Why should automotive IT companies be TISAX compliant?

- September 23

- 9 min

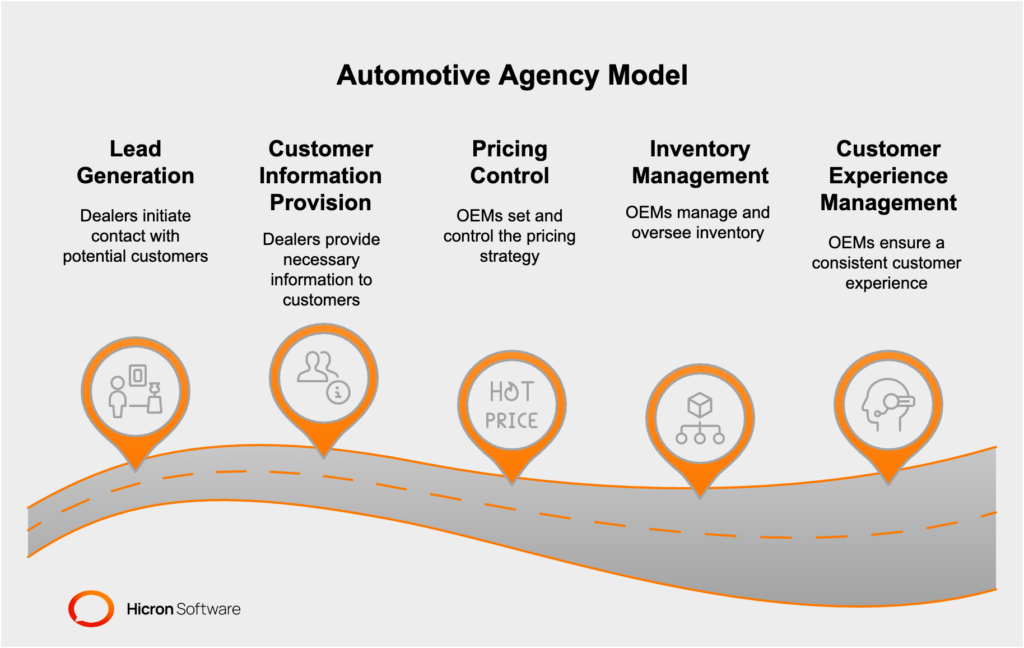

The shift to an agency model in the automotive industry represents a significant change in how cars are sold and distributed. In this new paradigm, the dealer evolves from being a traditional salesperson to acting more as an agent for the car manufacturer.

In the automotive agency model, dealers follow up on leads and provide customers with information, but the control over pricing, inventory management, and customer experience largely rests with the original equipment manufacturers (OEMs). This is a departure from the conventional dealership networks, where dealers purchased cars from the manufacturers and then sold them to the customers at a price they set.

This shift towards the automotive agency model is driven by several factors. It allows manufacturers to maintain uniform pricing across all channels, eliminating price competition between dealers and improving price transparency for customers. The new buying automotive business process enables manufacturers to directly control the inventory, leading to more efficient production planning and faster response to market changes.

The automotive agency model also lays the foundation for integrating online business with showroom-based business, which is particularly important in today’s digital age. It offers the potential to substantially disrupt retailer profitability, with the enterprise value at car retailers that switch to the genuine automotive agency model forecast to rise by as much as 12 percent.

Transitioning to the automotive agency model may not be smooth for all parties involved. Some car manufacturers are reportedly rethinking plans to transition their retail networks to an agency model due to potential challenges and resistance from dealers.

Overall, the agency model signifies a major transformation in the automotive industry, with implications for manufacturers, dealers, and customers alike.

However, this transition also poses significant challenges for automotive dealerships and original equipment manufacturers (OEMs), making preparation crucial for success.

A significant shift in the car buying process, with online platforms, is becoming increasingly popular. It started with resellers, but automotive giants are aiming for similar solutions. Here’s what this means for car buyers:

Convenience and Flexibility: Online platforms like Vroom, Carvana, and Cars.com provide a seamless and convenient way for buyers to purchase cars. They offer high-quality cars, easy buying processes, and even home delivery services.

Trade-In Options: Many of these platforms not only allow you to buy cars but also offer options to trade-in your old vehicle. This can make the process of upgrading your car simpler and more streamlined.

Selling Your Car: If you’re looking to sell your car, platforms like CarBuyerUSA, Peddle, and Family Car Buyers offer easy and efficient ways to do so. These platforms will pay cash for cars in any condition, and they handle pickup & payment for you.

Wide Range of Choices: Online platforms provide a wide range of choices for used and new cars. They also allow you to compare prices and explore financing options, helping you find your dream car within your budget.

Market for Junk Cars: Even if your car is in poor condition or non-working, there are platforms like Copart Direct that are ready to make an offer. They buy used and salvage vehicles all over the United States.

The shift to the agency model in the automotive industry offers several benefits for car makers:

The profitability of car dealerships depends on a variety of factors, including market trends, vehicle sales, and the shift to new business models such as the agency model in the automotive industry.

It appears that car dealerships have been quite profitable recently. In 2022, profits reached an estimated $6.5 million per location for dealerships owned by public auto retailers, more than triple the pre-pandemic levels. The average profit for new-car dealerships was estimated at $7.1 million.

Some industry experts predict that dealership profits may decline in the future. According to a report, owners of hundreds of dealerships expect profits to decline by 10 to 15% in 2023. This could be due to a variety of factors, including changes in consumer behavior, market saturation, increased competition, and the impact of the shift to the agency model.

In the agency model, car manufacturers have more control over pricing and inventory, which could potentially reduce the profit margins for dealers. The impact of this shift on dealership profits is still uncertain and may vary depending on specific circumstances.

Ultimately, whether car dealerships will lose profit in the future will depend on how they adapt to changing industry trends and business models.

It’s important to note that the transition to the agency model also presents challenges for dealerships, and its success may depend on the specific circumstances and how well dealerships can adapt to this new model.

Several car manufacturers have adopted or are transitioning to the agency model. These include:

Other brands reported to be adopting agency agreements include Abarth, Alfa Romeo, Citroen, Cupra, and DS.

It’s important to note that the specifics of the agency model can vary by manufacturer and market. The transition to this model is a significant shift in the automotive industry and is being closely watched by industry observers.

Read about The Role of The Agency Model in Cutting Distribution Costs

The shift to the agency model in the automotive industry is seen as a significant change, and there are several key points that the industry should be aware of:

Given these points, it’s crucial for both OEMs and dealerships to carefully consider the implications of the shift to the agency model and develop strategies to manage the transition effectively.

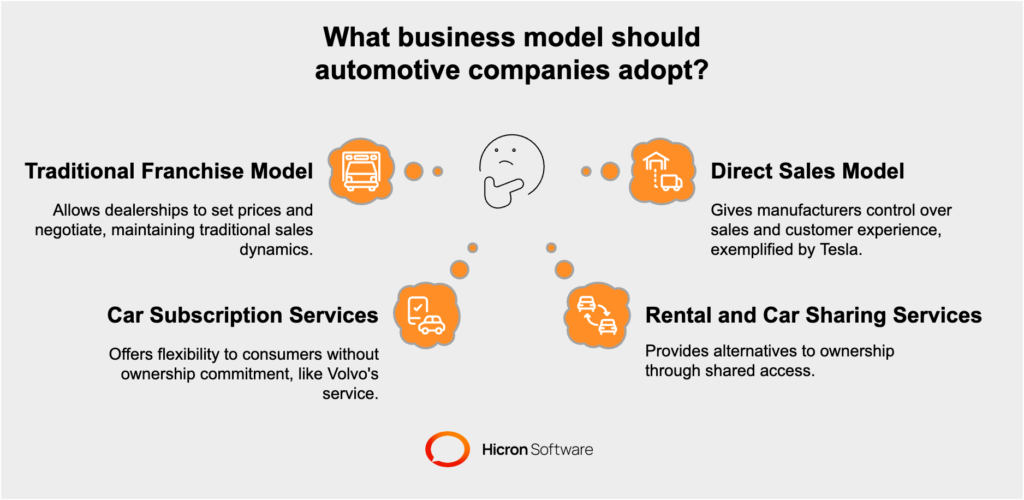

If not the automotive agency model, car companies have several alternatives they can consider for their business models:

Each of these alternatives has its own advantages and disadvantages, and the best choice may depend on a variety of factors including the specific needs and goals of the car company, market conditions, and consumer preferences.

The agency model can significantly improve supply chain processes by enhancing inventory management, optimizing operations, mitigating risks, and improving coordination and visibility. It can enable a faster response to economic shocks and aid in the digital transformation of the supply chain. However, its effectiveness largely depends on the adaptability of manufacturers and dealerships to this new approach.

Be an agency model or not, automotive faces the challenge of transformation to streamline its complex supply chain on the one hand and to retool with changing consumer expectations on the other. Digitization of business processes is crucial.