10 Real Estate Software Development Companies in 2025

- February 03

- 9 min

AI deal sourcing is the use of artificial intelligence to find and assess real estate investment opportunities. This article explains how AI deal sourcing systems work from a developer’s perspective. It covers the technical components, the data that powers them, and their effect on the market.

Key Takeaways:

For decades, real estate deal sourcing relied on personal relationships and local knowledge. Developers and investors built networks to find opportunities before they hit the open market. This traditional method has limitations, including a narrow reach and market blind spots. The process is often inefficient, depending heavily on who you know.

PropTech innovation is changing this. Artificial intelligence is creating new ways to find both on market and off market deals. Instead of just automating old tasks, AI is fundamentally altering how investment opportunities are found and evaluated. It introduces a data first approach that makes the process more efficient and accessible.

A strong AI deal sourcing system is built on several core technical components that work together. Each part plays a specific role in turning raw data into actionable investment insights.

|

Component |

Description |

|

Data Aggregation Layer |

Connects to and gathers information from diverse sources like public records, property listings, demographic data, and economic indicators using APIs and web scraping tools. |

|

Data Processing & Normalization Engine |

Cleans, organizes, and standardizes messy and inconsistent real estate data, creating a unified model for properties and ownership to ensure accurate analysis. |

|

Machine Learning Core |

Acts as the brain of the platform, using predictive models and Natural Language Processing (NLP) to analyze data and identify properties with high investment potential. |

|

User Interface (UI) & Visualization |

Presents findings to investors through well-designed dashboards, allowing users to filter, search, and visualize opportunities on a map to make complex data easy to understand. |

First is the data aggregation layer. This part of the system connects to and gathers information from different sources. These include

Building scalable connections through APIs and web scraping tools is essential to collect a wide range of information.

Next, the data processing and normalization engine cleans and organizes the collected information. Real estate data is often messy and inconsistent. This engine standardizes the data, creating a unified model for properties and their ownership so it can be analyzed correctly.

The machine learning core is the brain of the platform. It uses predictive models to sift through the data and find properties with high potential. Natural Language Processing (NLP) is used to analyze unstructured text, like property descriptions or news articles, for valuable details.

Tthe user interface (UI) and visualization tools present the findings to investors. Well designed dashboards allow users to filter, search, and see opportunities on a map. This makes complex data easy to understand and act on.

Data is the foundation of any AI deal sourcing platform. The quality and breadth of the data directly determine the quality of the investment insights. Acquiring and managing this data involves several technical challenges.

Essential public data sources include

This information provides a baseline for property details and legal status. Private data feeds from commercial listing services and brokerage firms add another layer of valuable, timely information.

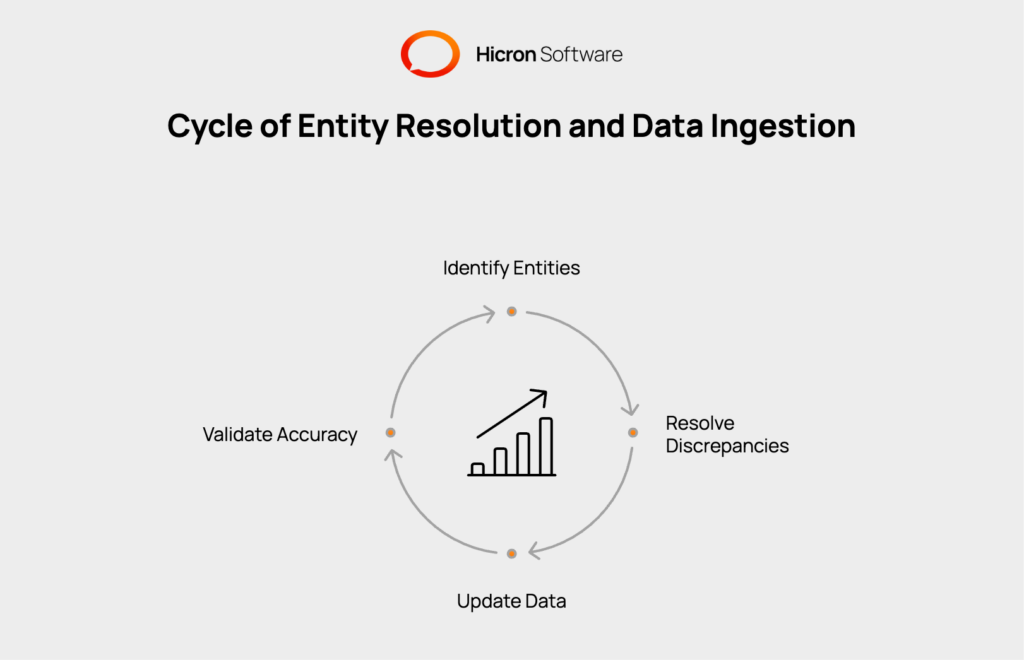

A major challenge is entity resolution. This is the process of correctly linking a single property or owner across different datasets. For example, an owner might be listed under a person’s name in one record and an LLC in another. Solving this problem is critical for building an accurate picture of ownership. The platform must also use real time data ingestion to keep information up-to-date, reflecting the latest transactions and market changes.

The machine learning models are what transform a data repository into a proactive deal sourcing tool. Creating these models requires a clear understanding of both real estate investment and data science.

The first step is to define the “ideal deal.” Investment criteria, such as desired cap rate or property type, are translated into features the machine can understand. From there, feature engineering comes into play. This involves creating new variables that help predict a property’s potential. Examples include

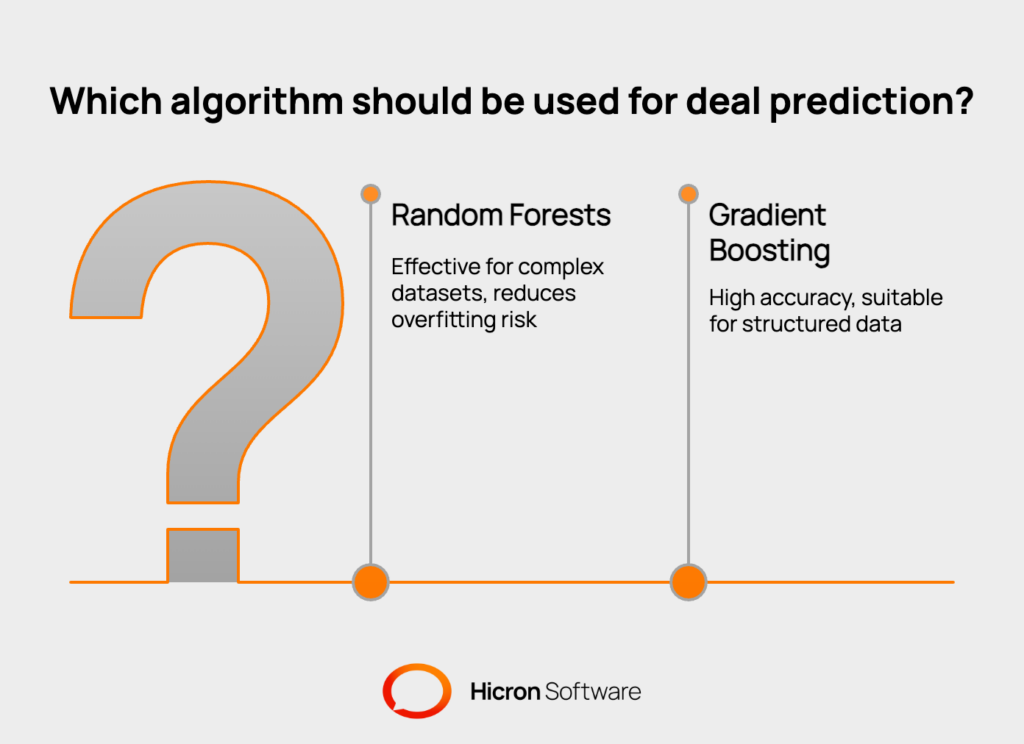

Developers then select the right algorithm for the job. Models like random forests or gradient boosting are often used to predict the likelihood of a deal. The final step is model training and validation. The algorithm is trained on historical transaction data to learn patterns. This process includes steps to avoid overfitting. This happens when a model performs well on past data but fails to predict future outcomes accurately.

AI-enhanced platforms offer specific features that give investors and developers a competitive advantage.

One of the most valuable features is off market deal detection. The system can identify properties that are not for sale but have a high probability of transacting soon. This is done by analyzing data points like owner history, mortgage information, or recent permits.

Automated underwriting is another feature worth developing. The platform can generate an initial financial analysis and pro forma projections for a property almost instantly. This helps investors quickly decide if an opportunity is worth pursuing further.

Other important features include market trend analysis and customizable alerts. Users can visualize

to inform their strategy. They can also set up watchlists to receive notifications when a property matching their specific criteria is identified.

The widespread adoption of AI in deal sourcing is having a broad effect on the real estate market. It is promoting greater market transparency. Information that was once difficult to find is now more accessible.

AI deal sourcing technology levels the playing field. Smaller investors can now use AI-enhanced tools to compete with larger, more established firms. AI allows them to find and analyze deals with a level of sophistication that was previously out of reach.

The role of the real estate broker is also evolving. With AI handling much of the data collection and initial analysis, brokers can focus more on providing strategic advice and managing relationships. AI helps uncover opportunities in emerging or overlooked markets that traditional methods might miss.

Building and maintaining these complex systems presents several challenges. Developers face technical hurdles like managing high data acquisition costs. This can be mitigated by prioritizing high-value public data and forming strategic data-sharing partnerships.

Ensuring data accuracy requires continuous validation and cleansing routines, while maintaining system performance demands a commitment to scalable cloud architecture and automated monitoring.

|

Challenge |

Solution |

|

Managing high data acquisition costs |

Prioritize high-value public data and pursue strategic data-sharing partnerships. |

|

Ensuring data accuracy |

Implement regular validation and cleansing routines. |

|

Maintaining complex systems |

Use scalable cloud architectures and automated performance monitoring. |

Ethically, developers must address potential biases in algorithms by regularly auditing models for fairness and ensuring data privacy through security best practices like data encryption and access controls.

Future Innovations:

AI deal sourcing platforms are built by combining data aggregation, processing engines, and predictive machine learning models into a cohesive system. The value created is clear: these platforms provide investors with a more efficient, transparent, and data-driven way to find and analyze opportunities. From off-market deals to automated underwriting. This modern real estate technology does not replace human expertise. It enhances, allowing developers and brokers to focus on strategy and relationships. As data becomes more accessible and algorithms more advanced, the future of real estate investment will belong to those who successfully pair code with capital.

AI systems analyze various data points, such as owner’s time in property, loan information, and local permit filings, to identify properties that are likely to be sold soon, even if they are not listed for sale.

Python is very popular for machine learning and data processing, while languages like JavaScript are used for building the user interface. Cloud platforms like AWS or Google Cloud provide the necessary infrastructure.

Reputable platforms use publicly available data and follow privacy regulations. They focus on property characteristics and ownership records from public sources, not sensitive personal information.

Yes, a key feature of these platforms is customization. Users can set specific criteria, such as property type, location, and financial metrics, to tailor the deal sourcing process to their unique strategy.

The biggest challenge is data quality and integration. Real estate data comes from many sources in different formats, so cleaning, standardizing, and resolving entities to create a single, accurate view is a constant effort.