10 Real Estate Software Development Companies in 2025

- February 03

- 9 min

AI property valuations are automated systems that use algorithms to estimate the market value of real estate. These real estate AI tools are designed to analyze large datasets of property listings and historical sales to produce a quick valuation figure. They promise a faster, more data-driven alternative to traditional appraisal methods.

This article explores the core limitations of current AI property valuations. It explains why they often fall short in accuracy and how advanced PropTech solutions can bridge this gap. We will cover how developers can build better tools by incorporating the local market knowledge that is essential for reliable real estate analysis.

Key Takeaways:

Property valuation is the process of determining the economic worth of a real estate asset. It involves a detailed analysis of various factors, including

An appraiser also considers

This valuation is vital for sales transactions, financing, insurance, and taxation purposes.

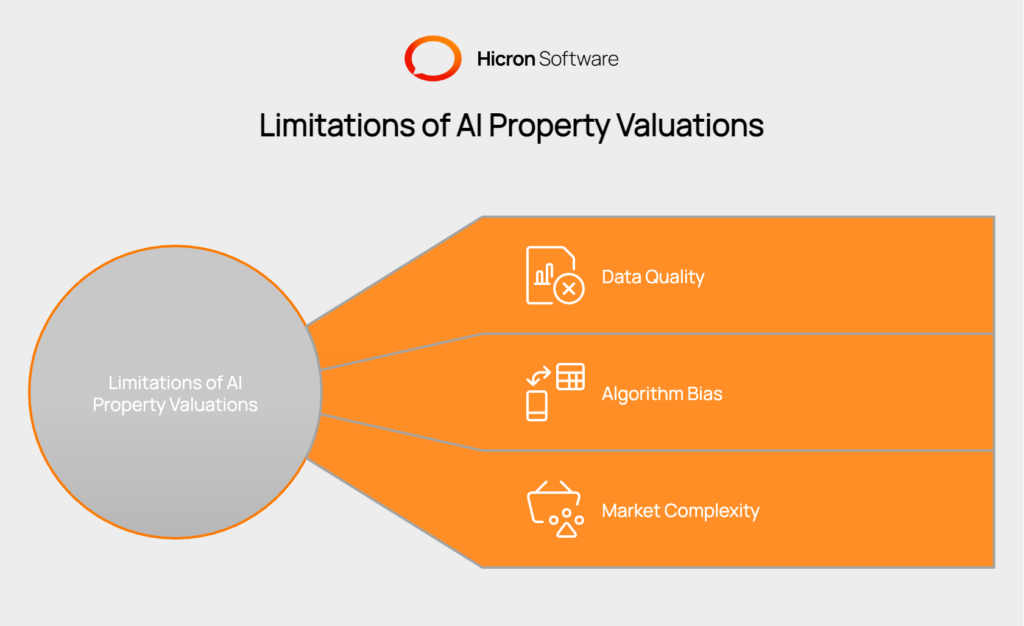

Many automated valuation models (AVMs) face fundamental challenges that restrict their accuracy.

A primary issue is their dependency on data quality. Automated property valuation systems rely on public records and sales data, which can be outdated, incomplete, or incorrect. Without clean and comprehensive information, the outputs of AI property valuations become unreliable.

Another problem is algorithm bias. Most models are built on historical transaction patterns, so they perform poorly in evolving markets or areas with few recent sales. They cannot easily process subjective property characteristics like interior condition, curb appeal, or the quality of a recent renovation. This leads to valuation errors for properties that do not fit a standard profile.

Market complexity adds another layer of difficulty. AI systems often miss hyperlocal factors that influence property values. These can include upcoming zoning changes, new school construction, or shifts in neighborhood reputation. A standard algorithm cannot account for these nuances, which a local expert would instantly recognize.

Local market knowledge is critical for accurate property valuation. Hyperlocal factors, such as

can create value pockets that broad AI models do not see. A property on one side of a street can be worth more than one on the other, but an algorithm may not understand the reason.

Cultural and demographic trends also shape property values.

can influence demand in ways that are difficult to capture with data alone. Real estate AI tools that lack this context may misjudge a property’s true market position.

The regulatory environment presents further complexities.

can all constrain a property’s use and affect its value. These details are often buried in local government documents that are not part of the standard datasets used for AI property valuations.

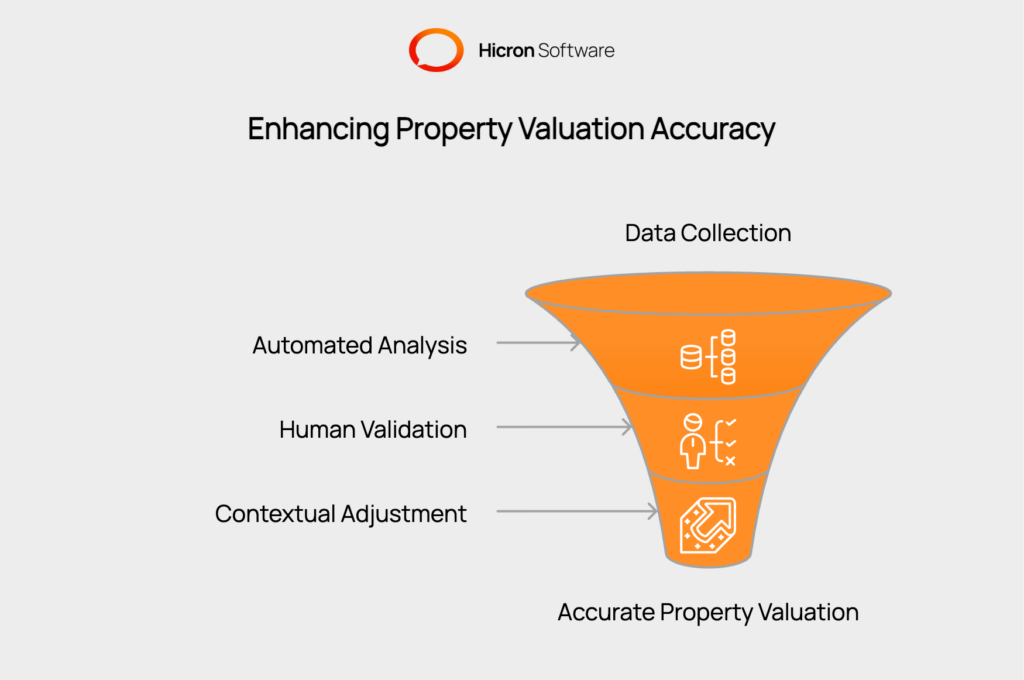

Modern PropTech solutions can offer a hybrid model that combines AI with human expertise. This allows for expert validation of automated results, correcting for outliers and adding context that the machine misses.

PropTech solutions enhance accuracy in property valuation by combining automated processes with sophisticated data analytics and local market intelligence.

Technologies such as machine learning algorithms, image recognition, and data aggregation platforms streamline the collection of property records, recent sales, geographic information, and even environmental data.

Developers are building real estate AI tools that pull information from a wider range of sources. This can include

By using more diverse data, these systems create a more complete picture of a property’s value.

For example, automated valuation models can pull satellite imagery to flag evidence of roof aging, access permit databases for renovation history, and monitor news sources for local developments like the introduction of new infrastructure or school zones.

While these technologies handle the heavy lifting in gathering and sorting large volumes of information, they often struggle with on-the-ground details. A noisy highway next door, hidden structural issues, or changes from a new transit line can all impact value in ways that automated tools may miss.

PropTech tools work best as assistance for professionals, not replacements. Appraisers and brokers can review AI-generated reports, validate findings with personal inspections, and adjust for qualitative factors the technology may overlook. This mix ensures that the valuation process benefits from data-driven speed and also reflects the context, subtleties, and human judgment needed for accuracy and reliability in real estate decisions.

Modern PropTech platforms also feature more customizable algorithm frameworks. They allow users to apply regional weighting adjustments to account for local factors. This flexibility makes the tools more adaptable to different markets and property types, moving beyond a one-size-fits-all model.

A modern PropTech platform for property valuation integrates multiple technologies and data sources to deliver accurate, reliable, and transparent results. These platforms are designed to assist real estate professionals by automating data collection while allowing for human oversight and expertise. The following are the core components that define a leading valuation platform, with key supporting technologies detailed for each.

|

Component |

Description |

Supporting Technologies |

|

Hybrid Intelligence Model |

Combines AI-driven data analysis with the contextual knowledge of human real estate professionals to validate results and add qualitative insights. |

|

|

Advanced Data Aggregation Engine |

Gathers information from diverse traditional and alternative sources, such as public records, MLS data, satellite imagery, and real-time economic feeds. |

|

|

Hyperlocal Data Integration |

Focuses on sourcing granular, location-specific information like zoning changes, school district performance, and neighborhood sentiment. |

|

|

Customizable Algorithm Framework |

Allows users to apply regional weighting and other adjustments to the valuation model, adapting it to unique market characteristics and property types. |

|

|

Transparent and Explainable UI |

Provides a user-friendly interface that displays a valuation’s confidence score and explains the key factors that influenced the final estimate. |

|

For developers aiming to create AI property valuations, the first step is to focus on local data collection. This means building partnerships with local real estate professionals and creating APIs that connect directly with municipal records. Sourcing this hyperlocal information is essential for adding the context that standard models lack.

Improving the machine learning models themselves is also necessary. Developers can use feature engineering to create new variables that represent local market characteristics. Using ensemble methods that combine multiple data sources can also produce more robust and reliable predictions.

User interface design should prioritize transparency. The best PropTech solutions show users the confidence score of a valuation and explain the factors that influenced the result. This helps real estate professionals understand the “why” behind the number, allowing them to use the tool more effectively alongside their own expertise.

AI property valuations offer speed, but their reliance on generic data often leads to inaccurate results. The future of valuation technology lies in PropTech solutions that combine automated analysis with deep local market intelligence. By creating real estate AI tools that are more transparent, data-rich, and context-aware, developers can provide the accuracy that real estate professionals need. Get in touch to learn more.

AI valuations rely on historical data from comparable properties. Unique homes or those with custom features lack sufficient comparables, making it difficult for algorithms to calculate an accurate value.

Effective PropTech solutions use hybrid models that integrate data from local professionals. They also use advanced data sources like municipal records and local news to capture market nuances that standard databases miss.

Human appraisers provide essential context, verify property conditions, and interpret complex market factors. They should use real estate AI tools to speed up data collection but apply their own expertise to finalize valuations.

Advanced PropTech solutions integrate real-time data feeds on economic indicators and market activity. This allows their models to adapt more quickly to changing market conditions than systems that rely only on historical sales data.

Upgrading to more advanced PropTech solutions involves subscription fees and potential training costs. However, the return on investment comes from more accurate valuations, better decision-making, and saved time.