incidents. An AI-based solution could, for instance, analyze satellite data to warn a shipping company about an approaching storm, giving them time to reroute vessels and avoid financial losses. This proactive approach reduces downtime and enhances safety on the seas.

The Internet of Things has revolutionized the way cargo and vessels are monitored. IoT sensors transmit real-time data on conditions like temperature, humidity, and vibrations, which are critical for safeguarding sensitive cargo. For example, a refrigerated container carrying perishable goods can alert stakeholders about temperature fluctuations, allowing immediate corrective action before spoilage occurs. Additionally, IoT devices installed on ships can track mechanical performance, enabling timely maintenance to prevent breakdowns during voyages.

By leveraging these technologies, the maritime insurance industry is optimizing risk assessment and setting new benchmarks for operational excellence. These tools allow the industry to address challenges with speed, precision, and confidence, ensuring safer global trade and shipping operations.

The adoption of advanced software solutions in marine insurance is revolutionizing how risks are managed, claims are processed, and operational decisions are made. Below, we explore key practical applications that are reshaping the industry.

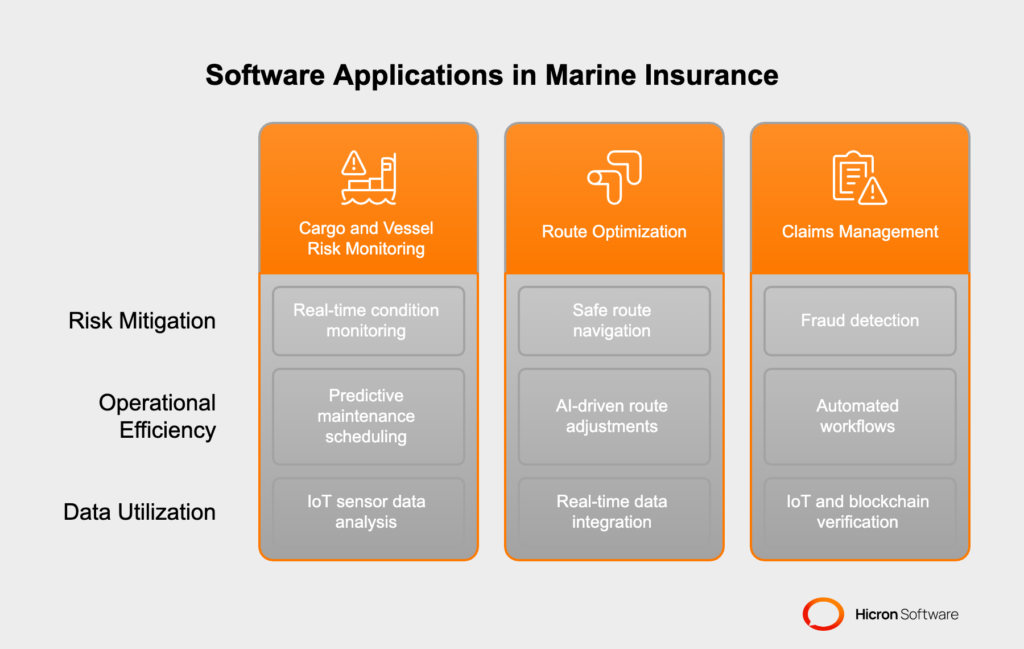

Protecting cargo and ensuring vessel compliance are critical to mitigating risks in maritime operations. Software tools equipped with IoT sensors and analytics capabilities help monitor cargo conditions in real-time, identifying vulnerabilities such as temperature fluctuations or unexpected vibrations. For example, perishable goods can be preserved during transit by instantly alerting operators to any deviations in refrigeration levels, reducing spoilage.

Similarly, software plays a pivotal role in tracking vessel maintenance schedules and compliance requirements. By analyzing performance data, it can predict potential mechanical issues before they escalate, ensuring that vessels remain safe and operational. This proactive approach extends the lifespan of assets and minimizes disruptions caused by downtime.

Navigating safe routes is essential to avoid risks like extreme weather, piracy zones, or congested passageways. Software solutions use AI and data analytics to provide route optimization based on real-time factors. For instance, an advanced risk evaluation tool can predict storm trajectories and suggest alternate routes to avoid delays or accidents.

Additionally, route planning tools incorporate geopolitics, such as unstable regions, to guide vessels away from areas with a higher likelihood of piracy attacks. By combining real-time data with AI algorithms, maritime businesses can make informed routing decisions that enhance safety and efficiency.

One of the most significant challenges in marine insurance is the timely and accurate resolution of claims. Digital solutions simplify this process by automating claims management workflows. For example, data collected through IoT sensors or blockchain-based documentation can verify an incident instantly, reducing the time typically needed for manual checks.

Software also helps detect irregularities that could indicate fraudulent claims. AI-driven tools analyze patterns in claims data to flag anomalies, like inconsistent reporting or altered documentation, ensuring only legitimate claims are processed. This enhances transparency and builds trust between insurers and their clients.

Software is enabling marine insurance providers and businesses to operate more safely, efficiently, and securely by integrating tools for monitoring, optimization, and claims management. As these applications evolve, they pave the way for a smarter and more resilient industry.

Implementing marine insurance risk assessment software can transform how businesses handle maritime risks. Organizations should follow these best practices to ensure a smooth transition and maximize the benefits of these tools.

For successful software deployment, new tools must work harmoniously with existing systems. Begin by thoroughly auditing your current operational and IT infrastructure to identify compatibility issues. Selecting solutions with API functionalities or pre-built integration tools can significantly simplify the process.

Collaboration between IT teams and software vendors during deployment is key. This partnership helps address technical challenges and ensures a tailored setup. Additionally, consider using sandbox environments to test the software’s functionality without disrupting regular operations. Managed step-by-step implementation also reduces downtime and makes the transition manageable for your team.

To sustain efficiency, it’s essential to maintain the software and keep your team adept at using it. Regularly updating tools ensures access to the latest features, security patches, and compliance with evolving regulations. Dated software can lead to vulnerabilities, inefficiencies, and missed opportunities for improvement.

Equally important is training employees to use the software effectively. Comprehensive onboarding sessions should start early and cover all tool functionality aspects. Furthermore, periodic refresher training keeps skills sharp and encourages staff to utilize advanced features. Investing in training enables your team to fully harness the software’s potential and maintain operational excellence.

Building a strong relationship with software providers can simplify adoption and enhance the product’s value. When choosing a vendor, prioritize those who offer customizable solutions. Open communication is crucial for articulating your business needs, whether custom reporting dashboards, integration requirements, or unique risk assessment features.

Providers can also guide ongoing optimization. Leverage their expertise for troubleshooting, feature recommendations, and software scaling as your business evolves. Many vendors offer customer success programs, which include regular health checks and performance evaluations to ensure the tool continues to meet your needs.

Businesses can unlock the full potential of marine insurance risk assessment software by focusing on seamless integration, continuous maintenance, and collaborative relationships with vendors. These best practices streamline adoption and lay the groundwork for long-term success in a dynamic industry.

Adopting software-driven marine insurance risk assessment solutions comes with its share of challenges. However, these obstacles can be addressed with strategic approaches that ensure smooth implementation and sustainable operations. Below are three key areas and actionable strategies to overcome them.

Handling sensitive data such as cargo details, policyholder information, and compliance documents requires robust security measures. To ensure data privacy, businesses should:

By building a culture of data security and choosing providers with strong cybersecurity measures, businesses can minimize risks and safeguard their operations.

Cost constraints are a common concern for businesses considering software adoption. However, finding software that balances affordability with scalability is possible by following these steps:

By focusing on solutions that deliver ROI and are affordable, companies can access the benefits of digital risk assessment without overextending budgets.

Resistance to change is a frequent hurdle when introducing new technology. To address this, companies can:

By fostering a collaborative approach and ensuring the workforce feels supported, organizations can ease the transition to digital tools and encourage adoption.

Overcoming privacy concerns, cost barriers, and resistance is essential to successfully adopting software-driven risk assessment in marine insurance. Focused efforts on data security, budget-conscious strategies, and open communication can help businesses unlock the full potential of these technologies while addressing challenges head-on. These steps lay the foundation for a dynamic and resilient operational future.

The marine insurance industry is on the brink of a technological revolution, with emerging tools and solutions redefining how risks are assessed and managed. Below, we explore some of the most promising trends shaping the future of marine insurance software.

Artificial intelligence (AI) and the Internet of Things (IoT) are transforming risk assessment in marine insurance. One groundbreaking application is the use of digital twins. A digital twin is a virtual replica of a physical asset, such as a vessel or cargo container, that mirrors real-time conditions. By simulating scenarios and predicting potential issues, digital twins empower insurers to anticipate risks, such as equipment failures or environmental impacts, before they arise.

Augmented reality (AR) is another rising technology with immense potential for marine insurance. AR tools can assist inspectors in assessing vessel conditions by overlaying digital information on physical components during inspections. This not only improves accuracy but also enhances efficiency, enabling faster decision-making in underwriting and claims processes.

Climate change is introducing new and increasingly unpredictable risks to the maritime industry, from severe weather events to rising sea levels. Predictive software tools are playing a critical role in helping businesses adapt to these challenges. For instance, advanced analytics platforms use historical and real-time weather data to forecast potential climate-related disruptions along shipping routes.

These tools also help insurers project long-term risks associated with climate change, allowing them to offer more precise coverage options. Additionally, marine insurance software can integrate with environmental monitoring systems to provide insights into carbon emissions and other compliance factors, aligning with global sustainability goals.

With international trade at the heart of maritime activities, the demand for global standards in marine insurance software is growing. Emerging software solutions are being designed to facilitate seamless collaboration between insurers, policyholders, and other stakeholders across borders.

Blockchain technology is one such innovation driving this trend. By enabling immutable and transparent record-keeping, blockchain ensures that all parties involved in a claim or policy agreement have a shared, tamper-proof view of the data. This fosters trust and streamlines processes in international transactions.

Additionally, many software platforms now incorporate multilingual interfaces and compliance tools to adhere to region-specific regulations. This enables insurers and businesses to operate efficiently across diverse jurisdictions, breaking down barriers and standardizing risk assessment practices worldwide.

By staying ahead of these future trends, marine insurance providers and their clients can unlock new levels of accuracy, efficiency, and collaboration. As innovation accelerates, the industry is poised to become more resilient, sustainable, and globally connected.

Marine insurance risk assessment software offers undeniable benefits, from enhancing accuracy and operational efficiency to improving decision-making. Tools leveraging AI, IoT, and predictive analytics are revolutionizing how risks are monitored and mitigated, helping businesses stay resilient in a dynamic maritime landscape.

Now is the time to embrace digital transformation. By adopting these innovative solutions, businesses can strengthen their risk management strategies, remain competitive, and meet the evolving demands of the industry. Take the first step toward smarter, more secure marine insurance operations. Get in touch!

Marine risk assessment is the process of identifying, evaluating, and mitigating risks associated with maritime operations. This includes analyzing potential threats such as severe weather conditions, cargo mishandling, and geopolitical instability. Modern tools, like marine insurance software using AI, IoT, and predictive modeling, help assess these risks more accurately and support informed decision-making.

Marine insurance faces several challenges, including:

By leveraging advanced technologies like real-time monitoring and climate-adaptive tools, insurers can overcome some of these challenges.

Basic risk in marine insurance refers to fundamental threats that may lead to financial losses, such as damage to cargo, vessel accidents, and weather-related incidents. These risks are evaluated to ensure proper coverage and compensation in case of an incident.

A comprehensive risk assessment should include the following elements:

The 4 critical elements of a risk assessment onboard a ship are:

AI enhances risk assessment by analyzing large sets of data to identify patterns and predict potential risks. It processes data quickly and accurately, enabling insurers to make informed decisions about policies, claims, and risk mitigation strategies.

IoT devices provide constant updates by tracking cargo conditions, vessel location, and environmental factors in real time. This improves operational efficiency and helps detect potential issues early, such as damaged goods or route deviations.

Predictive modeling uses historical and real-time data to forecast risks like weather disruptions, cargo damage, or route obstructions. By anticipating these issues, insurers and businesses can take preventive measures, such as adjusting shipping routes or reinforcing cargo handling processes.

Technologies like digital twins, blockchain for secure transactions, AI-enhanced analytics, and IoT devices are transforming marine insurance. These tools allow better risk assessment, improve transparency, and streamline claims management processes.

Climate-adaptive tools analyze weather trends and predict extreme conditions that could impact shipping operations. By offering advanced warnings and suggesting alternative actions, these tools help businesses prevent delays, losses, and damage caused by severe weather.

Marine cargo insurance software is a digital solution designed to help insurers manage policies, claims, risk assessments, and compliance related to marine cargo insurance. It streamlines operations and ensures accurate coverage for goods transported via sea, air, or land.

It automates time-consuming tasks like policy issuance and claims management, enhances accuracy in risk assessment, and improves decision-making with real-time analytics. The software also ensures regulatory compliance and delivers a more efficient and transparent customer experience.

The software is tailored to handle unique requirements like tracking shipments, managing diverse cargo types, and calculating premiums based on factors like route, cargo type, and destination. It also integrates with global transport networks to provide real-time updates and insights.

Most solutions are designed to integrate with existing systems, such as CRM, ERP, and logistics platforms, ensuring seamless data flow and improved operational efficiency across departments.

By analyzing historical claims data, shipping routes, and cargo types, the software provides predictive insights into potential risks. It helps insurers make data-driven decisions to minimize exposure and ensure optimized underwriting.