InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

Electronic Data Interchange (EDI) has become an indispensable backbone of the insurance industry, allowing for structured, secure, and efficient information exchange between insurers, brokers, and policyholders. At its core, EDI simplifies intricate processes, from policy creation to claim resolution, ensuring data flows occur without disruption. Yet, as the insurtech industry evolves and the demand for precision in insurance technology grows, EDI systems require a more dynamic approach to stay ahead of the curve.

Enter artificial intelligence (AI)—a force not just for refinement but redefinition. AI transcends the conventional limits of EDI by delivering previously unimaginable precision. It empowers insurers with tools to ensure unmatched data accuracy, streamline transaction reviews, and introduce proactive error management. This connection between EDI and AI doesn’t just fine-tune processes; it reshapes the operational ethos of insurance tech companies by harmonizing efficiency and innovation.

This article examines how the integration of AI unlocks the hidden potential within EDI systems. We will explore its impact on building smarter transaction workflows, advancing custom insurance software development, and modernizing outdated platforms to meet the demands of today’s insurance and tech realities. From predictive analytics to automated validations, discover how AI is not an optional enhancement for EDI but the catalyst for a more intelligent, agile, and robust future in insurance operations.

Picture this: a symphony orchestra playing in perfect harmony, each instrument seamlessly blending to create something extraordinary. That’s the link between AI and EDI in insurance. EDI, the reliable backbone for structured data exchange, has ensured that insurers, brokers, and policyholders communicate flawlessly. But as the demands of the modern insurance landscape grow, this tried-and-true system risks sounding a bit, well, predictable. Enter AI, the virtuoso soloist who takes the arrangements to another level.

The brilliance of this partnership lies in their complementary roles. On its own, EDI ensures data consistency and smooth transactions. It’s the dependable framework, like the classic pages of an Agatha Christie novel—a solid foundation that ensures everything unfolds logically. AI, on the other hand, is the Sherlock Holmes of the operation. It doesn’t just follow the clues (or, in this case, the data)—it analyzes, deduces, and predicts. AI transforms EDI into more than a messaging protocol through machine learning and predictive analytics. It evolves it into a decision-making powerhouse, ensuring precision, identifying anomalies, and even preventing fraud before it escalates.

Why is AI integration the next monumental leap for insurance workflows? Imagine replacing the stop-and-go traffic of manual validations with an autonomous car cruising on autopilot. AI automates approvals, detects irregularities, and updates records in the blink of an eye. This means insurers can handle increasing customer expectations without breaking a sweat. From commercial insurance giants to nimble insurtech startups, AI not only enhances efficiency but also delivers services at lightning speed, keeping up with today’s real-time demands.

And speaking of real-time, that’s the key to the future of insurance and tech convergence. Insurers no longer have the luxury of processing data in fragmented intervals. Picture the chaos of managing catastrophe claims during a hurricane if your data is delayed by an hour. Real-time data management, powered by AI, is like Bilbo in The Hobbit finding the One Ring at the perfect moment. It’s a game changer. Combined with intelligent automation, it ensures that policies are updated, claims are processed, and decisions are made in the moment, not after the fact.

By integrating AI into EDI platforms, the insurtech industry is no longer just keeping pace; it’s setting the tempo. It’s the merging of reliable tradition and bold innovation, creating a future where insurance processes are smarter, faster, and uniquely adaptable to the needs of the next generation.

Think of Electronic Data Interchange (EDI) as the conveyor belt of the insurance world. It keeps critical data moving smoothly between insurers, brokers, agents, and policyholders. But even this well-oiled machine isn’t immune to hiccups. A single error in data entry or transmission can sometimes feel like throwing a wrench into a finely tuned factory. That’s where AI steps in — not as just another tool in the shed but as the master technician, ready to enhance precision and nip mistakes in the bud.

AI significantly minimizes errors during data entry and exchange by leveraging machine learning, natural language processing, and predictive algorithms. Take, for example, AI-powered tools that auto-validate policyholder details during data submission. These solutions detect discrepancies on the spot, flagging mismatches or missing fields before they disrupt workflows. It’s like having an editor proofread an email before you hit “send” — it saves embarrassment, time, and effort.

Another example can be found in claims processing AI, which reads and analyzes data from multiple sources like invoices, medical records, or policy documents. It can compare this input against predefined standards to ensure accuracy and consistency. Imagine a broker trying to sort through hundreds of claims submissions manually. Even the most organized person is bound to overlook something under pressure. But AI thrives under these circumstances, delivering unmatched data fidelity at lightning speed.

For insurers, brokers, and agents, the ripple effect of accurate data is transformational. When errors are reduced, the need for manual corrections plummets, freeing up teams to focus on value-added tasks like enhancing customer support or refining product offerings. Brokers deal with fewer back-and-forth exchanges with clients to fix mistakes. Insurers get dependable data for evaluating claims and underwriting risks. Agents, in turn, can confidently provide clients with accurate quotes and timelines. Everyone wins.

The advantages go further. Accurate data doesn’t just streamline operations; it also builds trust. When a policyholder isn’t asked to reconfirm their address for the fourth time or resubmit a claim form due to typos, their confidence in their insurance provider grows. It’s like comparing a carefully curated bookshelf to a chaotic pile of books on the floor. The organized bookshelf isn’t just visually pleasing; it’s easier to use and fosters confidence.

By blending the structured foundation of EDI with AI’s ability to refine and validate every detail, insurers and the broader insurtech industry are redefining what efficiency and accuracy truly mean. It’s not just about avoiding errors; it’s about creating systems where errors barely stand a chance. That’s the kind of future insurers, brokers, and agents can build—with a bit of help from AI.

Whether validating coverage eligibility in life insurance policies or protecting sensitive data in commercial insurance claims, AI serves as a vigilant sentinel, constantly guarding the gates. Picture a high-tech vault, precision-engineered to withstand any attempt at intrusion, with every mechanism working flawlessly to secure what’s inside.

By detecting anomalies, safeguarding transactions, and strengthening compliance measures, AI isn’t just supporting the insurance industry—it’s redefining its standards. The result is a seamless blend of trust, security, and efficiency in every interaction, setting the bar higher for operational excellence.

Imagine EDI data as a sprawling, interconnected highway system. Every transaction is a vehicle moving toward its destination, and most of the time, traffic flows smoothly. But what about the anomalies? The “wrong-way drivers” or “broken-down cars” that could derail the system? This is where machine learning comes in, acting like an advanced traffic control system to identify irregularities before they cause chaos.

With machine learning algorithms at the helm, AI scans through vast amounts of EDI files, spotting inconsistencies, missing data, or unusual patterns that could go unnoticed. These models learn from historical transactions and become increasingly adept at pinpointing outliers. For instance, AI flags these discrepancies instantly if a policy detail is entered in an unusual format or a claims adjustment seems out of line with established benchmarks. It’s as if an ultra-alert librarian scans every book returning to the shelves for signs of damage or misplaced pages, ensuring everything stays in order.

Fraud is a disruptive force in the insurance world, often hiding in unexpected places. It could appear as inflated claims or fake credentials during benefit enrollments, creating headaches for insurers and policyholders. That’s where AI steps in, like a skilled detective with a sharp eye for detail, always staying one step ahead of potential fraudsters.

Take, for instance, disaster claims that list exaggerated losses. AI algorithms compare the details of these claims against historical data and similar cases. When discrepancies are found, such as overly inflated property damage figures, the system immediately raises an alert, helping insurers investigate further before unnecessary payouts occur.

Another example is duplicate billing in healthcare insurance. AI systems are trained to detect fraud patterns, such as repeated charges for the same service. These algorithms can instantly identify issues, flagging the suspicious transaction for closer inspection before it causes a financial impact.

Benefit enrollments are another area where fraud can seep in. AI is a vigilant checker here, cross-referencing every applicant’s credentials with secure databases. If it spots duplicate entries or fake information being used, the system ensures those applications are flagged, stopping fraud attempts in their tracks.

Thanks to these intelligent capabilities, AI is revolutionizing fraud detection. This technology saves the industry millions while protecting the relationships insurers have worked hard to build with policyholders. Like a tech-savvy detective, AI combines speed, precision, and foresight to catch fraud long before it causes harm.

Compliance isn’t just about adhering to regulations; it’s about safeguarding relationships between insurers, brokers, and policyholders. In a world where data breaches and identity theft are rising, ensuring robust security is paramount. AI enables insurers to create validation processes that achieve compliance and fortified protection in one stroke.

For example, automated validation systems powered by AI cross-check all incoming EDI files against regulatory standards in real-time. Only the transactions that meet these criteria move through, ensuring that errors or non-compliant entries are filtered out. Furthermore, AI-driven encrypted layers enhance security, securing sensitive data like policyholder details or payment transactions against malicious access.

Machine Learning is not just a tool for the insurance industry; it’s a partner in achieving precision, efficiency, and progress. By automating repetitive tasks, predicting potential disruptions, and improving handling processes over time, ML is helping insurers transform the way they manage EDI workflows.

Repetitive tasks can bog down efficiency, especially in the complex world of Electronic Data Interchange (EDI). Machine Learning (ML) changes the game by automating routine actions like claims processing and enrollment management.

Imagine an insurer that processes thousands of claims daily. Instead of relying on manual checks, ML systems seamlessly analyze, validate, and route claims data, ensuring everything runs like clockwork.

Similarly, ML streamlines the verification process for enrollment management, matching policyholder data with records in real time. This not only saves time but reduces the risk of human error, allowing insurers and brokers to focus on higher-value tasks.

Predictive analytics, powered by ML, offers the insurance industry a crystal ball for anticipating challenges.

For example, ML models can analyze historical data to identify bottlenecks in claims approval processes before they escalate. Perhaps a pattern emerges where certain types of claims consistently experience delays.

By flagging these risks early, ML systems allow teams to adjust to prevent workflow disruptions. Similarly, during peak enrollment periods, predictive analytics can forecast surges in data volume and recommend resource allocation. This proactive approach keeps systems running smoothly and policyholders satisfied.

Machine Learning doesn’t just process data; it learns from it. Over time, ML systems adapt to recognize new patterns, enhancing their accuracy and efficiency.

For instance, an ML model handling healthcare claims could begin to identify subtle anomalies that signal fraud or inefficiencies, building on its experiences with past cases.

This continuous feedback loop improves data quality, ensuring fewer errors in EDI transactions over time. Insurers benefit by maintaining cleaner, more reliable datasets, contributing to better decision-making and customer satisfaction.

AI-powered Electronic Data Interchange (EDI) integrates advanced computing capabilities into the traditionally rigid process of managing electronic transactions. Insurance companies rely on EDI to process claims, manage policy enrollments, and ensure compliance. However, older systems often have inefficiencies, limited scalability, and error vulnerability.

AI revolutionizes EDI by automating manual workflows, analyzing large datasets in real time, and continuously improving processes through machine learning. This speed, accuracy, and adaptability allow insurers to operate more effectively, even in high-pressure situations. Below are key scenarios where AI-powered EDI has transformed insurance operations.

The context: A leading global health insurer was tasked with processing over 100,000 claims every month. Their reliance on manual validation created operational bottlenecks, frequent errors, and ballooning labor costs. Employees spent hours cross-referencing claims with policy details and spotting inconsistencies, which delayed resolutions.

The challenge: A property and casualty insurer faced a surge of 20,000 disaster claims weekly. The inefficiency wasted resources and delayed customer responses, leading to complaints and eroding trust.

The solution: The company implemented an AI-driven EDI platform. This system automates claim validation, instantly cross-referencing claims with current policies and historical data. The AI engine could flag discrepancies or incomplete documentation before submission. This streamlined approach cut unnecessary payouts by 18% and redeployed staff to help customers in need. Removing redundant manual tasks reduced the processing time by 40%, saving the insurer millions in labor costs annually.

The result: Employees could focus on more complex claims and customer-facing activities, while customers benefited from faster claim resolutions. This efficiency improved operational sustainability, especially during periods of high claim volume.

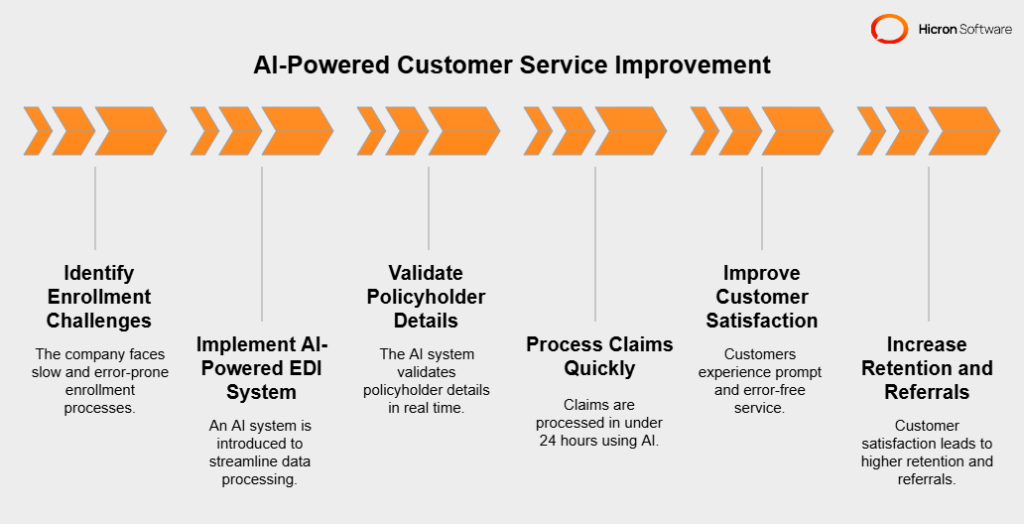

The context: During peak enrollment periods, a prominent life insurance company received thousands of new policy applications daily. Manual data entry frequently resulted in errors, such as incorrect beneficiary details or policy dates. Customers often had to wait weeks to receive confirmation on their newly purchased policies, which affected their confidence.

The challenge: The slow and error-prone enrollment process impacted customer satisfaction and risked losing out on potential referrals and renewals.

The solution: An AI-powered EDI system was implemented to handle data processing during enrollment. Using AI, the system validated policyholder details in real time, highlighting gaps immediately and ensuring accurate setups. What once took weeks was completed in days, removing friction from the process.

The result: Policyholders praised the prompt service and error-free onboarding. Customer satisfaction scores soared, directly contributing to retention rates and new business growth through referrals. The company also freed up administrative staff to engage in personalized customer interactions, enhancing the client experience.

Another illustration: For a motor insurer specializing in individual policies, processing accident claims used to take weeks as adjusters spent time verifying repairs and paperwork. After implementing AI-driven EDI, claims were processed in under 24 hours. The AI matched submitted documents with approved policy terms, estimated repair costs, and prior claims history. Customers were thrilled with the speed, leading to improved brand loyalty and a spike in renewal rates.

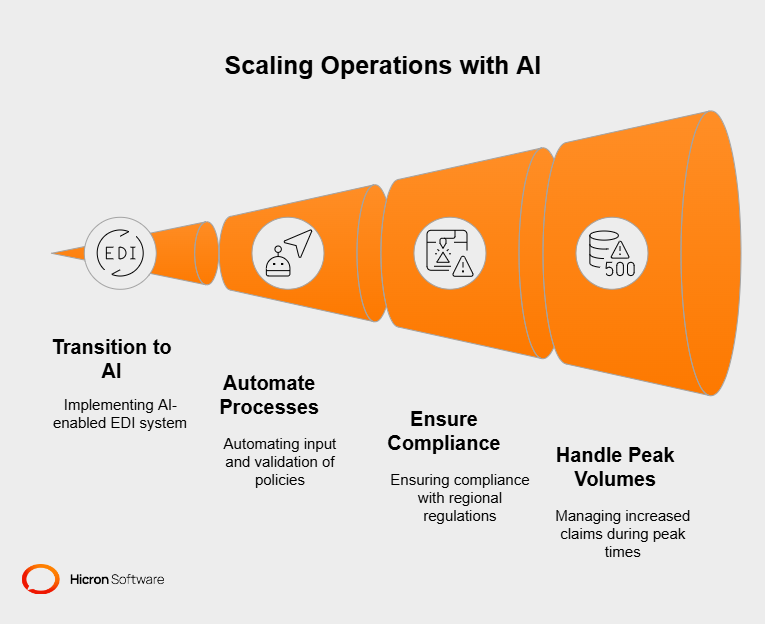

The context: A mid-sized property insurance company wanted to expand into new regions, offering innovative packages. However, their manual EDI system struggled to handle increased enrollment and transactional volume. Seasonal peaks, such as open enrollment periods, further strain resources, threatening service quality.

The challenge: Scaling operations with manual workflows meant increased hiring and extensive training, which inflated costs and slowed growth.

The solution: The insurer transitioned to an AI-enabled EDI system. This technology dynamically adapts to fluctuating enrollment volumes, automating the input and validation for thousands of new policies. The platform also ensured compliance with varying regional regulations, avoiding costly penalties.

The result: The company processed 25% more enrollments in a fraction of the time, without hiring additional administrative staff. The seamless integration with existing systems also allowed the team to maintain consistent quality in their core markets while expanding into new ones.

Special case study in scaling: A telehealth insurer saw a fivefold increase in claims during a pandemic surge when virtual healthcare became essential. Integrating an AI-enabled EDI system ensured that claims from teleconsultations were processed accurately and promptly. Claims were cross-referenced with healthcare provider records in real time, mitigating delays or denials. Despite unprecedented growth, the system maintained high accuracy and customer satisfaction, proving AI’s power in handling extreme scalability challenges.

AI-powered EDI is not just a tool; it’s a strategic enabler for the insurance industry. Its ability to automate, predict, and scale sets it apart from traditional approaches. Insurers can achieve the following with this technology:

These benefits empower insurers to meet today’s challenges and position themselves for a future defined by digital transformation. AI in EDI isn’t just a competitive advantage; it’s the foundation of a forward-thinking insurance enterprise.

The future of AI-driven EDI in insurance is both exciting and demanding. Emerging technologies offer possibilities never before imagined, from smarter workflows to predictive accuracy like no other. However, achieving this potential requires a commitment to technological growth, adaptability, and collective innovation across the insurance ecosystem. Companies that anticipate and prepare for these shifts will benefit and lead the industry into a new age of efficiency and innovation.

Artificial Intelligence is evolving at an unprecedented rate, and these advancements are set to redefine how Electronic Data Interchange (EDI) operates in the insurance industry.

Among the emerging trends, the rise of natural language processing (NLP) stands out for its potential to transform customer-facing workflows. For example, NLP-powered chatbots can seamlessly integrate with EDI systems, resolving policyholder queries and making real-time updates, all while reducing dependence on human involvement.

Another promising trend is the integration of generative AI. With the ability to simulate thousands of scenarios instantly, generative AI can enhance predictive modeling in EDI workflows. For insurers, this means more accurate forecasting of claim volumes during seasonal peaks, enabling proactive resource planning and better control over operational costs.

Additionally, advanced autonomous learning algorithms could enable “self-improving” EDI systems. These systems would continuously analyze data flows, identify inefficiencies, and adapt processes without manual intervention. This automated adaptability equips insurers to handle immediate demands and long-term industry shifts, all while maintaining compliance and quality standards.

The insurance industry is poised for rapid digital transformation, and companies ignoring the need for adaptability risk falling behind. Incorporating AI-driven EDI requires strategic investments in technology upgrades. Outdated infrastructure can’t support the dynamic capabilities of modern AI models, limiting scalability and impact.

For example, leveraging AI in EDI demands robust cloud-based systems capable of processing and analyzing massive datasets in real time. Companies with legacy systems will face bottlenecks when deploying even the most advanced AI solutions. Decision-makers must budget for adopting AI tools and foundational upgrades, such as enhanced server capabilities, cloud migration, and data security measures.

Adaptability also plays a key role here. Organizations need to build internal agility to respond quickly to advancements in AI. Regular employee training and fostering a digital-first mindset can ensure that staff understand and correctly utilize new tools. Investing in pilot projects to test new AI-driven EDI capabilities allows for fine-tuning without risking full-scale disruptions.

The successful integration of AI-driven EDI in insurance hinges on collaboration across multiple facets of the industry ecosystem. EDI and AI technology vendors must work closely with insurers to develop solutions tailored to the sector’s unique compliance, security, and operational requirements. Shared innovation initiatives, such as joint AI research labs or industry-specific hackathons, can drive the development of cutting-edge tools capable of addressing industry pain points.

Equally important is the collaboration among insurers themselves. Forums that foster the sharing of best practices and case studies can help smaller companies learn from the successes of market leaders. Pooling resources to establish shared data infrastructures could enhance predictive analytics while ensuring that proprietary or sensitive information is adequately safeguarded.

Public-private partnerships may also emerge as catalysts for AI innovation in insurance. Governments and regulatory bodies could provide incentives for adopting AI tools that align with broader industry goals, such as improving accessibility to affordable insurance products or enhancing disaster response readiness.

Integrating Artificial Intelligence (AI) with Electronic Data Interchange (EDI) is no longer a luxury for insurers; it’s necessary. The blend of these technologies offers unmatched advantages that drive operational efficiency, cost savings, and improved customer satisfaction.

AI-powered EDI automates labor-intensive processes, reducing claims processing time by as much as 40% while eliminating costly manual errors. It enhances customer experiences by ensuring faster, error-free journeys—from policy enrollments to claims approvals. Companies can scale their operations effortlessly, managing growth or seasonal surges without increasing administrative overhead.

Adopting AI in EDI also positions insurers as forward-thinking leaders. Predictive modeling, real-time data validation, and intelligent automation ensure that companies stay agile in a fast-evolving market. Ignoring this shift risks inefficiency, customer dissatisfaction, and falling behind competitors who leverage these innovative tools.

By investing in AI-driven EDI today, insurers can future-proof their operations, delivering improved outcomes for their business and customers. Intelligent automation isn’t just about surviving in the modern era; it’s about leading it. Don’t wait to adopt the tools defining the insurance industry’s future. Start preparing now, and set your organization toward long-term success.