10 Real Estate Software Development Companies in 2025

- February 03

- 9 min

AI underwriting tools are automated systems that use artificial intelligence to analyze financial documents, assess risk, and evaluate real estate investment opportunities with minimal human intervention. These PropTech innovation solutions transform traditional underwriting by processing data faster and more consistently than manual methods, while still requiring human expertise for complex decisions and relationship management.

This article explores how real estate AI streamlines underwriting processes, improves accuracy, and identifies where human oversight remains critical. We’ll examine the benefits of automated document processing, discuss implementation challenges, and provide guidance on creating effective hybrid workflows that combine technology with human expertise.

Key Takeaways:

Real estate underwriting is the comprehensive process of evaluating the financial risks associated with a property investment or loan. Underwriters analyze

to determine the viability of a transaction. This critical review involves

The primary goal is to make an informed decision on whether to approve a loan or proceed with an acquisition, ensuring the investment aligns with established risk tolerance and profitability goals.

Manual underwriting processes create bottlenecks that delay loan approvals and property acquisitions. Underwriters spend hours reviewing financial statements, rent rolls, and property documents to extract key data points. This manual approach leads to inconsistent analysis methods between different team members.

Human error rates increase when processing large volumes of financial data.

introduces mistakes that can affect lending decisions. These errors become more frequent during peak transaction periods when teams face time pressure.

Document review timelines often extend client expectations. Traditional underwriting requires

These delays can cause deals to fall through or force borrowers to seek alternative financing sources.

AI underwriting tools process documents in minutes rather than hours through advanced optical character recognition (OCR) technology. These systems extract data from financial statements, rent rolls, and property reports automatically, eliminating manual data entry tasks that consume underwriter time.

Automated property valuation methods instantly access comparable sales data and market trends. Real estate AI algorithms calculate cash flow projections and net operating income figures using current market parameters, providing immediate insights into property performance.

Risk scoring automation helps lenders make faster decisions by applying machine learning models trained on historical loan performance data. These systems evaluate

using objective criteria applied consistently across all applications.

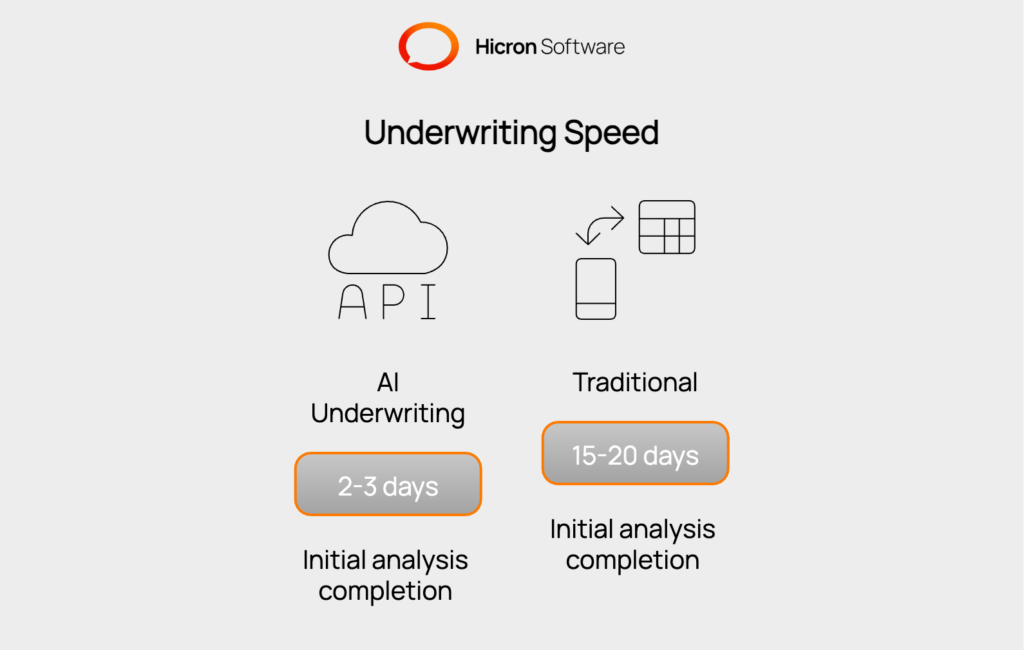

The speed improvements are substantial. Where traditional underwriting might take 15-20 business days, AI underwriting tools can complete initial analysis within 2-3 days, allowing teams to focus review time on complex scenarios requiring human judgment.

Real estate AI underwriting applies consistent criteria across all applications. This technology minimizes human error, standardizes evaluations, and improves fraud detection, leading to more reliable and objective decision-making.

|

Feature |

Description |

Benefit |

|

Error Elimination |

Applies mathematical formulas automatically for financial metrics. |

Ensures accurate computation of key ratios like DSCR. |

|

Standardized Criteria |

Consistently applies the same underwriting rules to all applications. |

Improves decision quality and ensures fair, uniform evaluations. |

|

Fraud Detection |

Identifies document inconsistencies and anomalies through data verification. |

Proactively flags potential fraud that human reviewers might miss. |

|

Automated Quality Control |

Flags unusual patterns and outliers in the data for human review. |

Focuses underwriter attention on high-risk items, improving efficiency. |

Automated systems eliminate calculation errors that occur during manual financial analysis. AI underwriting tools apply mathematical formulas, ensuring debt service coverage ratios and other key metrics are computed accurately every time.

Consistent application of underwriting criteria improves decision quality by removing subjective interpretation from standard calculations. The system applies the same loan-to-value thresholds, cash flow requirements, and creditworthiness standards across all applications, creating fair and uniform evaluation processes.

Enhanced fraud detection capabilities help identify document inconsistencies and income statement anomalies that human reviewers might miss. PropTech innovation includes cross-database verification processes that flag discrepancies between reported income and public records automatically.

Quality control improves when AI systems flag unusual patterns or outliers for human review. Rather than hoping manual reviewers catch every error, the technology identifies potential problems proactively, allowing underwriters to focus attention where it’s needed most.

Complex deal structures require human expertise that AI cannot replicate.

need experienced professionals who understand market dynamics and structural complexities that automated systems haven’t learned to evaluate properly.

Market nuance interpretation depends on local knowledge. Automated data analysis cannot dive into these nuances. Human underwriters understand economic trends, regulatory environments, and market conditions that affect property values. These may not appear in standardized databases used by AI underwriting tools.

Relationship management and client communication remain purely human functions. Borrowers need consultation during the application process, investors require explanation of underwriting decisions, and complex negotiations demand the interpersonal skills that technology cannot provide.

Risk assessment for unique situations benefits from human judgment that considers factors outside standard criteria. Experienced underwriters recognize when standard rules should be adjusted based on special circumstances, market conditions, or borrower profiles. In such cases, automated systems might evaluate incorrectly.

Effective implementation divides tasks between AI systems and human underwriters based on complexity and risk levels.

route through automated systems, while complex scenarios receive human attention from the start.

Quality control checkpoints ensure accuracy throughout automated workflows. Human reviewers validate AI outputs at critical decision points, checking unusual results and confirming that automated analysis aligns with market realities and lending policies.

Exception handling procedures address scenarios where AI underwriting tools encounter data they cannot process reliably. These procedures route complex cases to experienced underwriters while maintaining processing speed for standard applications.

Training requirements help underwriting teams work effectively with PropTech innovation. Staff need to understand how AI systems work, when to override automated recommendations, and how to interpret confidence scores and risk assessments provided by the technology.

Implementing AI underwriting tools offers major advantages. Yet, it requires overcoming key challenges like data quality, system integration, and regulatory compliance. Addressing these obstacles proactively is essential for maximizing the return on technology investment.

|

Challenge |

Description |

Consideration |

|

Data Quality |

Automated tools require clean, standardized input data to function properly. |

Improve document quality standards and data collection processes. |

|

System Integration |

Integrating with existing or legacy systems requires careful technical planning. |

Update or replace legacy systems and allocate budget for technical expertise. |

|

Regulatory Compliance |

AI-driven lending decisions must meet fair lending requirements and be explainable. |

Ensure systems can provide clear justifications for all automated decisions. |

|

Cost-Benefit Analysis |

Implementation costs must be weighed against efficiency gains and accuracy improvements. |

Analyze software licensing, training, integration, and maintenance expenses. |

Data quality requirements pose the biggest implementation challenge for real estate AI systems. Automated tools need clean, standardized input data to function properly, requiring organizations to improve document quality standards and data collection processes.

Integration with existing underwriting systems requires careful planning and technical expertise. Legacy systems may need updates or replacement to work effectively with AI underwriting tools, creating implementation costs that organizations must consider during the planning process.

Regulatory compliance considerations affect how AI systems can be used for lending decisions. Financial institutions must ensure automated underwriting meets fair lending requirements and can provide clear explanations for decisions when regulators or borrowers request them.

Cost-benefit analysis helps organizations determine which AI underwriting tools provide the best return on investment. Implementation costs include software licensing, staff training, system integration, and ongoing maintenance expenses that must be weighed against efficiency gains and accuracy improvements.

Start with pilot programs that test AI underwriting tools on specific property types or loan categories before full implementation. This approach helps organizations understand system capabilities and limitations while training staff gradually.

Establish clear policies for when human override of AI recommendations is appropriate and required. These policies should address unusual market conditions, complex deal structures, and borrower relationship considerations that automated systems cannot evaluate properly.

Monitor system performance continuously through accuracy metrics, processing times, and user feedback. Regular evaluation helps identify areas where AI systems need improvement or where human processes remain more effective.

Invest in staff training programs that help underwriters work effectively with AI systems. Training should cover system capabilities, interpretation of automated outputs, and decision-making processes for complex scenarios.

AI underwriting tools transform real estate finance by automating routine tasks while preserving human expertise for complex decisions. The technology delivers clear benefits in processing speed and accuracy when properly implemented with appropriate oversight. Organizations that combine PropTech innovation with experienced underwriting teams achieve optimal results for both efficiency and decision quality.

AI underwriting tools achieve 95-98% accuracy for standard calculations and data extraction, compared to 85-90% accuracy for manual processes. However, human expertise remains superior for complex deal evaluation and market analysis.

Standard office buildings, retail properties, and multifamily complexes with conventional lease structures benefit most from automated underwriting. Mixed-use properties and unique asset types still require significant human analysis.

Most AI underwriting tools connect through APIs that integrate with existing loan origination systems and document management platforms. Integration typically requires 2-4 weeks of setup time with IT support.

Underwriters need to understand data analysis, system interpretation, and technology troubleshooting. They also need strong judgment skills to know when to override automated recommendations based on market knowledge.

Regulators generally support AI use in underwriting provided that decisions remain explainable, fair, and compliant with lending regulations. Institutions must be able to document and justify all automated decisions.