InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

Insurance User Experience (UX) focuses on creating intuitive, user-friendly interfaces and processes for both policyholders and employees within the insurance sector. It aims to simplify complex insurance interactions, making them more accessible, efficient, and engaging. With the growing demand for digital insurance solutions, prioritizing UX design is essential to meet modern customer expectations and maintain a competitive edge in the industry.

Insurance user experience (UX) design refers to the strategic process of creating intuitive, and efficient interfaces tailored for the unique needs of the insurance industry. Whether it’s streamlining workflows for employees or simplifying online interactions for customers, great UX ensures that every engagement with insurance platforms is as smooth and productive as possible. This design discipline is centered on human-centric principles, making complex processes accessible and user-friendly for all stakeholders.

The intricacies of insurance require a dual approach to UX design, addressing both internal applications (used by employees) and external apps/portals (used by customers).

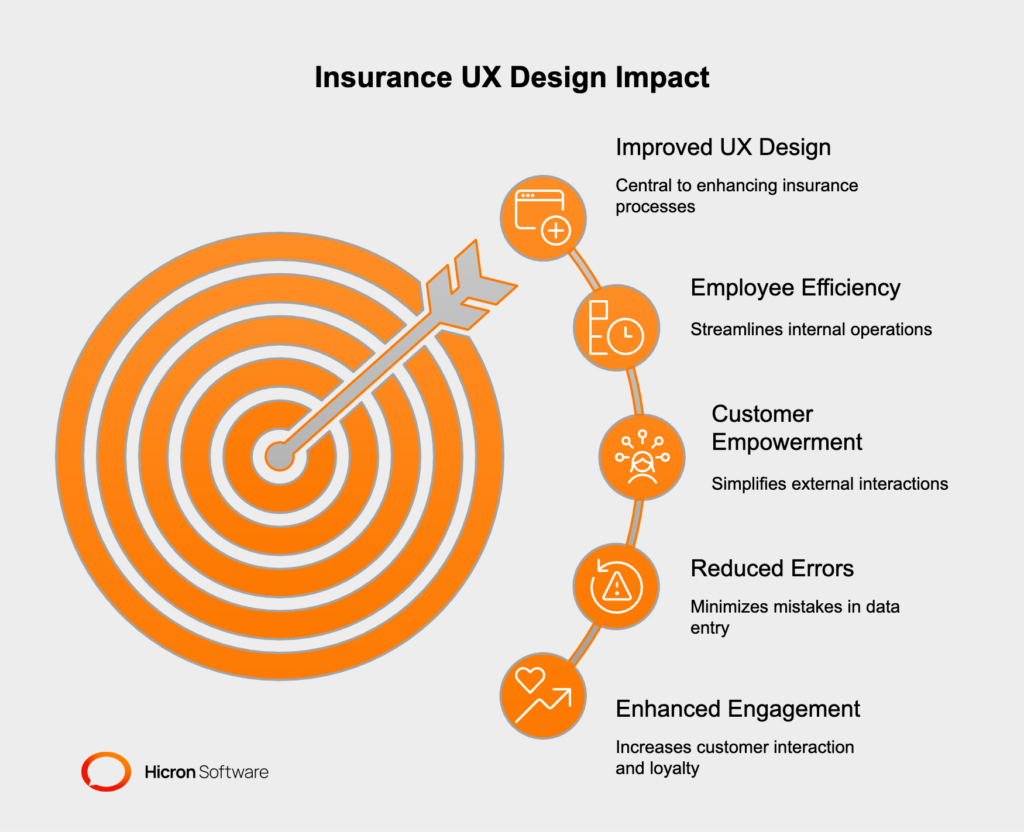

Investing in high-quality UX within the insurance industry delivers a range of advantages, including:

By prioritizing UX, insurance companies can strengthen relationships with both their customers and employees, fostering a sense of efficiency and ease across the entire ecosystem.

The insurance industry is known for its inherent complexity. Driven by legacy software, from managing intricate workflows to adhering to strict regulatory requirements. These challenges often result in frustrating user experiences for both employees and customers. This is where user experience (UX) design becomes critical—it simplifies processes, reduces inefficiencies, and creates a more intuitive environment across all applications and platforms.

Insurance processes are often dense and multi-layered. Employees, such as claims adjusters or underwriters, rely on multiple tools and quite often legacy software to manage customer information, process claims, and comply with industry regulations.

Without thoughtful insurance UX, these tools can become cumbersome, leading to time-consuming workflows and increased potential for errors. On the customer side, evaluating insurance policies, filing insurance claims, or receiving support can be overwhelming when insurance platforms are poorly designed, using jargon-heavy language or requiring excessive navigation steps.

The lack of user-centric design in insurance web applications hinders operational efficiency and erodes long-term customer trust and satisfaction. This highlights the need for intuitive insurance software solutions that prioritize usability while maintaining compliance with regulations.

|

Key Issue |

Impact |

Solution: UX Strategy for Insurance |

|

Poorly designed platforms |

Overwhelming for users |

Develop user-centric designs that are intuitive and easy to navigate |

|

Jargon-heavy language |

Confusion and frustration |

Use clear, accessible language to improve understanding |

|

Excessive navigation steps |

Inefficient processes and wasted time |

Streamline workflows to enhance efficiency and customer experience |

|

Lack of usability focus |

Erosion of customer trust and satisfaction |

Prioritize usability while ensuring regulatory compliance |

Investing in user-centric insurance platforms and applications is a competitive necessity. Insurance companies that prioritize an excellent insurance user experience differentiate themselves by offering services that are perceived as modern and trustworthy. This differentiation can improve customer loyalty, drive higher conversion rates, and even attract new clients seeking more user-friendly options in insurance applications.

Insurance companies that embed great UX into their operations and customer-facing apps position themselves as forward-thinking and client-focused organizations.

The foundation of exceptional insurance user experience design lies in adhering to key principles that address the unique needs of both employees and customers. Whether designing for internal insurance applications or creating user-friendly insurance apps for customers, these principles ensure consistency, clarity, and accessibility, ultimately driving satisfaction and loyalty.

|

Principle |

UX Strategy for Insurance |

|

Consistency |

Ensure smooth experiences across platforms. Internal apps benefit from unified workflows, while external portals build trust with consistent branding and navigation. |

|

Clarity |

Simplify complex insurance terms with clear language, visuals, and tooltips. Glossaries in user-friendly apps reduce confusion and improve engagement. |

|

Efficiency |

Minimize steps for tasks like claims filing. Streamline workflows in internal apps and use pre-filled forms in external portals to save time and reduce frustration. |

|

Accessibility |

Design for inclusivity with features like high-contrast colors, screen reader compatibility, and keyboard navigation, ensuring usability for all, including those with disabilities. |

|

Real-Time Feedback |

Provide instant confirmations and error alerts. Internal apps benefit from real-time updates, empowering employees to work efficiently and confidently. |

Consistency is key in providing a great experience for users interacting with different platforms. For internal insurance applications, employees benefit from familiar layouts and unified workflows across tools, reducing the time spent on learning and adaptation. Similarly, insurance portal design for customers should mirror this consistency in branding, navigation, and functionality to build trust and ensure smooth interactions.

Insurance policies are often riddled with industry-specific jargon, which can overwhelm users. Strive to present complex terms in a clear and concise manner, using visuals or tooltips to provide additional explanations. For example, incorporating glossaries or hover-over definitions in user-friendly insurance apps can help customers better understand their policies, claims, and premiums, reducing confusion and improving engagement.

Efficiency is crucial in both insurance UX for employees and customer-facing systems. Simplify workflows by minimizing the number of steps required to complete tasks, such as filing claims or updating policies. For internal applications, this can involve streamlining data input forms and automating repetitive processes. On external portals, use features like pre-filled forms and intuitive layouts to expedite user activities, saving time and reducing frustration.

Every insurance user experience creation should prioritize inclusivity. Ensure platforms cater to all users, including those with disabilities, by complying with web accessibility standards such as WCAG. Consider features like high-contrast color schemes, screen reader compatibility, and keyboard navigation, making the experience equitable. Proactively investing in accessibility also broadens your audience and reflects your commitment to serving every customer.

Real-time feedback is essential for keeping users informed and confident while navigating platforms. For example, insurance portal structure can include instant confirmation messages for completed transactions, while error indicators can guide users to correct mistakes on forms. For internal applications, real-time system alerts and progress updates empower employees to handle tasks efficiently without second-guessing their actions.

By prioritizing consistency, clarity, efficiency, accessibility, and real-time feedback in insurance UX, organizations improve user satisfaction, instill trust, and drive long-term engagement. These principles not only enhance day-to-day interactions but also create a competitive edge, positioning your brand as a leader in delivering cutting-edge digital experiences.

Next, companies can further optimize these principles by conducting user testing, gathering feedback, and iteratively improving their applications and platforms. Investing in the user experience is no longer optional—it’s a necessity for staying ahead in the rapidly evolving insurance landscape.

|

Frontend Technology/Practice |

Description |

Example/Benefit |

|

Modern JavaScript Frameworks |

Frameworks like React.js, Angular, and Vue.js enable dynamic, scalable, and interactive user interfaces. |

React.js for interactive dashboards; Angular for enterprise-grade applications. |

|

Responsive Web Design |

CSS frameworks (e.g., Bootstrap, Tailwind CSS) and media queries ensure platforms adapt seamlessly to different screen sizes. |

Consistent experience across desktops, tablets, and smartphones. |

|

Progressive Web Applications (PWAs) |

PWAs combine web and mobile app features, offering offline functionality, fast load times, and app-like experiences. |

Customers can manage policies or file claims on the go, even offline. |

|

Single Page Applications (SPAs) |

SPAs allow users to interact with the platform without constant page reloads, ensuring faster navigation and smoother experiences. |

Policy comparisons or claims submissions without delays. |

|

Micro-Frontend Architecture |

Breaks down the frontend into smaller, independent modules, enabling faster development and deployment of features. |

Large insurance platforms can add new features without disrupting existing ones. |

|

Web Components |

Custom, reusable elements ensure consistency across the platform while reducing development time. |

A claims submission form reused across multiple sections of the platform. |

|

Interactive Data Visualization |

Libraries like D3.js, Chart.js, and Highcharts create interactive charts and graphs for presenting complex data. |

Claims trends or policy performance visualized in user-friendly formats. |

|

Accessibility Standards |

Technologies like ARIA ensure compliance with accessibility standards, making platforms usable for individuals with disabilities. |

Screen reader compatibility, high-contrast modes, and keyboard navigation. |

|

Performance Optimization |

Techniques like lazy loading, code splitting, and image optimization ensure fast load times and smooth interactions. |

Faster navigation and reduced bounce rates due to improved performance. |

|

Frontend Testing Tools |

Tools like Jest, Cypress, and Selenium test usability, performance, and responsiveness, reducing bugs and errors. |

Ensures error-free user experience. |

Optimizing insurance user experience for internal systems is vital for enhancing employee efficiency and operational success. By addressing the specific needs of insurance teams, companies can create tools that simplify workflows, present information effectively, and minimize obstacles for users. Below are five strategies to improve insurance UX in internal insurance applications.

|

Principle |

Description |

Example |

|

Streamlined Workflows |

Automate tasks like claims management to reduce errors and boost productivity. |

Pre-filled forms for claims processing save time and minimize errors. |

|

Role-Based Dashboards |

Tailor dashboards for agents, underwriters, and adjusters to prioritize relevant tasks and metrics. |

Agents see renewals and leads; adjusters access active claims and investigations. |

|

Data Visualization |

Use charts and graphs to simplify data and enable faster, informed decisions. |

Underwriters analyze claims trends by region using visualized data. |

|

Integration with Tools |

Connect apps with CRM, ERP, and communication tools for smooth workflows and efficiency. |

Policy management software integrated with CRM shows full customer history in one place. |

|

Easy Onboarding |

Provide tutorials and guided training to reduce the learning curve for new employees. |

Step-by-step walkthroughs help new hires practice tasks in a simulated environment. |

Internal insurance workflows, such as claims management, underwriting, and policy administration, often involve repetitive and time-intensive tasks. Simplifying these processes through automation and intuitive design is key. For example, automating claims documentation with pre-filled forms or templates can reduce errors and free up time for employees to focus on more complex decision-making tasks. This approach ensures smoother operations and boosts productivity.

Custom dashboards tailored to specific user roles improve focus and usability. Agents, underwriters, and claims adjusters interact with different sets of data and tools daily. With user-friendly insurance apps, role-based dashboards can prioritize relevant metrics and tasks for each user. For example, an agent’s dashboard might highlight upcoming renewals and sales leads, while adjusters gain quick access to active claims and pending investigations. Personalization ensures that users see what’s most important to them, streamlining their work.

Insurance workflows often rely on large volumes of data, which can be overwhelming if not presented clearly. Incorporating data visualization tools like charts, graphs, and heatmaps into internal insurance applications allows employees to quickly identify patterns and trends. For instance, underwriters can use graphs to view claims trends by region, helping them make informed decisions faster. Visualized data reduces complexity while increasing understanding and insight.

Integration of Insurance Applications with Essential Tools

Integration with other critical systems enhances the overall functionality of insurance UX. Internal insurance applications should connect with CRM platforms, ERP systems, and communication tools to create a cohesive ecosystem. For example, integrating policy management software with the CRM system allows employees to view the customer’s full history—including policies, claims, and correspondence—all in one place. Such integration minimizes redundant tasks, reduces errors, and boosts efficiency.

Frequent updates and high employee turnover in insurance companies make intuitive and accessible designs crucial. Simplified onboarding processes within insurance portal design ensure that new team members can quickly learn the system. Features like contextual training modules, step-by-step walkthroughs, and interactive tutorials reduce the learning curve. For example, a claims processor could benefit from guided scenarios during training, allowing them to practice using the system in a low-stakes environment before managing real claims.

By prioritizing streamlined workflows, role-specific dashboards, effective data visualization, system integration, and intuitive onboarding, companies can create user-friendly insurance apps and platforms that empower employees. These improvements not only reduce friction in daily tasks but also increase job satisfaction, enabling team members to focus on strategic initiatives and deliver better customer service. Strong insurance UX in internal tools positions companies for long-term operational success in a competitive industry.

Creating exceptional external platforms is a key aspect of insurance user experience. These apps and portals act as the face of the company for customers, making their usability and functionality critical for fostering trust, satisfaction, and loyalty. By focusing on the following best practices, businesses can deliver user-friendly insurance apps and achieve a competitive edge.

|

Principle |

Description |

Example |

|

Intuitive Navigation |

Simplify navigation to help users find information, file claims, or update policies easily. |

Logical menus, robust search, and highlighted actions like claims submission and renewals. |

|

Personalization |

Use user data to offer tailored recommendations and reminders. |

Suggest policies or add-ons based on coverage history; send renewal reminders. |

|

Self-Service Features |

Enable users to perform tasks independently, reducing reliance on support. |

Premium calculators, policy comparisons, and real-time claim tracking. |

|

Mobile Optimization |

Ensure smooth experiences across all devices, especially mobile. |

Responsive design for consistent navigation and functionality on smartphones and tablets. |

|

Trust and Transparency |

Build trust with clear, jargon-free explanations of policies and terms. |

Display FAQs, policy details, and customer support prominently to reassure users. |

Customers seek simplicity when managing their insurance needs online. Ensure that your insurance portal design prioritizes intuitive navigation, making it effortless for users to locate information, file claims, or update policies. Organize menus logically, include a robust search feature, and highlight key actions like claims submission and policy renewal. A clutter-free interface ensures users can accomplish tasks without frustration.

Personalization plays a pivotal role in enhancing the customer experience. Leverage user data to provide tailored insights, such as policy suggestions based on coverage history or renewal reminders for expiring policies. These personalized touches within user-friendly insurance apps make customers feel valued and build stronger relationships. For example, integrate recommendation engines that suggest add-ons or premium adjustments aligned with user needs.

Empower customers by enabling self-service capabilities that make managing insurance simple and stress-free. Features like premium calculators, policy comparisons, and real-time claim tracking foster independence and minimize reliance on customer support. Streamlining these functionalities not only improves customer satisfaction but also reduces administrative overhead for your business.

With a growing number of users accessing insurance platforms on their smartphones, mobile optimization is essential. Ensure insurance UX is consistent across devices, offering a great experience whether accessed on mobile, tablet, or desktop. Use responsive design principles to adapt layouts while keeping navigation and functionality intact. Prioritizing mobile usability underscores your commitment to meeting users where they are.

Trust is a cornerstone of the insurance business. Build it by providing clear, jargon-free explanations of policies, terms, and conditions. Digital platforms should prominently display FAQs, policy details, and customer support options. Using transparent communication in your insurance UX reassures users and builds confidence, fostering long-term loyalty.

The success of insurance user experience strategy often depends on how well companies address common challenges. By tackling issues such as process complexity, data overload, compliance, legacy systems, and diverse user needs, insurers can create user-friendly insurance apps and platforms that resonate with their audience. Below, we explore effective strategies to overcome these hurdles.

|

Challenge |

Solution |

Example |

|

Simplify Complex Processes |

Insurance tasks like filing claims or understanding policies can be overwhelming for users. Simplify these processes by integrating step-by-step guidance and visual progress indicators. |

Insurance portal design could include a multi-step claims submission feature that walks users through each stage, providing reassurance and clarity. Simplification fosters confidence and ensures users complete tasks smoothly. |

|

Avoid Data Overload |

Presenting too much information at once can confuse and frustrate users. To avoid data overload, prioritize essential details and use clean, organized layouts. |

Internal insurance applications could highlight critical metrics like deadlines and flagged tasks, ensuring employees see what matters most. Similarly, customer-facing apps should use collapsible sections or tooltips for supplementary information, maintaining a clutter-free interface. |

|

Ensure Regulatory Compliance |

Insurance platforms must adhere to strict regulatory standards, but this shouldn’t come at the cost of usability. Design interfaces that incorporate compliance while keeping interactions intuitive. |

User-friendly insurance apps can use pre-filled forms with built-in validation to meet regulations, ensuring users provide accurate and complete information without added complexity. |

|

Outdated systems hinder performance and frustrate users. Modernizing legacy platforms improves speed, reliability, and user satisfaction. Invest in upgrading or replacing old systems with scalable and responsive architectures. |

Transforming a clunky policy management system into a streamlined, web-based interface can boost productivity for employees and simplify processes for customers, enhancing the overall insurance UX. |

|

|

Cater to Diverse User Needs |

Not every user will be equally tech-savvy. Design for inclusivity by creating tools that serve both advanced users and those unfamiliar with digital platforms. |

Mobile apps can offer customizable experiences, such as a “standard mode” for simplicity and an “expert mode” for users who prefer additional features. Ensuring accessibility and usability for all audiences strengthens the appeal of insurance portal designs. |

Overcoming UX challenges in insurance requires a thoughtful approach to addressing complexity, minimizing information overload, ensuring compliance, modernizing infrastructure, and catering to diverse needs. By prioritizing these areas in insurance user experience, companies can deliver innovative solutions that stand out in a competitive landscape. This focus on user-centric scenarios creates both long-term loyalty and operational efficiency, positioning insurers for success.

Measuring the success of insurance user experience design involves evaluating both internal applications and external apps or portals. By focusing on key performance metrics, organizations can determine the effectiveness of their platforms and identify areas for improvement. Below, we outline essential measures for each type of application and emphasize the value of continuous user feedback.

Internal insurance systems are vital for employee efficiency and operational excellence. To assess their impact, consider these metrics:

Customer-facing platforms are critical for fostering engagement, loyalty, and satisfaction. The following metrics can help gauge their performance:

No system is perfect, which is why user feedback should be at the core of your improvement strategy. Regularly solicit input from both employees and customers through surveys, interviews, or feedback forms. Analyze this data to identify patterns, uncover pain points, and prioritize enhancements. Incorporating feedback not only refines your insurance UX but also shows users that their opinions are valued, fostering trust and loyalty.

Measuring the success of insurance user experience design requires a balanced approach that focuses on

By tracking key metrics and acting on user feedback, insurers can build intuitive, effective, and user-centric systems that drive long-term success.

Hicron Software partnered with HDI Group to modernize a 20-year-old policy management application. The project involved reducing technical debt, improving communication between IT and business teams, and migrating the application to modern technologies like Vaadin. The result was a user-friendly, efficient system with faster bug fixes, shorter release cycles, and improved operational efficiency.

Hicron Software revamped a legacy medical claims application for the German market. The project focused on compliance with German healthcare regulations, secure data migration, and enhancing system efficiency. The updated platform enabled accurate claims data collection, better risk analysis, and improved customer trust, solidifying the client’s market position

Designing effective insurance platforms requires a user-focused approach combined with technical precision. By adopting the following best practices, insurers can create platforms that meet the needs of both employees and customers, ensuring satisfaction and operational efficiency.

|

Best Practice |

Description |

Example/Outcome |

|

Conduct User Research |

Understanding the pain points and preferences of employees and customers is crucial to effective platform design. Conduct interviews, surveys, and usability tests to gather insights into their workflows and challenges. |

Employees may need tools for quick claim reviews, while customers might prioritize easy policy comparisons. These insights form the foundation of a user-focused design strategy. |

|

Leverage Wireframes and Prototypes |

Testing concepts early in the design process can save time and resources. Use wireframes and functional prototypes to evaluate layouts, navigation, and user interactions. |

A prototype of a claims filing module can be tested to identify usability barriers, ensuring a seamless user experience upon deployment. |

|

Prioritize Performance |

A high-performing insurance platform is essential for retaining users and maintaining satisfaction. Optimize load times by minimizing unnecessary scripts and using efficient backend processing. |

Smooth interactions, such as instantaneous data retrieval during policy searches, enhance usability and keep users engaged. |

|

Regularly Update Designs |

User expectations and industry standards evolve constantly, making regular updates to your platform crucial. Schedule routine audits to identify outdated features or design elements that need a refresh. |

Incorporating trends like responsive design or accessibility enhancements ensures your platform remains modern and competitive. |

|

Foster Cross-Functional Collaboration |

Designing an exceptional insurance platform requires input from diverse stakeholders. Bring developers, designers, and business leaders together to align technical feasibility with user requirements and business goals. |

Regular design sprints or review sessions ensure a shared vision and effective contributions, fostering innovation and strategic alignment. |

By integrating user research, iterative design testing, performance optimization, regular updates, and cross-functional collaboration, insurers can create platforms that are not only functional but also user-centric. These best practices provide the foundation for a platform that supports operations and drives satisfaction for all users involved.

Prioritizing user experience (UX) is no longer optional in the insurance industry—it is essential for success. Both internal applications and customer-facing platforms benefit tremendously from thoughtful UX design, enabling smoother operations, higher satisfaction, and stronger brand loyalty across the board.

For internal systems, a well-designed platform streamlines workflows, reduces errors, and empowers employees to focus on high-value tasks. By removing friction and enhancing usability, organizations see measurable gains in productivity and operational efficiency.

On the external side, customer-facing portals with intuitive navigation, fast performance, and accessible features greatly enhance the overall client experience. These platforms make complex insurance processes feel simple and approachable, resulting in increased policy purchases, renewals, and long-term retention. Such outcomes don’t just improve relationships with customers; they also provide businesses with a competitive edge.

The long-term benefits of prioritizing UX extend beyond immediate gains. They pave the way for sustained growth by building trust, fostering loyalty, and ensuring systems adapt to evolving user expectations. Organizations that invest in UX are better positioned to innovate, meet market demands, and thrive in a competitive landscape.

Ready to elevate your insurance platform? Start optimizing your insurance user experience with us today!

Insurance UX design focuses on creating intuitive, user-friendly interfaces for both employees and customers. It simplifies complex processes, improves efficiency, and enhances satisfaction, making it essential for staying competitive in the industry.

UX design streamlines workflows, reduces errors, and boosts productivity for employees like claims adjusters and underwriters. It enables them to focus on high-value tasks by providing intuitive dashboards and efficient tools.

Key elements include intuitive navigation, responsive design, self-service features, clear language, and transparency. These features empower customers to manage policies, file claims, and make informed decisions independently.

Challenges include complex processes, jargon-heavy language, outdated systems, and diverse user needs. Addressing these issues with user-centric design improves usability and operational efficiency.

Success can be measured through metrics like employee productivity, error reduction, customer satisfaction scores (CSAT), net promoter scores (NPS), conversion rates, and customer retention rates.

Long-term benefits include improved efficiency, enhanced customer satisfaction, stronger loyalty, and a competitive edge in the market. It also positions companies as forward-thinking and client-focused.

Companies can simplify processes, avoid data overload, ensure compliance, modernize legacy systems, and design for inclusivity. These strategies create user-friendly platforms that meet the needs of both employees and customers.