Automating Insurance Operations with EDI and AI

- April 24

- 17 min

Imagine watching your favorite detective show, where mountains of clues are scattered, and the hero is desperately piecing it together before the big reveal. That’s kind of what traditional claims processing feels like. It’s slow, manual, and filled with opportunities for things to go wrong. Endless forms, data that doesn’t match up, and back-and-forth communication can turn a simple process into a nightmare for insurers and policyholders alike.

Now, enter EDI claims processing with AI, the tech world’s equivalent of Jarvis from Iron Man or the supercomputer from Person of Interest. EDI claims processing with AI can sift through mind-boggling amounts of data in seconds, spotting patterns and mistakes that human eyes might miss. On the other hand, EDI (Electronic Data Interchange) acts as the smooth operator, ensuring information flows seamlessly between systems without the headaches of manual input. Together, they don’t just fix the inefficiencies of claims processing; they completely transform it, making it faster, smarter, and more accurate.

This article dives into how this powerful duo is shaking up the insurtech industry and replacing clunky processes with cutting-edge insurance technology solutions. Whether you’re part of an insurtech startup, working with a forward-thinking insurance software company, or just curious about where insurance tech is headed, you’ll see how AI and EDI make claims processing less like detective work and more like magic.

AI and EDI might sound like something out of a sci-fi movie, but together, they are revolutionizing insurance workflows in the real world. On their own, AI (Artificial Intelligence) and EDI (Electronic Data Interchange) are valuable tools. AI excels at analyzing data, identifying patterns, and predicting outcomes, while EDI seamlessly facilitates the exchange of information between systems. But when you put them together, they become a true powerhouse for claims processing.

Picture this synergy like your favorite dynamic duo. Think Batman and Robin or peanut butter and jelly. EDI sets the foundation by ensuring accurate and efficient data exchanges between insurers, policyholders, and partners. Then AI steps in, almost like the brains of the operation, interpreting that data in real-time and providing insights that lead to faster, more informed decisions.

For example, instead of waiting hours or days for manual input and verification, AI uses machine learning to quickly identify inconsistencies or potential fraud within the data provided by EDI. This collaboration saves precious time, improves accuracy, and takes claims automation software to the next level.

What makes this combination such a game-changer? It’s all about automation. Manual claims processing is not just time-consuming; it’s prone to human error. Small mistakes in data interpretation can lead to costly delays and disputes.

By using AI to make sense of data transmitted via EDI, insurers can massively reduce these errors. The result? Claims are handled faster, policyholders are happier, and insurers can focus on innovation instead of damage control.

This shift represents one of the most impactful examples of digital transformation for insurance. It demonstrates how advanced technologies are moving the insurance tech industry forward from manual, outdated workflows towards a future defined by speed, efficiency, and customer satisfaction.

For insurers and policyholders alike, AI and EDI aren’t just tools but a competitive advantage in modern claims handling.

When it comes to claims processing, accuracy is everything. A slight mistake can lead to delays, disputes, or even financial losses for insurers. Yet, in traditional systems, these errors are all too common. That’s where AI-powered claims solutions step in, effectively taking the guesswork out of the process by working hand-in-hand with EDI to ensure precise and efficient data handling.

In claims processing, AI is a meticulous proofreader who never takes a break. It analyzes EDI (Electronic Data Interchange) data in real-time, scanning for inconsistencies or anomalies that might slip past human eyes. For instance, imagine someone entering their address wrong or forgetting to include a policy ID number. By applying predictive analytics, AI flags these potential inaccuracies before the claim gets through the initial stages. It’s like having your built-in safety net, ensuring issues are spotted and fixed early on.

Here’s a practical example. Powered by machine learning, predictive algorithms can assess historical trends and flag claims that deviate significantly from standard patterns. If a medical claim payment seems unusually high compared to similar past cases, the system raises a red flag for further review. This stops errors or fraud and saves time by minimizing the back-and-forth typically needed to correct mistakes after the fact.

What is the result here? A significant improvement in overall claims accuracy. By automating manual error-checking and optimizing workflows, insurers can process claims much more efficiently, reducing costly delays. Policyholders experience faster resolutions, building trust and satisfaction in the process.

Ultimately, this upgrade is a win-win. With predictive analytics for insurers driving better decisions, claims processing is no longer bogged down by preventable errors. For insurance providers striving to stay competitive, these AI tools aren’t just a bonus; they’re essential to delivering seamless, reliable service in today’s fast-paced world.

With AI and EDI working as a high-tech team, insurers are rewriting the rules on fraud detection. Fraud becomes harder to commit, legitimate claims get approved faster, and the entire industry benefits from a more secure system. This is what modern insurance technology is all about!

Fraud detection in insurance isn’t what it used to be. With the power of machine learning, insurers now have a tireless and highly efficient “detective” analyzing their data. AI-powered systems scan vast amounts of EDI (Electronic Data Interchange) data to identify unusual patterns or anomalies. These intelligent models compare historical claims data with current submissions, flagging inconsistencies that might indicate fraud. For instance, if a claim is submitted for repairs well above the market average or includes mismatched details, AI spots the issue immediately, not in weeks or months. This ability to process and interpret data at lightning speed allows insurers to stay one step ahead of potential fraudsters.

AI fraud detection systems operate in real-time, meaning insurers don’t have to wait for lengthy manual reviews. Predictive models assess claims as they’re being processed, flagging irregularities instantly. Automated systems identify red flags such as duplicate submissions, claims from unusual locations, or services inconsistent with typical patterns.

For example, if two identical claims for the same policyholder come from different geographic areas, AI will immediately alert insurers to investigate further. This quick, automated intervention ensures fraudulent claims are intercepted before they can cause financial damage.

AI and EDI integration is a game-changer for insurers across different sectors, seamlessly balancing fraud prevention and efficient service for genuine claims. Here are some additional scenarios showcasing how this dynamic duo keeps fraudsters at bay while speeding up legitimate claims:

Auto insurance: Spotting unusual repair costs

Picture this: A claim for car repairs comes in after an accident. While the damage described seems minor, the repair estimate submitted is shockingly high compared to similar cases. Using AI fraud detection, the system cross-checks the claim with previous repair data and flags the excessive cost as a potential red flag.

Additionally, it might notice similar repair shop addresses tied to multiple claims with inflated prices, suggesting a possible fraud ring. Thanks to this proactive detection, the insurer can investigate these anomalies while quickly greenlighting valid claims for customers needing their cars back on the road.

Health insurance: Uncovering medical billing schemes

Health insurance fraud is notoriously complex, but AI-powered systems make it manageable. Imagine a claim submitted for multiple costly procedures under one patient’s name. The AI system detects that these procedures don’t align with the patient’s medical history or the diagnosis provided.

Further analysis uncovers a pattern of identical claims submitted by the same clinic for other patients, pointing to a potential billing scam. Meanwhile, legitimate claims, such as a routine doctor visit or prescription renewals, sail through without delays, keeping policyholders satisfied.

Property insurance: Detecting duplicate damage claims

Regarding property insurance, AI helps identify unusual activities like duplicate claims for the same damage. Imagine a policyholder submits a claim for roof repairs after a storm. The AI system determines that a similar claim for the same address was filed last year, with no record of recent maintenance.

This anomaly suggests intentional fraud or a misunderstanding that can be resolved through further investigation. Simultaneously, claims for emergency repairs, such as a broken water pipe, are quickly processed, ensuring customers get help when needed.

Travel insurance: Identifying inflated loss claims

Traveling can be stressful when things go wrong, but insurance fraud makes it worse for everyone. AI systems help by identifying inflated claims for lost luggage or stolen items. For instance, someone claims their expensive jewelry and high-end electronics were stolen during a trip, presenting receipts as proof.

The AI fraud detection tool notices that the receipts are digitally altered or don’t match expected purchase patterns. This prompts the insurer to pause the payout until the claim is verified. At the same time, genuine claims for lost baggage or delayed flights are approved without any extra hurdles, ensuring a good customer experience.

Life insurance: Analyzing suspicious policy patterns

Life insurance fraud can be complicated, but AI simplifies the process. For example, AI might notice a surge of small policies taken out by the same person across multiple insurers. These policies could have unusually similar beneficiary details, suggesting a potential fraud scheme tied to staged or false claims. The AI flags these patterns for further review while allowing honest families to file legitimate claims so loved ones receive their payouts promptly.

AI-powered automated claim systems and insurance technology tools don’t just look for fraud in isolation; they foster a holistic approach that ensures honest policyholders aren’t inconvenienced while fraudulent activities are stopped. By integrating AI with EDI data, insurers across all sectors can maintain security, trust, and efficiency for every claim.

Imagine filing an insurance claim and having it processed almost instantly—that’s the promise of real-time automation powered by AI and EDI (Electronic Data Interchange). By streamlining complex workflows and eliminating delays, these technologies ensure that insurers and policyholders experience a faster, more efficient claims process.

Traditional claims processing often involves multiple steps, like data entry, manual reviews, and back-and-forth communication. These steps, while necessary, can slow down settlements and frustrate policyholders. This is where real-time claims processing shines. AI systems analyze incoming EDI data on the spot, cross-referencing it with historical records and predefined rules to flag potential issues and approve straightforward claims immediately. This rapid assessment minimizes the bottlenecks that stem from manual interventions, enabling insurers to handle higher claim volumes easily.

For instance, in auto insurance, AI tools can instantly verify accident details like location, weather conditions, and repair estimates provided through EDI. Claims that meet validity criteria are approved within minutes, while anomalies are sent for further investigation. This efficiency doesn’t just save time for insurers; it also provides swift resolution to customers when they need it most.

Combined with AI’s analytical power, EDI plays a pivotal role in real-time data exchange. Think of EDI as the bridge that connects insurers with policyholders, repair centers, medical providers, and others involved in the claims process in a seamless flow of information. When this exchange happens in real-time and is filtered through AI algorithms, insurers can quickly understand and act on the data they receive.

For example, a home insurance claim for water damage might include repair estimates, contractor details, and photographic evidence shared instantly via EDI. AI systems process this information, comparing it to similar claims and detecting inconsistencies or overcharges. Meanwhile, genuine claims are fast-tracked for approval.

Without EDI’s instant data exchange and AI’s oversight, this level of speed and accuracy simply wouldn’t be possible.

At the heart of this technological advancement is improving the customer experience. Insurance isn’t just about financial protection; it’s also about building trust. Customers want to feel assured that their claims will be handled quickly and fairly. Real-time, automated claims management delivers on these expectations.

Insurers can vastly improve customer satisfaction by reducing the settlement time from weeks to days or even hours. Policyholders no longer have to wait anxiously for updates or repeatedly contact the claims department. Instead, they receive prompt notifications about the status of their claims, creating a positive, reliable experience during what is often a stressful time.

From faster payouts to fewer disputes, real-time claims processing transforms every aspect of the customer relationship. Meanwhile, insurers benefit from streamlined operations, reduced costs associated with manual processing, and improved customer retention. This is the future of automated claims management, and the harmony between AI and EDI powers it.

Insurance companies face constant pressure to deliver exceptional service while keeping operational costs in check. AI and EDI integration have become game-changers for insurers aiming to meet these demands. This technological duo delivers tangible benefits that transform the way insurers operate by automating claims workflows, minimizing errors, and adapting to peak volumes.

Handling claims manually not only requires significant manpower but also increases the chances of human error. Whether incorrect data entry or missing information, each error costs time and money to fix. With AI in insurance working alongside EDI, much of the claims process is automated. AI algorithms analyze the data exchanged via EDI in real time, ensuring faster validation and error-free submissions. This minimizes the need for manual reviews, freeing up resources and cutting down on administrative costs.

For example, an automated system can flag incomplete claims information and request missing paperwork without requiring an employee to intervene. This results in direct cost savings and allows insurers to allocate their skilled workforce to more complex, value-added tasks like fraud investigations or customer retention strategies.

The speed at which claims are processed directly impacts customer satisfaction. No one enjoys the anxiety of waiting weeks for a claim to settle. AI-powered systems integrated with EDI streamline the process by instantly analyzing claims data, verifying its accuracy, and automatically identifying valid claims for approval.

When claims are processed in record time, customers take notice. Faster turnarounds translate into improved customer satisfaction ratings. For instance, if a policyholder files a claim after property damage from a storm, AI and EDI systems can expedite the flow of information from contractors, assess the damages, and initiate payout within days instead of weeks. Insurers build deeper trust and long-term relationships with their customers by providing such swift resolutions.

One of the biggest challenges insurers face is handling surges in claims volume, whether due to natural disasters, pandemics, or other widespread events. Traditional infrastructure often struggles to meet these spikes without resorting to significant overtime or hiring additional staff. However, AI and EDI integration offer unmatched scalability.

AI systems can handle large datasets and effortlessly adapt to sudden increases in claims. EDI ensures that all submitted data is standardized, making it easier for AI to process and analyze, regardless of volume. This adaptability allows insurers to maintain consistent service levels even during peak periods. Whether it’s processing thousands of auto insurance claims after a hailstorm or managing health insurance claims during a sudden flu outbreak, these systems ensure reliability and efficiency.

AI in insurance, combined with the power of EDI benefits, is reshaping how insurers conduct business. The result is a trifecta of reduced costs, rapid service delivery, and scalability that positions insurers to stay competitive in an industry where customer expectations continue to climb. Automated claims processing systems improve operational efficiency and strengthen relationships with policyholders by delivering faster, more accurate outcomes.

Insurers who invest in this advanced technology now stand to gain not just in the short term, but also in long-term growth and customer loyalty. By leveraging AI and EDI integration, they’re not just keeping up with the times, but defining the insurance industry’s future.

These case studies illustrate the game-changing potential of AI and EDI in the insurance world. From fighting fraud to managing disasters, these technologies aren’t just improving processes; they enable insurers to scale, save costs, and regain customer loyalty. By leveraging these tools, companies stay competitive in an industry where efficiency and trust are everything.

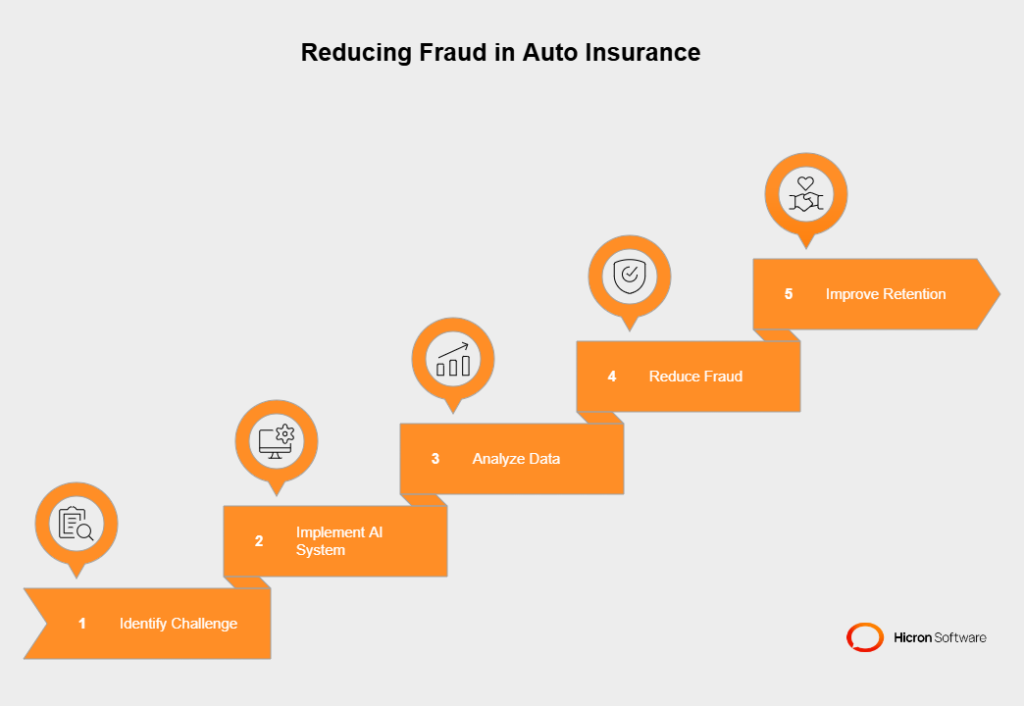

Challenge: A leading auto insurance provider faced escalating cases of fraudulent claims, including staged accidents, exaggerated damages, and collusion with repair shops. These fraudulent activities were draining their revenue and driving up premiums for honest policyholders. The insurer needed a smarter way to detect and deter fraud without disrupting legitimate claims.

Solution: The company implemented an AI-powered fraud detection system integrated with EDI. Using real-time data exchange, EDI ensured seamless transfer of details like accident reports, repair estimates, and previous claim histories. AI algorithms analyzed this data to identify suspicious patterns and anomalies. For example, the system flagged a repair shop submitting unusually high estimates for minor damages across multiple claims.

Outcome: Within the first year, the insurer reduced fraudulent payouts by 35%, saving millions. The automated system allowed investigators to focus on high-risk cases while legitimate claims were processed faster. By leveraging AI and EDI, they also restored customer confidence, which is evident in a 20% improvement in retention rates.

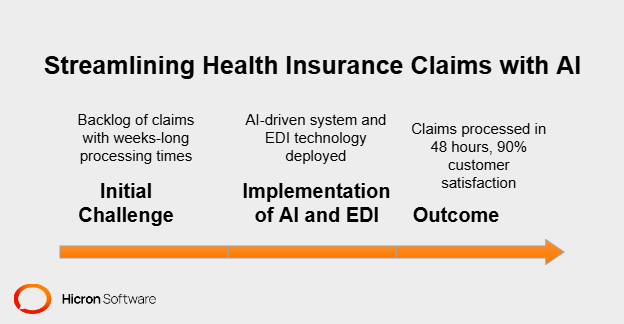

Challenge: A health insurance provider was experiencing a backlog of claims, with processing times stretching to several weeks. The issue stemmed from manual data cross-checking, inconsistent submission formats, and over-reliance on human review. Customers frequently complained about delays in reimbursements, putting the company at risk of losing trust.

Solution: The insurer deployed an AI-driven claims management system alongside EDI technology. EDI automated the submission of medical records and billing information in standardized formats. Simultaneously, AI verified policy coverage, flagged discrepancies, and categorized claims based on urgency. For example, critical claims like hospitalizations were fast-tracked, while routine check-ups went through standard workflows.

Outcome: Turnaround times for most claims dropped from an average of 15 days to just 48 hours. With 90% of policyholders reporting satisfaction with the new process, customer ratings soared. Operationally, the insurer cut administrative costs by 25%, redirecting resources to customer service initiatives.

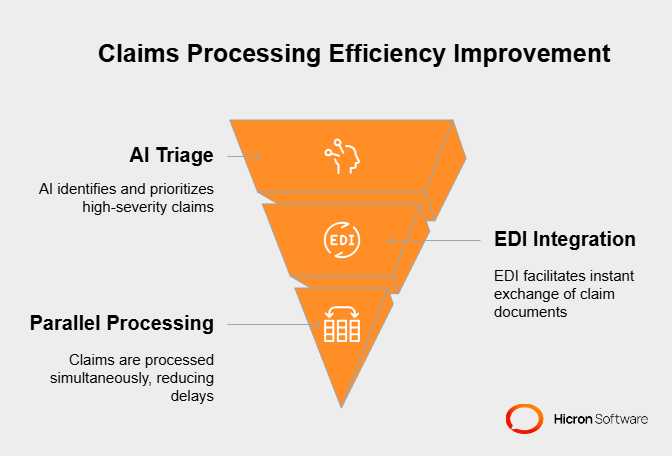

Challenge: A property insurance company was overwhelmed after a severe hurricane resulted in thousands of claims in just a few days. Their traditional processing methods couldn’t keep up, leading to a bottleneck that frustrated customers and delayed payouts.

Solution: The company turned to AI-powered automation and EDI integration to handle the surge. AI systems triaged claims by severity, automatically identifying key priorities like total property loss. Meanwhile, EDI facilitated instant exchanges of repair estimates, adjuster reports, and photographic evidence submitted by policyholders. This enabled the insurer to process claims in parallel rather than sequentially.

Outcome: The insurer processed 70% of claims within the first week, significantly improving from the usual 3-week timeframe. High-severity cases were addressed first, ensuring timely payouts for those in urgent need. The new system reduced administrative strain, maintained customer trust during a crisis, and reinforced the company’s reputation for reliability.

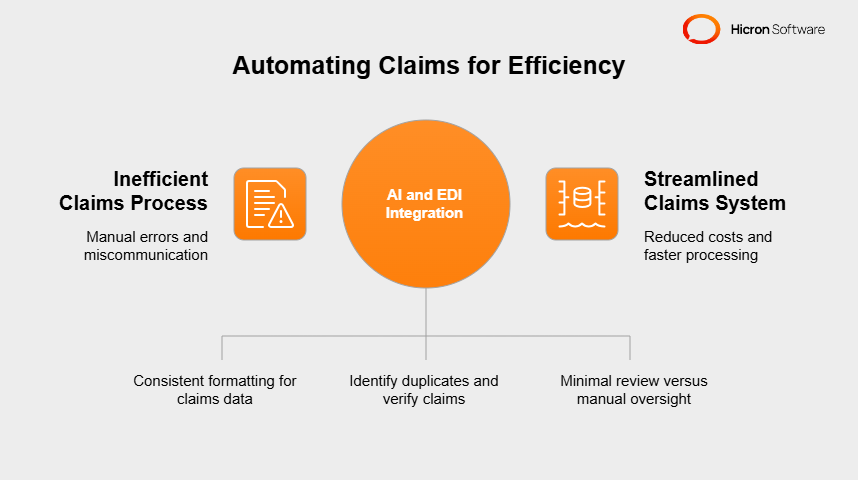

Challenge: A mid-sized insurer handling auto and property insurance wanted to cut costs, reduce manual errors, and scale operations to accommodate a growing customer base. However, their claims process was riddled with inefficiencies like duplicate entries, miscommunication between departments, and repetitive manual checks.

Solution: AI and EDI integration were introduced to automate routine tasks. EDI ensured consistent formatting for claims data submitted by policyholders, repair shops, and contractors. AI identified duplicates, verified the authenticity of claims, and assessed which claims required minimal review versus manual oversight.

Outcome: Processing times were reduced by 40%, and error rates dropped significantly. The streamlined system saved the company 30% in operational costs annually. As a result, the insurer could handle a 20% increase in claims volume without adding new staff, paving the way for sustainable growth.

The way insurance claims are handled today is already light-years ahead of what it used to be. Think about the difference between taking the scenic back roads versus cruising on a modern highway. With tools like AI-powered analytics and self-learning EDI systems driving the industry forward, the claims process is heading for a faster and smoother route. But just like navigating any road trip, insurers need to stay adaptable and work together with the right partners to keep the ride steady.

AI analytics is like having a GPS system that doesn’t just show you the way but anticipates traffic, suggests shortcuts, and even predicts future roadblocks. For insurers, this means more than just analyzing raw data. AI helps identify patterns, like spotting fraudulent claims that might otherwise slip under human radar. It’s akin to catching a tiny crack in your windshield before it turns into a spiderweb; the earlier you catch it, the less costly it becomes.

Another powerful example is in forecasting. AI leverages years of data to predict when and where claims might spike. For instance, insurers can preemptively allocate resources during hurricane season to handle increased claims volume. It’s like knowing it’ll rain tomorrow and bringing an umbrella instead of getting caught in a downpour unprepared.

Standard EDI systems have been around for years, acting like a well-oiled conveyor belt, moving information quickly and consistently. But self-learning EDI systems take it up a notch. Imagine that conveyor belt adjusting to different package sizes, fixing jams on its own, and making everything run smoother the longer it operates.

For example, these systems can notice recurring issues, like discrepancies in submitted claims from specific vendors, and then automatically adjust to address them. Over time, this reduces errors and speeds up processing. It’s the difference between a machine you need to babysit and one that learns to work better independently.

No one likes to be stuck in their ways, especially in an industry like insurance, where things are constantly shifting. Being adaptable is like having an off-road vehicle; if the road ahead gets bumpy, you can adjust and keep going without losing traction.

Insurers need systems to scale up for heavier claims loads or pivot for new regulations. For example, an AI program might start by focusing on fraud detection, but should be flexible enough to handle other tasks, like customer inquiries, as demands change. It’s not about replacing old tools; it’s about ensuring the tools grow with your business.

Insurers can’t do this alone. Partnering with tech providers is like hiring a mechanic for your car on a long road trip. They already know the ins and outs, so you don’t need to figure everything out yourself.

Tech providers can help tailor AI models or reconfigure EDI systems to fit your needs, like creating claims processes for smaller-scale operations or customizing platforms for global enterprise use. When everyone works together, insurers can focus less on troubleshooting and more on driving business growth.

Preparing for the future of claims processing is about making smart decisions today. AI-powered analytics and self-learning EDI systems will keep insurers ahead of the curve, helping them process claims faster, reduce unnecessary costs, and support customers in meaningful ways.

But the key to all this lies in adaptability and collaboration. By staying flexible and teaming up with experts, insurers won’t just keep up with change; they’ll thrive, building stronger processes and relationships with their policyholders. Like any great road trip, this future comes down to preparation, the right technology, and partnering with those who understand the twists and turns ahead.

AI and EDI technologies are transforming how insurers manage claims, offering streamlined workflows, improved accuracy, and faster resolutions. AI-powered analytics excel at detecting fraud early, forecasting claims surges, and providing actionable insights. Meanwhile, self-learning EDI systems adapt automatically to inefficiencies, reducing processing errors and handling high claims volumes. These advancements lead to cost savings, better customer experiences, and more efficient operations.

For insurers, the time to act is now. The industry is moving rapidly towards technology-driven solutions, and those who delay risk falling behind competitors leveraging these tools to enhance service delivery and build trust with policyholders. Adopting these systems isn’t just about keeping up; it’s about setting a foundation for growth in an increasingly dynamic environment.

Remaining competitive requires forward-thinking innovation in claims management. By integrating AI and EDI, insurers position themselves as leaders in efficiency and customer satisfaction while preparing to tackle future challenges head-on. Investing in these technologies today ensures a smarter, faster, and more resilient claims process for tomorrow.