InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

Safeguarding maritime businesses begins with accurate marine insurance premium calculations. These calculations are a financial necessity and a fundamental mechanism for mitigating risks in industries where uncertainties loom large.

Understanding marine insurance premiums is critical to making informed decisions, and modern insurance tools are revolutionizing how these calculations are approached. By blending precision and efficiency, modern insurance software empowers businesses to strategically manage risks and focus on long-term stability.

This discussion will explore how marine insurance premium rates are determined and highlight the transformational potential of leveraging modern insurance tools. Together, these insights shed light on the path to simplified processes and optimized outcomes in marine risk management.

Marine insurance premium rates hinge on several key factors, each reflecting the unique risks associated with maritime operations.

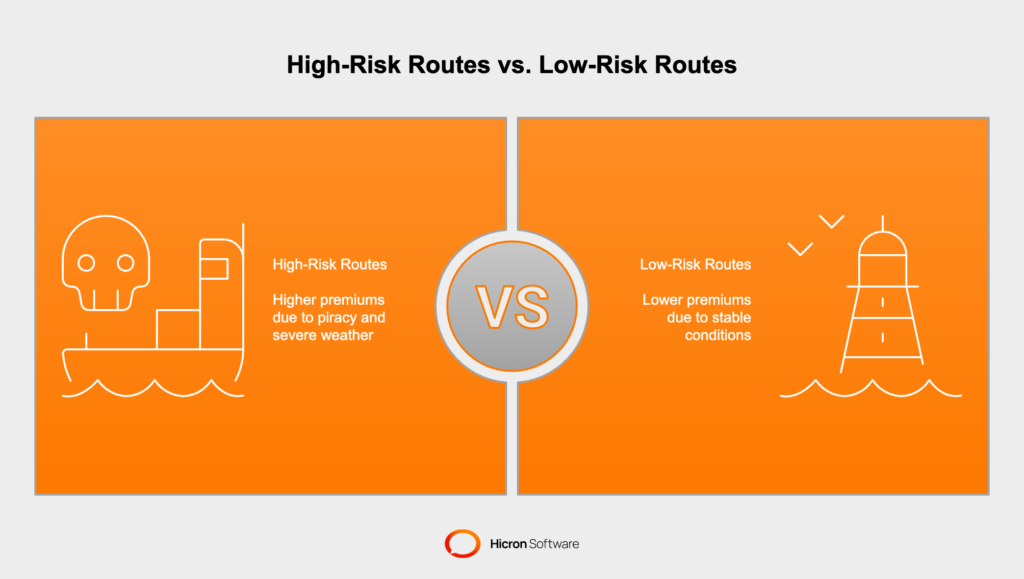

Marine insurance premium rates can vary greatly depending on the risks associated with specific shipping routes. High-risk routes typically come with higher premiums due to the increased likelihood of incidents, while low-risk routes offer more predictable and stable conditions, leading to lower costs.

High-Risk Routes & Marine Insurance Premium

Shipping routes that pass through dangerous zones often carry significantly higher premiums. For example, the Gulf of Aden, located between Yemen and Somalia, is infamous for piracy. Ships navigating this region are exposed to hijacking threats, cargo theft, and even potential harm to crew members. Insurers account for these risks by charging higher premiums to offset the potential for large claims. Similarly, regions prone to severe weather, like the North Atlantic during winter, come with heightened risks of storms, rough seas, and navigation challenges, further driving up the cost of coverage.

Low-Risk Routes & Marine Insurance Premium

On the other hand, routes considered safer and more predictable, such as those through the Mediterranean Sea or along the U.S. Eastern Seaboard, generally result in lower premium rates. These areas typically have well-monitored maritime conditions, reduced chances of piracy, and fewer extreme weather events. For example, shipping goods from major ports in Europe to the U.S. East Coast avoids many of the hazards present in less stable regions, leading to more affordable insurance premiums.

This contrast illustrates how geography and external conditions influence marine insurance costs. Understanding these differences enables shipping companies to assess routes strategically, balancing safety, efficiency, and insurance expenses to optimize their operations.

Historically, marine insurance premium calculations relied on manual processes that depended heavily on static data. Insurers would gather information such as vessel specifications, historical loss records, and average route risks to create a profile of the potential exposure. This data was then analyzed manually, often relying on the expertise of underwriters who could identify patterns and assess probabilities based on past trends.

While this approach provided a degree of reliability, it was not without challenges. Static data lacks the flexibility to account for sudden changes or unique circumstances. For example, the risks associated with a shipping route might fluctuate due to seasonal weather changes or new security threats, but manual methods struggled to respond to such circumstances in real time. The process was time-intensive and subject to human error, making it difficult to adapt quickly to evolving scenarios.

Modern maritime operations are influenced by a wide range of dynamic, real-time factors, which add layers of complexity to premium calculations. Today’s insurers must consider elements such as:

These dynamic conditions are challenging for traditional methodologies, as they require continuous monitoring and immediate responses to maintain accurate assessments. Manual processes that depend on pre-determined datasets simply cannot keep pace with the fluid nature of these risks.

Understanding these aspects and leveraging advanced tools helps marine insurance providers balance risk and costs effectively, fostering trust and security for all stakeholders.

Marine insurance premium rate management is a complex process that often encounters significant hurdles. Two of the most pressing challenges include fluctuating risk data and the errors that stem from manual calculations:

The challenges highlighted above underscore the urgent need for more efficient, tech-driven processes within premium rate management. Real-world examples emphasize the consequences of failing to adapt:

By addressing these challenges with advanced tools and streamlined methodologies, marine insurance providers can improve their premium rate management. This shift is no longer optional but essential for staying resilient and competitive in today’s fast-changing maritime industry.

Modern maritime insurance claim software is transforming how insurers manage premium calculations. Designed to merge efficiency with accuracy, these tools come equipped with a variety of cutting-edge features and benefits.

Key Features:

Primary Benefits:

These features and benefits not only enhance operational efficiency but also foster trust between marine insurers and their clients by delivering consistent, transparent results.

Beyond standard claim software, advanced tools are taking premium rate calculations to new heights, offering specialized solutions for risk optimization and cost reduction.

Examples of Modern Tools:

These tools are revolutionizing marine insurance by enabling smarter, more adaptable calculations. By equipping themselves with these advanced solutions, insurers can stay agile in a dynamic industry, ensuring both competitiveness and resilience.

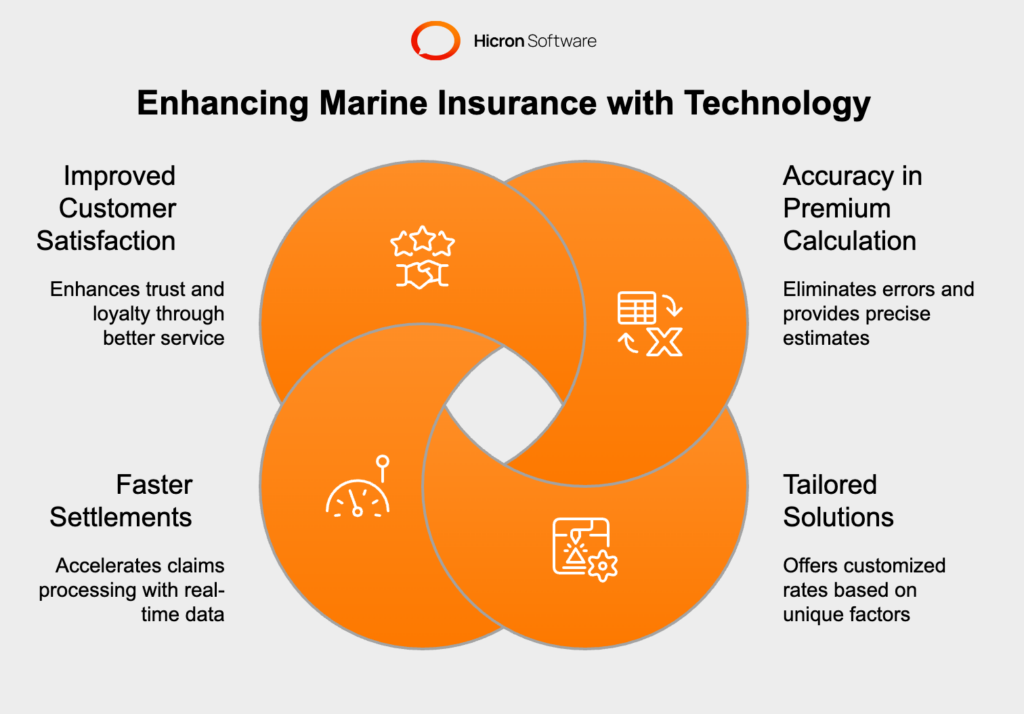

Leveraging software in marine insurance allows for a dramatic improvement in accuracy when calculating premiums. Here’s how it benefits you:

Efficiency is another game-changer when integrating technology into marine insurance. The benefits are immediate and impactful:

By adopting these advancements, you don’t just improve your operational processes; you provide clients with confidence and speed, ensuring their needs are met with precision and care. Technology isn’t just an upgrade; it’s the path to secure, efficient, and reliable marine insurance management.

It’s no surprise that artificial intelligence (AI) and machine learning (ML) are transforming every area of business. AI can manage marine insurance rates by offering tools to predict risk better and adjust premiums. These advances enable insurers to maintain an edge in an unpredictable marine environment.

For example, a system could assess the likelihood of severe storms in specific shipping regions during certain months, allowing insurers to adjust premiums proactively. This predictive capability reduces financial exposure while ensuring clients are adequately covered.

By integrating AI and ML, marine insurers can transform their operational models, delivering more accurate, personalized, and responsive services. While these technologies come with implementation challenges, their value in navigating a data-dependent and volatile industry is undeniable.

Accurate premium calculations are the backbone of effective marine insurance, ensuring fair pricing and risk management for clients and insurers alike. However, traditional methods face notable challenges, from handling fluctuating risk data to manual errors that can lead to costly discrepancies. These obstacles demand smarter solutions.

The adoption of advanced tools, such as maritime insurance software and big data analytics, has dramatically improved efficiency and accuracy in the industry. Automated risk analysis, real-time data integration, and customized premium algorithms have transformed processes, reducing errors and enabling faster, more reliable services. Looking ahead, the integration of artificial intelligence and machine learning promises even greater advancements. Predictive analytics and AI-driven customization will allow insurers to proactively address risks and tailor premiums to dynamic conditions, setting a new standard for precision and adaptability.

Now is the time for marine insurers to fully embrace these innovations. By investing in technology and staying ahead of industry trends, you can elevate your services, strengthen client relationships, and secure your place as a leader in the field. The future of marine insurance isn’t just about keeping up; it’s about setting the pace. Take the next step toward smarter, more efficient premium rate management today. Get in touch!

Marine insurance premiums are influenced by factors such as cargo type and value, shipping route risks, vessel age and condition, and geopolitical or weather-related risks.

High-risk routes, such as those prone to piracy or severe weather, typically have higher premiums, while low-risk routes with stable conditions result in lower costs.

Technology, such as advanced algorithms and real-time data integration, streamlines premium calculations by analyzing dynamic risks like weather changes, geopolitical events, and cargo-specific factors.

AI enhances accuracy by using predictive analytics to assess risks, automate data analysis, and provide tailored premium rates based on real-time conditions.

Challenges include handling fluctuating risk data, errors in manual calculations, and adapting to dynamic maritime conditions.

Tools like maritime monitoring platforms, big data analytics, and premium calculation algorithms help insurers analyze risks and calculate premiums more efficiently.

Insurers use real-time data from weather tracking systems, geopolitical intelligence, and IoT devices to adjust premiums dynamically and mitigate risks.

Accurate calculations ensure fair pricing, reduce financial exposure for insurers, and build trust with clients by reflecting true risks.

Benefits include reduced manual errors, faster processing times, tailored premium rates, and improved customer satisfaction.

Predictive analytics enables insurers to forecast risks, adjust premiums proactively, and provide more personalized and responsive services.

The calculation of a marine insurance premium involves assessing several factors, including the type of cargo, its value, the route, and the risks involved. Insurers start by determining the insured value, which typically includes the cost of the goods, shipping expenses, and a small markup (often 10%). From there, they apply a rate of premium, which reflects the level of risk. The premium is then calculated by multiplying the insured value by the rate of premium. Higher risks, such as poor weather routes, hazardous cargo, or long distances, usually result in higher premiums.

The formula to calculate a marine insurance premium is as follows:

Marine Insurance Premium = Insured Value × Rate of Premium

Insured Value is generally calculated as the sum of the goods’ cost, freight charges, and an additional markup (usually 10%).

Rate of Premium is based on the level of risk associated with the transport, type of cargo, and route conditions.

For example, if the insured value of cargo is $50,000 and the rate of premium is 0.5%, the premium would be $50,000 × 0.005 = $250.