InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

Risk-based analysis in marine insurance is a key component of the marine insurance industry. Shipping operators face a myriad of unpredictable challenges, from volatile weather patterns to geopolitical upheavals, making risk management a critical part of global trade. Central to navigating these uncertainties is risk-based pricing in marine insurance—a method that ensures insurance premiums reflect the true risks of each policyholder. But this isn’t just about calculations; it’s about fairness, precision, and leveraging cutting-edge tools to stay ahead.

Today, advanced technologies such as AI in marine insurance and predictive modeling in insurance are revolutionizing risk-based pricing, enabling insurers to make data-driven decisions with unparalleled accuracy. This shift is not just transforming the way marine risks are assessed; it’s redefining how marine insurance premium analysis is conducted in a rapidly changing world. Whether you’re an industry expert or a stakeholder eager to learn, this exploration into data-driven insurance pricing and its technological evolution is your guide to keeping afloat in a sea of complexity.

Risk-based pricing in marine insurance refers to the process of customizing premiums based on the unique risks associated with specific ships, cargoes, and shipping routes. Unlike flat-rate premiums, this approach factors in measurable elements like vessel age, cargo type risk assessment, and geographical risks in shipping, ensuring that pricing reflects the complexities of global trade.

This model benefits both insurers and policyholders. For insurers, it helps maintain profitability while mitigating exposure to potential losses. For policyholders, it ensures fair rates in exchange for responsible operations, such as maintaining younger vessels and adhering to safe shipping practices.

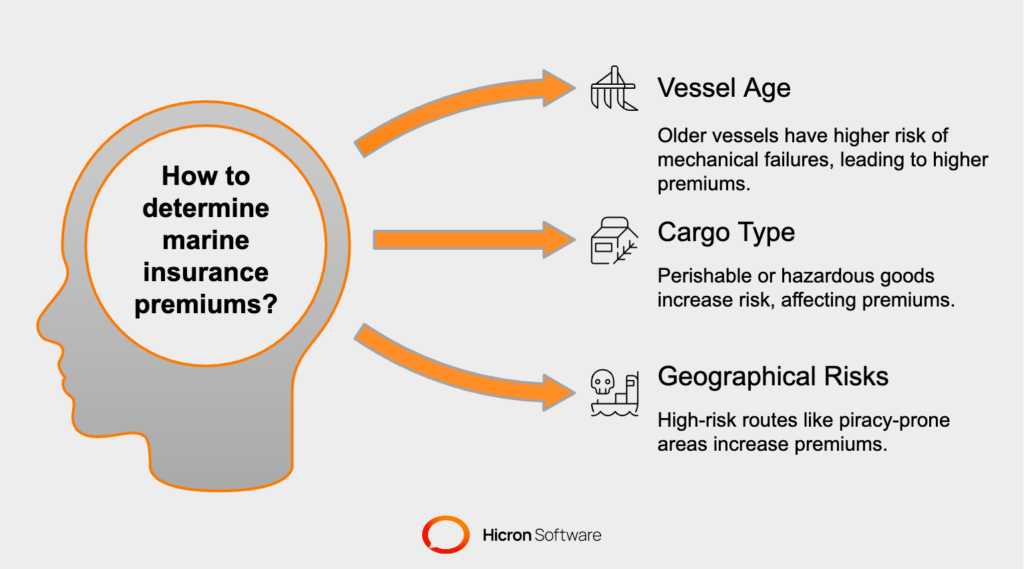

The accuracy of any marine insurance premium analysis depends on understanding the interplay of various risk factors. Below are the most critical considerations on how to calculate a marine insurance premium:

The age of a vessel plays a significant role in its risk profile. Older ships are more prone to mechanical failures and structural issues, resulting in higher premiums. For example, an aging container ship might require costly repairs, leading to increased likelihoods of claims.

Insurers often evaluate vessel maintenance histories and modernization efforts to refine their pricing models. Operators investing in regular upgrades can benefit from more favorable premiums.

The type of cargo being transported is another critical factor. Transporting perishable goods, such as fresh produce or seafood, carries a higher risk of spoilage, while hazardous materials may lead to environmental or safety hazards in case of accidents. Similarly, high-value shipments like luxury goods or electronics attract theft risks.

By conducting thorough cargo type risk assessments, insurers can allocate premiums according to the specific characteristics of goods being shipped.

The chosen shipping route heavily influences premiums. Certain regions, such as the Gulf of Aden, are notorious for piracy, while others might experience extreme weather or political instability. For instance, shipping through typhoon-prone areas can dramatically increase operational risks.

By weighing geographical risks in shipping, insurers ensure their pricing models account for the challenges specific to particular regions, protecting themselves and their clients from unforeseen losses.

Claims history is a direct measure of operational risk and helps insurers identify patterns. A policyholder with frequent claims, even if minor, may face heightened premiums due to perceived inefficiency. On the other hand, catastrophic but rare claims might suggest exposure to high-stakes risks.

For example:

By merging predictive modeling in insurance with historical claims data, insurers can anticipate future risks and adapt pricing structures proactively.

Predictive modeling in insurance involves analyzing historical and real-time data to forecast risks. It predicts potential incidents while revealing opportunities to minimize exposure.

The integration of AI in marine insurance has added significant depth to risk analyses. AI systems consider a broad spectrum of variables—from weather conditions to geopolitical trends—to assess risks in real-time. For example, tracking storms in key shipping lanes enables premium adjustments based on imminent threats.

AI has ushered in a new era of data-driven insurance pricing, making processes more agile, insightful, and efficient.

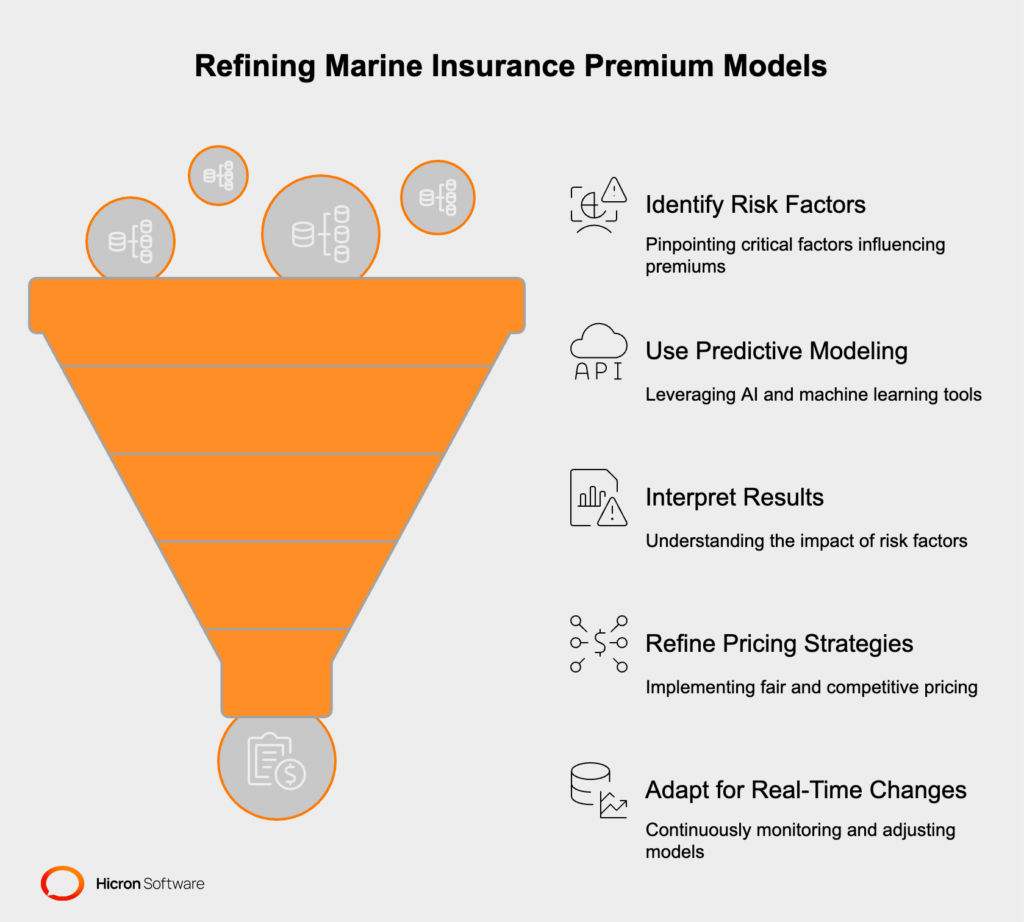

To conduct premium model analysis effectively, you can follow these structured steps:

Gather comprehensive and accurate data. This includes details on vessel age, cargo type, claims history, geographical routes, and operational activities. This data serves as the foundation for evaluating risks.

Data collection is the foundation of building effective premium models for risk-based marine insurance. Insurers must gather a diverse range of data from reliable sources to cover all aspects of risk evaluation. This includes:

Ensuring data accuracy is paramount. Insurers should validate the information by cross-referencing multiple data sources, using system checks for anomalies, and ensuring data integrity through proper storage and security practices. Leveraging automation and advanced analytics tools can also help ensure consistent and reliable data collection with minimal human error.

Pinpoint the critical factors that influence insurance premiums. Common factors include vessel condition, the type of cargo being transported, and the regions where shipping operations take place.

Once data is collected, the next step is to conduct a thorough risk assessment to categorize and evaluate the potential exposures. This step requires insurers to use the collected information to understand not only the frequency of risks but also their severity. Here’s how insurers approach this process:

This step serves as the bridge between raw data and actionable insights. Through systematic evaluation of risks, insurers ensure that their pricing models remain both accurate and adaptable to changing conditions. Combined with collaboration across teams, this comprehensive assessment lays the groundwork for more effective premium strategies.

Leverage advanced tools like AI and machine learning to process the collected data. These tools analyze patterns, estimate risks, and simulate various scenarios to predict outcomes.

Predictive modeling tools, particularly those powered by AI and machine learning, play a transformative role in premium model analysis for risk-based marine insurance. These tools are designed to handle vast amounts of complex data, making it possible to uncover critical insights that traditional methods might overlook. They work by analyzing historical and real-time datasets, such as vessel performance records, claims frequency, cargo type, weather conditions, and shipping routes, to identify recurring patterns and outliers.

For instance, AI algorithms can detect trends in claims that correlate with specific shipping regions or cargo types, highlighting risks that may not be immediately apparent. Machine learning, on the other hand, excels at refining these predictions by learning from the data over time, improving the accuracy of risk assessments with each iteration.

These tools also allow for scenario simulations, enabling insurers to forecast the impact of various situations, such as adverse weather patterns, economic shifts, or changes in international shipping regulations. By running multiple simulations, insurers can determine how specific risks influence premium pricing and make data-driven decisions to adjust models accordingly.

Predictive modeling tools enhance both accuracy and efficiency.

This level of sophistication strengthens the profitability of insurers while increasing confidence among policyholders by offering tailored policies that align with their unique risk profiles.

Review the findings from predictive models to understand how different risk factors impact marine insurance pricing. Use these insights to make informed decisions about adjustments to premium structures.

Collaboration across teams is essential during this step. Actuaries, underwriters, and data scientists must work together to ensure the findings are interpreted accurately and relevant to real-world operations. Teams can also discuss anomalies or unexpected results, which might indicate data quality issues or emerging risks that were previously unrecognized.

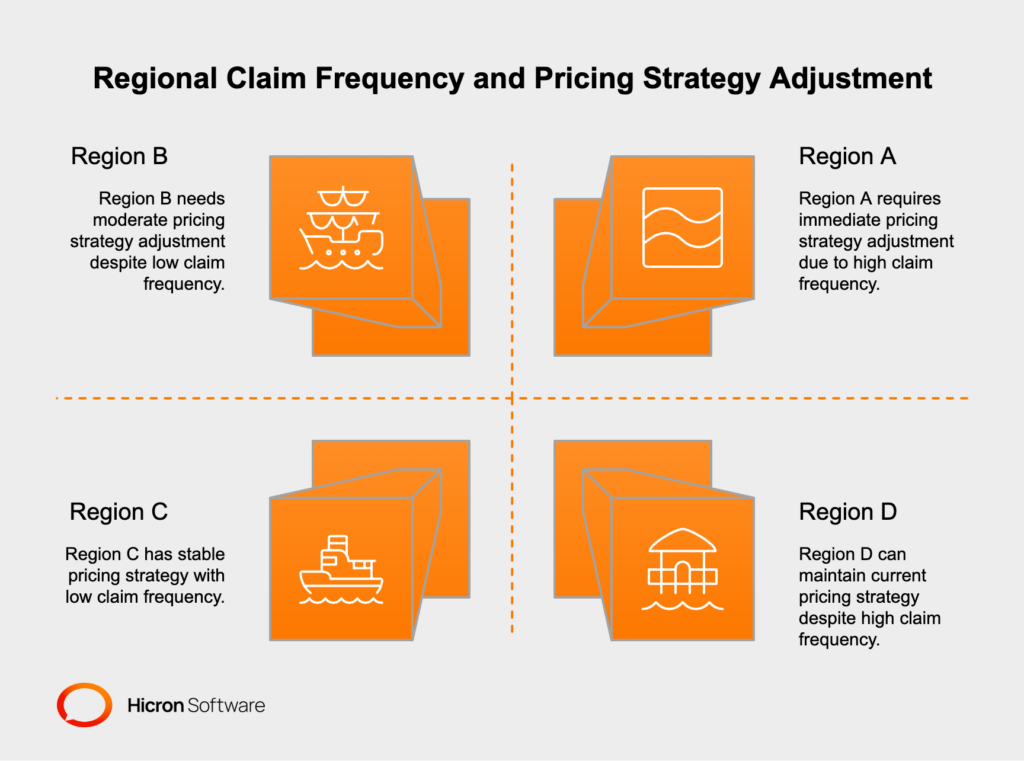

Visualization tools play a pivotal role in simplifying complex data for all stakeholders. Interactive dashboards, charts, and heat maps can present the predictive model’s results in an intuitive and accessible format. For example, a heat map might illustrate regions with the highest claim frequencies, enabling insurers to quickly adjust pricing strategies for those areas. These tools allow team members to analyze and communicate findings effectively, fostering informed decision-making.

Ultimately, the goal of interpreting the results is to derive meaningful strategies that balance profitability and fairness. By aligning the insights with their business objectives, insurers can refine their pricing models, improve predictive accuracy, and ensure their policies remain competitive and transparent. This comprehensive approach ensures that both the insurer’s and the policyholder’s needs are met, striking an optimal balance between commercial success and risk management.

Implement fair and competitive pricing strategies based on the analyzed data. This step ensures that both profitability for insurers and transparency for policyholders are maintained.

Refining pricing strategies is a crucial step where insights gained from data analysis are translated into actionable adjustments to premium models. Marine insurers leverage the findings from predictive tools and result interpretations to fine-tune their pricing structures. This involves reevaluating premium rates for different risk segments, such as vessel types, cargo categories, or geographic operations, to ensure the pricing reflects the underlying risks accurately and fairly.

To maintain fairness, insurers must consider not only profitability but also the needs and expectations of their policyholders. For instance, if analysis shows a particular cargo type consistently incurs high claims rates, pricing adjustments should balance the risk while remaining affordable for clients. Additionally, transparency in pricing calculations fosters trust, ensuring customers understand how their premiums are determined based on objective risk evaluations.

Continuous feedback is integral to this process. Insurers need to incorporate updates from claims data, customer feedback, and operational changes to refine models in real-time. For example, if losses surge due to an increase in piracy incidents in specific shipping lanes, pricing strategies should quickly adapt to include new risk factors. Likewise, technological advancements such as better hull materials or enhanced vessel monitoring systems might reduce risks, warranting lower premiums for compliant clients.

Market trends also play a significant role in refining strategies. Staying competitive requires analyzing how other insurers price similar risks and identifying areas where innovative pricing solutions, like discounts for safer shipping practices, could provide a unique selling proposition. Similarly, understanding economic shifts, like changes in global trade routes or fluctuating fuel costs, helps insurers predict risk concentration and adjust premiums dynamically.

Customer-centricity remains key when refining pricing. Offering flexible pricing models or personalized options, such as bundling multiple policies or providing scalable coverage for seasonal operations, ensures clients’ diverse needs are met. By aligning their pricing strategies with both market conditions and customer expectations, insurers can create a compelling balance between profitability and policyholder satisfaction.

Ultimately, the refinement of pricing strategies is an ongoing process that demands agility, precision, and a focus on fair risk sharing. This ensures marine insurance policies remain not only financially sustainable for insurers but also valuable and reliable for policyholders navigating unpredictable maritime conditions.

|

Aspect |

Details |

|

Objective |

Implement fair and competitive pricing strategies based on analyzed data to ensure profitability for insurers and transparency for policyholders. |

|

Actionable Adjustments |

Insights from data analysis are used to fine-tune premium models, reevaluating rates for different risk segments such as vessel types, cargo categories, or geographic operations to reflect risks accurately and fairly. |

|

Fairness and Transparency |

Pricing adjustments must balance risk and affordability for clients. Transparency in calculations fosters trust by helping customers understand how premiums are determined based on objective evaluations. |

|

Continuous Feedback |

Updates from claims data, customer feedback, and operational changes are incorporated in real-time to refine models. For example, increased piracy incidents or technological advancements like better hull materials are factored in. |

|

Market Trends |

Competitive analysis of other insurers’ pricing and innovative solutions, such as discounts for safer practices, help insurers stay competitive. Economic shifts like trade route changes or fuel costs are also considered. |

|

Customer-Centric Approach |

Flexible pricing models, bundling policies, or scalable coverage for seasonal operations ensure diverse client needs are met, aligning strategies with market conditions and customer expectations. |

|

Ongoing Process |

Refining pricing strategies is a continuous effort requiring agility, precision, and a focus on fair risk sharing to maintain financial sustainability for insurers and reliability for policyholders. |

This table organizes the key points into a structured format, making it more leisurely to digest and reference.

Continuously monitor market trends and emerging risks, using technology to make real-time updates to pricing models when needed. This flexibility ensures accuracy and relevance in a dynamic industry.

Monitoring and adjusting premium models for Risk-Based Marine Insurance is an ongoing process that ensures they remain relevant in an evolving risk landscape. Insurers must continuously track the performance of their pricing strategies to confirm alignment with both organizational goals and market conditions. This step involves evaluating key performance indicators (KPIs), such as

to determine whether the premium models are achieving the desired balance between profitability and competitive pricing.

Real-time data plays a pivotal role in this stage, enabling insurers to respond promptly to shifts in risk dynamics. For instance, data collected from vessel tracking systems, weather updates, and geopolitical developments can immediately signal emerging risks, such as heightened piracy threats or sudden changes in shipping routes. By integrating such live data into their models, insurers can make proactive adjustments to account for new variables without waiting for quarterly reviews or prolonged analysis periods.

Agility is essential when adapting to market changes. Marine insurers must be prepared to recalibrate their premiums swiftly in response to economic fluctuations, regulatory updates, or unexpected events like natural disasters. For example, in the case of a new international regulation requiring advanced safety equipment on vessels, insurers might adjust premiums to incentivize compliance while reducing costs for compliant operators. Similarly, if claims data reveals a spike in losses for specific cargo types due to unforeseen risks, pricing strategies should quickly reflect the increased exposure.

Regularly updating predictive models based on the latest data ensures accuracy and helps refine long-term risk projections. Collaboration between data analytics teams, underwriters, and claims managers is vital to maintain a consistent feedback loop, where lessons from claims experiences are fed back into the premium models. This iterative approach not only strengthens pricing strategies but also ensures fairness and transparency for policyholders.

By actively monitoring and fine-tuning their premium models, marine insurers can stay ahead in a competitive market, mitigate unforeseen losses, and offer policies that are both reliable and adaptable to the unique challenges of the maritime industry. The ability to adjust in real time provides a significant advantage, ensuring the sustainability of premium models while meeting the dynamic needs of their clients.

By following these steps, insurers can optimize their pricing strategies, improve decision-making, and stay competitive in the evolving marine insurance landscape.

Despite its promise, risk-based pricing in marine insurance faces several hurdles:

Challenge 1: Data Availability and Quality

Without consistent and accurate data, even the most advanced systems cannot deliver reliable results. This makes investments in technologies like IoT devices and automated reporting systems crucial.

Challenge 2: Balancing Profitability with Competition

Setting premiums too high risks alienating customers, while overly competitive pricing can lead to unsustainable losses. Striking the right balance requires iterative model refinement and market analysis.

Challenge 3: Regulatory Requirements

Navigating global compliance frameworks adds complexity to marine insurance premium analysis. Ensuring transparency in pricing models while adhering to international laws is increasingly important.

By leveraging the power of AI in marine insurance and building holistic pricing systems, these challenges can be effectively managed.

Imagine a shipping company navigating the busy waters of Southeast Asia. Using predictive modeling in insurance, their insurer factors in piracy risks on the Malacca Strait, frequent monsoons, and the age of the fleet. With detailed insights, the company receives a premium adjusted dynamically based on evolving risks.

Another example involves insurers managing specialized shipments, such as transporting hazardous cargo. Utilizing a cargo type risk assessment, they might recommend additional risk mitigation strategies, like reinforced containers or stricter safety protocols, alongside tailored premiums.

These instances showcase the tangible benefits of data-driven insurance pricing in providing both accurate premiums and operational recommendations.

Emerging Trends Shaping the Industry

Innovations such as blockchain for transparent contracts and IoT sensors for real-time vessel tracking are set to reshape risk-based pricing in marine insurance.

Staying Competitive with AI and Digital Tools

Companies adopting AI in marine insurance and leveraging advanced analytics will remain at the forefront, offering precise risk assessments and competitive pricing.

The intersection of technology and insurance will ensure the industry is more efficient, accurate, and future-ready than ever before.

Risk-based pricing in marine insurance is the key to balancing fairness and profitability in an increasingly complex world. By incorporating technologies like predictive modeling in insurance and real-time data analysis, insurers can create adaptive, robust models that benefit both clients and the market as a whole.

Investing in data-driven insurance pricing strategies is no longer optional; it’s critical for staying afloat in the high-stakes waters of global trade. The future belongs to insurers who are prepared to ride the wave of innovation.

Risk-based pricing in marine insurance refers to the method of determining premiums based on the unique risks associated with specific policyholders. This approach considers factors such as vessel age, cargo type, shipping routes, and claims history to ensure a fair and accurate evaluation. By reflecting the level of risk posed, insurers can create pricing models that are both equitable and sustainable.

AI enhances risk-based pricing by analyzing vast amounts of historical and real-time data with unparalleled accuracy. It helps insurers predict potential risks by considering factors like weather conditions, geopolitical events, and shipping trends. AI-powered systems automate risk assessments, streamline premium calculations, and detect subtle patterns that human analysis might miss, resulting in more precise and dynamic pricing strategies.

Marine insurance premiums are influenced by several factors, including the age and condition of vessels, the type and value of cargo, geographical risks along shipping routes, and the policyholder’s claims history. External factors like piracy in certain regions or severe weather events also play a big role in determining rates.

A policyholder’s claims history directly impacts their premium rates. Frequent or repeated claims, even for minor issues, indicate higher risk and typically lead to increased premiums. Conversely, a clean claims history demonstrates reliability and can lead to more favorable rates. Insurers assess both the frequency and severity of past claims to adjust premiums accordingly.

Predictive modeling in insurance involves using data analytics to forecast potential risks and outcomes. For marine insurance, it examines variables such as vessel performance, cargo characteristics, and environmental changes to predict future incidents. Insurers use predictive modeling to develop tailored risk assessments, ensuring accurate premium calculations and proactive mitigation measures.

Data-driven insurance pricing ensures that premiums reflect actual risk levels, improving fairness and precision. By leveraging data insights, insurers can identify patterns, optimize risk management, and avoid overpricing or underpricing policies. This approach fosters trust among policyholders and enhances the insurer’s ability to remain competitive and profitable.

Technology is integral to risk assessment by automating data collection, analysis, and reporting processes. Predictive modeling tools, AI algorithms, and IoT devices provide real-time insights into factors like vessel performance, route dangers, and weather patterns. These advancements help insurers evaluate risks more comprehensively and adapt quickly to market or environmental changes.

Geographical risks influence premiums, as certain regions are prone to piracy, extreme weather, or political instability. High-risk areas like the Gulf of Aden or typhoon-prone regions increase the likelihood of incidents, leading to higher premiums. Conversely, routes with stable conditions and low risk typically result in lower premium rates.

AI and predictive modeling provide numerous benefits, including improved accuracy in risk assessment, faster underwriting processes, and proactive risk mitigation. By analyzing data patterns, these tools enable insurers to predict potential incidents, refine premiums, and develop customized policies. This technological edge results in greater efficiency and enhanced customer satisfaction.

Insurers face challenges such as obtaining high-quality data, balancing competitive pricing with profitability, and navigating complex regulatory requirements. Implementation costs, including investments in advanced technologies like AI, can also be a hurdle. However, strategic planning and leveraging innovative tools can help insurers overcome these obstacles and master risk-based pricing.