10 Real Estate Software Development Companies in 2025

- February 03

- 9 min

AI-enhanced market research in CRE is the application of artificial intelligence to automate and improve the analysis of commercial real estate data. Brokers face persistent challenges with manual market analysis, including time-consuming data collection and the risk of using outdated information. PropTech tools are transforming these research workflows, with the promise of real estate automation saving brokers more than 10 hours of work each week. This article will explore how these AI tools work, the benefits they provide, and how brokerages can implement them to gain a competitive edge.

Key takeaways:

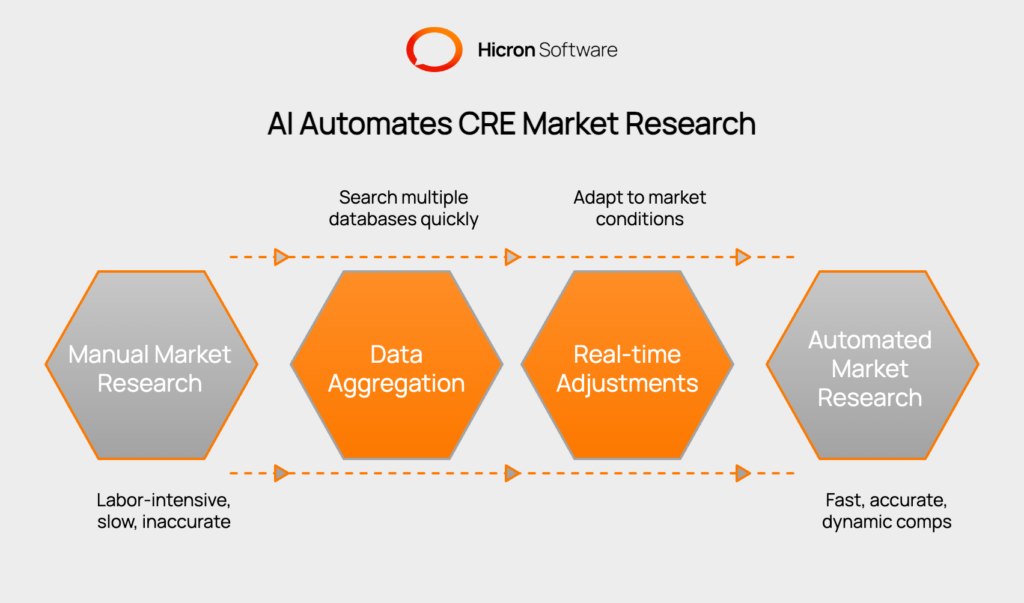

AI-powered market research changes how commercial real estate (CRE) brokers work by automating the most labor-intensive tasks. Machine learning algorithms can identify comparable properties by searching multiple databases at once (like CoStar, LoopNet, and proprietary internal data) and aggregating the data. These systems make adjustments based on real-time market conditions, such as recent lease signings or shifts in local economic indicators, providing a more dynamic and accurate set of comps than a manual search could produce.

Brokers spend a large part of their day on manual research processes that are often inefficient. Daily tasks include

These activities are essential but create a drag on productivity.

Traditional research methods suffer from common inefficiencies. Repetitive data entry and formatting introduce the potential for human error. Information is often stored in different, unconnected platforms. It creates silos that prevent a holistic view of the market. The reliance on static reports means brokers often work with outdated information, which compromises the quality of their decisions.

The cost implications of these manual processes are clear. The hours spent on research are hours not spent on prospecting, negotiating, or strengthening client relationships. This directly impacts the quality of client service. Slow response times can cause a broker to lose out on a deal, as opportunities in commercial real estate often move quickly.

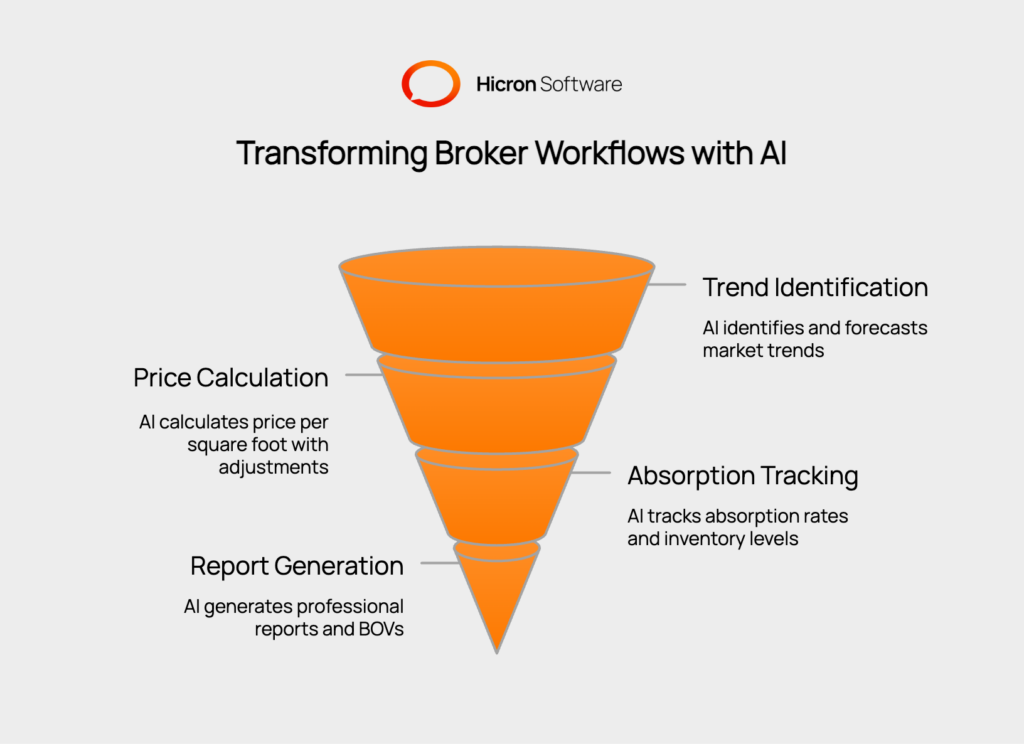

AI-backed market research platforms bring intelligent data analysis and pattern recognition to the forefront of CRE decision-making. They can identify and forecast market trends for specific asset classes like office, industrial, or retail, calculate price per square foot with appropriate adjustments for factors like tenant improvements (TI) and CAM charges, and track absorption rates and inventory levels automatically. This moves the broker from data collection to strategic analysis and client advisory.

AI-backed market research platforms bring intelligent data analysis and pattern recognition to the forefront. They can identify and forecast market trends, calculate price per square foot with appropriate adjustments, and track absorption rates and inventory levels automatically. This moves the broker from data collection to strategic analysis

Automated report generation and formatting is one more benefit. AI tools can take raw data and create professionally branded presentations and Broker Opinions of Value (BOVs), complete with charts, graphs, and even an executive summary. This allows brokers to prepare for client meetings in a fraction of the time.

Modern PropTech tools offer criteria for AI-driven comparable property selection. Location proximity algorithms define trade areas and submarket boundaries, while property characteristic matching and weighting systems ensure the most relevant comps are chosen. The platforms also make adjustments for transaction date relevance, accounting for CRE market cycles and velocity.

Advanced filtering and refinement capabilities allow brokers to drill down into the details. They can filter by property size, age, and condition. It is also possible to compare properties based on tenant creditworthiness and lease structure (e.g., NNN vs. Gross Lease) or specify market subtypes and asset classes for a more targeted analysis.

|

Feature |

Description |

Key Benefits |

|

AI-Driven Selection Criteria |

Uses algorithms for location proximity, property matching, and transaction date relevance to identify the best comps. |

Ensures that comps are highly relevant and adjusted for market cycles, providing a strong analytical foundation. |

|

Advanced Filtering & Refinement |

Allows brokers to narrow down comps by specific details like property size, age, condition, tenant creditworthiness, and asset class. |

Enables a highly targeted and granular analysis. Tailors results to specific client needs and property types. |

|

Improved Accuracy |

Automates the selection process to eliminate human bias and apply consistent criteria, often validated by statistical models. |

Enhances the defensibility and reliability of the analysis, thereby building client trust in the data. |

This level of automation brings accuracy improvements over manual comps selection. It helps eliminate human bias that may enter the process when a broker selects properties they are familiar with. The system applies selection criteria consistently and uses statistical models to validate the choices, resulting in a more defensible analysis that stands up to scrutiny from investors and lenders.

Beyond comps, real estate automation offers continuous market monitoring and alert systems. Brokers can receive notifications for new listings and price changes as they happen. They can also track market absorption rates and integrate economic indicators like employment growth and GDP data to spot trends before they become obvious.

Predictive analytics for market forecasting is another powerful feature. These tools can create rental rate projections and vacancy predictions for specific property types. They also offer cap rate trend analysis to help time investments and can identify market cycles so brokers can advise clients on positioning strategies, such as when to hold, sell, or refinance an asset.

AI also automates competitive intelligence. A broker can track competitor activity, calculate market share, and gain insights into their own positioning within a specific submarket. The system can even provide pricing strategy recommendations based on a complete view of market data.

|

Feature |

Description |

Key Benefits |

|

Continuous Market Monitoring |

Provides real-time alerts for new listings, price changes, and tracks market absorption rates and economic indicators. |

Enables brokers to spot trends and opportunities early; keeps them ahead of market shifts. |

|

Predictive Analytics |

Creates forecasts for rental rates, vacancies, and cap rate trends, and identifies market cycles to guide strategy. |

Allows for proactive client advising and data-driven investment timing; enhances strategic positioning. |

|

Automated Competitive Intelligence |

Tracks competitor activity, calculates market share, and provides data-based pricing strategy recommendations. |

Offers clear insights into the competitive landscape; helps brokers refine their own market position. |

The claim of saving over 10 hours weekly is grounded in specific workflow improvements. Brokers report saving four to five hours each week on comparable property research alone. Another three to four hours are saved on market report preparation, and two to three hours are reclaimed from creating client presentations.

|

Research Time Reduction |

|

Frees up over 10 hours per week, allowing brokers to focus on revenue-generating activities. |

These time savings do not come at the expense of quality. Automated systems provide more comprehensive market coverage and analysis than is possible manually. They reduce errors in calculations and data presentation and ensure a consistent, professional appearance for all client-facing materials.

Brokers can reinvest this saved time into high-value activities that drive revenue. This includes more time for client relationship building and prospecting for new business. It also frees them up for deal negotiation, transaction management, and networking opportunities.

AI-enhanced market research tools in commercial real estate (CRE) rely on several key components and technologies to deliver accurate, efficient, and actionable insights. Here’s a breakdown of key components:

|

Component |

Description |

Key Features/Strategies |

|

Data Integration Systems |

Connects to multiple data sources like MLS, public records, and commercial databases to ensure comprehensive market coverage by aggregating diverse datasets. |

|

|

Machine Learning Models |

Analyzes historical transaction patterns and local market factors, with models that continuously improve through user feedback and advanced training. |

|

|

User Interface (UI) Design |

Provides intuitive search parameters, filtering, customizable report templates, and mobile accessibility for broker efficiency in the office and field. |

|

|

Predictive Analytics |

Forecasts market trends, rental rates, and vacancy predictions, while also identifying market cycles to provide strategic investment insights. |

|

|

Automated Reporting Tools |

Generates professional, branded reports complete with charts, graphs, and summaries, saving time and ensuring consistent formatting for client presentations. |

|

Natural Language Processing (NLP):

Big Data Analytics:

Geospatial Analysis:

Explainable AI (XAI):

Cloud Computing:

These components and technologies work together to transform how brokers conduct market research, enabling them to save time, improve accuracy, and deliver better client outcomes.

For a brokerage to successfully adopt PropTech, the tools must be integrated with existing workflows. This means ensuring connections with CRM systems (like Apto or Salesforce) for data synchronization and compatibility with document management platforms. Partnering with automation experts can streamline these operations.

Training and adoption are important considerations. Firms need structured staff onboarding programs to get everyone comfortable with the new technology. Change management strategies can help traditional brokers see the value, while performance measurement (e.g., tracking deal velocity and commission growth) helps track success and justify the investment.

A cost-benefit analysis is essential for brokerage adoption. Leaders should weigh the technology investment against the value of time saved. They should also consider the competitive advantages gained and the potential for improved client satisfaction and retention rates in a highly competitive CRE landscape.

Measuring the return on investment from these tools is straightforward. Brokerages can conduct before-and-after time tracking studies to quantify productivity gains. They can also use client satisfaction scores and feedback to measure improvements in service quality.

The revenue impact of improved efficiency can be seen in several areas. Brokers may find they have the capacity for increased deal volume. Faster response times create competitive advantages, and higher-quality presentations can improve win rates.

Technology adoption success is measured by user engagement and feature utilization rates. It is also tied to training effectiveness and the long-term productivity improvements observed across the team.

To get the most out of these tools, brokerages should focus on optimal workflow design and process optimization. This includes establishing quality control checkpoints for human oversight and creating a culture of continuous improvement.

Technology proficiency is just the first step. Brokers need to build their skills in interpreting the analysis and presenting it to clients as valuable consultation.

Brokers should be transparent about their data sources and methodologies. This helps build trust and communicates a clear value proposition centered on better service and faster response times. To start enhancing your business, get in touch to discuss further AI implementation in your workflows.

Integrating data sources like MLS systems, public records, and commercial databases ensures comprehensive market coverage and provides brokers with a unified view of the market.

Machine learning models analyze historical transaction patterns and local market factors, continuously improving through user feedback to deliver precise and actionable insights.

A well-designed UI with intuitive search parameters, customizable templates, and mobile accessibility enhances broker efficiency and ensures ease of use in both office and field settings.

Predictive analytics helps forecast market trends, rental rates, and vacancy predictions, enabling brokers to provide strategic investment advice and identify market cycles.

Automated tools generate professional, branded reports with consistent formatting, charts, and summaries, reducing the time spent on client presentations and ensuring high-quality deliverables.