10 Real Estate Software Development Companies in 2025

- February 03

- 9 min

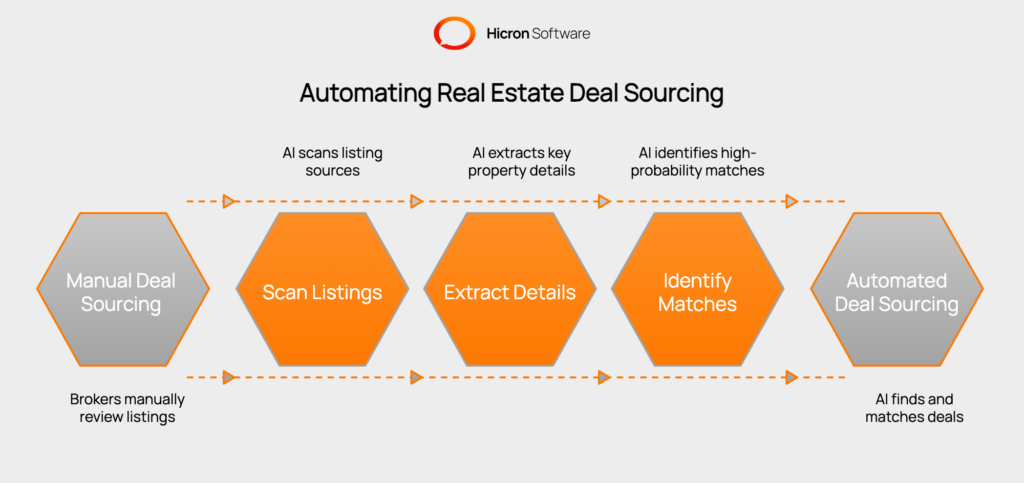

AI deal sourcing refers to the automated process of using artificial intelligence technologies to identify, analyze, and match commercial real estate opportunities with specific buyer criteria, eliminating manual review processes and accelerating deal discovery.

The commercial real estate industry faces a critical productivity challenge. Brokers spend countless hours each week manually reviewing hundreds of property listings, extracting data from rent rolls, and trying to match properties with buyer requirements. This article explores how AI-powered deal sourcing tools can transform broker efficiency by automating these time-consuming tasks while preserving the human expertise that closes deals.

Key Takeaways

AI deal sourcing uses artificial intelligence to automatically find, analyze, and match commercial real estate opportunities with buyer requirements, eliminating the need for brokers to manually review hundreds of property listings each week. This technology transforms how brokers work by scanning multiple listing sources, extracting key property details, and identifying high-probability matches based on specific buyer criteria.

For real estate professionals, AI deal sourcing reduces administrative work, improves accuracy in property matching, and uncovers opportunities that might be missed during manual searches. By automating time-consuming tasks like document analysis and buyer matching, AI allows brokers to focus on what they do best: building relationships, negotiating deals, and providing market expertise that actually closes transactions.

Commercial real estate brokers face an overwhelming volume of data. The average broker manually reviews over 200 listings weekly, spending precious time on administrative tasks instead of building client relationships. This manual approach creates bottlenecks in three critical areas.

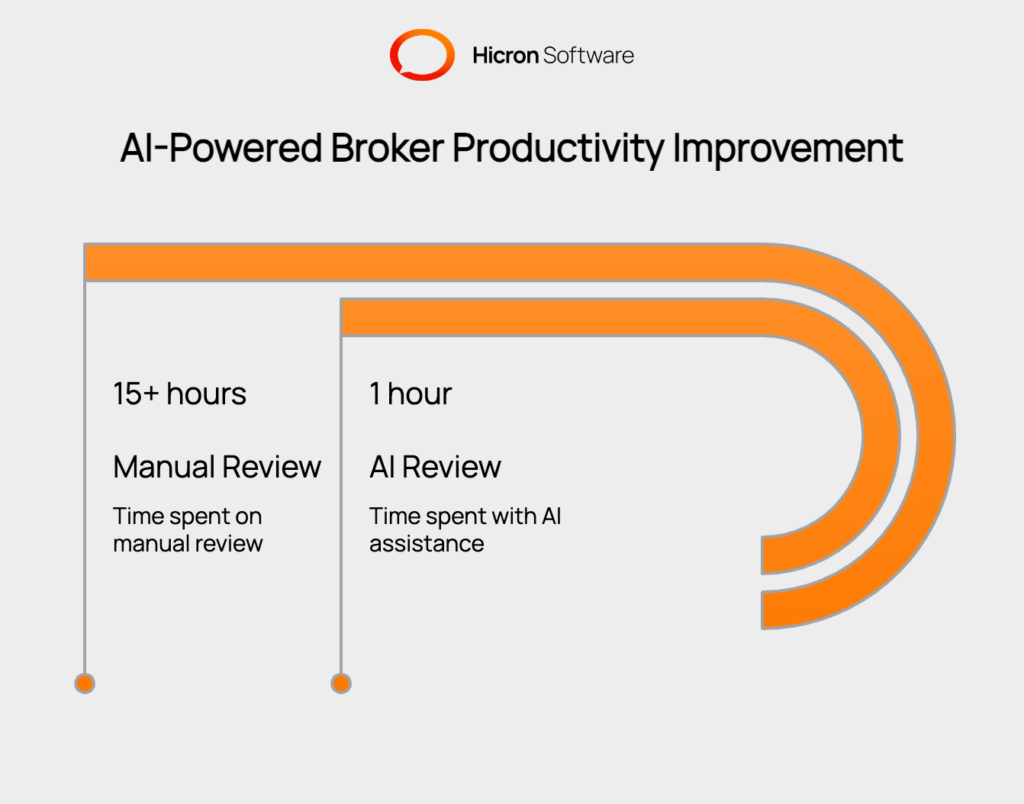

These inefficiencies compound over time. Brokers who spend 15+ hours weekly on administrative tasks have less time for the high-value activities that actually generate revenue: building relationships, negotiating deals, and providing market expertise to clients.

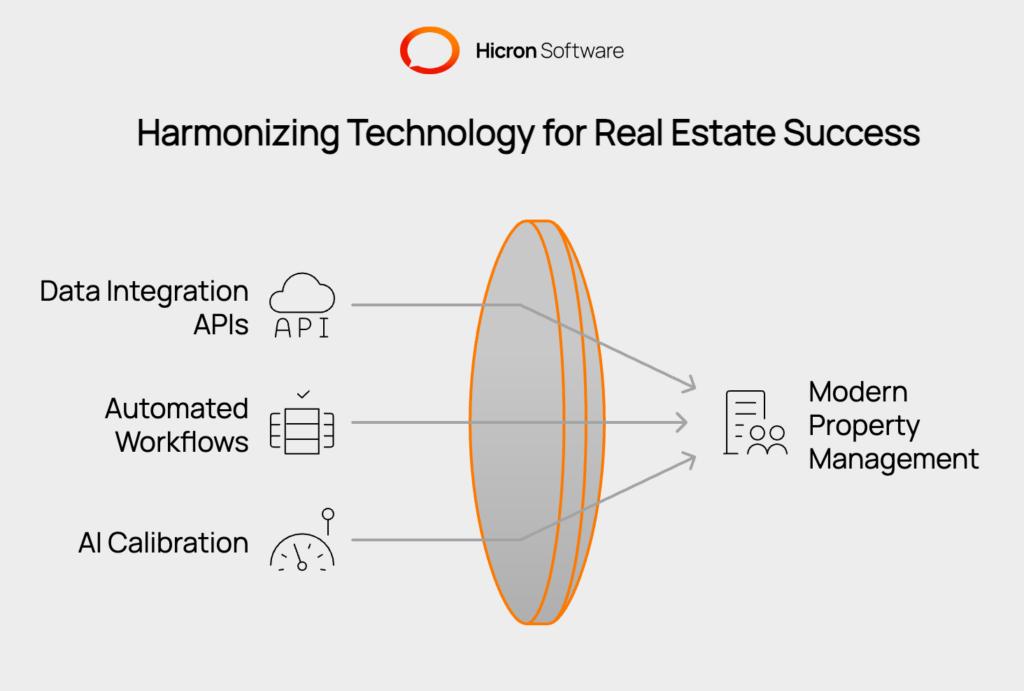

Modern AI deal sourcing systems rely on several key technologies working together.

Data integration APIs connect these systems to multiple listing sources, creating a comprehensive view of available properties. The combination of these technologies enables automated workflows that can process hundreds of listings in minutes rather than hours.

The key is choosing the right balance of speed and accuracy. While AI can process information faster than humans, it requires careful calibration to avoid overwhelming brokers with false positives or missing genuine opportunities due to overly restrictive filters.

Rent roll analysis represents one of the most time-consuming property evaluation tasks. Traditional methods require brokers to manually transcribe financial data from PDF documents, often taking hours per property. How OCR enhances rent roll analysis for brokers? AI-backed OCR (Optical Character Recognition )systems automate this entire workflow.

Effective OCR implementation starts with document preprocessing. Images must be enhanced and standardized to ensure accurate text recognition. Different OCR engines offer varying accuracy rates, and the best systems combine multiple engines to maximize precision. For financial documents, accuracy becomes critical since small errors can lead to incorrect valuations.

|

OCR Engine |

Strengths |

Weaknesses |

Example Use Case |

|

Google Cloud Vision API |

|

|

Processing typed tenant information and lease terms in standard rent rolls |

|

Amazon Textract |

|

|

Extracting data from standardized rent roll templates with consistent table formats |

|

Tesseract (Open Source) |

|

|

Processing simple property summaries and basic financial documents with standard formatting |

|

Azure Computer Vision |

|

|

Reading printed tenant names and rent amounts while requiring human review for handwritten notes |

|

Multi-Engine Approach |

|

|

Critical financial documents where accuracy is essential, such as due diligence rent rolls requiring validation of all monetary amounts |

The best systems combine multiple engines through consensus algorithms that compare results and assign confidence scores based on agreement levels.

Why combining OCR engines improves accuracy? When processing a rent roll where three engines agree on a rent amount of “$2,850,” confidence increases, but when results differ, the system flags discrepancies for human review. This multi-engine approach proves especially valuable for financial documents in real estate, where a system might use Azure Textract for table structure recognition, Google Vision for text clarity, and a specialized financial OCR engine for currency amounts, then select the most reliable result for each data field to ensure accuracy while maintaining processing efficiency.

The most sophisticated OCR systems include confidence scoring and error detection. When the system encounters unclear text or unusual formatting, it flags these areas for human review rather than making incorrect assumptions. This approach maintains accuracy while still providing substantial time savings.

Output formatting matters just as much as accuracy. Raw OCR output needs structuring into standardized formats that integrate with analysis workflows. The best systems convert messy rent roll data into clean, standardized spreadsheets that brokers can immediately use for underwriting.

Intelligent property matching requires converting buyer preferences into searchable parameters. This process is not simple filters like square footage or location. Advanced systems consider subtle preferences, market timing, and even behavioral patterns from previous transactions.

Scoring algorithms rank properties based on match quality across multiple dimensions.

The system must understand these nuances and weight factors accordingly.

Machine learning improves matching accuracy over time. As brokers provide feedback on suggested properties, the system learns which factors matter most for different buyer types. This creates a continuous improvement cycle where matching accuracy increases with use.

Real-time alert mechanisms notify brokers when high-probability matches appear. Rather than overwhelming users with every possible match, intelligent systems learn broker preferences and only surface the most relevant opportunities. This selective approach maintains broker attention and trust.

End-to-end deal sourcing requires integration across multiple platforms. MLS systems, private listing networks, and proprietary databases all contain valuable property information. The most effective AI systems aggregate data from all these sources into a single, searchable interface.

Successful AI tool development requires understanding broker priorities rather than assuming technical sophistication equals user value. Brokers prioritize tools that genuinely save time without creating additional work. They want systems they can trust with client relationships, which means accuracy and reliability matter more than advanced features.

Customization capabilities allow adaptation to specific market conditions and buyer types. A system that works perfectly in Manhattan might fail completely in rural markets without proper customization options. Brokers need flexibility to adjust algorithms and criteria based on local knowledge.

Simplicity in user interface design prevents adoption barriers. Brokers should be able to use the system without extensive training or technical expertise. The best AI tools feel intuitive and integrate naturally into existing workflows rather than requiring process changes.

Many developers overengineer solutions, creating complex systems that brokers find intimidating or time-consuming. The most successful tools focus on a few key functions rather than attempting to automate every aspect of the business.

|

Challenge |

Description |

Solution |

|

Data Quality Issues |

Inconsistent, incomplete data |

Include data cleaning and validation processes that handle inconsistencies |

|

Scalability Requirements |

Must handle more data as usage grows |

Implement cloud-based architectures and smart database design for sustainable growth |

|

Integration Complexity |

Difficulties with legacy tech and markets |

Provide multiple integration options and design solutions that work with existing broker technology |

|

User Adoption Barriers |

Brokers need clarity and training |

Develop comprehensive training and support programs with ongoing support and continuous feedback collection to address adoption barrier |

Data quality represents the biggest technical challenge. Real estate data comes in inconsistent formats with frequent missing information. Successful systems include robust data cleaning and validation processes that handle inconsistencies.

Scalability requirements grow rapidly as broker adoption increases. Systems must handle large volumes of real-time data without performance degradation. Cloud-based architectures and efficient database design become critical for sustainable growth.

Integration complexity varies widely across different real estate markets and technology stacks. Legacy systems often lack modern APIs, requiring custom integration work. The best solutions provide multiple integration options and work with existing broker technology.

User adoption requires comprehensive training and support programs. Brokers need to understand how to use systems, and why they benefit specific workflows. Successful implementations include ongoing support and continuous feedback collection to address adoption barriers.

The value of AI deal sourcing shows in measurable productivity improvements. Brokers using effective systems report reducing manual listing review time from 15+ hours weekly to less than one hour. This time savings translates directly to increased deal capacity and higher revenue potential.

Deal velocity improvements provide another key metric. Brokers who process more opportunities faster typically increase transaction volume. The most successful implementations report deal flow increases as brokers handle more opportunities without proportional increases in administrative time.

Quality metrics matter as much as quantity. Effective AI systems improve match accuracy over time, leading to higher close rates on presented opportunities. Brokers report finding deals they would have missed manually, expanding their effective market reach.

Client satisfaction often improves as brokers respond faster to inquiries and present more comprehensive market coverage. Time savings from AI automation allows more focus on client service and relationship building, the activities that differentiate successful brokers.

Advanced computer vision will soon process property photos and virtual tours automatically. Instead of reading descriptions, AI systems will analyze images to

Predictive analytics will forecast market trends and property performance based on historical patterns and current indicators. Brokers will receive current opportunities and predictions about which properties are likely to appreciate or face challenges.

Voice AI integration will enable hands-free deal sourcing and data entry. Brokers could verbally describe buyer criteria or property features, with systems automatically updating search parameters and generating new matches.

The competitive advantage belongs to developers who focus on broker user experience rather than pure technical capability. The most advanced AI means nothing if brokers find systems difficult to use or unreliable in practice.

AI-powered deal sourcing tools hold huge potential for commercial real estate brokers, but success depends on focusing on genuine user needs rather than technical complexity. The most effective systems eliminate mundane administrative tasks while preserving human expertise that actually closes deals.

OCR technology processes rent rolls and financial documents in minutes instead of hours. Intelligent matching algorithms identify opportunities brokers might otherwise miss. Integration with existing workflows ensures adoption success and measurable productivity improvements.

The key insight for developers: successful AI tools complement broker expertise rather than attempting to replace it. Brokers who adopt well-designed AI systems report

The future belongs to brokers who effectively use AI tools to amplify their capabilities. For developers, the opportunity lies in creating systems brokers actually want to use. Tools that solve real problems without creating new complexity. Start the development with the right partner today.

AI deal sourcing uses artificial intelligence to automatically scan property listings, extract relevant data, and match properties with specific buyer criteria, eliminating the need for manual review of hundreds of listings weekly.

Modern OCR systems achieve high accuracy rates for well-formatted documents. However, systems should include confidence scoring and human verification checkpoints for financial data where accuracy is critical.

No, AI cannot replace broker expertise, especially for understanding local market nuances, building relationships, and creative deal structuring. The most effective AI tools eliminate administrative tasks so brokers can focus on high-value activities.

Implementation timelines vary based on integration complexity and customization requirements. Simple systems can be deployed in weeks, while comprehensive solutions with multiple integrations may require several months of development and testing.

Brokers typically report 10-15 hours weekly time savings, increased deal velocity, and improved match accuracy. These improvements often translate to increased deal flow capacity, though actual ROI depends on market conditions and tool effectiveness.