Top InsurTech Trends Every Insurance Company Needs to Adopt

- March 28

- 32 min

Digital transformation is becoming the backbone of innovation across industries, and the insurance sector is no exception. Powered by cutting-edge advancements in insurance tech and the rapidly expanding insurtech sector, the way insurance agents and clients interact is evolving faster than ever. At the heart of this change are smart insurance portals, intuitive platforms designed to streamline processes, improve communication, and foster stronger agent-client connections.

Traditionally, the insurance world revolved around time-consuming paperwork, delayed processes, and limited client engagement. However, the rise of custom insurance software development and digital transformation for insurance is rewriting these outdated narratives. Innovative insurance portals are stepping in as client-centric digital tools, offering personalized experiences, real-time access to information, and seamless workflows. These innovative platforms aren’t just enhancing efficiency; they’re building trust and transparency between agents and clients, reshaping the insurance landscape one interaction at a time.

Smart insurance portals are innovative digital platforms designed to revolutionize how insurers, agents, and clients interact. These portals function as centralized hubs, allowing users to manage policies, track claims, and communicate effortlessly in one secure location. Built with cutting-edge insurance tech and supported by advancements in custom insurance software development, they prioritize seamless connectivity and user-friendly experiences for agents and policyholders.

At their core, smart insurance portals aim to simplify and optimize key insurance processes. Their primary functions include:

Smart insurance portals are bridging the gap between agents and clients, transforming a traditionally tedious process into one that feels intuitive and service-driven. By eliminating time-consuming paperwork and centralizing all key functionalities, these platforms empower agents to focus more on delivering personalized solutions while clients enjoy round-the-clock convenience.

Enhanced communication features ensure that policy updates, claim statuses, or premium notices are always just a click away, fostering more transparent relationships. This connectivity goes a long way in building customer trust and satisfaction, which is essential in a competitive market.

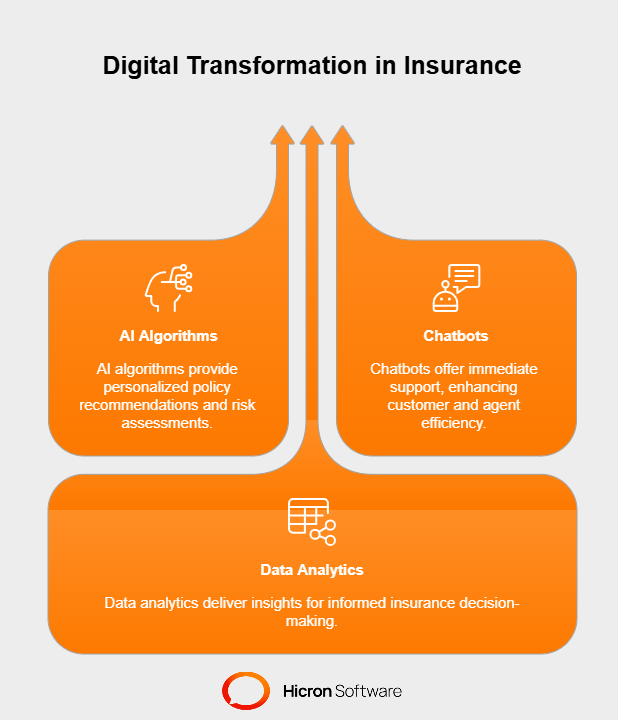

Their integration of advanced digital tools truly sets smart insurance portals apart. Leveraging the power of technologies like AI, chatbots, and data analytics, these platforms elevate insurance services to the next level:

Through these tools, innovative insurance portals are advancing the digital transformation for insurance, setting a new standard for efficiency, transparency, and customer satisfaction. Clients no longer view insurance as a cumbersome chore but as a streamlined, accessible, and client-focused service. For agents, these tools empower them to deliver faster and more proactive solutions, solidifying their role in an increasingly tech-savvy world.

The insurance industry is changing, with operational strategies shifting from organization-focused to client-centered. Placing the client at the heart of insurance operations is no longer just an ideal; it’s a necessity driven by evolving consumer expectations for convenience, transparency, and personalized service. This shift is fueled by innovations in insurance tech and the capabilities offered by insurance portals.

Smart insurance portals are redefining the client experience by putting control directly into the hands of policyholders. These client-centric digital tools allow customers to manage policies, file claims, and track updates from anywhere. Gone are the days of endless back-and-forth communication or waiting for an update from an agent. With real-time access to information, clients can make informed decisions on their terms.

Another critical feature of these platforms is transparency. By offering clear and detailed insights into policy terms, claims statuses, and premium structures, smart insurance portals ensure that clients always know where they stand. This openness reduces confusion and frustration, creating an environment where trust can thrive.

When clients feel empowered and informed, their trust in the insurance provider deepens. By prioritizing transparency and control, smart insurance portals help remove the historical perception of insurance as a complex and opaque industry. This trust lays the foundation for loyalty.

Loyal clients are not just retained customers; they become advocates. They appreciate companies that prioritize their needs and respond quickly to their concerns. By adopting custom insurance software development and cutting-edge features like digital claims management and personalized policy recommendations, insurers can tailor services to meet individual preferences. These tailored solutions demonstrate genuine customer care, reinforcing long-term relationships.

Today’s consumers, accustomed to seamless digital experiences in other industries, demand no less from their insurance providers. They expect fast, efficient, and intuitive interactions at every touchpoint. Smart insurance portals align perfectly with these expectations, combining modern technology with a people-first approach.

By adopting a client-centric strategy, insurers remain competitive in a crowded market and position themselves as trusted partners in their clients’ financial security. This transformation is not just about keeping up with technological trends; it’s about redefining what it means to serve the customer in the digital age.

The insurance world is changing fast, and one of the biggest shifts is how agents and clients connect. With smart insurance portals leading the way, the communication gap isn’t just closing—it’s disappearing. These tech-forward platforms are making everything easier, faster, and more personal. They’re not just tools; they’re game-changers.

Here’s how they’re shaking things up and helping agents and clients build stronger, better partnerships.

Nobody enjoys waiting on hold for answers or digging through endless email threads. Luckily, insurance portals are changing all that. With features that enable real-time communication, clients can get updates instantly. Want to check the status of your claim? Or do you need to update the policy details on the go? It’s all possible with just a few clicks.

These portals are also a lifesaver for agents. They put all the client’s information and recent interactions in one spot so agents don’t waste time scrolling through different systems. This means that answers come quicker, problems get resolved faster, and everyone stays on the same page. It’s not just about being efficient; it’s about building trust and showing clients they’re valued.

Here’s the thing about insurance. A lot of client queries are routine. “When is my next payment due?” “What’s covered in this policy?” “How do I file a claim?” Enter chatbots. These little pieces of AI magic handle the repetitive stuff so human agents don’t have to.

Chatbots can chat (obviously), guide clients through straightforward processes, and deliver accurate answers instantly. And they’re available 24/7. That means clients don’t have to wait for office hours to be over to get help, and agents can focus their energy on more complex cases.

Sure, bots might not replace human advisors regarding empathy and creativity, but they’re perfect for the simple stuff. Plus, they free up agents to deliver the kind of high-touch service only people can provide.

Even with all the automation in the world, sometimes you just need to sit down and talk it out. That’s where video consultations come in. They combine the personal connection of in-person meetings with the convenience of digital tools.

Imagine you’re trying to understand the finer points of a new life insurance policy or working through a complicated claim. A face-to-face call with your agent can make things crystal clear. It also helps build stronger relationships because, at the end of the day, people like to do business with people, not just systems.

This is especially handy for companies offering tailored insurance software or unique solutions like healthcare or automotive insurance. These niche industries require extra customization and care, and video consultations make it easy to deliver just that.

Real-time tools, chatbots, and video support might seem simple, but they’re reshaping the entire industry. We’re talking about faster workflows, better transparency, and a level of service that feels both modern and personal.

Tech solutions like usage-based insurance apps, predictive analytics, and IoT tools make it easier to deliver what clients need before they even ask. At the same time, custom insurance software development ensures that all of these features work together seamlessly.

The result? Clients who feel in control and supported, and agents who have the tools to do their jobs better.

What’s exciting is that this is just the beginning. The insurtech industry is overflowing with innovation right now. From telematics to fraud detection AI, companies are pushing boundaries to make insurance smarter and more client-friendly.

Investing in platforms like smart insurance portals isn’t just about being ahead of the curve. It’s about creating more meaningful relationships with clients and giving them the confidence that they’re in good hands.

This transformation is driven by a combination of cutting-edge technology and good old-fashioned people skills. Smart portals aren’t here to replace agents but to help them be the best at what they do.

The pace of change in the insurance industry has been startling, and much of that transformation centers on streamlining how things work behind the scenes. Thanks to digital tools, administrative tasks that used to be time-intensive and tedious are now faster, simpler, and more accurate. The key takeaway? These innovations are not just making operations smoother; they’re giving agents and teams more bandwidth to do what really matters—connecting with and supporting clients.

Here’s a closer look at how smart tools like automated claims processing and e-signatures reshape the industry and deliver measurable benefits.

Think about the traditional insurance workflow for a moment. Mountains of paperwork, endless back-and-forth emails, and repetitive data entry were often the norm. With today’s digital tools, much of this manual effort is becoming a thing of the past.

Take automated claims processing, for instance. What used to take days or weeks to finalize can now be processed in a fraction of the time. AI-powered platforms can analyze claims, verify information, detect potential fraud, and send approvals with minimal human involvement. This doesn’t just make operations faster—it also improves accuracy by reducing human errors.

Another time-saver is the rise of e-signatures for contracts and client agreements. Gone are when clients had to print, sign, and mail documents back. With secure platforms, they can sign policies and contracts online in seconds. This improves the client experience, shortens closing times, and helps agents move from one task to the next without unnecessary delays.

By automating these once-cumbersome processes, agencies can get more done in less time. The returns aren’t limited to better workflows; they extend to happier clients who experience fewer bottlenecks.

When agents no longer have to spend most of their day buried in paperwork, they can dedicate that time to something far more valuable: their clients. By leaning on tools like insurance automation software, insurers can shift their focus to building trust, solving complex problems, and tailoring products to fit each client’s unique needs.

For instance, imagine an agent who previously spent hours manually processing claims. With claims automation software in place, that same agent can now spend time counseling a client on tricky coverage decisions or proactively identifying opportunities for more robust protection.

The value of this shift is enormous. For clients, it means more substantial service and a better overall experience. For agencies, it means happier policyholders and stronger client retention.

While technology might streamline behind-the-scenes operations, it doesn’t replace the importance of human relationships in insurance. These tools free up agents to strengthen those connections.

Digital transformation solutions like e-signatures or automated workflows align perfectly with this balance. They reduce labor-intensive tasks while keeping the agent involved in the high-value, high-empathy work that technology can’t replicate. This could mean following up with a worried client about the status of a claim or discussing how a new policy change might better suit their evolving needs.

When implemented thoughtfully, insurance technology helps agents focus on the “people side” of the business without sacrificing speed or accuracy.

The advantages of digital tools extend far beyond streamlining operations. By modernizing processes, agencies position themselves as innovative and forward-thinking. This can attract new clients looking for providers who understand that convenience matters.

On a larger scale, insurance software development services are paving the way for even more exciting possibilities, from predictive analytics to personalized dashboards that give clients real-time policy and claim updates. These solutions, alongside automation, create leaner, more agile organizations that are better equipped to handle changes in the market.

Because automated processes are scalable, they can help agencies grow without needing to significantly expand their teams. With more efficient workflows, teams can easily manage higher workloads.

Streamlined operations aren’t just a nice-to-have in today’s insurance landscape—they’re essential. Automated claims processing, e-signatures, and other tools turn once-clunky tasks into smooth, seamless processes. But the real win? These innovations give agents more time to do their best: build relationships, solve problems, and make their clients feel cared for.

If the goal is to work smarter, not harder, digital tools are the way forward. They simplify, accelerate, and modernize while giving a human-centered profession room to thrive. That’s the kind of efficiency that benefits everyone involved.

The question isn’t whether insurance companies should adopt these tools. It’s how quickly they can start using them to deliver the extraordinary service their clients expect and deserve.

Today’s clients expect solutions that cater to their individual needs, and thanks to advancements in data analytics, insurers can deliver that. At the heart of this transformation are smart insurance portals. These platforms aren’t just tools for efficiency; they’re unlocking new possibilities for personalization by leveraging data in ways we never thought possible.

Here’s how these portals are using analytics to reshape the insurance experience—from tailored policy recommendations to predictive insights that solve problems before they even arise.

Every interaction, claim, and policy payment generates valuable data. When harnessed correctly, this information paints a detailed picture of each client’s unique circumstances, preferences, and risks. Insurance portals tap into this wealth of data to help insurers go beyond generic offerings and truly understand individual client needs.

For example, advanced analytics tools can identify client behavior patterns. For example, frequent travel might suggest the need for better travel insurance coverage, or a growing family might suggest revisiting life insurance options. By gathering and analyzing this information in real time, portals empower agents to make informed recommendations that feel personal and relevant.

This deep, data-driven understanding isn’t just a nice touch; it’s fast becoming the standard. Clients who feel their needs are understood are more likely to stick around and expand their relationship with their insurers.

Gone are the days when agents relied solely on their judgment to recommend policies. Today’s portals use sophisticated algorithms to generate tailored policy suggestions based on a client’s data. These smart systems analyze factors like age, location, lifestyle, and coverage history to identify the best options for each individual.

For instance, a young professional might be shown policies with lower premiums and coverage that prioritizes flexibility. At the same time, a family-oriented client might receive options emphasizing comprehensive health and life insurance. These recommendations aren’t pulled out of thin air; they’re grounded in actionable insights derived from data.

This level of personalization does two things. First, it helps clients feel like they’re being heard and understood. Second, it saves everyone time by narrowing options to those most aligned with the client’s goals and circumstances. And because these algorithms constantly learn and adapt, the recommendations get sharper over time.

The most exciting development in data-driven insurance is using predictive analytics. Predictive analytics goes beyond observing patterns; it forecasts what might happen next, allowing insurers to take action before potential issues escalate.

Imagine a client with a history of frequent claims in areas prone to natural disasters. Predictive models could flag this as a risk and trigger proactive outreach from the agent. The client could be advised to adjust their coverage limits or strengthen their disaster preparedness strategies.

In another scenario, predictive analytics might detect gaps in a client’s coverage based on recent life changes, such as buying a new home or starting a business. With this information, insurers can reach out proactively to offer updates or additions to the client’s policy. This not only provides peace of mind but builds deeper trust between clients and their insurance providers.

For insurers, predictive insights have clear benefits. They help mitigate risks, improve retention rates, and create a more proactive approach to client care. For clients, it’s about feeling supported and protected—even when they haven’t identified a need.

The implications of these technologies go far beyond individual policies. By integrating data analytics, predictive insights, and algorithmic recommendations, insurance portals are setting new standards for the entire industry.

From life insurance to commercial policies, forward-thinking companies are using custom insurance software to build platforms that simplify processes and put clients at the center of everything they do. Advanced features like predictive analytics for insurers and AI-powered insights are helping insurance tech companies create solutions that feel genuinely tailored, not templated.

And it’s not just clients who benefit. Insurers find that personalized offerings increase satisfaction rates, result in fewer complaints, and strengthen long-term relationships. By leveraging data insights, they’re designing experiences where everyone wins.

Using data analytics and predictive insights marks a shift from traditional, reactive workflows to a more forward-thinking approach. Rather than waiting for clients to voice concerns, insurers can anticipate needs and offer solutions before problems arise.

This proactive mindset is transforming not only how agents interact with clients but also trust. When clients see their providers taking the initiative to protect and support them, the relationship transcends transactional boundaries and becomes a partnership.

Data insights are the future of personalized insurance solutions, and smart portals are paving the way. From understanding client needs on a deeper level to offering tailored policy recommendations and predictive insights, these tools raise the bar for what clients can expect from their insurers.

The benefits aren’t just for clients. For insurers, data-driven personalization creates an opportunity to deepen trust, strengthen relationships, and stand out in an increasingly crowded market.

The question isn’t whether data insights should play a role in insurance. It’s how insurers can best use them to create meaningful, tailored experiences that keep clients happy, secure, and loyal.

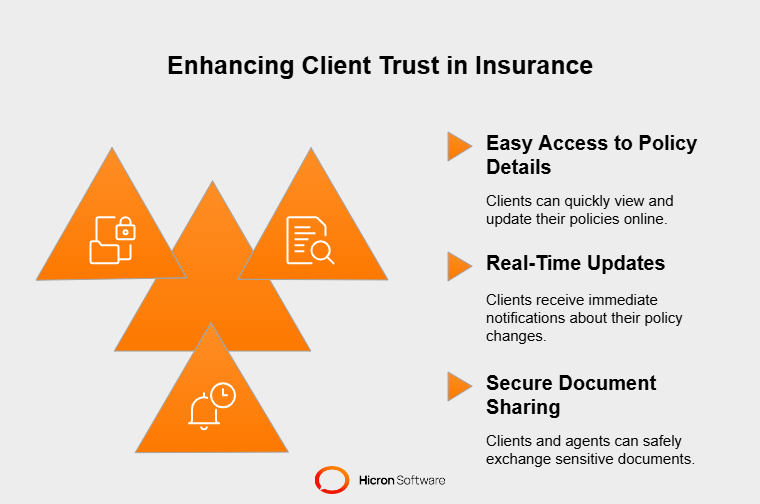

Trust and transparency are the cornerstones of any strong client-agent relationship in the insurance industry. Clients must feel confident that their providers aren’t just offering good coverage and acting in their best interest. This is where smart insurance portals come into play. These platforms redefine how agents and clients interact by providing tools that enhance openness and collaboration.

Trust naturally follows when clients have access to the correct information, secure channels to communicate and share documents, and a clear picture of their insurance experience. Here’s how these digital solutions set new transparency standards and foster stronger long-term relationships.

Picture this: A client wants to review their policy details or check the status of a claim. Traditionally, this might involve calling their agent, waiting for a response, or sifting through paperwork to find the necessary information. But innovative insurance portals make this process a breeze.

These platforms give clients real-time access to all their policy details, claim statuses, and essential updates. They can log in, review their coverage, make adjustments, or download necessary documents with a few clicks. Whether it’s a life insurance policy, travel insurance, or a homeowners’ claim, everything they need is in one convenient place.

This feature reduces the need for repetitive queries and allows agents to focus on providing higher-value support. For clients, full visibility into their policies builds confidence, reducing confusion and the “hidden surprises” that erode trust.

Smart insurance portals also come equipped with robust and secure document-sharing capabilities. The process is seamless and safe, whether sharing a signed policy, submitting proof for a claim, or exchanging sensitive legal documents.

These features enable clients and agents to collaborate without the back-and-forth of traditional communication methods like postal mail or unsecured emails. For example, if a client needs to send supporting documents for a claim, they can upload them directly to a secure portal where the agent can review and process them instantly.

Portals improve workflows and instill confidence in clients by ensuring sensitive information is handled safely and efficiently. Clients know their private data is protected and their agent is always in the loop, contributing to a smoother, more reliable experience.

Transparency isn’t just helpful in day-to-day interactions; it’s one of the foundational elements of a lasting client-agent relationship. When clients can see and understand what’s happening with their policies, they perceive their insurers as trustworthy partners—not just providers.

Smart portals foster this transparency in several ways. They encourage open communication by keeping clients informed about their coverage and claims without needing to chase down updates. Predictive analytics often integrated into these systems can also preemptively inform clients about potential issues (“Your coverage may need updating due to new regulations”) or suggest helpful adjustments.

Beyond technical features, transparency helps humanize the relationship between clients and agents. When you empower clients with knowledge, they feel valued and respected. And when issues do arise, a transparent system helps defuse tensions by showing a clear audit trail of what’s happened and why.

The result? Fewer misunderstandings, stronger trust, and long-term client loyalty.

The insurance industry has sometimes struggled with a reputation for being overly complex or opaque. But the shift toward smart insurance portals is changing all that. By making policy management more accessible, secure, and client-focused, these platforms are transforming what people expect from their insurance experience.

For insurers, this shift is more than just a way to stay competitive; it’s an opportunity to build genuine, lasting relationships with clients. When people feel informed and confident in the system, they’re far more likely to stay loyal, refer new clients, and explore additional products or policies.

With the world increasingly operating from the palm of our hands, mobile-friendly insurance portals are becoming the new standard—not just an added perk. These platforms provide instant, hassle-free access to policies, claims, and support, offering the ultimate convenience for busy customers.

But mobile-first designs go beyond just convenience; they’re transforming how agents and clients connect, especially for a younger, tech-savvy audience. Mobile accessibility is reshaping the insurance landscape and matters more than ever.

Mobile-friendly portals have simplified the once-cumbersome process of managing insurance. No more time-consuming calls or waiting days to meet an agent in person. Instead, clients can access their information and communicate with agents in real-time, no matter where they are.

For agents, this means faster responses to client inquiries and a better way to stay connected. Mobile-first designs foster engagement by making interactions seamless and intuitive. For example, clients can request updates on a claim, review policy terms, or even add coverage from their smartphones. This immediacy strengthens the client-agent relationship, turning what was once a transactional experience into an ongoing collaboration.

The days of sticking to rigid office hours are giving way to a new era of flexibility that fits into clients’ lifestyles, not the other way around.

One of the standout benefits of mobile-friendly insurance portals is their feature set, which is explicitly designed to meet the demands of modern consumers. Here are a few key capabilities that are changing the game for accessibility:

These features aren’t just “nice to have”; they’ve become vital tools for delivering the responsive, customer-centric experience that today’s clients expect.

Mobile adoption isn’t just about convenience; it’s about staying relevant. Younger generations, particularly Millennials and Gen Z, expect their financial services to mirror the user-friendly tech they rely on daily. A mobile insurance portal with a sleek interface, intuitive navigation, and real-time functionality appeals directly to this demographic.

For insurers, this presents a golden opportunity. By meeting younger clients where they already spend their time (their smartphones), you’re positioning your business as forward-thinking and accessible. Mobile-friendly features show that you value their time and align with their tech-first lifestyle.

This accessibility also broadens your reach to potential clients who may otherwise avoid traditional insurance processes simply because they seem outdated or complicated.

When you prioritize mobile accessibility, you’re not just meeting client expectations but exceeding them. The convenience of managing insurance needs anytime, anywhere eliminates frustration and builds trust. A customer who can easily file a claim and get an approval notification within hours is far more likely to stay loyal than one who has to wade through unnecessary bureaucracy.

Additionally, mobile portals encourage ongoing engagement. Regular app interactions, like exploring new coverage options or checking resourceful blogs hosted within the platform, keep clients meaningfully connected to their insurance providers. Over time, this fosters stronger brand loyalty and higher retention rates.

The shift toward mobile-friendly insurance isn’t just about adopting the latest tech trend; it’s about reimagining the customer experience. Mobile-first designs make it easier for insurers to adapt to their clients’ fast-paced lives, delivering value where and when it matters most.

By integrating tools like on-the-go policy management, claims processing, and real-time support, insurers are aligning with today’s consumers’ expectations while paving the way for future growth. Whether young professionals insuring their first car or seasoned travelers seeking comprehensive travel insurance, mobile-friendly portals serve every client quickly and efficiently.

Accessibility is a game-changer in the insurance industry, and mobile-friendly portals are leading the charge. From streamlining client-agent interactions to enabling 24/7 policy access, these platforms create a smarter, more connected insurance experience.

For insurers, it’s about more than just keeping up with the times; it’s about setting a new standard for service. With mobile-first designs, agencies can engage younger, tech-savvy clients while delivering the convenience and responsiveness that all clients appreciate.

By making insurance simple, intuitive, and accessible, you’re doing more than modernizing workflows. You’re building the foundation for stronger, lasting connections with your clients. And in today’s fast-moving world, accessibility isn’t just important; it’s essential.

The insurance industry has evolved significantly in recent years, and one of the most impactful innovations has been the adoption of smart portals. These platforms have revolutionized how insurers interact with their clients, addressing industry challenges while boosting customer satisfaction and retention. Here, we’ll explore real-world examples of insurance companies that have implemented smart portals successfully and the measurable benefits they’ve achieved.

Nationwide Insurance implemented a comprehensive smart portal that prioritized user experience, offering seamless access to policy details, claims updates, and customer support. One of the most significant features was their predictive analytics tool, which enabled personalized recommendations for policy upgrades or adjustments.

Measurable impact:

This example underscores how a well-designed portal can transform agent-client interactions, creating a seamless and transparent relationship that builds client loyalty.

Progressive utilized an advanced digital portal that focused on claims management efficiency. The platform allowed clients to file claims online by uploading necessary documents, photos, or videos of incidents directly into the system. Claims were then automatically routed to agents based on workload and policy type, utilizing automation to optimize workflow.

Measurable impact:

Progressive’s commitment to speeding up what is often seen as one of the most cumbersome aspects of insurance reinforced trust and significantly improved their customer experience.

Lemonade, a disruptor in the insurance market, designed a mobile-first smart portal targeting younger, tech-savvy clients. Their platform heavily emphasized accessibility and lightning-fast services, including AI-driven chatbots that could process claims in minutes. The app provides real-time updates, policy recommendations, and easy payment options.

Measurable impact:

By focusing on mobile accessibility and AI integration, Lemonade addressed one of the industry’s biggest challenges: attracting and retaining younger consumers who expect modern, seamless experiences in all facets of life.

State Farm introduced a smart portal that enhanced collaboration between agents and clients. A key feature was their secure document-sharing tool, which allowed clients to easily upload documents for claims or policy reviews while ensuring sensitive information remained protected.

Measurable impact:

This implementation proves the value of secure, intuitive tools in improving efficiency and strengthening client-agent relationships.

The above examples showcase how smart portals tackle some of the most pressing industry challenges, including slow claims processes, disengaged clients, and complex policy management. These platforms bridge the traditional insurance model and the digital-first expectations of today’s consumers.

Key benefits include:

Smart portals are no longer just a “nice-to-have”; they’re becoming essential in a rapidly evolving insurance landscape. The success stories of Nationwide, Progressive, Lemonade, and State Farm demonstrate that investing in these tools offers both short-term wins and long-term growth opportunities.

The insurance industry is moving full steam ahead into the digital age. Smart portals, automation, and predictive analytics are no longer futuristic innovations; they’re essential tools shaping today’s insurance landscape. However, while technology takes center stage, the agents hold the key to delivering personalized, impactful client experiences.

For agents to thrive in this evolving environment, they must do more than adapt to technology. They need the right training to maximize the potential of digital tools while maintaining the human connection clients still value. Here’s how insurers can prepare their teams for the digital transformation and ensure success in a technology-driven world.

Digital portals have revolutionized how insurers interact with clients, but even the most advanced system is only as strong as the people using it. Equipping agents with the skills to leverage these tools entirely is critical to avoid underutilization and lost opportunities.

Training ensures agents can confidently use smart portals for tasks like policy management, claim processing, and client communications. It also allows them to interpret these systems’ analytics, enabling more meaningful client interactions. Without this preparation, agents risk falling behind, leaving clients frustrated and disengaged.

While automation and AI are transforming workflows, they can never replace the empathy, understanding, and personalization that agents bring to the table. Clients still want to feel heard and valued, even in a digital-first world. Striking the right balance between technology and the human touch is essential.

For example, agents can use digital tools to identify personalized policy recommendations but still take the time for a one-on-one consultation to discuss a client’s unique needs. Similarly, while automated chatbots can assist with basic queries, agents should step in when clients require detailed explanations or emotional support, such as during a claim.

Using technology to handle repetitive tasks and data collection, agents free up time to focus on relationship-building, ensuring human interaction remains at the core of the client experience.

Successfully preparing agents for digital transformation requires technical training, strategic planning, and ongoing support. Here are some proven strategies to set your team up for success:

#1 Invest in comprehensive training programs

Provide hands-on training sessions that cover all aspects of your digital platforms, from basic navigation to advanced features. Include real-world examples to help agents understand how to use these tools effectively in client scenarios.

Pair technical training with soft skills development, emphasizing active listening, empathy, and communication. This ensures agents can fully integrate technology into their roles while maintaining the human connection that sets them apart.

#2 Establish ongoing learning opportunities

Technology evolves quickly, so training shouldn’t be a one-and-done process. Offer continuous education through webinars, online modules, and in-person workshops to update agents on new portal features and industry trends.

Encourage agents to participate in certifications or courses focused on digital tools and customer service excellence. Recognize and reward efforts to ensure motivation stays high.

#3 Create a knowledge-sharing culture

Leverage the experience of tech-savvy team members by implementing mentorship or peer-learning programs. This collaborative approach allows agents to learn from each other, fostering a supportive work environment and driving skill development.

For example, senior agents may mentor newer team members on client relationship-building, while younger agents could share tips for effectively utilizing digital tools.

#4 Provide robust support systems

Ensure agents have access to a responsive support team if they encounter technical issues with the digital platform. Empower them with help desks, FAQ sections, or real-time IT assistance so they can solve problems quickly without slowing down workflows.

Feedback loops are also crucial. Actively collect agent feedback about the portal’s functionality and pain points, then turn those insights into actionable improvements.

#5 Foster a digital-first mindset

Building a culture that embraces technology starts with leadership. During team meetings, highlight the benefits of digital transformation and share success stories of how it has improved client satisfaction, operational efficiency, or sales performance.

By emphasizing the role of technology in driving growth and client loyalty, organizations can foster buy-in and inspire agents to explore digital tools confidently.

Agents equipped to handle digital transformation don’t just succeed; they excel. They connect with clients on a deeper level by combining the convenience of smart portals with the warmth of a personal touch. And the results speak for themselves.

With the right training and tools, insurance companies often see measurable outcomes such as improved customer satisfaction and retention rates, faster policy processing, and increased sales opportunities. Agents, in turn, feel more motivated and confident in their work, leading to a more engaged workforce.

The insurance industry is in the midst of a digital revolution, reshaping how agents and clients interact. Emerging technologies like artificial intelligence (AI), blockchain, and advanced analytics are not just enhancing operations; they are transforming the very foundation of client-agent relationships. As we look toward the future, these advancements will enable hyper-personalization, streamline self-service options, and redefine the role of agents. The shift from transactional to advisory roles will open a new chapter in building more meaningful and value-driven client-agent connections.

Technologies like AI and blockchain are rapidly gaining traction within the insurance sector. They promise to improve efficiency, transparency, and trust. However, their true impact lies in enhancing smart portals and redefining the client experience.

AI enables deep data analysis, allowing insurers to offer tailored product recommendations, anticipate client needs, and streamline processes like claims and policy customizations. Imagine an agent who knows what coverage adjustments a client might need even before the client addresses it—that’s the power of AI in action.

Beyond personalization, AI chatbots are becoming valuable tools in smart insurance portals. They manage routine queries and deliver support 24/7, freeing up agents to focus on higher-value interactions, such as policy consultations and risk assessments.

Blockchain technology is poised to be pivotal in enhancing transparency and trust. By enabling secure, tamper-proof transaction records, blockchain allows clients to view complete histories of claims or coverage changes in smart portals. This level of accountability reassures clients that insurers are acting in their best interest, fostering greater long-term loyalty.

Blockchain can also speed up traditionally time-consuming processes, such as claims verification and fraud detection, ensuring quick and reliable resolutions.

The evolution of technology is driving noticeable trends that will shape how clients and agents engage. These aren’t just technological advancements; they reflect changing client preferences and expectations in a digital-first world.

#1 Hyper-personalization at every step

Today’s clients aren’t content with one-size-fits-all solutions. They expect products and services designed around their unique needs. Hyper-personalization, powered by robust data analytics and AI, allows insurers to offer highly customized policies, pricing, and recommendations.

For example, insurers could use lifestyle data, purchase behaviors, and risk analysis to present insurance bundles tailored to a client’s stage of life, whether it’s young professionals buying their first home or retirees planning long-term care. Personalized services ensure that clients feel valued while agents gain an edge in cultivating more profound relationships.

#2 The rise of self-service portals

Self-service options within smart insurance portals will see expanded adoption. Clients increasingly prefer managing simple transactions, such as updating contact information, reviewing policy details, or filing routine claims through intuitive, user-friendly platforms.

By optimizing these self-service offerings, smart portals cater to tech-savvy consumers who value convenience and speed. This reduces reliance on agents for basic tasks and shifts the focus of interactions toward more complex advisory services.

#3 Agents as trusted advisors

With technology handling transactional processes, agents will transition from task-oriented roles to advisory positions. This evolution hinges on their ability to provide deeper insights and guidance, offering clients value beyond what technology alone can achieve.

Agents of the future will act as risk consultants and strategists, helping clients make well-informed decisions about protection, investments, and future planning. By demonstrating true expertise and empathy, agents will reinforce trust and solidify their position as indispensable partners in navigating life’s uncertainties.

While the digital transformation of insurance offers unmatched efficiency, the human touch remains irreplaceable. Clients still value face-to-face discussions, emotional understanding, and personalized guidance that only a knowledgeable agent can provide.

Smart portals and AI tools empower agents to spend more time on the relational aspects of their work. Rather than being bogged down with paperwork or administrative tasks, agents can focus on actual client needs, understanding their goals, and building lasting connections.

This blending of technology and human interaction ensures that clients receive the best of both worlds: the efficiency of automation and the empathy of a professional advisor.

To stay ahead, insurers must invest in training programs and resources that help agents adapt to the digital-first model. By equipping them with insights into leveraging AI, blockchain, and other emerging technologies, insurers enable agents to deliver value in innovative ways.

Soft skills such as communication, emotional intelligence, and problem-solving will play an equally vital role. These skills ensure agents meet the relational demands of their evolving role, creating client experiences that inspire loyalty and trust for the long term.

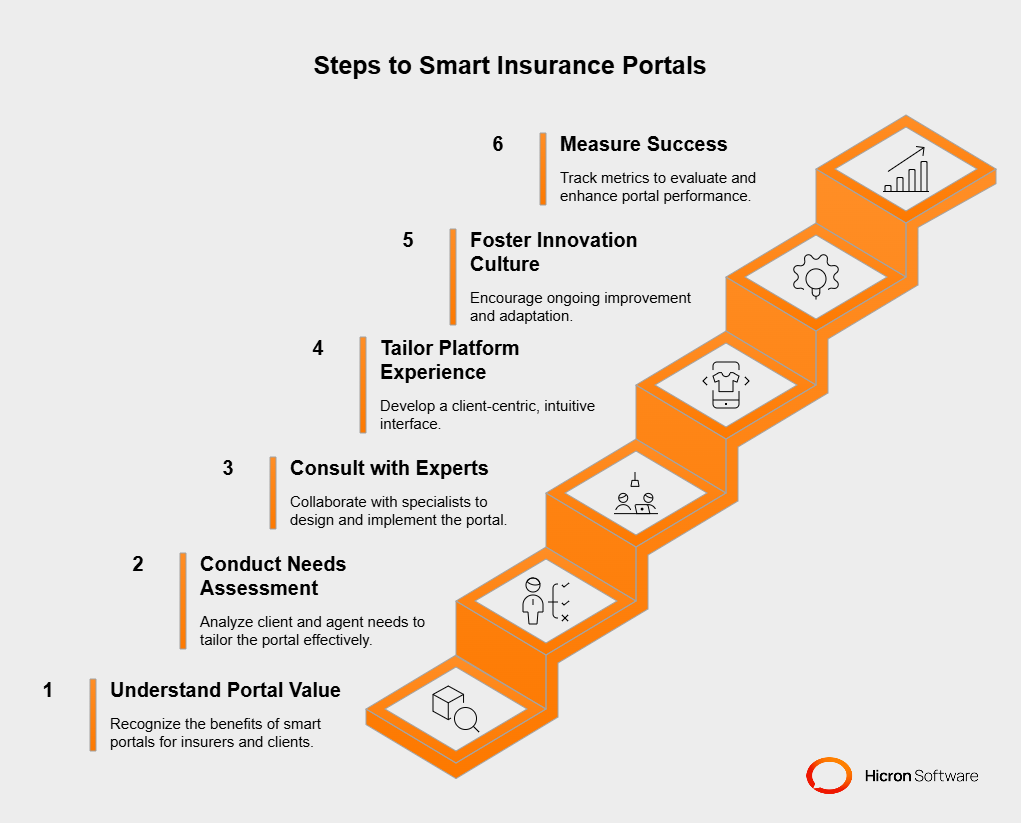

Traditional client interaction models have given way to smarter, tech-driven solutions that offer seamless service, personalization, and convenience. At the heart of this transformation are smart portals, which are revolutionizing how insurers engage with their clients. But the question remains: How do insurers take the first step toward adopting these solutions and staying competitive in an increasingly digital world?

This roadmap outlines actionable steps for insurers ready to modernize client interactions, create client-centric platforms, and foster a culture of continuous innovation.

Before adopting any technology, insurers must assess how portals align with their goals. These platforms serve as a central hub, allowing clients to access policies, file claims, and receive support from anywhere. Smart portals streamline workflows, reduce reliance on paper processes, and enhance customer satisfaction.

By centralizing operations and offering self-service options, insurers save time while allowing agents to focus on high-value tasks. The result? Happier clients and more efficient teams.

Not all insurers have the same requirements, and creating a one-size-fits-all platform won’t deliver optimal results. Before launching a smart portal solution, conducting a thorough needs assessment is essential.

Designing and implementing a smart portal isn’t a task to tackle alone. Collaborating with experts who specialize in client-centric platforms ensures your solution is both functional and tailored to your unique needs.

Tech consultants and digital transformation specialists can help insurers craft a roadmap prioritizing usability and efficiency. They also bring knowledge about best practices and emerging trends, ensuring your portal will remain relevant as technology evolves.

Key areas where expert guidance can make a difference include user interface design, compliance with data regulations, and integration of advanced features like AI-driven tools or blockchain.

Once you have the groundwork, it’s time to build a platform that puts clients first. The goal is to create an intuitive, responsive interface that delivers personalized services.

The work doesn’t stop once your portal goes live. Technology and client expectations evolve quickly, and staying ahead requires a commitment to ongoing innovation.

Finally, ensure you’re tracking the right metrics to understand how effective your smart portal is. Focus on KPIs like customer engagement rates, self-service adoption, claim resolution times, and overall customer satisfaction. These insights will help fine-tune your platform to deliver better results over time.

The path to smarter interactions starts with a clear commitment to modernization. Insurers can build platforms that redefine client-agent relationships by understanding client and agent needs, consulting with experts, and prioritizing continuous improvement.

Smart insurance portals are revolutionizing how agents and clients interact, making processes faster, more personalized, and highly efficient. These platforms enable insurers to streamline routine tasks, deliver tailored services, and empower agents to focus on building meaningful, advisory relationships with clients.

At the heart of this transformation lies the importance of placing client satisfaction front and center. By prioritizing user-friendly designs, mobile-first functionality, and continuous improvement, insurers can enhance trust, loyalty, and overall customer experience.

Adopting smart portal solutions isn’t just about technology; it’s about fostering deeper, dynamic partnerships that redefine the client-agent connection. For insurers looking to stay ahead, now is the time to invest in smarter tools that empower success today and in the future.