Real-time Finance Offers: Revolutionizing the Automotive Buying Experience

- October 23

- 15 min

When it comes to purchasing a vehicle, finding financial solutions that align with individual needs is crucial. This is where custom vehicle finance options come into play, providing flexibility and convenience for buyers and dealers alike. Among these solutions, vehicle buyback programs have emerged as a popular choice, offering unique advantages that stand out in the world of automotive finance.

A vehicle buyback program allows consumers to sell their vehicle back to the dealer at a pre-agreed price after a set period. For buyers, this creates an added layer of flexibility, reducing long-term financial commitments and allowing easier upgrades to newer models. For dealerships, it fosters customer loyalty and helps maintain a steady inventory of well-maintained pre-owned vehicles.

Custom finance solutions, like vehicle buyback programs, underscore the automotive industry’s shift toward consumer-centric practices. These solutions cater to varying budgets, preferences, and lifestyles, ensuring that both dealers and customers can find value and satisfaction.

This article dives into the many benefits of vehicle buyback programs and explores why they are an essential part of the evolving vehicle finance landscape. Whether you’re a car buyer seeking more thoughtful financial options or a dealer aiming to enhance customer satisfaction, there’s something here for everyone. Read on to discover how these programs redefine vehicle ownership!

Vehicle buyback programs are innovative financial arrangements in the automotive industry that provide both buyers and dealerships with unique benefits. At their core, these programs are agreements where a vehicle buyer can sell their car back to the dealer at a predetermined price after a specified time frame. By incorporating a guaranteed resale value into the equation, buyback programs reduce financial uncertainty for the buyer and foster long-term trust between the customer and the dealership.

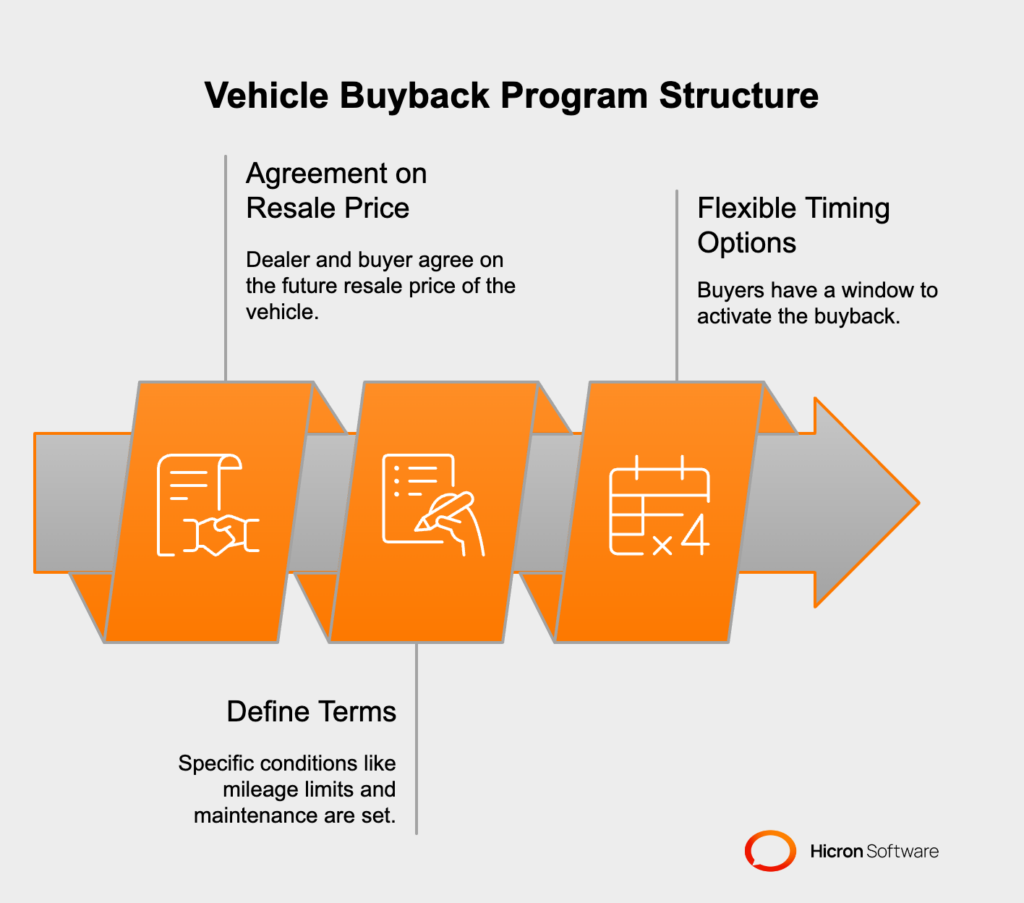

The structure of a vehicle buyback program is straightforward but powerful. When a vehicle is financed or leased under this model, the dealer and buyer agree on the following:

Pre-agreed resale price: This is the set amount the dealer will pay for the vehicle when it is returned at the end of the agreed period. It is calculated based on the anticipated depreciation of the car.

Specifically defined terms: The agreement often includes conditions such as mileage limits, maintenance requirements, and vehicle wear and tear guidelines. These ensure the car is returned in a suitable condition.

Flexible timing options: Buyers typically have a defined window within which they can activate the buyback, providing them with added control over their financial decisions.

This structure delivers significant value by giving consumers a clear exit strategy. It also benefits dealers by creating a predictable inventory of pre-owned vehicles in good condition, which can be resold to other buyers.

Car buyback programs are not a one-size-fits-all solution. There are several types of agreements designed to align with diverse consumer needs and dealership objectives:

Guaranteed buyback agreements: This is the most common type of car buyback program. Under this arrangement, the dealer guarantees to purchase the vehicle back at a fixed price, regardless of market conditions. This lets buyers upgrade to newer models more easily without worrying about fluctuating vehicle values.

Conditional buyback agreements: These agreements include additional stipulations that must be met for the buyback to proceed, such as the car having no significant accidents or being maintained according to the dealer’s guidelines. These conditions help protect the dealer’s investment while ensuring vehicles remain in top condition.

Flexible return options: Some vehicle buyback programs offer more flexibility, allowing buyers to decide at multiple points whether they want to return the car, continue financing, or pay off the remaining cost entirely. This type of agreement is ideal for consumers seeking maximum control over their vehicle ownership experience.

Each type of agreement has its unique appeal, catering to different customer profiles. For instance, someone who regularly upgrades to newer models may benefit from a guaranteed buyback. At the same time, a driver seeking long-term flexibility might prefer a program with conditional or open-ended return options.

By understanding these variations, consumers can make informed choices, and dealers can tailor their offerings to build lasting customer relationships. Car buyback programs are versatile automotive tools in custom vehicle finance, paving the way for smarter, more convenient vehicle ownership experiences.

As the automotive industry evolves, so do consumers’ expectations. Today’s buyers value options that align with their unique needs, preferences, and lifestyles, prompting a shift toward more customized vehicle finance solutions. These tailored approaches go beyond one-size-fits-all offerings, ensuring that every customer can find a plan that works for them.

No two customers are alike, and their financial needs reflect this diversity. Some car buyers may prioritize low monthly payments, while others may focus on the ability to upgrade vehicles frequently. To meet these varied demands, dealerships are designing flexible finance plans incorporating adjustable terms, personalized payment structures, and options to cater to specific circumstances.

For instance, younger buyers entering the market for the first time might prefer lower upfront costs or deferred payment options. On the other hand, seasoned drivers with established credit histories may seek financing plans that offer lower interest rates on shorter terms. By providing a spectrum of solutions, dealerships demonstrate their commitment to serving a broader audience, solidifying customer relationships, and increasing satisfaction.

Vehicle buyback programs add another layer of customization, enhancing the overall appeal of vehicle finance solutions. By integrating buyback options into these plans, dealerships empower customers with greater flexibility and assurance throughout their ownership experience.

Flexibility to adapt: A car buyback program allows customers to enjoy their vehicles without being locked into long-term commitments. Buyers can upgrade to the latest models, adjust their financial strategy, or simply return the car at the program’s conclusion. This level of adaptability is desirable to consumers who value freedom over ownership permanence.

Financial peace of mind: With a pre-agreed resale price, buyers eliminate the uncertainty that often comes with vehicle depreciation. They can focus on enjoying their cars, knowing they have a secure exit strategy in place. This assurance makes buyback programs particularly appealing in today’s unpredictable market.

Mutual benefits for dealerships: Integrating buyback options offers dealerships the advantage of customer retention and a steady supply of well-maintained used vehicles. Programs like these encourage repeat business, as satisfied customers are more likely to finance their next vehicle through the same dealership. Plus, returning pre-owned vehicles in good condition supports resale initiatives and helps maintain inventory levels.

By combining vehicle buyback programs with tailored financing solutions, dealerships can cater to the specific demands of modern consumers while driving business success. This approach ensures customers feel supported and valued, making it a win-win for both parties. Whether it’s a first-time buyer seeking simplicity or a seasoned car owner looking for value, these enhanced finance solutions elevate the car-buying and ownership experience to new heights.

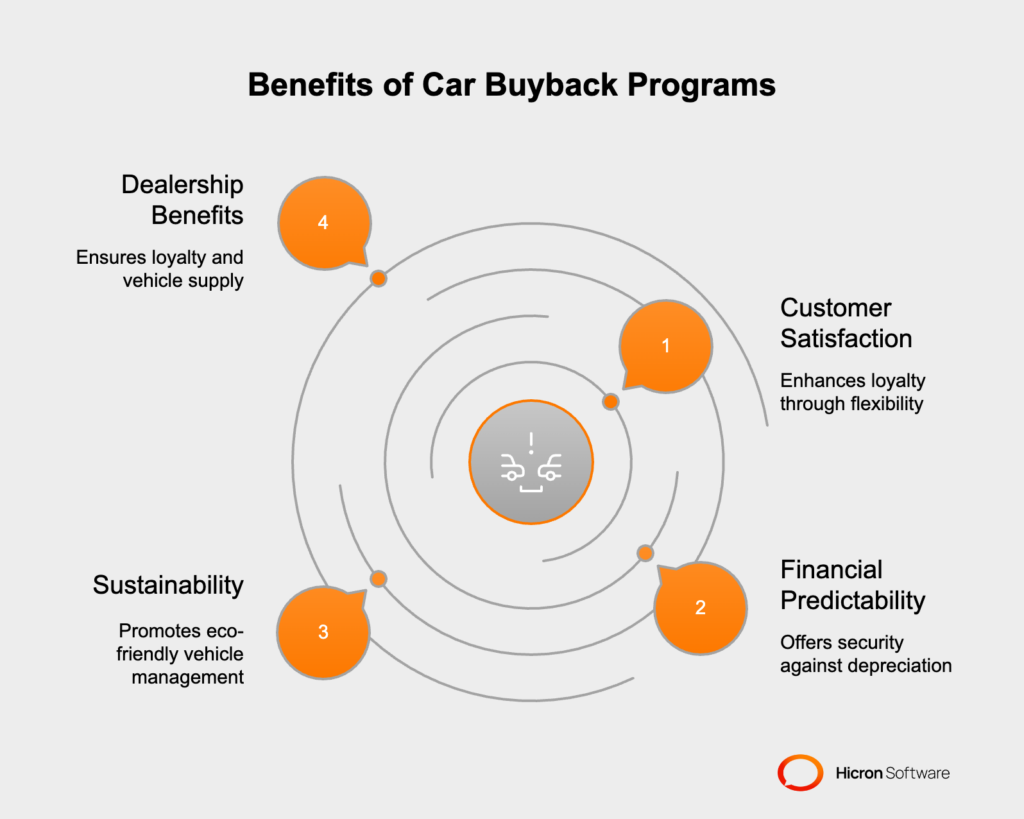

Car buyback programs are becoming a cornerstone of innovative vehicle finance solutions, offering benefits that resonate with both consumers and dealerships. By providing flexibility, financial assurance, and sustainability, these programs transform how we approach vehicle ownership.

One of the standout advantages of buyback programs is their ability to enhance customer satisfaction and foster loyalty. By introducing a clear and flexible path for vehicle ownership, customers are empowered to make decisions that align with their evolving needs. Whether it’s upgrading to the latest model, resizing their financial commitments, or simply initiating a planned return, buyers gain a sense of control.

This flexibility builds trust, making customers more likely to return to the same dealership for future purchases. For dealerships, this translates into long-term loyalty and a stronger, more engaged customer base. It’s not just about selling vehicles; it’s about building enduring relationships through customer-centric solutions.

Financial predictability is another compelling benefit of vehicle buyback programs. By agreeing on a pre-set resale price at the start of the contract, buyers gain protection from the risks associated with vehicle depreciation. This eliminates the stress of uncertain market conditions, offering peace of mind that their investment retains value over time.

This means no surprises, just clear terms and a dependable plan for buyers. For dealerships, this structure simplifies future interactions and ensures vehicles returning under the program are accounted for in financial planning. It helps both parties approach vehicle financing with greater confidence and mutual benefit.

Vehicle buyback programs also play a pivotal role in promoting sustainability across the automotive industry. With vehicles returned to the dealership after their initial use, there’s a seamless opportunity to manage their lifecycle effectively. Cars that are in good condition can be refurbished and resold as certified pre-owned options, extending their usability and reducing waste.

This method aligns with eco-friendly practices by promoting the reuse of resources and minimizing the environmental impact of vehicle production. Consumers who prioritize sustainability can feel good about participating in a program that supports responsible consumption, while dealerships enhance their commitment to green practices.

Ultimately, car buyback programs create a dynamic win-win solution that addresses key needs on both sides of the transaction. Consumers benefit from the flexibility, security, and confidence these programs provide. Dealerships enjoy stronger customer loyalty, a steady influx of well-maintained pre-owned vehicles, and a reputation for offering adaptable, customer-first finance solutions.

By integrating car buyback programs into vehicle financing, the industry is not only advancing financial innovation but also setting the stage for a more sustainable and customer-focused future. Everybody wins when vehicle ownership becomes smarter, simpler, and more environmentally responsible.

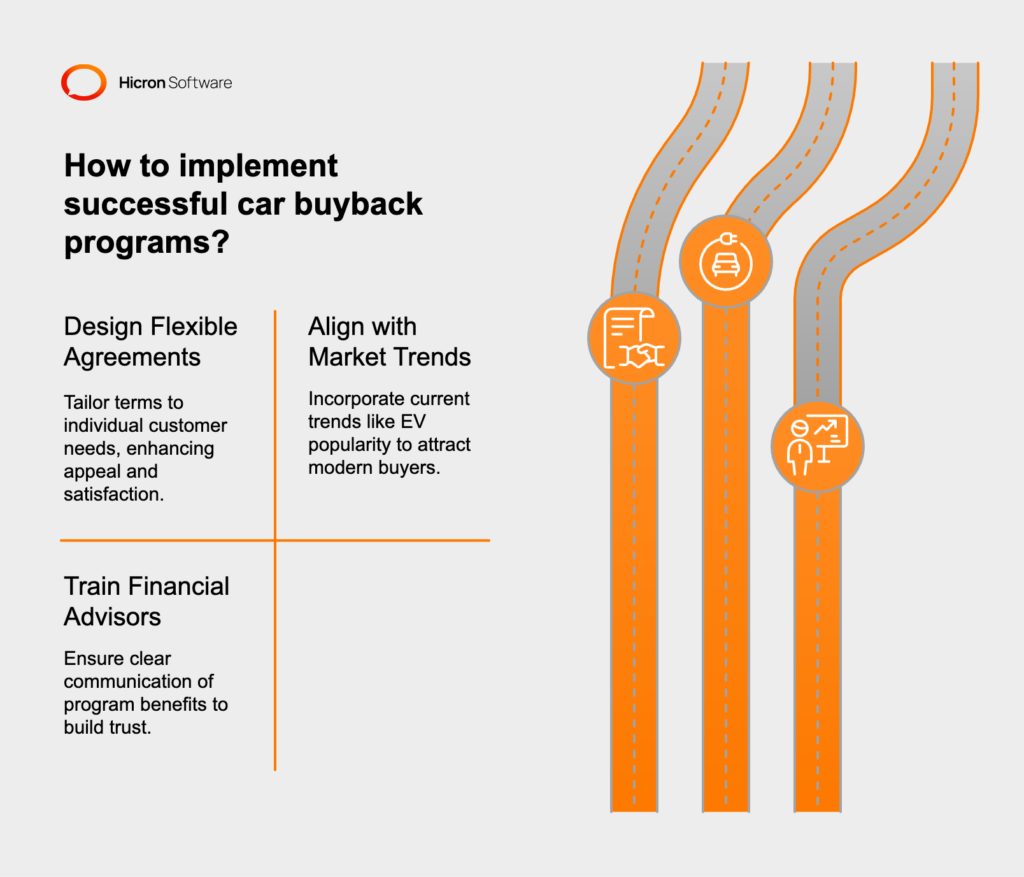

To truly deliver value for both customers and dealerships, vehicle buyback programs must be flexible, customer-focused, and effectively communicated. Here are key strategies to ensure their success in the competitive vehicle finance landscape.

Its ability to adapt to customers’ diverse needs is at the heart of any effective vehicle buyback program. A one-size-fits-all approach simply won’t suffice. Successful programs offer flexible terms that account for various factors such as mileage usage, maintenance requirements, and return timeframes. These agreements should also provide optionality, allowing customers to decide between reselling the vehicle, continuing ownership, or upgrading.

For example, a customer who drives long distances for work may benefit from higher mileage allowances, while someone who prioritizes regular upgrades may prefer short-term contracts. Flexibility in these agreements not only increases their appeal but also ensures that customers feel their unique circumstances are being acknowledged and addressed.

Understanding customer preferences and staying attuned to market trends is essential for designing resonating vehicle buyback programs. Current trends, such as the growing popularity of electric vehicles (EVs), shorter ownership cycles, and increasing financial uncertainty, should be factored into program structures. Offering specific incentives for EV owners, such as reduced depreciation rates or longer terms, can attract environmentally conscious buyers.

Similarly, car buyback programs must reflect shifting consumer behaviors, including the desire for affordability and convenience. By staying ahead of market trends and tailoring programs to meet evolving demands, dealerships can make their offerings more relevant and appealing to modern buyers.

Even the most well-designed buyback program can fall flat if customers fail to understand its benefits. This is where the role of financial advisors becomes crucial. Advisors act as the bridge between the dealership and the customer, ensuring clear communication of program terms, flexibility, and value.

Effective training programs for financial advisors should focus on:

By equipping advisors with detailed knowledge and communication skills, dealerships can foster trust and confidence in their programs. Customers who fully grasp the benefits are more likely to see buyback programs as an advantageous option.

When implemented effectively, car buyback programs deliver immense advantages. They provide a blend of financial security, adaptability, and choice for consumers. Buyers feel empowered in their decision-making, knowing they have a clear and flexible exit strategy. For dealerships, these programs increase customer satisfaction and retention while building a robust inventory of pre-owned vehicles. Additionally, staying aligned with market trends ensures a competitive edge and drives more business.

By focusing on flexibility, relevance, and education, dealerships can unlock the full potential of buyback programs and position themselves as forward-thinking industry leaders committed to modern customer needs.

Implementing vehicle buyback programs in vehicle finance involves clear financial considerations, but the long-term benefits often outweigh the initial costs. By examining the cost implications and return on investment (ROI), dealerships can better understand how these programs contribute to their bottom line while fostering more robust customer relationships.

Establishing a vehicle buyback program requires an upfront investment. Costs may include offering competitive pre-agreed resale values, staffing, and training financial personnel, and managing vehicle returns. Additionally, there are operational costs tied to certifying and reselling returned vehicles as part of a pre-owned inventory.

However, the ROI generated by these programs justifies these expenditures. Cars returned in good condition can be refurbished and sold as certified pre-owned vehicles, often commanding a higher resale price. This creates an additional revenue stream and prevents inventory shortages, a significant advantage in a competitive market.

Furthermore, the financial predictability afforded by buyback programs can make dealerships less vulnerable to economic downturns or fluctuating market demand. With a structured system for managing vehicle returns, dealerships can ensure a steady supply chain and avoid costly inventory procurement.

One of the most financial benefits of car buyback programs is their ability to build customer loyalty. By offering flexibility and reducing the financial risks associated with vehicle depreciation, customers are more likely to return to the same dealership for their next purchase. Retaining loyal customers is far more cost-effective than acquiring new ones, saving dealerships on marketing and sales expenses in the long run.

Additionally, car buyback programs provide a competitive edge to drive sales, especially among younger, budget-conscious buyers or those uncertain about long-term vehicle ownership. By addressing customer needs for flexibility and security, dealerships are trusted, customer-first businesses. This heightened trust can translate into repeat business, higher referrals, and increased revenue.

From the dealership perspective, the financial benefits of vehicle buyback programs extend beyond ROI and loyalty. These programs enhance inventory management by creating a predictable pipeline of well-maintained pre-owned vehicles, reducing the costs and time associated with acquiring and preparing new inventory.

Another key advantage is the ability to improve cash flow predictability. By forecasting the return of vehicles and their resale potential, dealerships gain clearer visibility into their financial cycles. This allows for more strategic planning, whether it’s for fleet replenishment or investments in new technologies like electric vehicles.

Strategically, vehicle buyback programs serve as a unifying force that ties together customer satisfaction, operational efficiency, and financial performance. When implemented thoughtfully, these programs provide a pathway for dealerships to strengthen their position in the automotive market, secure long-term profitability, and meet the evolving demands of modern consumers.

Vehicle buyback programs enable dealerships to offer something unique—flexibility and predictability in vehicle ownership. Unlike traditional financing options, which often tie customers into long-term commitments with limited exit strategies, buyback programs provide a clear path for returning, upgrading, or selling vehicles. This adaptability appeals to today’s consumers, who are increasingly driven by convenience and choice.

By incorporating vehicle buyback programs into their finance offerings, dealerships position themselves as forward-thinking and customer-centric. This distinction can be a deciding factor for buyers, particularly those who value financial security or consider alternatives like leasing. These programs help dealerships cut through the noise, making their offerings more appealing in a fiercely competitive marketplace.

Trust is a powerful currency in vehicle sales, and car buyback programs create an opportunity to strengthen it. By offering pre-agreed resale terms, dealerships reassure customers that their investments are protected, even in a fluctuating market. This transparency builds confidence, encouraging consumers to view dealerships as reliable partners rather than mere sellers.

Additionally, vehicle buyback programs highlight a commitment to customer satisfaction. Whether it’s giving customers the option to upgrade to the newest model every few years or simply allowing them a stress-free return process, these solutions demonstrate that dealerships prioritize their buyers’ needs. Over time, this focus on customer-first practices enhances brand reputation and fosters long-lasting loyalty.

The benefits of car buyback programs go beyond customer satisfaction; they contribute directly to a dealership’s growth and market position. By attracting first-time buyers with low-risk financing or appealing to experienced buyers who appreciate flexibility, these programs widen the customer base. Combined with higher retention rates driven by repeat business, dealerships can create a cycle of sustainable growth.

Dealerships leveraging car buyback programs gain access to valuable pre-owned inventory. Returned vehicles in good condition can be repurposed as high-quality certified pre-owned options, boosting profitability and inventory efficiency. This dual advantage of increased customer acquisition and improved resource management creates a significant edge in the market.

Vehicle buyback programs are more than just a competitive advantage. They’re a strategic solution that aligns with changing consumer expectations and industry trends. They allow dealerships to meet and exceed the demands of modern buyers who seek flexibility, predictability, and trust. By adopting these programs, dealerships position themselves at the forefront of the industry, securing a stronger market position and a reputation for innovation.

A successful vehicle buyback program hinges on its ability to manage risks effectively. While these programs provide immense benefits to both dealerships and customers, they also come with financial and operational challenges that require careful planning and oversight. Proactively identifying and mitigating these risks ensures the program’s stability, reliability, and long-term success.

Car buyback programs inherently pose financial risks due to factors like unexpected depreciation, market fluctuations, and condition variability of returned vehicles. If resale values fall short of projections, dealerships could face losses. To mitigate this, it’s crucial to base pre-agreed resale prices on thorough market analysis, factoring in historical trends, economic conditions, and vehicle demand. Regular reviews and updates to these projections ensure they remain accurate and realistic.

Operationally, the influx of returned vehicles can strain logistics, from storage requirements to inspection and refurbishment processes. To address this, dealerships should establish streamlined workflows and partner with reliable service providers to handle vehicle certifications efficiently. Proper inventory management systems can also prevent bottlenecks and help maintain a consistent pre-owned vehicle pipeline.

Clear communication is the foundation of effective risk management in buyback programs. Misunderstandings over terms like mileage limits, wear-and-tear standards, or return timeframes can lead to customer dissatisfaction and financial disputes. To minimize these risks, dealerships must develop comprehensive, easy-to-understand agreements.

Transparency is key, terms and conditions should be explicitly laid out, with no hidden fees or surprises. Providing customers with visual aids or real-world examples during discussions can further enhance clarity and ensure they fully understand their commitments and options. This level of openness builds trust and reduces the likelihood of disputes.

A robust risk assessment process is critical to identifying potential vulnerabilities in the program. This involves regular evaluation of market trends, vehicle performance, and customer behavior to anticipate risks early. Dealerships should also invest in training their financial advisors to recognize and communicate potential challenges, turning these into proactive solutions for customers.

Equally important is maintaining regular communication with customers throughout the program’s lifecycle. Keeping buyers informed about their options, upcoming return conditions, and any market-related changes helps avoid last-minute surprises and fosters confidence.

Effective risk management safeguards dealerships from financial or operational setbacks and bolsters the overall reputation and reliability of buyback programs. By ensuring accurate forecasting, providing transparent agreements, and integrating clear communication channels, dealerships reinforce the trustworthiness and appeal of their offerings.

The foundation of any effective vehicle buyback program lies in transparent and fair criteria. Customers should feel confident that the terms are equitable and easy to understand. In agreement documents, this means defining clear parameters, such as vehicle condition, mileage limits, and acceptable wear and tear standards. Pre-agreed resale values should reflect market realities while providing financial assurance to customers.

Fairness also involves ensuring that vehicle buyback terms are attainable for a wide range of customers. By catering to diverse needs without overcomplicating the structure, dealerships can attract more participants and build trust in the program.

The automotive industry is dynamic, with changing trends in buying behaviors, vehicle demand, and economic conditions. To maintain relevance, buyback programs must evolve. Regularly reviewing program policies ensures they remain aligned with customer expectations and external factors.

This practice includes re-evaluating pre-agreed car buyback values, adjusting criteria to reflect vehicle technology advancements (such as electric vehicles), and ensuring compliance with regulatory standards. Being proactive about updates not only prevents stagnation but also positions dealerships as adaptable and forward-thinking entities in the market.

Customer and market feedback are invaluable tools for refining buyback programs. Actively seeking input from participants provides insight into their experiences and unmet needs, allowing dealerships to adjust their offerings accordingly. For example, customers may express a desire for extended mileage limits or more flexible return windows.

Dealerships should also monitor competitor programs and market trends to identify areas for differentiation. By responding to feedback and aligning offerings with consumer preferences, dealerships strengthen their reputation as customer-centric leaders in the industry.

By following these best practices, dealerships set the stage for a buyback program that delivers on its promise to customers while benefiting the business. Clearly, fair criteria foster trust and transparency. Regular policy reviews keep the program competitive and up-to-date. Meanwhile, customer feedback ensures the program remains relevant and attuned to shifting market dynamics.

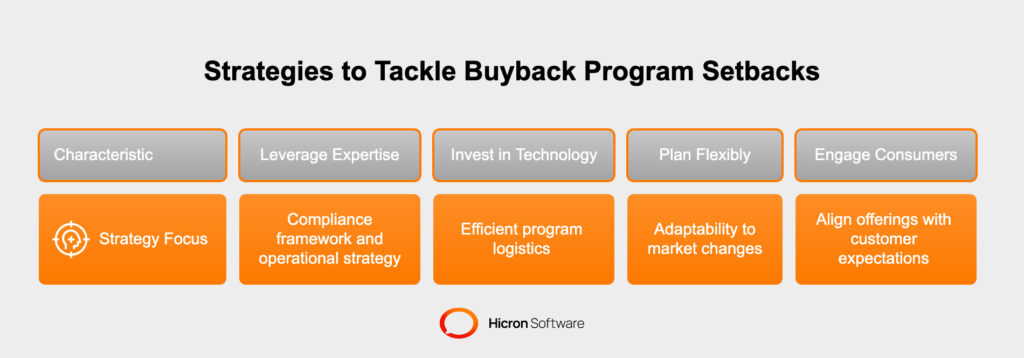

Implementing vehicle buyback programs in vehicle finance comes with its share of complexities. While these programs benefit both dealerships and customers, they also present several challenges that require strategic foresight and problem-solving to overcome.

One of the primary hurdles dealerships face is ensuring that buyback programs comply with local, state, and national regulations. Legal frameworks around vehicle financing and consumer rights can vary widely, and failure to adhere to these can lead to penalties or reputational damage. For instance, some jurisdictions may impose restrictions on pre-determined resale values or require specific disclosure practices.

To address this, dealerships must work closely with legal advisors to create program policies that fully comply with all relevant regulations. Regular staff training on compliance requirements and periodic audits of program practices can further reduce risks and promote transparency.

The operational aspects of buyback programs often present significant challenges. Dealing with a steady influx of returned vehicles requires efficient logistics and infrastructure. This includes having the capacity to inspect, refurbish, and resell cars while maintaining a well-organized inventory system. Without proper planning, dealerships could face bottlenecks or struggle to keep storage costs under control.

Administrative challenges can also arise from managing program documentation and tracking each participant’s eligibility, vehicle condition, and return terms. Investing in technology solutions, such as robust inventory management platforms and customer relationship management (CRM) tools, can streamline these processes. Additionally, building partnerships with third-party service providers for inspections and refurbishments can ease operational pressures.

Consumer needs and preferences constantly shift, and vehicle buyback programs must adapt accordingly to remain relevant. For instance, as electric vehicles gain popularity, dealerships may need to adjust their program criteria to accommodate unique aspects of EVs, such as battery health.

Market dynamics, including fluctuations in vehicle resale values and economic shifts, add another layer of complexity. Programs designed without flexibility risk becoming outdated or financially unsustainable. To overcome this, dealerships should conduct regular evaluations of program terms, stay informed about market trends, and seek customer feedback to guide continuous improvement.

Despite these setbacks, there are several ways to tackle them effectively:

With a proactive approach to these challenges, dealerships can implement vehicle buyback programs that address potential pitfalls and deliver a seamless and valuable customer experience. By investing in compliance, efficient operations, and adaptability, buyback programs can evolve into a practical, competitive advantage in the automotive market.

Financial analysts often highlight the dual benefit of buyback programs in fostering customer loyalty while mitigating risks for dealerships. According to a recent analysis from an automotive finance think tank, dealerships using buyback programs see up to a 15% uptick in customer retention rates compared to those without such offerings. Kelley Blue Book analysts add that these programs act as a safeguard against market volatility by ensuring a predictable return flow of pre-owned vehicles.

From dealerships’ perspectives, the current surge in demand for electric vehicles (EVs) adds an interesting dimension. Automotive expert Jennifer Lee, an EV market analyst, points out that buyback programs designed with EV-specific parameters, such as battery health and sustainability incentives, are becoming increasingly popular. She notes, “Companies like Tesla and Rivian are pioneering tailored buyback solutions, which support vehicle recycling and build long-term customer relationships.”

Looking ahead, experts foresee several key trends shaping the future of buyback programs:

The industry is also witnessing groundbreaking innovations. Blockchain technology is being proposed as a tool for buyback programs to ensure greater transparency and eliminate disputes over vehicle histories. A pilot project led by Volvo uses blockchain to track each vehicle’s life cycle, simplifying buyback eligibility and instilling confidence in customers.

Another promising innovation is the gamification of car buyback processes. Hyundai recently launched a pilot campaign where customers earn points for vehicle maintenance and eco-friendly driving habits, redeemable during buyback transactions. This not only incentivizes program participation but also encourages long-term customer engagement.

Industry voices agree on one essential takeaway, staying informed about emerging trends and leveraging expert insights is critical for dealerships. A long-time Toyota executive, Bob Carter, advises dealerships to adopt a proactive mindset: “Programs that react quickly to regulatory changes, market dynamics, and consumer shifts are the ones that will thrive.”

By monitoring industry innovations, dealerships can adapt their vehicle buyback programs to remain competitive. Whether implementing advanced technologies, exploring EV priorities, or experimenting with new ownership models, staying ahead of emerging trends ensures buyback programs evolve to meet the demands of a changing automotive ecosystem.

Vehicle buyback programs in custom vehicle finance solutions offer a range of benefits and have become strategically important for both consumers and dealerships. These programs enhance flexibility by allowing buyers to sell their vehicles back to dealerships at a pre-agreed price, enabling easier upgrades and reducing long-term commitments. This creates financial predictability and peace of mind for consumers, while dealerships gain customer loyalty and maintain a steady inventory of well-maintained pre-owned cars.

Customer satisfaction is a key advantage, as these programs provide a clear, adaptable path to vehicle ownership. Buyers appreciate the reduced risks associated with vehicle depreciation, while dealerships build trust and foster repeat business. Additionally, buyback programs support eco-friendly practices by managing the vehicle lifecycle efficiently, refurbishing returned cars for resale, and reducing waste. This appeal to sustainability attracts environmentally conscious consumers while promoting responsible business practices.

Vehicle buyback programs provide dealerships with a competitive edge in the automotive market. Their ability to adapt to consumer preferences for flexibility and convenience strengthens a dealership’s position and brand reputation. Collaboration with industry experts is vital for dealerships to continue reaping these benefits. Experts can help refine programs, factor in market trends, and integrate innovations like data analytics and EV-focused initiatives.

Through effective implementation and expert collaboration, car buyback programs enhance the car-buying experience and set the stage for sustainable growth, operational efficiency, and a customer-centric future in the automotive industry.