InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

Insurance frontend development plays a pivotal role in creating user-friendly platforms and web applications that enhance both customer satisfaction and operational efficiency in the insurance industry. The insurance frontend interface serves as the front of any insurance web application. It’s often the first point of contact between the customer and the company. Meaning it plays a critical role in shaping brand perception, trust, and engagement.

A well-developed insurance frontend fosters confidence in the services offered and helps build a positive brand image. Yet, the insurance frontend doesn’t operate in isolation; it must work in harmony with insurance backend systems. All to provide real-time data access, ensure functionality, and support smooth user interactions. Achieving excellence in insurance frontend development is crucial for insurance companies seeking to remain competitive and deliver unique digital experiences.

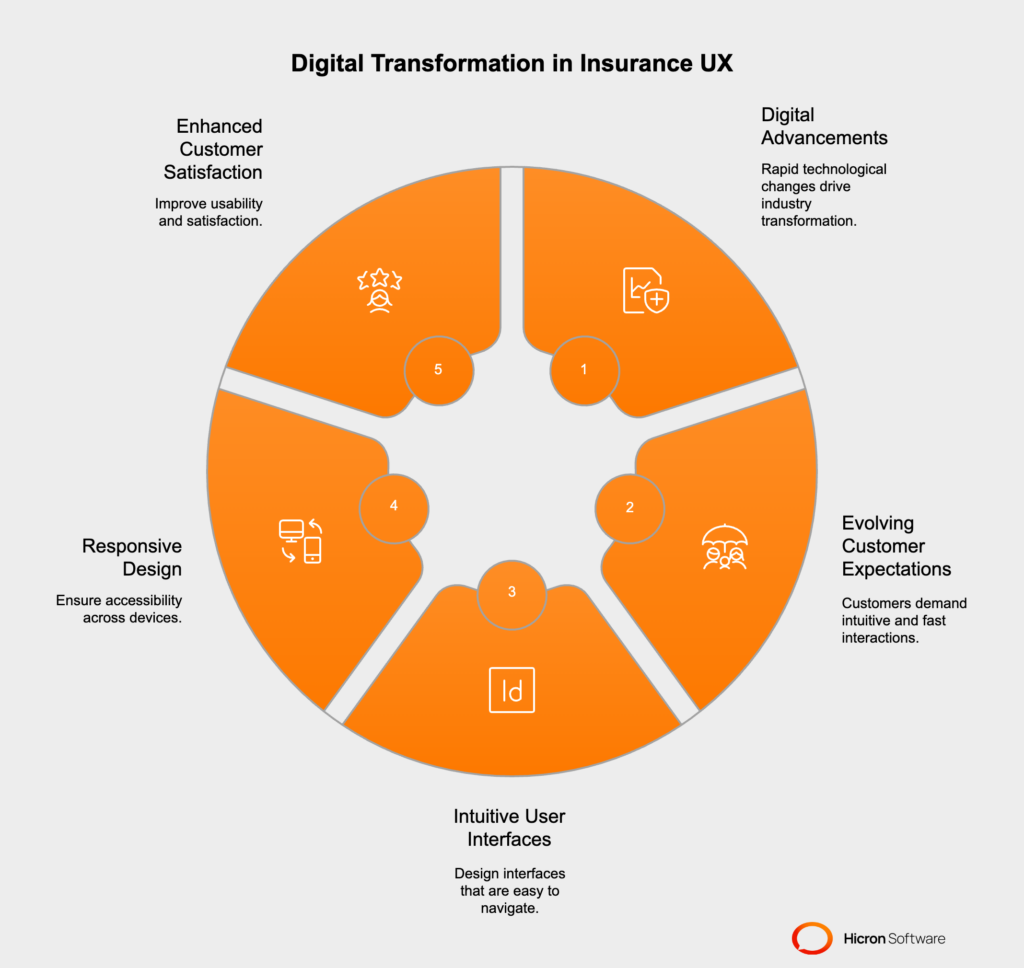

The insurance industry is undergoing a transformation driven by rapid digital advancements. With customers increasingly influenced by the easy-to-navigate digital experiences offered by other industries, their expectations for insurance providers have also evolved. Faster, more intuitive interactions become the new normal. This shift emphasizes the growing importance of integrating cutting-edge technology and design to meet these expectations.

At the core of exceptional insurance frontend & user experiences (UX) lies the need for intuitive user interfaces and responsive design. Today’s internal and external users expect insurance web applications that are easy to navigate and adapt across various devices, whether it’s a smartphone, tablet, or desktop.

A thoughtfully designed insurance user interface minimizes customer effort, enabling them to access policies, file claims, or get support quickly. Responsive insurance web app design ensures accessibility for a diverse audience, enhancing both usability and satisfaction.

Developing a modern insurance frontend requires a balanced focus on both business and user needs.

Insurance frontend development from a business perspective:

Insurance frontend development from the user perspective:

|

Business Perspective |

User Perspective |

|

Scalability: Ensures the platform can grow alongside the organization and handle increasing user demands. |

Intuitive Design: Simplifies complex processes such as claims processing and policy updates for ease of use. |

|

Compliance: Adheres to insurance regulations and data privacy standards to maintain trust and avoid legal risks. |

Accessibility: Follows WCAG guidelines, ensuring the insurance frontend is inclusive to diverse user demographics. |

|

Operational Efficiency: Streamlines workflows for both internal teams and external users. |

Mobile-First Design: Delivers consistent and optimized experiences across all devices. |

|

Customization: Provides flexibility to adapt the platform for various insurance web apps and market-specific requirements. |

Transparency: Builds trust through real-time updates, such as features for tracking claims status. |

Useful frontend development in the insurance industry hinges on strategic collaboration, robust processes, and scalable design principles.

Collaboration across teams is critical, requiring close coordination with designers using tools like Figma to ensure responsive and adaptive user interfaces.

Equally essential is working with insurance backend developers to achieve API integration and data flow, creating a unified insurance system that aligns with business needs. Incorporating user feedback into the development cycle is essential to refine functionalities and enhance the customer experience.

Agile development practices, such as employing SCRUM methodologies, enable iterative progress, with

helping teams maintain alignment, improve quality, and deliver results efficiently.

Scalability and reusability are key considerations for long-term success; building reusable UI components speeds up the insurance frontend development while ensuring consistency across the insurance platform.

Design systems like Storybook or Bit.dev support scalable frontend architecture, enabling insurance companies to adapt and grow their digital platforms while meeting evolving market demands and user expectations.

|

Key Aspect |

Details |

|

Collaboration Across Teams |

Coordination with designers using tools like Figma for responsive and adaptive UIs. Partnering with backend developers for API integration and data flow. Incorporating user feedback to refine functionality and improve customer experience. |

|

Agile Development Practices |

Implementing SCRUM methodologies for iterative progress. Using planning sessions, daily standups, and code reviews to ensure alignment and efficiency. |

|

Reusability and Scalability |

Building reusable UI components for faster insurance frontend development and consistent design. Leveraging tools like Storybook or Bit.dev to support scalable frontend architecture. Ensuring insurance platforms can adapt to market demands and user expectations. |

A well-designed technology stack is fundamental for developing effective and scalable insurance web applications.

At the core, ReactJS is an excellent choice for building Single Page Applications (SPAs) due to its ability to create dynamic and interactive user interfaces. TypeScript adds another layer of reliability by promoting type safety and maintainable codebases, reducing the likelihood of runtime errors. HTML and CSS, particularly when paired with tools like Tailwind CSS or CSS Modules, are essential for achieving responsive and visually appealing designs.

Version control, facilitated by GIT and Trunk-Based Development, ensures efficient collaboration and streamlined workflows among development teams.

Tools like Figma play a critical role in enabling collaborative design and prototyping, bridging the gap between designers and developers.

To uphold quality, unit testing frameworks are indispensable for verifying code reliability and functionality.

|

Category |

Technology/Tool |

Purpose |

|

Core Frontend Technologies |

ReactJS or Angular |

For building Single Page Applications (SPAs) with dynamic and interactive user interfaces. |

|

TypeScript |

For type safety and maintainable codebases. |

|

|

HTML & CSS, Tailwind CSS, CSS Modules |

For efficient styling and responsive design of the insurance frontend. |

|

|

Version Control and Collaboration |

GIT |

For version control. |

|

Trunk-Based Development |

For streamlined workflows. |

|

|

Design and Prototyping Tools |

Figma |

For collaborative design and prototyping. |

|

Testing and Quality Assurance |

Unit testing frameworks |

To ensure code reliability and maintainability. |

|

Optional Enhancements |

Backend familiarity (e.g., Python, MongoDB) |

For better collaboration with insurance backend teams. |

|

CI/CD pipelines (e.g., Azure DevOps) |

For automated deployments and faster iterations. |

Together, these technologies can create a robust, future-ready technology framework for the unique demands of the insurance industry.

A trusted partner in insurance frontend development delivers scalable, user-centric web applications by combining technological expertise with a deep understanding of industry challenges.

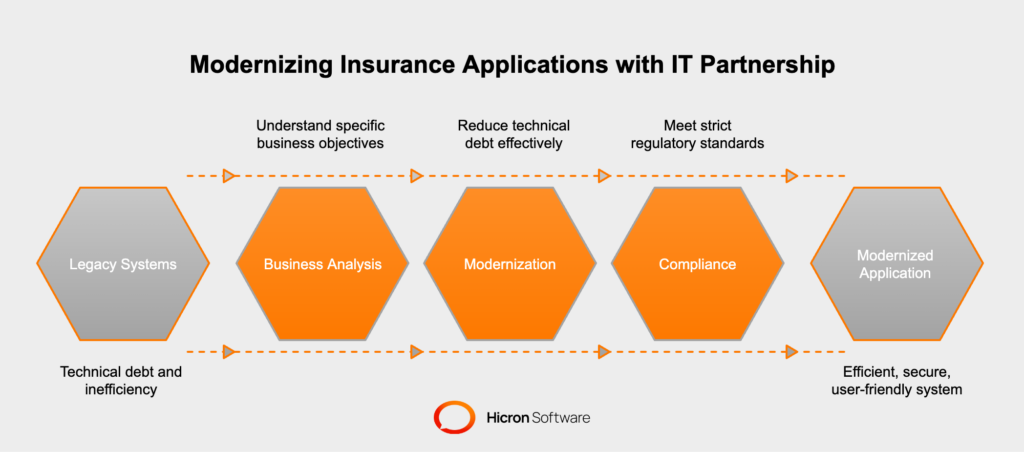

Backed by meticulous business analysis and close collaboration with stakeholders, Hicron Software successfully modernized a medical insurance application for the German market. This transformation ensured compliance with strict regulatory standards, enhanced data security, and significantly improved operational efficiency.

Similarly, the company revitalized HDI’s policy application, effectively reducing decades of technical debt, bridging communication gaps between IT and business teams, and delivering a dynamic and user-friendly web application.

Advising and recommending to clients at every stage of the development cycle, from gathering requirements to implementation, tailoring insurance solutions to specific business objectives, is the basis for a successful partnership in the IT world. This approach ensures integration with back-end systems and third-party services, equipping insurance companies with future-proof digital solutions designed for reliability, flexibility, and customer satisfaction.

Building a modern frontend for the insurance industry requires a deep understanding of both technological trends and business needs. Collaborating with a trusted partner can help insurance companies adapt to changing customer expectations while delivering platforms that are intuitive, efficient, and scalable.

Modern insurance applications are where business objectives, user expectations, and technological advancements converge. By aligning these critical factors, we can help create exceptional frontend applications that enhance customer experiences, streamline operational efficiency, and strengthen your competitive edge.

Partner with us to modernize your insurance frontend, build insurance web applications, or develop custom insurance solutions matching your unique needs. With our expertise, you can create insurance platforms that are both user-friendly and equipped to handle future challenges with ease. Together, we can drive innovation and position your company for long-term success in the insurance industry.

Frontend development in insurance is crucial as it serves as the first point of contact for customers, shaping brand perception, trust, and engagement. A well-designed frontend ensures smooth user interactions and aligns with backend systems for real-time data access and functionality.

From a business perspective, scalability, compliance, operational efficiency, and customization are essential. From a user perspective, intuitive design, accessibility, mobile-first approaches, and transparency are critical for enhancing usability and satisfaction.

Collaboration with designers, backend developers, and stakeholders ensures responsive designs, seamless API integration, and user-driven improvements. Tools like Figma and agile practices like SCRUM further streamline workflows and enhance quality.

Core technologies include ReactJS for SPAs, TypeScript for maintainable codebases, and Tailwind CSS for responsive design. Additional tools like GIT for version control, Figma for prototyping, and CI/CD pipelines for automated deployments are also recommended.

A scalable architecture allows companies to adapt to evolving market demands, handle increasing user loads, and ensure consistent user experiences across devices. Reusable UI components and design systems like Storybook support long-term scalability.

An IT partner provides expertise in modernizing applications, addressing challenges like compliance and technical debt, and delivering tailored solutions. They guide clients through the development lifecycle, ensuring integration with backend systems and future-ready platforms.