Insurance Fraud Detection Software in the Era of AI

- March 10

- 35 min

Efficiency and accuracy are now essential in the rapidly changing insurance industry. Automation, powered by EDI and AI, is transforming how insurers handle tasks like processing claims and managing policies. These tools set a new benchmark, helping insurance companies meet the growing need to optimize operations, enhance customer experiences, and meet insurance industry demands. This is where the power of technology, particularly Electronic Data Interchange (EDI) and Artificial Intelligence (AI), comes into play.

EDI simplifies the flow of critical information, connecting insurers with health providers, policyholders, and other stakeholders by enabling the secure transfer of standardized data. Meanwhile, AI transforms this data into actionable insights. Whether it’s detecting fraud in claims or automating repetitive tasks, these technologies are transforming the way insurance businesses operate.

This article explores the transformative potential of combining EDI and AI. Together, they are revolutionizing insurance workflows, driving innovation, and ushering in a new era of efficiency for insurance technology companies, life insurance technology companies, and the broader insurance industry. Get ready to discover how these advancements are enabling companies to deliver smarter, faster, and more reliable services, all while remaining agile in a competitive landscape.

Running an insurance business is no small feat. Keeping things smooth and efficient while handling policies, claims, and everything in between can feel like an uphill battle. That’s where automation becomes a game-changer. With tools like Electronic Data Interchange (EDI) and Artificial Intelligence (AI), insurance companies are finally finding ways to streamline their manual processes and scale their operations without compromising quality.

Think about it. Traditional methods of managing policies often involve repetitive tasks, heaps of paperwork, and opportunities for human error. Claims handling? It’s even trickier. Paper trails get lost, delays accumulate, and detecting fraudulent claims is akin to finding a needle in a haystack. These challenges aren’t just frustrating for your team, but also keep your customers waiting longer than they should.

Now imagine if you could swap those outdated processes for something faster, smarter, and more reliable. That’s what technologies like EDI and AI bring to the table. EDI streamlines data sharing by standardizing and automating the exchange of information between insurers, policyholders, and partners. No more sifting through emails or chasing down the latest version of a document. Meanwhile, AI-powered tools step in to handle the heavy lifting of identifying patterns, spotting inconsistencies, and making quick decisions. AI turns time-consuming headaches into seamless, accurate workflows, from flagging potential fraud to approving claims within minutes.

These tools don’t just improve efficiency; they set you up for the future. Custom solutions, tailored specifically to your business, ensure that your operations remain adaptable as the industry evolves. Whether you’re part of a life insurance tech company, an insurtech startup, or a longstanding player in the insurtech sector, automation helps you scale confidently while keeping your customers happy. It’s about working smarter, not harder, and paving the way for growth without the growing pains.

Automation in policy management is unlocking new possibilities for efficiency, accuracy, and customer satisfaction. By combining Electronic Data Interchange (EDI) with advanced AI-powered tools, insurance companies can effectively address diverse challenges, such as policy updates, fraud prevention, and customer communication. Below, let’s explore these use cases and how they benefit insurers and their clients.

One of the biggest hurdles in policy management is the sheer volume of repetitive manual tasks that must be completed. EDI simplifies operations by automating data exchange between insurers, policyholders, and partners. Whether creating new policies or updating existing ones, EDI ensures instant, accurate, and seamless information sharing.

For instance, when policyholders need to adjust their coverage or update their contact details, EDI handles it in real-time with minimal human input. This reduces processing time, eliminates clerical errors, and enables insurance teams to focus on providing more personalized customer support rather than being overwhelmed by administrative tasks.

The onboarding process is crucial for making a good first impression, but it is often hindered by paperwork and delays. AI-driven tools change the game by offering swift and accurate validation of customer information.

Think about it this way: A customer submits their required documents, and within moments, AI cross-checks them against regulatory standards and internal requirements. Missing or incorrect details are flagged immediately, preventing delays before they happen. Not only does this enhance efficiency, but it also establishes the customer relationship on a positive and professional note.

Policy renewals are a regular part of the insurance lifecycle and are often time-consuming for everyone involved. With EDI, renewals no longer require manual follow-ups or data collection. Automated processes ensure accurate renewal reminders are sent to customers while updated policy details are processed almost instantaneously.

This reduces the likelihood of missed renewals, ensuring policyholders enjoy uninterrupted coverage. For insurance providers, it means faster revenue recognition, happier clients, and fewer administrative headaches.

Insurance fraud is a persistent issue, but AI-powered fraud detection systems are transforming the landscape. These tools use machine learning to analyze patterns in claims and identify suspicious behavior in real-time.

For example, if a claim includes inconsistencies, such as duplicate documents or mismatched data, AI flags it for further investigation. This proactive approach protects insurers from payouts on fraudulent claims and speeds up approval for legitimate cases.

Communication is at the heart of customer satisfaction. Automated communication tools, powered by EDI and AI, enable insurers to keep policyholders informed without requiring constant manual effort.

Here’s how it works: EDI automates routine updates like policy changes or status notifications, while AI chatbots assist customers with queries 24/7. Whether clients want to track their claim’s progress or request policy details, these tools ensure they get accurate answers with minimal wait time. The result? A smoother, stress-free customer experience.

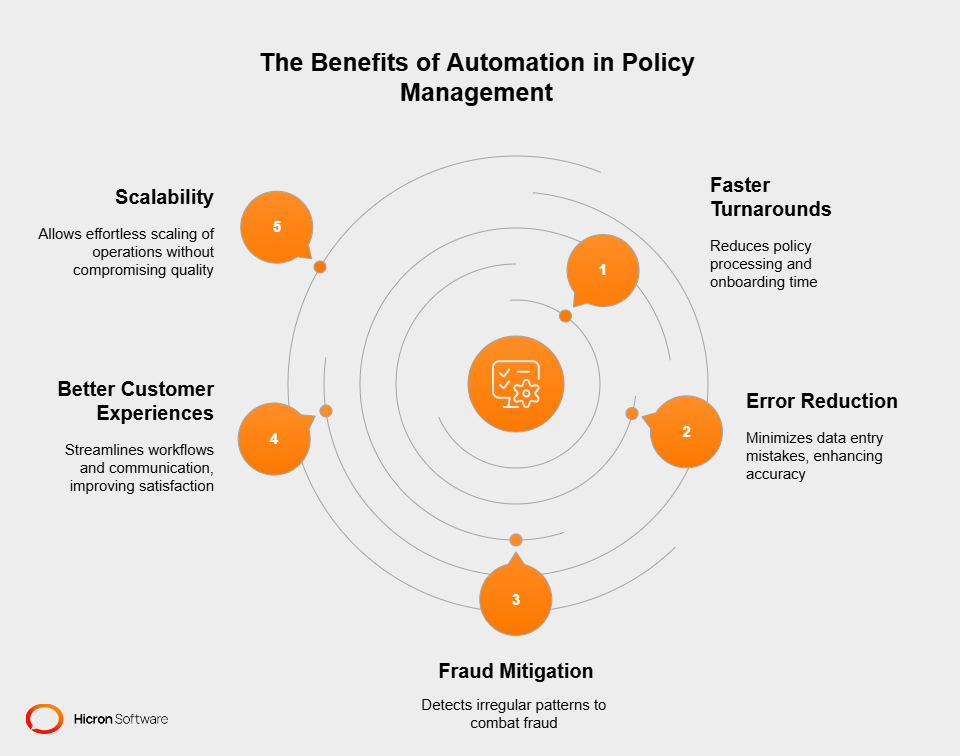

The advantages of automation in policy management go beyond immediate operational gains. Here are some of the key benefits:

Whether you operate as part of a life insurance tech company, an emerging insurtech startup, or a well-established player in the insurtech industry, automation is key to staying competitive. It’s about delivering your clients faster, smarter, and more reliably while setting your business up for long-term success.

Claims processing is at the heart of any insurance business, and getting it right isn’t just about efficiency—it’s about trust. With the power of Electronic Data Interchange (EDI) and Artificial Intelligence (AI), insurance companies are transforming how they handle claims, ensuring speed, accuracy, and security at every step.

Claims aren’t always straightforward, and manually reviewing all the supporting data can be time-consuming. AI-driven tools solve this by sifting through claims data in seconds. AI analyzes documents, images, and historical claims to verify their accuracy.

For example, if a policyholder submits a claim for property damage, AI can compare it against similar cases and instantly validate whether the reported loss aligns with the coverage terms. This accelerates the process and reduces the chances of errors that could delay settlements.

Behind every successful claim lies a web of communication between insurers, brokers, and third parties. EDI ensures that all this data flows seamlessly and accurately. From sharing policy details to processing payout approvals, EDI eliminates manual bottlenecks.

Picture this scenario: A broker must send additional details about a claimant to the insurer. Instead of emails or calls that risk miscommunication, EDI transmits the information directly into the insurer’s system. It’s faster, error-free, and keeps everyone on the same page, ensuring timely processing from start to finish.

Fraudulent claims pose a significant challenge, but AI-powered anomaly detection is helping to turn the tide. AI systems monitor claims data for patterns and red flags that could indicate fraud. It may be due to mismatched dates, duplicate documents, or suspiciously inflated amounts.

Take, for instance, a motor insurance claim. AI can identify inconsistencies in damage reports by tracking photo timestamps or cross-referencing repair estimates. This helps insurers prevent payouts on fraudulent claims and expedite legitimate ones by focusing resources where they’re needed most.

The results are game-changing when EDI’s precision and AI’s intelligence come together. Claims are processed faster, fraud is detected before it becomes a loss, and customers experience smoother settlements. For insurers, this isn’t just about saving time or cutting costs; it’s about building trust with clients by delivering on promises quickly and reliably.

By integrating EDI and AI into claims processing, you’re not just keeping up with modern demands but setting a higher standard for the insurtech industry. Faster, safer, and smarter claims handling is now within reach, reshaping how insurers operate and customers experience insurance.

The insurance industry thrives on precision, efficiency, and compliance. While off-the-shelf solutions can handle some of the workload, there’s nothing quite like custom software to fully automate workflows and meet the unique challenges of your business. By seamlessly integrating Electronic Data Interchange (EDI) and Artificial Intelligence (AI), tailor-made systems drive smooth operations, reduce redundancies, and ensure regulatory compliance.

No two insurance companies operate the same way. Different products, customer bases, and regulatory environments require distinct approaches. This is where custom software solutions make all the difference.

These systems are designed with your business in mind. They integrate EDI to automate data exchanges between insurers, brokers, reinsurers, and other stakeholders, ensuring every detail flows seamlessly. At the same time, AI capabilities can analyze complex data, streamline tasks like claims review or customer onboarding, and adapt to shifting operational needs.

For example, a life insurance company may require automated underwriting tools powered by AI to handle a high volume of modern applications. Meanwhile, a general insurance provider can rely on EDI to manage policy renewals and claims documentation with minimal manual intervention. Custom software ensures that these unique requirements are covered within a single, cohesive system.

Tailor-made solutions often combine multiple tools to create a comprehensive insurance workflow. Some examples include:

These scalable solutions unify processes, empowering insurance companies to operate more efficiently at every touchpoint.

Insurance workflows vary greatly depending on geography, customer base, and jurisdiction-specific rules. Custom software excels in this area by being adaptable. It enables businesses to create workflows that align with their internal operations while meeting stringent regulatory requirements.

For instance, a health insurance provider must ensure compliance with privacy laws, such as HIPAA, which demands secure and automated data handling. Custom solutions incorporate features such as encrypted EDI transactions and AI-driven data audits to maintain compliance while minimizing the risk of human error.

On the other hand, an auto insurer might need a system that quickly adjusts to dynamic pricing regulations. With custom software, such changes can be made effortlessly, keeping your business compliant and competitive.

Full workflow automation doesn’t just save time; it also enhances productivity. It builds agility, reduces errors, and enhances customer satisfaction. Custom software solutions do all this while growing alongside your business. Whether you’re an insurtech startup or a well-established enterprise, the ability to tailor technology to fit your needs ensures you remain ahead in the competitive insurance landscape.

Investing in bespoke solutions means you’re not settling for “good enough.” Instead, you’re empowering your business with tools that evolve with your operations, meet your compliance demands, and deliver exceptional service to your clients.

The insurance industry is rapidly evolving, and integrating Electronic Data Interchange (EDI) and Artificial Intelligence (AI) is a game-changer. These technologies don’t just streamline workflows; they revolutionize how insurers operate, slashing costs, saving time, and elevating customer satisfaction to new heights. Below, we will explore some striking examples of their impact, from hypothetical cases to real-life success stories, illustrating how automation reshapes the insurance experience.

Imagine a mid-sized car insurance company manually processing claims. Staff members often juggle stacks of paperwork and spend hours making phone calls or cross-referencing spreadsheets. Now, picture the same company implementing AI-powered EDI. Suddenly, the process transforms. Claims forms are automatically validated, data flows instantly to all relevant parties, and each claim is processed in a fraction of the time.

Here’s how it might look in numbers:

By adopting these tools, insurers can focus resources on high-priority cases, accelerating service while slashing expenses.

Take the example of an international health insurer that serves millions of clients. Before implementing EDI and AI, their policyholder update process was time-consuming and prone to errors. A policyholder changing their address might call in or email, but the update could get lost in a backlog of manual data entries, resulting in outdated records.

Once the insurer shifted to AI and EDI systems, the results were astounding:

One notable case involved automating their claims adjudication system. AI algorithms actively cross-referenced medical claim submissions against policy coverage, while EDI facilitated the accurate sharing of data between healthcare providers and the insurer. The result? A 40% reduction in claims settlement times and thousands saved on operational overheads.

Consider a disaster scenario in which a sudden flood affects thousands of homes. Traditionally, insurers have taken weeks to process claims, often overwhelmed by the influx of cases and relying on manual systems. With EDI and AI in play, the entire workflow can undergo significant changes.

This efficiency not only improves public perception of the insurer but also cements trust with customers during the most crucial moments.

The introduction of automation into insurance isn’t just about speeding up processes; it’s about creating a better relationship with customers. AI and EDI, in tandem, remove the lag and guesswork that often frustrate policyholders.

For example:

Unsurprisingly, insurers leveraging these technologies report higher Net Promoter Scores (NPS), a key indicator of customer loyalty.

Automation isn’t just a trend; it’s the insurance industry’s future. With EDI and AI driving efficiency gains and redefining customer interactions, companies can deliver faster, smarter, and more reliable services. As real-world examples and success stories demonstrate, the benefits extend beyond operational to deeply human levels. Happy customers, lower costs, and streamlined processes are a win-win for everyone in the insurance technology (insurtech) ecosystem.

The question isn’t whether to adopt automation but how quickly insurers can leap. For those who do, the rewards are immeasurable. The insurance experience as we know it is being redefined, and the results are simply too powerful to ignore.

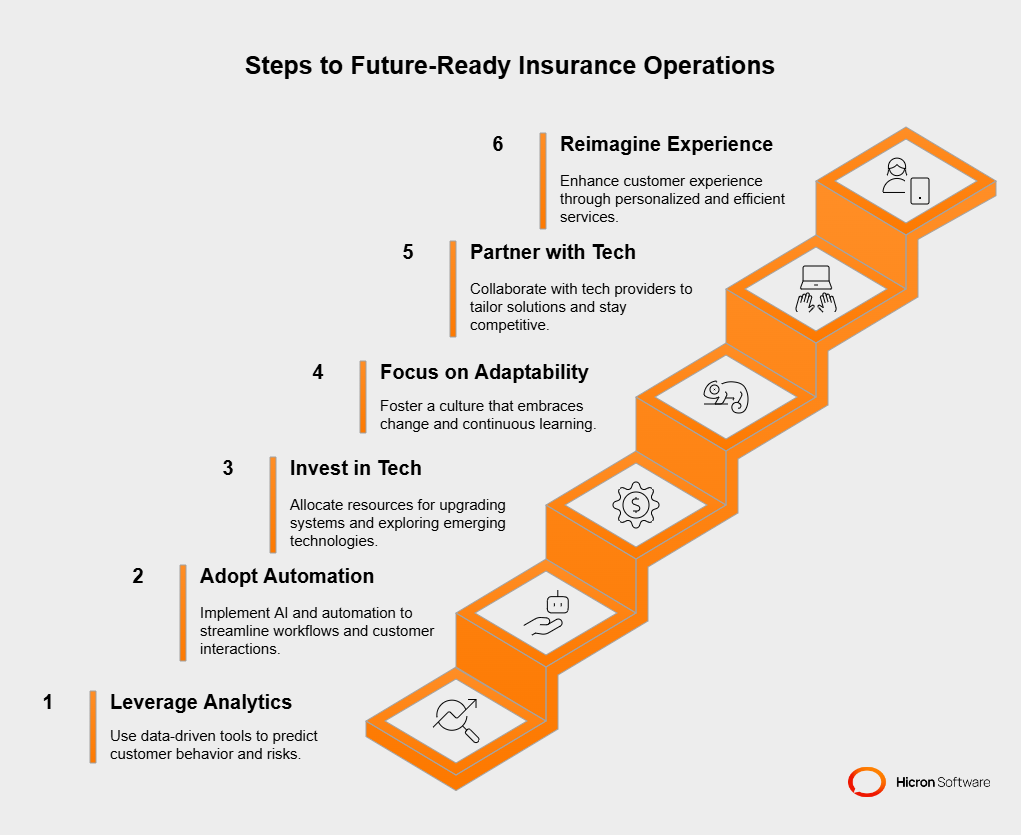

The insurance industry is advancing at a rapid pace, and staying ahead requires a clear, proactive approach. Here’s a step-by-step guide to help you prepare your operations for an automated, tech-driven future.

Predictive analytics is transforming how insurers anticipate and respond to challenges. Start integrating data-driven tools to predict customer behavior and risks.

Automation is no longer just about cutting costs; it’s about doing more with less effort. Intelligent automation doesn’t just follow rules; it learns and evolves.

Technology evolves rapidly, and insurers must invest regularly to stay ahead.

The ability to adapt quickly is crucial in such a fast-paced environment. Establish a company culture that embraces change.

Building a strong relationship with technology providers is a shortcut to staying competitive.

The ultimate goal of automation is to improve the customer’s experience while streamlining operations.

The future of insurance doesn’t belong to those who fear change. It belongs to companies that evolve, innovate, and stay adaptable. Start by following these steps, and you’ll not only keep pace but lead the way in transforming the industry. The time to act is now!

Integrating Electronic Data Interchange (EDI) and Artificial Intelligence (AI) is revolutionizing insurance operations, offering significant benefits such as streamlined workflows, cost reductions, and enhanced operational accuracy. Predictive analytics enables insurers to anticipate risks and customer needs, while intelligent automation handles time-consuming tasks such as claims processing and underwriting. Together, these technologies enhance efficiency, proactively combat fraud, and redefine the customer experience with personalized and faster support.

But the race to innovate is on. Insurers who fail to act now risk falling behind competitors already leveraging cutting-edge solutions to optimize their businesses. Insurers can stay ahead in this rapidly evolving market by continually investing in advanced technologies and forming strong partnerships with technology providers.

The future of insurance lies in fully automated, intelligent workflows. These systems will not only speed up operations but also empower insurers to deliver better service, build trust, and strengthen customer loyalty. Success belongs to forward-thinking insurers willing to lead the charge. Now is the moment to take bold action and secure a competitive edge in tomorrow’s insurance landscape.