11 DevOps Automation Tools to Streamline Your Workflow

- May 21

- 10 min

Contingency plans are backup strategies that help businesses handle unexpected problems before they become disasters. These detailed action plans outline specific steps to take when things go wrong, from equipment failures to natural disasters. Every business faces risks, but companies with proper contingency plans recover faster and protect their operations better than those caught unprepared.

This article explains what contingency plans are, why they matter, and how to create effective backup strategies for your business. You’ll learn practical steps to identify risks, develop response plans, and protect your company from disruptions.

Key Takeaways:

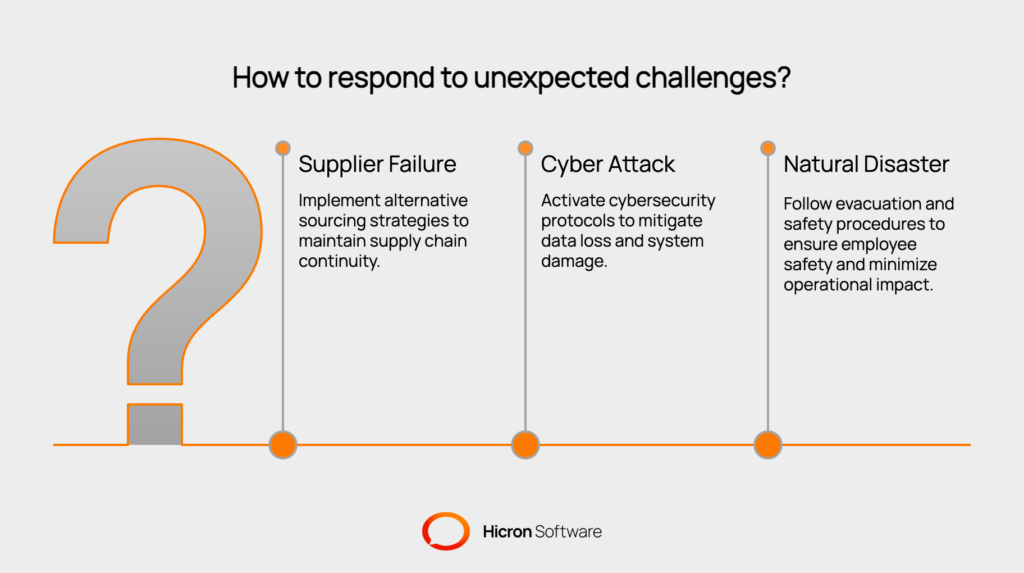

A contingency plan is a proactive strategy that prepares your business for potential disruptions. Unlike simple backup plans, contingency plans provide detailed instructions for specific scenarios. They answer critical questions: What happens if your main supplier fails? How do you handle a cyber attack? What steps do you take during a natural disaster?

These plans work as decision-making guides during stressful situations. When crisis strikes, clear thinking becomes difficult. Your contingency plan provides logical steps that help teams respond quickly and effectively.

The best contingency plans include specific details like

They remove guesswork from crisis response and help maintain business operations even when facing unexpected challenges.

Business disruptions happen more often than most owners expect. Equipment breaks down, key employees leave unexpectedly, and natural disasters strike without warning. Companies without proper planning often struggle to recover, while prepared businesses bounce back quickly.

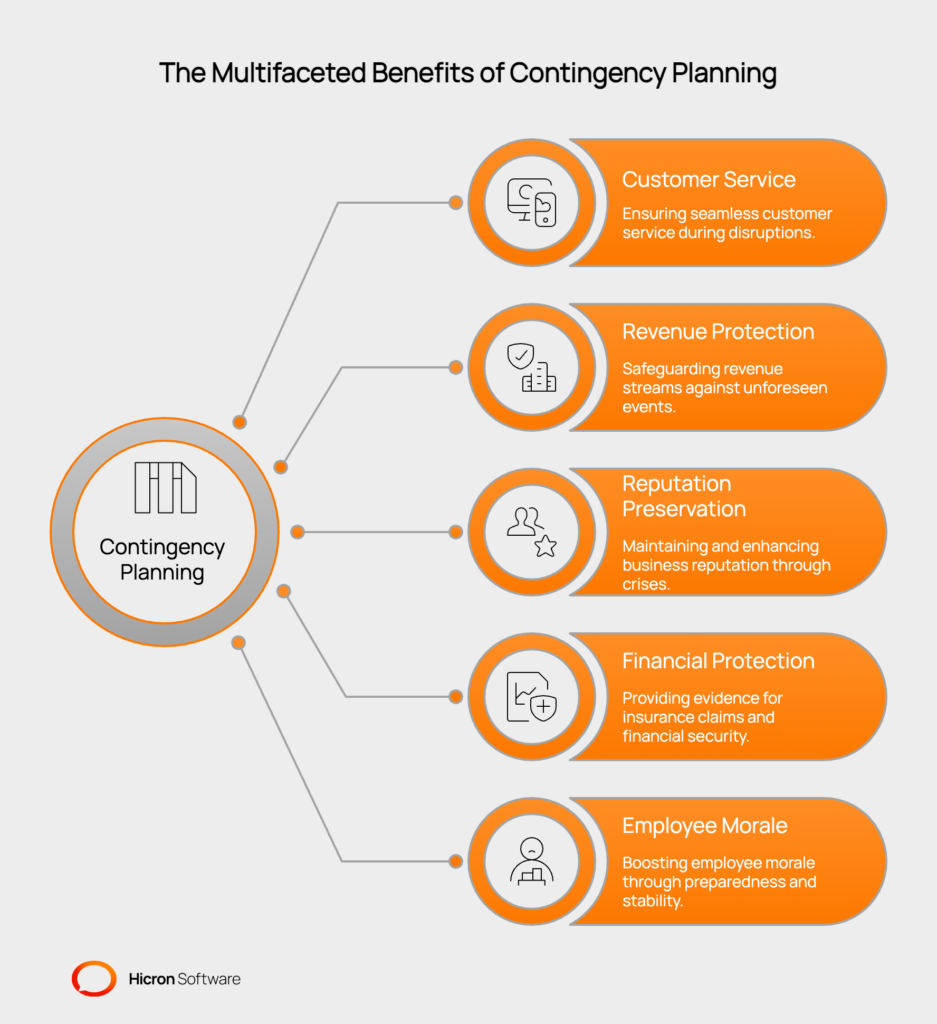

Contingency plans protect multiple aspects of your business. They help maintain customer service during disruptions, protect revenue streams, and preserve your company’s reputation. When customers see you handle problems professionally, their confidence in your business actually grows.

Financial protection represents another key benefit. Many insurance policies require evidence of proper planning to process claims. Your contingency plan serves as that proof, potentially saving thousands in uncovered losses.

Employee morale also improves when workers know leadership has prepared for various scenarios. This reduces workplace anxiety and builds confidence in company stability.

|

Risk Category |

Description |

|

Technology Failures |

Computer systems crash, internet connections fail, and software breaks down regularly. Contingency plans should cover data backup procedures, alternative communication methods, and temporary work solutions when email systems or main software stop working. |

|

Supply Chain Problems |

Suppliers go out of business, shipping delays occur, and material shortages happen frequently. Plans should identify backup suppliers, maintain emergency inventory levels, and establish relationships with multiple vendors across different regions. |

|

Personnel Issues |

Key employees quit, get injured, or become unavailable during critical times. Plans should address knowledge transfer, temporary staffing solutions, cross-training programs, process documentation, and maintaining contact lists for temporary staff. |

|

Natural Disasters |

Storms, floods, fires, and other natural events can shut down operations for days or weeks. Plans should address building damage, employee safety, data protection, and alternative work locations. |

|

Economic Downturns |

Market changes, economic recessions, and industry disruptions can dramatically impact revenue. Plans should include cost-cutting measures, alternative revenue sources, and cash flow management strategies. |

Creating a contingency plan may seem overwhelming, but breaking it down into manageable steps makes the process straightforward and achievable. A well-structured approach helps ensure you don’t miss critical risks or overlook important details that could make the difference during an actual crisis. The following five-step guide will walk you through building comprehensive contingency plans that protect your business operations. By following these steps, you’ll create actionable plans that your team can execute confidently when unexpected challenges arise.

Start by listing everything that could disrupt your business operations. Consider both internal risks like equipment failure and external risks like natural disasters. Involve your team in brainstorming sessions to identify potential problems you might miss.

Use a simple rating system to evaluate each risk based on how likely it is to happen and how much damage it could cause. Rate both factors on a scale of 1 to 5, then focus your planning efforts on the highest-scoring risks first.

Don’t forget about chain reactions. A power outage might seem minor, but it could trigger security system failures, spoil inventory, and prevent customer communication.

For each major risk, create specific response strategies that answer these questions: What immediate actions will you take? Who handles each task? What resources do you need? How will you communicate with customers and employees?

Write clear, actionable steps instead of vague instructions. Instead of “contact customers,” write “Marketing Manager calls top 10 clients within 2 hours using the contact list in the shared drive.”

Include decision points in your plans. Sometimes situations develop differently than expected, so build in flexibility while maintaining clear guidance.

Create a crisis response team with specific roles for each member. Include a crisis commander who makes final decisions, a communications lead who manages messaging, and an operations lead who handles recovery efforts.

Make sure every critical role has backup coverage. Your primary crisis commander might be traveling when disaster strikes, so someone else needs to know how to step in immediately.

Document contact information for all team members and keep it updated regularly. Include both work and personal phone numbers since emergencies often happen outside normal business hours.

Write down your plans in detail so anyone can follow them. Include contact information for team members and vendors, step-by-step procedures for each scenario, and important account details like insurance policy numbers.

Store copies in multiple locations, including cloud storage that remains accessible during local disasters. Print emergency copies and keep them in different physical locations too.

Create quick reference cards that employees can keep at their workstations. These should include key contacts, evacuation procedures, and their specific roles during different emergencies.

Plans that sit on shelves don’t work when you need them. Schedule regular tests to practice your procedures. Start with simple discussions where teams talk through scenarios, then progress to more realistic simulations.

After each test, gather feedback from participants. What worked well? What caused confusion? What resources were missing? Use this information to improve your plans.

Update your contact information quarterly and review your entire contingency plan at least once per year. Business changes constantly, so your plans need to evolve too.

Develop clear communication templates for different audiences. Employees need different information than customers or vendors. Create message templates you can customize quickly during actual crises.

Establish backup communication methods beyond email and phone systems. Consider text messaging, social media, or even traditional mail for different scenarios.

Practice your communication procedures during training exercises. Make sure everyone knows how to reach team members and key contacts when normal systems fail.

The best contingency plan fails without proper training. Conduct regular reviews of your procedures with all employees. New hires should learn about contingency plans during their first week.

Keep training sessions short and focused. Cover one scenario at a time rather than overwhelming people with too much information. Use real examples to help employees understand when and how to use different procedures.

Create simple checklists that employees can reference during actual emergencies. Stress situations make it hard to remember complex procedures, so simple guides work better than detailed manuals.

Review your contingency plans whenever you make major business changes. New locations, equipment, suppliers, or services might require plan updates. Set calendar reminders to check contact information and procedures regularly.

Monitor industry trends and emerging risks that might affect your business. New types of cyber threats, changing regulations, or economic shifts might require plan adjustments.

Consider getting professional help for complex planning needs. Risk management consultants can identify problems you might miss and help design comprehensive response strategies.

Companies with well-developed contingency plans experience faster recovery times when problems occur. Pre-planned responses eliminate confusion and help teams act quickly. This reduces downtime and gets operations running sooner.

Financial benefits include reduced losses from business interruptions and faster insurance claim processing. When you can document your preparation and response efforts, insurers typically process claims more quickly and completely.

Customer relationships often strengthen when crises are handled professionally. Clients notice companies that maintain service levels during difficult times, which builds long-term loyalty and trust.

Employee confidence improves when workers know leadership has planned for various scenarios. This reduces workplace anxiety and turnover during uncertain periods.

Many insurance companies offer discounts for businesses with documented contingency plans. Your preparation directly reduces their risk, creating savings you can invest back into your business.

Begin your contingency planning with these immediate steps. Schedule a risk assessment meeting with your team this month. Identify your top three business risks and start developing response strategies for each one.

Create a basic communication plan with employee and customer contact methods. Research backup solutions for your most critical business functions like payment processing or inventory management.

Document your current emergency procedures and identify gaps that need attention. Start simple and build complexity over time rather than trying to create perfect plans immediately.

Remember that contingency planning is an ongoing process, not a one-time project. Start with your biggest risks, test your plans regularly, and improve them based on what you learn.

The question isn’t whether your business will face unexpected challenges. The question is whether you’ll be ready when they happen. With proper contingency planning, you can turn potential disasters into manageable problems.

A basic contingency plan should include risk identification, response procedures, contact information for key personnel, communication templates, and recovery steps. Start with your most likely risks and expand from there.

Review your contingency plans at least annually or after major business changes like new locations, equipment, or key personnel. Check contact information quarterly to ensure accuracy during emergencies.

Include representatives from all major business functions like operations, finance, HR, and customer service. Key employees who understand daily operations and potential risks should participate in the planning process.

Contingency plans are action strategies that help you respond to problems, while insurance provides financial protection after losses occur. You need both for complete business protection, and many insurers require contingency plans for coverage.

Start with tabletop exercises where teams discuss scenarios verbally. Progress to limited simulations testing specific procedures, then conduct full-scale drills. Test communication systems, backup equipment, and employee knowledge regularly.