Technological Innovations that Improve Predictability in Automotive After-Sales Services

- May 28

- 10 min

In the dynamic landscape of the automotive industry, importers and OEMs are increasingly recognizing the transformative power of custom vehicle finance solutions. As the demand for automation and personalization in vehicle offers continues to rise, these tailored automotive finance innovation solutions are becoming indispensable for enhancing customer satisfaction and driving business success. While off-the-shelf automotive finance solutions offer a baseline of functionality, they often fall short when it comes to flexibility and integration. In contrast, tailored software for automotive empowers businesses to create unique, customer-centric offers that are perfectly aligned with their brand identity and the specific needs of their consumers.

By investing in custom vehicle finance solutions, importers and OEMs can automate complex processes, ensuring efficiency and accuracy while simultaneously providing personalized experiences that truly resonate with today’s discerning buyers. This approach boosts customer satisfaction and fosters greater loyalty, as customers feel understood and valued. Furthermore, custom-made vehicle finance software allows businesses to integrate car finance solutions into their existing systems, enhancing operational coherence and strategic agility. As a result, companies can maintain a competitive edge in the market, leveraging their tailored solutions to attract and retain customers in a rapidly evolving automotive landscape. This investment is not just about meeting current demands, but about future-proofing businesses by ensuring they can adapt to changing market dynamics and consumer expectations.

Keeping your automotive business ahead of the curve is more than just a goal, it’s a necessity. Today, innovative vehicle finance solutions are revolutionizing how automotive companies compete and grow. These financial strategies serve as a powerful engine, driving companies to keep pace with the industry’s rapid evolution and lead it.

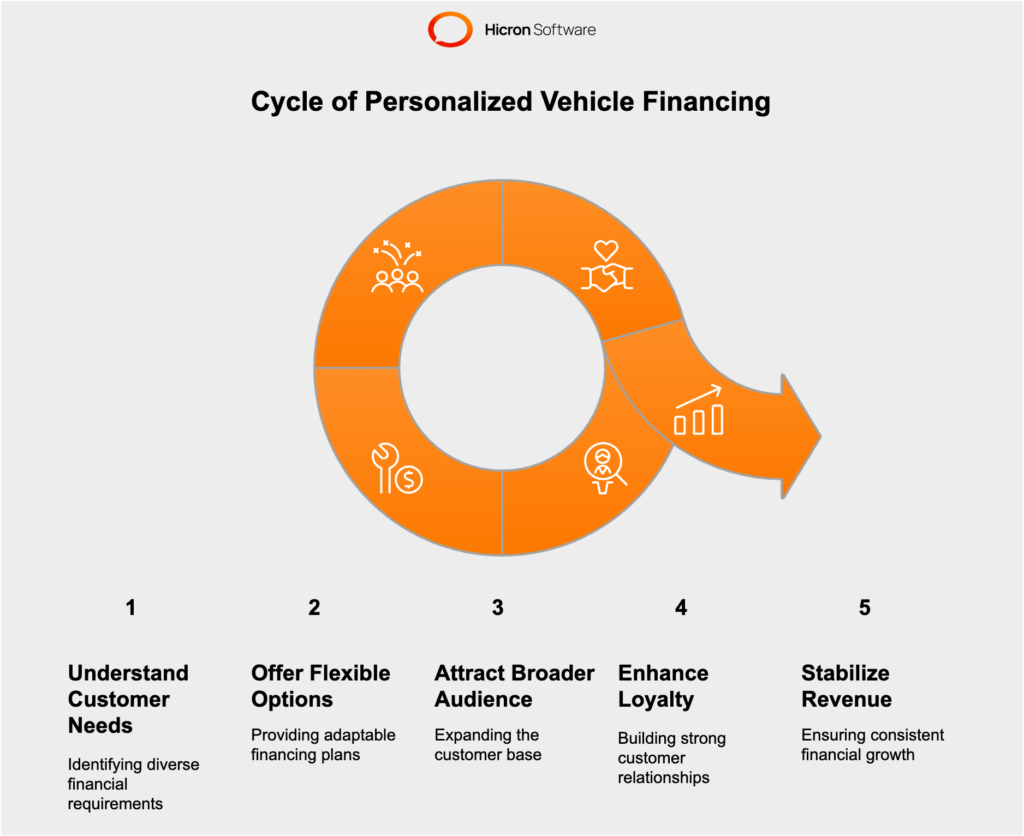

Imagine an auto company that offers flexible financing options tailored to its customers’ diverse needs. This approach attracts a broader customer base and enhances customer loyalty by providing personalized financial plans that resonate with individual circumstances. By leveraging such digital car finance platforms, businesses can create a competitive advantage that sets them apart in a crowded market.

These strategies are more than just financial maneuvers – they’re transformative tools that enable adaptation and growth. For instance, a dealership that embraces personalized auto finance leasing options can attract tech-savvy consumers eager for the latest models without the long-term commitment of ownership. This adaptability not only meets customer demands but also stabilizes revenue streams, allowing for steady growth even in fluctuating markets.

The key to unlocking customer satisfaction in automotive financing lies in understanding and implementing financial strategies that align with market trends and consumer preferences. By doing so, automotive businesses can ensure they are setting themselves up for long-term success. Now is the time to explore how financial innovation can redefine your business strategy, driving it toward new horizons and unlocking unprecedented opportunities.

Offering tailored vehicle finance solutions that speak directly to your customers’ needs. Personalized car finance offers do more than just help customers afford their dream vehicles; they create a seamless buying experience that encourages more sales and builds lasting customer relationships.

Imagine a customer excited about buying a new car but hesitant about budget concerns. By offering a personalized vehicle finance plan, perhaps a flexible loan term or a lower down payment option, you not only make that purchase possible but also gain a loyal customer who appreciates the individualized attention. This approach increases vehicle sales and enhances your dealership’s reputation as a customer-centric business.

Tailored vehicle finance solutions can also position your business as a market leader. By crafting offers that cater to different demographic groups, such as first-time buyers, families, or young professionals, you can effectively capture a broader audience. For instance, offering special rates for environmentally friendly vehicles can attract eco-conscious consumers who might otherwise overlook your dealership.

The key to leveraging these custom offers lies in understanding your market and customers. Using data analytics to discern consumer preferences and purchasing habits, you can design vehicle financial solutions that meet and exceed customer expectations. This strategic advantage boosts your sales figures and secures a stronger foothold in the competitive automotive landscape.

In essence, personalized vehicle finance solutions are not just about closing a sale – they’re about opening doors to new customer relationships and market opportunities. By integrating these strategies into your business model, you can drive your sales to new heights and ensure your dealership is always in the fast lane.

Remember that the race isn’t just about selling cars, it’s about building lasting relationships with customers. One of the most powerful strategies to achieve this is through bespoke vehicle finance packages tailored to meet individual customer needs. By offering personalized car financial solutions, automotive businesses can attract new customers and ensure they keep coming back.

Imagine a first-time car buyer who’s overwhelmed by the options and financial commitments. By providing flexible vehicle financing options, such as adjustable payment plans or incentives for early payments, dealerships can turn potential buyers into loyal customers. This personalized approach eases the buying process and enhances customer satisfaction, making them more likely to return for future purchases.

Strategic car finance solutions go beyond mere transactions; they create a foundation for long-term customer loyalty. For example, implementing loyalty programs that reward customers for repeat business or referrals can significantly boost retention rates. Additionally, offering exclusive vehicle finance deals for returning customers or bundling services like maintenance plans with car financing options can strengthen the relationship between the dealership and the customer.

The key to maximizing customer acquisition and retention lies in understanding and addressing the unique vehicle financial concerns of each customer. By doing so, automotive businesses can increase their market share and build a reputation as a trustworthy partner in their customers’ automotive journeys. With the right finance strategies, dealerships can drive customer satisfaction and loyalty to new heights, ensuring their success in a competitive market.

Simply, moving cars off the lot isn’t enough to keep businesses thriving, you have to be creative with car financial strategies to drive up those profit margins. Think about it, by crafting finance solutions that truly resonate with what customers want, dealerships can not only boost sales but also make a solid impact on their bottom line.

Imagine a dealership offering a zero-percent vehicle financing deal on select models for a short period. It’s a game-changer for anyone watching their budget, making it easier for them to say “yes” to a new car while helping the dealership clear out inventory faster. It’s this kind of smart financial thinking that can significantly fatten up those profit margins.

Companies play a pivotal role in this financial wizardry. They create a win-win situation by developing car finance packages that align with customer needs while still keeping an eye on profitability. Think of bundled packages that offer maintenance or insurance alongside the car loan. Not only do these add-ons provide extra value, but they also increase the overall sale value and leave customers feeling they’ve snagged a great deal.

It’s all about staying ahead by constantly innovating and tweaking those vehicle finance offers. With the help of data analytics to spot trends and understand customer habits, businesses can fine-tune their strategies to stay competitive. The result? A thriving company that’s leading the pack and ensuring growth and customer satisfaction.

Smart vehicle finance solutions don’t just sell cars, they build a foundation for long-term success in the automotive world. By keeping these strategies fresh and customer-focused, automotive businesses can secure their spot at the forefront of the industry.

Strategic partnerships have become the secret sauce for companies looking to elevate their game. By joining forces with tech pioneers, financial wizards, and tech experts, automotive finance entities can unlock new possibilities, refine their offerings, and ultimately deliver greater value to consumers. In this ever-evolving landscape, these alliances are not just beneficial, they are essential for growth and success. Let’s explore how these partnerships are reshaping the industry and paving the way for a brighter financial future in automotive.

Strategic partnerships offer automotive finance companies the opportunity to leverage each other’s strengths, resources, and expertise. By collaborating with technology firms, financial institutions, and even other automotive companies, businesses can tap into new markets, improve service offerings, and stay ahead of the curve.

One of the key benefits of these partnerships is the ability to innovate. For example, collaborations with tech companies can bring cutting-edge technology and data analytics into the mix, enabling more accurate risk assessments and tailored car financial products that meet the unique needs of consumers. This type of innovation is crucial in a market where customer expectations are constantly evolving.

Consider the successful collaboration between an automotive giant and a leading finance company that resulted in a seamless online platform for auto loans. This partnership expanded their customer base and streamlined the loan application process, significantly improving customer satisfaction.

Similarly, partnerships with data analytics firms can help automotive finance companies gain deeper insights into consumer behavior and market trends. These insights can be used to develop targeted financial products and marketing strategies, ultimately driving growth and profitability.

Market analysis is a cornerstone of strategic partnerships. By understanding market trends, consumer preferences, and economic indicators, companies can make informed decisions about which partners to engage with and what strategies to pursue.

For instance, in regions where electric vehicle adoption is on the rise, partnerships focused on providing financing solutions for EV purchases can position companies as leaders in this niche market. Additionally, analyzing demographic data can help identify underserved markets, paving the way for targeted partnerships and product offerings.

Automotive and tech company: One notable example is the partnership between a major automotive manufacturer and a global tech firm to create a digital finance platform. This collaboration enhanced the manufacturer’s financing capabilities and provided customers with a user-friendly, digital-first experience.

Automotive and financial company: Another example is the alliance between a leading bank and a renowned vehicle leasing company, which led to the development of innovative leasing options tailored to specific customer segments. This partnership not only expanded the bank’s portfolio but also addressed a growing demand for flexible vehicle ownership solutions.

So, strategic partnerships are important for automotive finance companies looking to achieve excellence. By collaborating with the right partners and leveraging market analysis, these companies can innovate, expand their capabilities, and deliver exceptional value to their customers. As the industry continues to evolve, embracing strategic partnerships will remain a crucial strategy for staying competitive and driving long-term success.

As consumers’ expectations evolve, the ability to deliver innovative financial solutions becomes crucial for staying competitive and maintaining industry leadership.

Today’s automotive customers are more informed and discerning than ever before. They demand flexibility, convenience, and personalized experiences from their financial interactions. Financial innovation is significant in meeting these expectations by offering tailored solutions that enhance customer satisfaction and foster loyalty.

Example: The rise of digital auto financing platforms has transformed the car-buying experience. By providing a seamless online process for loan applications, approvals, and payments, these platforms cater to tech-savvy consumers looking for quick and hassle-free solutions. Moreover, integrating data analytics into vehicle financial services allows companies to better understand consumer behavior and preferences, enabling them to offer customized financial products that fit individual needs.

To maintain a leading position in the industry, automotive finance companies must adopt cutting-edge strategies that leverage the latest technological advancements. Here are a few strategies that can help achieve this goal:

Several automotive finance companies have successfully implemented innovative solutions to enhance their offerings.

Automotive and tech company: A leading auto manufacturer partnered with a fintech company to develop an app-based financing platform, allowing customers to manage their payments and track their finance plans from their smartphones. This innovation not only improved customer engagement but also streamlined the finance process.

Automotive industry and financial company: Another success story involves a financial institution that introduced a “pay as you drive” insurance model, which adjusts premiums based on actual driving behavior. This innovative approach reduced costs for safe drivers and encouraged responsible driving habits.

Financial innovation is the cornerstone of leading the automotive industry into the future. By addressing evolving customer needs with innovative solutions and adopting cutting-edge strategies, companies can enhance customer satisfaction, loyalty, and ultimately, their market position. As the industry continues to evolve, those who embrace financial innovation will be best positioned to thrive and shape the future of automotive finance.

As we’ve explored, custom vehicle finance solutions are not just about closing sales, they’re about creating a tailored approach that resonates with each customer’s unique needs, enhancing their buying experience, and fostering long-term loyalty. By offering personalized vehicle finance options, automotive businesses can significantly boost customer satisfaction and retention, positioning themselves as leaders in a competitive market. These solutions cater to a broad range of clients, from first-time buyers to eco-conscious consumers, ensuring that every interaction is a step toward building lasting relationships.

Incorporating expertise-driven vehicle finance strategies is important for automotive businesses aiming to stay ahead. By understanding market trends and consumer preferences, businesses can develop innovative vehicle financial offerings that not only meet but exceed expectations. This adaptability ensures that companies not only survive the industry’s rapid changes but thrive, capturing new opportunities as they arise.

The time is now for automotive businesses to harness the power of custom finance solutions. By doing so, they can secure a competitive edge, drive growth, and achieve long-term success. Let this be a rallying call for industry professionals to embrace car financial innovation and lead the charge toward a prosperous future in automotive finance.