InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

Insurance core modernization is the process of upgrading outdated insurance legacy systems to modern, scalable, and flexible technologies that support digital transformation. It enables insurers to improve operational efficiency, enhance customer experiences, and adapt quickly to market and regulatory changes.

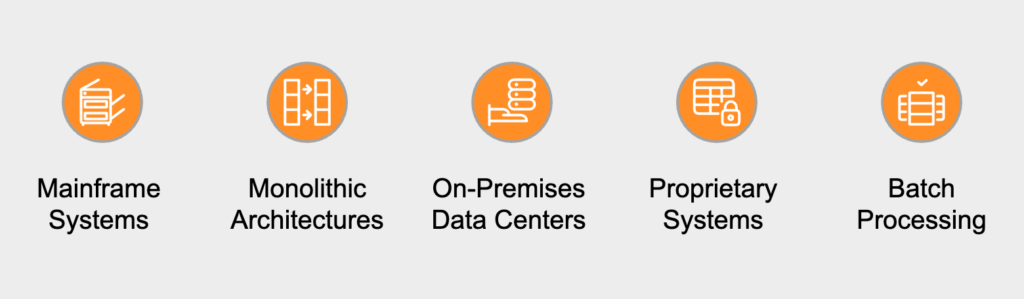

Insurance companies reached a crossroads. Aging legacy IT systems no longer support the agility, efficiency, and digital experiences essential in the evolving insurance landscape. These outdated insurance core platforms accumulate technical debt and unpredictable costs. They also hinder innovation and rapid product development. For insurance executives seeking to drive profitable growth and deliver modern customer service, insurance core modernization is not just a technology project; it’s a strategic necessity.

Drawing on core IT modernization in insurance, this article explores why insurance legacy modernization is vital, how to mitigate the technical risks of transformation, and which modernization approaches align with different insurer needs.

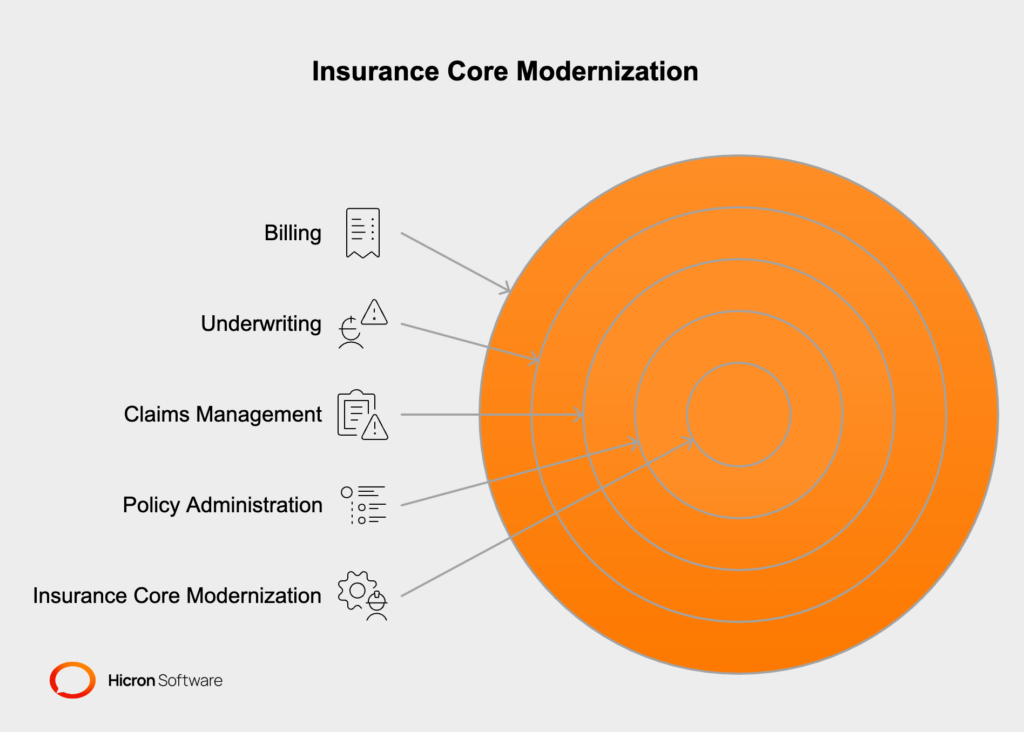

Insurance core refers to the basic systems and processes that enable an insurance company to operate. The insurance core includes key processes such as policy administration, claims management, underwriting, and accounting, ensuring uninterrupted service delivery and business continuity.

Insurance core modernization refers to the process of upgrading or replacing outdated legacy systems to improve the efficiency, flexibility, and capability of an insurer’s core operations.

Insurance core systems, which include policy administration, claims management, underwriting, and billing, often form the backbone of insurance operations but can become a bottleneck due to their limited scalability and incompatibility with modern technologies.

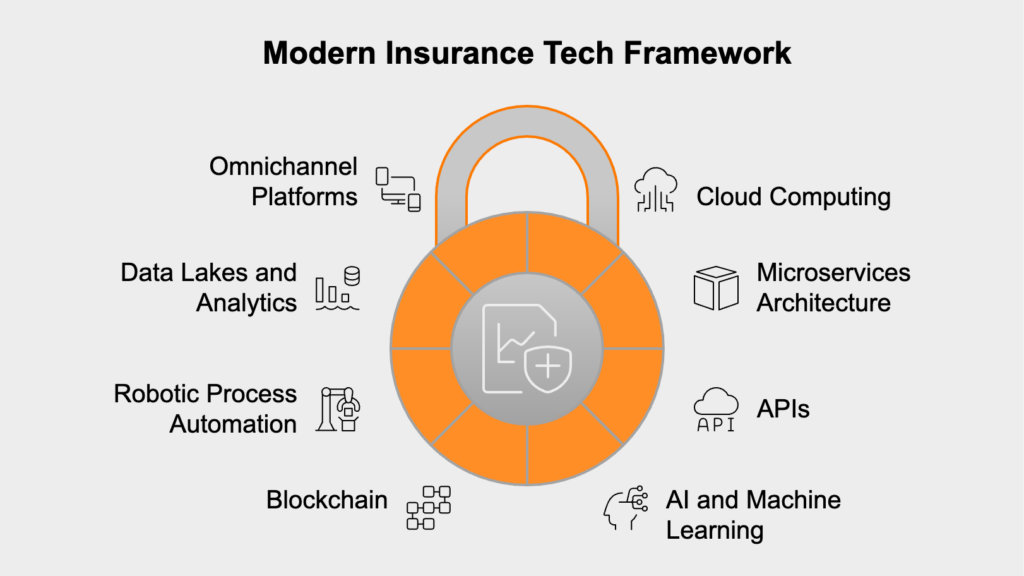

By adopting modern insurance platforms and technology stacks, insurers can respond more quickly to evolving customer expectations, regulatory changes, and market demands. Core modernization streamlines operations and enables insurers to innovate, leverage data analytics, and deliver a more personalized customer experience.

However, undertaking insurance core modernization is often easier said than done. It involves addressing technical debt accumulated over years of reliance on legacy systems. It requires a long-term commitment and close collaboration among vendors, businesses, and system integrators to ensure its success. This complexity can make the process daunting, but the rewards of enhanced operations and innovation make it a worthwhile endeavor.

Insurance core modernization has become a critical priority for insurers aiming to stay competitive and future-proof their operations.

Insurers today are facing mounting pressure from all sides: outdated core systems are increasingly difficult and expensive to maintain, while customer expectations for real-time, digital interactions continue to rise. Legacy IT environments struggle to provide the agility needed for process automation, omnichannel data access, and personalized customer experiences. As a result, many insurers are shifting their IT investments away from simply maintaining old systems and toward foundational upgrades that support digital transformation.

Modernizing these core systems enables:

For insurance leaders, these capabilities are crucial for boosting long-term competitiveness and improving both bottom-line performance and customer satisfaction.

Insurance core modernization isn’t just about keeping up with technology; it’s about responding to new regulatory, competitive, and operational realities. Regulatory mandates are pushing insurers to improve risk management, enhance digital customer access, and strengthen operational resilience.

At the same time, digital-first insurers and market innovators are driving up customer expectations for digital services and rapid product innovation.

Traditional insurers who hesitate risk falling behind, both in terms of efficiency and market relevance. Insurance legacy modernization and digital transformation is now a strategic necessity, enabling insurers to leverage emerging technologies like cloud computing, analytics, and artificial intelligence for greater agility and growth.

Modern core IT systems provide the technical foundation to drive revenue and enable business growth:

Core modernization streamlines operations and reduces costs in several key ways:

Today’s customers expect their insurers to deliver digital services that are intuitive, fast, and personalized. Core modernization supports:

The timeline for insurance core modernization can vary depending on the scope, strategy, and complexity of the project. However, here are some general estimates based on industry practices:

|

Strategy |

Timeline |

Scope |

Best For |

|

Incremental Modernization |

12 to 24 months |

Targeted upgrades to specific components or functionalities within the core IT system, implemented one at a time. |

Insurers aiming for quick wins to mitigate pressing system constraints without overhauling everything. |

|

Modular Modernization |

2 to 4 years |

Transformation of several interconnected systems and processes, enhancing crucial parts of operations but not the entire IT infrastructure. |

Insurers looking to balance cost and speed while addressing critical inefficiencies. |

|

Large-Scale Modernization |

3 to 5 years or more |

Comprehensive transformation of the entire core IT system, including policy administration, claims, billing, and customer engagement platforms. |

Large insurers with complex operations across multiple regions or lines of business. |

As the timeline for insurance core modernization shows, the road ahead is lengthy and bumpy. One of the key bumps is modernization projects is the cooperation with vendors, IT companies, and system integrators. Modernizing core insurance systems means managing the long-term relationship with technology vendors. Potential risks include:

To address these concerns, leading insurers:

Recommended Modern Technologies for Insurance Core:

BCG has identified three distinct strategies for insurance core modernization to help companies adapt to evolving market demands. These strategies include centralized, federal, and hybrid models, each offering unique benefits for different organizational needs.

|

Strategy |

Overview |

Best For |

BCG Technical Note |

|

Centralized |

Centralized modernization involves deploying a group-wide, bespoke IT platform managed by a central technology team. |

Large, multinational insurers aiming for standardized processes, compliance, and operating models across markets. |

Centralized models demand mature technical governance, shared service capabilities, and robust talent development. |

|

Federal |

The federal model combines off-the-shelf solutions at the group level with local adaptations and bespoke platforms for regional subsidiaries. |

Insurers needing balance between group-wide efficiencies and local product differentiation due to regulations or unique market needs. |

Federal approaches require well-defined API standards and disciplined integration management to prevent fragmentation. |

|

Hybrid |

Hybrid strategies merge centralized oversight with regional autonomy. Large, strategic markets pursue custom modernization, while smaller countries follow a standardized, group-level platform. |

Diverse insurers with both major and minor operating regions wanting to maximize standardization and fit. |

Hybrid success relies on modular architectures and strong program management to maintain consistency and scalability. |

Transformation success must be measured. Boston Consulting Group suggests insurers evaluate core modernization by tracking:

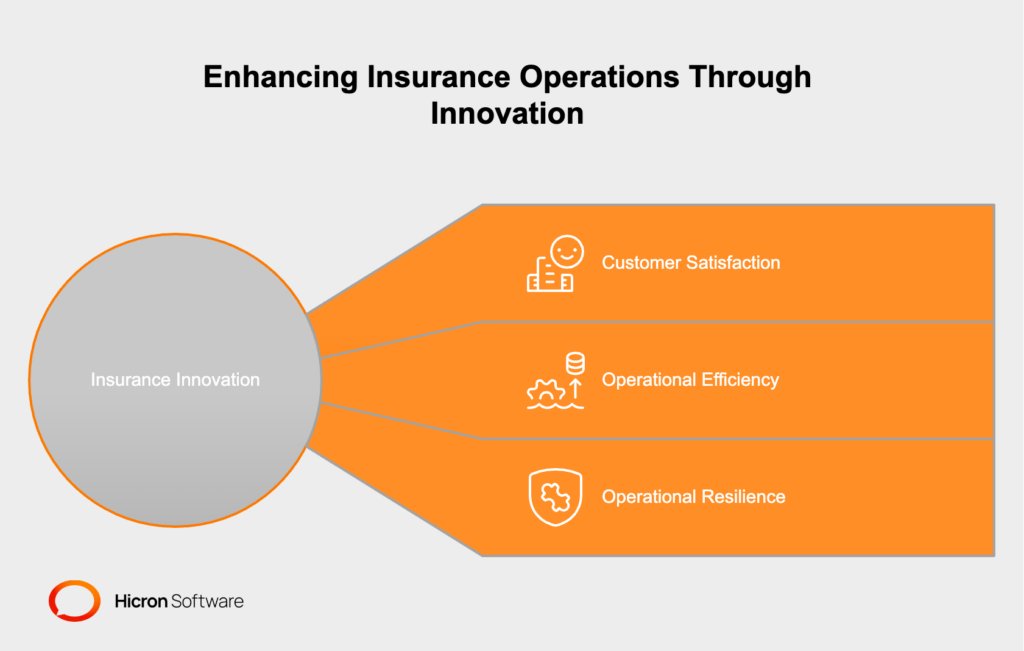

For customer satisfaction, insurers can improve the experience through faster claim processing and more tailored product offerings. For instance, leveraging AI to automate claim settlements can reduce turnaround times from days to hours and help automatically settle up to 70% of claims, freeing staff for more complex cases and improving customer retention.

In terms of operational efficiency, streamlined workflows and automation drive notable productivity gains and cost reductions. Implementing automated underwriting, for example, can decrease processing time by 60%, allowing staff to process twice as many applications and reducing manual error rates.

Operational resilience is strengthened through better risk control, compliance, and adaptability to regulatory changes. With modular systems and automation, new regulatory reports or product adjustments can be implemented in a matter of weeks, not months, helping insurers stay compliant and responsive to shifting market demands.

Insurers who strategically invest in insurance legacy modernization consistently outperform laggards in profitability, efficiency, and market growth.

Modernizing insurance core systems is no easy task. It requires huge investment, careful planning, and coordination across teams. However, ignoring the mounting technical debt associated with outdated legacy systems is not a sustainable solution. Over time, these legacy systems become more expensive to maintain, less secure, and increasingly incapable of meeting evolving customer and regulatory expectations. Addressing these challenges head-on is essential for long-term success and resilience in the competitive insurance market.

Insurance core modernization is a business-critical, technology-driven undertaking that determines future competitiveness. By leveraging open, modular, and cloud-based architectures; selecting the modernization strategy that fits their business; actively managing vendor relationships; and developing robust internal IT talent, insurers can unlock transformational gains in revenue, efficiency, and customer loyalty. Start your modernization today!

Insurance core modernization is the process of upgrading or replacing outdated legacy systems with modern technology to improve efficiency, flexibility, and customer experience. It is crucial for insurers to stay competitive, reduce operational costs, and meet evolving regulatory and customer demands.

Key drivers for insurance core modernization include the limitations of legacy IT systems, increasing customer expectations for digital services, regulatory pressures, and the need for enhanced speed, agility, and cost-efficiency in insurance operations.

The most common modernization strategies for insurance core systems are centralized, federal, and hybrid approaches. Each strategy offers unique advantages depending on the insurer’s size, market diversity, and business goals, allowing organizations to tailor core transformation to their specific needs.

Insurers can measure the return on investment (ROI) of core modernization by tracking IT cost reductions, improvements in time-to-market for new products, enhanced customer experience metrics, increased operational efficiency, and overall profitability gains.

The timeline for an insurance core modernization project varies by scope: small-scale projects usually take 6 months to 1 year, medium-scale efforts require 1 to 3 years, and large-scale transformations can take 3 to 5 years or more, depending on complexity and strategy.

Common risks in insurance core modernization include vendor lock-in, loss of internal IT expertise, misaligned technology roadmaps, and integration challenges. These risks can be minimized with open, modular system architectures, strong vendor management, and reliance on industry best practices.

Successful insurance core modernization delivers numerous business benefits including accelerated product launches, significant cost savings, improved digital customer experiences, increased operational performance, and greater resilience in adapting to market and regulatory changes.