InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

Custom insurance frontend development is a tailored approach to creating digital interfaces that meet the unique demands of insurance providers and their clients. Unlike generic platforms, a custom insurance frontend is designed specifically to deliver tailored insurance solutions that align with an organization’s business goals, workflows, and customer preferences.

A custom insurance frontend is more than just a digital interface. It acts as the face of an insurer’s operations, facilitating everything from efficient claims management to policy administration. Its purpose is to provide a user-centric insurance design, ensuring that every interaction prioritizes ease, utility, and satisfaction. By addressing specific business needs, such as integrating backend systems or streamlining the customer experience, custom solutions enable insurers to differentiate themselves in a highly competitive market.

Customers today demand speed, accessibility, and intuitive navigation all of which are hard to achieve with one-size-fits-all solutions. A well-implemented custom insurance frontend ensures your insurance platform is agile, responsive, and ready to adapt.

This article explores how a custom insurance frontend solution can tackle industry-specific challenges while giving the business a competitive edge. From enhancing user experience to improving operational efficiency, discover why investing in custom insurance frontend development is a strategic move for forward-thinking insurers.

Key takeaways:

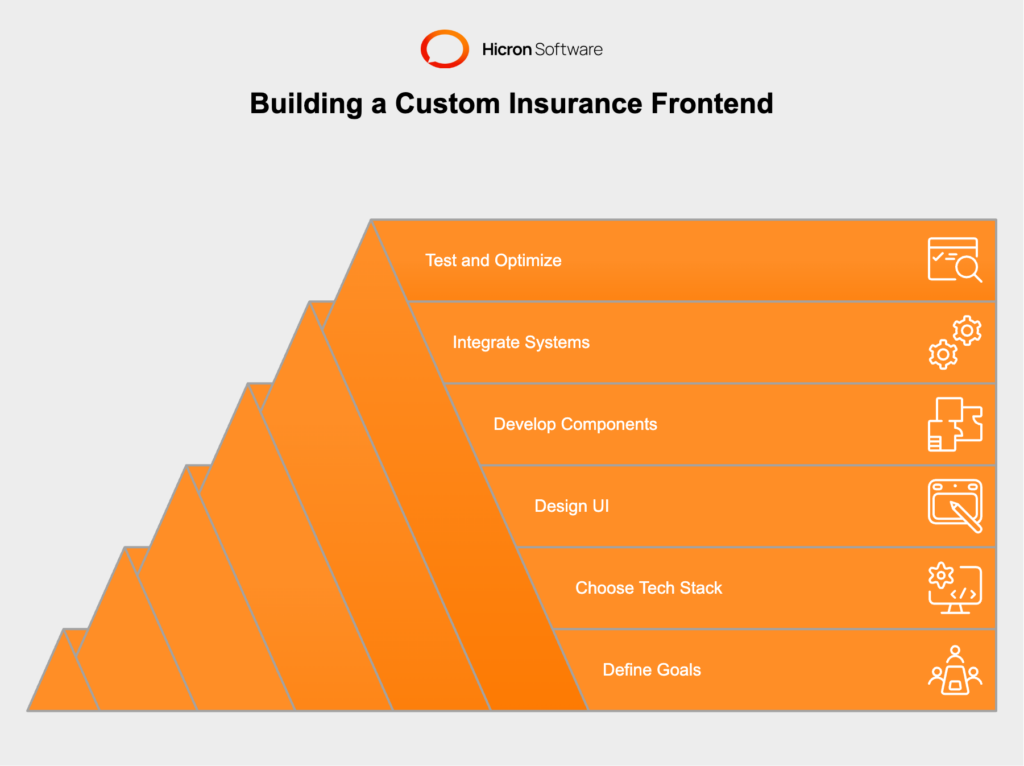

Building a custom insurance frontend is a transformational venture for insurers aiming to meet specific business needs, enhance user engagement, and maintain a competitive edge. This comprehensive guide breaks down the process into six actionable steps to help decision-makers design and implement a robust, scalable, and efficient custom insurance digital interface.

Every great project begins with a clear understanding of its goals and target audience. For custom insurance frontends, this involves outlining both business priorities and user expectations.

Identify Primary Objectives

Understand User Expectations

Why This Step Matters

By aligning the frontend with both user-centric insurance design and specific organizational goals, this step ensures the platform addresses genuine customer needs while meeting operational requirements.

The choice of technology underpins the functionality, performance, and future adaptability of your platform.

Select Frameworks for Scalability

Focus on Backend Compatibility

Future-Proof Your Platform

Why This Step Matters

A well-chosen insurance technology stack improves performance, simplifies integration, and ensures the frontend remains flexible to accommodate future growth.

The custom insurance user interface (UI) should be designed with simplicity, clarity, and usability in mind to deliver exceptional experiences.

Design Principles

Start with wireframes that outline the foundational layout and workflow. Move to full prototypes to test initial designs and gather feedback.

Ensure the design works across devices with a focus on lightweight, responsive insurance design that minimizes load times. Use clear navigation bars, actionable buttons, and easy menu structures.

User-Friendly Form Implementation

Why This Step Matters

A compelling UI ensures customer satisfaction, minimizes friction during interactions, and enhances engagement metrics by making platforms easy to use.

Modular development allows components to serve multiple purposes across the platform, improving flexibility and scalability.

Component-Based Architecture

Responsive Optimization

Why This Step Matters

Modular design offers frontend scalability and flexibility, reducing long-term maintenance costs and development efforts while enabling faster deployment of new features.

A connection between the frontend and backend systems is critical for operational efficiency and user satisfaction.

API Integration for Data Flow

Enable Real-Time Synchronization

For example:

Why This Step Matters

Strong frontend-backend integration promotes insurance workflow automation, leading to faster turnaround times and improved customer experiences.

An iterative approach to testing and optimization ensures your platform stays competitive and user-friendly over time.

Rigorous Testing

Data-Driven Optimization

Iterative Improvements

For instance:

Why This Step Matters

Optimization processes ensure the platform performs reliably while enhancing its competitive edge in a demanding market.

Developing a custom insurance frontend isn’t just about crafting a user interface; it’s about creating a platform that transforms how insurers operate and interact with clients. Following these six structured steps ensures your platform meets evolving customer demands, harmonizes with backend systems, and stands as a benchmark for innovation and operational excellence.

|

Step |

Description |

Key Actions |

Why It Matters |

| 1. Define Business Goals and User Needs |

Establish the objectives and user requirements for your custom insurance frontend. |

Identify key functions (claims processing, policy management), conduct user research, create personas. |

Aligns the insurance frontend with both business priorities and specific user pain points for better adoption. |

|

2. Choose the Right Technology Stack |

Select frameworks and tools to ensure performance, integration, and scalability. |

Pick frameworks (React, Angular, Vue.js), ensure backend compatibility, incorporate scalable APIs. |

Provides a solid technical foundation for a reliable, adaptable insurance platform. |

|

3. Design the User Interface (UI) |

Develop an intuitive, visually appealing, and responsive interface for better UX. |

Create wireframes, prototypes, responsive layouts, and user-friendly forms; focus on navigation clarity. |

Makes insurance processes simpler and more engaging for users. |

|

4. Develop Modular Components |

Build reusable and responsive frontend modules for agility and future enhancements. |

Create policy cards, claim status widgets, custom dashboards; test responsiveness across all devices. |

Enables efficient updates, greater flexibility, and supports future growth needs. |

|

Ensure connections with core data systems and third-party tools using APIs. |

Implement robust API connections, real-time data sync, and workflow automation for insurance processes. |

Guarantees data continuity, streamlines operations, and improves user satisfaction. |

|

|

6. Test and Optimize |

Continuously assess, analyze, and refine the platform for best results. |

Conduct usability and automated tests, monitor analytics, and iterate based on real user feedback. |

Sustains high performance and user satisfaction while keeping a competitive advantage. |

When tailored to specific business goals with a focus on user-centric insurance design, scalability, and integration, this investment yields long-term rewards, from customer retention to streamlined workflows. Start building today to set your business apart in a competitive insurance landscape.

A custom insurance frontend tailored to meet specific business goals addresses the challenges and opens doors to important benefits. From personalized user experiences to operational efficiency and competitive differentiation, the advantages of investing in a custom insurance frontend are unquestionable.

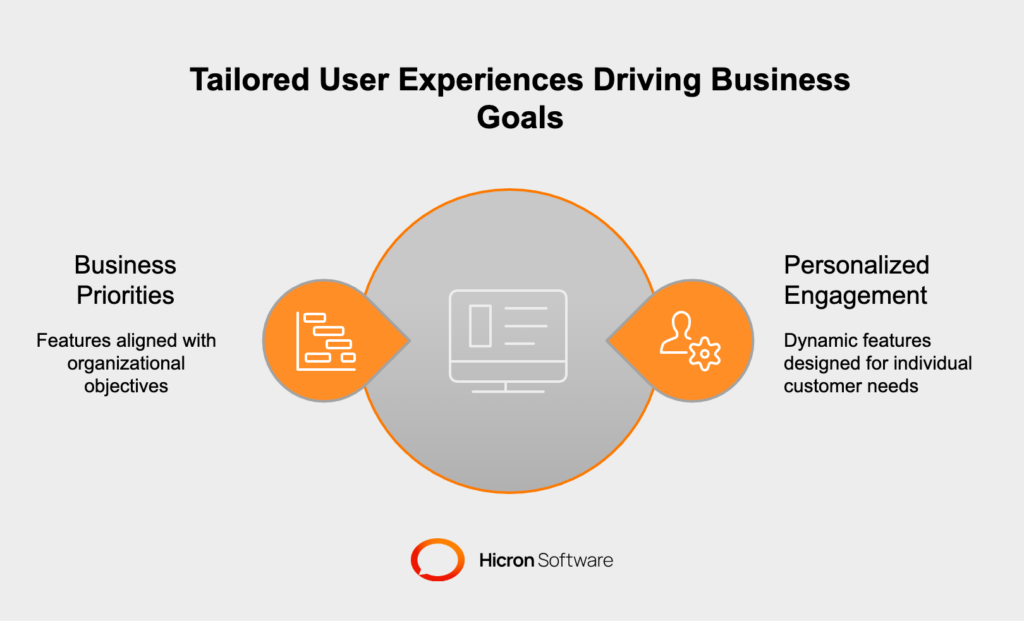

One of the most compelling benefits of a custom insurance frontend is its ability to deliver tailored insurance solutions. Unlike off-the-shelf platforms, a custom frontend is carefully designed to reflect an insurer’s unique value proposition and serve their distinctive audience.

Personalized Engagement

Insurers can integrate dynamic features specifically developed for their customers. For example:

Alignment with Business Priorities

With custom development, the insurance platform can prioritize features in line with business objectives. For instance:

By making the user experience the core focus, custom insurance frontends transform digital platforms into tools that meet customer expectations while driving organizational goals.

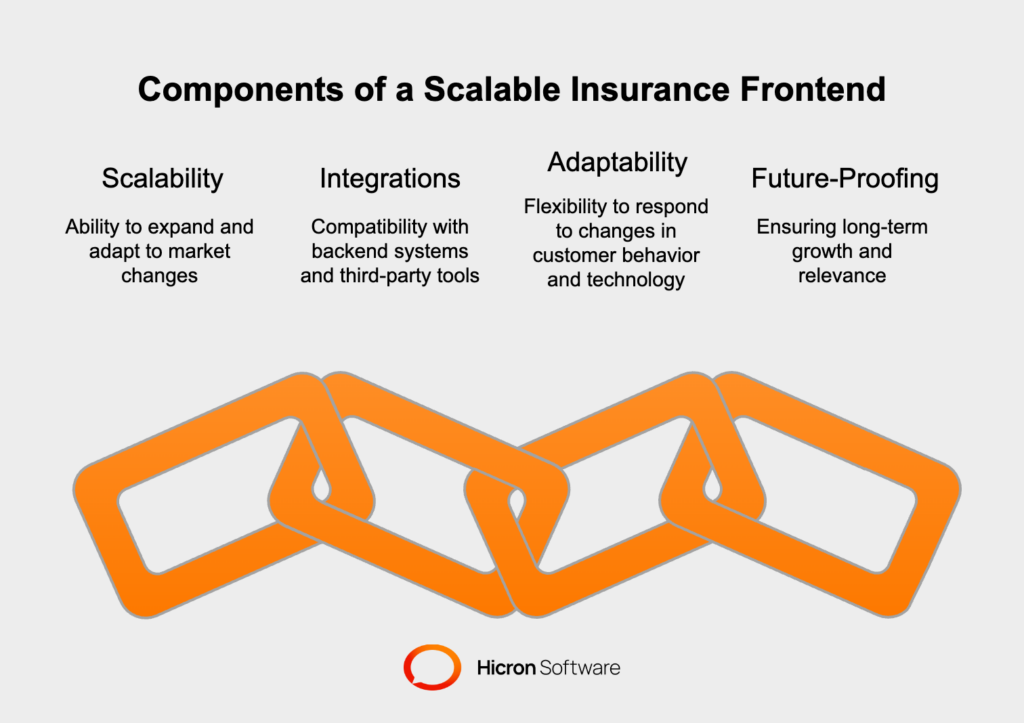

Staying agile is crucial for insurance providers in a competitive landscape. Custom insurance frontends lay the groundwork for enhanced operational efficiency and long-term growth by being scalable and adaptable.

Future-Proofing for Expansion

A custom-built frontend can easily scale as market needs evolve. Whether it’s the addition of new functionalities like AI-driven claims analysis or the integration of emerging payment methods, insurers can adapt their platform at a fraction of the cost and time required by one-size-fits-all solutions.

Integrations

Custom insurance frontends can integrate with backend systems and third-party tools. Advanced API integration for insurance allows for compatibility with:

Adaptability ensures insurers are always prepared to respond to changes in customer behavior, technological advances, and regulatory requirements.

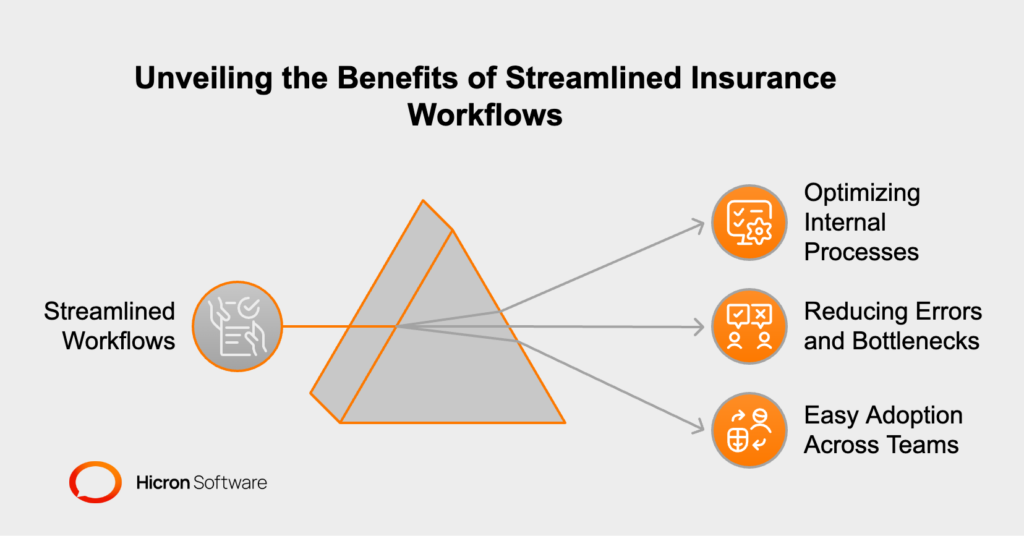

One of the most noteworthy impacts of a custom insurance frontend is its ability to simplify workflows, resulting in enhanced operational efficiency.

Optimizing Internal Processes

Custom platforms can be designed to cater specifically to the workflows of an insurance organization. This might include:

Reducing Errors and Bottlenecks

Workflow-specific tools eliminate redundancy and minimize errors. Tailored solutions ensure consistent communication between systems, enhancing accuracy and efficiency in claims processing, policy updates, and more.

Easy Adoption Across Teams

By designing interfaces that align with how teams operate, it becomes easier for employees to adopt and utilize the system. Training time is reduced, and productivity rises as workers engage with tools built to serve their direct needs.

Streamlining these internal operations results in cost savings and produces better customer experiences by reducing response times and ensuring high-quality interactions.

With increasing competition across the insurance industry, differentiation is key. A custom insurance frontend provides the tools needed to stand out in a crowded marketplace.

Unique Digital Experiences

Custom frontends allow insurers to present a unique interface that sets them apart from competitors. For example:

Faster Response to Market Demands

Insurers with custom platforms are more agile in responding to market trends. Adding or modifying features can be done on shorter development cycles, enabling rapid adjustments aligned with consumer expectations.

Enhanced Customer Loyalty

By prioritizing convenience and personalization, a custom frontend contributes to higher customer retention rates. Engaged, satisfied clients are less likely to shop around for competing providers, offering a clear competitive advantage in insurance.

From delivering tailored insurance solutions aligned with business objectives to fostering operations and achieving a competitive advantage in insurance, the benefits of customization are extensive.

For decision-makers in the insurance sector, a custom frontend represents an opportunity to build a platform that’s ready for future demands and resonates with insurance industry users.

Building a custom insurance frontend offers immense opportunities. Yet, it can be a complex and resource-intensive process. Whether it’s

these challenges require strategic planning and careful execution.

Below is a breakdown of the common challenges and actionable solutions that can guide insurance decision-makers through the process.

|

Challenge |

Description |

Solutions |

|

Balancing Customization and Complexity |

Customization can lead to overly complex solutions that are hard to manage, slow to deploy, and prone to errors. Striking the right balance between extensibility and simplicity is a challenge. |

1. Focus on Core Features First: Prioritize essential functionalities aligned with business goals and user needs. Organize features into “must-haves” and “nice-to-haves” for manageable initial builds. 2. Use Modular Development: Leverage modular design to build reusable components, starting with core modules like claims submission or payment processing. 3. Streamline the User Journey: Simplify workflows and navigation to ensure an intuitive frontend, avoiding non-essential elements. |

|

Integration with Existing Systems |

Custom insurance frontends must connect with backend systems like claims processing, policy management, and CRM platforms. Poor planning can lead to data silos, inconsistent performance, and operational downtime. |

1. Plan API Integration Strategies Early: Develop a comprehensive API plan for uninterrupted data flow, ensuring compatibility with legacy systems. 2. Conduct Technical Audits: Evaluate existing system architecture to identify pain points and address limitations upfront. 3. Use Middleware: Use middleware to standardize communication formats, manage API calls, and resolve compatibility issues, ensuring higher system reliability. |

|

Managing Costs and Timelines |

Custom insurance frontends require investments of time and money. Mismanagement of scope, inefficiencies, or unforeseen complexities can lead to budget overruns and missed deadlines, jeopardizing stakeholder confidence. |

1. Define a Clear Project Scope: Create a detailed roadmap with milestones, deliverables, and deadlines. Start small and grow incrementally. 2. Adopt Agile Methodologies: Use agile practices to break the project into sprints, allowing for periodic feedback and early identification of bottlenecks. 3. Invest in Project Management Tools: Use tools like JIRA or Trello to track progress, allocate resources, and monitor budgets. 4. Balance Quality with Cost Efficiency: Partner with experienced vendors and use cost-effective practices like open-source frameworks for non-core functionalities. |

Building a custom insurance frontend is not just a technical endeavor; it’s a long-term investment that demands strategic planning and foresight. With the rapid pace of technology and shifting customer expectations, ensuring your frontend remains relevant and agile is crucial.

Future-proofing your frontend equips your organization to adapt to industry advancements, maintain compliance, and secure a competitive edge. Here’s how decision-makers in the insurance industry can create robust, adaptable platforms that stand the test of time.

|

Aspect |

Description |

Key Points |

|

Designing for Modularity and Flexibility |

Modularity enables insurers to update and expand features without overhauling the entire system. A modular design ensures scalability and adaptability, allowing the platform to grow alongside business needs. |

|

|

Keeping Up with Evolving User Expectations |

User expectations evolve, with policyholders, agents, and brokers demanding intuitive, sleek interfaces that offer real-time insights and easy navigation. Failing to meet these expectations can harm customer satisfaction, retention, and overall competitiveness. |

|

|

Ensuring Compliance with Evolving Regulations |

The insurance industry is heavily regulated to protect customers and ensure fair practices. Failure to comply can lead to fines, legal issues, and reputational damage. Future-proofing must include mechanisms to adapt your frontend to meet new compliance requirements as they arise. |

|

|

Securing the Frontend and APIs |

Cybersecurity threats are evolving, posing risks to both frontend interfaces and the API connections that link with backend systems. A breach can disrupt operations, compromise sensitive customer data, and damage the insurer’s reputation. |

|

Future-proofing a custom insurance frontend isn’t a one-time initiative; it’s a continuous commitment to adaptability, compliance, and innovation. By prioritizing the security of the frontend and APIs, insurers protect sensitive customer data and demonstrate their commitment to safeguarding user trust in an increasingly digital environment.

Investing in future-proof strategies sets the foundation for growth and positions insurers to lead the way in the era of insurance digital transformation. A modern, adaptive frontend isn’t just advantageous; it’s essential for long-term success.

A custom insurance frontend is more than just a digital interface; it’s a strategic investment that reshapes how insurers operate and interact with their customers. By delivering tailored insurance solutions, these platforms address unique business goals while enhancing user satisfaction and loyalty. They enable insurers to meet evolving customer expectations by offering streamlined functionalities, intuitive user experiences, and adaptable features that support personalization, operational efficiency, and scalability.

Developing a custom frontend allows insurers to future-proof their operations, equipping them to thrive in a landscape marked by rapid technological advancements and growing customer demands. These platforms drive business growth by providing the flexibility to adapt to emerging trends, like real-time data synchronization and API-driven ecosystems, while ensuring compliance with regulatory standards and industry best practices.

For decision-makers in the insurance industry, investing in insurance frontend modernization is a forward-looking move that delivers immediate results and maintains a competitive edge in the long run. Get in touch to start today!

A custom insurance frontend is a tailored digital interface designed to meet the specific needs of insurers and their customers, providing personalized features and seamless functionality.

Unlike generic platforms, a custom insurance frontend is specifically built to align with an insurer’s unique business goals, workflows, and customer preferences, offering greater flexibility and integration capabilities.

Benefits include tailored user experiences, enhanced operational efficiency, scalability for future growth, compliance with evolving regulations, and a competitive edge in the insurance market.

Modular design allows insurers to build reusable components, such as policy cards or claim status widgets, which can be easily updated or expanded without overhauling the entire system.

By offering intuitive navigation, personalized dashboards, real-time updates, and streamlined workflows, a custom frontend ensures a user-centric experience that meets evolving customer expectations.

The process includes defining business goals and user needs, selecting the right technology stack, designing an intuitive user interface, developing modular components, integrating with backend systems, and continuous testing and optimization.

Regular compliance audits, built-in flexibility for regulatory changes, and secure data handling practices ensure the platform meets legal standards and builds customer trust.

Key measures include data encryption, multi-factor authentication (MFA), robust API security (e.g., token-based authentication and rate limits), and regular vulnerability testing to safeguard sensitive customer data.