InsurTech Innovations: Transforming the Insurance Industry

- November 14

- 8 min

Definition: Claim automation AI is a transformative technology that uses artificial intelligence to streamline and optimize insurance claims processes. Automating repetitive tasks and leveraging predictive analytics enables insurers to detect fraud faster, approve claims more efficiently, and reduce operational costs.

Claim automation AI is transforming the insurance industry by automating claims processes, improving accuracy, and reducing costs. This article dives into how claims automation with AI accelerates fraud detection, streamlines workflows, and enhances decision-making. Discover how AI claim automation enables insurers to handle high claim volumes effortlessly and how AI for claims processing leverages predictive analytics for better outcomes.

Learn about the benefits of AI automated claims management, including faster settlements, improved transparency, and superior customer experiences. Explore the future of AI for insurance claims automation, its game-changing impact on insurers, and how it reshapes the industry.

To implement effective transformative solutions, services such as Custom Insurance Software Solutions and DevOps Services and Solutions offer tailored tools and strategies for insurers to modernize their claims processes.

AI-powered automation uses artificial intelligence to perform repetitive, time-consuming tasks without constant human intervention. It leverages advanced algorithms and machine learning to analyze data, make decisions, and execute processes with unmatched speed and accuracy.

This technology has become a game-changer within the insurance industry, particularly in claims processing, where inefficiencies have historically plagued the system. Services like Legacy System Modernization and Cloud Application Development enable insurers to integrate AI seamlessly into their workflows, ensuring scalability and efficiency.

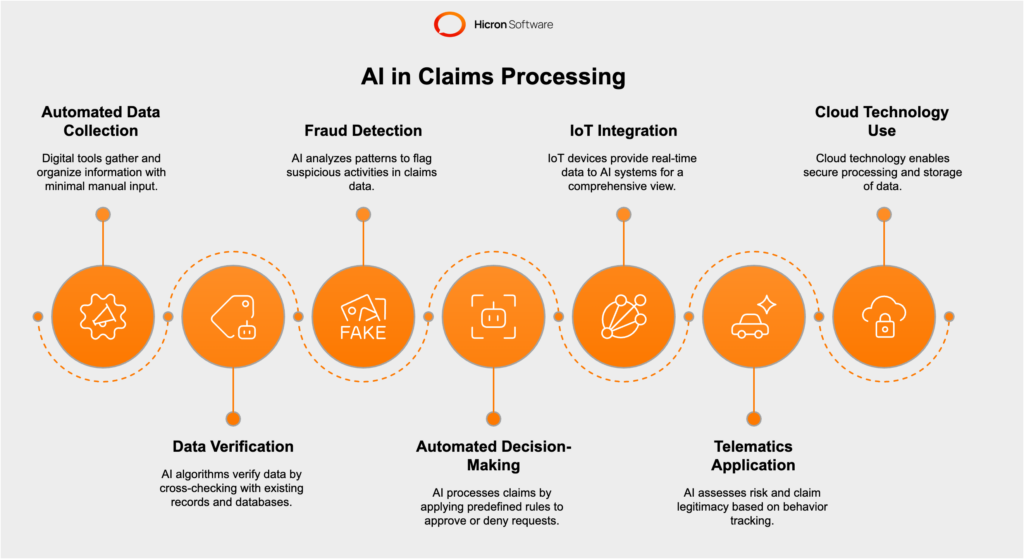

At its core, claim automation AI is streamlining workflows from start to finish. It begins with automated data collection, where digital tools gather and organize information from policyholders, adjusters, and other sources with minimal manual input. From there, AI algorithms verify the data, cross-checking it with pre-existing records and third-party databases for accuracy. This process alone eliminates bottlenecks caused by human error or delays.

One of the most significant advantages of AI claims processing is its ability to verify data with precision and accuracy. By automating the verification process, AI ensures that claims are accurate and complete before moving forward. For example, Modernizing a Medical Insurance Application for the German Market demonstrates how modernization efforts can unlock the full potential of AI-driven claims automation.

This reduces the risk of errors and speeds up the overall claims lifecycle. AI systems can cross-reference data from multiple sources, ensuring consistency and reliability in every step of the process.

One of AI’s strongest capabilities lies in fraud detection. By analyzing patterns and anomalies in claims data, AI-powered systems can flag suspicious activities that might otherwise go unnoticed.

For example, machine learning models are trained to identify inconsistencies that indicate staged accidents or inflated claims, enabling insurers to mitigate losses more efficiently.

This proactive approach not only saves costs but also builds trust with policyholders by ensuring fair practices.

Automated decision-making tools can simultaneously process high volumes of claims, applying predefined rules to approve or deny requests. This drastically reduces turnaround times, allowing policyholders to access settlements faster while providing insurers with a scalable solution for managing claims surges during peak seasons, such as natural disasters. Real-time data processing further enhances the speed and accuracy of approvals.

AI-powered automation also integrates seamlessly with other cutting-edge technologies in the insurtech ecosystem. Internet of Things (IoT) devices, such as connected cars and smart home sensors, can feed real-time data into AI claims systems, providing insurers with a more comprehensive view of an incident.

| Technology | Role in Claims Processing | Example Use Case |

| Machine Learning | Analyzes historical data to detect patterns and predict

outcomes. |

Identifies fraudulent claims by

spotting anomalies in data. |

| Natural Language Processing (NLP) | Interprets and processes

unstructured data like medical records or customer queries. |

Simplifies complex claims by

extracting key information automatically. |

| Predictive Analytics | Anticipates risks and trends based

on historical and real-time data. |

Flags high-risk claims for further investigation. |

| Image Recognition | Analyzes visual data, such as photos

of vehicle or property damage. |

Provides instant repair cost

estimates for auto insurance claims. |

| IoT Integration | Collects real-time data from connected devices like

telematics or smart sensors. |

Automatically triggers claims after

incidents like car accidents. |

Similarly, telematics and usage-based insurance applications rely on AI to assess risk and determine claim legitimacy based on behavior tracking. With cloud technology, insurers can securely process and store vast amounts of data, making collaboration across teams and systems more efficient.

By transforming claims processing into a faster, smarter, and more accurate operation, AI-powered automation is not just improving workflows; it’s redefining what modern insurance can achieve. This is how claims automation with AI sets new benchmarks for the insurtech industry, paving the way for a more innovative and customer-centric future.

Fraudulent claims have been a persistent challenge for the insurance industry, resulting in billions of dollars in losses each year. These financial setbacks not only affect insurers but also result in higher premiums for policyholders.

However, claim automation AI is revolutionizing how insurers detect and combat fraud. By leveraging AI claims processing and advanced algorithms, insurers can now analyze patterns and identify anomalies with unmatched precision, making fraud detection faster and more efficient than ever.

With claims automation powered by AI, suspicious activities such as staged accidents or inflated claims are flagged in real-time. Predictive analytics enhances this ability by identifying behavioral trends associated with fraudulent practices. These advanced systems not only reduce financial losses but also improve trust between insurers and their policyholders, fostering a more secure and transparent insurance ecosystem.

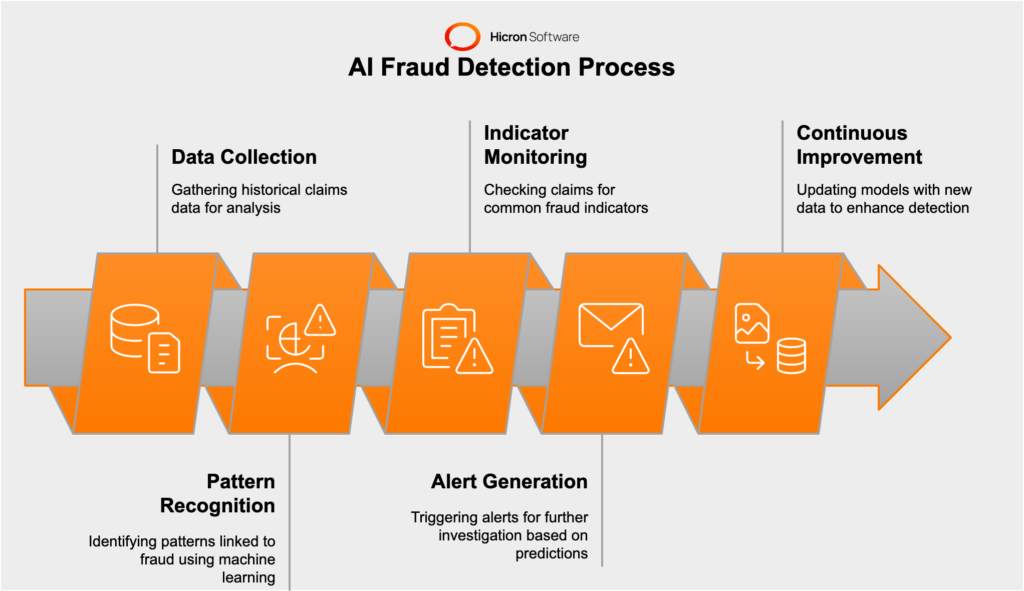

AI fraud detection in insurance relies on advanced algorithms to detect patterns and flag suspicious activities in real-time. With claim automation AI, insurers can analyze behaviors and trends in claims data, uncovering inconsistencies that might be overlooked during manual reviews.

AI claims processing focuses on identifying common indicators of fraud, such as multiple claims filed within a short period or exaggerated loss amounts.

Through claims automation with AI, predictive modeling, and real-time analytics, fraud detection is enhanced by identifying trends linked to fraudulent practices. This proactive approach not only helps insurers detect fraud earlier in the claims process but also mitigates financial losses and improves operational efficiency.

By integrating these advanced tools, insurers can build a more secure and trustworthy ecosystem for both themselves and their policyholders.

Machine learning and predictive analytics are central to the success of claim automation AI in fraud detection. These advanced tools utilize vast amounts of historical claims data to identify patterns and anomalies linked to fraudulent activity. By incorporating AI claims processing techniques, insurers can predict the likelihood of fraud with remarkable precision, leveraging past cases to inform real-time decisions.

For instance, claims automation with AI can detect behaviors like inflated medical expenses or repeated damage claims, triggering alerts for further investigation.

Machine learning models continuously evolve as they process new data, enabling them to stay ahead of emerging fraud schemes. This adaptive learning enables insurers to effectively mitigate risks, reduce false claims, and maintain trust with policyholders.

The adoption of claim automation AI is delivering tangible results in the fight against fraud within the insurance industry.

AI claims processing systems, for example, cross-check claims with telematics data from connected vehicles, making them invaluable tools for auto insurers.

These systems verify whether accidents occurred as reported, helping to identify inconsistencies in location, timing, or context.

In the healthcare sector, claims automation with AI has proven equally effective. AI-powered tools analyze medical claims to identify billing irregularities, including double charges or phantom treatments. By utilizing real-time fraud detection systems, insurers can identify suspicious claims promptly, conduct thorough investigations, and prevent substantial financial losses. These advanced applications not only improve operational efficiency but also strengthen trust with policyholders through accurate and fair claims handling.

The advantages of real-time fraud detection through claim automation AI extend far beyond cost reduction.

For insurers, these advanced systems revolutionize the claims process by eliminating unnecessary delays and ensuring fair treatment for policyholders. By leveraging AI claims processing, companies can automate routine tasks, reducing administrative burdens and reallocating resources to more complex issues.

For customers, claims automation with AI translates to faster resolutions and greater transparency, as accurate fraud detection helps to lower premiums by minimizing false claims.

This streamlined approach builds a more customer-focused and efficient insurance ecosystem, where trust and satisfaction are prioritized.

AI-powered fraud detection is setting new benchmarks for fraud prevention within the insurance industry. Utilizing machine learning, predictive analytics, and real-time monitoring, insurers can significantly reduce losses, enhance accuracy, and create a more resilient framework for future growth in the insurtech landscape.

Insurance claims approvals, often slowed by manual tasks such as document verification and data entry, are being transformed by claim automation AI. This innovative technology automates routine yet essential processes, enabling insurers to accelerate claims approvals while maintaining accuracy and efficiency.

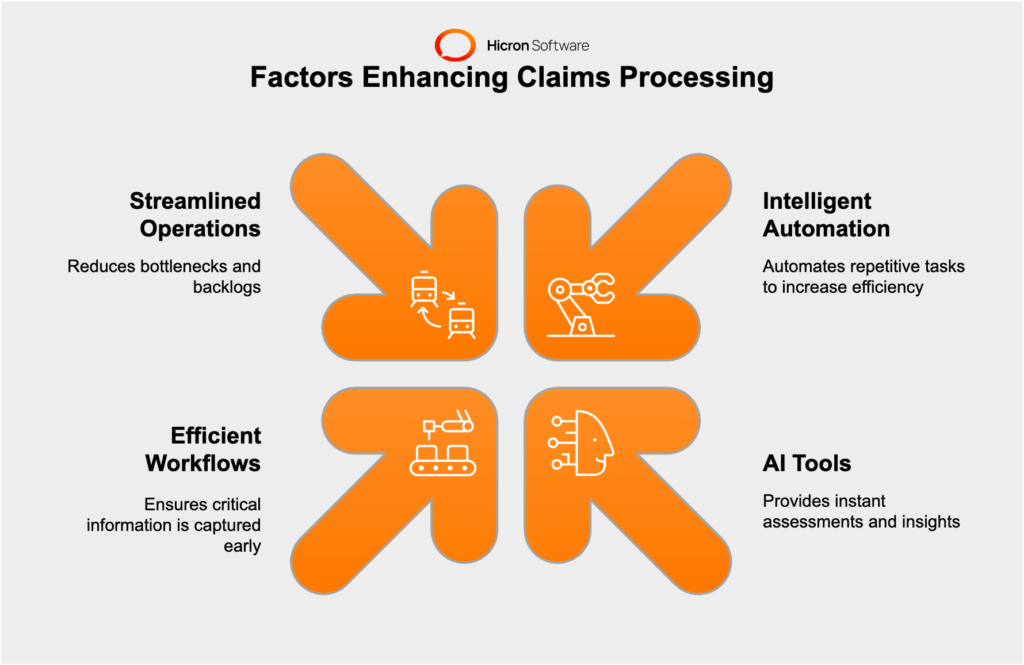

Through AI claims processing, insurers can handle large volumes of claims more effectively. Intelligent automation eliminates bottlenecks by instantly verifying documents, cross-checking data, and flagging inconsistencies, all without requiring constant human intervention.

Claims automation with AI streamlines workflows, ensuring faster settlements and enhancing both operational efficiency and customer satisfaction.

By adopting these advanced tools, insurers are unlocking new potential to deliver quicker resolutions and create a more scalable and customer-friendly claims management system.

Claim automation AI is revolutionizing the way repetitive tasks are handled in the insurance claims process. Document verification, once a time-consuming and error-prone step, is now seamlessly managed by AI-powered systems. These intelligent tools quickly scan and validate essential documents, such as policyholder information, damage reports, and proof of ownership, ensuring compliance with preset guidelines.

AI claims processing eliminates the need for manual cross-checking, reducing errors and streamlining workflows. By automating routine yet critical steps, claims automation with AI enables insurers to focus their resources on more complex tasks, resulting in greater efficiency and accuracy throughout the claims lifecycle.

Real-time data processing is transforming claims management by enabling faster and more accurate decision-making. Through claim automation AI, insurers can instantly evaluate incoming data, cross-referencing it with historical records and external sources to ensure accuracy. AI claims processing handles tasks like reviewing medical records for healthcare claims or analyzing vehicle damage photos for auto insurance with unmatched speed, significantly reducing turnaround times.

This advanced capability ensures that claims automation with AI accelerates the approval process, allowing insurers to move claims through the pipeline more efficiently than traditional methods.

By leveraging these tools, companies can enhance customer satisfaction, streamline operations, and provide faster resolutions for policyholders.

The advantages of claim automation AI in the insurance claims process extend far beyond speeding up approvals. Insurers can now handle claims intake with greater precision, ensuring all critical information is captured right at the beginning. With AI claims processing, instant assessments provide actionable insights in seconds, empowering decision-makers to approve claims or initiate further reviews without unnecessary delays.

Intelligent claims automation with AI also eliminates backlogs, particularly during peak periods, such as natural disasters, when claim volumes surge. This streamlined approach allows insurers to process higher volumes efficiently without the need to scale their workforce.

For policyholders, the result is a smoother experience and quicker resolutions, building trust and satisfaction. Insurers reap the benefits of improved operational efficiency and a stronger ability to deliver on customer expectations. Intelligent automation doesn’t just save time and effort; it redefines the claims process, setting a higher standard across the industry.

Reducing costs in claims processing is about more than just speeding up workflows; it’s about transforming operational efficiency. Traditionally, insurers relied on manual processes, requiring teams to manage intricate workflows, verify documents, and resolve cases individually. While effective, this method demanded significant time and resources, driving up expenses.

Claim automation AI is changing the game. By integrating AI into claims processing, insurers can streamline operations with automation, minimizing the need for manual intervention. Tasks like document verification and data validation are handled swiftly and accurately by intelligent systems. Claims automation with AI not only cuts administrative costs but also enhances productivity, enabling insurers to handle higher claim volumes without increasing overhead.

One of the key ways claim automation AI drives cost efficiency is by reducing dependency on manual tasks. AI algorithms now manage responsibilities such as data entry, document validation, and claims categorization, freeing up skilled staff to focus on more complex roles, such as customer care or fraud investigations. With AI claims processing, repetitive processes are streamlined through intelligent workflows and machine learning systems.

For example, claims automation with AI can efficiently prioritize claims, eliminating unnecessary delays and reducing operational overhead.

AI-based solutions not only save time but also significantly reduce costs in critical areas, such as claim accuracy. Errors or fraud in the claims process often result in overpayments, which strain insurers’ finances.

Claim automation AI analyzes data with unparalleled precision, ensuring payouts are made only for legitimate claims that have been properly evaluated. Through AI claims processing, insurers perform real-time cross-checking of submitted information against policies, historical data, and external sources to identify discrepancies early and prevent costly mistakes.

For instance, claims automation with AI is particularly beneficial in property insurance, where AI-powered image processing assesses damages precisely. It flags exaggerated claims or inconsistencies between reported damages and previous inspections.

These advancements enable insurers to avoid potential overpayments and protect their financial stability, thereby directly improving their bottom line.

The financial advantages of claim automation AI are already being realized by insurers worldwide. By incorporating AI claims processing into workflows, many companies have achieved significant cost reductions.

For example, an insurer that implemented an automated document verification system reported a 30% decrease in administrative expenses within the first year.

Similarly, a leading insurtech company utilized claims automation with AI and predictive analytics to minimize overpayments, resulting in millions of dollars saved annually in unnecessary payouts.

AI in claims processing goes beyond immediate cost-cutting; it lays the groundwork for long-term sustainability and scalability. By leveraging claims automation with AI, insurers can streamline workflows, reduce manual labor, and redirect resources toward innovation, enhancing customer experiences and offering more competitive pricing.

This AI-driven transformation isn’t just about shrinking costs. It enables companies to reimagine the claims processing model, delivering faster and more accurate outcomes while maintaining operational efficiency. Claim automation AI represents a strategic investment in the future of the insurance industry, creating a foundation for sustainable growth and redefining what’s possible in claims management.

Customer satisfaction is at the heart of any successful insurance provider’s strategy. Long wait times for claims processing have traditionally been a significant pain point, leaving customers frustrated and dissatisfied. However, claim automation AI is transforming this narrative by delivering faster and more efficient resolutions.

With AI claims processing, insurers can streamline workflows, automating tasks such as document verification and data validation to drastically reduce turnaround times. Claims automation with AI ensures that claims are processed accurately and efficiently, providing policyholders with peace of mind and a better overall experience.

Claims automation with AI is revolutionizing customer satisfaction in the insurance industry by addressing pain points quickly and effectively. When customers file a claim, they’re often facing stressful situations. Claim automation AI enables faster processing, from efficient intake to near-instant approval, reducing delays caused by manual workflows. This speed not only alleviates customer concerns but also builds trust and loyalty by demonstrating insurers’ responsiveness during critical moments.

Another significant advantage of AI claims processing is its ability to provide round-the-clock support through chatbots and digital assistants. These AI-powered tools deliver immediate responses to policy-related questions, guide customers through the claims filing process, and offer real-time updates on claims status.

For example, an AI chatbot can assist with initial documentation or clarify coverage details, ensuring uninterrupted service even outside standard business hours.

Claims automation with AI enhances convenience, meeting the modern policyholder’s expectation for accessible and timely support.

Fast claims processing is only part of the equation; customers today also value transparency and precision. Claim automation AI ensures that claims are processed accurately, reducing errors that could lead to disputes or delays. Automation provides data-driven decisions that are straightforward to explain, fostering a sense of transparency.

Additionally, online tracking portals enable policyholders to stay informed about the progress of their claims, giving them greater control and confidence.

By leveraging claim automation AI, insurers are achieving more than operational efficiency; they are fundamentally transforming how they interact with their customers. AI claims processing enables faster claims handling, ensuring policyholders receive prompt resolutions during critical moments. Additionally, claims automation with AI provides round-the-clock support through digital tools, such as chatbots, delivering responsiveness and accessibility whenever customers need assistance.

Transparency is another key benefit of AI. Automated solutions generate precise, data-driven decisions, reducing errors and building trust between insurers and their policyholders. Customers can also seamlessly track their claims through digital portals, which enhances their sense of control and confidence in the process.

With a powerful fusion of speed, accuracy, and accessibility, AI is reshaping the insurance customer experience into one that is seamless, efficient, and tailored to exceed expectations. For insurers seeking to foster loyalty and drive growth, now is the ideal time to invest in digital claims management solutions that prioritize the customer at the center.

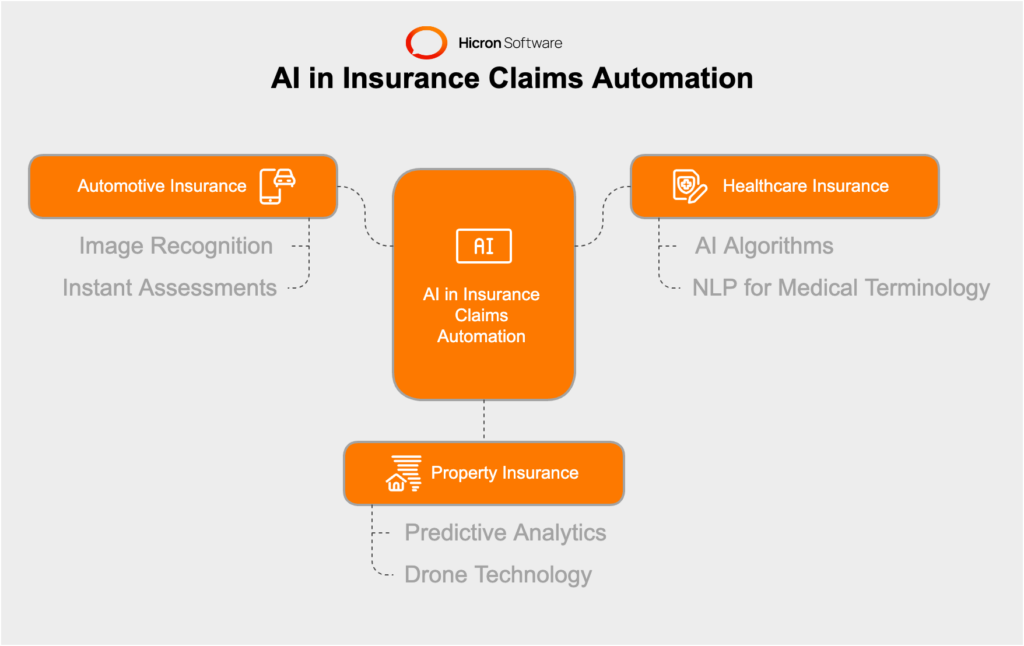

Claim automation AI is revolutionizing the insurance industry, reshaping how claims are handled with greater speed, accuracy, and reliability. Across sectors such as automotive, healthcare, and property insurance, real-world applications of claims automation with AI demonstrate remarkable improvements in efficiency and outcomes. Below are notable examples that highlight the groundbreaking capabilities of AI in claims processing.

| Industry | Application Example | Outcome |

| Automotive | Image recognition for vehicle

damage assessment. |

50% reduction in claim

settlement times. |

| Healthcare | Cross-checking medical records and

billing codes with policy details. |

30% boost in processing efficiency. |

| Property | Drone technology for assessing

property damage during natural disasters. |

90% of claims processed

within two weeks post-hurricane. |

AI has made a tremendous impact on automotive insurance by expediting accident claim resolutions. Insurers now utilize AI claims processing platforms that leverage image recognition technology to evaluate vehicle damage through photos. These tools provide instant repair cost estimates, significantly reducing claim settlement times.

For instance, one leading automotive insurer implemented such a system, achieving a 50% reduction in settlement turnaround times. This not only allowed faster payouts for policyholders but also significantly lowered administrative expenses.

AI claims processing has reshaped healthcare insurance by streamlining medical claims. Advanced algorithms cross-check treatment plans, billing codes, and medical records with policy terms to ensure accuracy. This process reduces errors and prevents fraudulent claims.

One healthcare insurance provider saw a 30% boost in processing efficiency after adopting claim automation AI for pre-authorizations and billing reviews.

Additionally, Natural Language Processing (NLP) tools interpret complex medical terminology, enabling seamless handling of intricate cases.

Property insurance significantly benefits from claims automation powered by AI, particularly during natural disasters. Predictive analytics and AI-powered systems enable insurers to manage high volumes of claims efficiently. Some firms utilize drone technology to assess property damage in remote or inaccessible areas, ensuring rapid evaluations.

For instance, after a devastating hurricane, a property insurer processed over 90% of claims within two weeks, utilizing AI-powered solutions, which far outpaced industry averages.

This level of efficiency improved customer satisfaction and mitigated delays during critical periods.

The adoption of claim automation AI translates into measurable success across industries. Key metrics include reduced claim times, improved fraud detection, and lower operational costs.

Insurers using AI-powered fraud detection have reported a 40% drop in fraudulent activities. Meanwhile, a global insurance provider achieved a 20% reduction in operating expenses and enhanced accuracy rates by over 25% through automated claims processing.

These metrics underscore the tangible value of claims automation with AI, reinforcing its role as a game-changing investment for the industry.

| Metric | Improvement Achieved |

| Fraud Detection Rates | 40% reduction in fraudulent activities. |

| Claims Processing Speed | Up to 3x faster claim resolutions. |

| Operational Cost Savings | 20% reduction in operating expenses. |

| Accuracy Rates | Over 25% improvement in claims accuracy. |

The diverse applications and proven results of AI claims processing demonstrate how insurers can revolutionize claims management. By delivering faster, more accurate resolutions and eliminating inefficiencies, claims automation with AI not only enhances operational performance but also elevates customer satisfaction.

The insurance industry is undergoing transformation as claim automation and AI continue to evolve. While current applications of AI claims processing have already brought substantial benefits, upcoming advancements promise to redefine the claims landscape.

Emerging technologies, including advanced AI models, IoT integrations, blockchain, and generative AI, are poised to enhance efficiency and deliver superior customer experiences. Case studies such as Modernizing Insurance Application: Vaadin and Java for Smooth Transformation provide a glimpse into how these advancements are already transforming the industry.

| Technology | Role in Claims Automation | Example Use Case |

| IoT | Provides real-time data

from connected devices like telematics and smart sensors. |

Automatic crash reporting

and claims initiation in auto insurance. |

| Blockchain | Ensures secure, transparent

workflows with immutable ledgers. |

Smart contracts for weather-related claims triggered by IoT data. |

| Generative AI | Personalizes workflows and

creates customer-friendly communication tools. |

Tailored explainer videos for

complex claims processes. |

AI models are becoming increasingly adaptive and intelligent thanks to advances in deep learning and neural networks. Claims automation with AI will soon use these capabilities to analyze complex data patterns, refine risk assessments, and detect fraudulent behaviors with greater accuracy.

For instance, future AI systems could proactively suggest policy optimizations to customers based on historical trends, adding value beyond claims processing.

These adaptive models will improve operational performance while enhancing the personalized experience for policyholders.

The integration of IoT with claim automation AI represents the next frontier in digital claims ecosystems. IoT devices such as vehicle telematics, smart home sensors, and wearable health monitors generate real-time data that can streamline claims management. By combining IoT data with AI claims processing, insurers can automate evidence gathering and initiate claims instantly.

For example, telematics can automatically report crash information to trigger claims workflows, significantly reducing response times and manual effort.

This advanced interconnectivity will create smoother, faster, and more transparent claims processes.

Blockchain technology offers unmatched transparency and security for claims processing. By creating immutable ledgers, blockchain eliminates disputes and ensures accurate record-keeping. Combined with claims automation with AI, blockchain enables smart contracts that validate and settle claims automatically based on predefined conditions.

For example, a weather-related claim could be processed instantly when a smart contract verifies inputs from IoT sensors and other trusted data sources.

This pairing reduces delays, ensures compliance, and builds trust between insurers and policyholders.

Generative AI presents compelling possibilities for personalizing claims workflows. By analyzing vast amounts of data, it can design custom solutions for niche industries, complex cases, or uncommon edge scenarios.

Generative models can also create user-focused communication tools, such as tailored templates, visual aids, or even explainer videos, enhancing transparency and understanding during the claims process. This dynamic and automated approach ensures that claims automation with AI caters to both the unique needs of insurers and the expectations of policyholders.

The benefits of claim automation AI are evident, but implementing this technology isn’t without its obstacles. Insurers often encounter challenges, including steep implementation costs, stringent data privacy requirements, and the difficulty of integrating AI with legacy systems. However, with a strategic approach and a long-term vision, these hurdles can become stepping stones to operational innovation and excellence.

| Challenge | Solution |

| High Implementation Costs | Phase implementation, starting with high-impact areas like claims processing. |

| Data Privacy and Security | Use encryption, comply with regulations like GDPR, and partner with privacy-focused InsurTech providers. |

| Legacy System Integration | Deploy AI as bolt-on solutions and gradually modernize systems

with cloud migration. |

The high initial investment in AI claims processing is one of the most significant concerns for insurers. Deploying sophisticated AI tools and training in-house teams can stretch budgets. However, the key to overcoming this challenge lies in viewing these upfront costs as a strategic, long-term investment.

Claims automation with AI yields measurable returns through reduced labor costs, enhanced efficiency, and fewer errors. By phasing the implementation, starting with smaller and high-impact areas, such as claims processing, insurers can steadily spread out expenses while seeing immediate operational improvements.

Maintaining data privacy and security is another critical challenge when adopting claims automation with AI. Insurers manage immense amounts of sensitive customer data, and a breach could jeopardize trust. Implementing robust AI systems that comply with stringent regulations, such as GDPR, is crucial.

Advanced encryption, permissioned data access, and robust data governance policies must be at the foundation of AI solutions. Collaborating with InsurTech providers experienced in privacy-focused designs can provide insurers with confidence that their customers’ data is being managed securely and responsibly.

Many insurers rely on legacy systems that lack the flexibility needed to integrate with modern AI-powered applications. Replacing these outdated systems entirely isn’t always feasible. A solution lies in taking a step-by-step approach to modernization. Insurers can start by deploying AI claims processing tools as bolt-on solutions that run in parallel with existing systems. Over time, gradual upgrades and cloud migration ensure a seamless transition to a modern tech stack without disrupting daily operations.

Strong partnerships with InsurTech providers can simplify the adoption of claim automation AI. These partners offer scalable, purpose-built solutions and provide the expertise needed to integrate AI effectively. With tailored onboarding and technical support, partnerships can reduce the learning curve for internal teams and accelerate the time-to-value realization of AI investments. This collaborative approach enables insurers to leverage the full potential of automation while minimizing resource strain.

Although initial challenges, such as cost and compatibility, might seem daunting, the long-term return on investment from claims automation with AI makes the effort worthwhile. Insurers reap tangible benefits, including faster claim resolutions, reduced operational expenses, enhanced fraud detection, and improved customer satisfaction. These outcomes foster stronger customer loyalty, boost market reputation, and improve profitability.

For example, insurers leveraging automated claims systems have reported up to threefold improvements in claims processing speeds, translating to substantial savings and happier policyholders.

Adopting claims automation with AI comes with its challenges, but the rewards far outweigh the initial hurdles. By addressing these issues proactively, phasing in implementations, and leveraging InsurTech partnerships, insurers can create an innovative ecosystem that is prepared for the demands of the future. These efforts go beyond integrating new technologies; they signify a fundamental transformation of how insurers operate, innovate, and grow.

By overcoming these barriers, insurers can establish themselves as pioneers in AI claims processing, ensuring both immediate operational gains and long-term success in a competitive landscape. With the right strategies, implementing claim automation AI becomes less of a challenge and more of an opportunity to unlock the full potential of digital transformation.

AI-powered automation is transforming the insurance industry, bringing unparalleled efficiency and accuracy to claims management. From curbing fraud with smart detection algorithms to accelerating approvals through automated workflows, these technologies significantly cut processing costs while enhancing customer satisfaction. The ability to process claims faster, more accurately, and with greater transparency sets a new standard for what insurers can achieve.

Insurers must welcome advanced tools like AI to thrive in a competitive marketplace. This investment delivers measurable returns, including reduced operational costs and faster resolution times, and helps insurers stay ahead in a rapidly evolving landscape. By adopting these innovations, insurers send a powerful commitment to efficiency, customer care, and future readiness.

At Hicron Software, we understand the industry’s unique challenges and demands. AI-driven claims automation systems are designed to seamlessly integrate into your workflows, delivering solutions tailored to your needs. Whether you’re looking to modernize operations or enhance customer experiences, we can help you. Get in touch!

Claims automation AI uses artificial intelligence to streamline the insurance claims process by automating repetitive tasks, improving accuracy, and reducing processing times.

AI enhances claims processing by automating data collection, detecting fraud through predictive analytics, and enabling faster approvals with real-time data analysis.

Benefits include reduced costs, faster claim resolutions, improved fraud detection, and enhanced customer satisfaction.

AI uses machine learning and predictive analytics to analyze patterns in claims data, flagging anomalies and inconsistencies that may indicate fraud.

AI plays a critical role in automating workflows, verifying data, and integrating with technologies like IoT and telematics to improve efficiency and accuracy.

By minimizing manual intervention, automating repetitive tasks, and preventing overpayments, AI significantly reduces operational expenses.

Examples include using image recognition for auto insurance claims, analyzing medical records for healthcare claims, and leveraging IoT data for property insurance.

Challenges include high implementation costs, data privacy concerns, and integrating AI with legacy systems.

AI speeds up claim resolutions, provides 24/7 support through chatbots, and ensures transparency, leading to a better customer experience.

The future includes advanced AI models, IoT integrations, blockchain for secure workflows, and generative AI for personalized claims management.