InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

Accurate marine risk modeling is the backbone of the marine insurance industry, where every decision can mean the difference between mitigating loss and facing financial setbacks. With the rise of sophisticated insurance modeling software, insurers now have the tools to transform vast amounts of data into actionable insights. This article explores the essentials of marine risk modeling, the capabilities of modern insurance software, and how their integration is revolutionizing marine risk assessment, enhancing efficiency, and driving smarter strategies within the sector.

Marine risk modeling is a systematic approach to identifying, analyzing, and predicting potential risks in the maritime domain. Its primary purpose is to provide insights that help safeguard both financial and operational stability in an inherently unpredictable industry. By examining data on weather patterns, vessel performance, and cargo operations, marine risk modeling allows stakeholders to proactively address potential threats before they materialize.

At its core, marine risk modeling acts as a decision-making tool. Whether assessing the likelihood of adverse weather disrupting trade routes or forecasting financial losses from delayed shipments, it plays a pivotal role in minimizing the impact of unforeseen challenges. This process not only protects assets but also supports the development of tailored insurance policies that reflect real-world risks.

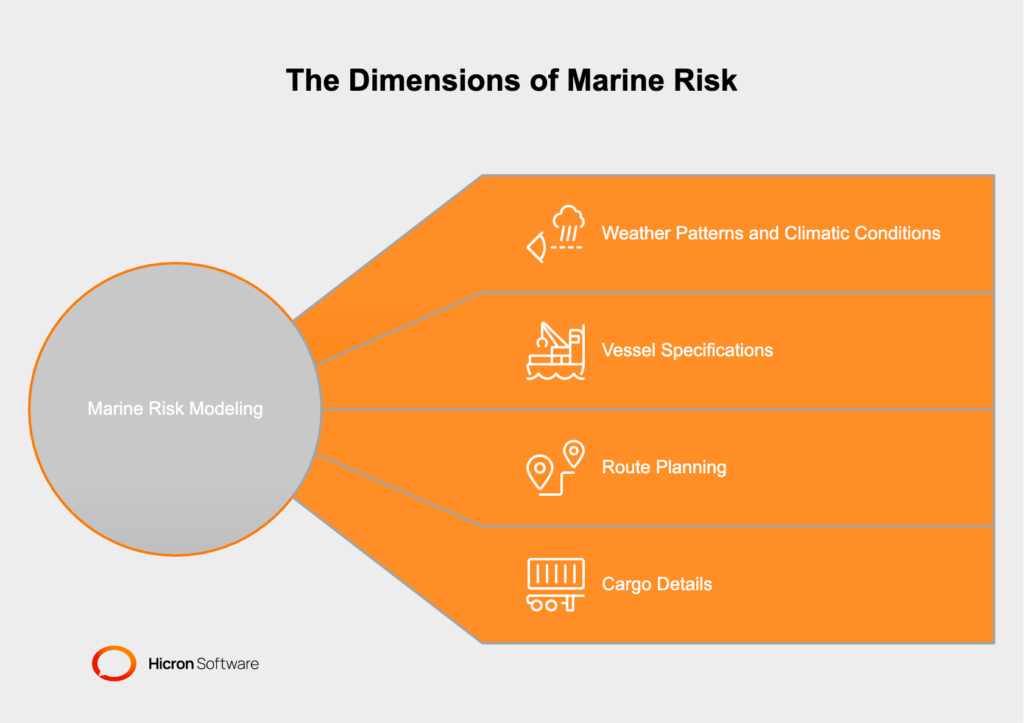

Marine risk modeling incorporates a wide range of variables to assess hazards effectively. Below are the key factors that influence this process:

Real-World Examples of Maritime Risks: Maritime risks include collisions in dense shipping lanes, vessels grounded in shallow waters, and damage caused by cargo shifts during turbulent weather. Understanding these real-life scenarios equips insurers and operators with valuable context to address similar challenges in the future.

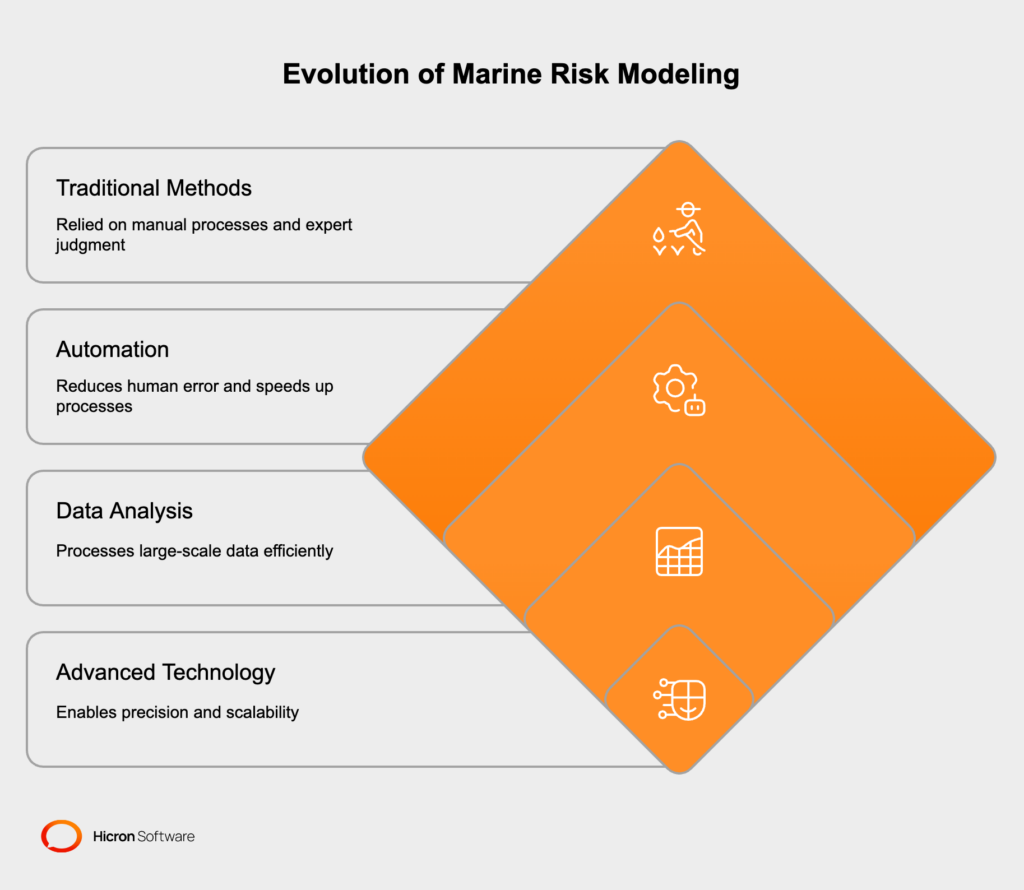

Marine risk modeling has evolved enormously with advancements in technology. Traditional methods relied heavily on manual processes, expert judgment, and qualitative assessments. While these approaches served as a starting point, they often lacked the precision, scalability, and speed required to handle complex, large-scale data. Additionally, manual calculations were prone to human error, which could undermine risk assessments.

The transition to modern, data-driven approaches has revolutionized the field. Advanced software and simulation-based models are now harnessing the power of big data and predictive analytics. These systems can process vast amounts of historical and real-time information to produce highly accurate risk evaluations. For example, algorithms can detect patterns in past weather events to better predict storm trajectories, while simulations can model the impact of potential collisions.

Today, this shift toward technology-driven processes not only improves reliability but also enables ongoing optimization. The integration of automation and analytics ensures that stakeholders can make faster, more informed decisions to mitigate risk in a rapidly changing maritime environment.

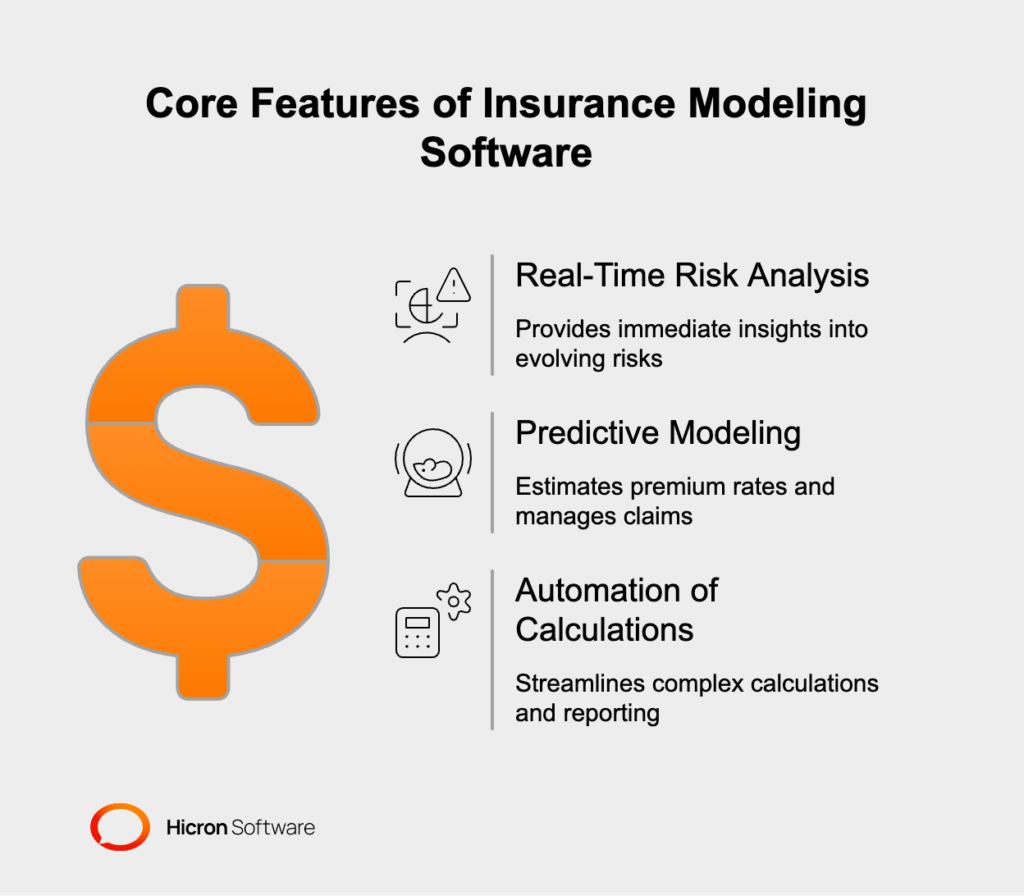

Insurance modeling software is a powerful technology solution designed to streamline and enhance various functions within the insurance industry. Specifically in the marine insurance sector, this software plays a pivotal role in managing the complexities of risk assessment, policy creation, and claims management.

The software’s scope extends beyond basic data processing. It incorporates advanced tools such as predictive analytics and machine learning to provide dynamic and actionable insights. By complementing marine risk modeling efforts, insurance modeling software ensures that insurers can accurately align their policies and pricing structures with current and anticipated risks. This results in more comprehensive risk mitigation strategies and better financial security for insurers and clients.

Insurance modeling software brings transparency, speed, and accuracy to the marine insurance landscape. By addressing some of the industry’s most intricate challenges, these tools empower insurers to deliver better outcomes for themselves and their clients, ultimately transforming how marine risks are managed across the board.

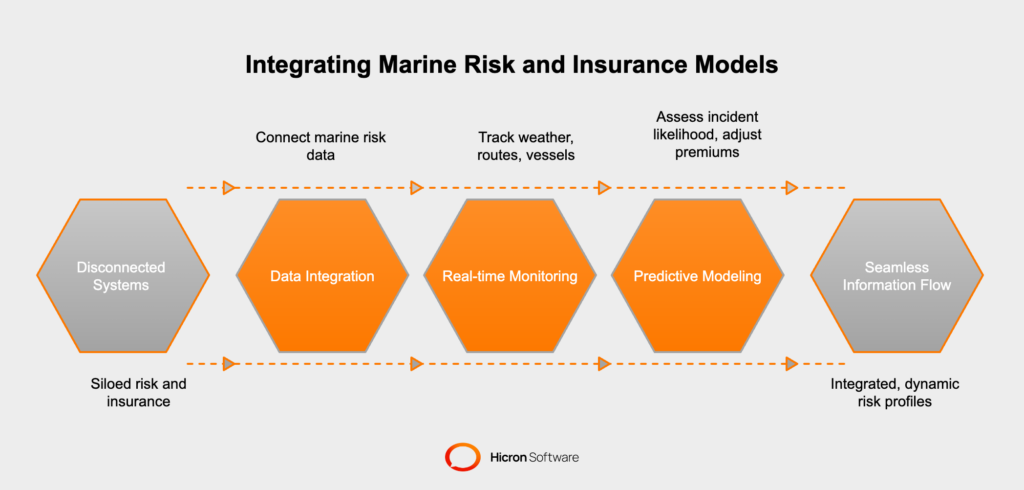

Advances in technology are bridging the gap between marine risk modeling and insurance modeling software, creating a seamless flow of information and decision-making. By integrating vast datasets from marine risk models into insurance tools, insurers now have access to highly detailed and dynamic risk profiles. This integration allows for real-time monitoring and management of factors like weather changes, route risks, and vessel conditions, ensuring that insurance policies and claims evolve with shifting circumstances.

The fusion of these technologies is powered by predictive capabilities, enabling smarter, faster decisions. For example, predictive models can assess the likelihood of specific incidents, such as shipping delays in extreme weather, and adjust premiums accordingly. This proactive approach minimizes financial exposure for both insurers and their clients while supporting smoother operations throughout the marine industry.

Despite its promising potential, adopting this integrated approach is not without challenges.

To address these challenges, companies can explore phased implementation strategies, where the integration begins with high-risk operations before expanding to other areas. Additionally, partnering with technology providers offering dedicated training programs can help employees quickly adapt to new systems.

The future lies in overcoming these hurdles and unlocking the full potential of bridging marine risk modeling with insurance modeling software. With the right investments and strategy, companies can modernize their marine insurance processes, resulting in smarter decision-making, reduced risks, and enhanced financial stability.

Integrating marine risk modeling with insurance modeling software offers unparalleled visibility into potential hazards in the maritime industry. By continuously analyzing real-time data, insurers and underwriters can identify and anticipate risks more effectively. For instance, advanced systems can provide granular insights into weather disruptions, cargo vulnerabilities, or navigational dangers.

This data-driven approach enables professionals to make well-informed decisions and craft policies that are tailored to the unique needs of their clients. Instead of relying on generic assessments or past experiences, insurers can base their evaluations on current trends and predictive analytics. This improved accuracy reduces both uncertainty and exposure to unforeseen liabilities, fostering a more reliable and responsive insurance process.

The integration of these systems also drives significant business efficiency. By automating complex calculations for policy evaluations and pricing adjustments, the risk of human error is drastically reduced. This ensures that every policy accurately reflects the hazards involved, enhancing both the insurer’s credibility and financial stability.

Streamlined workflows allow insurers to process claims and update policies with greater speed. For example, automated data-sharing between risk modeling and insurance platforms eliminates the need for redundant manual input, saving both time and resources. These enhanced processes not only improve the operational efficiency of insurance providers but also allow their clients to benefit from faster service and reduced administrative delays.

Adopting an integrated approach to marine risk and insurance modeling gives businesses a clear competitive edge. With access to advanced tools and real-time intelligence, insurers can stay ahead of market trends and better address emerging challenges. This agility is crucial in a competitive sector where insurers must balance innovation with risk management precision.

The ability to offer customized, data-backed solutions fosters stronger client relationships. Companies that consistently deliver accurate assessments and efficient services build trust within the industry. Happy clients are more likely to become loyal brand advocates, enhancing the provider’s reputation and market standing.

Combining these advanced systems ultimately transforms traditional marine insurance into a forward-thinking, client-oriented practice. By improving risk visibility, operational efficiency, and customer satisfaction, companies can strengthen their market position and thrive in an industry defined by rapid change and increasing complexity.

Building adequate insurance modeling software requires a blend of cutting-edge technologies, strategic methodologies, and a focus on user-centric design. At its core, the software should leverage advanced analytics tools to process complex risk data accurately and efficiently.

Scalability is another essential aspect, as the system must adapt to evolving market demands and seamlessly integrate with emerging technologies such as big data platforms and IoT devices.

User experience is equally important; intuitive interfaces and customizable features ensure that clients and insurers can interact with the system effortlessly. By combining these elements, businesses can create robust insurance modeling solutions that streamline operations, improve decision-making, and stay ahead in an increasingly dynamic industry.

Artificial intelligence (AI) and machine learning (ML) are set to revolutionize marine risk modeling and insurance software. These technologies enable smarter predictive analytics, processing vast amounts of data at incredible speeds to uncover patterns and predict risks with unmatched accuracy. For insurers, this means faster, more informed decision-making, whether for underwriting policies, setting premiums, or assessing claims.

AI-driven automation also enhances operational precision. Complex tasks, such as evaluating intricate risk scenarios or simulating diverse claims outcomes, can be conducted without human intervention, saving time and resources. Machine learning, in particular, ensures continuous improvement by learning from historical data and real-time inputs. These systems become more efficient and accurate over time, adapting to new challenges and trends in the maritime landscape.

By integrating AI and ML, insurance companies gain a dynamic edge, transforming traditional risk management into a proactive and data-centric practice that meets the needs of a rapidly evolving industry.

Big data is becoming a game-changer in the marine insurance sector, providing immense opportunities to enhance accuracy and efficiency. With the ability to process vast quantities of maritime data, big data solutions allow insurers to gain deeper insights into shipping routes, port usage, vessel conditions, and operator performance. This wealth of information supports precise risk evaluations and tailored policy offerings.

Another noteworthy advantage of harnessing big data is real-time monitoring. Modern systems can integrate data streams from various sources, such as satellite weather reports and vessel tracking systems, to detect potential hazards before they escalate. This enables insurers to adopt proactive risk management strategies, mitigating liabilities for both insurers and their clients.

Integrating data streams for real-time monitoring in marine risk modeling requires a combination of advanced techniques and tools. Application programming interfaces (APIs) are commonly used to connect disparate systems like satellite weather data and vessel tracking platforms, enabling data flow.

Cloud-based solutions and data warehouses can store and organize this information, ensuring accessibility and high-speed processing. Tools like real-time analytics engines analyze incoming data instantly to identify patterns or anomalies, providing actionable insights. Implementing an event-driven architecture further ensures that critical updates, such as sudden weather changes, trigger immediate notifications, enabling insurers to act quickly and manage risks proactively.

The increasing emphasis on big data adoption positions companies at the forefront of innovation. By leveraging comprehensive, granular data, insurers can not only refine their risk models but also offer transparent, cost-effective solutions, fostering trust and reliability in the competitive marine insurance market.

Through these advancements, the fusion of AI, ML, and big data is shaping a future where marine risk modeling and insurance become more integrated, responsive, and tailored to the complexities of the maritime industry.

Marine risk modeling and insurance software are vital in navigating the complexities of modern maritime operations. These tools provide the precision and efficiency needed for effective risk management, combining innovative technologies to deliver smarter, faster, and more accurate solutions. Integrating advanced software with marine risk modeling offers clear benefits, from reducing liabilities to improving decision-making and fostering resilience across the industry.

By merging marine risk modeling with cutting-edge technologies like artificial intelligence, machine learning, and big data, the future of marine insurance is set to transform. This represents a key step forward, streamlining operations and setting new standards for adaptability and foresight in the face of evolving risks.

Now is the time for marine insurance providers to seize this opportunity. By adopting these technologies, they can drive innovation, enhance efficiency, and safeguard their operations against unpredictable challenges. Take action today and set a course for a more resilient and forward-thinking approach to marine risk management. Get in touch!

Marine risk modeling is the process of identifying, analyzing, and predicting potential risks in maritime operations to ensure financial and operational stability.

Insurance modeling software uses advanced analytics, real-time data, and automation to streamline risk assessments, premium calculations, and claims management.

Key factors include weather patterns, vessel specifications, shipping routes, and cargo details, all of which influence risk assessments and insurance policies.

Predictive analytics processes historical and real-time data to forecast risks, enabling insurers to adjust premiums and policies proactively.

Integration improves risk visibility, enhances decision-making, automates complex calculations, and ensures tailored insurance solutions.

Big data enables insurers to analyze vast amounts of maritime information, such as shipping routes and vessel performance, for more accurate risk evaluations and policy customization.

Common challenges include high implementation costs, training requirements, and integrating new tools with legacy systems.

AI improves accuracy by analyzing complex data patterns, automating risk assessments, and continuously learning from historical and real-time inputs.

Real-time data allows insurers to monitor evolving risks, such as weather changes or geopolitical events, and adjust policies or premiums accordingly.

Automation reduces manual errors, accelerates claims processing, and ensures efficient premium calculations, improving overall operational efficiency.

Risk modeling allows insurers to balance profitability with fairness by enabling precise premium pricing. It improves decision-making, enhances compliance with regulations, and prepares insurers for unforeseen risks.

Essential features include predictive analytics, data visualization, scenario testing, compliance tools, and integration with existing systems like claims and policy management software.

Marine insurance software integrates risk modeling tools to analyze factors specific to marine operations, like route risks, vessel conditions, and cargo types. It provides real-time insights to streamline underwriting and claims processes.