Digital Transformation in 2025: Predicting the Future of IT and Business

- October 11

- 14 min

These days, customer experience can make or break an insurance company. People expect more than just coverage; they want fast, smooth, and personalized service. That’s where a mix of technology and innovation comes in. From life insurance tech companies to insurtech startups, the industry is leaning on tools like EDI (Electronic Data Interchange) and AI to rethink the way they connect with customers.

EDI has been a workhorse for insurers for years, helping them share data, process claims, and manage policies more efficiently. Meanwhile, AI ups the game by adding smarts to the mix. Think predictive tools that anticipate customer needs, automation that speeds up tasks, and analytics to make everything more accurate and intuitive.

In this post, we will examine how EDI and AI are collaborating to transform the way insurers engage with their customers. Whether it’s streamlining claims through custom software or creating a more user-friendly experience overall, this tech duo is paving the way for a smarter, more responsive insurance landscape. If you’re curious about where the insurtech industry is headed or how it’s tackling new challenges, you’re in the right place.

The insurance industry is undergoing a transformation, and delivering a great customer experience is at the heart of this change. Electronic Data Interchange (EDI) and Artificial Intelligence (AI) are two powerful tools working hand in hand to create solutions that truly focus on the needs of customers.

EDI handles the heavy lifting of securely and efficiently moving data. It ensures that claims, policies, and payments are processed quickly and accurately, thereby eliminating unnecessary delays and errors. AI, on the other hand, provides smart, actionable insights. It analyzes customer behavior, predicts needs, and helps automate repetitive tasks. Together, they take efficiency and customer interaction to the next level.

Real-time data processing is one of the biggest advantages of combining EDI and AI. When a customer files a claim, they want fast results, not endless waiting. EDI ensures the data flows seamlessly, while AI instantly reviews and processes details. What used to be a weeks-long process can now be completed in hours or even minutes. This kind of speed and responsiveness makes customers feel valued and cared for.

Another game-changer is personalization. AI helps insurers understand their customers’ needs by analyzing patterns and predicting future requirements. Meanwhile, EDI ensures that this information is shared and acted upon without delay. For instance, if a policyholder frequently travels, AI can identify this and suggest tailored travel insurance options. It’s this kind of thoughtful, customized experience that builds loyalty and trust.

The push for digital transformation in the insurance industry isn’t just about adopting trendy tech; it’s about keeping pace with customer expectations. People today demand convenience, clarity, and a more human touch. By integrating EDI and AI into their operations, insurance companies can deliver on those expectations, offering smarter, faster, and more intuitive customer service.

By working together, these technologies don’t just help insurers improve operations. They create a more meaningful way to connect with customers, proving that insurance companies can be as efficient, adaptable, and customer-friendly as the best in any industry.

By integrating AI and EDI into chat support, insurers are creating a smoother and stress-free way for customers to manage their policies and obtain answers. It’s this kind of forward-thinking approach that helps build trust and loyalty in a competitive market.

AI-powered chatbots are transforming customer support by working with EDI (Electronic Data Interchange) to deliver fast and accurate answers. EDI provides a structured and secure way to manage vast amounts of policyholder data, like claims history and coverage details. AI then leverages this data to provide customers with real-time solutions. Whether it’s a question about policy updates, billing inquiries, or filing a claim, these chatbots can instantly access the information, saving customers time and frustration. This blend of automation and data access ensures that customers get reliable answers tailored to their specific needs.

The combination of AI and EDI shines when tackling everyday policyholder concerns. For example, consider a scenario where a customer loses their house keys and wants to know if their homeowner’s insurance includes locksmith services. A quick question to an AI chatbot gives them a direct answer, avoiding an anxious wait.

Another example? Updating a policy. A family may want to add a new teen driver to their auto insurance policy. Instead of navigating phone trees or paper forms, they can open a chat and provide the necessary details. The chatbot, using EDI data, verifies eligibility, calculates the new premium, and updates the policy while the family finishes breakfast. This efficient process ensures the details are correct and the update is processed instantly.

Even complex support inquiries benefit. Say a customer has a medical insurance claim denied and is unsure why. By asking the chatbot to review their claim, the system can retrieve EDI-stored documentation and provide a clear explanation, such as missing paperwork or policy limitations. If needed, it can even guide them on how to resolve the issue, providing the customer with actionable solutions on the spot.

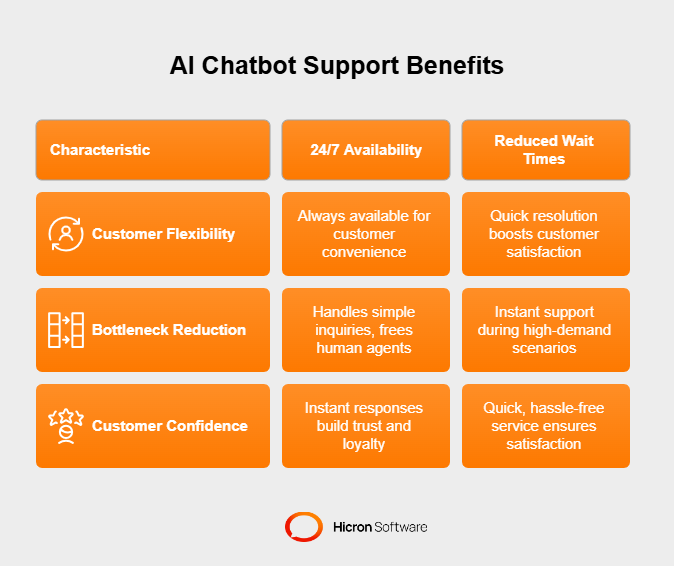

The benefits of AI-driven chat support go beyond convenience.

First and foremost, it offers customers flexibility. Whether it’s a working parent who can only sort out life insurance adjustments at 10 PM, or a traveler stuck in an airport needing urgent clarification on their policy, the chatbot is always at their service. There’s no stress about reaching someone “before closing time” or frustration over call center hold music.

For insurance companies, 24/7 chatbot availability also means fewer bottlenecks. Customers with simpler needs, such as basic policy inquiries or payment confirmations, can resolve issues themselves, allowing human agents to focus on more complex cases that require a personal touch.

For instance, chatbots can efficiently handle routine requests during disaster scenarios, such as hurricanes, when call centers are overwhelmed with claims. Customers who need to check a policy detail aren’t competing for support with those needing emergency assistance, creating smoother operations for everyone.

Reduced wait times also play a vital role in boosting customer satisfaction. Imagine a newlywed couple calling to merge their insurance policies. Waiting days for a call back from an agent could take the excitement out of their milestone. Instead, chatting with an AI support system lets them manage everything in minutes, ensuring the process is quick and hassle-free.

Beyond speed, these tools build customer confidence. When policyholders can ask questions and know they’ll get a clear, instant response, they feel seen and valued. This leads to higher trust and loyalty, making it far more likely that they will stick with their provider and recommend it to others.

By leveraging EDI and AI, insurers are moving beyond outdated processes. They’re delivering transparency, tailored recommendations, and automated updates that customers appreciate and increasingly expect. These tools enhance the insurer-client relationship, strengthening it and fostering greater collaboration.

#1 Real-time notifications at every step

Filing an insurance claim can be stressful, and often, the biggest frustration arises from not knowing the status of your case. EDI (Electronic Data Interchange) solves this by automating claims updates. Customers no longer need to constantly follow up with calls or emails to receive updates. Instead, they can get real-time notifications through their preferred channels, such as email, text messages, or a mobile app.

For example, when a claim is received, the customer may receive a message stating, “We’ve received your claim, and it’s currently under review.” As the claim progresses—for instance, when supporting documents are reviewed or a decision is made—automated updates ensure the policyholder stays informed every step. It’s a simple but powerful feature, reducing frustration and building trust through consistent communication.

#2 Streamlining the claims process

This technology also helps insurers internally. By utilizing structured EDI data, claim handlers can quickly access all relevant information without manually reviewing records. This means fewer delays for customers. For instance, if a car insurance claim needs additional photos of the vehicle, an automated message can be sent instantly, specifying exactly what the customer needs to provide and where to upload it. By keeping the process clear and efficient, both insurers and clients save a significant amount of time.

#1 AI as your personal insurance advisor

Navigating insurance options can feel overwhelming. Deciding what you truly need can be challenging with so many coverage types. That’s where AI, powered by insights from EDI, makes a huge difference. By analyzing a customer’s unique profile, including past claims, current policies, and even behaviors like travel or home improvements, AI suggests coverage tailored to their exact needs.

For example, if a customer frequently travels for work, AI might recommend adding travel insurance or expanding their existing policy to include trip cancellation protection. Similarly, suppose a young entrepreneur reaches out to explore life insurance options.

In that case, AI can suggest specific policies tailored for small business owners, considering their need for key-person insurance or income protection. These recommendations go beyond generic brochures, making customers feel understood and valued.

#2 Dynamic adjustments over time

What makes AI truly remarkable is its ability to adapt and learn. Life changes fast, and your insurance needs evolve too. AI-powered systems can review recent updates to your lifestyle, such as adding a teenager to your car insurance or renovating your home, and suggest policy modifications to ensure you’re always covered.

Picture an app that notifies you, “Based on your recent policy activity, we recommend evaluating bundled home and auto insurance for additional savings.” Personalized touches like these make decisions easier and more meaningful.

#1 Clear and reliable access to information

Insurance often feels complicated because it hasn’t always been highly transparent. EDI changes this by organizing policyholder data in a way that is easy to access and understand. With EDI integration, customers can review their insurance details, including premium payments, claims history, and policy terms, with just a few clicks. A customer might log into their insurer’s app and see, “Your last payment was received on October 15, 2023. Your next payment is scheduled for November 15, 2023.” This level of clarity eliminates confusion, giving customers confidence in their coverage.

#2 Crisis communication done right

Transparency becomes even more critical during emergencies. Imagine a natural disaster strikes, leaving insurance policies and claims at the forefront of everyone’s mind who is affected. With EDI-driven systems, insurers can send urgent messages to policyholders, informing them, “Your policy is active, and claims related to this event are being prioritized.” They can also provide regular updates on processing times or direct customers to additional resources. Knowing your insurer is communicating clearly during a crisis reinforces trust when it matters most.

When customers experience transparent and efficient communication, they’re more likely to feel secure. For instance, consider a couple reviewing their health insurance policy as they plan for a family. Seeing real-time breakdowns of maternity benefits and out-of-pocket costs helps them prepare financially without guesswork. Similarly, a small business owner who can instantly access precise details about their commercial liability policy feels reassured they’ve made the right choice. Trust isn’t built on words alone but on clear, consistent, and reliable actions.

EDI and AI tackle customer pain points from multiple angles by working together. They make data more accurate, resolve issues before they arise, and give customers the tools to manage their insurance confidently. The result? A smoother, more satisfying insurance experience sets a new industry standard.

Errors in customer data can be a major source of frustration. Small mistakes can have big consequences, whether it’s a misspelled name, incorrect contact details, or mismatched policy numbers. Enter Electronic Data Interchange (EDI) and Artificial Intelligence (AI). Together, they ensure data accuracy by implementing intelligent validation systems.

For example, when a customer submits a change of address, EDI ensures that the data is entered in a structured format across all systems, maintaining consistent records. AI takes it further by running validation checks. If an address does not align with the matching ZIP code or fields are left incomplete, the system flags the issue in real-time, prompting the customer or agent to correct it immediately.

These same systems can also prevent billing errors. Suppose a policyholder sets up auto-pay for their policy. Intelligent validation verifies account details, ensuring the payment goes through as planned. Such accuracy minimizes disruptions and gives customers confidence that their data is always handled correctly.

What if your insurance company could anticipate issues before they became headaches? That’s the power of predictive analytics, which is driven by AI and fueled by the structured data managed through Electronic Data Interchange (EDI). Instead of reacting to problems, insurers can now prevent them, resulting in a smoother customer experience.

Take billing as an example. Predictive analytics can identify patterns in late payments and send timely reminders to customers before their due dates are missed, thereby preventing missed payments. Analyzing past data can reveal common errors that slow processing times for claims. Instead of waiting for customers to submit incomplete forms, insurers can offer proactive guidance, such as notifying them about missing documents upfront.

Another application is risk management. Health insurers may notice trends indicating high-risk health conditions by analyzing claim histories. If patterns suggest that a customer is at risk of developing a chronic illness, the system could notify them about wellness programs or policy adjustments that could save money and improve outcomes. Such foresight is invaluable in building trust and satisfaction.

Modern customers want to handle tasks on their terms, without waiting on hold or wading through confusing documentation. That’s where enhanced self-service tools, powered by AI and EDI, empower customers to manage their policies more effectively.

For example, self-service portals and apps enable customers to view their coverage details, download important documents, and even file claims without contacting an agent. AI provides convenience by allowing intuitive chat features and guided assistance.

Imagine you’re a homeowner who needs to check whether your policy covers roof repairs after a storm. Instead of hunting through a lengthy policy document, you can ask a virtual assistant, “Am I covered for roof damage?” The assistant taps into EDI-stored policy data and provides a quick answer.

Even complex tasks, such as updating policies, are now more manageable. Need to add a family member to your car insurance? Customers can input their information via a user-friendly app. AI ensures all details are validated, while EDI instantly syncs the update across the insurer’s systems.

Streamlined service for all

Self-service benefits customers and insurers. By automating routine inquiries, companies can free up human agents to focus on cases that require a personal touch. This creates a better overall experience, especially during high-demand situations, such as a natural disaster, when support teams are stretched thin.

The symbiosis between EDI and AI creates a powerful engine for insurers, driving more efficient operations, smarter spending, and stronger customer relationships. For clients, it transforms the experience of dealing with insurance, from fast resolutions when it matters most to personalized and hassle-free interactions. It’s a partnership in technology that benefits everyone, paving the way for a more connected and customer-centric industry.

Think of EDI and AI as the teamwork behind a well-oiled pit crew in a high-stakes race. EDI ensures data moves accurately and securely between systems, while AI analyzes and resolves issues at lightning speed. Together, they enable insurers to respond to customer concerns more quickly and effectively than ever.

For instance, EDI minimizes manual errors in claims processing by seamlessly transferring key information, such as policy details and documentation. AI then analyzes this data in real-time to determine coverage or identify missing elements. The outcome? Claims decisions that used to take weeks now happen in hours, sometimes even minutes. That’s the kind of speed customers notice and appreciate, especially in stressful situations when time is of the essence.

Take a homeowner dealing with unexpected storm damage. Instead of anxiously chasing updates in the aftermath, this technology duo ensures quick answers and fast resolutions. The process feels less like a lengthy uphill struggle and more like having an express service for your peace of mind.

Manual processes have long been the costly bottlenecks of the insurance world. Imagine relying on paper forms and endless back-and-forths to process routine customer updates. It’s like taking the scenic route when you just want to arrive at your destination quickly. EDI and AI streamline these workflows, reducing delays and expenses.

Let’s take an example: EDI automatically updates customer profiles across systems whenever changes occur, eliminating repetitive and error-prone tasks that would otherwise require manual work. Simultaneously, AI-powered automation handles customer requests, from checking claim statuses to processing policy updates. It’s like delegating mundane chores to highly efficient assistants, freeing human teams to focus on the issues needing their expertise.

This significantly reduces operational costs for insurers and customers, and those savings can translate to more competitive premiums or enhanced services. When the system runs more smoothly and efficiently, everyone benefits, reducing unnecessary overhead.

EDI and AI do more than improve efficiency or cut costs; they add a human touch to technology-driven processes. By personalizing customer experiences, these tools help insurers build trust and demonstrate care in ways that resonate.

AI leverages data from EDI to understand customers on an individual level. For example, it can analyze a customer’s travel habits and recommend tailored travel insurance packages. It might detect when a family is expanding and suggest updates to their life insurance coverage. These interactions feel thoughtful and relevant, turning routine business into moments of genuine connection.

EDI, on the other hand, ensures that all relevant data is presented accurately and promptly, eliminating common frustrations such as mismatched records or repeated questions. Imagine logging into a mobile app and instantly accessing a clear snapshot of your coverage or receiving near-instant claim updates during an emergency. It’s a seamless experience that strengthens relationships and keeps customers confident in their provider.

These real-world examples demonstrate how EDI and AI transform the traditional insurance experience. From faster claims to proactive problem-solving and personalized service, these technologies improve operational efficiency and create meaningful, lasting customer connections.

The measurable increases in satisfaction and retention reveal the power of being there for policyholders when it matters most. Whether navigating life changes or responding to disasters, the future of insurance lies in leveraging these innovative solutions to exceed customer expectations.

When Hurricane Irene caused widespread property damage, many homeowners were left scrambling to file claims. Response time became a key differentiator for insurers utilizing the combined power of EDI and AI. One company implemented EDI to ensure seamless data transfer between customers, adjusters, and contractors, thereby avoiding the typical delays caused by paperwork bottlenecks. Meanwhile, AI scanned incoming claims for accuracy and flagged inconsistencies before they could slow down processing.

For many, claims were finalized within 48 hours rather than the traditional weeks-long wait for assessment and approval. Real-time communication updates, sent via text or app notifications, reassured policyholders at every step. After the recovery period, customer surveys highlighted a 30% increase in satisfaction rates, with policyholders citing efficiency and transparency as the standout qualities. Retention rates for affected customers spiked, proving the long-term impact of timely support during a crisis.

A growing family in suburban Ohio needed to revisit their insurance policies after welcoming twins. They had questions about health insurance for the new additions, life insurance for their changing circumstances, and whether their home policy covered the high chair their toddler had already managed to damage.

Instead of enduring hours of policy research and agent calls, the family turned to their insurer’s AI-driven chatbot, powered by EDI for real-time data updates. The system analyzed their existing policies, identified gaps in coverage, and proactively suggested updates tailored to their new lifestyle. Recommendations included expanding health coverage for pediatric care and adding accidental damage protection to homeowners’ policies.

The experience felt tailored, seamless, and efficient. The family upgraded their policies without leaving the comfort of their home, and follow-up surveys reported a 40% improvement in perceived ease of service compared to the insurer’s pre-AI operations. This personalized experience met their immediate needs and turned the family into vocal advocates for the brand.

A leading health insurance provider integrated EDI and AI to help predict potential health risks among policyholders. By analyzing claim histories, medical records, and wellness trends, the system identified individuals at a heightened risk for chronic illnesses, such as diabetes. It then used these insights to offer tailored wellness programs and incentives, such as discounted premiums for consistent participation.

Take the example of a 45-year-old policyholder flagged for rising health risks due to a sedentary lifestyle and a history of borderline glucose levels. Instead of waiting to file claims for eventual medical expenses, the system proactively reached out through a personalized app notification, offering enrollment in a fitness rewards program.

The policyholder joined a local gym, which offered discounts provided by the insurer, and began receiving monthly progress reports. AI-generated encouragement notifications and activity-based gift cards helped maintain high motivation.

Within a year, this demographic’s claims related to lifestyle-driven health complications fell by 15%, while satisfaction scores increased dramatically. Customers felt seen, valued, and supported, which reduced churn and fostered stronger, long-term relationships.

When wildfires swept through parts of California, tens of thousands of policyholders needed immediate claim assistance. A major insurer turned to EDI and AI to efficiently handle the volume. EDI facilitated the quick aggregation and distribution of disaster-related policyholder data, including property locations and specific coverage details. Concurrently, AI assessed drone footage of affected neighborhoods to prioritize claims based on the severity of the damage.

Priority claims were identified within hours, and adjusters were dispatched to high-need zones. Policyholders received automated updates about their status and were advised on immediate steps to confirm claims, such as uploading photos. This reduced bottlenecks in processing and ensured the insurer could assist the maximum number of customers quickly.

Feedback from a post-disaster survey revealed a 40% improvement in trust scores compared to the insurer’s response to past disasters, underscoring the significant impact of technology on customer sentiment during critical moments.

Integrating EDI and AI, bolstered by emerging technologies like machine learning and NLP, marks a new chapter in building customer-focused insurance operations. By investing in these solutions now and fostering strong partnerships with tech providers, insurers can create systems that aren’t just responsive to today’s needs and adaptive to tomorrow’s challenges.

To remain competitive, insurers must prioritize digital transformation, harnessing the power of these technologies to drive efficiency, innovation, and customer satisfaction. The result? Not just better operations but a stronger connection with customers that stands the test of time. It’s not just about keeping up but staying ahead in an increasingly customer-centric industry.

The insurance industry is undergoing a rapid transformation, and staying ahead means staying agile. Investing in Electronic Data Interchange (EDI) and Artificial Intelligence (AI) solutions isn’t just a nice-to-have anymore; it’s a strategic necessity. Customers expect faster service, personalized experiences, and seamless interactions, and insurers that fail to deliver risk losing their competitive edge.

EDI streamlines data flow, enabling insurers to process claims and manage policies with unparalleled efficiency and accuracy. AI, meanwhile, brings intelligence to these workflows by automating operations and complex tasks and providing actionable insights. Together, they form the backbone of modern customer-focused operations, reducing costs, minimizing errors, and delivering the kind of responsiveness that customers value.

Simply put, insurers that fail to adopt and adapt risk falling behind, not just to industry peers but also to insurtech startups and tech-savvy entrants disrupting the market. By championing AI and EDI, forward-thinking insurers position themselves as innovative and customer-first, ensuring they remain relevant in a rapidly evolving landscape.

While EDI and AI lay the groundwork for transformation, emerging technologies like machine learning (ML) and natural language processing (NLP) are taking things further. ML identifies trends and patterns in data, enabling insurers to make informed decisions more quickly than ever. Whether detecting fraud in claims or forecasting risk, machine learning enhances accuracy and efficiency, saving time for insurers and customers.

Natural language processing, on the other hand, is revolutionizing customer interactions. Integrated into chatbots and virtual assistants, NLP enables AI to understand and respond to customer questions in a conversational tone. This creates a more human-like experience, turning tasks like filing a claim or updating a policy into smooth, effortless interactions.

Imagine a customer needing clarification on policy coverage; instead of digging through documents or waiting on hold, they ask a virtual assistant that provides instant, relevant answers in plain language.

Together, these technologies enhance the effectiveness of EDI and AI, enabling hyper-personalized service, increased accuracy, and predictive capabilities that transform how insurers interact with their customers.

Innovation in insurance doesn’t happen in isolation. Forward-thinking insurers recognize the value of collaboration with technology providers to leverage cutting-edge solutions effectively. These partnerships combine deep industry expertise with technical innovation, enabling insurers to effectively implement AI and EDI in ways that align with their specific operational needs.

Tech providers often offer tailored solutions, from custom insurance software to AI-powered analytics tools, designed to address industry-specific pain points. For instance, insurers working closely with providers can co-create systems that integrate predictive analytics into claims workflows or adopt advanced automation to improve underwriting accuracy. Such collaboration accelerates the adoption of modern tools and ensures scalability and relevance as the industry continues to evolve.

This approach is particularly crucial as insurers seek to future-proof their systems amid rising customer expectations. Developers and insurers working hand-in-hand ensure these solutions meet regulatory requirements and consumer demands, balancing innovation with practicality.

Bringing AI and EDI together is like giving the insurance industry a much-needed upgrade. For companies, it means smoother operations, fewer mistakes, and quicker decisions that save time and money. For customers, it’s all about better experiences—from faster claims to personalized policies that make sense for their lives. Everyone wins.

For insurers, now is the moment to step up. Customers expect speed, simplicity, and excellent service; companies prioritizing these aspects will lead the way. Adopting AI and EDI isn’t just about keeping up with technology; it’s about standing out in a crowded market by showing customers you’ve got their backs.

The future is full of opportunities. With tools like machine learning and smart assistants, insurance is becoming easier, faster, and more human. The companies that move now will set the standard for the best insurance service. This isn’t just about tech; it’s about building trust, loyalty, and lasting connections. The time to leap is now, and the payoff? Happier customers and a business that’s ready for whatever comes next.