InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

Insurance is no stranger to change. Over the past few years, technology has shifted gears in the industry, bringing smarter solutions to age-old problems. From automating claims to offering more personalized policies, digital innovation has transformed how insurers work. And right at the heart of this shift is something you’ve probably heard about but may not fully understand yet: Electronic Data Interchange (EDI).

Think of EDI as a universal translator for the countless systems and data streams insurers deal with daily. It slashes through the chaos of manual processes, making everything—from claims processing to policy updates—faster, far more straightforward, and accurate. EDI is a definite game-changer for an industry juggling massive amounts of data.

This piece dives into why EDI matters so much right now. We’ll break down its benefits, dig into the standards that make it work seamlessly across systems, and share real-world examples of how it’s making a big difference in modern insurance workflows. Whether you’re curious about how EDI works or looking for ways to modernize your insurance operations, you’re in the right place.

Check our case study about insurance app modernization.

Imagine having a way to translate, share, and process information between systems without the headaches of endless paperwork or manual data entry. That’s exactly what Electronic Data Interchange (EDI) does. At its core, EDI is like a digital handshake between organizations, allowing them to exchange structured data in a format both sides can understand automatically. Whether it’s policyholder updates, claims submissions, or billing details, EDI eliminates the need for phone calls, emails, or spreadsheets, making everything faster and less error-prone.

Now, why does this matter so much in insurance? Because insurance thrives on data. Every policy written, claim filed, or customer inquiry comes with a flood of information that needs to be processed, shared, and stored accurately. Without a system like EDI, this could get messy very quickly. The industry handles some of the most sensitive, detail-driven datasets, and the margin for error is razor-thin. A typo in a claim or a missing policy application field could cost money and trust.

Transform your legacy insurance application!

Here’s where EDI shines. Automating data exchange speeds things up and cuts out human errors, ensuring that processes run smoothly. For example, health insurers often use EDI 834 transactions to transfer employee benefit enrollment data. A misstep in these files could cause significant service disruptions, but with EDI’s standardized approach, these risks are dramatically reduced.

Beyond efficiency and accuracy, EDI is important in compliance. The insurance industry is wrapped in layers of regulations, whether protecting customer data, ensuring proper reporting, or meeting healthcare and financial standards. EDI isn’t just a helper; it’s a safeguard, ensuring information flows align with these strict requirements.

Ultimately, EDI doesn’t just improve insurance workflows; it makes them possible in today’s fast-moving, tech-driven world. It’s the behind-the-scenes workhorse powering smoother operations while giving insurance companies the tools to deliver better, faster customer service.

When it comes to managing the massive exchange of data in insurance, standardization isn’t just helpful—it’s essential. Electronic Data Interchange (EDI) uses specific formats to ensure that information shared between systems and organizations is universally understood, regardless of platform. These standards are the backbone of efficient communication in the insurance industry.

One of the most widely used EDI standards is EDI 834 (Benefit Enrollment and Maintenance). It is a roadmap for transmitting crucial enrollment details like employee benefits, coverage changes, or termination data. For instance, when an employer updates their group health insurance plan, the EDI 834 format ensures that all the information about new enrollments or changes in employee data gets to the insurance provider without missing a beat. This isn’t just about speed; EDI 834 ensures every detail is accurate, reducing risks of miscommunication or errors that could disrupt coverage.

EDI standards like EDI 834 do more than streamline data exchange. They also ensure compatibility across diverse systems. Whether dealing with a legacy system at one end or a cutting-edge insurance software platform at the other, these standardized formats act as a common language. This ensures that insurers, brokers, employers, and other stakeholders stay perfectly aligned.

Another significant benefit of EDI standards is their role in regulatory compliance. The insurance industry has to juggle compliance with various rules, from HIPAA in healthcare to state-specific financial regulations. By adhering to defined EDI standards, insurance companies can reliably meet reporting requirements, safeguard sensitive customer information, and avoid penalties. For example, EDI protocols often include built-in validations that flag incomplete or non-compliant transactions before they’re processed, saving stakeholders from potential headaches.

From simplifying enrollment and policy updates to maintaining secure and compliant operations, EDI standards like 834 are critical players in modern insurance workflows. They create a foundation of reliability and consistency, allowing insurers to focus on what truly matters: delivering timely, precise service to their customers.

Data exchange has always been at the heart of the insurance business. Whether sharing policy details, updating claims, or transmitting client information, insurers, brokers, and agents constantly exchange massive amounts of data. Historically, many of these exchanges relied on manual input, spreadsheets, or email attachments to get the job done. While these methods worked for a time, they came with their fair share of headaches. Think typos, misplaced files, extended wait times, and security lapses—not exactly a recipe for efficiency.

Enter Electronic Data Interchange (EDI). EDI automates data exchanges by using standardized formats to connect systems directly. Instead of manually typing out policyholder information or relying on emails to share claims updates, EDI seamlessly transmits structured data from one system to another. This eliminates many of the pitfalls of traditional methods and ensures that the right information reaches the right people at the right time.

The benefits of this streamlined approach are hard to ignore. First and foremost, reduced errors stand out as one of the key advantages. Since EDI eliminates manual entry, there’s less risk of typos, missing fields, or misinterpretations that could lead to costly mistakes. For example, a broker submitting client details through EDI can trust that the information will remain accurate and intact as it travels to the insurer.

Another advantage is secure communication. The insurance industry handles sensitive data like personal information, medical records, and financial details. Unlike email, which can be vulnerable to breaches, EDI uses secure channels to protect data as it’s being shared, reducing the risk of cyberattacks or compliance violations.

Finally, there’s the undeniable speed. Faster transactions mean quicker turnaround times on policy approvals, claims processing, and benefit updates. Imagine a customer needing updated policy details. With EDI, the information can be shared and processed in minutes instead of days, improving customer satisfaction and boosting operational efficiency.

EDI transforms how insurers, brokers, and agents collaborate by automating and optimizing data exchanges. It replaces outdated, error-prone methods with a faster, safer, and more reliable system, keeping the insurance industry running smoothly in a fast-paced digital world.

Electronic Data Interchange (EDI) has emerged as a game changer for streamlining operations in the insurance industry. It eliminates the chaos of manual workflows, reduces costs, and accelerates processes. But how does this technology make a tangible difference in practice? Below, we explore multiple case studies, scenarios, and quantifiable gains demonstrating EDI’s transformative impact on enrollment, claims processing, and compliance management.

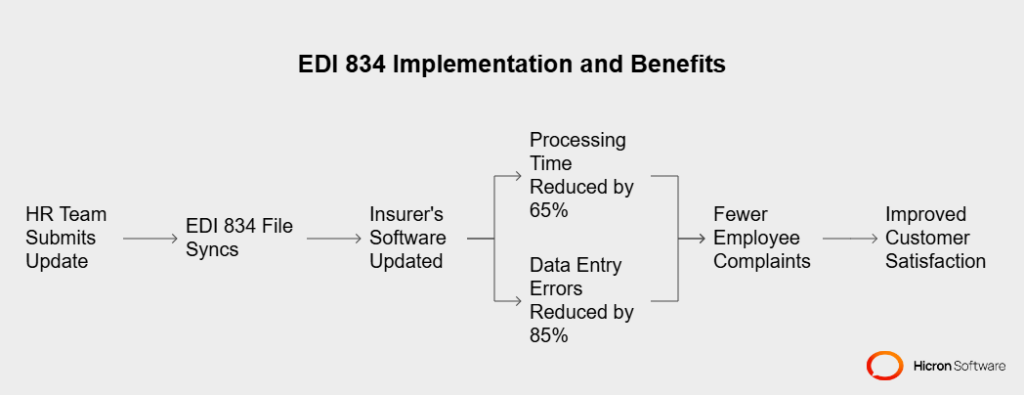

Consider a major health insurance provider known for managing benefits for thousands of employees through employer-sponsored plans. Before adopting EDI, benefit enrollment updates were plagued with inefficiencies. Employer HR teams had to fill out spreadsheets, which were sent back and forth between brokers and insurers. Manual processing often caused delays, with new hires waiting weeks before their coverage became active or errors jeopardizing coverage altogether.

With EDI 834 (Benefit Enrollment and Maintenance), the insurer automated data exchange between employers, brokers, and their internal systems. Now, when an HR team submits an update, like adding a dependent, the EDI 834 file directly syncs with the insurer’s software. This automation cut processing time by 65% and reduced data entry errors by nearly 85%. Employers reported fewer employee complaints, and the insurer saw a sharp improvement in customer satisfaction scores.

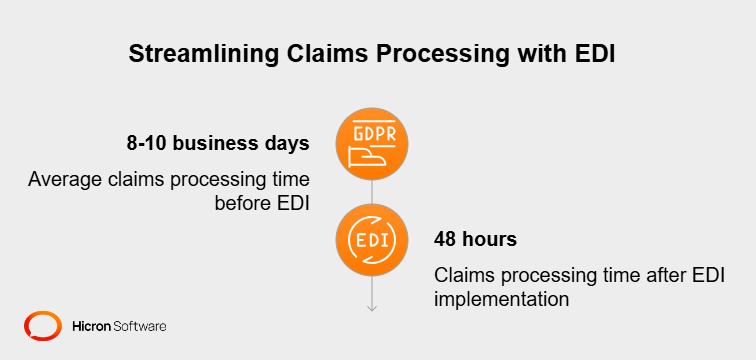

A mid-sized property and casualty (P&C) insurance company faced significant bottlenecks in its claims processes. Claims intake relied heavily on physical documents and email submissions, requiring multiple handoffs between adjusters and underwriters. On average, processing even straightforward claims took 8-10 business days, frequently frustrating policyholders.

To address this, the company integrated EDI for claims submissions and adjudication. Healthcare providers and policyholders now submit claims electronically using EDI standards, which route structured data directly into the insurer’s claims management software. This eliminated duplicate data entry while triggering automated verification processes.

The results? The insurer reduced claims processing time from 10 days to 48 hours, boosted claims accuracy by 70%, and significantly decreased operational labor costs. Policyholders, in turn, praised the quick turnarounds, reporting improved loyalty to the company.

Imagine a global insurance firm juggling compliance with HIPAA regulations, state-specific mandates, and internal policy audits. Initially, compliance reporting was labor-intensive. Teams manually compiled transaction data for reports, leading to inconsistencies and late submissions that could incur regulatory penalties.

The insurer transformed its reporting operations by deploying EDI with automated compliance checks. Transaction data now automatically adheres to the required regulatory formats during processing. For instance, when preparing state-mandated premium filings, the EDI system flags non-compliant entries for correction before submission. Compliance tasks that had taken weeks to complete were reduced to mere hours, and the firm avoided hefty fines that once plagued its operations. Additionally, annual savings were estimated at $750,000, combining reduced penalties and freed-up staff resources.

Consider an insurer specializing in personal lines, such as home and auto policies. Previously, mid-term policy adjustments often involved customers submitting requests via email, followed by lengthy back-and-forth communication with agents and underwriters. For customers, this meant waiting days to get a simple policy change approved.

Post-EDI adoption, the insurer introduced an automated data exchange process. Customers use an online portal to submit their change requests, which transmit instantly via an EDI standard, like EDI 820 (Premium Payments) or EDI 210 (Policy Changes). The system reviews and validates the request for accuracy before routing it directly to the insurer’s policy management platform. This process shaved down approval times from several days to just an hour or two, earning the insurer high marks in efficiency and customer satisfaction.

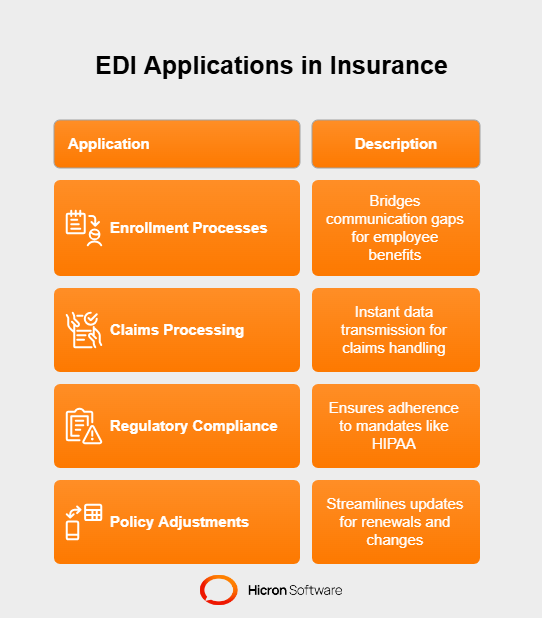

#1 Enrollment processes: EDI bridges the communication gaps between HR departments, brokers, and insurance providers, ensuring the timely and error-free processing of employee benefits. Updates to benefit plans, such as new hires or dependent additions, are handled without paper trails, reducing delays.

#2 Claims processing: With EDI, claims handling is no longer slow and manual. Claims data is instantly transmitted and verified in standardized formats, minimizing delays, reducing inaccuracies, and enabling faster payouts.

#3 Regulatory compliance: EDI ensures insurance providers efficiently meet regulatory mandates like HIPAA. Built-in validation processes catch compliance issues early, saving companies significant time and money while maintaining secure, auditable records.

#4 Policy adjustments: Insurance companies can use EDI to streamline policy updates like renewals, coverage changes, and cancellations. Standardized formats ensure that data flows seamlessly across systems without increasing administrative burdens.

Implementing EDI doesn’t just simplify operations; it delivers measurable results that directly impact insurers’ bottom lines and customer experiences. Examples of these impacts include:

By integrating EDI, insurers don’t just improve operational efficiency; they future-proof their businesses. These technologies create smoother workflows, boost customer satisfaction, and enable organizations to remain compliant and competitive. Whether it’s through faster claims processing or bulletproof compliance strategies, EDI showcases its potential as an indispensable tool in the modern insurance landscape. For insurers, brokers, and policyholders alike, the value of EDI is clear and measurable.

Electronic Data Interchange (EDI) has been a game changer for efficiency in the insurance sector, but its story is far from over. As digital transformation accelerates, EDI is evolving, integrating with next-generation technologies like artificial intelligence (AI), machine learning (ML), and blockchain. These advancements promise to take EDI to a new level, enabling insurers to innovate, scale, and stay competitive.

AI and machine learning are reshaping industries, and insurance is no exception. When merged with EDI, these technologies can turn data processing into a more intelligent and proactive system. For example, AI-powered EDI could automatically identify anomalies or trends in claims, benefit enrollments, or policy updates. This enables insurers to flag real-time discrepancies, reducing the chances of fraud or errors before they escalate into more significant problems.

Machine learning can optimize EDI workflows by predicting customer needs based on past behaviors. Imagine an insurer equipped with an ML-enhanced EDI system that analyzes historical data and identifies patterns—for instance, when clients are likely to change their coverage based on industry trends or personal history. The result? Insurers can proactively engage with clients and offer tailored solutions, creating stronger customer relationships.

One of insurers’ biggest challenges is ensuring secure and tamper-proof data exchanges. This is where blockchain steps in. When paired with EDI, blockchain can add an immutable layer of security by recording every transaction in a distributed ledger. This is particularly valuable for compliance-heavy processes, such as claims adjudication or premium payments.

For example, an insurer using blockchain-integrated EDI could instantly verify a policyholder’s claim with the help of a transparent, time-stamped data exchange. The blockchain ensures that all parties (insurers, brokers, and agents) see and interact with the same unalterable information, eliminating disputes while maintaining a detailed audit trail.

The insurance industry constantly adapts to changing needs, from on-demand coverage to usage-based policies. EDI is poised to play a key role in supporting new business models by seamlessly connecting the diverse players involved. Consider the rise of microinsurance, where policies are designed to cover short-term, specific events, like travel delays or a day of ride-sharing.

EDI can facilitate real-time data exchange between insurers, underwriters, and service providers. For instance, EDI-powered systems might process a short-term policy for a gig economy worker in minutes, ensuring immediate coverage and claims settlement aligned with the user’s actual risk exposure. Insurers that leverage EDI in this way can tap into these emerging markets, scale their operations, and diversify their offerings.

Insurers must prioritize integration to harness the full potential of future EDI solutions. Updating legacy systems to work in tandem with modern EDI capabilities is crucial. It’s not just about adding new technology but also about ensuring compatibility and scalability. Insurers who adopt an agile approach to integrating EDI with AI, machine learning, blockchain, and cloud systems will be better positioned to adapt to market changes.

Additionally, adopting EDI alongside IoT (Internet of Things) devices opens new doors. EDI can process this information instantaneously with IoT sensors capturing real-time data, particularly in sectors like property insurance or auto coverage. This paves the way for innovative offerings, like usage-based policies or hyper-personalized premium structures.

Electronic Data Interchange (EDI) has proven to be a game changer for insurance companies seeking to thrive in today’s dynamic market. Its benefits are clear and far-reaching. By automating and streamlining processes, EDI unlocks unparalleled scalability, ensuring your operations can grow without friction, no matter the volume or complexity of transactions. Its built-in security safeguards sensitive communications, keeping your business compliant and your clients’ trust intact. In addition, there is a significant boost in efficiency, which reduces manual errors and slashes operational costs, and it becomes undeniable that EDI is a must-have for competitive insurance businesses.

The time to act is now. The market is transforming rapidly, with industry leaders leveraging EDI alongside cutting-edge technologies like AI and blockchain to deliver faster, more personalized service offerings. Businesses that cling to outdated, manual processes will struggle to keep pace, risking inefficiencies and losing out to competitors better equipped to meet modern demands. Adopting EDI isn’t just about keeping up; it’s about securing your place at the forefront of the insurance industry, creating a foundation for long-term growth and success.

EDI is not just a tool; it’s a strategic advantage. It’s the key to unlocking agility, precision, and innovation in a time when insurance companies must adapt to rapidly shifting customer expectations and market pressures. From simplifying enrollment and expediting claims processing to enabling secure compliance and scaling new business models, EDI empowers insurers to run smarter, faster, and more effectively.

If you’re ready to transform your operations and strengthen your competitive edge, now is the perfect time to explore the possibilities of EDI. Don’t wait until inefficiencies hold your business back or competitors race ahead. Start the transition today and embrace EDI as the future of modern insurance operations.

Take the first step toward elevated efficiency and innovation. Consult EDI experts to integrate this powerful system into your operations and position your business for lasting success. Your future in the insurance industry begins with EDI.